- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -183.37 23940.78 -0.76%

TOPIX -9.84 1901.23 -0.51%

Hang Seng +27.99 32958.69 +0.08%

CSI 300 +7.28 4389.89 +0.17%

Euro Stoxx 50 -29.07 3643.22 -0.79%

FTSE 100 -88.40 7643.43 -1.14%

DAX -144.86 13414.74 -1.07%

CAC 40 -40.10 5495.16 -0.72%

DJIA +41.31 26252.12 +0.16%

S&P 500 -1.59 2837.54 -0.06%

NASDAQ -45.23 7415.06 -0.61%

S&P/TSX -73.34 16284.21 -0.45%

Major US stock indexes ended the session in different directions after US Secretary of Commerce Wilber Ross called China's technological strategy in 2025 a "direct threat" and hinted at actions against Beijing.

A certain pressure on the indices was also provided by the US data. Data for January indicated another solid expansion of business activity in the private sector in the US, supported by the fastest growth in new orders within 5 months. At the same time, production continued to grow much faster than the activity of the service sector. The combined PMI index from IHS Markit for the US was 53.8 in January, compared with 54.1 in December, and showed the least noticeable pace of business expansion since May 2017. Nevertheless, the index for today remains above the threshold level of 50.0 for 23 consecutive months.

Meanwhile, home sales in the US fell more than expected in December, as housing supply in the market fell to a record low, pushing up prices and probably alienating some buyers. The National Association of Realtors (NAR) said that home sales in the secondary market declined in December by 3.6%, to 5.57 million units (seasonally adjusted and in annual terms). Meanwhile, the November sales were revised from 5.81 million to 5.78 million units, which is still the highest since February 2007. Economists predicted that housing sales in December will decrease only to 5.70 million units.

Most components of the DOW index recorded a rise (19 out of 30). The leader of growth was the shares of The Goldman Sachs Group, Inc. (GS, + 2.05%). Outsider were shares of General Electric Company (GE, -2.22%).

Most sectors of S & P showed an increase. The commodities sector grew most (+ 1.0%). The largest decrease was shown by the sector of conglomerates (-0.6%).

At closing:

DJIA + 0.16% 26.252.19 +41.38

Nasdaq -0.61% 7,415.06 -45.23

S & P -0.05% 2.837.59 -1.54

U.S. stock-index futures rose on Wednesday following as a string of earnings from industrial giants buoyed market sentiment. Particular attention was paid to the financials of General Electric (GE) and United Technologies (UTX).

Global Stocks:

Nikkei 23,940.78 -183.37 -0.76%

Hang Seng 32,958.69 +27.99 +0.08%

Shanghai 3,560.73 +14.23 +0.40%

S&P/ASX 6,054.70 +17.70 +0.29%

FTSE 7,694.04 -37.79 -0.49%

CAC 5,529.79 -5.47 -0.10%

DAX 13,556.78 -2.82 -0.02%

Crude $64.70 (+0.36%)

Gold $1,351.60 (+1.11%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 1,379.05 | 16.51(1.21%) | 98938 |

| American Express Co | AXP | 98 | 0.02(0.02%) | 833 |

| Apple Inc. | AAPL | 177.83 | 0.79(0.45%) | 196533 |

| AT&T Inc | T | 37.29 | 0.10(0.27%) | 8852 |

| Barrick Gold Corporation, NYSE | ABX | 15.11 | 0.28(1.89%) | 75191 |

| Boeing Co | BA | 337.16 | 1.57(0.47%) | 8251 |

| Caterpillar Inc | CAT | 170.3 | 0.87(0.51%) | 14565 |

| Chevron Corp | CVX | 131 | -0.02(-0.02%) | 1646 |

| Cisco Systems Inc | CSCO | 42.28 | 0.18(0.43%) | 2839 |

| Citigroup Inc., NYSE | C | 79 | 0.45(0.57%) | 16076 |

| Deere & Company, NYSE | DE | 169.49 | 0.83(0.49%) | 1002 |

| Exxon Mobil Corp | XOM | 88.4 | 0.10(0.11%) | 1996 |

| Facebook, Inc. | FB | 190.21 | 0.86(0.45%) | 131884 |

| Ford Motor Co. | F | 12.02 | 0.06(0.50%) | 40467 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.85 | 0.30(1.53%) | 20486 |

| General Electric Co | GE | 17.78 | 0.89(5.27%) | 5886527 |

| Goldman Sachs | GS | 260.22 | 0.13(0.05%) | 4024 |

| Google Inc. | GOOG | 1,179.34 | 9.37(0.80%) | 6109 |

| Hewlett-Packard Co. | HPQ | 23.93 | 0.12(0.50%) | 2137 |

| Home Depot Inc | HD | 205.5 | 0.60(0.29%) | 1785 |

| Intel Corp | INTC | 45.85 | -0.21(-0.46%) | 20097 |

| International Business Machines Co... | IBM | 166.7 | 0.45(0.27%) | 8858 |

| Johnson & Johnson | JNJ | 142.7 | 0.87(0.61%) | 37732 |

| JPMorgan Chase and Co | JPM | 114.79 | 0.58(0.51%) | 18758 |

| Microsoft Corp | MSFT | 92.39 | 0.49(0.53%) | 43058 |

| Nike | NKE | 67.01 | -0.13(-0.19%) | 1886 |

| Pfizer Inc | PFE | 36.95 | 0.13(0.35%) | 3588 |

| Procter & Gamble Co | PG | 89.3 | 0.25(0.28%) | 4460 |

| Starbucks Corporation, NASDAQ | SBUX | 61.65 | -0.04(-0.06%) | 6439 |

| Tesla Motors, Inc., NASDAQ | TSLA | 355.55 | 2.76(0.78%) | 24472 |

| Twitter, Inc., NYSE | TWTR | 22.86 | 0.11(0.48%) | 73728 |

| United Technologies Corp | UTX | 135.3 | -0.73(-0.54%) | 57819 |

| UnitedHealth Group Inc | UNH | 246.02 | 0.81(0.33%) | 195 |

| Verizon Communications Inc | VZ | 53.25 | 0.02(0.04%) | 3230 |

| Visa | V | 125.15 | 0.50(0.40%) | 8794 |

| Wal-Mart Stores Inc | WMT | 106.27 | 0.37(0.35%) | 14491 |

| Walt Disney Co | DIS | 110.83 | 0.42(0.38%) | 504 |

| Yandex N.V., NASDAQ | YNDX | 38.01 | -0.02(-0.05%) | 310 |

Microsoft (MSFT) initiated with a Buy at Nomura; target $102

Caterpillar (CAT) target raised to $180 from $162 at Barclays

Home Depot (HD) target raised to $222 from $183 at Credit Suisse

Chevron (CVX) target raised to $145 from $130 at Morgan Stanley

Johnson & Johnson (JNJ) target raised to $145 at Stifel

Amazon (AMZN) target raised to $1475 from $1350 at JMP Securities

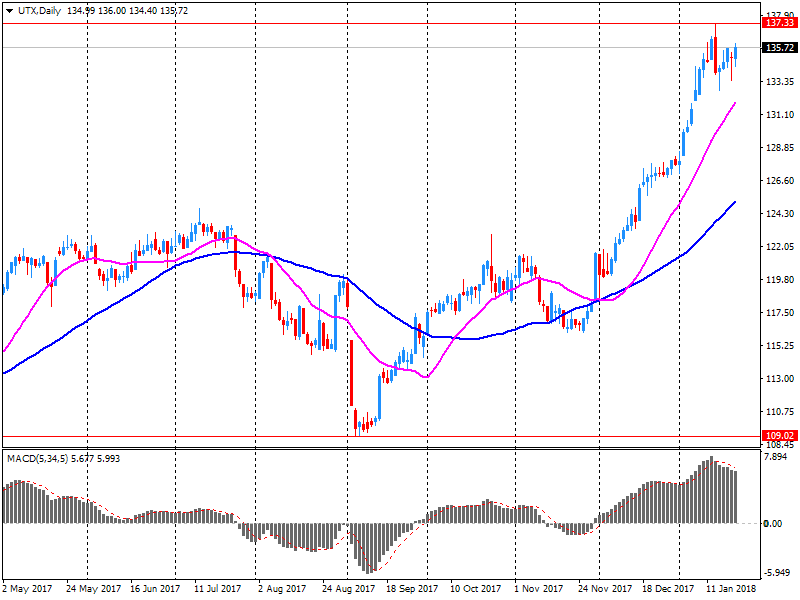

United Tech (UTX) reported Q4 FY 2017 earnings of $1.60 per share (versus $1.56 in Q4 FY 2016), beating analysts' consensus estimate of $1.56.

The company's quarterly revenues amounted to $15.680 bln (+7.0% y/y), beating analysts' consensus estimate of $15.344 bln.

The company also issued in-line guidance for FY 2018, projecting EPS of $6.85-7.10 (versus analysts' consensus estimate of $6.97) and revenues of $62.5-64.0 bln (versus analysts' consensus estimate of $62.97 bln).

UTX fell to $136.00 (-0.02%) in pre-market trading.

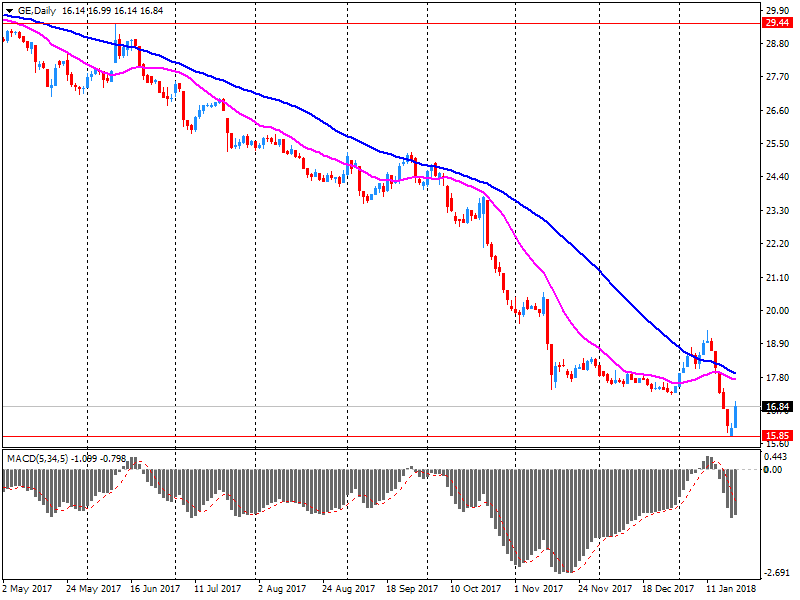

General Electric (GE) reported Q4 FY 2017 earnings of $0.27 per share (versus $0.46 in Q4 FY 2016), missing analysts' consensus estimate of $0.28.

The company's quarterly revenues amounted to $31.402 bln (-5.1% y/y), missing analysts' consensus estimate of $33.927 bln.

The company reaffirmed guidance for FY 2018, projecting EPS of $1.00-1.07 versus analysts' consensus estimate of $1.01.

GE rose to $17.06 (+1.01%) in pre-market trading.

Europeans stocks pushed higher Monday, with Spanish and Greek shares gaining in the wake of sovereign ratings upgrades and closing at a 5-month and almost three-year highs, respectively. The Stoxx Europe 600 index SXXP, +0.17% ended up 0.3% at 402.11, closing at its highest since August 2015. Last week, the pan-European gauge rose for a third consecutive week.

U.S. stocks mostly rose on Tuesday, with the S&P 500 and the Nasdaq ending at an all-time highs, a day after a partial shutdown of the government came to an end. The S&P 500 index SPX, +0.22% closed up 0.2% at 2,839, the Nasdaq Composite Index COMP, +0.71% closed up 0.7% at 7,460.

Asia's blazing stock rally took a pause on Wednesday as investors took stock of the best start to a year for the region since 2006. A strengthening yen hit Japanese shares, and a record winning streak for Chinese stocks in Hong Kong was at risk of finally ending.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.