- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| index | closing price | change items | % change |

| Nikkei | -96.29 | 21292.29 | -0.45% |

| TOPIX | -4.98 | 1703.80 | -0.29% |

| Hang Seng | +86.72 | 30180.10 | +0.29% |

| CSI 300 | -24.44 | 3862.48 | -0.63% |

| Euro Stoxx 50 | -14.57 | 3346.93 | -0.43% |

| FTSE 100 | -26.15 | 7030.46 | -0.37% |

| DAX | -94.28 | 12002.45 | -0.78% |

| CAC 40 | -15.18 | 5152.12 | -0.29% |

| DJIA | +389.17 | 24033.36 | +1.65% |

| S&P 500 | +32.57 | 2614.45 | +1.26% |

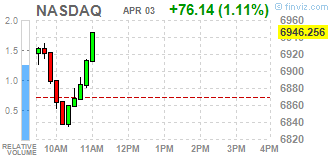

| NASDAQ | +71.16 | 6941.28 | +1.04% |

| S&P/TSX | -32.69 | 15180.76 | -0.21% |

The main US stock indexes rose strongly against the backdrop of the rebound in technology and consumer sectors after yesterday's sell-off.

Shares of Amazon (AMZN; + 1.67%) and automakers were the main drivers of market growth.

Shares of General Motors (GM) jumped 2.9% after the company reported a 16% yoy increase in auto sales in March.

Shares of Tesla Inc. (TSLA) rose by almost 5.9%, as the company's operating results for the first quarter indicated a progress in the process of increasing production of the sedan for the mass market of Model 3 and optimistic forecasts for the next quarters.

In addition, significant support for the market was provided by shares of the financial sector, the value of which increased against the backdrop of growth in yields of US government bonds. In the meantime, fears of a possible global trade war have temporarily come to the fore.

Almost all components of the DOW index finished trading in positive territory (28 out of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 3.62%). Outsider were shares of General Electric Co. (GE, -0.27%).

Almost all sectors of the S & P index recorded an increase. The consumer goods sector grew most (+ 1.5%). The decrease was shown only by the conglomerate sector (-0.4%).

At closing:

Dow 24,030.64 +386.45 +1.63%

S&P 500 2,614.43 +32.55 +1.26%

Nasdaq 100 6,941.28 +71.16 +1.04%

Major U.S. stock-indexes solidly higher on Tuesday, helped by a recovery in beaten-down technology and consumer discretionary stocks.

Most of Dow stocks in positive area (27 of 30). Top gainer - UnitedHealth Group Inc. (UNH, +2.58%). Top loser - General Electric Co. (GE, -0.99%).

All S&P sectors in positive area. Top gainer - consumer goods (+0.8%) and financial sector (+0.8%).

At the moment:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Dow | 23805.00 | +253.00 | +1.07% |

| S&P 500 | 2596.25 | +21.25 | +0.83% |

| Nasdaq 100 | 6440.75 | +47.50 | +0.74% |

| Crude Oil | 63.49 | +0.48 | +0.76% |

| Gold | 1333.00 | -13.90 | -1.03% |

| U.S. 10yr | 2.78% | +0.04 | +1.54% |

U.S. stock-index futures surged on Tuesday on the back of a recovery in beaten-down technology stocks.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 21,292.29 | -96.29 | -0.45% |

| Hang Seng | 30,180.10 | +86.72 | +0.29% |

| Shanghai | 3,136.44 | -26.74 | -0.85% |

| S&P/ASX | 5,751.90 | -7.50 | -0.13% |

| FTSE | 7,054.27 | -2.34 | -0.03% |

| CAC | 5,154.02 | -13.28 | -0.26% |

| DAX | 12,026.67 | -70.06 | -0.58% |

| Crude | $63.41 | | +0.63% |

| Gold | $1,342.60 | | -0.32% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 213.26 | 0.64(0.30%) | 10484 |

| ALTRIA GROUP INC. | MO | 60.95 | 0.44(0.73%) | 2239 |

| Amazon.com Inc., NASDAQ | AMZN | 1,388.00 | 16.01(1.17%) | 152977 |

| Apple Inc. | AAPL | 168.06 | 1.38(0.83%) | 205432 |

| AT&T Inc | T | 35.34 | 0.24(0.68%) | 24842 |

| Barrick Gold Corporation, NYSE | ABX | 12.6 | -0.02(-0.16%) | 17184 |

| Boeing Co | BA | 325 | 2.56(0.79%) | 24782 |

| Caterpillar Inc | CAT | 144.97 | 1.08(0.75%) | 5538 |

| Chevron Corp | CVX | 112.9 | 0.66(0.59%) | 4117 |

| Cisco Systems Inc | CSCO | 41.39 | 0.38(0.93%) | 90200 |

| Citigroup Inc., NYSE | C | 68.29 | 0.58(0.86%) | 51101 |

| Exxon Mobil Corp | XOM | 73.65 | 0.43(0.59%) | 23167 |

| Facebook, Inc. | FB | 156.59 | 1.20(0.77%) | 133596 |

| Ford Motor Co. | F | 10.92 | 0.06(0.55%) | 39884 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.32 | 0.18(1.05%) | 311 |

| General Electric Co | GE | 13.17 | 0.05(0.38%) | 136473 |

| General Motors Company, NYSE | GM | 35.98 | 0.22(0.62%) | 2623 |

| Goldman Sachs | GS | 248.98 | 1.63(0.66%) | 2964 |

| Google Inc. | GOOG | 1,016.00 | 9.53(0.95%) | 6410 |

| Home Depot Inc | HD | 173.55 | 0.65(0.38%) | 6933 |

| Intel Corp | INTC | 49.1 | 0.18(0.37%) | 204014 |

| International Business Machines Co... | IBM | 151 | 0.93(0.62%) | 4094 |

| International Paper Company | IP | 51.5 | 0.37(0.72%) | 500 |

| Johnson & Johnson | JNJ | 125.28 | 0.72(0.58%) | 3366 |

| JPMorgan Chase and Co | JPM | 108.77 | 0.92(0.85%) | 28535 |

| McDonald's Corp | MCD | 157.87 | 0.15(0.10%) | 12582 |

| Merck & Co Inc | MRK | 53.44 | 0.17(0.32%) | 3223 |

| Microsoft Corp | MSFT | 89.55 | 1.03(1.16%) | 111306 |

| Nike | NKE | 64.35 | 0.23(0.36%) | 16281 |

| Pfizer Inc | PFE | 35.12 | 0.07(0.20%) | 10646 |

| Procter & Gamble Co | PG | 77.79 | 0.39(0.50%) | 9250 |

| Starbucks Corporation, NASDAQ | SBUX | 56.65 | 0.41(0.73%) | 970 |

| Tesla Motors, Inc., NASDAQ | TSLA | 255.3 | 2.82(1.12%) | 102373 |

| The Coca-Cola Co | KO | 42.8 | 0.13(0.30%) | 4992 |

| Travelers Companies Inc | TRV | 135.4 | 0.56(0.42%) | 2334 |

| Twitter, Inc., NYSE | TWTR | 28.24 | 0.20(0.71%) | 88091 |

| United Technologies Corp | UTX | 123.81 | 0.33(0.27%) | 2064 |

| UnitedHealth Group Inc | UNH | 219.5 | 2.30(1.06%) | 10661 |

| Verizon Communications Inc | VZ | 47.31 | 0.15(0.32%) | 11677 |

| Visa | V | 119 | 0.61(0.52%) | 4771 |

| Wal-Mart Stores Inc | WMT | 86.15 | 0.60(0.70%) | 17315 |

| Walt Disney Co | DIS | 99.29 | 0.63(0.64%) | 6022 |

| Yandex N.V., NASDAQ | YNDX | 39.45 | 0.31(0.79%) | 3200 |

3M (MMM) target lowered to $225 from $251 at Stifel

General Electric (GE) target lowered to $13 from $15 at Stifel

German stocks led European equities higher Thursday, but the broader market couldn't avoid losses for March and the first quarter of 2018.

The Nasdaq Composite's COMP, -2.74% 2.7% tumble Monday, amid broad selling in the technology sector and uncertainty surrounding trade policy, came with the most panic-like selling in nearly two years. The Nasdaq's Arms Index, a volume-weighted breadth measure that tends to rise above 1.000 when the market falls, spiked up to 2.238, while readings above 2.000 are viewed as having panic-like characteristics.

Asian stock markets headed lower Tuesday as a selloff of tech shares deepened in the U.S. and escalating trade tensions with China dampened investor confidence. Traders took cues from Wall Street after the Nasdaq Composite fell 2.7% Monday, leading a 2.2% decline for the S&P 500 and marking a damp start to the month after U.S. stocks logged the worst quarterly performance since mid-2015.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.