- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +71.74 20225.09 +0.36%

TOPIX +6.81 1619.02 +0.42%

Hang Seng -31.90 25839.99 -0.12%

CSI 300 +6.63 3674.72 +0.18%

Euro Stoxx 50 -23.44 3538.32 -0.66%

FTSE 100 -12.44 7434.36 -0.17%

DAX -99.81 12671.02 -0.78%

CAC 40 -37.17 5258.58 -0.70%

DJIA -98.89 21310.66 -0.46%

S&P 500 -19.69 2419.38 -0.81%

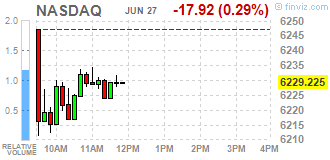

NASDAQ -100.53 6146.62 -1.61%

S&P/TSX -34.80 15281.22 -0.23%

The main US stock indices fell noticeably. Pressure on the market provided sales in the technological segment and conglomerate sector, while some support was provided by the market from the growth of shares of banks, as well as securities of the energy sector.

In addition, investors reacted to the message that the confidence of consumers unexpectedly improved. The Conference Board said that the consumer confidence index rose to 118.9 in June. It was expected to decline to 116 from 117.6 in May. The index of the current situation increased by 5.3 points to 146.3, while the index of expectations fell by 1.7, to 100.6. At the same time, the S & P / Case-Shiller report showed that prices for single-family homes in the US accelerated at a slower pace than expected in April. According to the report, the composite index for 20 megacities rose in April at 5.7% per annum after an increase of 5.9% in March. The growth was forecasted at 5.9%.

Attention of market participants was also attracted by reports that the IMF worsened the outlook for the US economy due to doubts about the effectiveness of measures promised by Tramp to reduce taxes and increase spending on infrastructure. The IMF expects US GDP growth by 2.1% in 2018 against the previous forecast of + 2.5%, and predicts a slowdown in growth to 1.7% in the next 5 years. The IMF also believes that the US dollar rate is 10% -20% higher than the level justified in terms of economic fundamentals. In addition, the IMF said that the Fed should continue to raise interest rates "depending on the incoming data."

Most components of the DOW index finished trading in the red (22 of 30). Most fell shares of Verizon Communications Inc. (VZ, -1.76%). Leader of the growth were JPMorgan Chase & Co. shares. (JPM, + 1.18%).

Most sectors of the S & P index showed a decline. The conglomerate sector fell most of all (-2.0%). The leader of growth was the financial sector (+ 0.3%).

At closing:

DJIA -0.45% 21.313.54 -96.01

Nasdaq -1.61% 6,146.62 -100.53

S & P -0.80% 2.419.45 -19.62

Major U.S. stock-indexes were little changed, as equities managed to retrace a good portion of their opening losses. The investors' sentiment remained subdued due to continuing selloff in technology shares and ahead of the speech by Federal Reserve Chair Janet Yellen. On the contrary, names, belonging to financial and energy sectors, helped to keep the broader market afloat. Better-than-expected consumer confidence data also provided some support to the market.

A majority of Dow stocks in negative area (16 of 30). Top loser - Verizon Communications Inc. (VZ, -1.84%). Top gainer - JPMorgan Chase & Co. (JPM, +1.50%).

Most of S&P sectors in negative area.Top loser - Utilities (-0.7%). Top gainer - Basic Materials (+0.8%).

At the moment:

Dow 21381.00 +13.00 +0.06%

S&P 500 2436.75 +0.75 +0.03%

Nasdaq 100 5763.00 -15.25 -0.26%

Crude Oil 44.41 +1.03 +2.37%

Gold 1247.80 +1.40 +0.11%

U.S. 10yr 2.20 +0.06

U.S. stock-index futures slipped, as a selloff in technology shares continued, while investors awaited the speech by Federal Reserve Chair Janet Yellen.

Stocks:

Nikkei 20,225.09 +71.74 +0.36%

Hang Seng 25,839.99 -31.90 -0.12%

Shanghai 3,191.51 +6.07 +0.19%

S&P/ASX 5,714.19 -5.97 -0.10%

FTSE 7,433.86 -12.94 -0.17%

CAC 5,259.10 -36.65 -0.69%

DAX 12,689.72 -81.11 -0.64%

Crude $43.98 (+1.38%)

Gold $1,249.80 (+0.27%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 31.45 | 0.27(0.87%) | 11474 |

| Amazon.com Inc., NASDAQ | AMZN | 989.3 | -4.68(-0.47%) | 25566 |

| Apple Inc. | AAPL | 145.23 | -0.59(-0.40%) | 109456 |

| AT&T Inc | T | 37.94 | -0.21(-0.55%) | 51686 |

| Barrick Gold Corporation, NYSE | ABX | 16.49 | 0.15(0.92%) | 16061 |

| Boeing Co | BA | 200 | 0.02(0.01%) | 592 |

| Caterpillar Inc | CAT | 104.2 | -0.05(-0.05%) | 300 |

| Cisco Systems Inc | CSCO | 32.2 | -0.04(-0.12%) | 1681 |

| Citigroup Inc., NYSE | C | 64.01 | 0.23(0.36%) | 6098 |

| Exxon Mobil Corp | XOM | 81.27 | 0.03(0.04%) | 1423 |

| Facebook, Inc. | FB | 153 | -0.59(-0.38%) | 45356 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.91 | 0.09(0.76%) | 5237 |

| General Electric Co | GE | 27.66 | 0.05(0.18%) | 6701 |

| General Motors Company, NYSE | GM | 34.34 | -0.18(-0.52%) | 5618 |

| Goldman Sachs | GS | 221.8 | 1.36(0.62%) | 3113 |

| Google Inc. | GOOG | 940.01 | -12.26(-1.29%) | 18761 |

| Hewlett-Packard Co. | HPQ | 18.17 | 0.01(0.06%) | 100 |

| Intel Corp | INTC | 34 | -0.07(-0.21%) | 43267 |

| Johnson & Johnson | JNJ | 136.88 | 0.54(0.40%) | 734 |

| JPMorgan Chase and Co | JPM | 87.6 | 0.36(0.41%) | 4898 |

| Merck & Co Inc | MRK | 66.5 | 0.58(0.88%) | 231683 |

| Microsoft Corp | MSFT | 70.16 | -0.37(-0.52%) | 9559 |

| Nike | NKE | 53.2 | -0.08(-0.15%) | 1615 |

| Procter & Gamble Co | PG | 89.28 | -0.08(-0.09%) | 701 |

| Starbucks Corporation, NASDAQ | SBUX | 59.59 | -0.05(-0.08%) | 622 |

| Tesla Motors, Inc., NASDAQ | TSLA | 374.41 | -3.08(-0.82%) | 51387 |

| The Coca-Cola Co | KO | 45.42 | -0.01(-0.02%) | 2296 |

| Twitter, Inc., NYSE | TWTR | 18.34 | 0.05(0.27%) | 37148 |

| Verizon Communications Inc | VZ | 45.23 | -0.52(-1.14%) | 89196 |

| Yandex N.V., NASDAQ | YNDX | 27.26 | 0.09(0.33%) | 910 |

European stocks finished with gains on Monday, helped by Italian banks after that country's government stepped in to shut down two failed lenders, and as Nestlé SA rallied after a hedge fund snapped up a big stake in the consumer-products giant.

The Dow industrials on Monday ended a string of daily losses at four, but the Nasdaq Composite faltered, putting pressure on the broader market. For the first half of 2017, the benchmark S&P 500 is on track to advance about 9%, with some analysts suggesting that the second half will likely be positive as well.

Global shares were higher in Asia-Pacific trade Tuesday, lifted in part by a stronger U.S. dollar, though markets in Australia bucked the trend due to declines in utility and mining stocks. Spot gold prices were recently down 0.2%, extending losses after Monday's flash crash, which was caused by suspected human error. It plunged 1% shortly after the opening call in London on Monday and traded about 1.8 million troy ounces in a minute, "which is more than the volumes traded seen during recent global risk events," noted ANZ Research.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.