- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major US stock indices grew moderately on Friday amid reports that the US Senate approved the budget plan for the 2018 financial year. The budget plan is $ 4 trillion. was approved by the US Senate in a vote of 51 to 49 votes. The adoption of the budget is one of the stages in the implementation of the tax reform promised by US President Donald Trump, since it allows Republicans to avoid blocking this process by the Democrats. The tax reform will be possible due to the reduction in expenses set in the draft budget. The document also sets the budget framework for the period from 2019 to 2027. It is worth emphasizing that the reduction of taxes provided by Trump within 10 years will increase the US budget deficit by $ 1.5 trillion. The plan should now be coordinated with the budget plan of the House of Representatives.

In addition, as it became known today, in September, home sales in the United States unexpectedly increased, as the consequences of Hurricanes Harvey and Irma began to dissipate, but the constant shortage of offers for sale continued to affect overall activity. The National Association of Realtors said on Friday that home sales in the secondary market increased by 0.7% to a seasonally adjusted annual figure of 5.39 million units last month. Economists predicted that sales would fall to 5.30 million units. Sales have decreased by 1.5 percent since September 2016, this is the first annual decline since July 2016.

Most components of the DOW index finished trading in positive territory (25 out of 30). The leader of growth was the shares of The Boeing Company (BA, + 2.19%). Outsider were the shares of The Procter & Gamble Company (PG, -4.04%).

Almost all sectors of the S & P index recorded an increase. The sector of industrial goods grew most (+ 1.0%). The largest decrease was shown by the consumer goods sector (-0.2%).

At closing:

Dow + 0.71% 23,328.63 +165.59

Nasdaq + 0.36% 6,629.05 +23.98

S & P + 0.51% 2.575.13 +13.03

U.S. stock-index futures rose, supported by reports the U.S. Senate has approved a budget resolution for the 2018 fiscal year.

Global Stocks:

Nikkei 21,457.64 +9.12 +0.04%

Hang Seng 28,487.24 +328.15 +1.17%

Shanghai 3,379.50 +9.33 +0.28%

S&P/ASX 5,906.99 +10.86 +0.18%

FTSE 7,534.14 +11.10 +0.15%

CAC 5,370.10 +1.81 +0.03%

DAX 12,999.81 +9.71 +0.07%

Crude $51.06 (-0.87%)

Gold $1,285.10 (-0.38%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 219.65 | 0.41(0.19%) | 328 |

| ALCOA INC. | AA | 46.85 | 0.31(0.67%) | 4445 |

| Amazon.com Inc., NASDAQ | AMZN | 992.65 | 6.04(0.61%) | 24945 |

| American Express Co | AXP | 92.2 | 0.30(0.33%) | 2230 |

| AMERICAN INTERNATIONAL GROUP | AIG | 65.15 | 0.08(0.12%) | 250 |

| Apple Inc. | AAPL | 156.61 | 0.63(0.40%) | 131679 |

| AT&T Inc | T | 35.74 | 0.05(0.14%) | 19236 |

| Barrick Gold Corporation, NYSE | ABX | 16.05 | -0.05(-0.31%) | 24823 |

| Boeing Co | BA | 260.6 | 1.56(0.60%) | 331 |

| Caterpillar Inc | CAT | 131.5 | 0.73(0.56%) | 6558 |

| Cisco Systems Inc | CSCO | 33.9 | 0.15(0.44%) | 15261 |

| Citigroup Inc., NYSE | C | 73.85 | 0.97(1.33%) | 117851 |

| Exxon Mobil Corp | XOM | 82.48 | -0.26(-0.31%) | 13383 |

| Facebook, Inc. | FB | 175.5 | 0.94(0.54%) | 67816 |

| FedEx Corporation, NYSE | FDX | 223.9 | -0.07(-0.03%) | 236 |

| Ford Motor Co. | F | 12.1 | 0.02(0.17%) | 34612 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15 | 0.19(1.28%) | 24757 |

| General Electric Co | GE | 21.63 | -1.95(-8.27%) | 10976463 |

| General Motors Company, NYSE | GM | 45.59 | 0.24(0.53%) | 3455 |

| Goldman Sachs | GS | 242.78 | 2.79(1.16%) | 4713 |

| Google Inc. | GOOG | 988.58 | 4.13(0.42%) | 3992 |

| Hewlett-Packard Co. | HPQ | 22.1 | 0.14(0.64%) | 222 |

| HONEYWELL INTERNATIONAL INC. | HON | 145 | 1.38(0.96%) | 12951 |

| Intel Corp | INTC | 40.36 | 0.27(0.67%) | 13661 |

| International Business Machines Co... | IBM | 161.11 | 0.21(0.13%) | 13196 |

| Johnson & Johnson | JNJ | 142.95 | 0.91(0.64%) | 1345 |

| JPMorgan Chase and Co | JPM | 99.35 | 1.24(1.26%) | 58982 |

| Microsoft Corp | MSFT | 78.19 | 0.28(0.36%) | 5716 |

| Nike | NKE | 52.87 | 0.18(0.34%) | 10018 |

| Pfizer Inc | PFE | 36.16 | -0.08(-0.22%) | 288 |

| Procter & Gamble Co | PG | 90 | -1.59(-1.74%) | 40527 |

| Starbucks Corporation, NASDAQ | SBUX | 55.2 | -0.20(-0.36%) | 3361 |

| Tesla Motors, Inc., NASDAQ | TSLA | 351.6 | -0.21(-0.06%) | 24720 |

| Twitter, Inc., NYSE | TWTR | 17.94 | 0.05(0.28%) | 6917 |

| United Technologies Corp | UTX | 119.5 | 0.01(0.01%) | 100 |

| UnitedHealth Group Inc | UNH | 203 | -0.25(-0.12%) | 2140 |

| Verizon Communications Inc | VZ | 49.31 | 0.10(0.20%) | 8811 |

| Visa | V | 107.56 | 0.54(0.50%) | 1630 |

| Wal-Mart Stores Inc | WMT | 86.63 | 0.23(0.27%) | 7840 |

Travelers (TRV) reiterated with a Neutral at FBR & Co., target $119

Freeport-McMoRan (FCX) reiterated with a Neutral at FBR & Co., target $12

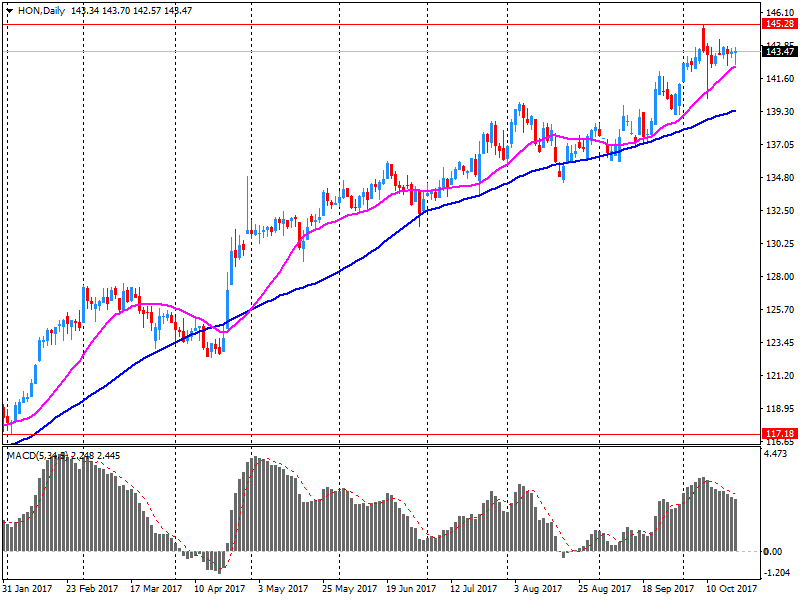

Honeywell (HON) reported Q3 FY 2017 earnings of $1.75 per share (versus $1.51 in Q3 FY 2016), beating analysts' consensus estimate of $1.74.

The company's quarterly revenues amounted to $10.121 bln (+3.2% y/y), generally in-line with analysts' consensus estimate of $10.046 bln.

HON rose to $144.60 (+0.68%) in pre-market trading.

Procter & Gamble (PG) reported Q1 FY 2018 earnings of $1.09 per share (versus $1.03 in Q1 FY 2017), beating analysts' consensus estimate of $1.08.

The company's quarterly revenues amounted to $16.653 bln (+0.8% y/y), generally in-line with analysts' consensus estimate of $16.687 bln.

The company also reaffirmed guidance for FY2018, projecting EPS of +5-7% to ~$4.12-4.19 (versus analysts' consensus estimate of $4.18) and revenues of +3% to ~$67.0 bln (versus analysts' consensus estimate of $67.15 bln).

PG fell to $90.00 (-1.74%) in pre-market trading.

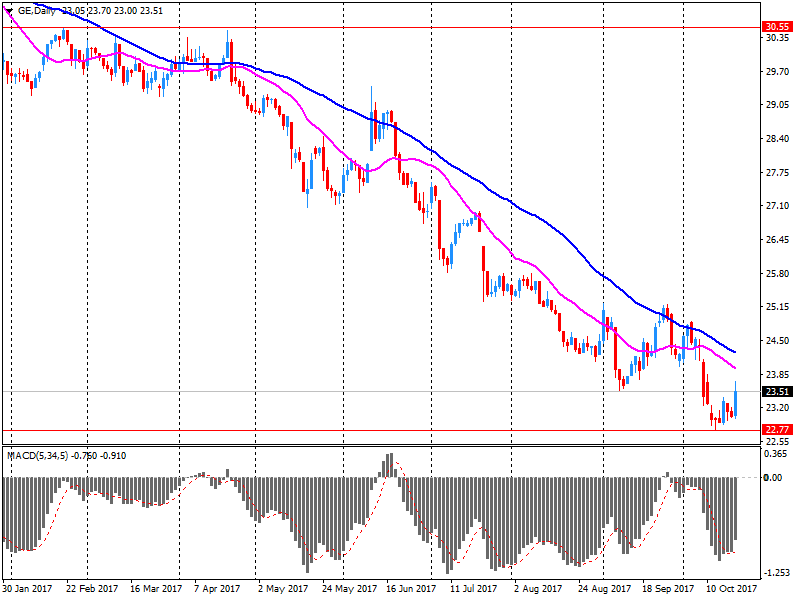

General Electric (GE) reported Q3 FY 2017 earnings of $0.29 per share (versus $0.32 in Q3 FY 2016), missing analysts' consensus estimate of $0.49.

The company's quarterly revenues amounted to $33.470 bln (+11.5% y/y), beating analysts' consensus estimate of $32.505 bln.

The company also issued downside guidance for FY2017, projecting EPS of $1.05-1.10, compared to prior $1.60-1.70 and analysts' consensus estimate of $1.53.

GE fell to 21.94 (-6.95%) in pre-market trading.

U.S. stocks finished mixed on Thursday, with the Dow and S&P 500 inching up in the last minute to secure record finishes, according to preliminary numbers, shaking off earlier weakness tied to political headlines in Europe, muted data from China and the 30th anniversary of Black Monday--the worst one-day percentage fall in history.

Early weakness in Japan, Australia and New Zealand stocks faded Friday morning, but Asia-Pacific markets overall lacked direction following weakness in Europe and swings on Wall Street. Hong Kong stocks rebounded strongly at the open, with the Hang Seng Index HSI, +0.98% up 0.7%. A late-session selloff Thursday put the benchmark down 2%, after a warning from the governor of China's central bank rattled investors.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.