- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -20.47 19955.20 -0.10%

TOPIX -4.50 1617.07 -0.28%

Hang Seng +5.22 26852.05 +0.02%

CSI 300 -23.91 3719.56 -0.64%

Euro Stoxx 50 +20.37 3473.54 +0.59%

FTSE 100 +57.09 7434.82 +0.77%

DAX +55.36 12264.31 +0.45%

CAC 40 +33.38 5161.08 +0.65%

DJIA +100.26 21613.43 +0.47%

S&P 500 +7.22 2477.13 +0.29%

NASDAQ +1.36 6412.17 +0.02%

S&P/TSX +73.68 15202.37 +0.49%

The major stock indexes of the US ended the session above zero, helped by a string of strong quarterly earnings from companies, including McDonald's and Caterpillar.

Additional support for the market also provided statistics on the United States. The Consumer Confidence Index from the Conference Board improved in July after slightly declining in June. The index is now 121.1 (1985 = 100), compared with 117.3 in June. The index of the current situation increased from 143.9 to 147.8, and the index of expectations increased from 99.6 to 103.3. "Consumer confidence increased in July after a slight decline in June," said Lynn Franco, director of economic performance at the Conference Board. - Consumers rated the current conditions at a 16-year high, and their expectations for short-term forecasts improved somewhat after cooling in June. In general, consumers predict that the current economic expansion will continue in the second half of the year. "

At the same time, the results of the survey of the Federal Reserve Bank of Richmond indicated that the mood of the producers of the fifth district improved in July. The composite index rose from 11 to 14 in July - the result of a slight increase in new orders and employment. The index of shipments remained at June level 13. A large proportion of firms reported higher wages and a longer workweek in July, as the wage index rose from 10 in June to 17 in July, and the average index of the working week rose from 1 to 9.

Oil prices rose by more than 3%, as the promises of Saudi Arabia and Nigeria sparked hopes that the pace of market rebalancing could accelerate.

Most components of the DOW index recorded a rise (22 out of 30). Caterpillar Inc. was the growth leader. (CAT, + 5.84%). Outsider were shares of 3M Company (MMM, -5.40%).

Most sectors of the S & P index showed growth. The sector of basic materials grew most (+ 1.4%). The health sector showed the greatest decline (-0.5%).

At closing:

DJIA + 0.46% 21.612.95 +99.78

Nasdaq + 0.02% 6,412.17 +1.36

S & P + 0.29% 2,477.18 +7.27

U.S. stock-index futures were slightly higher with the earnings season gaining momentum and ahead of a two-day meeting of FOMC.

Global Stocks:

Nikkei 19,955.20 -20.47 -0.10%

Hang Seng 26,852.05 +5.22 +0.02%

Shanghai 3,243.77 -6.83 -0.21%

S&P/ASX 5,726.60 +38.53 +0.68%

FTSE 7,437.75 +60.02 +0.81%

CAC 5,183.75 +56.05 +1.09%

DAX 12,291.21 +82.26 +0.67%

Crude $47.06 (+1.55%)

Gold $1,250.70 (-0.29%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 205 | -5.00(-2.38%) | 14997 |

| Amazon.com Inc., NASDAQ | AMZN | 1,038.00 | -0.95(-0.09%) | 35813 |

| American Express Co | AXP | 85.5 | 0.50(0.59%) | 605 |

| Apple Inc. | AAPL | 152.21 | 0.12(0.08%) | 51348 |

| AT&T Inc | T | 36.28 | 0.05(0.14%) | 4020 |

| Barrick Gold Corporation, NYSE | ABX | 15.41 | -0.02(-0.13%) | 40375 |

| Boeing Co | BA | 213.47 | 1.29(0.61%) | 1810 |

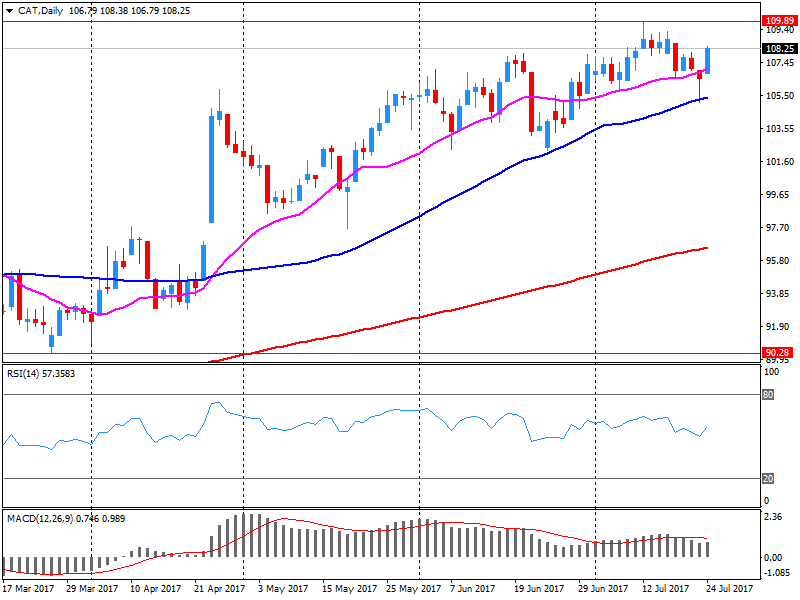

| Caterpillar Inc | CAT | 113.29 | 5.11(4.72%) | 403953 |

| Cisco Systems Inc | CSCO | 31.98 | 0.12(0.38%) | 1449 |

| Citigroup Inc., NYSE | C | 67.56 | 1.46(2.21%) | 331476 |

| Deere & Company, NYSE | DE | 128.25 | 1.70(1.34%) | 1805 |

| E. I. du Pont de Nemours and Co | DD | 85.3 | 0.95(1.13%) | 28677 |

| Exxon Mobil Corp | XOM | 80.36 | 0.49(0.61%) | 15526 |

| Facebook, Inc. | FB | 165.45 | -0.55(-0.33%) | 96268 |

| Ford Motor Co. | F | 11.28 | -0.01(-0.09%) | 137218 |

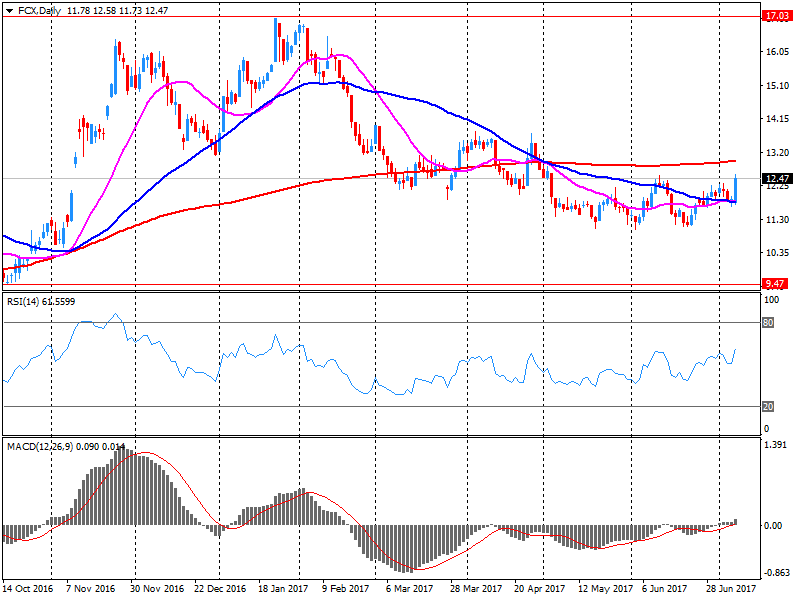

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.19 | 0.23(1.77%) | 192585 |

| General Electric Co | GE | 25.49 | 0.06(0.24%) | 32970 |

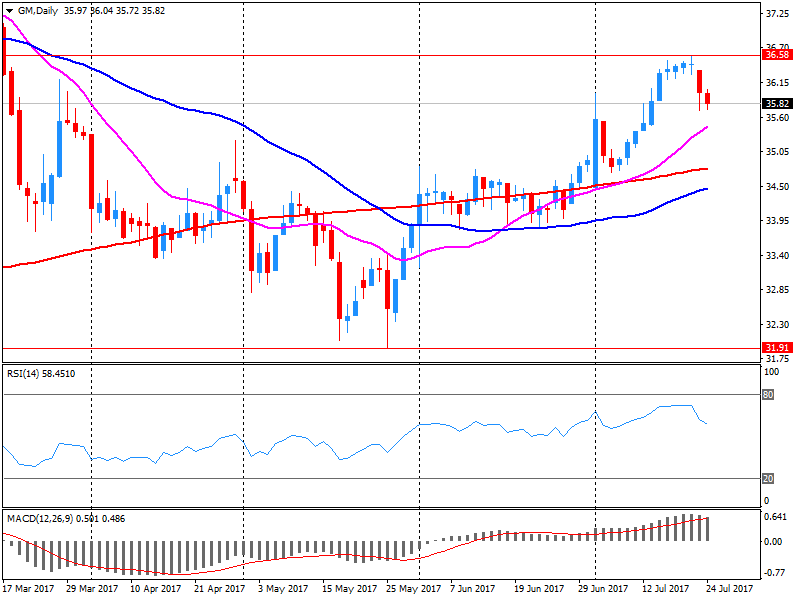

| General Motors Company, NYSE | GM | 35.7 | -0.12(-0.34%) | 212032 |

| Goldman Sachs | GS | 220.19 | 2.01(0.92%) | 15429 |

| Google Inc. | GOOG | 951.75 | -28.59(-2.92%) | 41740 |

| Home Depot Inc | HD | 145.37 | 0.79(0.55%) | 1519 |

| Intel Corp | INTC | 34.63 | 0.13(0.38%) | 4812 |

| International Business Machines Co... | IBM | 146.8 | 0.81(0.55%) | 2502 |

| Johnson & Johnson | JNJ | 133.1 | 0.09(0.07%) | 1226 |

| JPMorgan Chase and Co | JPM | 92.15 | 0.87(0.95%) | 20384 |

| McDonald's Corp | MCD | 155.74 | 3.89(2.56%) | 147655 |

| Microsoft Corp | MSFT | 73.55 | -0.05(-0.07%) | 21559 |

| Pfizer Inc | PFE | 33.25 | -0.07(-0.21%) | 41186 |

| Procter & Gamble Co | PG | 88.6 | 0.42(0.48%) | 768 |

| Tesla Motors, Inc., NASDAQ | TSLA | 345 | 2.48(0.72%) | 73357 |

| The Coca-Cola Co | KO | 44.99 | 0.15(0.33%) | 1487 |

| Travelers Companies Inc | TRV | 127.13 | 0.75(0.59%) | 684 |

| Twitter, Inc., NYSE | TWTR | 20.04 | 0.04(0.20%) | 29106 |

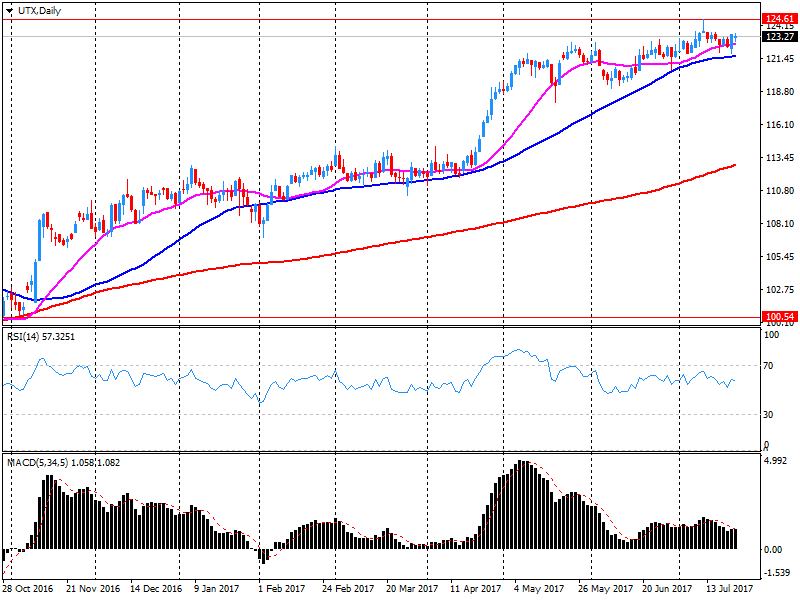

| United Technologies Corp | UTX | 123 | -0.13(-0.11%) | 2700 |

| UnitedHealth Group Inc | UNH | 192.61 | 1.72(0.90%) | 733 |

| Verizon Communications Inc | VZ | 43.89 | 0.18(0.41%) | 3016 |

| Visa | V | 100.75 | 0.38(0.38%) | 2547 |

| Wal-Mart Stores Inc | WMT | 77.23 | 0.34(0.44%) | 1080 |

| Walt Disney Co | DIS | 107.4 | 0.40(0.37%) | 1313 |

| Yandex N.V., NASDAQ | YNDX | 31.95 | 0.11(0.35%) | 2900 |

Apple (AAPL) initiated with a Buy at Loop Capital; target $172

General Electric (GE) target lowered to $28 from $33 at Stifel

Freeport-McMoRan (FCX) reported Q2 FY 2017 earnings of $0.17 per share (versus -$0.02 in Q2 FY 2016), missing analysts' consensus estimate of $0.20.

The company's quarterly revenues amounted to $3.711 bln (+11.3% y/y), beating analysts' consensus estimate of $3.672 bln.

FCX rose to $13.22 (+2.01%) in pre-market trading.

McDonald's (MCD) reported Q2 FY 2017 earnings of $1.73 per share (versus $1.45 in Q2 FY 2016), beating analysts' consensus estimate of $1.62.

The company's quarterly revenues amounted to $6.050 bln (-3.4% y/y), beating analysts' consensus estimate of $5.964 bln.

MCD rose to $156.30 (+2.93%) in pre-market trading.

General Motors (GM) reported Q2 FY 2017 earnings of $1.89 per share (versus $1.86 in Q2 FY 2016), beating analysts' consensus estimate of $1.72.

The company's quarterly revenues amounted to $36.984 bln (-1.1% y/y), missing analysts' consensus estimate of $37.673 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $6.00-6.50 versus analysts' consensus estimate of $6.08.

GM rose to $36.12 (+0.84%) in pre-market trading.

3M (MMM) reported Q2 FY 2017 earnings of $2.58 per share (versus $2.08 in Q2 FY 2016), missing analysts' consensus estimate of $2.59.

The company's quarterly revenues amounted to $7.810 bln (+1.9% y/y), generally in-line with analysts' consensus estimate of $7.858 bln.

The company also raised the low end of guidance for FY 2017 EPS to $8.80-9.05 from $8.70-9.05 (versus analysts' consensus estimate of $8.98).

MMM fell to $206.35 (-1.74%) in pre-market trading.

Caterpillar (CAT) reported Q2 FY 2017 earnings of $11.49 per share (versus $1.09 in Q2 FY 2016), beating analysts' consensus estimate of $1.26.

The company's quarterly revenues amounted to $11.331 bln (+9.6% y/y), beating analysts' consensus estimate of $10.961 bln.

The company also raised FY 2017 sales guidance to $42-44 bln from $38-41 bln (versus analysts' consensus estimate of $40.74 bln).

CAT rose to $113.25 (+4.69%) in pre-market trading.

United Tech (UTX) reported Q2 FY 2017 earnings of $1.85 per share (versus $1.82 in Q2 FY 2016), beating analysts' consensus estimate of $1.77.

The company's quarterly revenues amounted to $15.280 bln (+2.7% y/y), generally in-line with analysts' consensus estimate of $15.241 bln.

The company also raised its FY 2017 EPS projection to $6.45-6.60 from $6.30-6.60 (versus analysts' consensus estimate of $6.59), while FY 2017 revenues projection was improved to $58.5-59.5 bln from $57.5-59 bln (versus analysts' consensus estimate of $59.08 bln).

UTX fell to $122.50 (-0.51%) in pre-market trading.

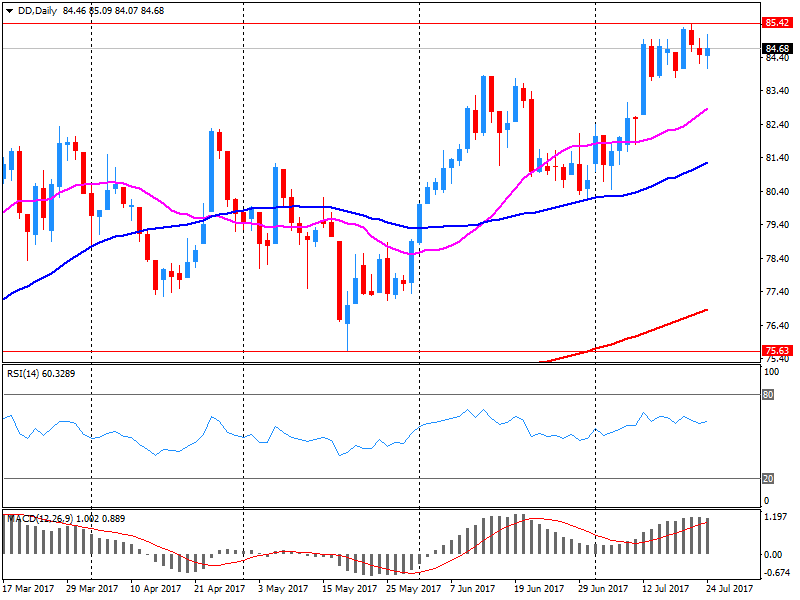

DuPont (DD) reported Q2 FY 2017 earnings of $1.38 per share (versus $1.24 in Q2 FY 2016), beating analysts' consensus estimate of $1.28.

The company's quarterly revenues amounted to $7.424 bln (+5.1% y/y), beating analysts' consensus estimate of $7.277 bln.

DD closed Monday's trading session at $84.35 (-0.22%).

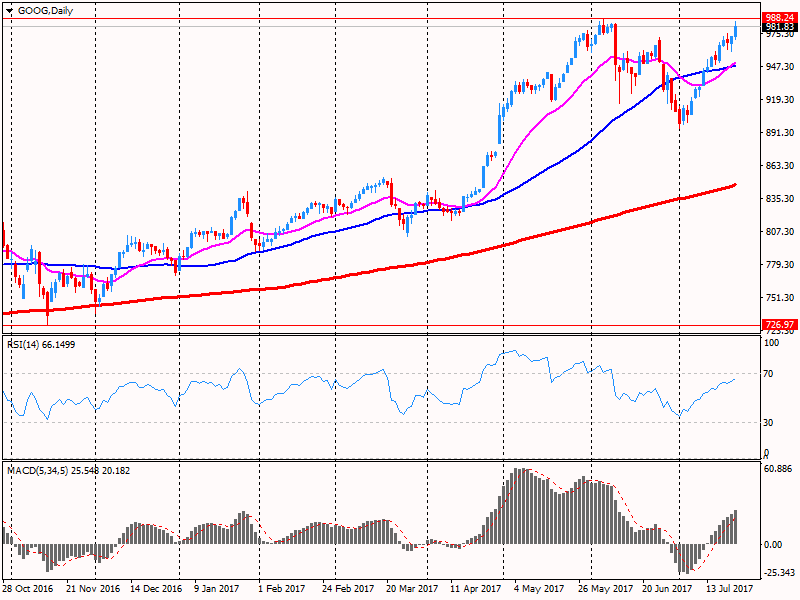

Alphabet (GOOG) reported Q2 FY 2017 earnings of $5.01 per share (versus $8.42 in Q2 FY 2016), beating analysts' consensus estimate of $4.43.

The company's quarterly revenues amounted to $26.010 bln (+21% y/y), beating analysts' consensus estimate of $25.614 bln.

GOOG fell to $954.92 (-2.59%) in pre-market trading.

European stocks closed lower Monday, with shares of German auto makers and Dutch firm Gemalto NV among those pushing the market to its weakest finish in two weeks. The Stoxx Europe 600 SXXP, -0.24% was off 0.2% to end at 379.23, adding to its recent retreat and notching its lowest close since July 11. The index on Friday slid 1%, contributing to last week's loss of 1.9%.

The Dow and the S&P 500 on Monday finished modestly lower, as the market kicked off a busy week of earnings, but the Nasdaq logged another record as technology stocks shook off the broader market's weakness. The Nasdaq Composite Index COMP, +0.36% closed 0.4% at 6,410, boosted by a continued rally in the highflying technology sector XLK, +0.24% However, the Dow Jones Industrial Average DJIA, -0.31% ended the session 0.3% lower at 21,513, while the S&P 500 index SPX, -0.11% wrappeed up Monday trade off 0.1% at 2,469, as gains in the financials sector XLF, +0.44% and tech were more than offset by sharp slumps in telecommunications, utilities, and consumer-discretionary stocks.

Asian stock markets were mostly stronger in early trading Tuesday, with Australia leading the way higher after badly lagging regional peers a day earlier. Helping sentiment has been stabilization for now in the U.S. dollar. Its recent weakness had been pressuring down stocks in Australia and Japan in particular. The WSJ Dollar Index BUXX, -0.08% finished flat on Monday and was up 0.1% early Tuesday.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.