- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

U.S. stock-index futures fell on Thursday, as disappointing jobless claims data and rising numbers of new Covid-19 cases in the U.S. outweighed better-than-expected earnings reports from Morgan Stanley (MS), Bank of America (BAC) and Johnson & Johnson (JNJ).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,770.36 | -175.14 | -0.76% |

Hang Seng | 24,970.69 | -510.89 | -2.00% |

Shanghai | 3,210.10 | -151.21 | -4.50% |

S&P/ASX | 6,010.90 | -42.00 | -0.69% |

FTSE | 6,258.74 | -33.91 | -0.54% |

CAC | 5,070.63 | -38.35 | -0.75% |

DAX | 12,853.42 | -77.56 | -0.60% |

Crude oil | $1,806.60 | -0.40% | |

Gold | $40.72 | -1.17% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 158.67 | -0.66(-0.41%) | 3210 |

ALCOA INC. | AA | 13.13 | 0.44(3.47%) | 172071 |

Amazon.com Inc., NASDAQ | AMZN | 2,969.00 | -39.87(-1.33%) | 66538 |

American Express Co | AXP | 96.5 | -0.86(-0.88%) | 7309 |

AMERICAN INTERNATIONAL GROUP | AIG | 31.33 | -0.44(-1.39%) | 5185 |

Apple Inc. | AAPL | 386 | -4.90(-1.25%) | 372458 |

AT&T Inc | T | 29.9 | -0.11(-0.37%) | 58502 |

Boeing Co | BA | 184 | -3.94(-2.10%) | 306306 |

Caterpillar Inc | CAT | 137.75 | -0.61(-0.44%) | 11774 |

Chevron Corp | CVX | 88.75 | -0.14(-0.16%) | 30461 |

Cisco Systems Inc | CSCO | 45.45 | -0.95(-2.05%) | 130908 |

Citigroup Inc., NYSE | C | 51.18 | -0.66(-1.27%) | 81762 |

Deere & Company, NYSE | DE | 171.01 | -1.38(-0.80%) | 984 |

E. I. du Pont de Nemours and Co | DD | 54.06 | -0.80(-1.46%) | 1108 |

Exxon Mobil Corp | XOM | 44.39 | -0.24(-0.54%) | 25713 |

Facebook, Inc. | FB | 237.15 | -3.13(-1.30%) | 148834 |

FedEx Corporation, NYSE | FDX | 160 | -1.25(-0.78%) | 493 |

Ford Motor Co. | F | 6.65 | -0.09(-1.33%) | 340053 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.38 | -0.15(-1.11%) | 27560 |

General Electric Co | GE | 7.04 | -0.10(-1.40%) | 2208721 |

General Motors Company, NYSE | GM | 26.52 | -0.36(-1.34%) | 30000 |

Goldman Sachs | GS | 214.49 | -2.41(-1.11%) | 32891 |

Google Inc. | GOOG | 1,492.50 | -21.14(-1.40%) | 9179 |

Hewlett-Packard Co. | HPQ | 17.73 | -0.06(-0.34%) | 22559 |

Home Depot Inc | HD | 255.8 | -2.00(-0.78%) | 15933 |

HONEYWELL INTERNATIONAL INC. | HON | 150.21 | -1.73(-1.14%) | 1189 |

Intel Corp | INTC | 58.4 | -0.63(-1.07%) | 44212 |

International Business Machines Co... | IBM | 122.5 | -0.50(-0.41%) | 6185 |

International Paper Company | IP | 36.3 | -0.01(-0.03%) | 10224 |

Johnson & Johnson | JNJ | 148.5 | 0.24(0.16%) | 101662 |

JPMorgan Chase and Co | JPM | 98.38 | -1.35(-1.35%) | 60426 |

McDonald's Corp | MCD | 190.46 | -1.31(-0.68%) | 20154 |

Merck & Co Inc | MRK | 79.5 | 0.06(0.08%) | 5517 |

Microsoft Corp | MSFT | 205.24 | -2.80(-1.35%) | 212166 |

Nike | NKE | 98 | -0.54(-0.55%) | 4452 |

Pfizer Inc | PFE | 35.62 | -0.10(-0.28%) | 56971 |

Procter & Gamble Co | PG | 124.3 | -0.20(-0.16%) | 4686 |

Starbucks Corporation, NASDAQ | SBUX | 74.75 | -0.86(-1.14%) | 10662 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,475.63 | -70.38(-4.55%) | 375204 |

The Coca-Cola Co | KO | 46.12 | -0.28(-0.60%) | 22624 |

Travelers Companies Inc | TRV | 118.67 | -0.47(-0.39%) | 2684 |

Twitter, Inc., NYSE | TWTR | 34.31 | -1.36(-3.81%) | 1024922 |

UnitedHealth Group Inc | UNH | 305 | 0.93(0.31%) | 21970 |

Verizon Communications Inc | VZ | 54.9 | -0.16(-0.29%) | 7764 |

Visa | V | 194.5 | -2.05(-1.04%) | 9763 |

Wal-Mart Stores Inc | WMT | 131.21 | -0.79(-0.60%) | 20568 |

Walt Disney Co | DIS | 117.79 | -3.11(-2.57%) | 92159 |

Yandex N.V., NASDAQ | YNDX | 53.99 | -0.83(-1.51%) | 1655 |

Apple (AAPL) target raised to $444 from $310 at Canaccord Genuity

Amazon (AMZN) target raised to $3450 from $2800 at Morgan Stanley

Cisco (CSCO) downgraded to Neutral from Overweight at JP Morgan; target $50

Walt Disney (DIS) downgraded to Market Perform from Outperform at Cowen; target lowered to $97

Morgan Stanley (MS) reported Q2 FY 2020 earnings of $1.96 per share (versus $1.23 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.13 per share.

The company’s quarterly revenues amounted to $13.414 bln (+30.9% y/y), beating analysts’ consensus estimate of $10.392 bln.

MS rose to $51.80 (+0.88%) in pre-market trading.

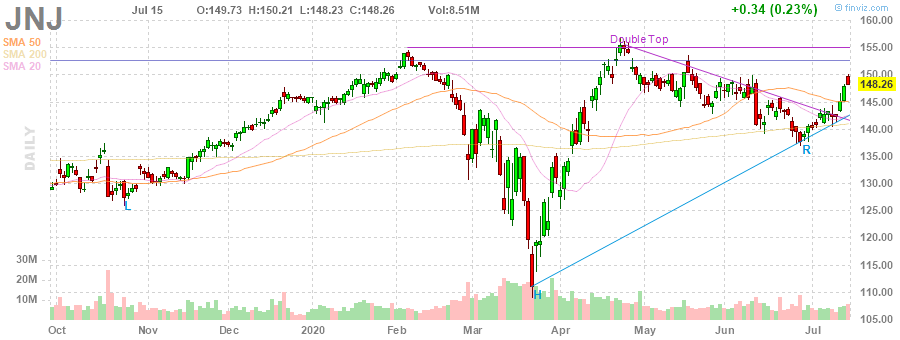

Johnson & Johnson (JNJ) reported Q2 FY 2020 earnings of $1.67 per share (versus $2.58 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.51 per share.

The company’s quarterly revenues amounted to $18.336 bln (-10.8% y/y), beating analysts’ consensus estimate of $17.730 bln.

The company also issued raised guidance for FY2020, projecting EPS of $7.75-7.95 (compared to its previous forecast of $7.50-7.70 and analysts’ consensus estimate of $7.75) and revenues of $81.0-82.5 bln (compared to its previous forecast of $79.2-82.2 bln and analysts’ consensus estimate of $79.7 bln).

JNJ fell to $147.55 (-0.48%) in pre-market trading.

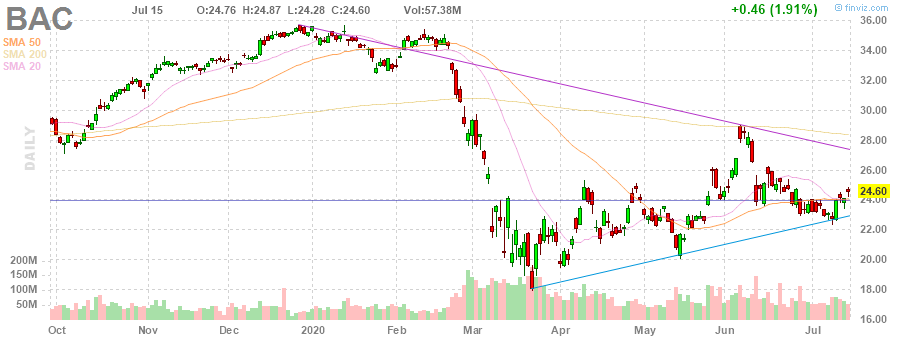

Bank of America (BAC) reported Q2 FY 2020 earnings of $0.37 per share (versus $0.74 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.28 per share.

The company’s quarterly revenues amounted to $22.300 bln (-3.5% y/y), beating analysts’ consensus estimate of $21.715 bln.

BAC fell to $24.15 (-1.83%) in pre-market trading.

FXStreet notes that equity market indices and economic fundamentals have already decoupled. When the uncertainty subsides, this decoupling will become even more pronounced, which will lead to a tax on buyers of equities, a misallocation of savings and the appearance of bubbles and the risk of a financial crisis if these bubbles burst, per Natixis.

“The level of uncertainty remains high when it comes to public health (will there be a second wave of the pandemic?), geopolitics (will there be a new wave of US protectionism?) and the economy (how fast will it recover?). Yet we are seeing a clear recovery in equity market indices and the sharp rise in PERs is a clear illustration that indices and fundamentals have decoupled, indices having risen far more than the trajectory of future earnings would imply.”

“When the uncertainty subsides, we should therefore expect equity market indices to be markedly higher than fundamentals. This situation has both microeconomic and macroeconomic consequences: a tax on buyers of equities, since they will buy them at excessive prices, a misallocation of savings, since share prices will no longer give information on the situation of companies and the risk of financial crises, due to the appearance of equity bubbles, then the risk of these bubbles bursting, as we saw in 2000-2001.”

Alcoa (AA) reported Q2 FY 2020 loss of $0.02 per share (versus -$0.01 per share in Q2 FY 2019), much better than analysts’ consensus estimate of -$0.23 per share.

The company’s quarterly revenues amounted to $2.148 bln (-20.8% y/y), beating analysts’ consensus estimate of $2.116 bln.

AA rose to $13.20 (+4.02%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 358.49 | 22945.5 | 1.59 |

| Hang Seng | 3.69 | 25481.58 | 0.01 |

| KOSPI | 18.27 | 2201.88 | 0.84 |

| ASX 200 | 111.8 | 6052.9 | 1.88 |

| FTSE 100 | 112.9 | 6292.65 | 1.83 |

| DAX | 233.62 | 12930.98 | 1.84 |

| CAC 40 | 101.52 | 5108.98 | 2.03 |

| Dow Jones | 227.51 | 26870.1 | 0.85 |

| S&P 500 | 29.04 | 3226.56 | 0.91 |

| NASDAQ Composite | 61.91 | 10550.49 | 0.59 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.