- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Hang Seng 27,718.2 +140.86 +0.51 %

S&P/ASX 200 5,625.2 -9.32 -0.17 %

Shanghai Composite 4,334.02 +128.10 +3.05 %

FTSE 100 7,029.85 -16.97 -0.24 %

CAC 40 5,027.87 -62.52 -1.23 %

Xetra DAX 11,673.35 -36.38 -0.31 %

S&P 500 2,105.33 -10.77 -0.51 %

NASDAQ Composite 4,993.57 -9.98 -0.20 %

Dow Jones Industrial Average 18,105.17 -85.94 -0.47 %

Polish equity market posted losses on Monday. The broad market measure - the WIG index fell by 0.2%, while the large liquid companies' indicator - the WIG30 index lost 0.35%.

Besides LPP (WSE: LPP) that lost 3.57%, the shares of KGHM (WSE: KGH) also went down significantly - by 2.16% as consolidated 1QFY2015 financials posted by KGHM International frustrated the market participants. In addition BZ WBK (WSE: BZW) dropped down rather significantly - by 1.92%. At the same time PKN ORLEN (WSE: PKN) recorded the highest growth among the WIG30 index components - 2.65%. It was followed by GRUPA AZOTY (WSE: ATT) and PGNIG (WSE: PGN), adding 1.81% each.

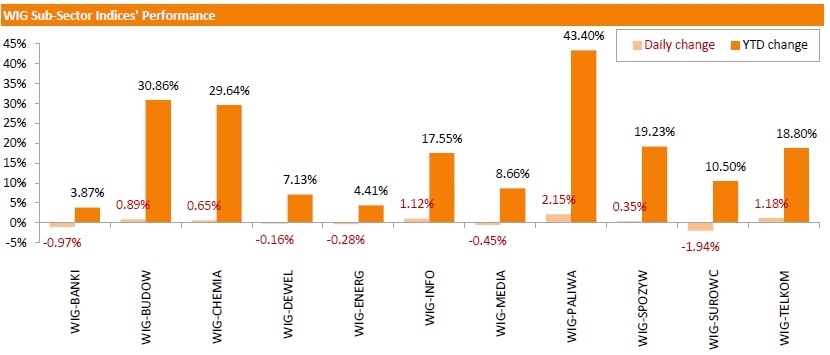

Among the WIG sub-sector indices the oil&gas names' indicator added the most (+2.15%). In the mean time, the indicators related to basic material producers (-1.94%) and the banks (-0.97%) underperformed.

Major U.S. stock-indexes mixed on Monday amid worries about Greece's precarious financial condition and slowing growth in China, while energy stocks fell on weaker oil prices.

Almost of the Dow stocks are trading in negative area (23 of 30). Top looser - Exxon Mobil Corporation (XOM, -2.11%). Top gainer - Caterpillar Inc. (CAT, +2.27%).

Almost all S&P index sectors also in negative area. Top gainer - Healthcare (+0,2%). Top looser - Basic materials (-1.0%).

At the moment:

Dow 18091.00 -30.00 -0.17%

S&P 500 2106.25 -2.25 -0.11%

Nasdaq 100 4446.50 -2.25 -0.05%

10-year yield 2.22% +0.07

Oil 59.12 -0.27 -0.45%

Gold 1182.90 -6.00 -0.50%

Stock indices closed lower on the Greek debt problem. The Eurogroup meeting is scheduled to be today. It is unlikely that the €7.2 billion tranche of loans will be unlocked at this meeting because there are still differences despite the progress of negotiations.

German Finance Minister Wolfgang Schaeuble said on Monday that a referendum on the Greek bailout in Greece may be helpful. "If the Greek government thinks it should have a referendum, then it should organize a referendum," he noted.

Schaeuble ruled out any deal between Greece and its creditors at today's Eurogroup meeting as "there is not sufficient progress".

Greece must repay the IMF €750 million loan on May 12. Athens said that it has enough money to pay the IMF this week.

European Central Bank Governing Council Member Ewald Nowotny said on Monday that the Greek debt crisis "is much more a political question than an economic question."

The Bank of England (BoE) released its interest rate decision on Monday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The interest rate decision was delayed because of last Thursday's parliamentary election in the U.K. The Conservative Party won enough seats to take a majority in parliament.

Low inflation and weak wages weighed on the BoE's interest rate decision.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,029.85 -16.97 -0.24 %

DAX 11,673.35 -36.38 -0.31 %

CAC 40 5,027.87 -62.52 -1.23 %

San Francisco Federal Reserve President John Williams told in an interview to CNBC on Monday that there are improvements in the labour market, but inflation is still low due to a stronger U.S. dollar.

Williams noted that the interest rate hike by the Fed will depend on the economic data, and he added that the Fed may raise its interest rate at every monetary policy meeting.

He expects the economy to bounce back in the second quarter.

The San Francisco Federal Reserve president pointed out that equities valuations are high, but he is not worried about financial stability. Williams added that the Fed should monitor developments in financial markets around the world.

Williams is a voting member of the Federal Open Market Committee this year.

The European Central Bank (ECB) purchased €13.65 billion of government bonds last week. The central bank said on Monday it had settled a total of €108.709 billion of purchases of government bonds as of May 8, up from €95.056 billion the previous week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB also said that it bought €2.9 billion of covered bonds last week, and €42 million of asset-backed securities. Covered bonds programmes totalled €77.976 billion, while asset-backed securities programmes totalled €5.827 billion.

European Central Bank Governing Council Member Ewald Nowotny said on Monday that the Greek debt crisis "is much more a political question than an economic question."

Nowotny offered no solution for the problem. He pointed out that the ECB's role was to ensure price and financial stability.

"We cannot substitute the political sphere," Nowotny said.

U.S. stock-index futures were little changed.

Global markets:

Nikkei 19,620.91 +241.72 +1.2%

Hang Seng 27,718.2 +140.86 +0.5%

Shanghai Composite 4,334.02 +128.10 +3.0%

FTSE 7,050.55 +3.73 +0.1%

CAC 5,034.21 -56.18 -1.1%

DAX 11,667.78 -41.95 -0.4%

Crude oil $59.53 (+0.22%)

Gold $1184.60 (-0.02%)

German Finance Minister Wolfgang Schaeuble said on Monday that a referendum on the Greek bailout in Greece may be helpful. "If the Greek government thinks it should have a referendum, then it should organize a referendum," he noted.

Schaeuble ruled out any deal between Greece and its creditors at today's Eurogroup meeting as "there is not sufficient progress".

(company / ticker / price / change, % / volume)

| Procter & Gamble Co | PG | 81.00 | +0.05% | 0.5K |

| Barrick Gold Corporation, NYSE | ABX | 12.76 | +0.08% | 12.6K |

| Exxon Mobil Corp | XOM | 88.38 | +0.14% | 8.2K |

| Twitter, Inc., NYSE | TWTR | 37.65 | +0.16% | 11.9K |

| UnitedHealth Group Inc | UNH | 115.90 | +0.19% | 3.4K |

| Wal-Mart Stores Inc | WMT | 78.71 | +0.23% | 22.8K |

| Boeing Co | BA | 145.87 | +0.28% | 4.7K |

| Deere & Company, NYSE | DE | 90.15 | +0.29% | 0.1K |

| General Motors Company, NYSE | GM | 35.43 | +0.31% | 2.1K |

| Walt Disney Co | DIS | 110.49 | +0.35% | 0.3K |

| Caterpillar Inc | CAT | 88.00 | +0.79% | 3.2K |

| HONEYWELL INTERNATIONAL INC. | HON | 103.00 | +0.86% | 0.3K |

| Cisco Systems Inc | CSCO | 29.57 | +1.16% | 41.0K |

| AT&T Inc | T | 33.69 | 0.00% | 0.1K |

| United Technologies Corp | UTX | 118.43 | 0.00% | 0.8K |

| ALCOA INC. | AA | 13.82 | 0.00% | 3.2K |

| International Business Machines Co... | IBM | 172.66 | -0.01% | 0.2K |

| Chevron Corp | CVX | 108.63 | -0.02% | 0.8K |

| Johnson & Johnson | JNJ | 101.45 | -0.02% | 0.1K |

| 3M Co | MMM | 160.55 | -0.03% | 0.5K |

| Starbucks Corporation, NASDAQ | SBUX | 49.75 | -0.06% | 1.3K |

| General Electric Co | GE | 27.34 | -0.08% | 23.5K |

| Facebook, Inc. | FB | 78.44 | -0.09% | 5.4K |

| Goldman Sachs | GS | 200.30 | -0.10% | 0.3K |

| Tesla Motors, Inc., NASDAQ | TSLA | 236.31 | -0.13% | 7.7K |

| Amazon.com Inc., NASDAQ | AMZN | 433.01 | -0.16% | 0.7K |

| Verizon Communications Inc | VZ | 50.05 | -0.18% | 4.9K |

| Microsoft Corp | MSFT | 47.66 | -0.19% | 3.0K |

| McDonald's Corp | MCD | 98.00 | -0.23% | 1.9K |

| E. I. du Pont de Nemours and Co | DD | 75.10 | -0.24% | 12.8K |

| Apple Inc. | AAPL | 127.32 | -0.24% | 131.8K |

| Ford Motor Co. | F | 15.63 | -0.26% | 6.9K |

| Citigroup Inc., NYSE | C | 53.87 | -0.28% | 4.7K |

| JPMorgan Chase and Co | JPM | 65.30 | -0.29% | 15.8K |

| Yahoo! Inc., NASDAQ | YHOO | 43.92 | -0.39% | 1.6K |

| Merck & Co Inc | MRK | 60.50 | -0.40% | 0.1K |

| Visa | V | 69.16 | -0.45% | 5.2K |

| Intel Corp | INTC | 32.65 | -0.46% | 62.2K |

European Central Bank (ECB) Vice President Vitor Constancio said on Friday that he did not the worst case for Greece. He added that the ECB is providing liquidity to the banks.

Constancio also said that he did not expect "excessive volatility in the bond market to continue".

Upgrades:

Caterpillar (CAT) upgraded from Neutral to Outperform at Robert W. Baird, target raised from $80 to $101

Downgrades:

Other:

The Bank of England (BoE) released its interest rate decision on Monday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The interest rate decision was delayed because of last Thursday's parliamentary election in the U.K. The Conservative Party won enough seats to take a majority in parliament.

Low inflation and weak wages weighed on the BoE's interest rate decision.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

Investors are awaiting the BoE Governor Mark Carney's inflation report on Wednesday and the minutes of the monetary policy committee (MPC). The minutes of the meeting will be released on May 20.

All members voted in April to keep the central bank's monetary policy unchanged, according to MPC's meeting minutes.

Most stock indices traded lower on the Greek debt crisis. The Eurogroup meeting is scheduled to be today. It is unlikely that the €7.2 billion tranche of loans will be unlocked at this meeting because there are still differences despite the progress of negotiations.

Greece must repay the IMF €750 million loan on May 12. Athens said that it has enough money to pay the IMF this week.

German finance minister Wolfgang Schaeuble warned over the weekend that Greece can slide into insolvency.

Current figures:

Name Price Change Change %

FTSE 100 7,063.99 +17.17 +0.2 %

DAX 11,646.11 -63.62 -0.5 %

CAC 40 5,016.06 -74.33 -1.5 %

The National Australia Bank (NAB) released its business consumer index for Australia on Monday. The business confidence index remained unchanged at 3 in April.

"Recent signs of improvement in the economic partials are encouraging but the non mining sector needs to lift more to offset the impact on domestic demand of sharply lower mining investment and the hit to income from commodity prices," the Chief Economist at NAB Alan Oster said.

National Australia Bank's index of business conditions fell to +4 in April from +6 in March.

The business sales was at +10 in April, while the index of employment declined to -2 in April from 0 in March.

The capital expenditure index decreased to +6 in April from +9 in March.

European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Friday that controls on the movement of capital may be helpful for countries in an emergency.

"They might be helpful as a temporary measure in some extreme situations," he noted.

Nowotny added that such measures proved to be efficient in the case of Cyprus.

The People's Bank of China (PBOC) cut its one-year lending rate by 25 basis points to 5.1% on Sunday. It lowered the benchmark deposit rate by 25 basis points to 2.25%. It was third interest rate cut in six months.

China's central bank noted that the country's economy is still facing "relatively big downward pressure".

"At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average," the central bank added.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.