- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

The major stock indexes of the United States finished trading with a rise, as weak economic data reduced the chances of an increase in rates this year. Meanwhile, the moderate forecasts of JPMorgan and Wells Fargo limited profit.

As it became known, the prices that Americans pay for goods and services remained unchanged in June, which reflects more low prices for gasoline, and also shows that the recent surge in inflation was temporary. The consumer price index, or the cost of living, did not change last month, the government said on Friday. Economists predicted an increase in the CPI by 0.1%.

In addition, retailers spending in the US declined in June for the second consecutive month. Retail sales - an indicator of consumer spending in stores, restaurants and websites - fell by 0.2% in seasonally adjusted terms in June compared to the previous month, the Ministry of Commerce said. Economists had expected growth of 0.1%. In May, retail sales decreased by 0.1%. This was the first decline in sales from July to August 2016.

Industrial production in the US increased in June stronger than analysts' forecasts, as the demand for natural resources, cars and equipment recovered, according to the Federal Reserve. Industrial production grew 0.2% after falling 0.4%, overall industrial production, which also includes mining and utilities, increased by 0.4% after rising 0.1%, and capacity utilization rose to 76.6% from 76.4%.

It is also worth noting that the preliminary results of the studies presented by Thomson-Reuters and the Michigan Institute showed that the mood sensor among US consumers fell in June more than predicted by average experts' forecasts. According to the data, in July the consumer sentiment index fell to 93.1 points compared to the final reading for June at the level of 95.1 points. According to average estimates, the index had to drop to the level of 95 points.

Almost all components of the DOW index recorded a rise (27 out of 30). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 1.95%). Outsider were the shares of JPMorgan Chase & Co. (JPM, -0.69%).

All sectors of S & P completed the auction in positive territory. The sector of basic materials grew most (+ 0.9%).

At closing:

Dow + 0.40% 21.639.59 +86.50

Nasdaq + 0.61% 6,312.47 +38.03

S & P + 0.45% 2,458.96 +11.13

Before the bell: S&P futures +0.04%, NASDAQ futures +0.35%

U.S. stock-index futures were slightly higher as investors analyzed a slew of important U.S. economic data and Q2 earnings reports from several big U.S. banks.

Global Stocks:

Nikkei 20,118.86 +19.05 +0.09%

Hang Seng 26,389.23 +43.06 +0.16%

Shanghai 3,222.31 +4.15 +0.13%

S&P/ASX 5,765.10 +28.33 +0.49%

FTSE 7,396.72 -16.72 -0.23%

CAC 5,238.79 +3.39 +0.06%

DAX 12,646.70 +5.37 +0.04%

Crude $46.64 (+1.22%)

Gold $1,227.60 (+0.85%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.1 | 0.09(0.25%) | 11292 |

| Amazon.com Inc., NASDAQ | AMZN | 1,002.88 | 2.25(0.22%) | 11301 |

| American Express Co | AXP | 85.1 | -0.27(-0.32%) | 2200 |

| AMERICAN INTERNATIONAL GROUP | AIG | 63.15 | -0.98(-1.53%) | 272 |

| Apple Inc. | AAPL | 147.72 | -0.05(-0.03%) | 155479 |

| AT&T Inc | T | 36.29 | 0.08(0.22%) | 6912 |

| Barrick Gold Corporation, NYSE | ABX | 15.94 | 0.23(1.46%) | 118237 |

| Boeing Co | BA | 208.2 | 1.97(0.96%) | 12056 |

| Caterpillar Inc | CAT | 108.5 | 0.03(0.03%) | 1501 |

| Chevron Corp | CVX | 104.5 | 0.37(0.36%) | 2000 |

| Cisco Systems Inc | CSCO | 31.34 | 0.07(0.22%) | 202 |

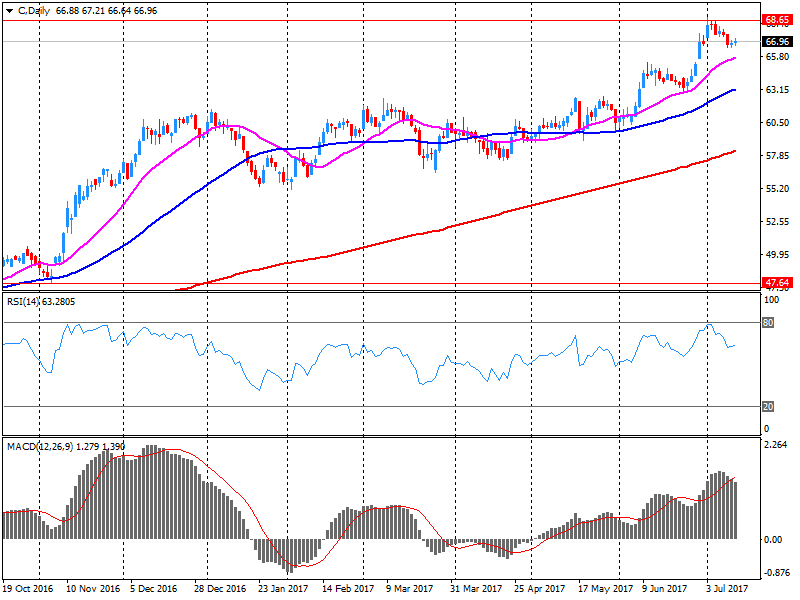

| Citigroup Inc., NYSE | C | 66.5 | -0.52(-0.78%) | 392238 |

| Exxon Mobil Corp | XOM | 81.05 | 0.08(0.10%) | 974 |

| Facebook, Inc. | FB | 159.55 | 0.29(0.18%) | 29958 |

| Ford Motor Co. | F | 11.64 | 0.04(0.34%) | 5753 |

| General Electric Co | GE | 26.83 | 0.04(0.15%) | 12522 |

| General Motors Company, NYSE | GM | 36.1 | 0.24(0.67%) | 2100 |

| Goldman Sachs | GS | 227.83 | -2.57(-1.12%) | 23073 |

| Google Inc. | GOOG | 950.43 | 3.27(0.35%) | 893 |

| Intel Corp | INTC | 34.3 | 0.06(0.18%) | 1685 |

| Johnson & Johnson | JNJ | 132.5 | 0.64(0.49%) | 634 |

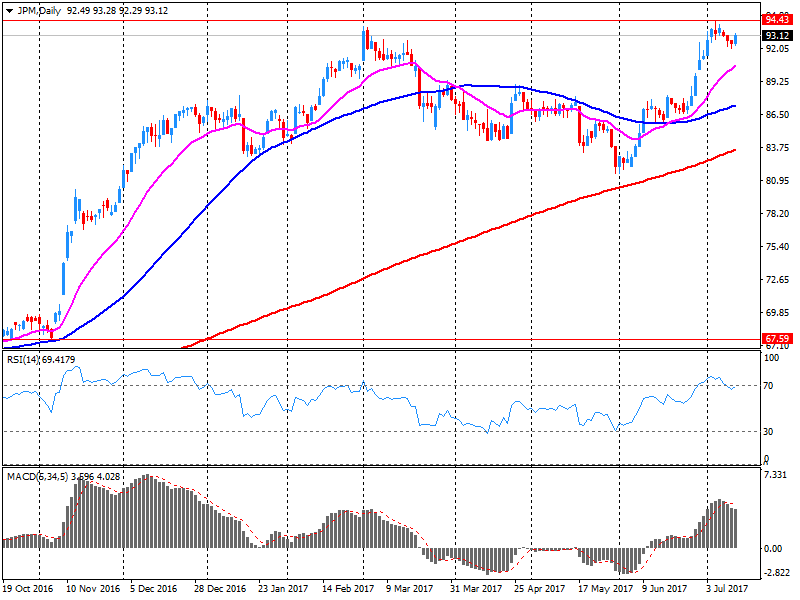

| JPMorgan Chase and Co | JPM | 91.5 | -1.60(-1.72%) | 878704 |

| McDonald's Corp | MCD | 155.11 | 0.07(0.05%) | 539 |

| Merck & Co Inc | MRK | 63.05 | 0.16(0.25%) | 200 |

| Microsoft Corp | MSFT | 71.97 | 0.20(0.28%) | 1482 |

| Procter & Gamble Co | PG | 86.73 | 0.03(0.03%) | 764 |

| Tesla Motors, Inc., NASDAQ | TSLA | 323.73 | 0.32(0.10%) | 23283 |

| Verizon Communications Inc | VZ | 43.55 | 0.06(0.14%) | 3379 |

| Visa | V | 96 | 0.06(0.06%) | 2373 |

| Wal-Mart Stores Inc | WMT | 76.2 | 1.15(1.53%) | 60622 |

| Walt Disney Co | DIS | 104.56 | 0.27(0.26%) | 838 |

| Yandex N.V., NASDAQ | YNDX | 31.6 | -0.08(-0.25%) | 19749 |

Hewlett Packard Enterprise (HPE) reinstated with a Hold at Maxim Group; target $18

Wal-Mart (WMT) upgraded and added to Conviction Buy List at Goldman

Boeing (BA) upgraded to Overweight from Neutral at JP Morgan; target raised to $240

Citigroup (C) reported Q2 FY 2017 earnings of $1.28 per share (versus $1.24 in Q2 FY 2016), beating analysts' consensus estimate of $1.21.

The company's quarterly revenues amounted to $17.901 bln (+2% y/y), beating analysts' consensus estimate of $ 17.379 bln.

C rose to $67.25 (+0.34%) in pre-market trading.

JPMorgan Chase (JPM) reported Q2 FY 2017 earnings of $1.82 per share (versus $1.55 in Q2 FY 2016), beating analysts' consensus estimate of $1.59.

The company's quarterly revenues amounted to $25.500 bln (+4.6% y/y), beating analysts' consensus estimate of $24.360 bln.

The company also cut FY 2017 net interest income guidance slightly. Now it expects 2017 net interest income to be up $4 bln y/y (down from $4.5 bln).

JPM fell to $92.30 (-0.86%) in pre-market trading.

European stocks largely stepped higher Thursday, building on the prior day's sizable jump that was sparked by dovish comments from U.S. Federal Reserve chief Janet Yellen. The Stoxx Europe 600 SXXP, +0.32% rose 0.3% to close at 386.14, after the index on Wednesday notched its biggest one-day percentage advance since April 24, tacking on 1.5%. Global equity benchmarks have been given a midweek shot in the arm by Yellen saying interest rates don't have to rise all that much further.

The Dow on Thursday closed at a record for the 24th time in 2017, as gains in the financial sector helped the broader market book modest gains ahead of a roster of corporate results from the U.S.'s biggest banks.

Global stocks continued to move higher Friday, with most Asia-Pacific markets poised to end the week on a high note as investors maintained their risk for appetite. "Asia has done well in the past couple of days," despite commentary from Federal Reserve chief Janet Yellen and the latest worries regarding U.S. President Donald Trump, said Tai Hui, chief market strategist in Asia at J.P. Morgan Funds.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.