- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Index | Change items | Closing price | % change |

| Nikkei | +80.40 | 22091.18 | +0.37% |

| TOPIX | +1.35 | 1652.07 | +0.08% |

| CSI 300 | +4.77 | 3188.20 | +0.15% |

| KOSPI | -8.52 | 2097.58 | -0.40% |

| FTSE 100 | +7.77 | 6962.98 | +0.11% |

| DAX | -82.65 | 11191.63 | -0.73% |

| CAC 40 | -14.60 | 4953.09 | -0.29% |

| DJIA | -608.01 | 24583.42 | -2.41% |

| S&P 500 | -84.59 | 2656.10 | -3.09% |

| NASDAQ | -329.14 | 7108.40 | -4.43% |

Major US stock indexes have declined significantly, as weak quarterly results from AT&T and poor forecasts from chip makers overshadowed optimism from Boeing results for the quarter.

In addition, investors were disappointed data on the US housing market. As it became known, sales of single-family homes fell to almost 2-year lows in September, and the data for the previous three months were revised down, which is the last sign that rising mortgage rates and higher prices are undermining the country's housing market . The Commerce Department reported that new home sales fell 5.5% to a seasonally adjusted annual figure of 553,000 units. It was the lowest level since December 2016. The pace of sales in August was revised to 585,000 units from 629,000 units.

The focus was also on the Fed Beige Book. The paper said that companies are still optimistic about the economic growth trajectory, but they pointed to concerns that prices will continue to rise due to import duties. Most of the 12 regions in the zone of responsibility of the Fed reported moderate or modest economic growth in early autumn. The beige book was based on information received before October 15 inclusive.

Most of the components of DOW finished trading in the red (24 of 30). Outsiders were United Technologies Corporation (UTX, -5.44%). The growth leader was the shares of The Procter & Gamble Company (PG, + 2.76%).

Almost all sectors of the S & P recorded a decline. The largest decline was shown by the technology sector (-3.8%). The utility sector grew the most (+ 1.8%).

At the time of closing:

Index

Dow 24,581.28 -610.15 -2.42%

S & P 500 2,656.18 -84.51 -3.08%

Nasdaq 100 7,108.40 -329.14 -4.43%

U.S. stock-index futures traded flat on Wednesday, as investors assessed a slew of corporate earnings reports.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,091.18 | +80.40 | +0.37% |

| Hang Seng | 25,249.78 | -96.77 | -0.38% |

| Shanghai | 2,603.30 | +8.47 | +0.33% |

| S&P/ASX | 5,829.00 | -14.10 | -0.24% |

| FTSE | 7,036.04 | +80.83 | +1.16% |

| CAC | 5,035.52 | +67.83 | +1.37% |

| DAX | 11,358.94 | +84.66 | +0.75% |

| Crude | $66.96 | | +0.80% |

| Gold | $1,232.40 | | -0.36% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 37.28 | -0.04(-0.11%) | 2421 |

| ALTRIA GROUP INC. | MO | 62 | 0.15(0.24%) | 1679 |

| Amazon.com Inc., NASDAQ | AMZN | 1,777.25 | 8.55(0.48%) | 52314 |

| AMERICAN INTERNATIONAL GROUP | AIG | 44.2 | 0.02(0.05%) | 2580 |

| Apple Inc. | AAPL | 222.75 | 0.02(0.01%) | 271655 |

| AT&T Inc | T | 31.96 | -1.06(-3.21%) | 1687199 |

| Barrick Gold Corporation, NYSE | ABX | 13.3 | -0.04(-0.30%) | 18930 |

| Boeing Co | BA | 366.43 | 16.38(4.68%) | 161221 |

| Caterpillar Inc | CAT | 120.06 | 1.08(0.91%) | 45993 |

| Cisco Systems Inc | CSCO | 45.26 | -0.16(-0.35%) | 23379 |

| Exxon Mobil Corp | XOM | 80.02 | 0.18(0.23%) | 2500 |

| Facebook, Inc. | FB | 154.5 | 0.11(0.07%) | 75201 |

| FedEx Corporation, NYSE | FDX | 216.06 | -2.32(-1.06%) | 989 |

| Ford Motor Co. | F | 8.58 | -0.01(-0.12%) | 12733 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.15 | 0.54(4.65%) | 164599 |

| General Electric Co | GE | 12.65 | -0.04(-0.32%) | 30569 |

| General Motors Company, NYSE | GM | 32 | -0.12(-0.37%) | 4557 |

| Google Inc. | GOOG | 1,107.00 | 3.31(0.30%) | 2519 |

| Home Depot Inc | HD | 178 | -0.53(-0.30%) | 748 |

| HONEYWELL INTERNATIONAL INC. | HON | 151 | 0.40(0.27%) | 1520 |

| Intel Corp | INTC | 44.3 | -0.20(-0.45%) | 25826 |

| International Business Machines Co... | IBM | 131.35 | 0.14(0.11%) | 1830 |

| International Paper Company | IP | 41.55 | 0.17(0.41%) | 1001 |

| Johnson & Johnson | JNJ | 139.03 | 0.10(0.07%) | 1403 |

| JPMorgan Chase and Co | JPM | 105.26 | 0.01(0.01%) | 7711 |

| McDonald's Corp | MCD | 176.35 | -0.80(-0.45%) | 21773 |

| Microsoft Corp | MSFT | 108.5 | 0.40(0.37%) | 155698 |

| Nike | NKE | 73.34 | -0.01(-0.01%) | 2571 |

| Pfizer Inc | PFE | 43.86 | -0.24(-0.54%) | 2978 |

| Procter & Gamble Co | PG | 87.03 | -0.13(-0.15%) | 6645 |

| Tesla Motors, Inc., NASDAQ | TSLA | 300.8 | 6.66(2.26%) | 411943 |

| Twitter, Inc., NYSE | TWTR | 28.8 | 0.03(0.10%) | 49702 |

| United Technologies Corp | UTX | 130.63 | 0.61(0.47%) | 2211 |

| UnitedHealth Group Inc | UNH | 265.68 | 0.82(0.31%) | 1321 |

| Verizon Communications Inc | VZ | 57.09 | -0.12(-0.21%) | 10859 |

| Visa | V | 139.47 | 0.35(0.25%) | 12153 |

| Walt Disney Co | DIS | 117.4 | -0.45(-0.38%) | 3449 |

| Yandex N.V., NASDAQ | YNDX | 27.6 | 0.82(3.06%) | 54519 |

Tesla (TSLA) initiated with a Mkt Outperform at JMP Securities; target $350

Verizon (VZ) coverage resumed with Buy at Guggenheim

McDonald's (MCD) target raised to $195 at Telsey Advisory Group

Morgan Stanley (MS) upgraded to Outperform from Market Perform at Wells Fargo

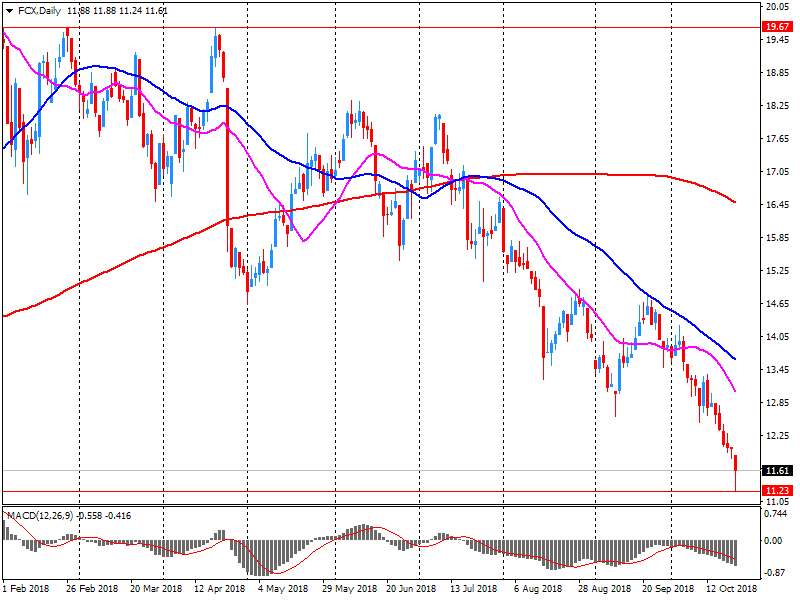

Freeport-McMoRan (FCX) reported Q3 FY 2018 earnings of $0.35 per share (versus $0.34 in Q3 FY 2017), beating analysts' consensus estimate of $0.32.

The company's quarterly revenues amounted to $4.908 bln (+13.9% y/y), beating analysts' consensus estimate of $4.499 bln.

FCX rose to $12.00 (+3.36%) in pre-market trading.

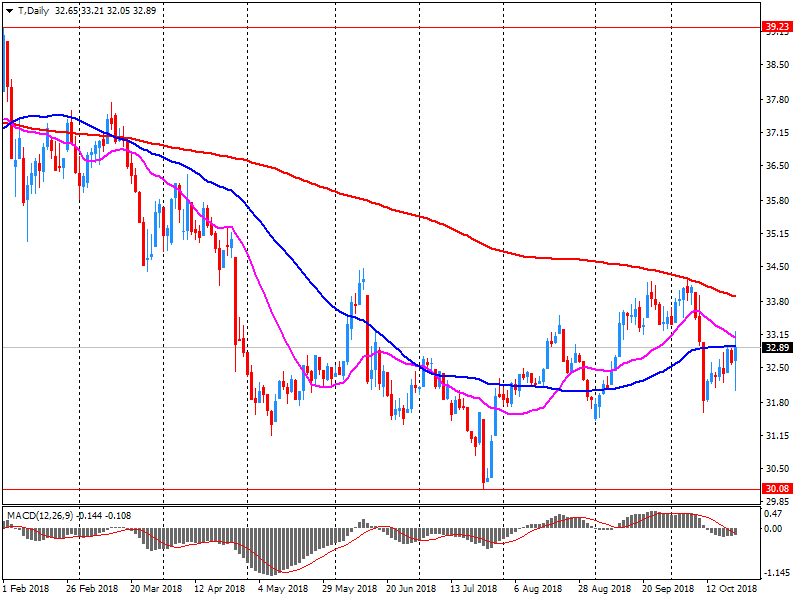

AT&T (T) reported Q3 FY 2018 earnings of $0.90 per share (versus $0.74 in Q3 FY 2017), missing analysts' consensus estimate of $0.95.

The company's quarterly revenues amounted to $45.739 bln (+15.3% y/y), generally in line with analysts' consensus estimate of $45.733 bln.

The company also reaffirmed guidance for FY 2018, projecting EPS of $3.50 versus analysts' consensus estimate of $3.53.

T fell to $32.00 (-3.09%) in pre-market trading.

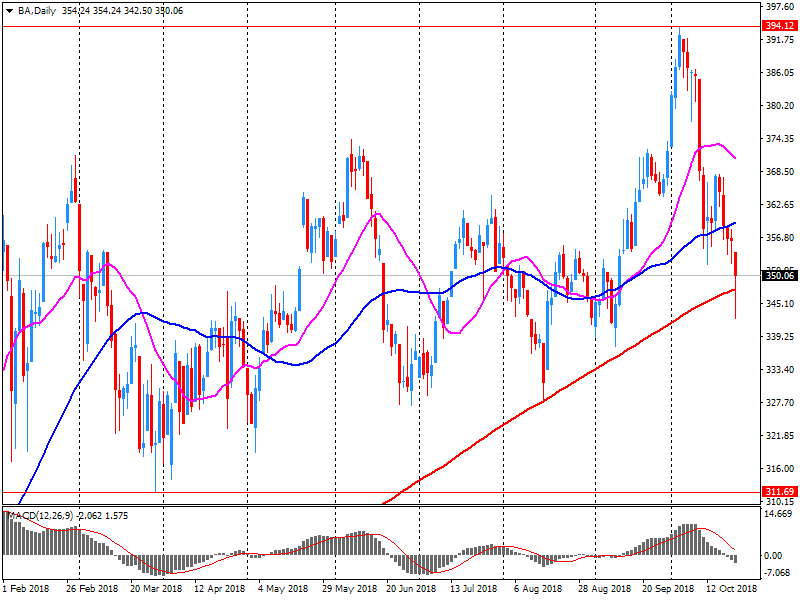

Boeing (BA) reported Q3 FY 2018 earnings of $3.58 per share (versus $2.72 in Q3 FY 2017), beating analysts' consensus estimate of $3.47.

The company's quarterly revenues amounted to $25.146 bln (+3.8% y/y), beating analysts' consensus estimate of $23.839 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $14.90-15.10 (versus analysts' consensus estimate of $14.64 and its prior guidance of $14.30-14.50) and revenues of $98-100 bln (versus analysts' consensus estimate of $98.48 bln and its prior guidance of $97-99 bln).

BA rose to $365.50 (+4.41%) in pre-market trading.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.