- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 16,807.62 +315.47 +1.91%

Shanghai Composite 3,025.48 +2.48 +0.08%

S&P/ASX 200 5,339.56 +36.03 +0.68%

FTSE 100 6,834.77 +3.98 +0.06%

CAC 40 4,409.55 +20.95 +0.48%

Xetra DAX 10,436.49 +42.63 +0.41%

S&P 500 2,163.12 +23.36 +1.09%

Dow Jones Industrial Average 18,293.70 +163.74 +0.90%

S&P/TSX Composite 14,710.82 +188.84 +1.30%

Major U.S. stock-indexes rose on Wednesday, helped by gains in technology and energy stocks, ahead of the Federal Reserve's decision later in the day. The Fed is scheduled to release, followed by Chair Janet Yellen's press conference. While the chances of a hike are marginal this time, investors will comb the central bank's statements for clues about a December hike.

Most of Dow stocks in positive area (21 of 30). Top gainer - Caterpillar Inc. (CAT, +1.11%). Top loser - The Walt Disney Company (DIS, -0.97%).

Most of S&P sectors also in positive area. Top gainer - Basic Materials (+1.4%). Top loser - Conglomerates (-0.4%).

At the moment:

Dow 18088.00 +41.00 +0.23%

S&P 500 2137.75 +6.75 +0.32%

Nasdaq 100 4805.75 +7.25 +0.15%

Oil 45.20 +1.15 +2.61%

Gold 1330.50 +12.30 +0.93%

U.S. 10yr 1.71 +0.02

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, surged by 0.20%. Sector performance within the WIG Index was mixed. Materials (+1.32%) outperformed, while food sector (-1.46%) lagged behind.

The large-cap stocks gained 0.28%, as measured by the WIG30 Index, with the way up led by coking coal producer JSW (WSE: JSW), jumping by 4.89%. Among the other major advancers were banking name ALIOR (WSE: ALR) and two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), adding 2.42%, 1.92% and 1.62% respectively. On the other side of the ledger, agricultural producer KERNEL (WSE: KER), videogame developer CD PROJEKT (WSE: CDR), genco TAURON PE (WSE: TPE) and oil refiner LOTOS (WSE: LTS) were the biggest decliners, losing between 1.09% and 1.82%.

The American market started trading with a slight, expected rise. It did not make any impression on investors in Warsaw, where the index of the largest companies remain in consolidation around the opening level.

An hour before the close of trading the WIG20 index was at the level of 1,758 points (+ 0.16%) with the turnover of slightly over PLN 400 million.

U.S. stock-index futures rose before the Federal Reserve's policy decision, with the Bank of Japan reinforcing optimism that central banks will continue to support global growth.

Global Stocks:

Nikkei 16,807.62 +315.47 +1.91%

Hang Seng 23,669.90 +139.04 +0.59%

Shanghai 25.48 +2.48 +0.08%

FTSE 6,846.74 +15.95 +0.23%

CAC 4,426.32 +37.72 +0.86%

DAX 10,484.18 +90.32 +0.87%

Crude $44.90 (+1.93%)

Gold $1331.00 (+0.97%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.53 | 0.09(0.9534%) | 54029 |

| Amazon.com Inc., NASDAQ | AMZN | 782.65 | 2.43(0.3115%) | 8188 |

| Apple Inc. | AAPL | 114.15 | 0.58(0.5107%) | 122360 |

| AT&T Inc | T | 40.11 | 0.15(0.3754%) | 3387 |

| Barrick Gold Corporation, NYSE | ABX | 17.6 | 0.40(2.3256%) | 56538 |

| Chevron Corp | CVX | 98.39 | 0.69(0.7062%) | 400 |

| Cisco Systems Inc | CSCO | 31.15 | 0.05(0.1608%) | 100 |

| Citigroup Inc., NYSE | C | 46.85 | 0.31(0.6661%) | 30323 |

| Exxon Mobil Corp | XOM | 83.02 | 0.48(0.5815%) | 857 |

| Facebook, Inc. | FB | 128.96 | 0.32(0.2488%) | 74425 |

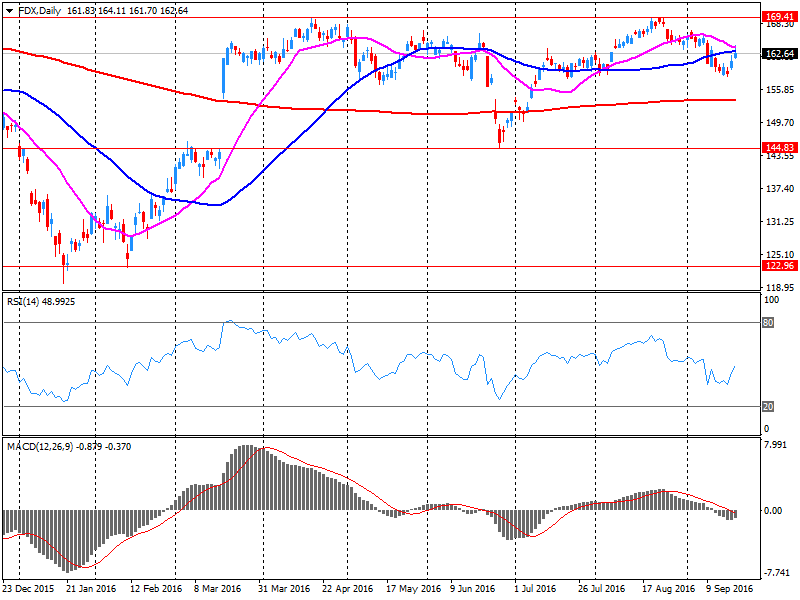

| FedEx Corporation, NYSE | FDX | 168.84 | 6.19(3.8057%) | 8417 |

| Ford Motor Co. | F | 12.05 | 0.05(0.4167%) | 40418 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.11 | 0.16(1.608%) | 54149 |

| General Electric Co | GE | 29.83 | 0.16(0.5393%) | 5468 |

| General Motors Company, NYSE | GM | 31.73 | 0.08(0.2528%) | 10309 |

| Google Inc. | GOOG | 774 | 2.59(0.3357%) | 626 |

| Hewlett-Packard Co. | HPQ | 14.55 | 0.01(0.0688%) | 600 |

| Intel Corp | INTC | 37.25 | 0.11(0.2962%) | 543 |

| JPMorgan Chase and Co | JPM | 66.79 | 0.33(0.4965%) | 3839 |

| Microsoft Corp | MSFT | 57.55 | 0.74(1.3026%) | 114988 |

| Nike | NKE | 55.07 | 0.20(0.3645%) | 1813 |

| Procter & Gamble Co | PG | 88.62 | 0.04(0.0452%) | 13346 |

| Starbucks Corporation, NASDAQ | SBUX | 53.75 | 0.45(0.8443%) | 2059 |

| Tesla Motors, Inc., NASDAQ | TSLA | 205.1 | 0.46(0.2248%) | 534 |

| The Coca-Cola Co | KO | 42.4 | 0.06(0.1417%) | 28011 |

| Wal-Mart Stores Inc | WMT | 72.07 | 0.10(0.1389%) | 8560 |

| Walt Disney Co | DIS | 93.3 | 0.35(0.3765%) | 746 |

| Yahoo! Inc., NASDAQ | YHOO | 43.01 | 0.22(0.5141%) | 500 |

Upgrades:

Downgrades:

Other:

Altria (MO) initiated with a Hold at Jefferies; target $70

Starbucks (SBUX) initiated with a Buy at Longbow

FedEx (FDX) target raised to $186 from $179 at Stifel

FedEx reported Q1 FY 2017 earnings of $2.90 per share (versus $2.42 in Q1 FY 2016), beating analysts' consensus estimate of $2.78.

The company's quarterly revenues amounted to $14.700 bln (+19.5% y/y), beating analysts' consensus estimate of $14.441 bln.

FedEx also improved guidance for FY 2017, increasing EPS to $11.85-12.35 from $11.75-12.25 versus analysts' consensus estimate of $11.88.

FDX rose to $168.00 (+3.29%) in pre-market trading.

The first half of trading on European markets brought stabilization after high openings and the DAX and the CAC indices are gaining about 1 percent.

In the Warsaw we do not see much enthusiasm and WIG20 index hovering around the level of yesterday's closing auction. Relatively weak behavior is in other emerging markets. The next hours will shift attention to Wall Street and today's FOMC decision, which carries risks for emerging markets and for this reason the Warsaw Stock Exchange may maintain a distance in relation to the developed markets. The market activity improves today, however, the variability remains a sensitive subject, and in the first half of the session was a mere 6 points. At the halfway point of today's session the WIG20 index was at the level of 1,747 points (-0,12%).

European stock indices show an increase for the second time in three days on optimism that the policy of the world's central banks will continue to support growth.

At the end of the two-day meeting, the Bank of Japan left interest rates on deposits at the level of -0.1%. The Board also left unchanged the target volume of purchases of government bonds - at 80 trillion yen per year. However, the Central Bank unexpectedly introduced a target rate of return on 10-year government bonds at 0% within the framework of strengthening the fight against deflation. This measure was taken after the assessment of existing measures that do not yield results. The Bank of Japan first introduced the target level for the long-term rates, and it happened at a time when other central banks have difficulty in finding ways of accelerating inflation. "Investors reacted positively to the decision, considering that the Central Bank will make every effort to overcome deflation," - said Kengo Suzuki analyst at Mizuho Securities.

In the last session, European stocks fluctuated between gains and losses, in response to mixed economic data and fears that central banks may be less willing to strengthen measures to stimulate the economy.

To the growth also contributes the situation on the oil market. Quotes of oil rose by about 2 per cent due to a report from the American Petroleum Institute, which pointed to a significant reduction in US oil inventories. According to API, oil reserves in the previous week fell by 7.5 million barrels, while analysts had expected an increase. Later today iUS Department of Energy data will be published. It is estimated that crude oil inventories rose by 2.25 million barrels to 513.05 million barrels.

Also in focus were revised forecasts from the Organisation for Economic Cooperation and Development. The OECD lowered the forecast for world GDP in 2016 to 2.9%. In June, the OECD expected an increase of 3%. Global GDP in 2017 deteriorated to 3.2% from 3.3%. A slight decrease reflects the weakening of forecasts of major economies of the world, especially in Britain, in 2017, partially offset by the gradual improvement of the situation in the main emerging markets. Also, the OECD pointed out the very weak growth in trade. The rate of increase in world trade slowed down approximately double compared to pre-crisis levels.

The composite index of the largest companies in the regios Stoxx Europe 600 grew by 0.9 percent. Shares of banks and insurance companies show the most gains, which is associated with the decision of the Bank of Japan, and the expectation of the Fed's meeting today. It is unlikely that the Fed will raise rates in September, but investors will be closely watching the press conference and forecasts looking for indications that a decision may be taken in December.

Capitalization of Banco Santander SA rose 3.4 percent after reports that the lender has completed negotiations with the Royal Bank of Scotland, to buy Williams & Glyn.

Shares of Inditex SA rose 0.9 percent after the world's largest clothing retailer reported that earnings exceeded analysts' expectations.

The cost of Eurofins Scientific SE has increased by 3.9 percent, as the company raised its earnings forecast for the current year and said it remains on track to achieve its objectives for 2020.

At the moment:

FTSE 100 6854.75 +23.96 + 0.35%

DAX +113.99 10507.85 + 1.10%

CAC 40 +53.45 4442.05 + 1.22%

Tuesday's session on Wall Street ended with a modest changes in the major indexes. There was no impulse yesterday, which is worth to remember and will be important during today's trading. After a month of focus on the question "what the Fed will do in September?" the stock exchanges reached the day on which the whole trade will be dominated by reactions to the actions and signals from the central banks. We may expect that opening of European markets will be a simple reaction to today's decision of the BoJ and the related conference of the BoJ head.

However, investor's attention should quickly move in the direction of Wall Street and waiting for the evening decision of the Federal Open Market Committee. In the case of the Fed's decision is a lot of uncertainty, statements of the Fed indicated that in September will raise interest rates. The data indicate rather the lack of such action.

The session on the Warsaw market will be than strongly associated with other exchanges. The Fed's decision will appear after the close of trading in Warsaw, so a serious reaction we will see tomorrow.

U.K. stocks gained ground Tuesday, finding support as the pound lost some of its value ahead of much anticipated decisions by the U.S. Federal Reserve and the Bank of Japan. The blue-chips benchmark had been darting in and out of positive territory Tuesday, but stepped higher as the pound GBPUSD, -0.1694% dropped below $1.30, trading below that level for the first time since mid-August.

U.S. stocks on Tuesday ended little-changed, paring modest gains into the close, as traders grew cautious on the eve of a pair of major central-bank decisions. Volatile oil prices pressured energy shares, limiting overall gains. The S&P 500 index SPX, +0.03% finished up less than a point at 2,139.76. Health care and consumer staples led winners, while energy shares lagged behind, falling 0.8%.

Japan's Nikkei stock market rose and the yen weakened immediately following the BOJ announcement. Japan's central bank announced Wednesday that it would keep its key interest rate steady at -0.1%. The Bank of Japan also said it would expand its monetary base until inflation becomes stable above 2%. The BOJ intends to abandon its monetary base target, but maintain an annual pace of government-bond buying at 80 trillion yen. Experts had been nervously awaiting the bank's move, with many concerned the BOJ would cut interest rates even deeper into negative territory.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.