- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major US stock indexes rose moderately, as results exceeded expectations Estee Lauder and Ralph Lauren spurred optimism about corporate reporting in anticipation of the long-awaited US President's report to Congress on the situation in the country.

Trump's speech before the Congress should take place at 02:00 GMT on Wednesday. Market participants will listen carefully to Trump's speech, hoping to find out the latest news about trade negotiations with China and the wall on the border with Mexico. Earlier it was reported that the American president is considering the use of emergency powers to fulfill his promise to finance the wall on the border with Mexico. Trump agreed to stop the 35-day partial closure of the federal government (“shatdaun”) last week, without receiving the necessary $ 5.7 billion for the construction of the wall.

The focus of market participants was also on US data. A report by the Institute for Supply Management (ISM) pointed to a slowdown in business growth in the services sector last month. The index of business activity in the service sector from ISM fell in January to 56.7 points compared to 58.0 points in December. Analysts predicted that the index will drop to 57.2 points. A value greater than 50 is usually considered as an indicator of growth in production activity.

Separate data showed that the US economic optimism index, calculated by Investor's Business Daily newspaper and TechnoMetrica Institute of Policy and Politics, fell in February to 50.3 points from 52.3 points in January and reached its lowest level since October 2017. Experts expected the index to rise to 53.1 points. It is worth emphasizing that the index is above the level of 50 points for 29 months in a row (since October 2016), which is the longest series in the entire history of this study, that is, more than a decade. At the same time, the index is now 2.3 points higher than its long-term average value and 2.3 points higher than the indicator of December 2007, when the economy entered a recession.

Most of the components of DOW finished trading in positive territory (18 out of 30). The growth leader was the shares of The Boeing Co. (BA, + 3.18%). Pfizer Inc. shares turned out to be an outsider. (PFE, -0.66%).

All sectors of the S & P recorded an increase. The largest growth was shown by the service sector (+ 0.9%).

At the time of closing:

Dow 25,411.52 +172.15 +0.68%

S & P 500 2,737.66 +12.79 +0.47%

Nasdaq 100 7,402.08 +54.55 +0.74%

U.S. stock-index rose on Tuesday, as market participants continued to assess corporate earnings, while awaiting President Donald Trump’s State of the Union address.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,844.45 | -39.32 | -0.19% |

Hang Seng | - | - | - |

Shanghai | - | - | - |

S&P/ASX | 6,005.90 | +114.70 | +1.95% |

FTSE | 7,128.56 | +94.43 | +1.34% |

CAC | 5,054.09 | +53.90 | +1.08% |

DAX | 11,296.74 | +120.16 | +1.08% |

Crude | $53.89 | -1.23% | |

Gold | $1,319.00 | -0.02% |

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 49.15 | 0.04(0.08%) | 3103 |

Amazon.com Inc., NASDAQ | AMZN | 1,645.38 | 12.07(0.74%) | 43143 |

Apple Inc. | AAPL | 172.5 | 1.25(0.73%) | 237564 |

AT&T Inc | T | 29.69 | 0.08(0.27%) | 23566 |

Boeing Co | BA | 400.5 | 3.50(0.88%) | 41701 |

Caterpillar Inc | CAT | 131.52 | 0.64(0.49%) | 7211 |

Chevron Corp | CVX | 119.31 | -0.43(-0.36%) | 3240 |

Cisco Systems Inc | CSCO | 47.43 | 0.08(0.17%) | 3250 |

Citigroup Inc., NYSE | C | 64.38 | 0.32(0.50%) | 2706 |

Exxon Mobil Corp | XOM | 74.84 | 0.02(0.03%) | 19147 |

Facebook, Inc. | FB | 169.3 | 0.05(0.03%) | 102638 |

FedEx Corporation, NYSE | FDX | 183 | 0.27(0.15%) | 527 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.96 | 0.10(0.84%) | 3550 |

General Electric Co | GE | 10.24 | 0.03(0.29%) | 75757 |

General Motors Company, NYSE | GM | 39.01 | 0.08(0.21%) | 1706 |

Google Inc. | GOOG | 1,114.01 | -18.79(-1.66%) | 46135 |

Home Depot Inc | HD | 186.35 | -0.08(-0.04%) | 261 |

HONEYWELL INTERNATIONAL INC. | HON | 148.39 | 0.46(0.31%) | 581 |

Intel Corp | INTC | 49.09 | -0.13(-0.26%) | 8964 |

International Business Machines Co... | IBM | 135.75 | 0.56(0.41%) | 8153 |

Johnson & Johnson | JNJ | 133.15 | 0.27(0.20%) | 740 |

JPMorgan Chase and Co | JPM | 104.4 | 0.15(0.14%) | 4385 |

McDonald's Corp | MCD | 178.4 | 0.85(0.48%) | 2414 |

Merck & Co Inc | MRK | 77.59 | 0.72(0.94%) | 5415 |

Microsoft Corp | MSFT | 105.9 | 0.16(0.15%) | 37470 |

Nike | NKE | 82.1 | 0.11(0.13%) | 2753 |

Pfizer Inc | PFE | 42.4 | -0.04(-0.09%) | 1260 |

Procter & Gamble Co | PG | 97.97 | -0.06(-0.06%) | 874 |

Starbucks Corporation, NASDAQ | SBUX | 67.75 | 0.17(0.25%) | 1501 |

Tesla Motors, Inc., NASDAQ | TSLA | 312.8 | -0.09(-0.03%) | 43668 |

The Coca-Cola Co | KO | 49.42 | 0.17(0.35%) | 1276 |

Twitter, Inc., NYSE | TWTR | 34.4 | 0.46(1.36%) | 110637 |

United Technologies Corp | UTX | 120 | 0.86(0.72%) | 506 |

UnitedHealth Group Inc | UNH | 268.37 | 0.16(0.06%) | 570 |

Verizon Communications Inc | VZ | 54.1 | 0.06(0.11%) | 520 |

Visa | V | 142 | 0.50(0.35%) | 9348 |

Wal-Mart Stores Inc | WMT | 95.23 | 0.46(0.49%) | 4654 |

Walt Disney Co | DIS | 112.5 | 0.70(0.63%) | 27264 |

Yandex N.V., NASDAQ | YNDX | 34.19 | -0.07(-0.20%) | 12302 |

American Intl (AIG) initiated with a Neutral at Credit Suisse; target $46

Tesla (TSLA) target lowered to $283 from $291 at Morgan Stanley

Boeing (BA) target raised to $459 from $435 at Bernstein

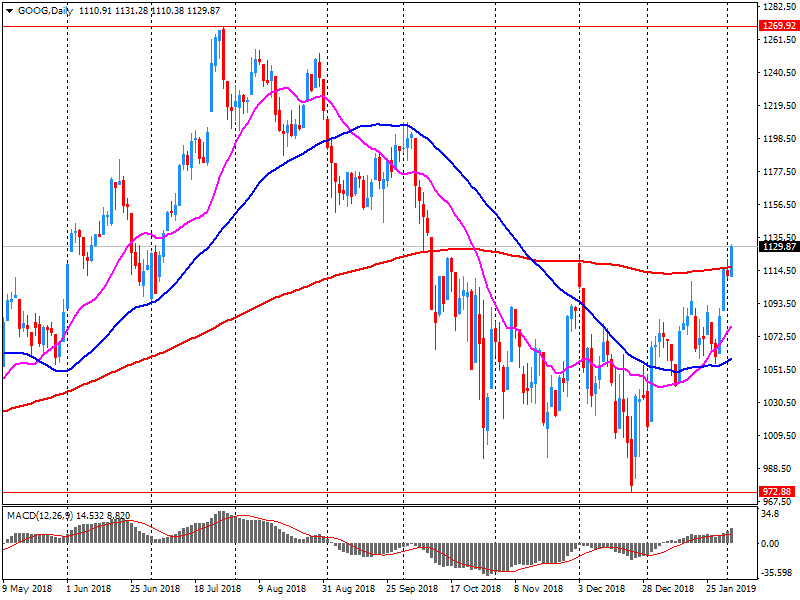

Alphabet (GOOG) reported Q4 FY 2018 earnings of $10.95 per share (versus $9.70 in Q4 FY 2017), beating analysts’ consensus estimate of $10.91.

The company’s quarterly revenues amounted to $39.276 bln (+21.5% y/y), beating analysts’ consensus estimate of $38.911 bln.

GOOG fell to $1,106.00 (-2.37%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 95.38 | 20883.77 | 0.46 |

| Hang Seng | 59.47 | 27990.21 | 0.21 |

| ASX 200 | 28.4 | 5891.2 | 0.48 |

| FTSE 100 | 13.91 | 7034.13 | 0.2 |

| DAX | -4.08 | 11176.58 | -0.04 |

| Dow Jones | 175.48 | 25239.37 | 0.7 |

| S&P 500 | 18.34 | 2724.87 | 0.68 |

| NASDAQ Composite | 83.67 | 7347.54 | 1.15 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.