- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -414.50 19041.38 -2.13%

TOPIX -33.22 1530.20 -2.12%

Hang Seng -272.71 24320.41 -1.11%

CSI 300 -16.30 3450.05 -0.47%

Euro Stoxx 50 -8.92 3420.70 -0.26%

FTSE 100 -53.62 7324.72 -0.73%

DAX -58.01 11904.12 -0.48%

CAC 40 -7.73 4994.70 -0.15%

DJIA -6.71 20661.30 -0.03%

S&P 500 +4.43 2348.45 +0.19%

NASDAQ +27.82 5821.64 +0.48%

S&P/TSX +35.33 15348.46 +0.23%

The main stock indexes mainly grew, as the decline of the conglomerate sector was offset by the growth of shares of technology companies.

At the same time, market participants are increasingly doubting that Trump will be able to quickly and fully agree on all the promised reforms in Congress.

The focus was also on statistics for the United States. In January, housing prices remained at the same level in accordance with the monthly housing price index (HPI) of the Federal Housing Finance Agency. HPI reflects positive monthly increases from the beginning of 2012, with the exception of November 2013 and January 2017. The previously reported increase of 0.4% in December was confirmed. From January 2016 to January 2017, house prices rose 5.7%.

Meanwhile, the National Association of Realtors reported that in the US, home sales in the secondary market fell more than expected in February amid a continuing shortage of homes in the market. Sales of housing on the secondary market decreased by 3.7 percent and, taking into account seasonal fluctuations, reached an annual level of 5.48 million units. The pace of sales in January was not revised and remained at the level of 5.69 million units, which was the highest since February 2007. Economists predicted that sales would fall 2.0 percent to 5.57 million units. Sales increased 5.4 percent compared to February 2016, which underlines the sustainability of the housing market recovery, despite the growth in mortgage rates. Demand for housing is currently supported by the labor market, which has reached almost full employment. But home sales continue to be constrained by the shortage of homes available for sale, which leads to higher prices. The average price of the house increased by 7.7 percent compared to a year earlier to $ 228,400 in February. This marked the 60th consecutive month of annual growth in prices.

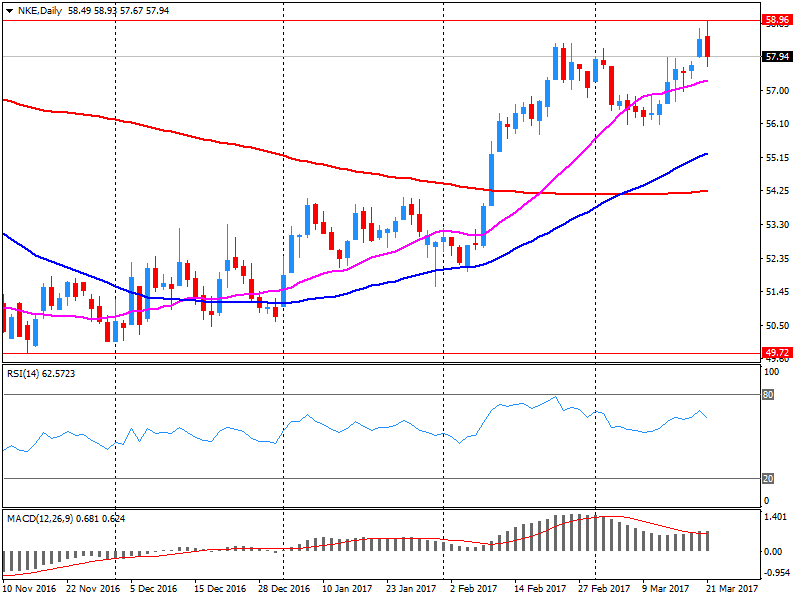

The components of the DOW index have mostly grown (19 out of 30). More shares fell NIKE, Inc. shares. (NKE, -6.94%). The leader of growth was shares of Microsoft Corporation (MSFT, + 1.31%).

The S & P sector finished the session mostly in positive territory. The conglomerate sector fell most of all (-0.4%). The leader of growth was the technological sector (+ 0.5%).

At closing:

Dow -0.03% 20.661.37 -6.64

Nasdaq + 0.48% 5,821.64 +27.81

S & P + 0.19% 2,348.45 +4.43

Major U.S. stock-indexes little changed on Wednesday as investors sought bargains a day after the major indexes posted their biggest one-day loss since before the election.

Dow stocks mixed (15 in positive area, 15 in negative area). Top loser - NIKE, Inc. (NKE-6.38%). Top gainer - Microsoft Corporation (MSFT, +1.06%).

S&P sectors also mixed. Top loser - Conglomerates (-0.6%). Top gainer - Utilities (+0.4%).

At the moment:

S&P 500 2339.00 -3.25 -0.14%

Nasdaq 100 5353.25 +15.00 +0.28%

Oil 47.81 -0.43 -0.89%

Gold 1249.00 +2.50 +0.20%

U.S. 10yr 2.40 -0.04

U.S. stock-index futures were flat amid rising worries about the ability of President Donald Trump to deliver on his campaign promises of cutting taxes.

Global Stocks:

Nikkei 19,041.38 -414.50 -2.13%

Hang Seng 24,320.41 -272.71 -1.11%

Shanghai 3,245.45 -16.16 -0.50%

FTSE 7,317.21 -61.13 -0.83%

CAC 4,979.75 -22.68 -0.45%

DAX 11,903.82 -58.31 -0.49%

Crude $47.57 (-1.39%)

Gold $1,247.00 (+0.04%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 192.49 | 0.36(0.19%) | 208 |

| ALCOA INC. | AA | 33.3 | 0.08(0.24%) | 6178 |

| ALTRIA GROUP INC. | MO | 75.57 | -0.36(-0.47%) | 425 |

| Amazon.com Inc., NASDAQ | AMZN | 841.24 | -1.96(-0.23%) | 11358 |

| American Express Co | AXP | 77.4 | -0.13(-0.17%) | 295 |

| AMERICAN INTERNATIONAL GROUP | AIG | 61.65 | -0.11(-0.18%) | 100 |

| Apple Inc. | AAPL | 139.52 | -0.32(-0.23%) | 174737 |

| AT&T Inc | T | 42.12 | 0.04(0.10%) | 2909 |

| Barrick Gold Corporation, NYSE | ABX | 19.62 | 0.17(0.87%) | 61753 |

| Boeing Co | BA | 175.51 | -0.45(-0.26%) | 1060 |

| Caterpillar Inc | CAT | 92.35 | -0.08(-0.09%) | 6043 |

| Chevron Corp | CVX | 107.59 | -0.45(-0.42%) | 3458 |

| Cisco Systems Inc | CSCO | 33.62 | -0.26(-0.77%) | 8377 |

| Citigroup Inc., NYSE | C | 57.8 | -0.24(-0.41%) | 31686 |

| Exxon Mobil Corp | XOM | 81.6 | -0.23(-0.28%) | 1210 |

| Facebook, Inc. | FB | 138.29 | -0.22(-0.16%) | 72455 |

| FedEx Corporation, NYSE | FDX | 196.5 | 4.66(2.43%) | 41789 |

| Ford Motor Co. | F | 11.78 | 0.06(0.51%) | 51667 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.7 | 0.13(1.03%) | 64740 |

| General Electric Co | GE | 29.48 | 0.09(0.31%) | 37302 |

| General Motors Company, NYSE | GM | 34.5 | -0.05(-0.14%) | 32004 |

| Goldman Sachs | GS | 232 | -1.00(-0.43%) | 13238 |

| Google Inc. | GOOG | 828.85 | -1.61(-0.19%) | 1812 |

| Hewlett-Packard Co. | HPQ | 17 | -0.15(-0.87%) | 1039 |

| Home Depot Inc | HD | 146.58 | -0.03(-0.02%) | 1863 |

| Intel Corp | INTC | 35.11 | 0.07(0.20%) | 7001 |

| International Business Machines Co... | IBM | 174.11 | 0.23(0.13%) | 686 |

| Johnson & Johnson | JNJ | 126.87 | -0.38(-0.30%) | 1679 |

| JPMorgan Chase and Co | JPM | 87.1 | -0.29(-0.33%) | 70052 |

| McDonald's Corp | MCD | 127.98 | -0.54(-0.42%) | 463 |

| Merck & Co Inc | MRK | 63.5 | -0.41(-0.64%) | 2058 |

| Microsoft Corp | MSFT | 64.05 | -0.16(-0.25%) | 11524 |

| Nike | NKE | 54.83 | -3.18(-5.48%) | 786595 |

| Pfizer Inc | PFE | 34.05 | -0.20(-0.58%) | 4035 |

| Starbucks Corporation, NASDAQ | SBUX | 55.34 | -0.20(-0.36%) | 4715 |

| Tesla Motors, Inc., NASDAQ | TSLA | 252.02 | 1.34(0.53%) | 21906 |

| The Coca-Cola Co | KO | 42.64 | 0.14(0.33%) | 436 |

| Twitter, Inc., NYSE | TWTR | 14.58 | 0.04(0.28%) | 41344 |

| Verizon Communications Inc | VZ | 50.1 | -0.06(-0.12%) | 1509 |

| Visa | V | 87.6 | -0.46(-0.52%) | 1314 |

| Walt Disney Co | DIS | 111.3 | -0.45(-0.40%) | 1097 |

| Yahoo! Inc., NASDAQ | YHOO | 45.56 | -0.21(-0.46%) | 1512 |

| Yandex N.V., NASDAQ | YNDX | 22.2 | 0.02(0.09%) | 5500 |

Upgrades:

Freeport-McMoRan (FCX) upgraded to Hold from Sell at Berenberg

Downgrades:

Other:

Nike (NKE) target lowered to $66 from $68 at Stifel

Nike reported Q3 FY 2017 earnings of $0.68 per share (versus $0.55 in Q3 FY 2016), beating analysts' consensus estimate of $0.53.

The company's quarterly revenues amounted to $8.432 bln (+5% y/y), generally in-line with analysts' consensus estimate of $8.467 bln.

The company also revealed its worldwide futures were down 4% in Q3 and announced it expected its revenues to grow in the mid-single digit range in Q4 (slightly below Q3 reported rate of growth).

NKE fell to $54.76 (-5.60%) in pre-market trading.

FedEx reported Q3 FY 2017 earnings of $2.35 per share (versus $2.51 in Q3 FY 2016), missing analysts' consensus estimate of $2.62.

The company's quarterly revenues amounted to $15.00 bln (+18.1% y/y), being in-line with analysts' consensus estimate.

The company also reaffirmed guidance for FY 2017, projecting EPS of $11.85-12.35 versus analysts' consensus estimate of $11.93.

FDX rose to $197.24 (+2.81 %) in pre-market trading.

European stocks finished with losses Tuesday, with French equities surrendering gains that came after respondents in a poll viewed center-right politician Emmanuel Macron as the winner of the first presidential debate ahead of this spring's elections.

U.S. stocks sank Tuesday as the Dow and the Nasdaq logged their worst daily drops since September, while the S&P 500 also tumbled the most in a single session in five months.

Stock markets pulled back as in early Asian trade on Wednesday following declines in stocks, the dollar and bond yields overnight, as investors re-evaluated their optimism around the 'Trump trade.'

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.