- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +49.97 19919.82 +0.25%

TOPIX +4.23 1584.23 +0.27%

Hang Seng -35.65 25335.94 -0.14%

CSI 300 +29.46 3428.65 +0.87%

Euro Stoxx 50 +0.01 3641.89 +0.00%

FTSE 100 +67.66 7522.03 +0.91%

DAX -2.51 12804.53 -0.02%

CAC 40 -11.30 5406.10 -0.21%

DJIA -2.19 20979.75 -0.01%

S&P 500 -1.65 2400.67 -0.07%

NASDAQ +20.20 6169.87 +0.33%

S&P/TSX -86.14 15543.33 -0.55%

The main US stock indexes finished trading near zero. The negative impact on the mood of investors was provided by data on the US housing market, as well as reports that Trump could give the Russian Foreign Minister secret information concerning the threat posed by the terrorist organization Islamic State.

As it became known, bookings of new houses in the USA unexpectedly fell in April against the background of a constant decrease in the construction of multi-apartment houses and a modest rebound in one-family projects, which indicates a slowdown in the housing market recovery. The Ministry of Housing reported that bookings of new homes fell 2.6% to 1.17 million (seasonally adjusted). This was the lowest level since November 2016, after a downward revision to the level of 1.20 million in March. Economists predicted that last month's bookmarks rose to 1.26 million units from the previously announced level of 1.22 million units in March.

Meanwhile, the optimism of the market has added data on industrial production. The Federal Reserve said that industrial production in April rose at the fastest monthly pace in more than three years, thanks to the broad achievements in the manufacturing sector. According to the data, the volume of industrial production grew by 1% in April, exceeding the consensus forecast of growth economists by 0.3%. This was the fastest growth rate since February 2014.

The components of the DOW index showed mixed dynamics (15 in positive territory, 15 in negative territory). Most fell shares of UnitedHealth Group Incorporated (UNH, -2.06%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 1.53%).

Most sectors of the S & P index finished trading in the red. The conglomerate sector fell most of all (-1.2%). The leader of growth was the technological sector (+ 0.5%).

At closing:

DJIA -0.01% 20.979.54 -2.40

Nasdaq + 0.33% 6,169.87 +20.20

S & P -0.07% 2,400.64 -1.68

U.S. stock-index futures rose moderately as investors paused for a breather a day after the S&P 500 and the Nasdaq closed at record highs. Investors assessed statistics on the U.S. housing market and industrial production.

Stocks:

Nikkei 19,919.82 +49.97 +0.25%

Hang Seng 25,335.94 -35.65 -0.14%

Shanghai 3,113.50 +23.27 +0.75%

S&P/ASX 5,850.52 +12.12 +0.21%

FTSE 7,511.95 +57.58 +0.77%

CAC 5,407.06 -10.34 -0.19%

DAX 12,817.24 +10.20 +0.08%

Crude $49.26 (+0.84%)

Crude $1,235.30 (+0.44%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 960.57 | 2.60(0.27%) | 10614 |

| AMERICAN INTERNATIONAL GROUP | AIG | 62.87 | 1.05(1.70%) | 3768 |

| Apple Inc. | AAPL | 156.18 | 0.48(0.31%) | 79932 |

| AT&T Inc | T | 38.6 | 0.01(0.03%) | 1769 |

| Barrick Gold Corporation, NYSE | ABX | 17.04 | 0.14(0.83%) | 37648 |

| Caterpillar Inc | CAT | 102.7 | 0.28(0.27%) | 1116 |

| Chevron Corp | CVX | 107.5 | 0.65(0.61%) | 1635 |

| Cisco Systems Inc | CSCO | 34.37 | 0.14(0.41%) | 7045 |

| Citigroup Inc., NYSE | C | 61.5 | 0.08(0.13%) | 3953 |

| Exxon Mobil Corp | XOM | 83 | 0.20(0.24%) | 3273 |

| Facebook, Inc. | FB | 150.4 | 0.21(0.14%) | 60536 |

| Ford Motor Co. | F | 11.02 | 0.08(0.73%) | 138116 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.88 | 0.13(1.11%) | 29422 |

| General Motors Company, NYSE | GM | 33.85 | 0.03(0.09%) | 6408 |

| Goldman Sachs | GS | 225.1 | -0.02(-0.01%) | 1620 |

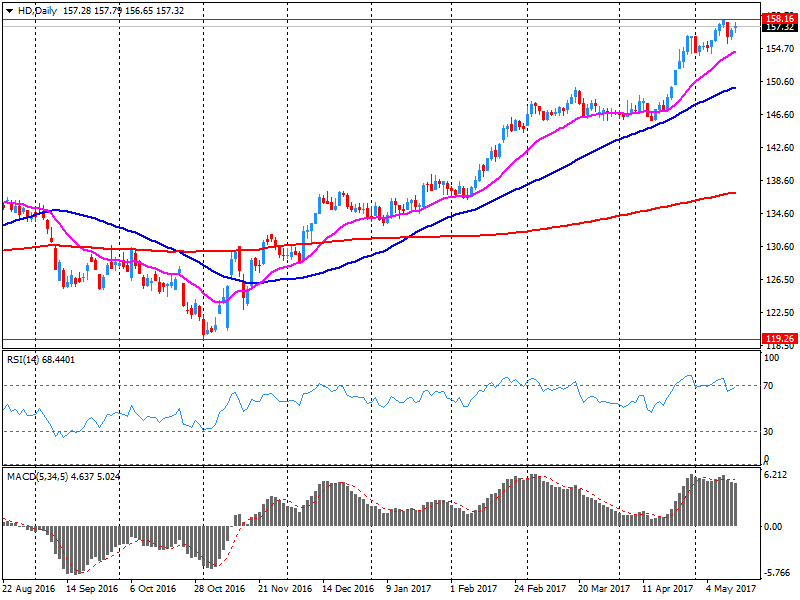

| Home Depot Inc | HD | 159.36 | 2.03(1.29%) | 123780 |

| Intel Corp | INTC | 35.74 | 0.11(0.31%) | 1934 |

| JPMorgan Chase and Co | JPM | 87.3 | -0.04(-0.05%) | 2191 |

| Microsoft Corp | MSFT | 68.2 | 0.16(0.24%) | 16175 |

| Nike | NKE | 53.5 | -0.27(-0.50%) | 28935 |

| Pfizer Inc | PFE | 32.55 | -0.57(-1.72%) | 64195 |

| Procter & Gamble Co | PG | 86.68 | 0.35(0.41%) | 6597 |

| Starbucks Corporation, NASDAQ | SBUX | 60.7 | 0.25(0.41%) | 3289 |

| Tesla Motors, Inc., NASDAQ | TSLA | 318 | 2.12(0.67%) | 47290 |

| The Coca-Cola Co | KO | 43.94 | 0.21(0.48%) | 128 |

| Twitter, Inc., NYSE | TWTR | 19.39 | 0.16(0.83%) | 87227 |

| UnitedHealth Group Inc | UNH | 171.02 | -0.51(-0.30%) | 11888 |

| Verizon Communications Inc | VZ | 45.5 | 0.12(0.26%) | 5081 |

| Visa | V | 93.3 | 0.07(0.08%) | 1359 |

| Walt Disney Co | DIS | 109 | -0.13(-0.12%) | 2672 |

| Yahoo! Inc., NASDAQ | YHOO | 50.09 | 0.23(0.46%) | 302297 |

| Yandex N.V., NASDAQ | YNDX | 28.25 | -0.65(-2.25%) | 25632 |

Upgrades:

Downgrades:

Pfizer (PFE) downgraded to Sell from Neutral at Citigroup

Other:

NIKE (NKE) initiated with a Buy at Berenberg; target $70

Home Depot (HD) reported Q1 FY 2017 earnings of $1.67 per share (versus $1.44 in Q1 FY 2016), beating analysts' consensus estimate of $1.61.

The company's quarterly revenues amounted to $23.887 bln (+4.9% y/y), generally in-line with analysts' consensus estimate of $23.738 bln.

HD rose to $159.90 (+1.63%) in pre-market trading.

European equity-index gauges finished with modest gains Monday, scoring a fillip from commodity shares as oil and metals prices rose. The Stoxx Europe 600 index SXXP, +0.09% ended up 0.1% at 395.97, marking a second straight advance and keeping the index around its highest since August 2015. But the index moved between small gains and losses throughout the session. The oil-and-gas, basic-materials and financial sectors fared the best, but health-care, consumer-related and telecom shares struggled.

The S&P 500 and the Nasdaq Composite closed at fresh records on Monday as a jump in oil prices to a two-week high lifted Wall Street sentiment. The proposed extension still needs to be confirmed when the 13 members of the Organization of the Petroleum Exporting Countries gather for a closely watched meeting in Vienna on May 25.

Stock markets across Asia-Pacific lacked direction early Tuesday, with gains for regional energy and mining firms thanks to a jump in commodity prices, while Chinese markets again succumbed to selling pressure.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.