- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -73.47 19520.69 -0.37%

TOPIX +1.20 1555.68 +0.08%

Hang Seng +322.22 22456.69 +1.46%

CSI 300 -0.52 3367.79 -0.02%

Euro Stoxx 50 -1.05 3316.47 -0.03%

FTSE 100 +5.57 7195.31 +0.08%

DAX +0.63 11584.94 +0.01%

CAC 40 +1.24 4900.64 +0.03%

DJIA -42.87 19899.29 -0.21%

S&P 500 -1.75 2269.00 -0.08%

NASDAQ +10.93 5487.94 +0.20%

S&P/TSX +69.83 15586.58 +0.45%

Major US stock markets closed mixed, as the technology and healthcare growth could not compensate for the drop in shares of conglomerates sector. Investors were also evaluated a variety of economic data, including the ADP report on the number of jobs.

As it became known, the number of Americans who applied for unemployment benefits fell sharply last week to one of the lowest levels in the past four decades, reinforcing the view the Federal Reserve that the labor market is strengthening. The number of initial claims for unemployment benefits, a measure of how many workers were laid off, and fell by 28,000 to a seasonally adjusted reached 235,000 for the week ended December 31, reported Thursday the Ministry of Labour. It was the lowest level since mid-November, and the second lowest level since the end of 1973. Economists had expected 260,000 initial claims.

In addition, data for December showed a steady rise in business activity and new orders in the US services sector. Large workloads, and increased confidence in business prospects, in turn, contributed to a rapid increase in jobs since September 2015. The seasonally adjusted final index of business activity in the US services sector from Markit fell to 53.9 in December from 54.6 in November, and signaled the slowest growth in activity in the services sector for three months. Nevertheless, the last reading was significantly above the neutral level of 50.0, and pointed to solid growth.

However, the index of business activity in the US service sector, which is calculated by the Institute of Supply Management (ISM), remained unchanged at 57.2 in December. According to the forecast, the rate was expected to decline to 56.6. Recall, the indicator is the result of a survey of about 400 companies from 60 sectors across the United States.

DOW index closed mixed components (15 black, 15 red). Most remaining shares rose Visa Inc. (V, + 1.27%). Outsider were shares of The Travelers Companies, Inc. (TRV, -1.69%).

Sector S & P index closed trading mixed. The leader turned out to be the health sector (+ 0.7%). conglomerates (-1.7%) sectors fell most.

At the close:

Dow -0.22% 19,899.22 -42.94

Nasdaq + 0.20% 5,487.94 +10.93

S & P -0.08% 2,269.01 -1.74

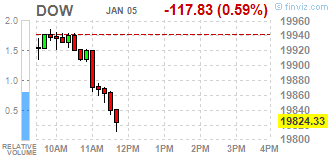

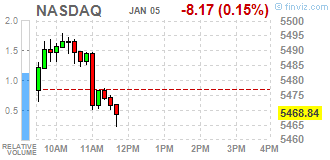

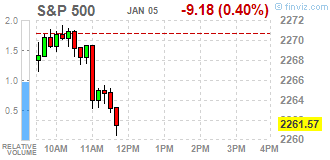

Major U.S. stock-indexes fells on Thursday as a drop in banks and discretionary stocks weren't offset by gains in technology names. Investors are also assessing a host of economic data including the ADP payrolls report, which showed that 153 000 jobs were added in the private sector in December compared with economists' expectation of 170 000. The report sets a precedent to Friday's nonfarm payrolls data, which includes hiring in both private and public sectors.

Most of Dow stocks in negative area (16 of 30). Top gainer - Visa Inc. (V, +1.05%). Top loser - The Travelers Companies, Inc. (TRV, -2.15%).

S&P sectors mixed. Top gainer - Healthcare (+0.5%). Top loser - Conglomerates (-1.1%).

At the moment:

Dow 19764.00 -92.00 -0.46%

S&P 500 2256.50 -7.75 -0.34%

Nasdaq 100 4946.00 +12.50 +0.25%

Oil 52.96 -0.30 -0.56%

Gold 1184.30 +19.00 +1.63%

U.S. 10yr 2.38 -0.08

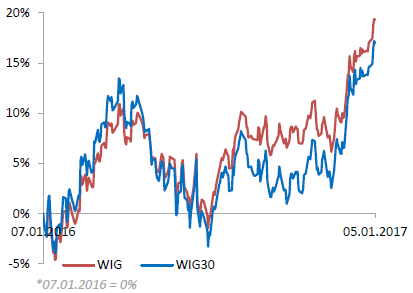

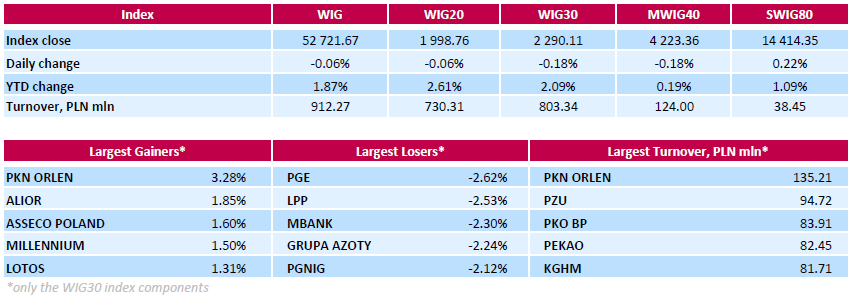

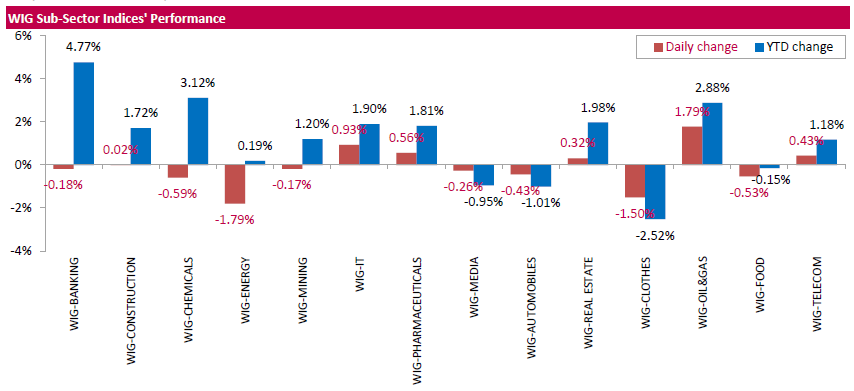

Polish equities closed flat on Thursday. The broad market benchmark, the WIG Index, edged down 0.06%. Sector-wise, oil and gas names (+1.79%) outperformed, while energy stocks (-1.79%) lagged behind.

The large-cap stocks fell by 0.18%, as measured by the WIG30 Index. Within the index components, genco PGE (WSE: PGE) and clothing retailer LPP (WSE: LPP) were the weakest performers, tumbling by 2.62% and 2.53% respectively. Other major losers were bank MBANK (WSE: MBK), chemical producer GRUPA AZOTY (WSE: ATT), oil and gas producer PGNIG (WSE: PGN) and genco TAURON PE (WSE: TPE), dropping by 2.04%-2.30%. On the other side of the ledger, oil refiner PKN ORLEN (WSE: PKN) led the gainers with a 3.28% advance, followed by bank ALIOR (WSE: ALR), IT-company ASSECO POLAND (WSE: ACP) and bank MILLENNIUM (WSE: MIL), jumping by 1.85%, 1.6% and 1.5% respectively.

The Warsaw Stock Exchange will be closed on Friday, January 6, due to celebration of Epiphany or Three Kings' Day (Swieto Trzech Kroli) in Poland.

The market in the US took off with a small decline of 0.1%, which is fully in line with previously presented small discount in the futures market. In Europe we may see today lack of appetite for growth and in the US growth weakens when approaching a resistance in the form of all time records. It seems that investors are waiting for tomorrow's release from the US labor market.

An hour before the end of trading the WIG20 index was at the level of 2,003 points (+0,15%).

U.S. stock-index futures fell as investors assessed the prospects of further growth of the stocks as a two-day rally sent valuations high, while the world's central banks are scaling down stimulus programs.

Global Stocks:

Nikkei 19,520.69 -73.47 -0.37%

Hang Seng 22,456.69 +322.22 +1.46%

Shanghai 3,165.55 +6.75 +0.21%

FTSE 7,200.84 +11.10 +0.15%

CAC 4,892.66 -6.74 -0.14%

DAX 11,569.51 -14.80 -0.13%

Crude $53.64 (+0.71%)

Gold $1,175.80 (+0.90%)

We would like to remind that there will be no trading session (the Exchange will be closed) on Friday, January 6, 2017.

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 30.25 | -0.01(-0.033%) | 27605 |

| ALTRIA GROUP INC. | MO | 67.95 | 0.10(0.1474%) | 1435 |

| Amazon.com Inc., NASDAQ | AMZN | 757.74 | 0.56(0.074%) | 8082 |

| American Express Co | AXP | 76.37 | 0.11(0.1442%) | 139 |

| Apple Inc. | AAPL | 116 | -0.02(-0.0172%) | 29132 |

| AT&T Inc | T | 42.89 | 0.12(0.2806%) | 42075 |

| Barrick Gold Corporation, NYSE | ABX | 16.76 | 0.36(2.1951%) | 76420 |

| Boeing Co | BA | 158.45 | -0.17(-0.1072%) | 550 |

| Caterpillar Inc | CAT | 93.43 | -0.14(-0.1496%) | 4118 |

| Chevron Corp | CVX | 118.4 | 0.58(0.4923%) | 600 |

| Cisco Systems Inc | CSCO | 30.08 | -0.02(-0.0664%) | 17528 |

| Citigroup Inc., NYSE | C | 61.12 | -0.29(-0.4722%) | 30244 |

| Deere & Company, NYSE | DE | 106.15 | 0.33(0.3119%) | 250 |

| Exxon Mobil Corp | XOM | 89.8 | -0.09(-0.1001%) | 202 |

| Facebook, Inc. | FB | 118.57 | -0.12(-0.1011%) | 36398 |

| Ford Motor Co. | F | 13.18 | 0.01(0.0759%) | 36378 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.75 | -0.08(-0.5394%) | 100369 |

| General Electric Co | GE | 31.66 | -0.04(-0.1262%) | 4278 |

| General Motors Company, NYSE | GM | 37 | -0.09(-0.2427%) | 3041 |

| Goldman Sachs | GS | 242.7 | -0.43(-0.1769%) | 3413 |

| Home Depot Inc | HD | 135.26 | -0.24(-0.1771%) | 534 |

| Intel Corp | INTC | 36.45 | 0.04(0.1099%) | 4398 |

| Johnson & Johnson | JNJ | 115.55 | -0.10(-0.0865%) | 7347 |

| JPMorgan Chase and Co | JPM | 86.5 | -0.41(-0.4718%) | 1716 |

| Nike | NKE | 52.8 | -0.27(-0.5088%) | 25994 |

| Procter & Gamble Co | PG | 84.11 | -0.39(-0.4615%) | 200 |

| Starbucks Corporation, NASDAQ | SBUX | 55.95 | -0.04(-0.0714%) | 18019 |

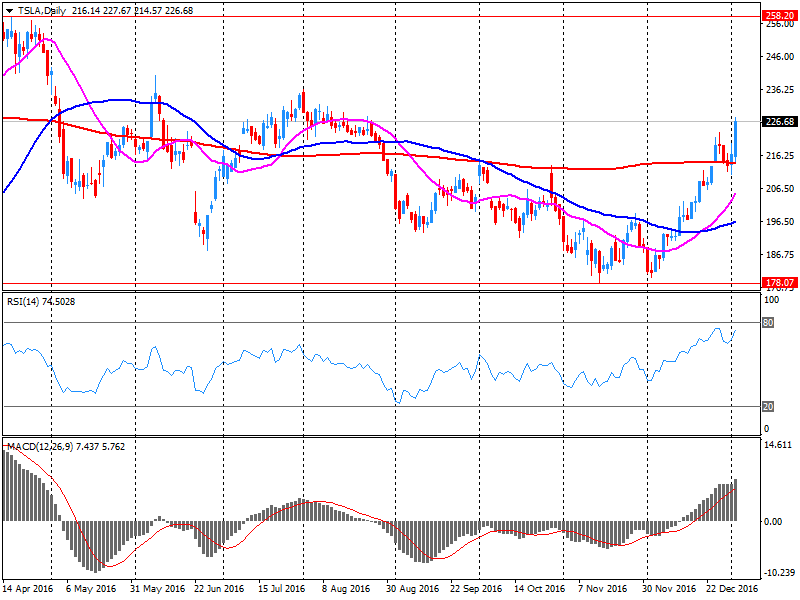

| Tesla Motors, Inc., NASDAQ | TSLA | 226.25 | -0.74(-0.326%) | 16087 |

| Travelers Companies Inc | TRV | 119.25 | -1.00(-0.8316%) | 1394 |

| Twitter, Inc., NYSE | TWTR | 16.92 | 0.06(0.3559%) | 34924 |

| United Technologies Corp | UTX | 111 | 0.10(0.0902%) | 685 |

| Verizon Communications Inc | VZ | 54.5 | -0.02(-0.0367%) | 2712 |

| Wal-Mart Stores Inc | WMT | 68.61 | -0.45(-0.6516%) | 6000 |

| Yahoo! Inc., NASDAQ | YHOO | 40.1 | 0.04(0.0998%) | 2430 |

| Yandex N.V., NASDAQ | YNDX | 20.57 | 0.13(0.636%) | 22183 |

Upgrades:

Downgrades:

Travelers (TRV) downgraded to Underweight from Equal-Weight at Morgan Stanley

Other:

The manufacturer of electric vehicles Tesla Motors Inc reported yesterday that it has partnered with the Japanese company Panasonic to start mass production of lithium-ion battery cells on Gigafactory plant in Nevada.

According to the report, cylindrical "cell in 2170", jointly developed by Tesla and Panasonic, will be used for energy storage products and Tesla Model 3.

TSLA shares fell in premarket trading to $ 225.99 (-0.44%).

The first half of today's session brought another attempts to gain the level of 2,000 points for the WIG20 index. Quite helpful was the growth boost in Europe, which unfortunately ended quickly. The WIG20 at noon reported on the new session maximum, so the upward trend both in the today's session as well as in whole wave of growth initiated in mid-November is continued.

At the halfway point of the session the WIG20 index was at the level of 1,998 points (-0,06%); the turnover in the segment of large companies was amounted to PLN 320 million.

Markets in Europe traded with slight modifications after opening in the red zone.

The composite index Stoxx 600 rose 0.08 percent, with most sectors trading in negative territory. However, the UK FTSE index set a new intraday record, rising above 7,200.

UK service sector expanded at the fastest pace since July 2015, due to the high level of growth in new orders, data showed today. Purchasing Managers Index from Markit rose to 56.2 in December from 55.2 in November. The index remains above 50 for the fifth month in a row, indicating continuing recovery of growth after contracting in July related to the EU referendum. The index was is expected to drop to 54.7. The growth rate was also sharper than the 20-year long-term average.

The increase in new orders was the strongest since July 2015. Employment rose in a constant pace since November, at seven-month high, and the mood in relation to the 12-month outlook strengthened, despite ongoing uncertainty regarding Brexit and European elections. Price pressures remain elevated at the end of 2016. Purchasing prices rose the second fastest pace since April 2011. As a result, providers have raised their own costs at the fastest pace since April 2011.

Eurozone producer prices rose for the first time since mid-2013 in November, showed on Thursday Eurostat data. In November, producer prices unexpectedly rose 0.1 percent from a year earlier, after falling 0.4 percent in October. It was the first annual increase since June 2013, when prices rose by 0.2 percent. Economists had forecast a drop of 0.1 percent.

Shares of Persimmon increased by more than 5.5 percent. The company reported revenue of £ 3,14 billion ($ 3.86 billion), an increase of 8 percent for the full year.

Bellway, another UK developer, was also among the best performers, its market capitalization has increased by more than 3.5 percent.

Shares of insurance companies were among the outsiders after JP Morgan cut its estimates for several companies in the sector, including RSA Insurance Group, whose stock fell more than 2 percent.

Shares of Deutsche Bank rose 2 percent after the German lender agreed to pay $ 95 million to settle a lawsuit with the US government, accused the bank of tax evasion.

At the moment:

FTSE 7186.23 -3.51 -0.05%

DAX 11572.14 -12.17 -0.11%

CAC 4898.96 -0.44 -0.01%

WIG20 index opened at 1994.72 points (-0.26%)*

WIG 52664.38 -0.17%

WIG30 2288.81 -0.23%

mWIG40 4229.91 -0.03%

*/ - change to previous close

The cash market began from a discount with the turnover focused on the shares of PGNiG (WSE: PGN) losing as a result of the reduction of gas prices in retail tariffs. The German DAX also opened so poorly. The level of 2,000 points still remains unassailable, although we are in the process of testing the main resistance on the WIG20.

After fifteen minutes of trading the WIG20 index was at the level of 1,993 points (-0,31%).

Wednesday's session on the New York stock exchange ended with increases in the major indexes. The Dow Jones Industrial rose at the close of 0.30 percent, the S&P 500 was firmer by 0.57 percent and the Nasdaq Comp. went up by 0.88 percent.

The minutes published after the December meeting of the Federal Reserve indicates that its members can raise growth forecasts for the US economy because of the prospect of fiscal loosening. At the same time, however, some members indicated that further strengthening of the dollar could have a negative impact on inflation and this fact has been noticed by investors. As a result, weakens the dollar, more expensive are raw materials and rising Asian stock markets, outside Tokyo, where the Nikkei index lost due to the strengthening of the yen. Also helps good data from China, better PMI for the services sector and stronger yuan.

Therefore, it is particularly favorable environment for emerging markets and can help to defeat the level of 2,000 points by the WIG20 index.

In the case of the Polish market, today's session will be the last before a long weekend.

European stock markets charged higher again on Tuesday, closing at a fresh one-year high after upbeat Chinese and U.S. manufacturing data fueled optimism over economic growth in the world's two largest economies.

U.S. stocks closed just shy of record levels on Wednesday following the release of the Federal Reserve's policy minutes from its December meeting and a strong showing in auto sales.

Asian equities started Thursday's session largely higher, building on start-of-the-year strength as U.S. stocks continued to gain overnight, though Japan equities retreated slightly after their stout kickoff to 2017.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.