- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major stock indexes in Wall Street closed higher for a third day, helped by growth in health care stocks and technology stocks.

As shown by the preliminary results of research presented by Thomson-Reuters and Institute of Michigan in December, US consumers felt more optimistic about the economy than last month. According to the data, in December consumer sentiment index rose to 98 points versus 93.8 points last month. It was predicted that the index was 94.5 points. Recall, the index is a leading indicator of consumer sentiment. The indicator is calculated by adding 100 to the difference between the number of optimists and pessimists, expressed as a percentage.

At the same time, wholesale inventories in the US fell, as previously reported, in October, amid the surge in sales, supporting the view that investment in inventories would provide a modest boost to economic growth in the fourth quarter. The Commerce Department reported Friday that wholesale inventories fell 0.4% after rising 0.1% in September.

Oil prices added about one percent, as investors remain optimistic before the meeting of the major oil-producing countries on the reduction of production, which will be held tomorrow. On Saturday, the ministers of oil from OPEC countries will meet with the producers, not OPEC, to ask for help in the fight against global glut the market. Recall at the meeting of November 30, participants of the cartel agreed to cut production in January by 1.2 million barrels a day to 32.5 million barrels.

DOW index components closed mostly in positive territory (25 of 30). Most remaining shares rose Pfizer Inc. (PFE, + 2.52%). Outsider were shares of Caterpillar Inc. (CAT, -0.66%).

Most of the S & P sectors recorded increase. The leader turned out to be the health sector (+ 1.3%). Most of the basic materials sector fell (-0.3%).

Major U.S. stock-indexes hit a trifecta of records for the third day in a row on Friday as the month-long post-election rally got a boost from healthcare and technology stocks. The three main U.S. stock indexes have hit a series of record highs as investors piled into sectors such as banks and industrials, betting that President-elect Donald Trump would usher in a business-friendly environment.

Most of Dow stocks in positive area (19 of 30). Top gainer - The Coca-Cola Company (KO, +2.87%). Top loser - Caterpillar Inc. (CAT, -0.69%).

Most S&P sectors also in positive area. Top gainer - Healthcare (+1.4%). Top loser - Basic Materials (-0.4%).

At the moment:

Dow 19627.00 +63.00 +0.32%

S&P 500 2247.50 +5.00 +0.22%

Nasdaq 100 4885.25 +23.00 +0.47%

Oil 51.42 +0.58 +1.14%

Gold 1162.90 -9.50 -0.81%

U.S. 10yr 2.46 +0.08

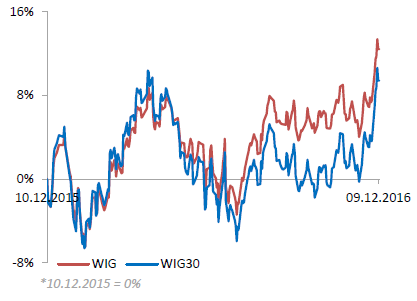

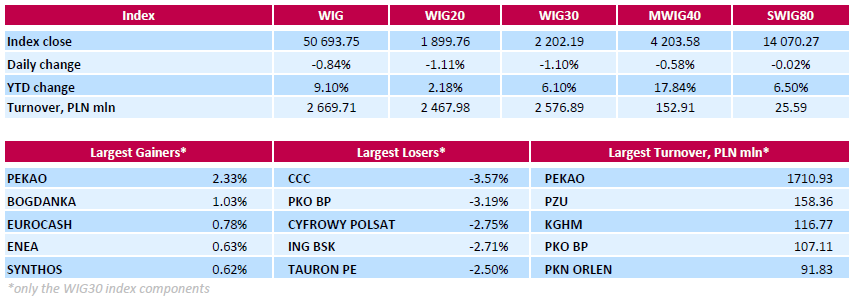

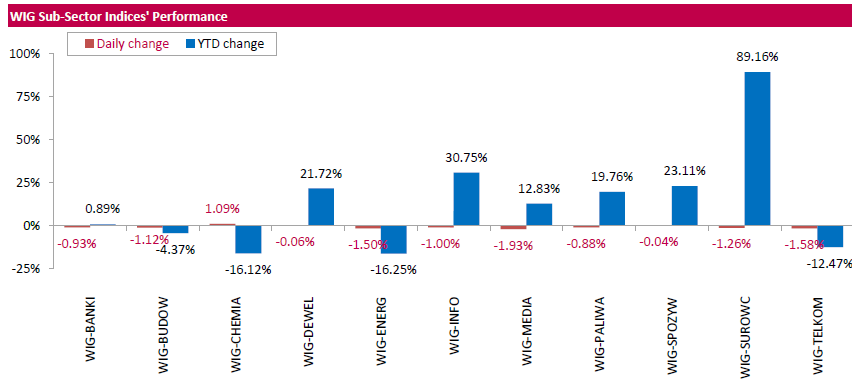

Polish equity market closed lower on Friday. The broad market measure, the WIG index, lost 0.84%. All sectors, but for chemicals (+1.09%), were down, with media (-1.93%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.10%. Within the WIG30 Index components, footwear retailer CCC (WSE: CCC) and bank PKO BP (WSE: PKO) recorded the biggest declines, slumping by 3.57% and 3.19%. They were followed by media group CYFROWY POLSAT (WSE: CPS), bank ING BSK (WSE: ING) and genco TAURON PE (WSE: TPE), dropping by 2.75%, 2.71% and 2.5% respectively. On the other side of the ledger, bank PEKAO (WSE: PEO) and thermal coal miner BOGDANKA (WSE: LWB) led a handful of advancers, gaining a respective 2.33% and 1.03%.

On the threshold of the final hours of the session, the Warsaw market takes on greater distance to the core markets and the WIG20 index is unresponsive to attempts to increases in the US and Germany. The reason may be the Polish zloty, losing before the weekend both to the dollar and to the euro. As a result, going into the last hour of the week the WIG20 lost 1.4 percent and locate below 1,900 points. In the index on positive territory there are only three companies, including the heavily played today, Bank Pekao.

An hour before the close of trading WIG20 index was at the level of 1,894 points (-1.40%).

U.S. stock-index futures advanced as the Trump rally continued and oil prices rebounded.

Global Stocks:

Nikkei 18,996.37 +230.90 +1.23%

Hang Seng 22,760.98 -100.86 -0.44%

Shanghai 3,232.07 +16.70 +0.52%

FTSE 6,944.11 +12.56 +0.18%

CAC 4,758.17 +22.69 +0.48%

DAX 11,186.87 +7.45 +0.07%

Crude $51.39 (+1.08%)

Gold $1,169.60 (-0.24%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 31.3 | -0.01(-0.0319%) | 353 |

| Amazon.com Inc., NASDAQ | AMZN | 769.27 | 1.94(0.2528%) | 6946 |

| AMERICAN INTERNATIONAL GROUP | AIG | 66 | 0.18(0.2735%) | 1399 |

| Apple Inc. | AAPL | 112.35 | 0.23(0.2051%) | 43985 |

| AT&T Inc | T | 40.2 | -0.21(-0.5197%) | 3971 |

| Barrick Gold Corporation, NYSE | ABX | 15.8 | -0.12(-0.7538%) | 104984 |

| Cisco Systems Inc | CSCO | 30.1 | 0.15(0.5008%) | 2871 |

| Deere & Company, NYSE | DE | 103.17 | -0.75(-0.7217%) | 1042 |

| Exxon Mobil Corp | XOM | 88.35 | 0.03(0.034%) | 2561 |

| Facebook, Inc. | FB | 119.15 | 0.24(0.2018%) | 50873 |

| Ford Motor Co. | F | 13 | -0.03(-0.2302%) | 16205 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.8 | 0.20(1.2821%) | 202523 |

| Goldman Sachs | GS | 241.01 | -0.44(-0.1822%) | 47559 |

| Google Inc. | GOOG | 778.65 | 2.23(0.2872%) | 1716 |

| Hewlett-Packard Co. | HPQ | 16.01 | -0.15(-0.9282%) | 300 |

| Intel Corp | INTC | 35.85 | 0.15(0.4202%) | 4087 |

| International Business Machines Co... | IBM | 164.95 | -0.41(-0.2479%) | 793 |

| JPMorgan Chase and Co | JPM | 85.1 | -0.02(-0.0235%) | 16093 |

| Microsoft Corp | MSFT | 61.02 | 0.01(0.0164%) | 34888 |

| Pfizer Inc | PFE | 31.1 | 0.16(0.5171%) | 3153 |

| Procter & Gamble Co | PG | 83.52 | 0.02(0.0239%) | 851 |

| Starbucks Corporation, NASDAQ | SBUX | 58.8 | 0.15(0.2558%) | 556 |

| Tesla Motors, Inc., NASDAQ | TSLA | 190.5 | -1.79(-0.9309%) | 8876 |

| The Coca-Cola Co | KO | 41.36 | 0.38(0.9273%) | 73475 |

| Twitter, Inc., NYSE | TWTR | 19.65 | 0.01(0.0509%) | 68622 |

| Verizon Communications Inc | VZ | 51.03 | -0.10(-0.1956%) | 479 |

| Visa | V | 79.31 | 0.03(0.0378%) | 2103 |

| Walt Disney Co | DIS | 103.15 | -0.23(-0.2225%) | 3559 |

| Yahoo! Inc., NASDAQ | YHOO | 41.58 | 0.17(0.4105%) | 601 |

| Yandex N.V., NASDAQ | YNDX | 20 | 0.05(0.2506%) | 11210 |

The morning phase of trading on the Warsaw Stock Exchange did not bring new content. The market is still focused on the shares of Pekao (more than half of the turnover among the WIG20 companies). Support at 1,900 points holds tight and we may talk about trying to stabilize above the psychological barrier of 1,900 points. The German DAX stabilizes after morning hesitance in the area of 11200 pts. and the zloty slightly weakened.

At the halfway point of today's trading WIG20 index was at the level of 1,910 points (-0,53%).

European stocks were little changed after a sharp rise the previous session. The market appreciates the recent decision of the European Central Bank, and investors focus on the meeting of the Federal Reserve next week.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,1%, to 352.43 points.

The Italian FTSE MIB stock index lost 1.1% during the trading session. Since the beginning of this week the value of the indicator soared by 6.7%, best week in five years.

The stock market virtually ignored the decision of the Italian Prime Minister Matteo Renzi to resign after constitutional reform was rejected in the referendum held on 4 December.

The European Central Bank had decided to extend quantitative easing (QE) to the end of 2017. Monthly volumes of purchase of assets within the framework of QE, however, will be reduced from April to 60 billion euros to 80 billion euros.

In addition, the ECB kept its benchmark interest rate unchanged at a record low, in line with expectations.

Against this backdrop, bank stocks rose sharply, but on Friday are correcting. Barclays shares fell by 2%, Lloyds Banking Group - 1,4%, Royal Bank of Scotland - 0,8%, HSBC - 0.2%.

Oil and mining companies rise slightly in the course of trading. BP shares increased by 0,2%, Total +0,4%, Antofagasta +0,3%, BHP Billiton +1.1%.

Shares of the German insurance company Allianz fell 0.4% after the Financial Services Authority (FCA) published Friday a proposal of rules and guidelines for insurance in case of insolvency.

Vivendi shares rose 2.1% after the French media group increased its stake in Ubisoft Entertainment to 25.15%, approaching the "hostile takeover."

At the moment:

FTSE 6937.97 6.42 0.09%

DAX 11147.95 -31.47 -0.28%

CAC 4740.93 5.45 0.12%

WIG20 index opened at 1916.66 points (-0.23%)*

WIG 51041.72 -0.16%

WIG30 2221.58 -0.23%

mWIG40 4232.75 0.11%

*/ - change to previous close

The last session of the week the Warsaw market begins in slightly weaker mood in relation to those of the previous four days. The WIG20 index on a "good day" gives what further gained yesterday on the final fixing. The correction for the time being mainly concerns Pekao, PGE and Tauron (WSE: TPE) but on the red side is the majority of shares. After all, it is difficult to treat this 0.4 percent revocation of the main index in terms of the decline taking into consideration the distance that the index beat up from last Friday. Again, we have a solid turnover, already PLN 150 million around the WIG20.

After twenty minutes of trading the WIG20 index was at the level of 1,914 points (-0,36%).

European stocks on Thursday closed at an 11-month high, with German stocks hitting a 2016 peak as the euro was yanked down, after the European Central Bank said it would continue buying government bonds through next year, but at a lower amount each month beginning in April.

European stocks on Thursday closed at an 11-month high, with German stocks hitting a 2016 peak as the euro was yanked down, after the European Central Bank said it would continue buying government bonds through next year, but at a lower amount each month beginning in April.

Asian currencies were hit Friday by a perceived easing by the European Central Bank, even as the Asian stock market reaction was mostly positive. The ECB said Thursday it would extend its bond-purchase program by nine months to the end of 2017, but cut its monthly purchases to €60 billion from €80 billion, as of April.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.