- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major stock Wall Street indices closed in the red zone against the backdrop of falling shares of Oracle (ORCL), which led to a decrease in the technology sector. The focus of investors were shares of Deutsche Bank (DB), which have fallen by more than 9% on news that the US Department of Justice required by the lender to pay $ 14 billion. As a settlement in the case of fraudulent mortgage loans in the period from 2005 to 2007.

In addition, as shown by the preliminary results of the studies submitted by Thomson-Reuters and Institute of Michigan, showed in September the US consumers feel at the same level in relation to the economy, as in the past month. According to the data, in September consumer sentiment index was at 89.8 points. It was predicted that the index was 90.8 points.

Oil prices fell to multi-week lows, as the increase in Iranian exports and the resumption of oil supplies from Libya and Nigeria heightened investors' fears that the global glut will persist. The cost of oil futures for Brent and WTI fell by 9-10% within one week, underscoring the volatility of the oil market. "We've seen a lot of bearish news this week The weak fundamental factors are putting pressure on the market.", - Said Frank Klumpp, an oil analyst at LBBW.

Most DOW components of the index closed in negative territory (23 of 30). Most remaining shares rose Intel Corporation (INTC, + 3.21%). Outsider were shares of United Technologies Corporation (UTX, -2.44%).

Almost all of the S & P registered a decline. The leader turned conglomerates sector (+ 1.7%). financial sector (-0.9%) fell the most.

At the close:

Dow -0.49% 18,123.80 -88.68

Nasdaq -0.10% 5,244.57 -5.12

S & P -0.38% 2,139.16 -8.10

Major U.S. stock-indexes near session lows on Friday as Oracle led a decline in tech stocks and financials came under pressure in the wake of Deutsche Bank's $14 billion fine. The far bigger-than-expected penalty was levied by the U.S. Department of Justice to settle claims that the German bank missold mortgage-backed securities. Deutsche Bank's U.S.-listed shares (DB) were down 9,3%.

Most of Dow stocks in negative area (27 of 30). Top gainer - Intel Corporation (INTC, +2.27%). Top loser - Cisco Systems, Inc. (CSCO, -1.88%).

Most of all S&P sectors also in negative area. Top gainer - Conglomerates (+0.4%). Top loser - Financial (-1.0%).

At the moment:

Dow 18047.00 -68.00 -0.38%

S&P 500 2128.75 -9.25 -0.43%

Nasdaq 100 4804.50 -9.25 -0.19%

Oil 43.87 -0.65 -1.46%

Gold 1312.60 -5.40 -0.41%

U.S. 10yr 1.70 -0.01

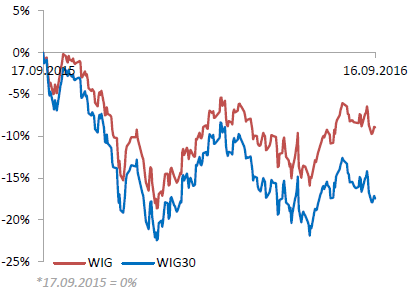

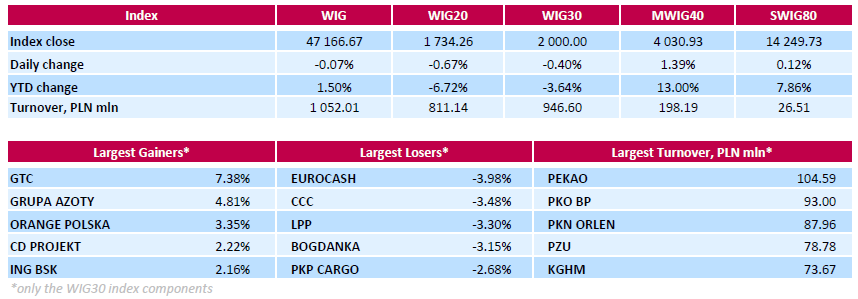

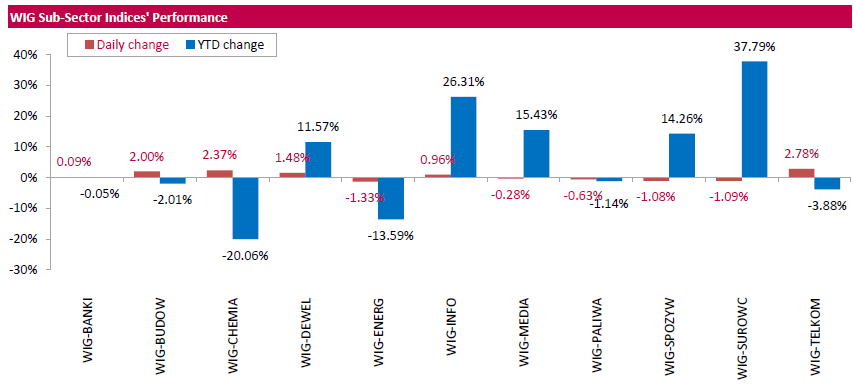

Polish equity market closed little changed on Friday. The broad market measure, the WIG Index, edged down 0.07%. Sector performance within the WIG Index was mixed. Utilities (-1.33%) sank the most, while telecoms (+2.78%) outperformed.

The large-cap stocks' measure, the WIG30 index, went down 0.4%. In the index basket, FMCG-wholesaler EUROCASH (WSE: EUR) led the decliners with a 3.98% drop, followed by thermal coal miner BOGDANKA (WSE: LWB) and two apparel retailers CCC (WSE: CCC) and LPP (WSE: LPP), retreating by 3.15%-3.48%. Elsewhere, Poland's state-controlled utilities PGE (WSE: PGE), ENERGA (WSE: ENG) and ENEA (WSE: ENA) as well as oil and gas producer PGNIG (WSE: PGN) recorded losses between 0.93% and 2.36%, weighted down by the announcement the companies jointly submitted a preliminary, nonbinding offer for purchase of Polish assets of France's power group EDF. On the country, property developer GTC (WSE: GTC), chemical producer GRUPA AZOTY (WSE: ATT) and telecommunication services provider ORANGE POLSKA (WSE: OPL) were the biggest advancers, gaining 7.38%, 4.81% and 3.35% respectively.

Today's readings of CPI inflation in the United States provide arguments for the September increase in the cost of credit. CPI and CPI-Core were in August higher than expected and the market reaction is adequate to the data. Strengthening of the dollar sheds EURUSD pair into daily lows. Retreating also contracts on the S&P500 and the German DAX. The Warsaw Stock Exchange should follow the environment, but slowly approaching the time for determining the settlement price of contracts on the WIG20 and we think that this is the most important topic of today's session.

U.S. stock-index futures slipped as investors awaited next week's Federal Reserve meeting, with economic indicators pointing to uneven growth in the world's largest economy.

Global Stocks:

Nikkei 16,519.29 +114.28 +0.70%

Hang Seng Closed

Shanghai Closed

FTSE 6,713.84 -16.46 -0.24%

CAC 4,339.82 -33.40 -0.76%

DAX 10,316.55 -114.65 -1.10%

Crude $43.12 (-1.80%)

Gold $1313.90 (-0.31%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.38 | -0.09(-0.9504%) | 6650 |

| Amazon.com Inc., NASDAQ | AMZN | 772 | 2.31(0.3001%) | 28712 |

| Apple Inc. | AAPL | 115.13 | -0.44(-0.3807%) | 504951 |

| Barrick Gold Corporation, NYSE | ABX | 17.53 | -0.12(-0.6799%) | 38051 |

| Caterpillar Inc | CAT | 81.5 | -0.53(-0.6461%) | 732 |

| Citigroup Inc., NYSE | C | 46.56 | -0.52(-1.1045%) | 43781 |

| Exxon Mobil Corp | XOM | 83.9 | -1.18(-1.3869%) | 52406 |

| Facebook, Inc. | FB | 128.01 | -0.34(-0.2649%) | 25814 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.64 | -0.14(-1.4315%) | 49255 |

| General Electric Co | GE | 29.69 | -0.06(-0.2017%) | 12322 |

| General Motors Company, NYSE | GM | 31.34 | 0.22(0.7069%) | 150 |

| Goldman Sachs | GS | 167 | -1.08(-0.6426%) | 400 |

| Google Inc. | GOOG | 769.5 | -2.26(-0.2928%) | 1861 |

| Intel Corp | INTC | 36.48 | -0.08(-0.2188%) | 6932 |

| JPMorgan Chase and Co | JPM | 66.3 | -0.34(-0.5102%) | 11332 |

| Microsoft Corp | MSFT | 57.03 | -0.16(-0.2798%) | 3050 |

| Nike | NKE | 55.41 | -0.06(-0.1082%) | 101 |

| Procter & Gamble Co | PG | 87.5 | -0.56(-0.6359%) | 584 |

| Starbucks Corporation, NASDAQ | SBUX | 53.98 | -0.13(-0.2403%) | 3298 |

| Tesla Motors, Inc., NASDAQ | TSLA | 200 | -0.42(-0.2096%) | 2476 |

| Twitter, Inc., NYSE | TWTR | 18.89 | 0.59(3.224%) | 541951 |

| Verizon Communications Inc | VZ | 51.8 | -0.18(-0.3463%) | 153 |

| Visa | V | 82.2 | 0.19(0.2317%) | 2000 |

| Wal-Mart Stores Inc | WMT | 72.46 | 0.06(0.0829%) | 849 |

| Walt Disney Co | DIS | 93.81 | 1.31(1.4162%) | 140 |

| Yahoo! Inc., NASDAQ | YHOO | 43.89 | -0.10(-0.2273%) | 301 |

| Yandex N.V., NASDAQ | YNDX | 20.46 | -0.04(-0.1951%) | 200 |

Upgrades:

Downgrades:

Citigroup (C) downgraded to Neutral from Buy at Goldman

Other:

Coca-Cola (KO) initiated with a Neutral at Credit Suisse; target $44

Wal-Mart (WMT) resumed/upgraded with a Outperform at Credit Suisse

Amazon (AMZN) target raised to $1000 from $840 at RBC Capital Mkts

Apple (AAPL) target raised to $140 from $120 at Canaccord Genuity

The first half of today's trading is part of the scenario usually played on settlement day of derivatives. Low activity accompanied by modest volatility. The market is shallow and the bulls failed to overcome the resistance level at 1,750 points. This quiet waiting for the final hour of the session was disrupted by changes in the key indices Euroland. The DAX went at daily minima daily losing more than 1 percent. That's exactly what we have in Paris. Our market did not react to this fact and still bravely holding up with a fall of the WIG20 index 0.56 percent.

WIG20 index opened at 1745.20 points (-0.04%)*

WIG 47254.48 0.12%

WIG30 2010.59 0.13%

mWIG40 3983.23 0.19%

*/ - change to previous close

Yesterday, strong growth, session in the US had no impression on investors in Europe. This is evidenced by cons of contracts for the major European indices in the morning and slightly downward opening of the Warsaw Stock Exchange. Today we have a day of witches - settlement of the September series of futures contracts. This specific session, which usually doing flat character, a real trading occurs only in the last hour.

In the first transactions on the cash market bulls have managed to maintain and even improve the growth of the WIG20 stretched during yesterday's final fixing. Could not however reach and exceed the level of 1750 points, which in the short term technical resistance. As a result, we return to the yesterday's status quo.

Thursday's session on the New York stock exchange has brought one-percent increase in the major indexes. To the fourth day in a row rising contributed quotes of Apple, higher oil prices as well as positive data from the US economy closely followed by the market.

Markets returned to calm after a period of increased volatility at the beginning of the week, which was caused by speculation on the future of monetary policy in the United States, among others, on a wave of conflicting signals from the speech of Fed members.

In the morning, we see a slight withdrawal of the contract on the S&P500, so we may expect a neutral openings in Europe. Also the oil market and the EURUSD currency pair does not show on some fireworks.

We also may not forget that today's session will be held on the third Friday of September, which simply directs the attention of investors towards the derivative market and the so-called day of three witches, what means shifts in prices associated with the expiration of futures contracts. That is why today's trading in the equity markets may be - and probably will - distorted by noise generated by the players in the derivatives market.

Hence for the return of regular trading we have to wait for the new week, which will bring the most anticipated event of September - a two-day meeting of the FOMC.

Today, markets will get another important US data that will shape expectations before September 21 - reading of the CPI from the US.

On the Warsaw market, investors should move out today the WIG20 over support in the region of 1,750 points, however, trade will be subordinated to the time in which derivative market players will be settled their positions on the WIG20 futures contracts. This usually results in low turnover till the final hour and abrupt increase of activity in the last hour of trading.

European stocks snapped a losing streak Thursday, as soft U.S. economic data underscored expectations that borrowing rates in the world's largest economy will be held at ultra-low levels a while longer.

U.S. stocks finished higher Thursday, near their intraday highs, as an Apple-inspired rally in the tech sector helped to lift the broader market following a deluge of macroeconomic reports. Earlier in the session, investors were training their focus on retail sales, which showed a decline in August-the first since March. Meanwhile a weekly report on jobless claims ticked higher but remained at historically low levels. And, producer prices remained flat, suggesting lack of inflation pressures.

Gains in Asian markets followed a sharp rise in Apple shares overnight which boosted major U.S. indexes. Apple began shipping its new iPhone models Friday. Markets in China, Hong Kong, Taiwan, South Korea and Malaysia were closed for the mid-autumn festival.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.