- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -80.87 19353.77 -0.42%

TOPIX -7.85 1592.20 -0.49%

Hang Seng +116.93 27518.60 +0.43%

CSI 300 -21.44 3734.65 -0.57%

Euro Stoxx 50 +6.10 3444.73 +0.18%

FTSE 100 +24.41 7407.06 +0.33%

DAX +6.53 12180.83 +0.05%

CAC 40 -2.26 5113.13 -0.04%

DJIA -28.69 21783.40 -0.13%

S&P 500 -5.07 2438.97 -0.21%

NASDAQ -7.08 6271.33 -0.11%

S&P/TSX +13.00 15076.16 +0.09%

Major US stock indices fell slightly as investors worried about funding the US government, and were waiting for news from the annual conference of the Fed in Jackson Hole.

The theme of the conference this year is "Promoting the dynamics of the global economy." Traditionally, the event will be visited by the heads of many central banks and their statements can have a significant impact on the markets. First of all, attention will be directed to the speech of the head of the Federal Reserve, Janet Yellen, who are expected to hear signals about the further actions of the American regulator in the sphere of monetary policy. Given the recent cooling of the housing market, as well as inflationary pressures, the head of the federal budget is likely to be less optimistic about its estimates than before, which in the end should reduce expectations about the pace of further tightening of the monetary policy of the US central bank.

In addition, according to the Ministry of Labor, the number of people applying for unemployment benefits in the US increased by 2,000 to 234,000 in the week ending August 19 after reaching a six-month low in the previous week. This level of initial appeals is a sign of another month of solid hiring. Economists had expected that applications for state unemployment benefits would increase to 238,000 from 232,000 the previous week.

Sales of housing in the secondary market fell to the lowest level for the year in July, as the dynamics of restrained supply and strong demand continues to strain the housing market. According to the National Association of Realtors, home sales in the secondary market, taking into account seasonal correction reached 5.44 million units. Sales decreased by 1.3% compared to the revised June figure. While the July rate was 2.1% higher than a year ago, it was the lowest since August last year. Economists forecast sales at 5.57 million units

Components of the DOW index finished the session in different directions (14 in positive territory, 16 in negative territory). The leader of growth were the shares of Cisco Systems, Inc. (CSCO, + 1.15%). Wal-Mart Stores, Inc. turned out to be an outsider. (WMT, -2.20%).

Most sectors of the S & P index showed a decline. The largest drop was shown by the consumer goods sector (-0.5%). The healthcare sector grew most (+ 0.3%).

At closing:

DJIA -0.13% 21.782.92 -29.17

Nasdaq -0.11% 6,271.33 -7.08

S & P -0.21% 2,438.97 -5.07

U.S. stock-index futures rose moderately on Thursday following yesterday's modest decline. Investors remained cautious ahead of the start of the annual meeting of central bankers at Jackson Hole, Wyoming.

Global Stocks:

Nikkei 19,353.77 -80.87 -0.42%

Hang Seng 27,518.60 +116.93 +0.43%

Shanghai 3,271.99 -15.71 -0.48%

S&P/ASX 5,745.48 +8.32 +0.14%

FTSE 7,419.66 +37.01 +0.50%

CAC 5,129.80 +14.41 +0.28%

DAX 12,233.92 +59.62 +0.49%

Crude $48.21 (-0.41%)

Gold $1,292.20 (-0.19%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 41.05 | -0.01(-0.02%) | 5395 |

| ALTRIA GROUP INC. | MO | 63.88 | 0.17(0.27%) | 2042 |

| Amazon.com Inc., NASDAQ | AMZN | 960.95 | 2.95(0.31%) | 13507 |

| Apple Inc. | AAPL | 160.6 | 0.62(0.39%) | 70438 |

| AT&T Inc | T | 38 | 0.08(0.21%) | 381 |

| Barrick Gold Corporation, NYSE | ABX | 16.95 | -0.07(-0.41%) | 5850 |

| Boeing Co | BA | 238.5 | 0.41(0.17%) | 716 |

| Caterpillar Inc | CAT | 114.96 | 0.21(0.18%) | 1275 |

| Citigroup Inc., NYSE | C | 67.55 | 0.32(0.48%) | 15978 |

| Exxon Mobil Corp | XOM | 76.64 | 0.03(0.04%) | 1133 |

| Facebook, Inc. | FB | 169.38 | 0.67(0.40%) | 33489 |

| Ford Motor Co. | F | 10.75 | 0.04(0.37%) | 4082 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.38 | 0.09(0.59%) | 15641 |

| General Electric Co | GE | 24.44 | 0.05(0.21%) | 13202 |

| General Motors Company, NYSE | GM | 35.55 | 0.06(0.17%) | 1538 |

| Goldman Sachs | GS | 224 | 1.26(0.57%) | 868 |

| Google Inc. | GOOG | 931 | 4.00(0.43%) | 1523 |

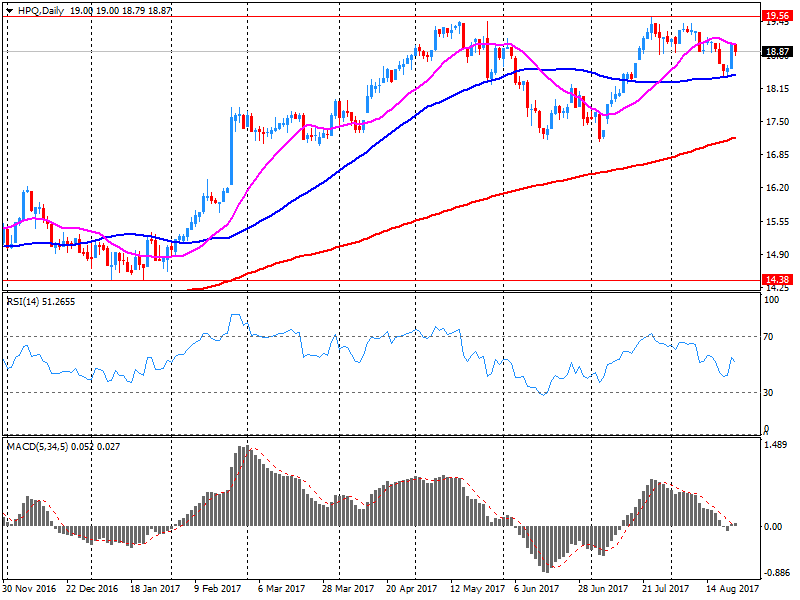

| Hewlett-Packard Co. | HPQ | 18.5 | -0.36(-1.91%) | 13241 |

| Home Depot Inc | HD | 149.3 | 0.20(0.13%) | 3116 |

| Intel Corp | INTC | 34.88 | 0.22(0.63%) | 7785 |

| International Business Machines Co... | IBM | 142.8 | 0.66(0.46%) | 558 |

| McDonald's Corp | MCD | 159.1 | 0.29(0.18%) | 5156 |

| Merck & Co Inc | MRK | 62.55 | 0.40(0.64%) | 220 |

| Microsoft Corp | MSFT | 72.92 | 0.20(0.28%) | 3551 |

| Pfizer Inc | PFE | 33.19 | -0.05(-0.15%) | 395 |

| Starbucks Corporation, NASDAQ | SBUX | 54.29 | 0.21(0.39%) | 1982 |

| Tesla Motors, Inc., NASDAQ | TSLA | 352.8 | 0.03(0.01%) | 20591 |

| Twitter, Inc., NYSE | TWTR | 17.04 | 0.08(0.47%) | 16880 |

| Wal-Mart Stores Inc | WMT | 80.45 | 0.49(0.61%) | 3220 |

| Walt Disney Co | DIS | 101.51 | 0.01(0.01%) | 189 |

| Yandex N.V., NASDAQ | YNDX | 30.07 | 0.13(0.43%) | 13910 |

HP Inc. (HPQ) target raised to $22 from $21 at Maxim Group

HP Inc. (HPQ) reported Q3 FY 2017 earnings of $0.43 per share (versus $0.48 in Q3 FY 2016), beating analysts' consensus estimate of $0.42.

The company's quarterly revenues amounted to $13.060 bln (+9.8% y/y), beating analysts' consensus estimate of $12.306 bln.

HPQ fell to $18.79 (-0.37%) in pre-market trading.

European stocks slumped Wednesday, with investors assessing fresh data on the health of the eurozone economy, as market participants counted down to a key meeting of central bankers. The Stoxx Europe 600 index SXXP, -0.50% lost 0.5% to close at 373.92, partly erasing a 0.8% jump from Tuesday, when the benchmark ended a three-session losing streak.

U.S. stocks traded at their lowest volume of the year on Wednesday as traders awaited the kickoff of the Kansas City Federal Reserve's Jackson Hole, Wyo., meeting of central bankers. Total composite volume for U.S. stocks finished at 5 billion shares Wednesday, its lightest volume of the year excluding half-day trading sessions, according to Dow Jones data.

Asian stocks and the dollar edged up on Thursday, shaking off the risk aversion that gripped financial markets overnight after President Donald Trump threatened to shut down the U.S. government and end the North American Free Trade Agreement.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.