- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

S&P/ASX 200 5,109.05 +2.39 +0.05%

TOPIX 1,531.28 -5.82 -0.38%

SHANGHAI COMP 3,642.63 +63.67 +1.78%

HANG SENG 21,791.68 +36.12 +0.17%

FTSE 100 6,034.84 -17.58 -0.29%

CAC 40 4,565.17 -60.09 -1.30%

Xetra DAX 10,497.77 -110.42 -1.04%

S&P 500 2,021.15 +15.60 +0.78%

NASDAQ Composite 4,968.92 +45.84 +0.93%

Dow Jones 17,251.62 +123.07 +0.72%

U.S. stocks fluctuated as China's signal that it may add to stimulus boosted metals prices from copper to gold. Brent crude slipped to an 11-year low on signs the global glut will persist, while Treasuries advanced.

The Standard & Poor's 500 Index pared gains to 0.1 percent, after earlier rallying as much as 0.9 percent. The U.S. benchmark recovered from a 3.3 percent rout over two days after the Federal Reserve raised interest rates. Ten-year Treasury notes erased losses for December, while the dollar slipped. Brent futures in London fell to the weakest intraday level since July 2004, with drilling in the U.S. increasing. Emerging-market equities headed for the fourth gain in five days.

The rout in crude prices has pushed oil to the lowest levels since before financial crisis, threatening to keep inflation from rising to levels targeted by central banks in Europe and America. Equities have tumbled since the Fed's tightening on concern that U.S. growth could slow without zero-percent interest rates. China's government said monetary policy must be more "flexible" and fiscal policy more "forceful" to combat slowing growth in the world's second-largest economy.

Brent crude futures were 1.9 percent lower at $36.19 a barrel, after a 2.8 percent decline last week. It fell as low as $36.04 on Monday, the lowest since July 2004. West Texas Intermediate crude in New York was little changed at $34.74 a barrel.

Gas, which has been battered by widespread warmth in the eastern half of the country, headed for the biggest one-day gain in seven weeks as forecasts showed mild weather fading in the U.S. Midwest. Gas futures for January delivery rose 7.9 percent, to $1.907 per million British thermal units on the New York Mercantile Exchange.

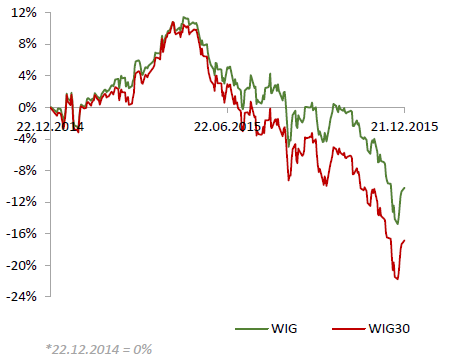

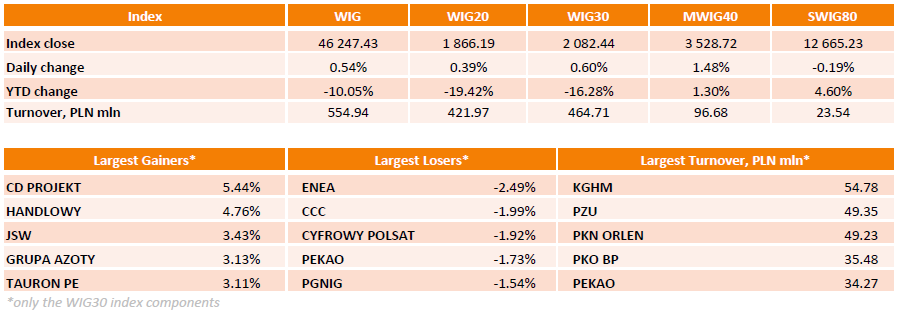

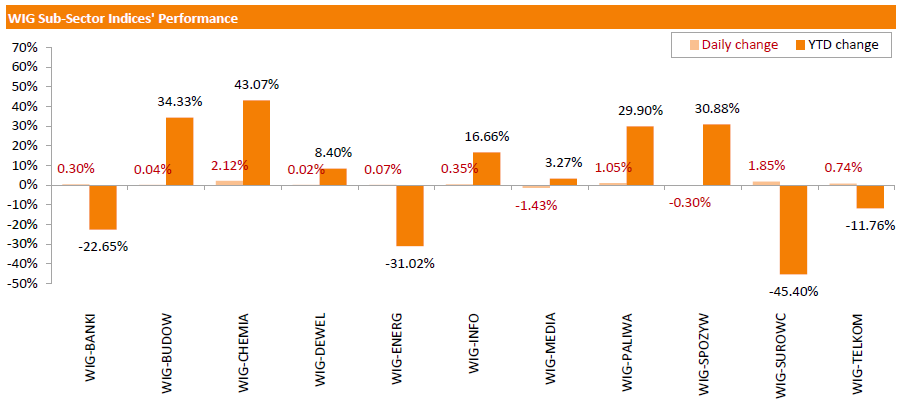

Polish equity market surged on Monday. The broad market measure, the WIG Index, added 0.54%. Except for media (-1.43%) and food sector (-0.30%), every sector in the WIG Index gained, with chemicals (+2.12%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced by 0.6%. Videogame developer CD PROJEKT (WSE: CDR) closed its first day as WIG30 Index component with a 5.44% boost. CDR replaced the shares of auto components producer BORYSZEW (WSE: BRS). Other major gainers included bank HANDLOWY (WSE: BHW), coal miner JSW (WSE: JSW), chemical producer GRUPA AZOTY (WSE: ATT) and genco TAURON PE (WSE: TPE), advancing between 3.11% and 4.76%. On the other side of the ledger, genco ENEA (WSE: ENA) was the weakest name, retreating by 2.49% after two consecutive sessions of gains. Retailer CCC (WSE: CCC) and media group CYFROWY POLSAT (WSE: CPS) posted declines of 1.99% and 1.92% respectively.

Major U.S. stock-indexes started the Christmas holiday week on a positive note, led by tech and financials, but energy stocks lagged as Brent crude hit an 11 year low. Trading volumes are expected to be relatively light this week, with U.S. stock markets operating a shortened session on Thursday and closing on Friday for Christmas.

Oil prices have been sliding under continued pressure from global oversupply and tepid demand.

Most of Dow stocks in positive area (24 of 30). Top looser - The Walt Disney Company (DIS, -1,33%). Top gainer - JPMorgan Chase & Co. (JPM, +1.18%).

All S&P index sectors in positive area. Top looser - Conglomerates (+0,7%).

At the moment:

Dow 17087.00 +70.00 +0.41%

S&P 500 2004.00 +12.00 +0.60%

Nasdaq 100 4530.50 +26.00 +0.58%

Oil 35.57 -0.49 -1.36%

Gold 1078.30 +13.30 +1.25%

U.S. 10yr 2.19 -0.01

U.S. stock-index futures were rose.

Global Stocks:

Nikkei 18,916.02 -70.78 -0.37%

Hang Seng 21,791.68 +36.12 +0.17%

Shanghai Composite 3,642.63 +63.67 +1.78%

FTSE 6,108.01 +55.59 +0.92%

CAC 4,644.48 +19.22 +0.42%

DAX 10,696.51 +88.32 +0.83%

Crude oil $34.57 (-0.46%)

Gold $1073.70 (+0.82%)

(company / ticker / price / change, % / volume)

| Barrick Gold Corporation, NYSE | ABX | 7.40 | 2.35% | 1.4K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 6.31 | 1.61% | 24.9K |

| Hewlett-Packard Co. | HPQ | 11.68 | 1.48% | 0.1K |

| Walt Disney Co | DIS | 109.25 | 1.42% | 73.5K |

| ALCOA INC. | AA | 9.33 | 1.08% | 15.0K |

| Apple Inc. | AAPL | 107.16 | 1.07% | 246.7K |

| Microsoft Corp | MSFT | 54.70 | 1.05% | 87.1K |

| Goldman Sachs | GS | 177.30 | 1.03% | 0.1K |

| Citigroup Inc., NYSE | C | 51.72 | 1.00% | 10.7K |

| Intel Corp | INTC | 34.20 | 0.99% | 8.6K |

| Starbucks Corporation, NASDAQ | SBUX | 59.20 | 0.99% | 1.0K |

| Nike | NKE | 129.68 | 0.90% | 0.5K |

| Visa | V | 77.00 | 0.89% | 2.1K |

| Chevron Corp | CVX | 90.60 | 0.88% | 1.1K |

| Yahoo! Inc., NASDAQ | YHOO | 33.24 | 0.88% | 3.3K |

| ALTRIA GROUP INC. | MO | 57.61 | 0.84% | 9.7K |

| Boeing Co | BA | 140.70 | 0.80% | 0.3K |

| JPMorgan Chase and Co | JPM | 64.90 | 0.78% | 1.0K |

| E. I. du Pont de Nemours and Co | DD | 63.88 | 0.76% | 2.3K |

| Facebook, Inc. | FB | 104.81 | 0.74% | 45.0K |

| AT&T Inc | T | 33.80 | 0.60% | 6.7K |

| Amazon.com Inc., NASDAQ | AMZN | 667.80 | 0.55% | 4.0K |

| Home Depot Inc | HD | 131.00 | 0.54% | 0.5K |

| Johnson & Johnson | JNJ | 102.50 | 0.54% | 0.5K |

| Exxon Mobil Corp | XOM | 77.69 | 0.53% | 0.9K |

| Pfizer Inc | PFE | 32.16 | 0.53% | 45.6K |

| Ford Motor Co. | F | 13.87 | 0.51% | 1.0K |

| Tesla Motors, Inc., NASDAQ | TSLA | 231.62 | 0.50% | 3.2K |

| Twitter, Inc., NYSE | TWTR | 23.10 | 0.48% | 6.8K |

| The Coca-Cola Co | KO | 42.70 | 0.47% | 22.3K |

| Google Inc. | GOOG | 742.52 | 0.43% | 1.1K |

| Procter & Gamble Co | PG | 78.45 | 0.41% | 1.0K |

| General Electric Co | GE | 30.40 | 0.40% | 0.2K |

| Cisco Systems Inc | CSCO | 26.37 | 0.38% | 2.3K |

| Verizon Communications Inc | VZ | 45.72 | 0.35% | 0.4K |

| Caterpillar Inc | CAT | 65.32 | 0.32% | 31.7K |

| International Business Machines Co... | IBM | 135.31 | 0.30% | 0.5K |

| Wal-Mart Stores Inc | WMT | 59.02 | 0.29% | 0.3K |

| American Express Co | AXP | 67.94 | 0.10% | 0.1K |

| Deere & Company, NYSE | DE | 75.03 | 0.08% | 0.1K |

| Yandex N.V., NASDAQ | YNDX | 15.30 | -0.13% | 0.5K |

Upgrades:

Downgrades:

Other:

Alphabet (GOOG) target raised to $850 from $820 at Pacific Crest

U.S. stock indices fell on Friday weighed by declines in oil prices.

The Dow Jones Industrial Average fell 367.39 points, or 2.1%, to 17,128.45 (-0.8% over the week). The S&P 500 dropped 36.37 points, or 1.8%, to 2,005.52 (-0.3% over the week; financials led declines with a 2.5% fall). The Nasdaq Composite lost 79.47 points, or 1.6% to 4,923.08 (-0.2% over the week).

Earlier in the week Fed's decision to raise interest rates spurred a rally in stocks. Normally higher rates steepen the spread between ten-year and 2-year yields, but this effect is not seen yet this time. That's why investors focused on concerns over bank's exposure to energy companies.

This morning in Asia Hong Kong Hang Seng climbed 0.40%, or 86.09, to 21,841.65. China Shanghai Composite Index advanced 1.98%, or 70.42, to 3.649.88. The Nikkei fell by 0.41%, or 78.19, to 18,908.61.

Asian indices outside Japan rose.

Japanese stocks fell reacting to declines in Wall Street on Friday.

The People's Bank of China strengthened the daily fix for the yuan by 0.09% to 6.4753 per dollar avoiding an unprecedented 11th weakening in a row.

(index / closing price / change items /% change)

Nikkei 225 18,986.8 -366.76 -1.90 %

Hang Seng 21,755.56 -116.50 -0.53 %

Shanghai Composite 3,579.49 -0.51 -0.01 %

FTSE 100 6,052.42 -50.12 -0.82%

CAC 40 4,625.26 -52.28 -1.12%

Xetra DAX 10,608.19 -129.93 -1.21%

S&P 500 2,005.55 -36.34 -1.78%

NASDAQ Composite 4,923.08 -79.47 -1.59%

Dow Jones 17,128.55 -367.29 -2.10%

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.