- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

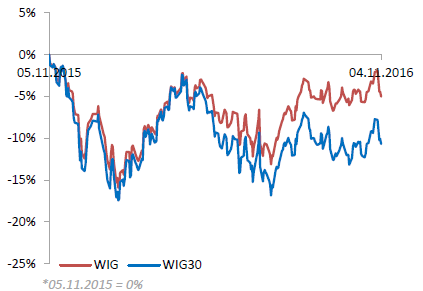

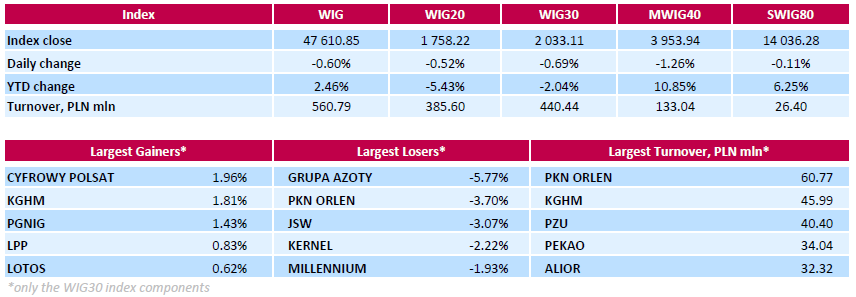

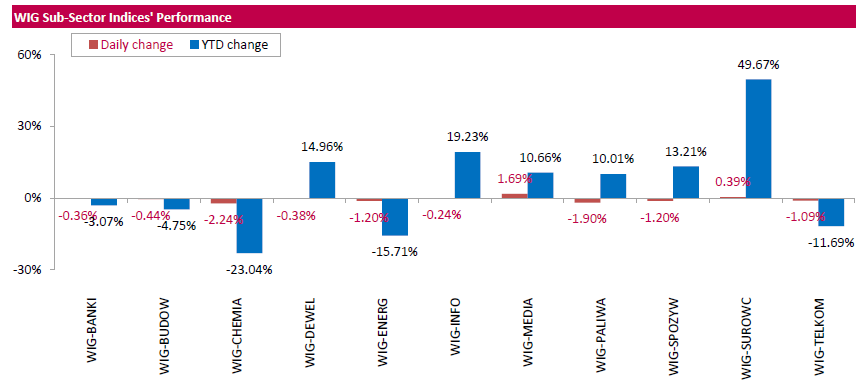

Polish equity market closed lower on Friday. The broad market measure, the WIG index, declined by 0.6%. Except for media (+1.69%) and materials (+0.39%), every sector in the WIG Index fell, with chemicals (-2.24%) lagging behind. The large-cap stocks' benchmark, the WIG30 Index, lost 0.69%. In the index basket, chemical producer GRUPA AZOTY (WSE: ATT) was the weakest name, tumbling by 5.77%. It was followed by oil refiner PKN ORLEN (WSE: PKN), coking coal producer JSW (WSE: JSW) and agricultural producer KERNEL (WSE: KER), slumping by 3.7%, 3.07% and 2.22% respectively. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS) led the advancers, climbing by 1.96%. Other major gainers were copper producer KGHM (WSE: KGH), oil and gas producer PGNIG (WSE: PGN) and clothing retailer LPP (WSE: LPP), adding 1.81%, 1.43% and 0.83% respectively.

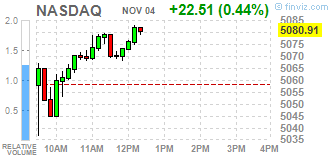

Major U.S. stock-indexes rose on Friday, despite worries over the outcome of the U.S. presidential election continued to weigh on sentiment. Investors have been unnerved by signs the U.S. presidential race between Democrat Hillary Clinton and Republican Donald Trump is tightening, after Clinton had until recently been thought to have a clear lead.

Most of Dow stocks in positive area (19 of 30). Top gainer - General Electric Company (GE, +1.70%). Top loser - The Procter & Gamble Company (PG, -1.07%).

Most of all S&P sectors also in positive area. Top gainer - Conglomerates (+1.3%). Top loser - Basic Materials (-0.3%).

At the moment:

Dow 17889.00 +37.00 +0.21%

S&P 500 2093.25 +9.75 +0.47%

Nasdaq 100 4690.50 +16.00 +0.34%

Oil 44.11 -0.55 -1.23%

Gold 1304.70 +1.40 +0.11%

U.S. 10yr 1.78 -0.03

U.S. stock-index futures fluctuated after data showed steady progress in the labor market, while investors remained focused on the looming presidential election.

Global Stocks:

Nikkei 16,905.36 -229.32 -1.34%

Hang Seng 22,642.62 -40.89 -0.18%

Shanghai 3,125.08 -3.86 -0.12%

FTSE 6,691.54 -98.97 -1.46%

CAC 4,373.57 -38.11 -0.86%

DAX 10,246.84 -79.04 -0.77%

Crude $44.31 (-0.78%)

Gold $1,302.00 (-0.10%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 768.4 | 1.37(0.1786%) | 16320 |

| AMERICAN INTERNATIONAL GROUP | AIG | 139.51 | -0.51(-0.3642%) | 180 |

| Apple Inc. | AAPL | 109.73 | -0.10(-0.091%) | 71169 |

| AT&T Inc | T | 36.83 | 0.20(0.546%) | 1110 |

| Barrick Gold Corporation, NYSE | ABX | 18.24 | -0.09(-0.491%) | 63802 |

| Boeing Co | BA | 139.51 | -0.51(-0.3642%) | 180 |

| Caterpillar Inc | CAT | 81.31 | 0.04(0.0492%) | 195 |

| Chevron Corp | CVX | 105 | -0.39(-0.3701%) | 12025 |

| Cisco Systems Inc | CSCO | 30.25 | -0.07(-0.2309%) | 203 |

| E. I. du Pont de Nemours and Co | DD | 68.49 | -0.01(-0.0146%) | 300 |

| Facebook, Inc. | FB | 120.14 | 0.14(0.1167%) | 106387 |

| Ford Motor Co. | F | 11.33 | -0.02(-0.1762%) | 9709 |

| General Electric Co | GE | 28.3 | 0.02(0.0707%) | 2704 |

| Goldman Sachs | GS | 176.74 | 0.53(0.3008%) | 250 |

| Google Inc. | GOOG | 115 | -0.03(-0.0261%) | 300 |

| Hewlett-Packard Co. | HPQ | 139.51 | -0.51(-0.3642%) | 180 |

| Intel Corp | INTC | 33.85 | -0.08(-0.2358%) | 3953 |

| Johnson & Johnson | JNJ | 115 | -0.03(-0.0261%) | 300 |

| Microsoft Corp | MSFT | 59.19 | -0.02(-0.0338%) | 4914 |

| Pfizer Inc | PFE | 115 | -0.03(-0.0261%) | 300 |

| Starbucks Corporation, NASDAQ | SBUX | 52.47 | 0.70(1.3521%) | 32063 |

| Tesla Motors, Inc., NASDAQ | TSLA | 188.09 | 0.67(0.3575%) | 14083 |

| The Coca-Cola Co | KO | 41.83 | -0.20(-0.4758%) | 2220 |

| Twitter, Inc., NYSE | TWTR | 17.53 | -0.05(-0.2844%) | 20042 |

| UnitedHealth Group Inc | UNH | 137.93 | 0.10(0.0725%) | 554 |

| Walt Disney Co | DIS | 93.15 | -0.22(-0.2356%) | 3066 |

| Yahoo! Inc., NASDAQ | YHOO | 40.15 | -0.08(-0.1989%) | 482 |

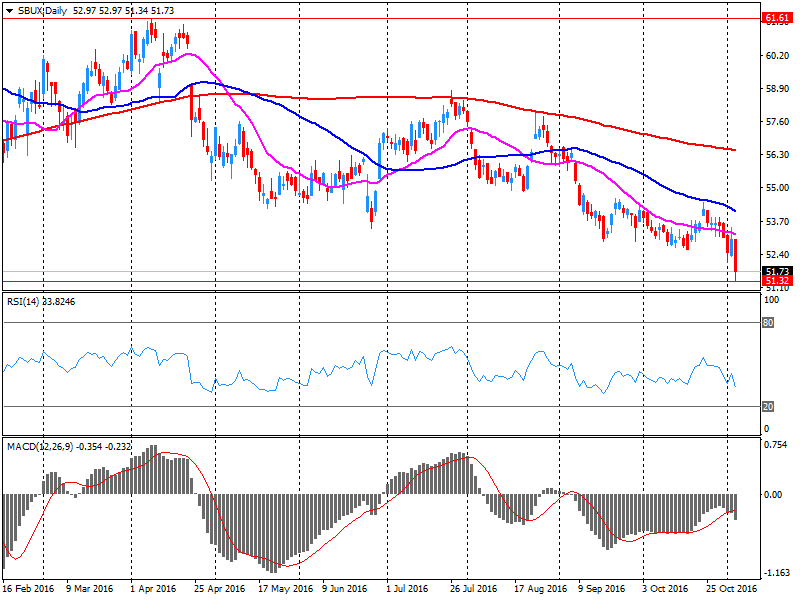

Starbucks reported Q4 FY 2016 earnings of $0.56 per share (versus $0.43 in Q4 FY 2015), beating analysts' consensus estimate of $0.55.

The company's quarterly revenues amounted to $5.711 bln (+16.2% y/y), slightly beating analysts' consensus estimate of $5.688 bln.

The company also issued downside guidance for FY2017, projecting EPS of $2.12-2.14 (versus analysts' consensus estimate of $2.16) and consolidated revenue growth in the double digits (consensus +8%).

SBUX rose to $52.70 (+1.80%) in pre-market trading.

Europe's main stock benchmark closed a touch higher on Thursday, with banks providing support after a dose of upbeat results and a U.K. court ruling viewed as favorable for the country's financial sector. Banking shares moved higher in the wake of encouraging quarterly reports from Société Générale SA and ING Groep NV, plus a ruling that the British government can't trigger the Brexit process without signoff from parliament.

The S&P 500 on Thursday fell for an eighth straight session, notching its longest retreat since the financial crisis in 2008. The epic losing streak has prompted a steady stream of predictions from doomsayers about an impending market collapse. But it's important to remember that in the grand scheme of things, this selloff is a mere blip.

Asian shares were broadly lower Friday, with Japan shrugging off better-than-expected economic data as concerns around the narrowing race for the White House curbed investor appetite. Early Friday, the Nikkei Japan services purchasing managers index rose to 50.5 in October from 48.2 in September. A reading above 50 indicates expansion, while a reading below 50 indicates contraction.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.