- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

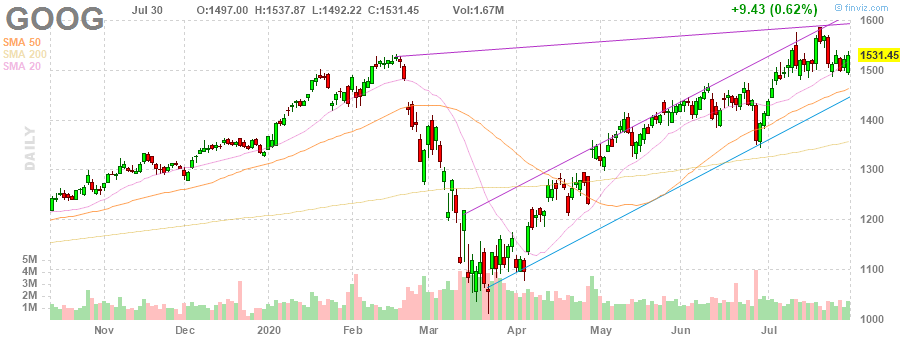

U.S. stock-index futures rose on Friday, following better-than-expected earnings reports from some of the biggest tech companies and market leaders, including Facebook (FB), Amazon (AMZN), Alphabet (GOOG) and Apple (AAPL).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,710.00 | -629.23 | -2.82% |

Hang Seng | 24,595.35 | -115.24 | -0.47% |

Shanghai | 3,310.01 | +23.18 | +0.71% |

S&P/ASX | 5,927.80 | -123.30 | -2.04% |

FTSE | 5,974.61 | -15.38 | -0.26% |

CAC | 4,863.28 | +10.34 | +0.21% |

DAX | 12,476.71 | +97.06 | +0.78% |

Crude oil | $40.36 | +1.10% | |

Gold | $1,992.60 | +2.59% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 151.75 | -0.37(-0.24%) | 7880 |

ALCOA INC. | AA | 13.18 | 0.00(0.00%) | 652 |

ALTRIA GROUP INC. | MO | 41.41 | -0.17(-0.41%) | 6822 |

Amazon.com Inc., NASDAQ | AMZN | 3,220.00 | 168.12(5.51%) | 171716 |

American Express Co | AXP | 93.6 | -1.05(-1.11%) | 9236 |

AMERICAN INTERNATIONAL GROUP | AIG | 32 | 0.22(0.69%) | 4962 |

Apple Inc. | AAPL | 409.75 | 24.99(6.50%) | 1926350 |

AT&T Inc | T | 29.53 | -0.04(-0.14%) | 118413 |

Boeing Co | BA | 161.69 | -0.26(-0.16%) | 137087 |

Caterpillar Inc | CAT | 138.1 | 1.37(1.00%) | 44258 |

Chevron Corp | CVX | 82.92 | -3.35(-3.88%) | 150576 |

Cisco Systems Inc | CSCO | 46.5 | 0.06(0.13%) | 57820 |

Citigroup Inc., NYSE | C | 50.18 | -0.18(-0.36%) | 147075 |

E. I. du Pont de Nemours and Co | DD | 53.7 | -0.06(-0.11%) | 9093 |

Exxon Mobil Corp | XOM | 40.95 | -0.92(-2.20%) | 348889 |

Facebook, Inc. | FB | 251.15 | 16.65(7.10%) | 1003771 |

FedEx Corporation, NYSE | FDX | 172.7 | -0.01(-0.01%) | 3125 |

Ford Motor Co. | F | 6.93 | 0.19(2.82%) | 618061 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13 | 0.06(0.46%) | 26775 |

General Electric Co | GE | 6.3 | 0.04(0.64%) | 668205 |

General Motors Company, NYSE | GM | 25.21 | 0.01(0.04%) | 44437 |

Goldman Sachs | GS | 198.5 | -1.03(-0.52%) | 21571 |

Google Inc. | GOOG | 1,515.01 | -16.44(-1.07%) | 18338 |

Hewlett-Packard Co. | HPQ | 17.36 | 0.12(0.70%) | 27938 |

Home Depot Inc | HD | 264.8 | -1.51(-0.57%) | 14947 |

HONEYWELL INTERNATIONAL INC. | HON | 149.72 | 0.56(0.38%) | 701 |

Intel Corp | INTC | 48.43 | 0.44(0.92%) | 318619 |

International Business Machines Co... | IBM | 122.79 | -0.11(-0.09%) | 14464 |

Johnson & Johnson | JNJ | 147.3 | 0.46(0.31%) | 17569 |

JPMorgan Chase and Co | JPM | 96.55 | -0.47(-0.48%) | 92559 |

McDonald's Corp | MCD | 194.2 | -1.21(-0.62%) | 13481 |

Merck & Co Inc | MRK | 81.3 | 2.31(2.92%) | 157613 |

Microsoft Corp | MSFT | 205 | 1.10(0.54%) | 198467 |

Nike | NKE | 96.3 | -0.52(-0.54%) | 9543 |

Pfizer Inc | PFE | 38.79 | 0.05(0.13%) | 145073 |

Procter & Gamble Co | PG | 129.16 | -2.26(-1.72%) | 22573 |

Starbucks Corporation, NASDAQ | SBUX | 76.48 | -0.16(-0.21%) | 12889 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,520.00 | 32.51(2.19%) | 129655 |

The Coca-Cola Co | KO | 47.53 | -0.16(-0.34%) | 15730 |

Travelers Companies Inc | TRV | 115 | -0.93(-0.80%) | 3988 |

Twitter, Inc., NYSE | TWTR | 37.45 | 0.73(1.99%) | 88417 |

UnitedHealth Group Inc | UNH | 304.99 | -0.24(-0.08%) | 451 |

Verizon Communications Inc | VZ | 57.03 | -0.27(-0.47%) | 12447 |

Visa | V | 193.85 | -0.21(-0.11%) | 23419 |

Wal-Mart Stores Inc | WMT | 129.82 | -0.30(-0.23%) | 26115 |

Walt Disney Co | DIS | 115.5 | -0.16(-0.14%) | 29087 |

Yandex N.V., NASDAQ | YNDX | 56.67 | -0.56(-0.98%) | 4636 |

Apple (AAPL) target raised to $470 from $400 at Cowen

Amazon (AMZN) target raised to $4000 from $3600 at Telsey Advisory Group

Exxon Mobil (XOM) reported Q2 FY 2020 loss of $0.70 per share (versus earnings of $0.61 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.60 per share.

The company’s quarterly revenues amounted to $32.605 bln (-52.8% y/y), missing analysts’ consensus estimate of $38.157 bln.

XOM fell to $40.98 (-2.13%) in pre-market trading.

FXStreet notes that the S&P 500 Index has yet again held above key support at 3205/3198, which reduces the topping threat somewhat, although economists at Credit Suisse still lean towards a breakdown below this level on balance.

“S&P 500 moved higher on Thursday as the market saw a sharp intraday reversal back higher after yet again holding support from its rising 13-day exponential average, now at 3225 as well as the range lows at 3215/3198. This leaves the market still trapped in its range and whilst we remain of the view the threat of a correction lower remains in place, this threat is somewhat reduced given the market’s ongoing resilience above key supports.”

“We need to see a close below 3225 to see the topping threat increase again, although only below 3205/3198 would finally see this confirmed, with support then seen initially at 3173. Above 3265/66 would instead open the door to a retest of the ‘reversal day’ high and price resistance at 3279/81.”

“Ultimately we need to see above 3279/81 to ease the threat of a corrective setback for an extension of the rally with resistance seen next at 3288 and the more importantly at the top of the February price gap at 3328/38.”

Merck (MRK) reported Q2 FY 2020 earnings of $1.37 per share (versus $1.30 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.05 per share.

The company’s quarterly revenues amounted to $10.872 bln (-7.6% y/y), beating analysts’ consensus estimate of $10.524 bln.

MRK rose to $81.20 (+2.80%) in pre-market trading.

Chevron (CVX) reported Q2 FY 2020 loss of $1.59 per share (versus earnings of $2.27 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.89 per share.

The company’s quarterly revenues amounted to $13.949 bln (-64.1% y/y), missing analysts’ consensus estimate of $21.707 bln.

CVX fell to $84.00 (-2.63%) in pre-market trading.

Caterpillar (CAT) reported Q2 FY 2020 earnings of $1.03 per share (versus $2.83 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.72 per share.

The company’s quarterly revenues amounted to $9.997 bln (-30.7% y/y), beating analysts’ consensus estimate of $9.397 bln.

CAT rose to $141.00 (+3.12%) in pre-market trading.

Ford Motor (F) reported Q2 FY 2020 loss of $0.35 per share (versus earnings of $0.28 per share in Q2 FY 2019), better than analysts’ consensus estimate of -$1.16 per share.

The company’s quarterly revenues amounted to $16.622 bln (-53.5% y/y), beating analysts’ consensus estimate of $15.629 bln.

F rose to $6.92 (+2.67%) in pre-market trading.

Apple (AAPL) reported Q3 FY 2020 earnings of $2.58 per share (versus $2.18 per share in Q3 FY 2019), beating analysts’ consensus estimate of $2.07 per share.

The company’s quarterly revenues amounted to $59.685 bln (+10.9% y/y), beating analysts’ consensus estimate of $52.555 bln.

The company’s board of directors also approved a four-for-one stock split to make the stock more accessible to a broader base of investors.

AAPL rose to $408.50 (+6.17%) in pre-market trading.

Amazon (AMZN) reported Q2 FY 2020 earnings of $10.30 per share (versus $5.22 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.62 per share.

The company’s quarterly revenues amounted to $88.912 bln (+40.2% y/y), beating analysts’ consensus estimate of $81.269 bln.

The company also issued upside guidance for Q3, projecting revenues of $87-93 bln versus analysts’ consensus estimate of $86.36 bln and operating income of $2.00-5.00 bln versus analysts’ consensus estimate of $2.90 bln.

AMZN rose to $3,218.01 (+5.44%) in pre-market trading.

Alphabet (GOOG) reported Q2 FY 2020 earnings of $10.13 per share (versus $14.21 per share in Q2 FY 2019), beating analysts’ consensus estimate of $8.23 per share.

The company’s quarterly revenues amounted to $38.297 bln (-1.7% y/y), beating analysts’ consensus estimate of $37.342 bln.

GOOG rose to $1,543.06 (+0.76%) in pre-market trading.

Facebook (FB) reported Q2 FY 2020 earnings of $1.80 per share (versus $1.99 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.38 per share.

The company’s quarterly revenues amounted to $18.690 bln (+10.7% y/y), beating analysts’ consensus estimate of $17.361 bln.

FB rose to $248.20 (+5.84%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -57.88 | 22339.23 | -0.26 |

| Hang Seng | -172.55 | 24710.59 | -0.69 |

| KOSPI | 3.85 | 2267.01 | 0.17 |

| ASX 200 | 44.7 | 6051.1 | 0.74 |

| FTSE 100 | -141.47 | 5989.99 | -2.31 |

| DAX | -442.61 | 12379.65 | -3.45 |

| CAC 40 | -105.8 | 4852.94 | -2.13 |

| Dow Jones | -225.92 | 26313.65 | -0.85 |

| S&P 500 | -12.22 | 3246.22 | -0.38 |

| NASDAQ Composite | 44.87 | 10587.81 | 0.43 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.