- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -139.55 21042.09 -0.66%

TOPIX -13.55 1694.79 -0.79%

Hang Seng -697.06 29886.39 -2.28%

CSI 300 +1.64 4018.10 +0.04%

Euro Stoxx 50 +30.57 3355.32 +0.92%

FTSE 100 +46.08 7115.98 +0.65%

DAX +177.16 12090.87 +1.49%

CAC 40 +30.65 5167.23 +0.60%

DJIA +336.70 24874.76 +1.37%

S&P 500 +29.69 2720.94 +1.10%

NASDAQ +72.84 7330.70 +1.00%

S&P/TSX +156.69 15541.28 +1.02%

The main US stock indices grew strongly, which was facilitated by the fading fears that the threat of President Donald Trump to impose high tariffs on imports of steel and aluminum would cause a global trade war.

In addition, the focus was on statistics for the United States. As it became known, business activity in the US services sector expanded sharply in February, according to the latest PMI data. The increase in production volume accelerated to a maximum since August 2017. In addition, customer demand has led to a sharp increase in new orders, which have grown as much as almost three years. The pressure of capacity has increased due to the growth in demand, while the unfinished production has grown to the maximum extent since March 2015. Meanwhile, the inflation of both procurement and holiday prices has accelerated, and the fastest pace since June 2015. The seasonally adjusted final US business activity index from IHS Markit rose to 55.9 in February, up from 53.3 in January. After falling to a nine-month low in the previous survey period, the pace of expansion of business activity was the fastest since August 2017.

At the same time, the index of business activity in the US services sector, calculated by the Institute for Supply Management (ISM), fell to 59.5 points in February, compared with 59.9 points in January. Analysts predicted that the figure will drop to 59.0 points. Recall, the indicator is the result of a survey of about 400 firms from 60 sectors across the US. A value greater than 50 is usually considered an indicator of the growth of production activity.

Almost all components of the DOW index finished trading in positive territory (29 out of 30). Caterpillar Inc. was the growth leader. (CAT, + 3.37%). Outsider were the shares of NIKE, Inc. (NKE, -1.06%).

All sectors of S & P recorded a rise. The conglomerate sector grew most (+ 2.8%).

At closing:

Dow + 1.37% 24.874.76 +336.70

Nasdaq + 1.00% 7.330.70 +72.84

S & P + 1.10% 2,720.94 +29.69

U.S. stock-index futures tumbled on Friday, as investors continued fretting about the potential for a trade war, following the U.S. President Trump's decision to impose tariffs on steel and aluminum imports, which was announced on Thursday.

Global Stocks:

Nikkei 21,042.09 -139.55 -0.66%

Hang Seng 29,886.39 -697.06 -2.28%

Shanghai 3,257.53 +3.00 +0.09%

S&P/ASX 5,895.00 -33.90 -0.57%

FTSE 7,085.84 +15.94 +0.23%

CAC 5,147.69 +11.11 +0.22%

DAX 12,004.68 +90.97 +0.76%

Crude $61.30 (+0.08%)

Gold $1,323.00 (-0.03%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 230 | -0.37(-0.16%) | 960 |

| ALTRIA GROUP INC. | MO | 62.79 | 0.24(0.38%) | 1463 |

| Amazon.com Inc., NASDAQ | AMZN | 1,500.00 | -0.25(-0.02%) | 68923 |

| AMERICAN INTERNATIONAL GROUP | AIG | 56.52 | 0.01(0.02%) | 260 |

| Apple Inc. | AAPL | 175.8 | -0.41(-0.23%) | 182725 |

| AT&T Inc | T | 36.31 | -0.04(-0.11%) | 6173 |

| Barrick Gold Corporation, NYSE | ABX | 11.61 | 0.07(0.61%) | 5112 |

| Boeing Co | BA | 341.36 | -3.31(-0.96%) | 24802 |

| Caterpillar Inc | CAT | 145.76 | -0.62(-0.42%) | 9627 |

| Chevron Corp | CVX | 110.88 | -0.76(-0.68%) | 541 |

| Cisco Systems Inc | CSCO | 43.99 | -0.07(-0.16%) | 15063 |

| Citigroup Inc., NYSE | C | 73.4 | -0.28(-0.38%) | 1075 |

| Exxon Mobil Corp | XOM | 75.6 | 0.05(0.07%) | 4332 |

| Facebook, Inc. | FB | 176.73 | 0.11(0.06%) | 63626 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.35 | 0.03(0.16%) | 5687 |

| General Electric Co | GE | 14.2 | 0.08(0.57%) | 149670 |

| General Motors Company, NYSE | GM | 37.68 | 0.25(0.67%) | 9257 |

| Goldman Sachs | GS | 256.98 | -1.14(-0.44%) | 2637 |

| Google Inc. | GOOG | 1,078.00 | -0.92(-0.09%) | 7459 |

| Home Depot Inc | HD | 177.86 | -0.60(-0.34%) | 4951 |

| HONEYWELL INTERNATIONAL INC. | HON | 148.09 | -0.05(-0.03%) | 631 |

| Intel Corp | INTC | 48.95 | -0.03(-0.06%) | 18338 |

| JPMorgan Chase and Co | JPM | 112.75 | -0.57(-0.50%) | 5844 |

| McDonald's Corp | MCD | 148.25 | -0.02(-0.01%) | 6658 |

| Microsoft Corp | MSFT | 92.92 | -0.13(-0.14%) | 59527 |

| Nike | NKE | 65.74 | -0.15(-0.23%) | 4013 |

| Procter & Gamble Co | PG | 79.57 | 0.07(0.09%) | 681 |

| Tesla Motors, Inc., NASDAQ | TSLA | 334.82 | -0.30(-0.09%) | 20205 |

| The Coca-Cola Co | KO | 43.8 | 0.08(0.18%) | 254 |

| Twitter, Inc., NYSE | TWTR | 32.88 | -0.12(-0.36%) | 38592 |

| United Technologies Corp | UTX | 129.87 | -0.07(-0.05%) | 746 |

| UnitedHealth Group Inc | UNH | 224.6 | -0.59(-0.26%) | 257 |

| Verizon Communications Inc | VZ | 48.15 | -0.11(-0.23%) | 1242 |

| Visa | V | 120.76 | -0.01(-0.01%) | 3917 |

| Wal-Mart Stores Inc | WMT | 88.57 | -0.20(-0.23%) | 10619 |

| Walt Disney Co | DIS | 102.9 | -0.09(-0.09%) | 2547 |

| Yandex N.V., NASDAQ | YNDX | 41.35 | 0.09(0.22%) | 2665 |

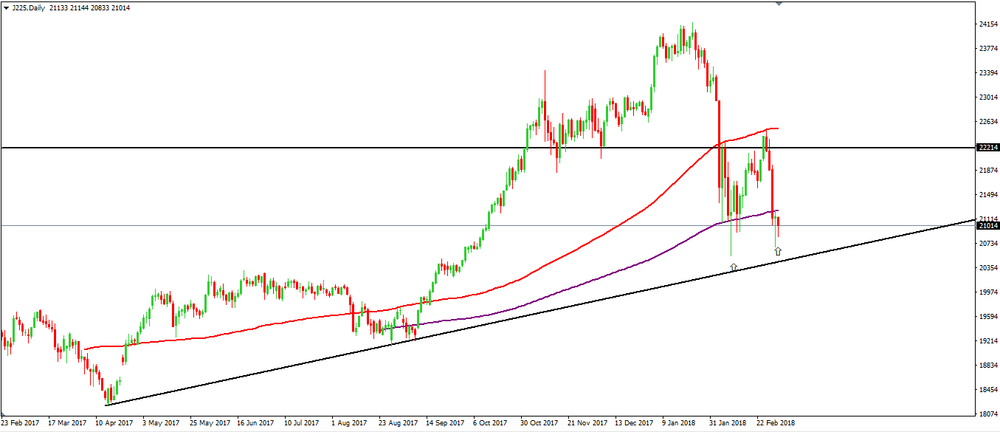

Nikkei 225 on daily time frame chart we can see that the price is showing some rejections of more downside movements, and simultaneously reject above the upside trend line.

Therefore, it may be interesting to enter long in this index once the price remains above the trend line.

Our suggestions is to put the stop-loss below the trend line and the take profit close to the previous highs or for the more conservative people, near the support line at which the price has had some difficulty going through.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.