- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

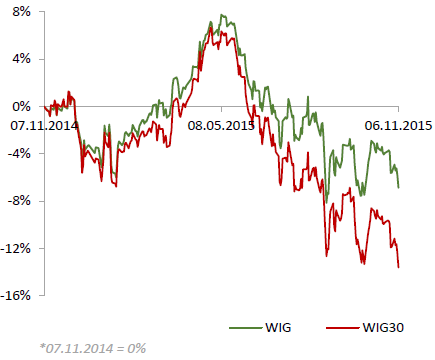

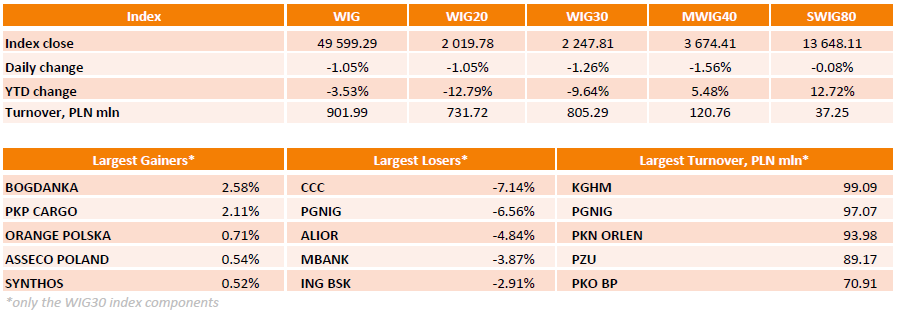

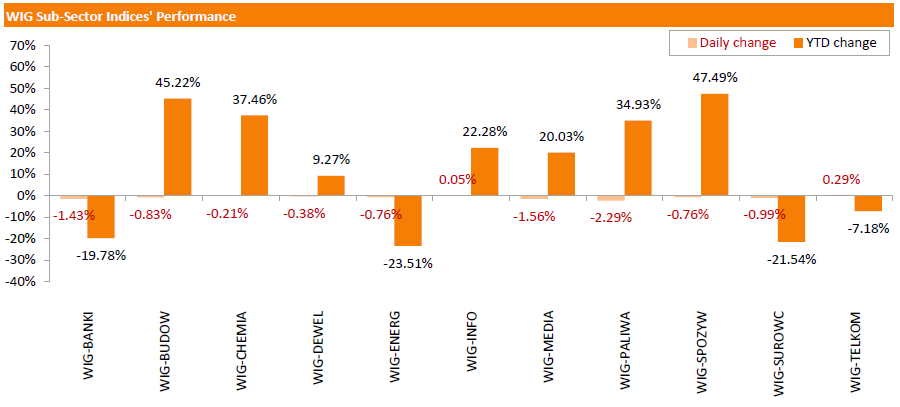

Polish equities declined on Friday. The broad market benchmark, the WIG Index, lost 1.05%. Most sectors fell, with oil and gas sector stocks (-2.29%) posting the sharpest drop.

The large-cap stocks plunged by 1.26%, as measured by the WIG30 Index. Within the index components, CCC (WSE: CCC) and PGNIG (WSE: PGN) were the biggest laggards, plunging by 7.14% and 6.56% respectively after publishing quarterly reports. The former reported Q3 net income of PLN 33.8 mln, beating consensus of PLN 31.1 mln.; the company, however, lowered its full year 2015 expectations. The latter posted Q3 profit of PLN 291 mln versus consensus of PLN 512.7 mln. All banking sector names, but for PKO BP (WSE: PKO; +0.32%) also suffered steep losses, tumbling by 1.09%-4.84% as stronger USD is seen unfavorable for them. At the same time, BOGDANKA (WSE: LWB) and PKP CARGO (WSE: PKP) led a handful of gainers, advancing by 2.58% and 2.11% respectively.

Major U.S. stock-indexes near zero level on Friday after a stronger-than-expected October jobs report boost prospects that the Federal Reserve will raise interest rates next month.

The Labor Department's report showed nonfarm payrolls increased by 271,000 in October, beating the 180,000 expected. Data for August and September were revised to show 12,000 more jobs on average were created than previously reported. The unemployment rate fell to 5.0%, the lowest since April 2008, from 5.1% in September. The jobless rate is now at a level many Fed officials view as consistent with full employment.

Most of Dow stocks in negative area (20 of 30). Top looser - Chevron Corporation (CVX, -2.24%). Top gainer - The Goldman Sachs Group, Inc. (GS, +3.21%).

Most of S&P index sectors in negative area. Top gainer - Conglomerates (+3,2%). Top looser - Utilities (-3.6%).

At the moment:

Dow 17769.00 -33.00 -0.19%

S&P 500 2085.25 -8.75 -0.42%

Nasdaq 100 4693.25 -2.00 -0.04%

Oil 44.58 -0.62 -1.37%

Gold 1086.70 -17.50 -1.58%

U.S. 10yr 2.34 +0.09

U.S. stock-index futures declined.

Global Stocks:

Nikkei 19,265.6 +149.19 +0.78%

Hang Seng 22,867.33 -183.71 -0.80%

Shanghai Composite 3,589.76 +66.94 +1.90%

FTSE 6,355.48 -9.42 -0.15%

CAC 4,951.92 -28.12 -0.56%

DAX 10,923.2 +35.46 +0.33%

Crude oil $45.29 (+0.20%)

Gold $1093.60 (-0.96%)

(company / ticker / price / change, % / volume)

| JPMorgan Chase and Co | JPM | 68.00 | 2.35% | 62.7K |

| Citigroup Inc., NYSE | C | 55.30 | 2.12% | 1.2K |

| Goldman Sachs | GS | 195.40 | 1.76% | 0.1K |

| AMERICAN INTERNATIONAL GROUP | AIG | 62.84 | 1.35% | 1.1K |

| International Business Machines Co... | IBM | 139.49 | 0.65% | 0.3K |

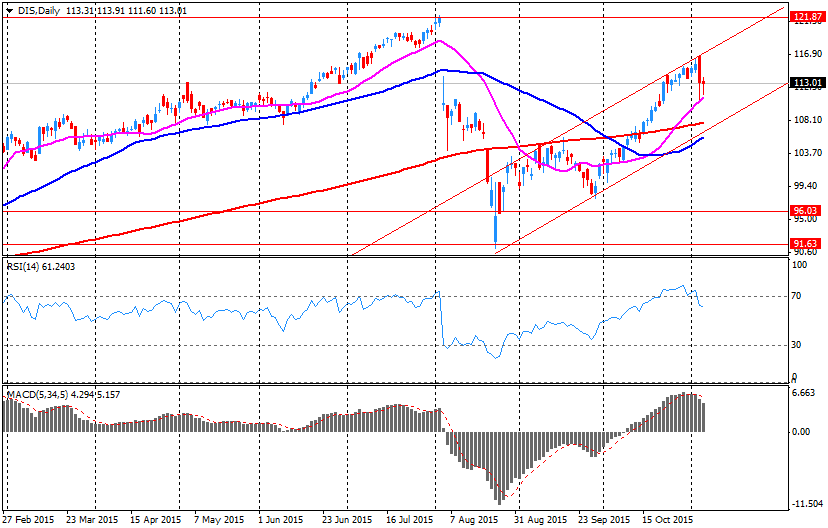

| Walt Disney Co | DIS | 113.65 | 0.58% | 31.5K |

| Travelers Companies Inc | TRV | 114.54 | 0.50% | 1K |

| Apple Inc. | AAPL | 121.48 | 0.46% | 120.3K |

| American Express Co | AXP | 74.10 | 0.23% | 1.4K |

| Facebook, Inc. | FB | 109.00 | 0.22% | 10.5K |

| Nike | NKE | 132.04 | 0.14% | 2.3K |

| Twitter, Inc., NYSE | TWTR | 28.70 | 0.14% | 12.7K |

| Wal-Mart Stores Inc | WMT | 58.68 | 0.12% | 0.5K |

| Visa | V | 79.30 | 0.05% | 0.1K |

| Amazon.com Inc., NASDAQ | AMZN | 656.00 | 0.05% | 13.5K |

| Cisco Systems Inc | CSCO | 28.44 | 0.04% | 0.5K |

| Microsoft Corp | MSFT | 54.40 | 0.04% | 1.1K |

| 3M Co | MMM | 158.99 | 0.00% | 37.0K |

| Pfizer Inc | PFE | 34.15 | 0.00% | 0.1K |

| ALCOA INC. | AA | 9.20 | 0.00% | 3.9K |

| Starbucks Corporation, NASDAQ | SBUX | 62.28 | 0.00% | 3.3K |

| E. I. du Pont de Nemours and Co | DD | 64.79 | -0.03% | 0.2K |

| Chevron Corp | CVX | 94.50 | -0.05% | 6.9K |

| Ford Motor Co. | F | 14.56 | -0.07% | 4.4K |

| Procter & Gamble Co | PG | 76.33 | -0.08% | 2.2K |

| Caterpillar Inc | CAT | 74.15 | -0.09% | 0.2K |

| Verizon Communications Inc | VZ | 46.15 | -0.11% | 0.1K |

| AT&T Inc | T | 33.30 | -0.12% | 2.8K |

| Home Depot Inc | HD | 125.57 | -0.12% | 0.1K |

| McDonald's Corp | MCD | 112.72 | -0.12% | 8.1K |

| Boeing Co | BA | 147.78 | -0.13% | 0.2K |

| General Electric Co | GE | 29.59 | -0.17% | 12.3K |

| Exxon Mobil Corp | XOM | 84.62 | -0.22% | 6.5K |

| Merck & Co Inc | MRK | 54.90 | -0.27% | 7.2K |

| Intel Corp | INTC | 33.90 | -0.29% | 2.0K |

| UnitedHealth Group Inc | UNH | 115.89 | -0.29% | 0.8K |

| Google Inc. | GOOG | 729.14 | -0.29% | 8.2K |

| General Motors Company, NYSE | GM | 35.33 | -0.31% | 1.8K |

| Johnson & Johnson | JNJ | 102.00 | -0.32% | 0.1K |

| Yandex N.V., NASDAQ | YNDX | 15.69 | -0.32% | 0.5K |

| Tesla Motors, Inc., NASDAQ | TSLA | 231.00 | -0.33% | 1.6K |

| Yahoo! Inc., NASDAQ | YHOO | 35.00 | -0.34% | 16.2K |

| The Coca-Cola Co | KO | 42.12 | -0.50% | 1.1K |

| ALTRIA GROUP INC. | MO | 57.70 | -0.60% | 1.8K |

| United Technologies Corp | UTX | 100.02 | -0.77% | 0.1K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.35 | -1.13% | 0.5K |

| Barrick Gold Corporation, NYSE | ABX | 7.05 | -4.21% | 3.1K |

Upgrades:

Downgrades:

Other:

Facebook (FB) target raised to $130 from $115 at Argus

HP Inc. (HPQ) initiated with a Buy at Brean Capital

U.S. stock indices edged lower on Thursday as investors were cautious ahead of a key jobs report, which could determine the Federal Reserve's decision at the next meeting.

The Dow Jones Industrial Average slid 4.15 points, or less than 0.1%, to 17,863.43. The S&P 500 lost 2.38 points, or 0.1%, to 2,099.93 (seven out of its 10 sectors fell with energy, utilities and materials leading declines). The Nasdaq Composite fell 14.74 points, or 0.3%, to 5,127.74.

According to the Labor Department the number of Americans who applied for unemployment benefits rose by 16,000 to 276,000 at the end of October marking the highest level in two months. Economists had expected 262,000 claims.

This morning in Asia Hong Kong Hang Seng fell 0.82%, or 189.84, to 22,861.2. China Shanghai Composite Index gained 0.52%, or 18.20, to 3.541.02. The Nikkei 225 rose 0.43%, or 81.53, to 19,197.94.

Asian indices are mixed. Japanese stocks rose due to a relatively weaker yen ahead of U.S. employment data. Recent comments by Fed officials intensified expectations for a rate hike in December pushing the dollar up against the yen.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.