- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 18,947.12 +121.82 +0.65 %

Hang Seng 23,116.25 -35.69 -0.15 %

Shanghai Composite 3,430.36 +17.92 +0.53 %

FTSE 100 6,417.02 -27.06 -0.42 %

CAC 40 4,897.13 -26.51 -0.54 %

Xetra DAX 10,801.34 +6.80 +0.06 %

S&P 500 2,071.18 -3.97 -0.19 %

NASDAQ Composite 5,034.7 +2.84 +0.06 %

Dow Jones 17,623.05 -23.65 -0.13 %

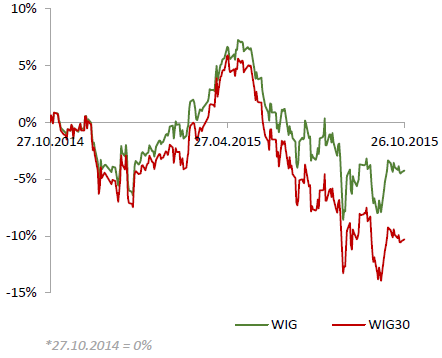

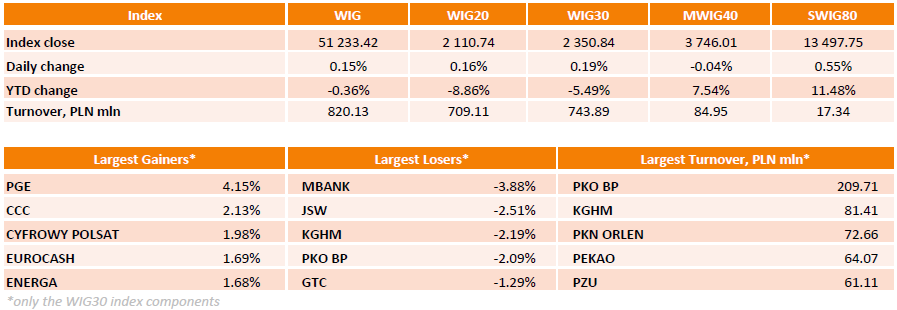

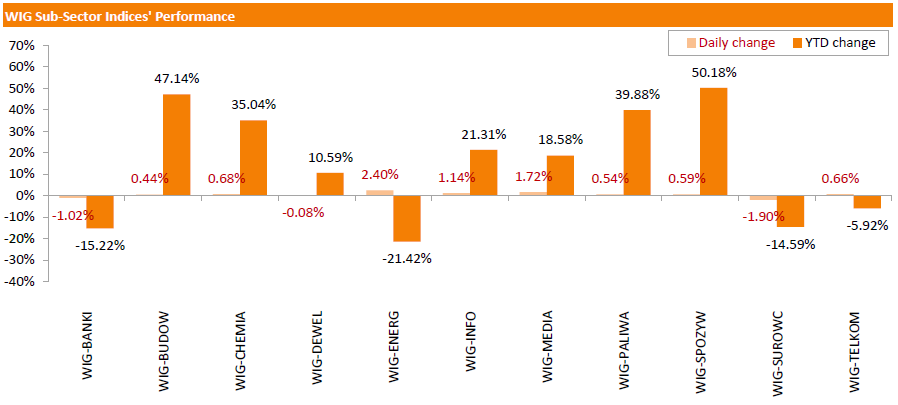

Polish equity market closed higher on Monday. The broad market measure, the WIG index, inched up 0.15%. Sector performance in the WIG Index was mixed. Utilities names (+2.40%) recorded the biggest gain, rebounding from the previous session's sharp decline. At the same time, materials (-1.90%) fared the worst, followed by banking stocks (-1.02%), which declined after the opposition Law & Justice party, which announced plans to tax bank assets and burden the banks with the costs of conversion of Swiss franc mortgages to zloty, claimed victory in national elections.

The large-cap stocks' measure, the WIG30 Index, rose by 0.19%. In the index basket, PGE (WSE: PGE) posted the strongest advance, up 4.15%. Other major outperformers included CCC (WSE: CCC), CYFROWY POLSAT (WSE: CPS), EUROCASH (WSE: EUR) and ENERGA (WSE: ENG), adding 1.68%-2.13%. On the other side of the ledger, MBANK (WSE MBK) led the decliners with a 3.88% drop, followed by JSW (WSE: JSW), KGHM (WSE: KGH) and PKO BP (WSE: PKO), sliding 2.09%-2.51%.

Stock indices closed mixed on corporate earnings. The German stock index DAX was supported by the better-than-expected German Ifo business climate data. German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index fell to 108.2 in October from 108.5 in September, beating expectations for a decline to 107.8.

"Companies were slightly less satisfied with their current business situation than in September. Optimism with a view to future business developments nevertheless continued to grow. The German economy is proving remarkably resilient in view of this autumn's multiple challenges," Ifo President Hans-Werner Sinn said.

He added that the Volkswagen scandal had no impact on the German automotive industry.

The Ifo current conditions index declined to 112.6 from 114.0. Analysts had expected the index to fell to 113.5.

The Ifo expectations index rose to 103.8 from 103.3. Analysts had expected the index to decrease to 102.4.

The German Bundesbank released its monthly economic report on Monday. The central bank said that the underlying trend in the German economy remains strong, but it lost some momentum.

"The upward momentum of overall economic activity in Germany continued in the third quarter," the central bank said.

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance dropped to -18% in October from -7% in September.

Ona quarterly basis, the CBI industrial order books balance declined to -8% in the third quarter from +9% in the second quarter. It was the lowest reading since October 2012.

"Manufacturers have been struggling with weak export demand for several months, because of the strength of the pound and subdued global growth. But now they're also facing pressure back home as domestic demand is easing," the CBI director of economics Rain Newton-Smith said.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Monday. The number of mortgage approvals decreased to 44,489 in September from 46,567 in August. August's figure was revised down from 46,743.

"Borrowing figures in the mortgage market remain strong as customers take advantage of record low interest rates. In particular, remortgaging remains high as savvy customers secure attractive deals ahead of a possible rate rise," the chief economist at the BBA, Richard Woolhouse, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,417.02 -27.06 -0.42 %

DAX 10,801.34 +6.80 +0.06 %

CAC 40 4,897.13 -26.51 -0.54 %

Major U.S. stock-indexes mixed on Monday as energy stocks fell on concerns of a crude oil supply glut and Apple's shares retreated a day ahead of its quarterly results. Investors are also awaiting the Federal Reserve's two-day policy meeting, which begins on Tuesday. While the Fed is not expected to raise rates at the meeting, its statement on Wednesday will provide clues on the timing of a rate hike.

Most of Dow stocks in negative area (16 of 30). Top looser - Apple Inc. (AAPL, -2.88%). Top gainer - Microsoft (MSFT, +1.20%).

Most of S&P index sectors in negative area. Top looser - Basic Materials (-1.6%). Top gainer - Healthcare (+0,5%).

At the moment:

Dow 17541.00 -5.00 -0.03%

S&P 500 2064.00 -2.00 -0.10%

Nasdaq 100 4620.25 +8.75 +0.19%

Oil 44.30 -0.30 -0.67%

Gold 1166.50 +3.70 +0.32%

U.S. 10yr 2.06 -0.02

The European Central Bank (ECB) purchased €12.25 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference last Thursday that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December. He noted that the Governing Council discussed the possibility to cut interest rates, but the decision was not made. Draghi pointed out that the central bank will expand its asset-buying programme if needed to boost inflation toward the 2% target.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €2.03 billion of covered bonds, and €200 million of asset-backed securities.

The U.S. Commerce Department released new home sales data on Monday. New home sales dropped 11.5% to a seasonally adjusted annual rate of 468,000 units in September from 529,000 units in August. August's figure was revised down from 552,000 units. It was the highest figure since February 2008.

Analysts had expected new home sales to reach 550,000 units.

The decline was driven by lower sales in the Northeast. New home sales in the Northeast plunged 61.8% in September.

This data points to a cooling in the U.S. housing market.

The German Bundesbank released its monthly economic report on Monday. The central bank said that the underlying trend in the German economy remains strong, but it lost some momentum.

"The upward momentum of overall economic activity in Germany continued in the third quarter," the central bank said.

Households' real income benefited from higher wages and lower energy prices, according to the report.

The Bundesbank pointed out that the construction sector lost momentum.

Upgrades:

Goldman Sachs (GS) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

American Express (AXP) downgraded to Sell at UBS

Citigroup (C) downgraded to Equal-Weight from Overweight at Morgan Stanley

Other:

Apple (AAPL) reiterated with a Market Perform at Cowen; target raised to $135 from $130

Hewlett-Packard (HPQ) initiated with a Neutral at Goldman

Alphabet (GOOG) target raised to $900 from $850 at Argus

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance dropped to -18% in October from -7% in September.

Ona quarterly basis, the CBI industrial order books balance declined to -8% in the third quarter from +9% in the second quarter. It was the lowest reading since October 2012.

"Manufacturers have been struggling with weak export demand for several months, because of the strength of the pound and subdued global growth. But now they're also facing pressure back home as domestic demand is easing," the CBI director of economics Rain Newton-Smith said.

October 27

Before the Open:

DuPont (DD). Consensus EPS $0.10, Consensus Revenue $5252.39 mln

Ford Motor (F). Consensus EPS $0.46, Consensus Revenue $35086.01 mln

Merck (MRK). Consensus EPS $0.92, Consensus Revenue $10077.72 mln

Pfizer (PFE). Consensus EPS $0.51, Consensus Revenue $11574.43 mln

Yandex N.V. (YNDX). Consensus EPS $10.08, Consensus Revenue $15044.01 mln

After the Close:

Apple (AAPL). Consensus EPS $1.87, Consensus Revenue $50947.22 mln

Twitter (TWTR). Consensus EPS $0.05, Consensus Revenue $561.04 mln

October 28

Before the Open:

Intl Paper (IP). Consensus EPS $0.93, Consensus Revenue $5846.20 mln

After the Close:

Barrick Gold (ABX). Consensus EPS $0.07, Consensus Revenue $2312.24 mln

October 29

Before the Open:

Altria (MO). Consensus EPS $0.75, Consensus Revenue $4885.53 mln

After the Close:

Starbucks (SBUX). Consensus EPS $0.43, Consensus Revenue $4899.10 mln

October 30

Before the Open:

Chevron (CVX). Consensus EPS $0.74, Consensus Revenue $34810.56 mln

Exxon Mobil (XOM). Consensus EPS $0.90, Consensus Revenue $63671.16 mln

Stock indices traded mixed on the better-than-expected German Ifo business climate data. German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index fell to 108.2 in October from 108.5 in September, beating expectations for a decline to 107.8.

"Companies were slightly less satisfied with their current business situation than in September. Optimism with a view to future business developments nevertheless continued to grow. The German economy is proving remarkably resilient in view of this autumn's multiple challenges," Ifo President Hans-Werner Sinn said.

He added that the Volkswagen scandal had no impact on the German automotive industry.

The Ifo current conditions index declined to 112.6 from 114.0. Analysts had expected the index to fell to 113.5.

The Ifo expectations index rose to 103.8 from 103.3. Analysts had expected the index to decrease to 102.4.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Monday. The number of mortgage approvals decreased to 44,489 in September from 46,567 in August. August's figure was revised down from 46,743.

"Borrowing figures in the mortgage market remain strong as customers take advantage of record low interest rates. In particular, remortgaging remains high as savvy customers secure attractive deals ahead of a possible rate rise," the chief economist at the BBA, Richard Woolhouse, said.

Current figures:

Name Price Change Change %

FTSE 100 6,427.4 -16.68 -0.26 %

DAX 10,808.38 +13.84 +0.13 %

CAC 40 4,892.5 -31.14 -0.63 %

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Monday. The number of mortgage approvals decreased to 44,489 in September from 46,567 in August. August's figure was revised down from 46,743.

"Borrowing figures in the mortgage market remain strong as customers take advantage of record low interest rates. In particular, remortgaging remains high as savvy customers secure attractive deals ahead of a possible rate rise," the chief economist at the BBA, Richard Woolhouse, said.

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Monday. The Spanish producer prices dropped 0.9% in September, after a 1.7% fall in August.

On a yearly basis, producer price inflation in Spain fell 3.6% in September, after a 2.2% decline in August. Producer prices have been declining since July 2014.

Producer prices excluding energy climbed 0.4% year-on-year in September, after a 0.6% rise in August.

Energy prices slid 14.2% year-on-year in September.

German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index fell to 108.2 in October from 108.5 in September, beating expectations for a decline to 107.8.

"Companies were slightly less satisfied with their current business situation than in September. Optimism with a view to future business developments nevertheless continued to grow. The German economy is proving remarkably resilient in view of this autumn's multiple challenges," Ifo President Hans-Werner Sinn said.

He added that the Volkswagen scandal had no impact on the German automotive industry.

The Ifo current conditions index declined to 112.6 from 114.0. Analysts had expected the index to fell to 113.5.

The Ifo expectations index rose to 103.8 from 103.3. Analysts had expected the index to decrease to 102.4.

The International Monetary Fund (IMF) said last week that the slowdown in the Chinese economy could drag North Asia region, which includes Japan, South Korea, Hong Kong and Taiwan, into recession. The lender expects the region to expand 5.5% this year. It is the weakest growth since the global financial crisis.

Reuters reported on Friday that the Bank of Japan (BoJ) will lower its growth and inflation forecasts for this fiscal year ending on March 31, 2016 at its monetary policy meeting this week. But forecasts for next year will remain almost unchanged, the source with direct knowledge of the matter said.

Forecasts could be changed ahead of the announcement, according to the source.

Reuters reported on Sunday that the International Monetary Fund (IMF) officials said that the IMF will add the yuan to its basket of reserve currencies soon. The lender will decide in November.

"Everything is on course technically and there is no obvious political obstacle. The report leans clearly towards including the RMB in the (basket) but leaves the decision for the board," one IMF official said.

U.S. stock indices rose on Friday with technology companies leading the gains amid positive earnings reports.

The Dow Jones Industrial Average gained 157.81, or 0.9%, to 17,646.97 (+2.5% over the week). The S&P 500 rose 22.65 points, or 1.1%, to 2,075.16 (+2.1% over the week). The Nasdaq Composite Index rose 111.81, or 2.3%, to 5,031.86 (+3% over the week).

Shares of Amazon rallied 6.2% on a strong earnings report and expectations for good profits during the holiday season.

An unexpected rate cut by the People's Bank of China also pushed stocks up. The bank lowered its one-year deposit rate by 25 basis points to 1.5% and its one-year lending rate by 25 basis points to 4.35%.

"The estimated cash released from these policy changes is 600 to 700 billion yuan in liquidity (about $93.75 to $109.3 billion)," IG's market strategist Evan Lucas wrote in a note.

This morning in Asia Hong Kong Hang Seng rose 0.25%, or 58.52, or 23,210.46. China Shanghai Composite Index climbed 0.79%, or 27.11, to 3.439.54. The Nikkei gained 0.83%, or 157.16, to 18,982.46.

Asian indices rose amid a rate cut by the central bank of China and expectations of more stimulus from the European Central Bank.

Meanwhile China has begun its four-day plenary session to finalize the country's economic and social policies for the next five years.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.