- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 16,840.00 -184.76 -1.09%

Shanghai Composite 3,059.13 -6.12 -0.20%

S&P/ASX 200 5,474.62 0.00 0.00%

FTSE 100 7,024.01 -46.87 -0.66%

CAC 40 4,452.24 -19.50 -0.44%

Xetra DAX 10,523.07 -54.09 -0.51%

S&P 500 2,139.18 +2.45 +0.11%

Dow Jones Industrial Average 18,144.20 +15.54 +0.09%

S&P/TSX Composite 14,618.97 +69.37 +0.48%

Major US stock indexes finished trading in different directions, but near zero. Investors' attention was focused on the minutes of the Fed meeting, as well as the dynamics of the oil market.

Minutes of the September Fed meeting showed that Fed officials expect rate hikes soon enough, but there were differences with regards to the timing of the next increase. "Several Fed officials said that the decision to leave rates unchanged in September, was not unanimous. Meanwhile, some officials were concerned that the delay in raising interest rates may reduce the credibility of the Federal Reserve, "- reports showed. Also noted in the report that many Fed officials see little signs of emerging inflationary pressures. "Fed officials also agreed that labor market conditions" significantly "improved over the last year. Several executives indicated that too strong a drop in the unemployment rate is also undesirable, "- reported in the minutes.

Oil futures fell by about 1% after OPEC announced increase oil production up to a maximum of eight. Such news offset optimism about the agreement, which aims to control the market glut.

A certain pressure on the indices provided investors' concerns about corporate profits amid disappointing nachalla reporting season. According to a survey of analysts conducted by FactSet, profit companies from the S & P 500 are expected in the 3rd quarter decreased sixth consecutive quarter.

Focus was also an overview of vacancies and labor turnover (JOLTS), published by the US Bureau of Labor Statistics. It was reported that in August the number of vacancies decreased to 5.443 million. The indicator was revised up to 5.831 million. With 5.871 million in July. Analysts had expected the number of vacancies will fall to 5.72 million.

DOW index components closed in different directions (11 red, 19 black). Most remaining shares rose NIKE, Inc. (NKE, + 1.37%). Outsider were shares of Cisco Systems, Inc. (CSCO, -2.24%).

Sector S & P index finished the session mixed. The leader turned utilities sector (+ 0.9%). the health sector fell the most (-0.7%).

At the close:

Dow + 0.09% 18,144.68 +16.02

Nasdaq -0.15% 5,239.02 -7.77

S & P + 0.12% 2,139.25 +2.52

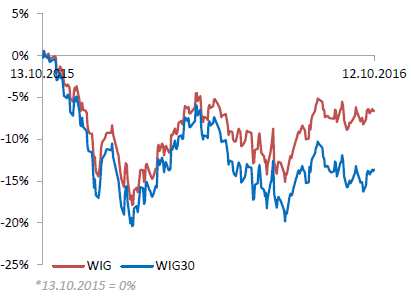

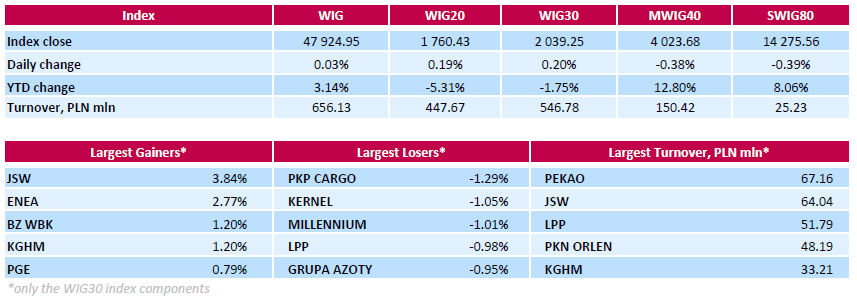

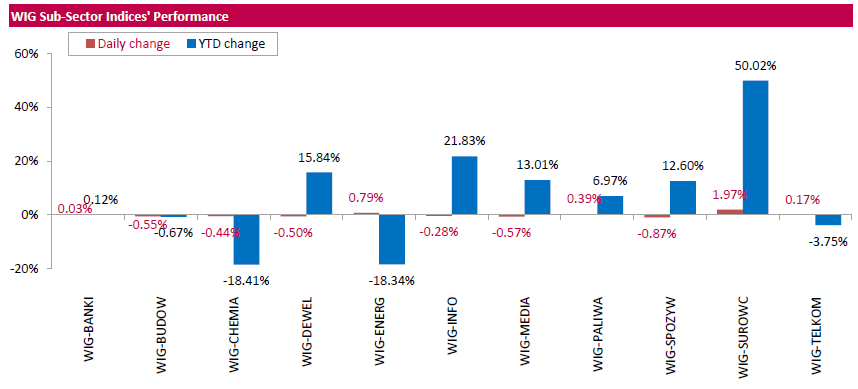

Polish equity market closed flat on Wednesday. The broad market measure, the WIG Index inched up 0.03%. Sector-wise, food stocks were depressed the most (-0.87%), while materials outperformed (+1.97%).

The large-cap stocks' measure, the WIG30 Index, gained 0.2%. Within the Index components, coking coal producer JSW (WSE: JSW) and genco ENEA (WSE: ENA) led the gainers, jumping by 3.84% and 2.77% respectively. They were followed by bank BZ WBK (WSE: BZW) and copper producer KGHM (WSE: KGH), which added 1.2% each. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) topped the list of the session's underperformers, tumbling 1.29%. Other biggest losers were agricultural producer KERNEL (WSE: KER) and bank MILLENNIUM (WSE: MIL), dropping 1.05% and 1.01% respectively.

Major U.S. stock-indexes little changed on Wednesday due to losses in energy and technology shares. Investors are focusing on the release of the minutes from the Federal Reserve's September policy meeting that will reveal policymakers' views on the progress of the U.S. economy and its ability to absorb an interest rate hike this year.

Dow stocks mixed (16 in negative area, 14 in positive area). Top gainer - NIKE, Inc. (NKE, +1.31%). Top loser - Cisco Systems, Inc. (CSCO, -2.25%).

S&P sectors also mixed. Top gainer - Utilities (+0.4%). Top loser - Healthcare (-0.6%).

At the moment:

Dow 18043.00 -27.00 -0.15%

S&P 500 2131.25 -3.25 -0.15%

Nasdaq 100 4812.50 -14.50 -0.30%

Oil 50.02 -0.77 -1.52%

Gold 1253.50 -2.40 -0.19%

U.S. 10yr 1.79 +0.03

U.S. stock-index futures slipped slipped, with investors wary that minutes from the Federal Reserve's latest policy meeting due for release later could reveal a more hawkish tone from officials.

Global Stocks:

Nikkei 16,840.00 -184.76 -1.09%

Hang Seng 23,407.05 -142.47 -0.60%

Shanghai 3,059.13 -6.12 -0.20%

FTSE 7,052.29 -18.59 -0.26%

CAC 4,456.68 -15.06 -0.34%

DAX 10,529.71 -47.45 -0.45%

Crude $50.83 (+0.08%)

Gold $1,254.70 (-0.10%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 27.78 | -0.13(-0.4658%) | 25136 |

| ALTRIA GROUP INC. | MO | 62.07 | 0.08(0.1291%) | 110 |

| Amazon.com Inc., NASDAQ | AMZN | 831.32 | 0.32(0.0385%) | 6792 |

| Apple Inc. | AAPL | 116.66 | 0.36(0.3095%) | 181185 |

| AT&T Inc | T | 39.18 | 0.08(0.2046%) | 504 |

| Barrick Gold Corporation, NYSE | ABX | 15.5 | -0.02(-0.1289%) | 45771 |

| Cisco Systems Inc | CSCO | 30.6 | -0.44(-1.4175%) | 67022 |

| Citigroup Inc., NYSE | C | 49.14 | 0.15(0.3062%) | 1779 |

| Deere & Company, NYSE | DE | 87.28 | 0.23(0.2642%) | 1200 |

| Exxon Mobil Corp | XOM | 87.75 | 0.01(0.0114%) | 1701 |

| Facebook, Inc. | FB | 128.85 | -0.03(-0.0233%) | 35362 |

| Ford Motor Co. | F | 12 | 0.01(0.0834%) | 19160 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.89 | 0.02(0.2026%) | 32125 |

| General Electric Co | GE | 28.95 | 0.03(0.1037%) | 7019 |

| Intel Corp | INTC | 37.2 | -0.07(-0.1878%) | 1033 |

| JPMorgan Chase and Co | JPM | 68.4 | 0.09(0.1318%) | 6276 |

| Procter & Gamble Co | PG | 88.88 | 0.34(0.384%) | 596 |

| Starbucks Corporation, NASDAQ | SBUX | 52.9 | -0.02(-0.0378%) | 1163 |

| Tesla Motors, Inc., NASDAQ | TSLA | 201.4 | 1.30(0.6497%) | 8356 |

| The Coca-Cola Co | KO | 41.6 | 0.06(0.1444%) | 4833 |

| Twitter, Inc., NYSE | TWTR | 18.1 | 0.10(0.5556%) | 168988 |

| Visa | V | 82.17 | 0.13(0.1585%) | 150 |

| Wal-Mart Stores Inc | WMT | 67.5 | 0.11(0.1632%) | 1125 |

| Yahoo! Inc., NASDAQ | YHOO | 42.69 | 0.01(0.0234%) | 478 |

| Yandex N.V., NASDAQ | YNDX | 21.54 | 0.14(0.6542%) | 900 |

Upgrades:

Procter & Gamble (PG) upgraded to Buy from Hold at Argus

Downgrades:

Alcoa (AA) downgraded to Neutral from Buy at BofA/Merrill

Other:

Apple (AAPL) target raised to $130 from $120 at Mizuho

Alcoa (AA) target lowered to $31 from $33 at RBC Capital Mkts

Amazon (AMZN) target raised to $1000 from $835 at Cantor Fitzgerald

European stocks ended in the red Tuesday, but luxury shares were solidly higher on an earnings report from LVMH Moët Hennessy Louis Vuitton SE.

U.S. stocks on Tuesday posted their biggest percentage drop since early September after aluminum giant Alcoa Inc.'s results cast a shadow over the broader market as third-quarter earnings season got under way. A stronger dollar and a retreat in oil prices also hurt sentiment.

Asian shares were trading broadly lower Wednesday amid heightened odds of a December rate rise by the U.S. Federal Reserve, leading to worries that foreign investors will pull money out of Asia. "People are starting to wake up that the hike is coming," said Hao Hong, head of research at Bocom International. "The Fed is running out of excuses not to hike."

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.