- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +135.18 19445.70 +0.70%

TOPIX +10.53 1550.30 +0.68%

Hang Seng -12.25 24683.88 -0.05%

CSI 300 -8.74 3404.39 -0.26%

Euro Stoxx 50 +41.63 3627.88 +1.16%

FTSE 100 +13.57 7248.10 +0.19%

DAX +119.94 12647.78 +0.96%

CAC 40 +71.42 5372.42 +1.35%

DJIA -6.43 20951.47 -0.03%

S&P 500 +1.39 2389.52 +0.06%

NASDAQ +2.79 6075.34 +0.05%

S&P/TSX -146.44 15396.70 -0.94%

Major US stock indexes finished trading in different directions, but near the zero mark. Pressure on the market had a strong decline in quotations in the sector of basic materials. Investors also evaluated fresh statistics on the US economy and financial statements of large companies.

As it became known, new applications for unemployment benefits in the US fell more than expected last week, and the number of repeated applications for unemployment benefits fell to a 17-year low, indicating a tightening of the labor market, which could prompt the Fed to raise interest rates next month. Initial claims for unemployment benefits fell by 19,000 to 238,000, seasonally adjusted for the week ending April 29.

At the same time, labor productivity unexpectedly fell in the 1st quarter, which led to an increase in labor costs. The Ministry of Labor reported that labor productivity in the non-agricultural sector, which measures the hourly output per employee, decreased by 0.6% year-on-year. This was the weakest indicator for the year and followed an increase of 1.8% in the fourth quarter.

The cost of oil futures collapsed by almost 5%, reaching the lowest level since the end of November. Concerns over the growing global supplies and persistently high oil reserves actually offset most of the positions earned after OPEC reported the first eight-year oil production reduction agreement.

Most components of the DOW index showed a decrease (19 out of 30). Caterpillar Inc. shares fell more than others. (CAT, -2.21%). The leader of growth was UnitedHealth Group Incorporated (UNH, + 0.93%).

The S & P indexes have finished trading without a single dynamic. Most of all fell the sector of main materials (-1.8%). The highest increase was recorded in the consumer goods sector (+ 0.6%).

At closing:

DJIA -0.03% 20.951.24 -6.66

Nasdaq + 0.05% 6.075.34 + 2.79

S & P + 0.06% 2.389.54 +1.41

U.S. stock-index futures rose, a day after the Fed left interest rates unchanged and expressed confidence in the strength of the U.S. economy.

Stocks:

Nikkei -

Hang Seng 24,683.88 -12.25 -0.05%

Shanghai 3,127.29 -8.06 -0.26%

S&P/ASX 5,876.37 -15.97 -0.27%

FTSE 7,256.68 +22.15 +0.31%

CAC 5,349.75 +48.75 +0.92%

DAX 12,622.11 +94.27 +0.75%

Crude $46.89 (-1.94%)

Gold $1,228.90 (-1.57%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 31.51 | -0.18(-0.57%) | 5848 |

| Amazon.com Inc., NASDAQ | AMZN | 944 | 2.97(0.32%) | 12828 |

| AMERICAN INTERNATIONAL GROUP | AIG | 62.4 | 0.86(1.40%) | 142820 |

| Apple Inc. | AAPL | 146.72 | -0.34(-0.23%) | 122715 |

| AT&T Inc | T | 38.48 | 0.08(0.21%) | 15934 |

| Barrick Gold Corporation, NYSE | ABX | 16 | -0.21(-1.30%) | 118726 |

| Caterpillar Inc | CAT | 101.97 | 0.43(0.42%) | 2003 |

| Chevron Corp | CVX | 106.03 | -0.69(-0.65%) | 619 |

| Cisco Systems Inc | CSCO | 34.36 | 0.11(0.32%) | 10215 |

| Citigroup Inc., NYSE | C | 60.52 | 0.28(0.46%) | 434480 |

| Exxon Mobil Corp | XOM | 82.68 | -0.02(-0.02%) | 5052 |

| Facebook, Inc. | FB | 150.13 | -1.67(-1.10%) | 1152797 |

| FedEx Corporation, NYSE | FDX | 191.5 | 1.58(0.83%) | 200 |

| Ford Motor Co. | F | 11.09 | 0.02(0.18%) | 17538 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.85 | -0.17(-1.41%) | 52295 |

| General Electric Co | GE | 29.28 | 0.05(0.17%) | 4983 |

| General Motors Company, NYSE | GM | 33.64 | 0.16(0.48%) | 1860 |

| Goldman Sachs | GS | 227.55 | 1.24(0.55%) | 58712 |

| Google Inc. | GOOG | 925.51 | -1.53(-0.17%) | 7513 |

| Intel Corp | INTC | 37.1 | 0.12(0.32%) | 12638 |

| International Business Machines Co... | IBM | 158.2 | -0.43(-0.27%) | 635 |

| Johnson & Johnson | JNJ | 123.61 | 0.28(0.23%) | 962 |

| JPMorgan Chase and Co | JPM | 87.3 | 0.30(0.34%) | 533581 |

| Merck & Co Inc | MRK | 63.55 | -0.08(-0.13%) | 2114 |

| Microsoft Corp | MSFT | 69.1 | 0.02(0.03%) | 2334 |

| Nike | NKE | 54.94 | 0.41(0.75%) | 595 |

| Pfizer Inc | PFE | 33.34 | -0.13(-0.39%) | 9518 |

| Procter & Gamble Co | PG | 86.11 | -0.32(-0.37%) | 100 |

| Tesla Motors, Inc., NASDAQ | TSLA | 305 | -6.02(-1.94%) | 108217 |

| Twitter, Inc., NYSE | TWTR | 18.65 | 0.08(0.43%) | 345490 |

| Verizon Communications Inc | VZ | 46.22 | 0.07(0.15%) | 4170 |

| Visa | V | 92.94 | 0.50(0.54%) | 511 |

| Walt Disney Co | DIS | 112 | 0.38(0.34%) | 1117 |

| Yandex N.V., NASDAQ | YNDX | 26.73 | -0.48(-1.76%) | 2045 |

Upgrades:

Downgrades:

Other:

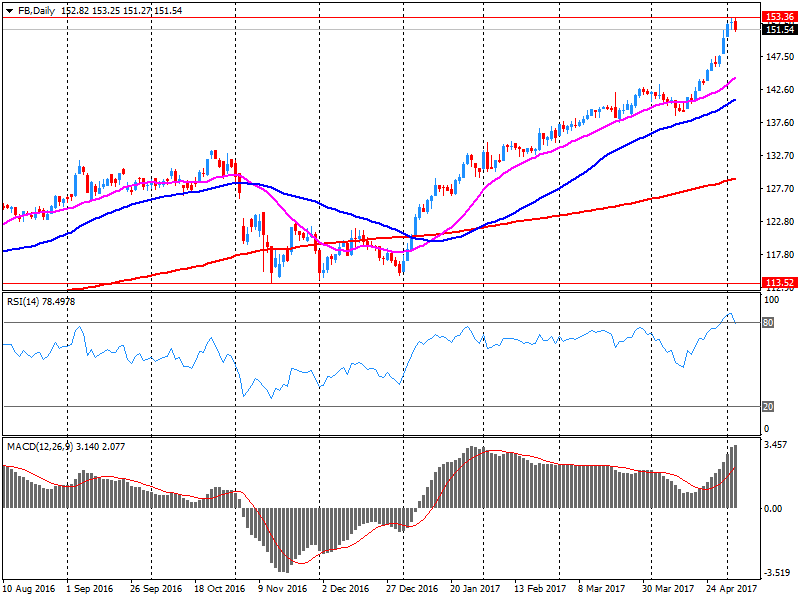

Facebook (FB) target raised to $170 from $165 at Stifel Research

Facebook (FB) target raised to $165 from $160 at Aegis Capital

Facebook (FB) reported Q1 FY 2017 earnings of $1.04 per share (versus $0.77 in Q1 FY 2016), beating analysts' consensus estimate of $0.86.

The company's quarterly revenues amounted to $8.032 bln (+49.2% y/y), beating analysts' consensus estimate of $7.829 bln.

The company reiterated meaningful slowdown in advertisement growth revenue in 2017 and CapEx of $7.0-7.5 bln.

FB fell to $151.07 (-0.49%) in pre-market trading.

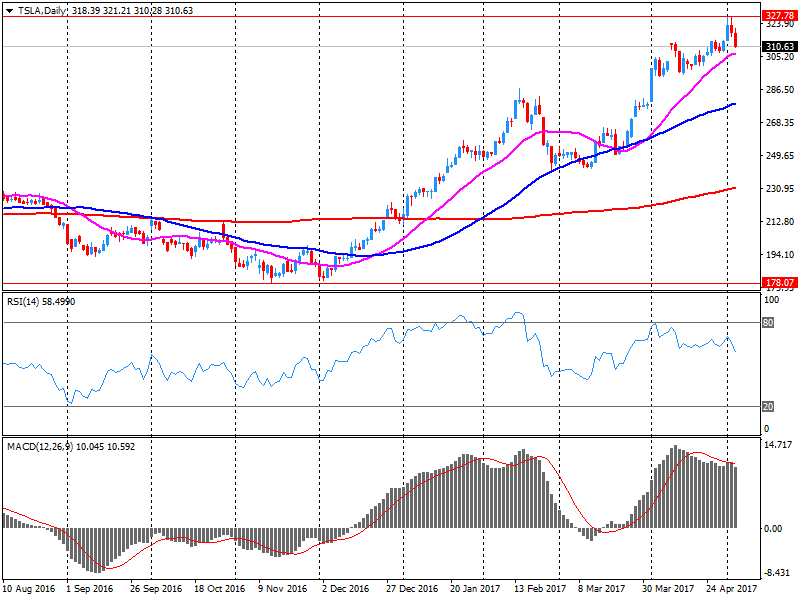

Tesla (TSLA) reported Q1 FY 2017 loss of $1.33 per share (versus -$0.57 in Q1 FY 2016), missing analysts' consensus estimate of -$0.78.

The company's quarterly revenues amounted to $2.696 bln (+135.1% y/y), beating analysts' consensus estimate of $2.610 bln.

The company also noted its H1 FY2017 outlook remained unchanged at 47,000 to 50,000 deliveries.

TSLA fell to $305.50 (-1.77%) in pre-market trading.

European stock markets finished down slightly from a 20-month high on Wednesday, holding lower after a reading on eurozone economic growth matched the market's expectations.

U.S. stocks closed mostly lower Wednesday after the Federal Reserve left interest rates unchanged, as widely expected, and deemed a recent patch of economic weakness as temporary. The main indexes traded in a narrow range over the past several sessions, unable to break to new highs.

Asian stocks tilted lower, with Australian stocks continuing to lag behind, as investors were largely unmoved by an as-expected policy announcement from the Federal Reserve.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.