- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 16,544.56 -209.46 -1.25%

Shanghai Composite 2,981.25 -52.65 -1.74%

S&P/ASX 200 5,431.42 +0.123 0.00%

FTSE 100 6,818.04 -91.39 -1.32%

CAC 40 4,407.85 -80.84 -1.80%

Xetra DAX 10,393.71 -233.26 -2.19%

S&P 500 2,146.10 -18.59 -0.86%

Dow Jones Industrial Average 18,094.83 -166.62 -0.91%

S&P/TSX Composite 14,619.46 -78.47 -0.53%

Major Wall Street stock indexes fell as investors anxiously await the first presidential debate in the United States, to assess how candidates plan to shape the economy and politics.

While the race for the seat in the White House still does not have an appreciable impact on the market, this may change after the first debate between Hillary Clinton and Donald Trump. Just six weeks before election day, some investors note volatility in certain sectors, including among health insurance companies, drug manufacturers and industrialists.

As it became known today, sales of new single-family homes in the US fell less than expected in August, while prices fell and stocks rose. The Commerce Department reported that new home sales fell by 7.6% to a seasonally adjusted annual rate reached 609,000 units last month. Sales rose by 20.6 percent compared to last year. Economists had forecast that sales will fall to 597 000 units in the last month.

Oil has risen dramatically today as the largest manufacturers in the world have gathered in Algiers to discuss ways to support the market. Recall, today in Algeria launched the International Energy Forum. On the sidelines of the forum members of the Organization of Petroleum Exporting Countries will meet in an informal setting to discuss a possible deal to curb oil production. Iran, which is still ramping up production, diminishes the chances of the deal, although several other members of the group said they still hope that will be reached some kind of agreement that will solve the problem of global excess oil.

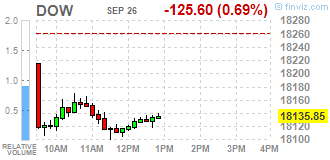

Almost all the components of DOW index closed in negative territory (27 of 30). More rest up shares The Procter & Gamble Company (PG, + 0.42%). Outsider were shares of The Goldman Sachs Group, Inc. (GS, -2.29%).

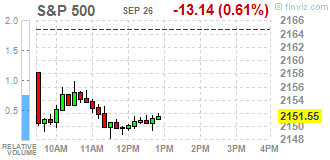

All business sectors S & P index showed a decline. the health sector fell the most (-1.2%).

At the close:

Dow -0.91% 18,095.99 -165.46

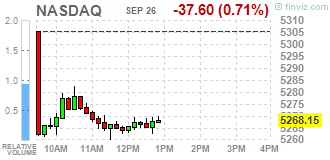

Nasdaq -0.91% 5,257.49 -48.26

S & P -0.86% 2,146.18 -18.51

Major U.S. stock-indexes lower on Monday morning as investors anxiously await the first U.S. presidential debate to gauge how the candidates plan to shape the economy and policy. While the White House race has so far had little discernible effect on the market, that may soon change as polls show a tightening race ahead of the first debate between Hillary Clinton and Donald Trump.

Almost all of Dow stocks in negative area (25 of 30). Top gainer - Apple Inc. (AAPL, +0.27%). Top loser - The Goldman Sachs Group, Inc. (GS -1.87%).

All S&P sectors also in negative area. Top loser - Healthcare (-1.1%).

At the moment:

Dow 18044.00 -146.00 -0.80%

S&P 500 2144.00 -14.00 -0.65%

Nasdaq 100 4821.25 -35.25 -0.73%

Oil 46.08 +1.60 +3.60%

Gold 1344.00 +2.30 +0.17%

U.S. 10yr 1.58 -0.04

Polish equity closed lower on Monday. The broad market measure, the WIG Index, fell by 0.87%. All sectors in the WIG generated negative returns, with media (-1.80%) and materials (-1.50%) underperforming.

The large-cap stocks' benchmark, the WIG30 Index, slumped by 1.19%. There were only three gainers among the index components. Thermal coal miner BOGDANKA (WSE: LWB) recorded the biggest advance of 0.58%. Other outperformers were oil and gas producer PGNIG (WSE: PGN) and property developer GTC (WSE: GTC), adding 0.4% and 0.12% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) topped the list of laggards, tumbling by 3.46%. It was followed by media group CYFROWY POLSAT (WSE: CPS), genco PGE (WSE: PGE) and bank MBANK (WSE: MBK), declining by 2.24%, 2.17% and 2.05% respectively.

The afternoon trading phase has not changed the balance of power on the Warsaw market. The turnover in the segment of blue chips is still meager and the mood in Warsaw and across Europe is declining today. The German DAX was deepened morning intraday lows and consequently descends falling more than 2%. Thus the weakness of the German market today is basically indisputable. The start of the day on Wall Street was inscribed in the mood already set by Europe and the S&P500 index began testing support. So far, we may see that the vision of the upcoming elections and the real possibility of Trump victory quite effectively inhibits bulls aspirations.

An hour before the end of trading, the WIG20 was at the level of 1,734 points (-1.60%).

U.S. stock-index futures fell, tracking declines in European shares spurred by weakness in banks, while investors awaited a presidential debate and a meeting between major oil producers this week.

Global Stocks:

Nikkei 16,544.56 -209.46 -1.25%

Hang Seng 23,317.92 -368.56 -1.56%

Shanghai 2,981.25 -52.65 -1.74%

FTSE 6,828.82 -80.61 -1.17%

CAC 4,411.49 -77.20 -1.72%

DAX 10,427.91 -199.06 -1.87%

Crude $45.05 за баррель (+1.28%)

Gold $1342.00 за унцию (+0.02%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.73 | -0.03(-0.3074%) | 3899 |

| ALTRIA GROUP INC. | MO | 63.72 | -0.15(-0.2349%) | 1034 |

| Amazon.com Inc., NASDAQ | AMZN | 802 | -3.75(-0.4654%) | 26077 |

| Apple Inc. | AAPL | 111.5 | -1.21(-1.0736%) | 399552 |

| AT&T Inc | T | 41.4 | 0.12(0.2907%) | 2798 |

| Barrick Gold Corporation, NYSE | ABX | 18.05 | -0.06(-0.3313%) | 15346 |

| Caterpillar Inc | CAT | 82.39 | -0.05(-0.0607%) | 474 |

| Chevron Corp | CVX | 99.41 | 0.19(0.1915%) | 725 |

| Cisco Systems Inc | CSCO | 31.2 | -0.14(-0.4467%) | 2379 |

| Citigroup Inc., NYSE | C | 46.64 | -0.51(-1.0817%) | 20760 |

| Exxon Mobil Corp | XOM | 83.55 | 0.10(0.1198%) | 2850 |

| Facebook, Inc. | FB | 127.51 | -0.45(-0.3517%) | 100529 |

| Ford Motor Co. | F | 12.11 | -0.06(-0.493%) | 21663 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.66 | 0.03(0.2822%) | 53836 |

| General Electric Co | GE | 29.76 | -0.13(-0.4349%) | 6251 |

| General Motors Company, NYSE | GM | 32.05 | -0.07(-0.2179%) | 1099 |

| Goldman Sachs | GS | 164 | -1.13(-0.6843%) | 2460 |

| Google Inc. | GOOG | 784.23 | -2.67(-0.3393%) | 1423 |

| Home Depot Inc | HD | 127.2 | -0.59(-0.4617%) | 938 |

| Intel Corp | INTC | 37.06 | -0.13(-0.3496%) | 27261 |

| International Business Machines Co... | IBM | 154.43 | -0.55(-0.3549%) | 455 |

| Johnson & Johnson | JNJ | 118.7 | -0.11(-0.0926%) | 406 |

| McDonald's Corp | MCD | 117.01 | -0.16(-0.1366%) | 250 |

| Microsoft Corp | MSFT | 57.28 | -0.15(-0.2612%) | 3288 |

| Nike | NKE | 54.72 | -0.43(-0.7797%) | 4861 |

| Pfizer Inc | PFE | 33.78 | -0.48(-1.4011%) | 21301 |

| Starbucks Corporation, NASDAQ | SBUX | 54.02 | -0.41(-0.7533%) | 1927 |

| Tesla Motors, Inc., NASDAQ | TSLA | 206.26 | -1.19(-0.5736%) | 5498 |

| Twitter, Inc., NYSE | TWTR | 21.71 | -0.91(-4.023%) | 1559989 |

| Verizon Communications Inc | VZ | 52.5 | -0.06(-0.1142%) | 303 |

| Visa | V | 82.2 | -0.34(-0.4119%) | 2477 |

| Wal-Mart Stores Inc | WMT | 72.2 | -0.15(-0.2073%) | 830 |

| Walt Disney Co | DIS | 92.6 | -0.67(-0.7183%) | 8644 |

| Yahoo! Inc., NASDAQ | YHOO | 42.3 | -0.50(-1.1682%) | 17268 |

| Yandex N.V., NASDAQ | YNDX | 21.52 | -0.05(-0.2318%) | 1400 |

Upgrades:

AT&T (T) upgraded to Hold from Reduce at HSBC Securities

Downgrades:

Walt Disney (DIS) downgraded to Hold from Buy at Drexel Hamilton

Twitter (TWTR) downgraded to Underperform from Perform at Oppenheimer

Other:

NIKE (NKE) removed from Focus List at JP Morgan

Amazon (AMZN) target raised to $960 from $900 at Cowen; maintain Outperform

The first half of today's trading on the Warsaw Stock Exchange was marked by deepening, following by similar behavior of environment, discounts.

The September reading of the German Ifo index surprised positively with respect to forecasts and the index has gained significantly in relation to the level a month ago. The impact of these data on the market was not significant, although the euro slightly strengthened. Today, new historical lows reached the shares of Deutsche Bank after the press releases, that Angela Merkel does not agree on a plan support the bank by the state.

On the Warsaw market, the half of the session brought a turnover of barely PLN 146 million in the segment of blue chips, while the WIG20 index was at the level of 1,739 points (-1.31%).

WIG20 index opened at 1756.50 points (-0.34%)*

WIG 47641.42 -0.47%

WIG30 2020.83 -0.69%

mWIG40 4085.75 0.11%

*/ - change to previous close

The futures market started the new week with a discount of 0.63% to 1,738 points. Contract for the DAX also opened up with a downward gap and lost approx. 0.5%.

The cash market opened with discount at modest turnover. After the first transactions the discount worsened, which compensated the optimistic fixing on Friday. Market returns to the level of 1750 points, which attracts like a magnet. The day in whole of Europe begins with declines. The same today's morning quite clearly indicates how dramatically the mood changed in relation to Thursday of the last week.

After fifteen minutes of trade WIG20 index it was at the level of 1,743 points (-1,09%).

The new week on the markets begins with not very good mood. Poor closure of Wall Street on Friday - a decline of 0.6% and closing at daily minima resulted in clearer discounts in Asia. Such a distribution of forces will put pressure on the supply side of the markets in Europe after and so weak session on Friday.

In the macro calendar macro this morning we will know the reading of the Ifo index in Germany. Today begins also the informal meeting of OPEC countries, which will end on Wednesday and will have a major impact on the prices of crude oil, and thus the shares of oil companies. But the most important event of the day will be the first TV debate of the main candidates for president of the United States. It will be held on 21 am New York time (3:00 am Warsaw time). Positive behavior of the markets to maintain US interest rates unchanged, at very quickly gave way to fear of the elections in the US.

On the Warsaw market, the key element is still the level of 1,750 points on the index of the largest companies and the defeat or the lack of such a defeat will decide on the next trend on the Warsaw parquet.

European stocks moved decisively lower on Friday, giving back a chunk of the prior day's rally after economic data painted a mixed picture of the region's recovery. The week's gains came as the U.S. Federal Reserve refrained from raising interest rates and indicated it would keep monetary policy loose for at least another few months. Traders in Europe and the U.K. closely watch where U.S. interest rates are headed, as they are a major driver for the global economy and currency markets.

U.S. stocks closed near session lows Friday, with investor sentiment hit by a renewed slide in crude-oil prices. Reports that major oil producers are not likely to reach an agreement to freeze production at a meeting this weekend resulted in the largest one-day loss for oil futures since mid-July.

Asian shares were broadly lower Monday, following declines in U.S. stocks on Friday and amid nervousness about the state of global oil markets. The Organization of the Petroleum Exporting Countries gathers for an informal meeting this week in Algiers, with production cuts likely up for discussion.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.