- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -0.06 22011.61 +0.00%

TOPIX -4.88 1765.96 -0.28%

Hang Seng -90.65 28245.54 -0.32%

CSI 300 -3.00 4006.72 -0.07%

Euro Stoxx 50 +11.77 3673.95 +0.32%

FTSE 100 +5.27 7493.08 +0.07%

DAX +12.03 13229.57 +0.09%

CAC 40 +9.66 5503.29 +0.18%

DJIA +28.50 23377.24 +0.12%

S&P 500 +2.43 2575.26 +0.09%

NASDAQ +28.71 6727.67 +0.43%

S&P/TSX +22.81 16025.59 +0.14%

Major US stock indices slightly increased due to a rise in the price of shares of Mondelez and Kellogg after the publication of quarterly reports.

Some support for the market was also provided by statistics on the United States. As it became known that the growth in house prices accelerated in August, which indicates that despite the slowdown in sales in recent months, the demand for housing remains strong. The national housing price index from S & P / Case-Shiller, covering the whole country, grew by 6.1% in the 12 months ending August, higher than the 5.9% increase compared to the same period last year in July .

However, the data published by the Managers Association in Chicago showed that in October the index of purchasing managers in Chicago improved to 66.2 points from 65.2 points in September. The latter value was the highest since March 2011. Experts expected that the index will drop to 61.0 points.

In addition, the Conference Board consumer confidence index improved significantly in October after recording a slight increase in September. The index now stands at 125.9 (1985 = 100), compared with 120.6 in September (revised from 119.8). The index of the current situation increased from 146.9 to 151.1, and the index of expectations increased from 103.0 last month to 109.1.

Components of the DOW index finished trading mixed (16 in positive territory, 14 in negative territory). The leader of growth was shares of Intel Corporation (INTC, + 2.77%). Outsider were shares of General Electric Company (GE, -1.27%).

Almost all sectors of the S & P index recorded an increase. The consumer goods sector grew most (+ 1.0%). Only the financial sector declined (-0.1%).

At closing:

DJIA + 0.12% 23,377.11 +28.37

Nasdaq + 0.43% 6,727.67 +28.71

S & P + 0.09% 2.575.26 + 2.43

U.S. stock-index futures rose slightly on Tuesday following a fresh set of earnings reports, while investors awaited the outcomes of the FOMC's October meeting, as well as a decision on the next Fed chair.

Global Stocks:

Nikkei 22,011.61 -0.06 0.00%

Hang Seng 28,245.54 -90.65 -0.32%

Shanghai 3,394.50 +4.17 +0.12%

S&P/ASX 5,909.02 -10.06 -0.17%

FTSE 7,492.11 +4.30 +0.06%

CAC 5,505.19 +11.56 +0.21%

DAX 13,229.57 +12.03 +0.09%

Crude $54.15 (0.00%)

Gold $1,272.40 (-0.41%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 47.5 | 0.08(0.17%) | 1311 |

| ALTRIA GROUP INC. | MO | 64.5 | 0.45(0.70%) | 6714 |

| Amazon.com Inc., NASDAQ | AMZN | 1,112.60 | 1.75(0.16%) | 26748 |

| Apple Inc. | AAPL | 168.35 | 1.63(0.98%) | 331657 |

| AT&T Inc | T | 33.62 | 0.08(0.24%) | 10468 |

| Barrick Gold Corporation, NYSE | ABX | 14.66 | -0.03(-0.20%) | 6078 |

| Caterpillar Inc | CAT | 136.61 | 0.12(0.09%) | 1621 |

| Chevron Corp | CVX | 116 | 1.61(1.41%) | 467 |

| Citigroup Inc., NYSE | C | 73.8 | 0.02(0.03%) | 1105 |

| Deere & Company, NYSE | DE | 134.62 | 2.32(1.75%) | 765 |

| Exxon Mobil Corp | XOM | 83.8 | 0.26(0.31%) | 200 |

| Facebook, Inc. | FB | 180.4 | 0.53(0.29%) | 121111 |

| Ford Motor Co. | F | 12.15 | 0.05(0.41%) | 66779 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.87 | -0.07(-0.50%) | 30267 |

| General Electric Co | GE | 20.37 | -0.04(-0.20%) | 46877 |

| General Motors Company, NYSE | GM | 43.25 | -0.12(-0.28%) | 3410 |

| Google Inc. | GOOG | 1,019.00 | 1.89(0.19%) | 1091 |

| HONEYWELL INTERNATIONAL INC. | HON | 144.26 | -0.38(-0.26%) | 255 |

| Intel Corp | INTC | 45.2 | 0.83(1.87%) | 863310 |

| JPMorgan Chase and Co | JPM | 101.65 | 0.24(0.24%) | 817 |

| Merck & Co Inc | MRK | 54.83 | 0.12(0.22%) | 6085 |

| Microsoft Corp | MSFT | 84.11 | 0.22(0.26%) | 28950 |

| Nike | NKE | 54.45 | -0.82(-1.48%) | 51384 |

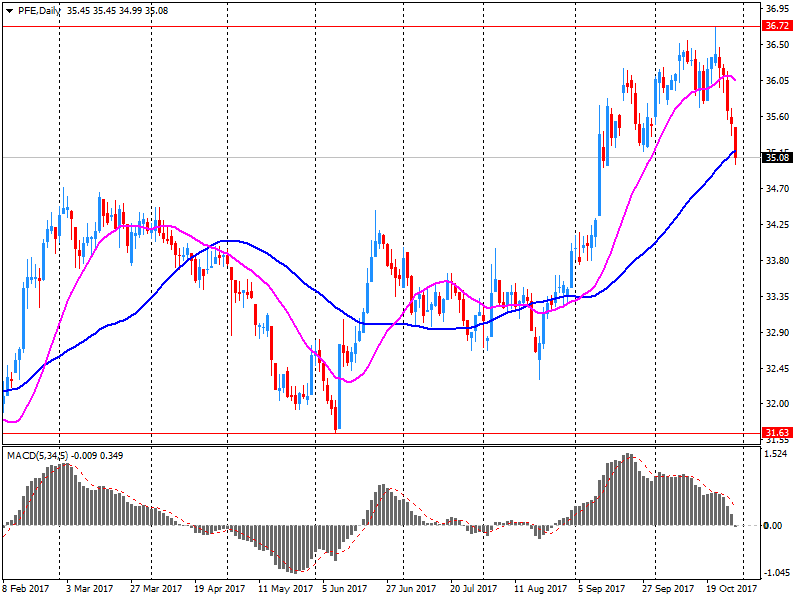

| Pfizer Inc | PFE | 35.07 | -0.08(-0.23%) | 130844 |

| Procter & Gamble Co | PG | 86.6 | 0.33(0.38%) | 10875 |

| Tesla Motors, Inc., NASDAQ | TSLA | 321.15 | 1.07(0.33%) | 18103 |

| The Coca-Cola Co | KO | 46.19 | 0.33(0.72%) | 33252 |

| Verizon Communications Inc | VZ | 47.88 | 0.05(0.10%) | 908 |

| Visa | V | 110.47 | 0.43(0.39%) | 7597 |

| Walt Disney Co | DIS | 98.15 | 0.11(0.11%) | 1657 |

| Yandex N.V., NASDAQ | YNDX | 32.89 | -0.21(-0.63%) | 700 |

Microsoft (MSFT) upgraded to Buy from Hold at Argus

Merck (MRK) upgraded to Hold from Underperform at Jefferies

MasterCard (MA) reported Q3 FY 2017 earnings of $1.34 per share (versus $1.08 in Q3 FY 2016), beating analysts' consensus estimate of $1.23.

The company's quarterly revenues amounted to $3.400 bln (+18.1% y/y), beating analysts' consensus estimate of $3.281 bln.

MA rose to $150.50 (+1.04%) in pre-market trading.

Pfizer (PFE) reported Q3 FY 2017 earnings of $0.67 per share (versus $0.61 in Q3 FY 2016), beating analysts' consensus estimate of $0.65.

The company's quarterly revenues amounted to $13.168 bln (+0.9% y/y), generally in-line with analysts' consensus estimate of $13.175 bln.

The company also raised guidance for FY2017 EPS to $2.58-2.62 from $2.54-2.60 versus analysts' consensus estimate of $2.56, as well as for FY2017 revenues to $52.4-53.1 bln from $52.0-54.0 bln versus analysts' consensus estimate of $52.76 bln.

PFE rose to $35.38 (+0.65%) in pre-market trading.

Asian stock markets were lacking direction early Tuesday, with Japan's benchmark index underperforming as investors were cautious amid a stronger yen and the central bank's latest monetary policy announcement. As was widely expected, the Bank of Japan announced during the trading day that it would stand pat on interest rates.

European stocks scored the highest close in five months Monday, with much of the action centered around Spanish equities after the central government in Madrid took control of the Catalonia region following its push for independence.

U.S. stocks closed lower Monday as a report that the House of Representatives is considering phasing in a cut to corporate taxes rather than enacting them immediately weighed on investors' confidence. Tax cuts are the centerpiece in President Donald Trump's business-friendly agenda and are viewed as critical to sustaining the stock market's record-setting rally.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.