- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| index | closing price | change items | % change |

| Nikkei | | | |

| TOPIX | | | |

| Hang Seng | -135.41 | 31414.52 | -0.43% |

| CSI 300 | -16.65 | 4061.05 | -0.41% |

| Euro Stoxx 50 | -11.04 | 3401.04 | -0.32% |

| DAX | +1.82 | 12309.15 | +0.01% |

| CAC 40 | -12.69 | 5239.74 | -0.24% |

| DJIA | -44.96 | 24682.31 | -0.18% |

| S&P 500 | -5.01 | 2711.93 | -0.18% |

| NASDAQ | -19.02 | 7345.29 | -0.26% |

Major U.S. stock-indexes rose on Wednesday before the announcement of the Federal Reserve's policy decision (18:00 GMT), as energy sector rallied, underpinned by a jump in oil prices after a surprise drop in U.S. inventories. Meanwhile, Facebook (FB; +1.4%) rebounded after steep declines in the previous two sessions.

Most of Dow stocks in positive area (18 of 30). Top gainer - Chevron Corp. (CVX, +2.04%). Top loser - The Procter & Gamble Co. (GE, -0.93%).

Most of S&P sectors in positive area. Top gainer - Basic Materials (+2.2%). Top loser - Conglomerates(-0.6%).

At the moment:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Dow | 24794.00 | +29.00 | +0.12% |

| S&P 500 | 2726.50 | +3.00 | +0.11% |

| Nasdaq 100 | 6909.50 | -8.00 | -0.12% |

| Crude Oil | 65.04 | +1.50 | +2.36% |

| Gold | 1326.20 | +14.30 | +1.09% |

| U.S. 10yr | 2.90% | +0.02 | +0.83% |

U.S. stock-index futures fell on Wednesday as investors were cautious ahead of the announcement of the Fed's policy decision, while Facebook (FB) shares continued to slide in reaction to the Cambridge Analytica scandal.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | - | - | - |

| Hang Seng | 31,414.52 | -135.41 | -0.43% |

| Shanghai | 3,281.59 | -9.05 | -0.27% |

| S&P/ASX | 5,950.30 | +13.90 | +0.23% |

| FTSE | 7,024.91 | -36.36 | -0.51% |

| CAC | 5,231.71 | -20.72 | -0.39% |

| DAX | 12,270.85 | -36.48 | -0.30% |

| Crude | 64.11 | | +0.90% |

| Gold | 1,316.50 | | +0.35% |

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 61.25 | -0.27(-0.44%) | 3061 |

| Amazon.com Inc., NASDAQ | AMZN | 1,587.40 | 0.89(0.06%) | 43869 |

| American Express Co | AXP | 94.92 | -0.03(-0.03%) | 999 |

| Apple Inc. | AAPL | 175.05 | -0.19(-0.11%) | 79482 |

| AT&T Inc | T | 36.4 | 0.06(0.17%) | 840 |

| Barrick Gold Corporation, NYSE | ABX | 12.1 | 0.06(0.50%) | 26916 |

| Boeing Co | BA | 337.7 | 0.07(0.02%) | 2873 |

| Cisco Systems Inc | CSCO | 44.29 | -0.08(-0.18%) | 5939 |

| Citigroup Inc., NYSE | C | 72.94 | 0.02(0.03%) | 3570 |

| Deere & Company, NYSE | DE | 159.4 | -0.59(-0.37%) | 700 |

| Exxon Mobil Corp | XOM | 74.13 | 0.14(0.19%) | 2820 |

| Facebook, Inc. | FB | 166.7 | -1.45(-0.86%) | 788056 |

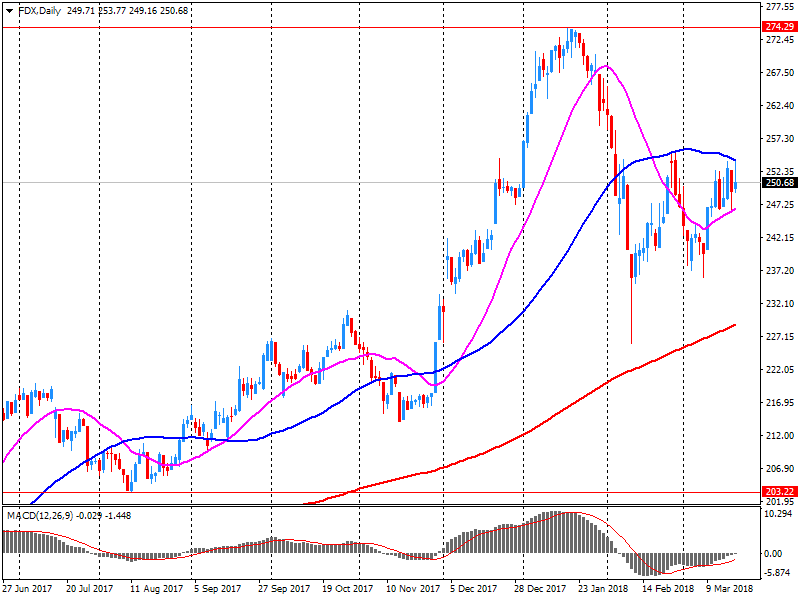

| FedEx Corporation, NYSE | FDX | 250.4 | -1.59(-0.63%) | 71309 |

| Ford Motor Co. | F | 11 | 0.01(0.09%) | 14651 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.5 | 0.01(0.05%) | 2016 |

| General Electric Co | GE | 13.68 | 0.04(0.29%) | 81889 |

| General Motors Company, NYSE | GM | 37.1 | 0.21(0.57%) | 2159 |

| Home Depot Inc | HD | 178 | -0.16(-0.09%) | 334 |

| Intel Corp | INTC | 51.54 | -0.01(-0.02%) | 48779 |

| International Business Machines Co... | IBM | 156.81 | 0.61(0.39%) | 655 |

| Johnson & Johnson | JNJ | 131.32 | 0.11(0.08%) | 8462 |

| Microsoft Corp | MSFT | 92.97 | -0.16(-0.17%) | 11071 |

| Pfizer Inc | PFE | 36.26 | -0.07(-0.19%) | 939 |

| Procter & Gamble Co | PG | 78.17 | -0.14(-0.18%) | 4766 |

| Tesla Motors, Inc., NASDAQ | TSLA | 310.5 | -0.05(-0.02%) | 8590 |

| The Coca-Cola Co | KO | 43.13 | -0.03(-0.07%) | 2544 |

| Twitter, Inc., NYSE | TWTR | 32.15 | 0.80(2.55%) | 570211 |

| Verizon Communications Inc | VZ | 47.7 | 0.01(0.02%) | 730 |

| Visa | V | 125 | 0.09(0.07%) | 945 |

| Wal-Mart Stores Inc | WMT | 88.24 | 0.29(0.33%) | 2191 |

| Yandex N.V., NASDAQ | YNDX | 42.9 | 0.12(0.28%) | 500 |

Facbook (FB) reiterated with a Overweight at KeyBanc Capital Mkts; target $245

FedEx (FDX) reported Q3 FY 2018 earnings of $3.72 per share (versus $2.35 in Q3 FY 2017), beating analysts' consensus estimate of $3.12.

The company's quarterly revenues amounted to $16.526 bln (+10.2% y/y), beating analysts' consensus estimate of $16.171 bln.

The company also issued upside guidance for FY 2018, raising EPS to $15.00-15.40 from $12.70-13.30 versus analysts' consensus estimate of $13.63.

FDX fell to $251.00 (-0.39%) in pre-market trading.

Stock markets rose Wednesday in Asia, following modest rebounds in Europe and the U.S. that partially reversed Monday's global declines. Despite the strong start, trading volume across asset classes is likely to be muted in Asia through the day, ahead of the looming Federal Reserve interest-rate hike and updated economic projections.

European stocks ended higher on Tuesday, aided by a pullback for the euro following a weak German business sentiment reading. As well, a drop in the pound after a slowdown in British inflation helped lift U.K. blue-chip stocks.

U.S. stocks ended higher Tuesday, led by strong gains in the energy sector as the overall market reclaimed some lost ground from the previous day, when tech shares fell sharply. Market participants also were anticipating the Federal Reserve's two-day policy meeting, which started in the early afternoon. Investors are watching for signs that the central bank will take a more aggressive path toward normalizing monetary policy.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.