- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major US stock indices fell significantly on Friday, weighed down by weak earnings reports of blue chip companies, and also due to the fact that a reliable US employment report raised bond yields to multi-year highs to 2.85%. So, employment growth in the US accelerated in January, and wages increased, recording the largest annual profit for more than 8.5 years, confirming expectations that inflation will rise this year, as the labor market will reach full employment. The number of people employed in the non-agricultural sector jumped by 200,000 jobs last month after rising by 160,000 in December, the Ministry of Labor said on Friday. The unemployment rate was unchanged at the 17-year low of 4.1%. Average hourly earnings rose by nine cents, or 0.3%, in January to $ 26.74, after rising 0.4% in December. This increased the annual increase in the average hourly earnings to 2.9%, which is the biggest increase since June 2009 compared to 2.7% in December.

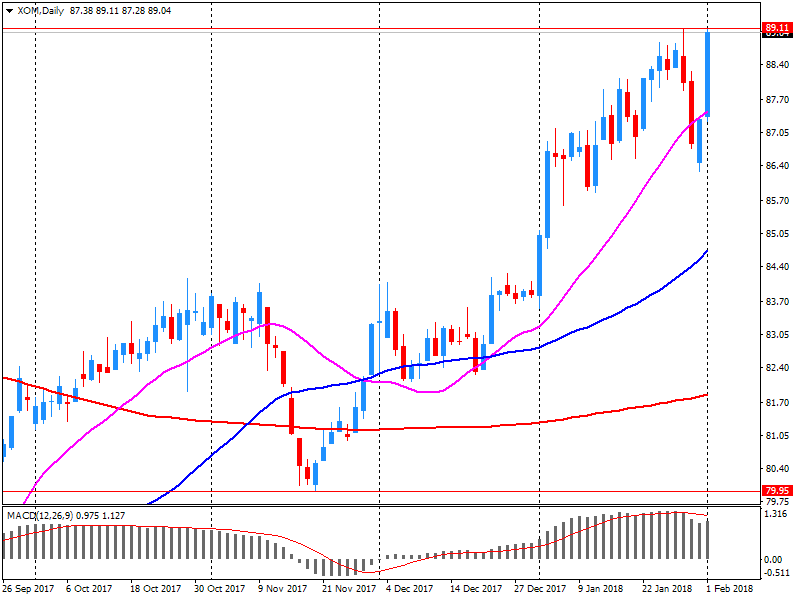

All components of the DOW index finished trading in the red (28 of 30). Outsider were shares of Exxon Mobil Corporation (XOM, -6.12%).

All sectors of the S & P index recorded a decline. The largest drop was shown by the main materials sector (-3.6%).

At closing:

Dow -2.54% 25,520.96 -665.75

Nasdaq -1.96% 7,240.95 -144.92

S & P -2.12% 2.762.13 -59.85

U.S. stock-index futures fell on Friday as strong U.S. labour market data bolstered expectations that inflation would push higher and pushed up bond yields further.

Global Stocks:

Nikkei 23,274.53 -211.58 -0.90%

Hang Seng 32,601.78 -40.31 -0.12%

Shanghai 3,462.94 +15.96 +0.46%

S&P/ASX 6,121.40 +31.30 +0.51%

FTSE 7,467.57 -22.82 -0.30%

CAC 5,392.36 -62.19 -1.14%

DAX 12,838.45 -165.45 -1.27%

Crude $65.81 (+0.02%)

Gold $1,342.10 (-0.43%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 245.46 | -2.48(-1.00%) | 1385 |

| ALCOA INC. | AA | 52 | -0.42(-0.80%) | 615 |

| ALTRIA GROUP INC. | MO | 69.71 | -0.22(-0.31%) | 1450 |

| Amazon.com Inc., NASDAQ | AMZN | 1,469.90 | 79.90(5.75%) | 240684 |

| American Express Co | AXP | 99.13 | -0.87(-0.87%) | 1024 |

| Apple Inc. | AAPL | 166.84 | -0.94(-0.56%) | 3185925 |

| AT&T Inc | T | 38.88 | -0.28(-0.72%) | 35001 |

| Barrick Gold Corporation, NYSE | ABX | 14.25 | -0.17(-1.18%) | 20325 |

| Boeing Co | BA | 355 | -1.94(-0.54%) | 23384 |

| Caterpillar Inc | CAT | 161.23 | -1.01(-0.62%) | 6002 |

| Chevron Corp | CVX | 122.51 | -3.06(-2.44%) | 93472 |

| Cisco Systems Inc | CSCO | 41.2 | -0.50(-1.20%) | 52985 |

| Citigroup Inc., NYSE | C | 79 | 0.12(0.15%) | 32408 |

| Deere & Company, NYSE | DE | 165.65 | -2.20(-1.31%) | 774 |

| Exxon Mobil Corp | XOM | 86.47 | -2.60(-2.92%) | 156839 |

| Facebook, Inc. | FB | 192.05 | -1.04(-0.54%) | 252649 |

| Ford Motor Co. | F | 10.87 | -0.05(-0.46%) | 70474 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.22 | -0.23(-1.18%) | 5063 |

| General Electric Co | GE | 15.91 | -0.11(-0.69%) | 448449 |

| General Motors Company, NYSE | GM | 42 | -0.43(-1.01%) | 4145 |

| Goldman Sachs | GS | 271.82 | -0.41(-0.15%) | 10288 |

| Google Inc. | GOOG | 1,130.63 | -37.07(-3.17%) | 28394 |

| Hewlett-Packard Co. | HPQ | 22.95 | -0.35(-1.50%) | 5638 |

| Home Depot Inc | HD | 198.9 | -1.00(-0.50%) | 4696 |

| HONEYWELL INTERNATIONAL INC. | HON | 158.9 | -0.75(-0.47%) | 599 |

| Intel Corp | INTC | 47.49 | -0.16(-0.34%) | 43223 |

| International Business Machines Co... | IBM | 161.87 | -0.53(-0.33%) | 9788 |

| Johnson & Johnson | JNJ | 139.05 | -0.97(-0.69%) | 7610 |

| JPMorgan Chase and Co | JPM | 117.23 | 0.36(0.31%) | 7955 |

| McDonald's Corp | MCD | 170.65 | -1.25(-0.73%) | 4092 |

| Merck & Co Inc | MRK | 59.75 | -0.11(-0.18%) | 15754 |

| Microsoft Corp | MSFT | 94.05 | -0.21(-0.22%) | 122233 |

| Nike | NKE | 67.13 | -0.52(-0.77%) | 1710 |

| Pfizer Inc | PFE | 36.6 | -0.23(-0.62%) | 17566 |

| Procter & Gamble Co | PG | 85.51 | -0.34(-0.40%) | 6972 |

| Starbucks Corporation, NASDAQ | SBUX | 55.75 | -0.25(-0.45%) | 10535 |

| Tesla Motors, Inc., NASDAQ | TSLA | 347 | -2.25(-0.64%) | 39279 |

| The Coca-Cola Co | KO | 47.19 | -0.26(-0.55%) | 5896 |

| Travelers Companies Inc | TRV | 149.18 | -0.82(-0.55%) | 1148 |

| Twitter, Inc., NYSE | TWTR | 26.87 | -0.27(-0.99%) | 129609 |

| United Technologies Corp | UTX | 136.32 | -2.00(-1.45%) | 1339 |

| UnitedHealth Group Inc | UNH | 233.23 | -1.99(-0.85%) | 1616 |

| Verizon Communications Inc | VZ | 54 | -0.30(-0.55%) | 2307 |

| Visa | V | 123 | -2.72(-2.16%) | 25377 |

| Wal-Mart Stores Inc | WMT | 105 | -0.52(-0.49%) | 6017 |

| Walt Disney Co | DIS | 109.65 | -0.84(-0.76%) | 6960 |

| Yandex N.V., NASDAQ | YNDX | 38.73 | -0.68(-1.73%) | 3200 |

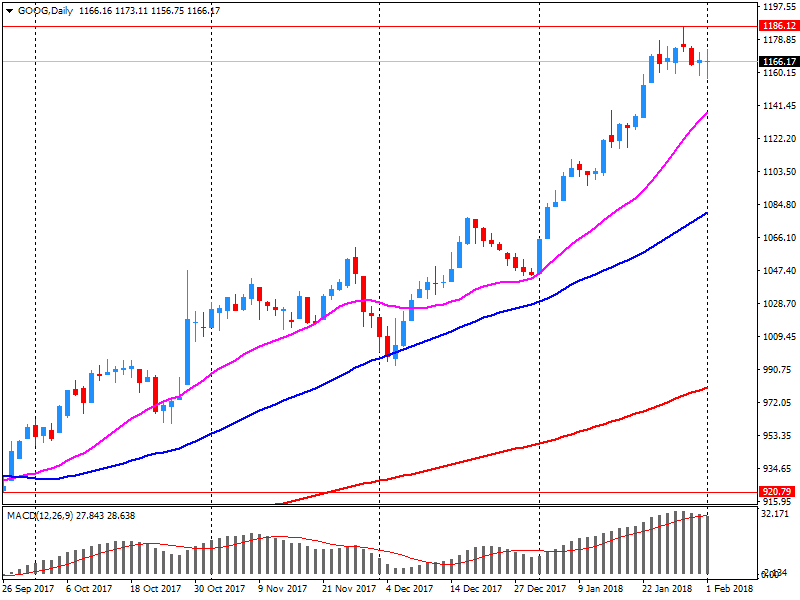

Alphabet A (GOOGL) reiterated with a Buy at Needham; target $1,350

Alphabet A (GOOGL) target lowered to $1,350 from $1,375 B. Riley FBR; Buy

Alphabet A (GOOGL) downgraded to Hold from Buy at Stifel; target $1,150

HP (HPQ) downgraded to Neutral from Buy at Mizuho; target $23

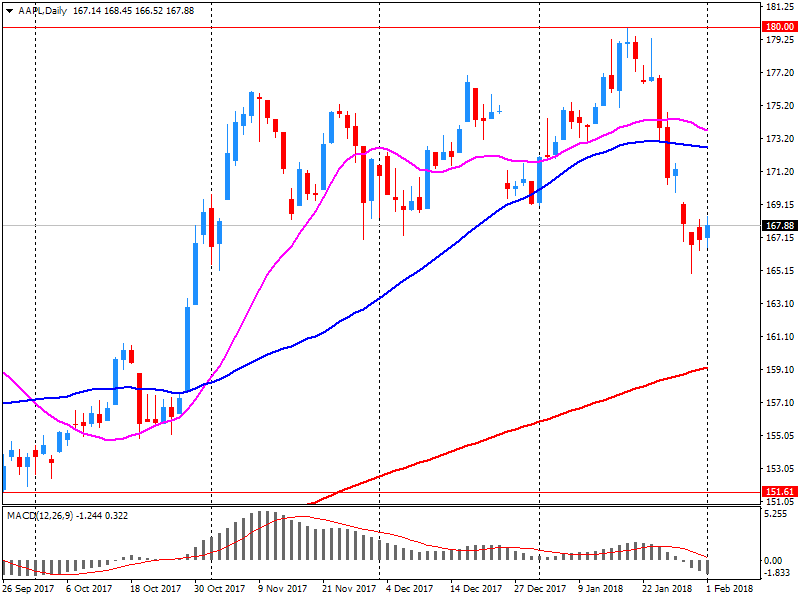

Apple (AAPL) downgraded to Mkt Perform from Outperform at Bernstein

Apple (AAPL) downgraded to Sector Weight from Overweight at KeyBanc Capital Mkts

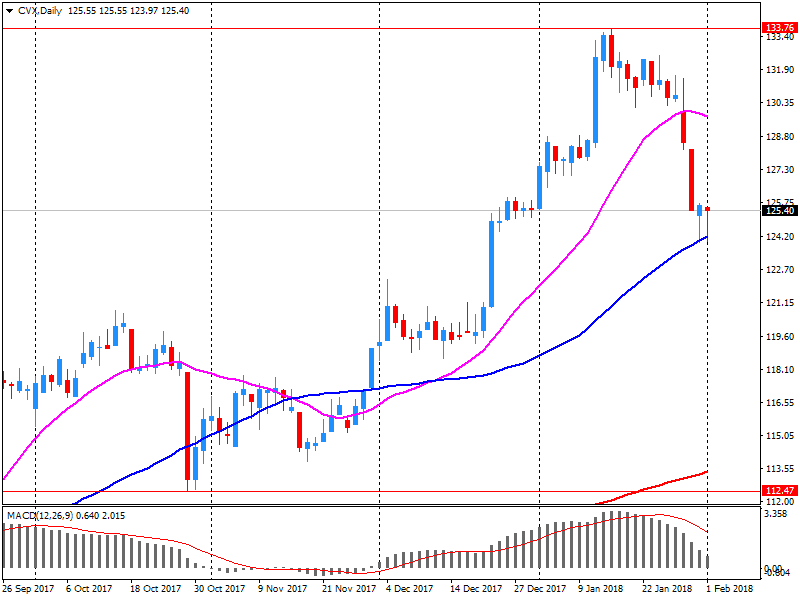

Chevron (CVX) reported Q4 FY 2017 earnings of $1.64 per share (versus $0.22 in Q4 FY 2016), may not be comparable to the analysts' consensus estimate of $1.24.

The company's quarterly revenues amounted to $37.616 bln (+19.4% y/y), missing analysts' consensus estimate of $38.425 bln.

The company's Board of Directors also approved a $0.04 per share increase in the quarterly dividend to $1.12 per share, payable in March 2018.

CVX fell to $122.12 (-2 75%) in pre-market trading.

Exxon Mobil (XOM) reported Q4 FY 2017 earnings of $0.88 per share (versus $0.41 in Q4 FY 2016), missing analysts' consensus estimate of $1.03.

The company's quarterly revenues amounted to $66.515 bln (+9.0% y/y), missing analysts' consensus estimate of $74.408 bln.

XOM fell to $86.35 (-3.05%) in pre-market trading.

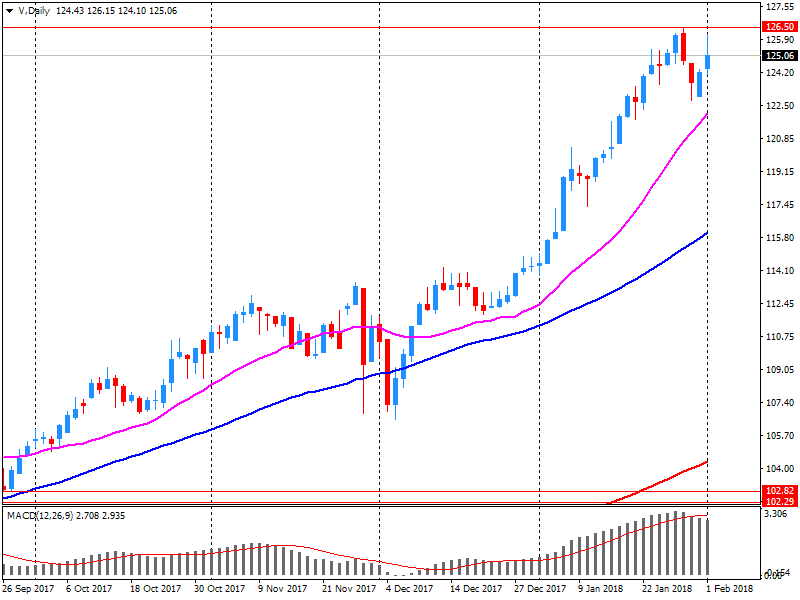

Visa (V) reported Q1 FY 2018 earnings of $1.08 per share (versus $0.86 in Q1 FY 2017), beating analysts' consensus estimate of $0.98.

The company's quarterly revenues amounted to $4.862 bln (+9.0% y/y), generally in-line with analysts' consensus estimate of $4.824 bln.

V fell to $123.60 (-1.69%) in pre-market trading.

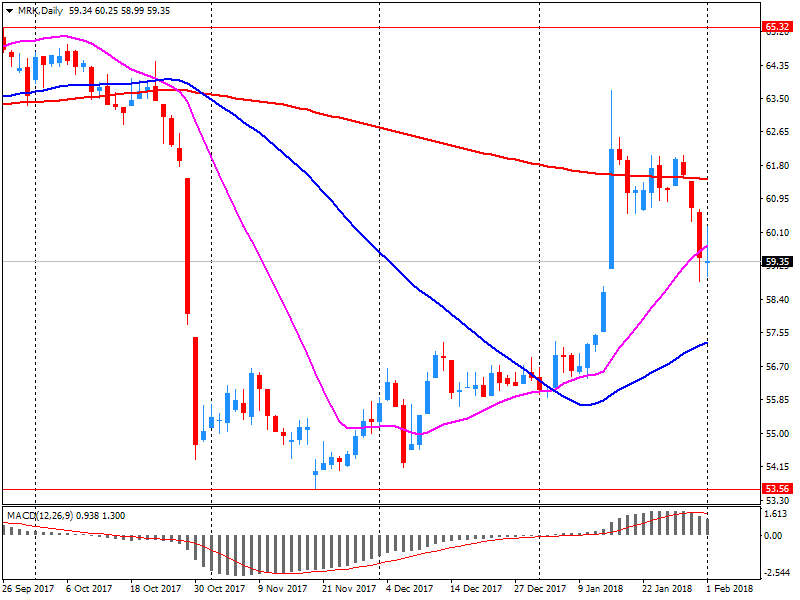

Merck (MRK) reported Q4 FY 2017 earnings of $0.98 per share (versus $0.89 in Q4 FY 2016), beating analysts' consensus estimate of $0.94.

The company's quarterly revenues amounted to $10.433 bln (+3.1% y/y), generally in-line with analysts' consensus estimate of $10.485 bln.

The company also issued guidance for FY 2018, projecting EPS of $4.08-4.23 (versus analysts' consensus estimate of $4.11) and revenues of $41.2-42.7 bln (versus analysts' consensus estimate of $41.1 bln).

MRK rose to $60.00 (+0.23%) in pre-market trading.

Apple (AAPL) reported Q1 FY 2018 earnings of $3.89 per share (versus $3.36 in Q1 FY 2017), beating analysts' consensus estimate of $3.85.

The company's quarterly revenues amounted to $88.293 bln (+12.7% y/y), generally in-line with analysts' consensus estimate of $87.617 bln.

AAPL rose to $169.25 (+0.88%) in pre-market trading.

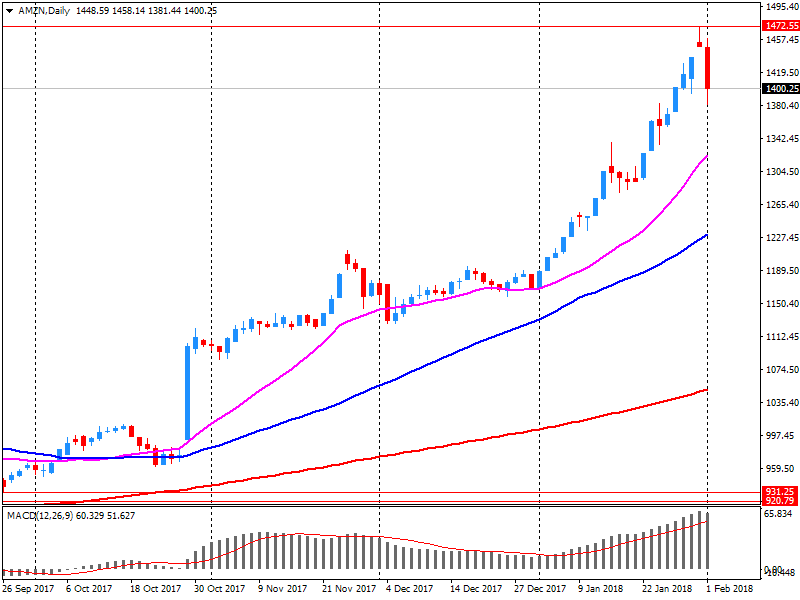

Amazon (AMZN) reported Q4 FY 2017 earnings of $2.19 per share (versus $1.54 in Q4 FY 2016), beating analysts' consensus estimate of $1.83.

The company's quarterly revenues amounted to $60.453 bln (+38.2% y/y), generally in-line with analysts' consensus estimate of $59.851 bln.

AMZN rose to $1472.40 (+5.93%) in pre-market trading.

Alphabet (GOOG) reported Q4 FY 2017 earnings of $9.70 per share (versus $9.36 in Q4 FY 2016), missing analysts' consensus estimate of $10.07.

The company's quarterly revenues amounted to $32.323 bln (+24.0% y/y), beating analysts' consensus estimate of $31.879 bln.

GOOG fell to $1,131.00 (-3.14%) in pre-market trading.

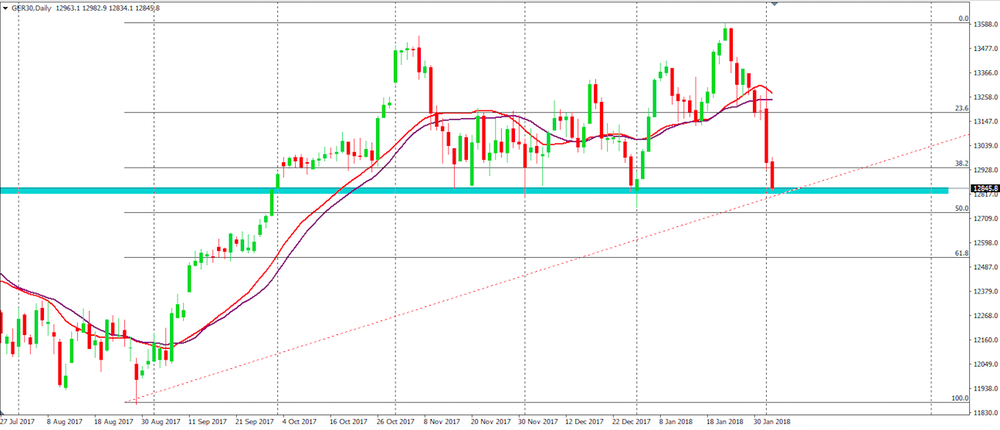

DAX has shown some indecision on the last few days.

On daily time frame chart, we can see that the price is stuck in a consolidation zone.

However, at this movement it is close to the bottom of the consolidation (which is a support level).

Therefore, if the price starts to reject more downside movements we can expect a further bullish movement soon.

European stock gauges finished with sizable losses Thursday as February kicked off, falling for a fourth session in a row as global bond yields extended their recent climb. The Stoxx Europe 600 index SXXP, -0.50% dropped 0.5% to end at 393.52, turning negative after a morning gain. It closed at a four-week low, cutting its 2018 gain to 1.1%.

U.S. stock indexes ended mostly lower on Thursday, switching between gains and losses as fears of a pick up in inflation and rising bond yields fostered emerging volatility on Wall Street.

Stock indexes in Japan and South Korea suffered earnings-related hits Friday, with Samsung Electronics falling 3.5% after rival Apple's latest quarterly financial results. Apple AAPL, +0.21% reported a slight drop in iPhone sales in the three months through December and gave a downbeat revenue forecast for the current quarter.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.