- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Index | Change items | Closing price | % change |

| Nikkei | +93.53 | 24033.79 | +0.39% |

| SHANGHAI | +25.68 | 2806.81 | +0.92% |

| ASX 200 | +6.40 | 6192.30 | +0.10% |

| FTSE 100 | +3.93 | 7511.49 | +0.05% |

| DAX | +11.23 | 12385.89 | +0.09% |

| CAC 40 | +33.63 | 5512.73 | +0.61% |

| DJIA | -106.93 | 26385.28 | -0.40% |

| S&P 500 | -9.59 | 2905.97 | -0.33% |

| NASDAQ | -17.10 | 7990.37 | -0.21% |

Major US stock indexes finished trading in negative territory, affected by the collapse of the conglomerate sector and the financial sector.

The focus of investors' attention is also data on the housing market and the results of the Fed meeting. The Commerce Department reported that sales of new single-family homes in the US rose more than expected in August after two direct monthly decreases, but the main trend still indicates a weakening of the housing market amid rising mortgage rates and higher housing prices . The report showed that sales of new buildings recovered 3.5 percent to a seasonally adjusted level of 629,000 units. The pace of sales in July was revised to 608,000 units from 627,000 units. Sales in June were also much weaker than previously reported. Economists predicted that sales of new homes rose to 630,000 units.

As for the Fed meeting, as expected, the Central Bank raised interest rates by another 0.25% and signaled its intention to continue raising rates next year. This rate increase was the third this year and the eighth since the Fed began tightening policies in late 2015. In addition, for the first time in a decade, the rate exceeded the level of inflation according to the Fed's preferred index of prices for personal consumption expenditure, which in July rose by 2%.

Most of the components of DOW finished trading in the red (22 of 30). Outsider were shares of American Express Company (AXP, -1.69%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 1.81%).

Almost all S & P sectors recorded a decline. The largest drop was shown by the sector of conglomerates (-1.1%). The services sector grew most (+ 0.3%).

At closing:

Dow 26,385.28 -106.93 -0.40%

S & P 500 2,905.97 -9.59 -0.33%

Nasdaq 100 7,990.37 -17.10 -0.21%

U.S. stock-index futures edged higher on Wednesday, as bank stocks gained ahead of the announcement of the Federal Reserve's latest monetary-policy decision.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 24,033.79 | +93.53 | +0.39% |

| Hang Seng | 27,816.87 | +317.48 | +1.15% |

| Shanghai | 2,806.82 | +25.68 | +0.92% |

| S&P/ASX | 6,192.30 | +6.40 | +0.10% |

| FTSE | 7,505.70 | -1.86 | -0.02% |

| CAC | 5,496.83 | +17.73 | +0.32% |

| DAX | 12,350.08 | -24.58 | -0.20% |

| Crude | $71.81 | | -0.65% |

| Gold | $1,198.60 | | -0.54% |

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 213.4 | 2.76(1.31%) | 1500 |

| ALCOA INC. | AA | 41.4 | 0.16(0.39%) | 1236 |

| Amazon.com Inc., NASDAQ | AMZN | 1,976.95 | 2.40(0.12%) | 31583 |

| American Express Co | AXP | 109.28 | -0.59(-0.54%) | 197 |

| Apple Inc. | AAPL | 222.18 | -0.01(-0.00%) | 126654 |

| AT&T Inc | T | 33.78 | 0.02(0.06%) | 13966 |

| Barrick Gold Corporation, NYSE | ABX | 11.19 | 0.01(0.09%) | 88715 |

| Boeing Co | BA | 368 | 0.77(0.21%) | 1163 |

| Chevron Corp | CVX | 123 | -0.37(-0.30%) | 520 |

| Cisco Systems Inc | CSCO | 48.66 | 0.19(0.39%) | 1660 |

| Citigroup Inc., NYSE | C | 73.75 | 0.24(0.33%) | 15579 |

| Facebook, Inc. | FB | 164.88 | -0.03(-0.02%) | 54579 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.45 | -0.04(-0.28%) | 9397 |

| General Electric Co | GE | 11.25 | -0.02(-0.18%) | 237184 |

| General Motors Company, NYSE | GM | 33.65 | 0.10(0.30%) | 5672 |

| Google Inc. | GOOG | 1,189.39 | 4.74(0.40%) | 3047 |

| Intel Corp | INTC | 45.87 | -0.04(-0.09%) | 20271 |

| International Business Machines Co... | IBM | 151.41 | 2.50(1.68%) | 36027 |

| Merck & Co Inc | MRK | 70.39 | -0.26(-0.37%) | 2047 |

| Microsoft Corp | MSFT | 114.75 | 0.30(0.26%) | 19079 |

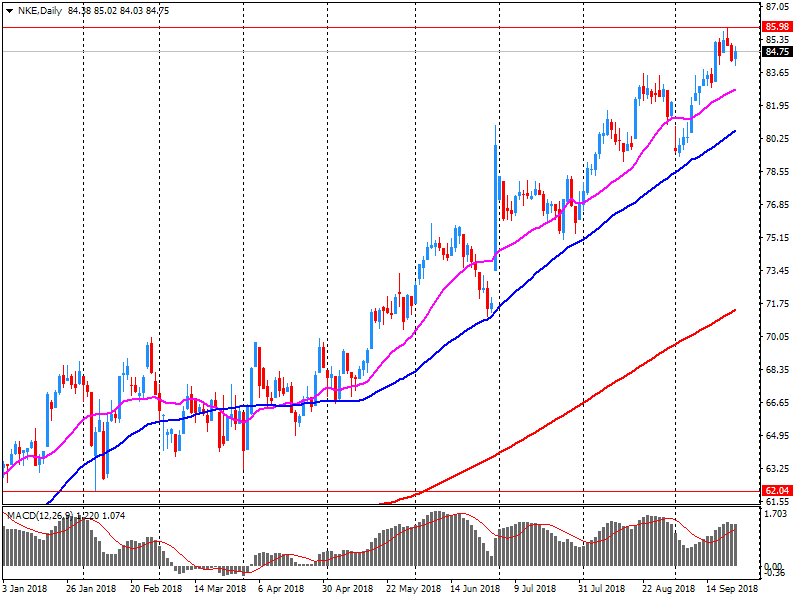

| Nike | NKE | 82.51 | -2.28(-2.69%) | 189352 |

| Pfizer Inc | PFE | 43.64 | -0.15(-0.34%) | 287 |

| Tesla Motors, Inc., NASDAQ | TSLA | 301.11 | 0.12(0.04%) | 11061 |

| Verizon Communications Inc | VZ | 53.17 | 0.12(0.23%) | 4607 |

| Visa | V | 149.75 | 0.17(0.11%) | 873 |

| Wal-Mart Stores Inc | WMT | 95.47 | 0.37(0.39%) | 214 |

| Walt Disney Co | DIS | 114 | 0.37(0.33%) | 3713 |

Downgrades before the market open

DowDuPont (DWDP) downgraded to Neutral from Buy at Nomura; target $76

Upgrades before the market open

IBM (IBM) upgraded to Buy from Neutral at UBS; target raised to $180 from $160

NIKE (NKE) reported Q1 FY 2019 earnings of $0.67 per share (versus $0.57 in Q1 FY 2018), beating analysts' consensus estimate of $0.63.

The company's quarterly revenues amounted to $9.948 bln (+9.7% y/y), generally in-line with analysts' consensus estimate of $9.918 bln.

NKE fell to $82.70 (-2.46%) in pre-market trading.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.