- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| index | closing price | change items | % change |

| Nikkei | -339.91 | 22018.52 | -1.52% |

| TOPIX | -25.72 | 1736.13 | -1.46% |

| Hang Seng | -427.79 | 30056.79 | -1.40% |

| CSI 300 | -80.64 | 3723.37 | -2.12% |

| Euro Stoxx 50 | +13.05 | 3441.19 | +0.38% |

| FTSE 100 | +56.93 | 7689.57 | +0.75% |

| DAX | +117.25 | 12783.76 | +0.93% |

| CAC 40 | -10.71 | 5427.35 | -0.20% |

| DJIA | +306.33 | 24667.78 | +1.26% |

| S&P 500 | +34.15 | 2724.01 | +1.27% |

| NASDAQ | +65.86 | 7462.45 | +0.89% |

| S&P/TSX | +126.05 | 16048.66 | +0.79% |

Major US stock indexes finished trading with a confident increase against the background of the restoration of the energy and banking sectors after the sale in the course of the previous session due to concerns about the political crisis in Italy.

A certain influence on the course of trading also provided data on the United States. The report from Automatic Data Processing (ADP) showed that the growth rate of employment in the private sector of the US slowed in May more than experts predicted. According to the report, in May, the number of employed increased by 178 thousand people compared with the index for April at 204 thousand. Analysts had expected that the number of employed will increase by 190 thousand. In addition, the data showed that, in the sectoral context, the number of employees among companies production of goods increased by 64 thousand, while among those who provide services, rose by 114 thousand.

In addition, the Ministry of Trade reported that US economic growth slowed slightly slightly than initially expected in the first quarter, due to downward revision of investments in inventories and consumer spending, but a reduction in the profit tax is likely to increase activity this year . Gross domestic product increased by 2.2 percent year-on-year, instead of the previously reported rate of 2.3 percent. In the fourth quarter, the economy grew by 2.9 percent. Economists had expected that GDP growth in the first quarter would remain at 2.3 percent.

In addition, the Fed's Beige Book indicated that economic activity in most of the US regions grew at a moderate pace in the spring, partly due to improvements in the manufacturing sector, despite tensions in foreign trade relations. The report also reported that employment in most regions grew at a modest to moderate pace. Many companies raised their salaries due to a shortage of qualified employees, but the growth rate of wages was still modest.

Quotes of oil rose by more than 2.5%, supported by tight supplies, despite expectations that OPEC and its allies will pump more in the second half of 2018. In addition, the increase in prices was due to the projected decline in oil products in the US.

Almost all components of DOW have finished trading in positive territory (27 out of 30). Exxon Mobil Corporation (XOM, + 3.98%) was the leader of growth. Outsider were the shares of Cisco Systems, Inc. (CSCO, -0.28%).

All sectors of S & P recorded a rise. The commodities sector grew most (+ 2.5%).

At closing:

Index

Dow 24,667.78 +306.33 +1.26%

S&P 500 2,724.01 +34.15 +1.27%

Nasdaq 100 7,462.45 +65.86 +0.89%

U.S. stock-index futures rose moderately on Wednesday, signaling a rebound in equity market after a sharp decline on Tuesday due to a political turmoil in Italy.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,018.52 | -339.91 | -1.52% |

| Hang Seng | 30,056.79 | -427.79 | -1.40% |

| Shanghai | 3,041.65 | -78.82 | -2.53% |

| S&P/ASX | 5,984.70 | -28.90 | -0.48% |

| FTSE | 7,658.73 | +26.09 | +0.34% |

| CAC | 5,415.77 | -22.29 | -0.41% |

| DAX | 12,753.04 | +86.53 | +0.68% |

| Crude | $67.04 | | +0.46% |

| Gold | $1,304.50 | | +0.03% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 47.6 | 0.30(0.63%) | 756 |

| ALTRIA GROUP INC. | MO | 55.85 | 0.12(0.22%) | 610 |

| Amazon.com Inc., NASDAQ | AMZN | 1,618.80 | 5.93(0.37%) | 34613 |

| American Express Co | AXP | 98.43 | 0.71(0.73%) | 890 |

| AMERICAN INTERNATIONAL GROUP | AIG | 52.65 | 0.47(0.90%) | 200 |

| Apple Inc. | AAPL | 187.7 | -0.20(-0.11%) | 144317 |

| AT&T Inc | T | 32.38 | 0.05(0.15%) | 21945 |

| Barrick Gold Corporation, NYSE | ABX | 13.37 | 0.07(0.53%) | 18424 |

| Boeing Co | BA | 354.5 | 2.02(0.57%) | 10330 |

| Caterpillar Inc | CAT | 154.5 | 0.88(0.57%) | 2644 |

| Chevron Corp | CVX | 122.5 | 1.11(0.91%) | 7310 |

| Cisco Systems Inc | CSCO | 43.12 | 0.15(0.35%) | 10998 |

| Citigroup Inc., NYSE | C | 66.5 | 0.79(1.20%) | 144897 |

| Deere & Company, NYSE | DE | 155.79 | 0.78(0.50%) | 883 |

| Exxon Mobil Corp | XOM | 79.35 | 0.93(1.19%) | 18884 |

| Facebook, Inc. | FB | 186.46 | 0.72(0.39%) | 60108 |

| FedEx Corporation, NYSE | FDX | 248 | 0.39(0.16%) | 330 |

| Ford Motor Co. | F | 11.49 | 0.05(0.44%) | 16973 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.86 | 0.21(1.26%) | 220 |

| General Electric Co | GE | 14.22 | 0.04(0.28%) | 129803 |

| General Motors Company, NYSE | GM | 37.68 | 0.30(0.80%) | 1077 |

| Goldman Sachs | GS | 228.33 | 2.10(0.93%) | 23236 |

| Google Inc. | GOOG | 1,063.50 | 3.18(0.30%) | 1930 |

| Hewlett-Packard Co. | HPQ | 22.18 | 0.88(4.13%) | 64740 |

| Home Depot Inc | HD | 184.85 | 0.88(0.48%) | 3640 |

| Intel Corp | INTC | 55.68 | 0.36(0.65%) | 21724 |

| International Business Machines Co... | IBM | 141.76 | 0.54(0.38%) | 4039 |

| Johnson & Johnson | JNJ | 119.99 | 0.59(0.49%) | 1739 |

| JPMorgan Chase and Co | JPM | 107.36 | 1.43(1.35%) | 78529 |

| McDonald's Corp | MCD | 161.44 | 0.82(0.51%) | 953 |

| Microsoft Corp | MSFT | 98.45 | 0.44(0.45%) | 21853 |

| Pfizer Inc | PFE | 35.88 | 0.18(0.50%) | 500 |

| Procter & Gamble Co | PG | 74.35 | 0.30(0.41%) | 3259 |

| Starbucks Corporation, NASDAQ | SBUX | 57.42 | 0.19(0.33%) | 1057 |

| Tesla Motors, Inc., NASDAQ | TSLA | 284 | 0.24(0.08%) | 16344 |

| The Coca-Cola Co | KO | 42.81 | 0.13(0.30%) | 1433 |

| Twitter, Inc., NYSE | TWTR | 34.23 | 0.19(0.56%) | 84505 |

| United Technologies Corp | UTX | 125.21 | 0.10(0.08%) | 203 |

| UnitedHealth Group Inc | UNH | 242.18 | 0.01(0.00%) | 229 |

| Visa | V | 130.5 | 0.81(0.62%) | 270 |

| Wal-Mart Stores Inc | WMT | 82.6 | 0.20(0.24%) | 6300 |

| Walt Disney Co | DIS | 100.17 | 0.48(0.48%) | 5950 |

| Yandex N.V., NASDAQ | YNDX | 33 | 0.54(1.66%) | 6757 |

Exxon Mobil (XOM) upgraded to Outperform from Sector Perform at RBC Capital Mkts

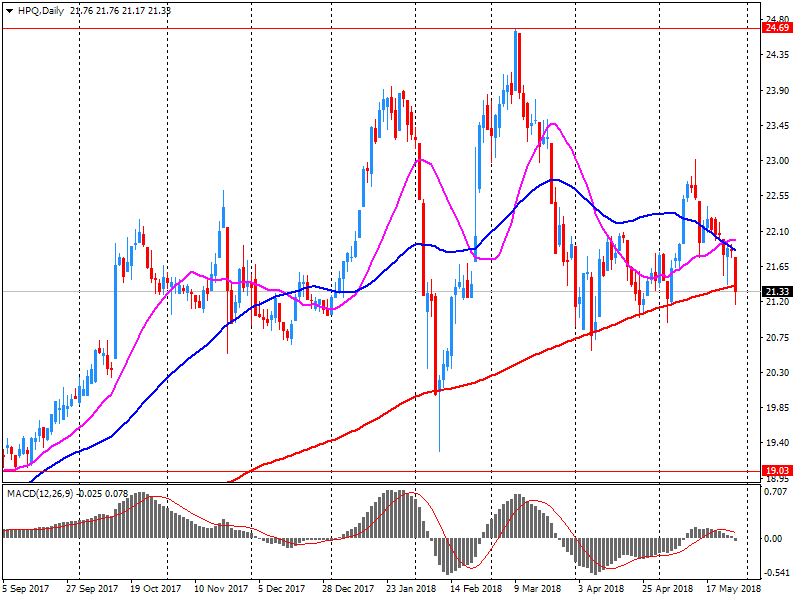

HP (HPQ) upgraded to Buy from Hold at Maxim Group; target raised to $28 from $27

HP (HPQ) reported Q2 FY 2018 earnings of $0.48 per share (versus $.40 in Q2 FY 2017), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $14.000 bln (+12.9% y/y), beating analysts' consensus estimate of $13.573 bln.

The company also issued in-line guidance for Q3 and FY18, projecting EPS of $0.49-$0.52 and $1.97-$2.02, respectively (versus analysts' consensus estimates of $0.49 and $1.97).

HPQ rose to $21.89 (+2.77%) in pre-market trading.

The Stoxx Europe 600 opened roughly flat, while Italy's FTSE MIB rose around 1%, driven higher by shares of its under-pressure banks which have seen losses of around 20% so far this month.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.