- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +216.21 19753.31 +1.11%

TOPIX +17.15 1616.21 +1.07%

Hang Seng -75.27 27174.96 -0.28%

CSI 300 +11.38 3706.06 +0.31%

Euro Stoxx 50 +11.25 3461.91 +0.33%%

FTSE 100 +29.96 7383.85 +0.41%

DAX +11.92 12177.04 +0.10%

CAC 40 +18.58 5140.25 +0.36%

DJIA +5.28 21998.99 +0.02%

S&P 500 -1.23 2464.61 -0.05%

NASDAQ -7.22 6333.01 -0.11%

S&P/TSX -22.07 15097.84 -0.15%

Major US stock indexes finished the session near the zero mark amid a decrease in the tension around the possible military conflict between the US and North Korea.

North Korean media reported that the head of the DPRK, Kim Jong-un, decided to postpone consideration of the version of the missile strike at the US base on Guam Island in the Pacific Ocean. According to him, the US "must make the right choice to avoid a dangerous military conflict." At the same time, the leader of North Korea warned that he could change his mind and ordered the military to be ready to strike at any moment.

In addition, the US Department of Commerce reported that retail sales rose in July to the highest level in 2017, driven by strong demand for new cars and special purchases of Amazon's Prime Day. According to the report, sales in retail chains grew by 0.6%. Economists forecast an increase of 0.4%. Retail sales in June rose by 0.3% instead of falling by 0.2%, and sales in May were unchanged. Sales of so-called non-stationary retailers grew by 1.3%, which is the largest increase since December. Sales also grew by 1.2% in auto dealers, by 1.2% in garden centers and by 1% in department stores.

The confidence of builders in the market for newly built single-family homes rose 4 points to 68 in August, according to the housing market index (HMI) from the National Association of House Builders / Wells Fargo. The component measuring current sales conditions grew by 4 points to 74, and the index predicting sales in the next six months jumped 5 points to 78. Meanwhile, the component measuring consumer traffic increased by one point to 49.

At the same time, the Ministry of Commerce reported on Tuesday that inventories increased by 0.5% after an increase of 0.3% in May. In June, retail inventories increased by 0.6%, as announced in the preliminary report for the previous month. In May, retail inventories increased by 0.6%.

Most components of the DOW index recorded a rise (19 out of 30). The leader of growth was shares of American Express Company (AXP, + 1.67%). Outsider was the shares of The Home Depot, Inc. (HD, -2.76%).

The S & P sector showed mixed dynamics. The greatest decline was shown by the sector of conglomerates (-0.5%). The consumer goods sector grew most (+ 0.4%).

At closing:

DJIA + 0.02% 21.999.09 +5.38

Nasdaq -0.11% 6.333.01 -7.22

S & P -0.05% 2,464.61 -1.23

U.S. stock-index futures advanced on Tuesday, as tensions over a possible military conflict with North Korea continued to abate, supported by reports that the leader of the DPRK, Kim Jong-un, had delayed a decision on firing missiles towards the U.S. military bases in Guam.

Global Stocks:

Nikkei 19,753.31 +216.21 +1.11%

Hang Seng 27,174.96 -75.27 -0.28%

Shanghai 3,251.64 +14.28 +0.44%

S&P/ASX 5,757.48 +27.08 +0.47%

FTSE 7,391.46 +37.57 +0.51%

CAC 5,150.26 +28.59 +0.56%

DAX 12,217.79 +52.67 +0.43%

Crude $47.23 (-0.76%)

Crude $1,274.00 (-1.27%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 37.4 | 0.21(0.56%) | 1589 |

| Amazon.com Inc., NASDAQ | AMZN | 987 | 3.70(0.38%) | 22703 |

| American Express Co | AXP | 85 | -0.47(-0.55%) | 1620 |

| Apple Inc. | AAPL | 160.67 | 0.82(0.51%) | 167798 |

| AT&T Inc | T | 38.51 | 0.01(0.03%) | 7270 |

| Barrick Gold Corporation, NYSE | ABX | 16.4 | -0.32(-1.91%) | 139715 |

| Boeing Co | BA | 238.5 | 1.35(0.57%) | 1829 |

| Caterpillar Inc | CAT | 114 | 0.29(0.26%) | 1526 |

| Chevron Corp | CVX | 108.83 | 0.12(0.11%) | 15406 |

| Cisco Systems Inc | CSCO | 31.85 | 0.01(0.03%) | 7859 |

| Citigroup Inc., NYSE | C | 68.5 | 0.61(0.90%) | 28930 |

| Deere & Company, NYSE | DE | 126 | -2.57(-2.00%) | 2555 |

| Facebook, Inc. | FB | 171.4 | 0.65(0.38%) | 90522 |

| FedEx Corporation, NYSE | FDX | 211.72 | 3.86(1.86%) | 200 |

| Ford Motor Co. | F | 10.9 | -0.01(-0.09%) | 6226 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.26 | 0.11(0.78%) | 8218 |

| General Electric Co | GE | 25.25 | -0.11(-0.43%) | 50825 |

| General Motors Company, NYSE | GM | 35.7 | 0.23(0.65%) | 6621 |

| Goldman Sachs | GS | 228.71 | 1.35(0.59%) | 7317 |

| Home Depot Inc | HD | 153.5 | -0.76(-0.49%) | 354641 |

| Intel Corp | INTC | 36.45 | 0.11(0.30%) | 3506 |

| International Business Machines Co... | IBM | 142.9 | 0.58(0.41%) | 112 |

| JPMorgan Chase and Co | JPM | 93.12 | 0.63(0.68%) | 14437 |

| Microsoft Corp | MSFT | 73.42 | 0.22(0.30%) | 28249 |

| Nike | NKE | 58.75 | -1.03(-1.72%) | 10649 |

| Procter & Gamble Co | PG | 91.97 | 0.32(0.35%) | 380 |

| Starbucks Corporation, NASDAQ | SBUX | 53.38 | 0.16(0.30%) | 1014 |

| Tesla Motors, Inc., NASDAQ | TSLA | 364.82 | 1.02(0.28%) | 42239 |

| The Coca-Cola Co | KO | 45.76 | -0.04(-0.09%) | 1190 |

| Twitter, Inc., NYSE | TWTR | 16.16 | 0.07(0.44%) | 5960 |

| Verizon Communications Inc | VZ | 48.52 | -0.26(-0.53%) | 1202 |

| Visa | V | 102.1 | 0.23(0.23%) | 880 |

| Wal-Mart Stores Inc | WMT | 81 | 0.30(0.37%) | 566 |

| Walt Disney Co | DIS | 101.85 | 0.45(0.44%) | 3260 |

Freeport-McMoRan (FCX) initiated with a Mkt Perform at Raymond James

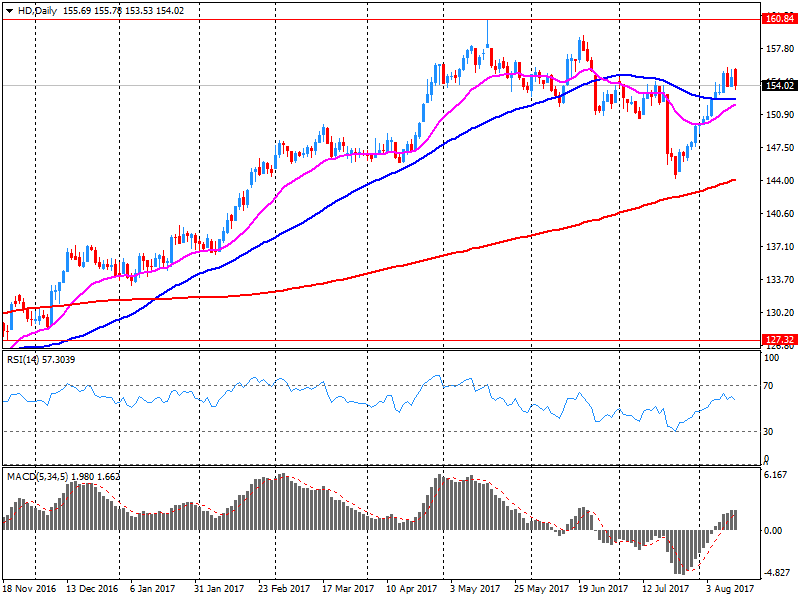

Home Depot (HD) reported Q2 FY 2017 earnings of $2.25. per share (versus $1.97 in Q2 FY 2016), beating analysts' consensus estimate of $2.22.

The company's quarterly revenues amounted to $28.108 bln (+6.2% y/y), generally in-line with analysts' consensus estimate of $27.836 bln.

HD fell to $153.66 (-0.39%) in pre-market trading.

Global stocks continued to rebound Tuesday, getting a fresh lift as North Korea pulled back its threat to attack Guam. After days of heated rhetoric between North Korea and President Donald Trump, Pyongyang dialed back the political tensions Tuesday with North Korean state media saying Kim Jong Un had decided not to fire missiles at the U.S. territory.

European stocks on Monday bounced back from last week's sharp losses after senior U.S. officials over the weekend sought to play down the risk of a nuclear conflict with North Korea. The Stoxx Europe 600 index SXXP, +1.08% rallied 1.1% to close at 376.16, winning back parts of the 2.7% loss it suffered last week.

U.S. stocks gained on Monday with the S&P 500 rising 1% for the first time in three months as the verbal standoff between the U.S. and North Korea cooled for now. The S&P 500 SPX, +1.00% added 24.52 points, or 1%, to close at 2,465.84. The best performers were technology shares XLK, +1.59% and real-estate stocks.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.