- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-01-2013

European stocks retreated, after the Stoxx Europe 600 Index reached its highest valuation in almost three years, offsetting gains by lenders as central-bank governors diluted a proposed liquidity rule.

In the U.S., Republicans are planning to use the need to raise the American government’s $16.4 trillion debt ceiling to force President Barack Obama to accept spending cuts to entitlement programs such as Medicare. Congress must act as early as mid-February to prevent a default.

National benchmark indexes fell in 11 of the 18 western- European markets. France’s CAC 40 Index fell 0.7 percent and Germany’s DAX lost 0.6 percent. The U.K.’s FTSE 100 retreated 0.4 percent.

Rolls-Royce fell 1.5 percent to 904.5 pence. Europe’s largest maker of commercial aircraft and ship engines bribed an executive at Air China Ltd. and China Eastern Airlines Corp. to obtain $2 billion of deals, according to a Sunday Times report. The company declined to comment on the article. The U.K.’s Serious Fraud Office is holding an enquiry into Rolls-Royce’s activity in several countries.

Infineon Technologies AG declined 2.2 percent to 6.43 euros, its biggest drop in a month, as Bank of America Corp. downgraded the shares to underperform, the equivalent of a sell recommendation, from neutral. The brokerage cited Infineon’s valuation.

Barclays Plc and BNP Paribas SA climbed 3.8 percent to 287.2 pence and 1.9 percent to 45.21 euros, respectively. Deutsche Bank AG, Germany’s largest lender, increased 2.8 percent to 35.78 euros and Societe Generale SA, France’s second- biggest bank, added 2.7 percent to 30.13 euros.

Peugeot gained 5.6 percent to 6.52 euros. More than 17 percent of the French carmaker’s shares are out on loan, according to data compiled by Markit. Some investors borrow shares and then sell them, betting that the securities will drop before they have to be repurchased.

Wereldhave NV added 2.3 percent to 50.11 euros after agreeing to sell its U.S. real estate to Lone Star Funds for about $720 million. The Dutch property company plans to focus on shopping centers in western Europe and use the proceeds from the sale to reduce its debt.

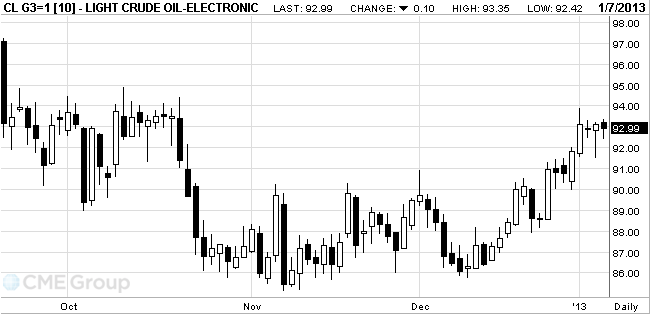

Oil fluctuated amid concern that Congress will fail to raise the U.S. debt ceiling, hurting economic confidence, and on speculation that supplies in the world’s biggest crude-consuming country will rebound.

Futures traded in a 93-cents-a-barrel range as Republicans vowed to require spending cuts in exchange for increasing the U.S. borrowing limit. Lawmakers struck a compromise last week that averted a package of spending cuts and tax gains known as the fiscal cliff. Crude supplies in the week ended Dec. 28 were up 9.2 percent from a year earlier, Energy Department data show.

Enterprise Products Partners LP (EPD) and Enbridge Inc. (ENB) plan to resume service on the 500-mile (805-kilometer) Seaway link at full rates this week after more than doubling the line’s capacity to 400,000 barrels a day from 150,000.

U.S. crude supplies tumbled 11.1 million barrels to 359.9 million barrels in the week ended Dec. 28, leaving stockpiles at the lowest level since September, last week’s report showed. Stockpiles have decreased during December for the past six years because of inventory shifts for tax and accounting purposes. Companies in Gulf Coast states minimize supplies at the end of the year to reduce local taxes.

Crude oil for February delivery fell to $92.42 a barrel on the New York Mercantile Exchange. Brent oil for February settlement slipped 12 cents to $111.19 a barrel on the London-based ICE Futures Europe exchange.

Gold is getting cheaper, but prices remain in the range of the previous session, as in the absence of significant events, investors prefer to refrain from shopping.

The focus of traders is the decision of the European Central Bank concerning the interest rate that will be taken on Thursday. Some economists said the likelihood of a lower interest rate.

In the absence of new economic data players continue to focus on reports of the December meeting of the Federal Open Market U.S. Federal Reserve. Central Bank officials reminded the market that sooner or later the quantitative easing program ends.

Three presidents of regional Fed, whose performances are expected this week, likely to touch this issue in their speeches. Fed President Saint Louis James Bullard, president of the Federal Reserve Bank of Kansas City, Esther George and Minneapolis Fed President Narayana Kocherlakota will make their statements on Thursday, and while the Philadelphia Fed President will speak on Friday.

February futures price of gold on COMEX today fell to 1642.60 dollars per ounce.

U.S. stock futures fell as investors awaited the start of the earnings season tomorrow.

Global Stocks:

Nikkei 10,599.01-89.10 -0.83%

Hang Seng 23,329.75-1.34 -0.01%

Shanghai Composite 2,285.36+8.37 +0.37%

FTSE 6,065.54-24.30 -0.40%

CAC 3,702.22-27.80 -0.75%

DAX 7,731.07-45.30 -0.58%

Crude oil $92.62 -0.50%

Gold $1646.50 -0.15%

EUR/USD $1.3000, $1.3050, $1.3150, $1.3200

USD/JPY Y87.50

AUD/USD $1.0400, $1.0500Data

08:00United Kingdom Halifax house price indexDecember 0.0%+0.1%+1.3%

08:00United Kingdom Halifax house price index 3m Y/YDecember -1.2%-0.3%

08:00Switzerland Foreign Currency ReservesDecember 427.4 423.0427.2

09:30Eurozone Sentix Investor ConfidenceJanuary -16.8-13.7-7.0

10:00Eurozone Producer Price Index, MoMNovember +0.1%-0.1%-0.2%

10:00Eurozone Producer Price Index (YoY)November +2.6%+2.4%+2.1%

The euro weakened against the dollar in relation to, approaching with up to three-week low, driven by speculation that the European Central Bank at its meeting on Thursday could signal a possible downgrade of the rates in the near future.

According to the poll, 55 economists suggest that the ECB President Mario Draghi will hold the key refinancing rate at a record low of 0.75%, while the five experts expect it to fall 0.5%.

Meanwhile, the corporation Citigroup Inc expects the ECB to cut rates at its meeting next month.

The European single currency fell against 13 of its 16 major counterparts after a report showed that producer price inflation slowed in November, more than economists forecast. Statistical Office of the European Union in Luxembourg stated that producer prices in the euro zone rose an annualized 2.1%, after increasing 2.6% in October, while economists expected an increase of 2.4%.

The yen rose, departing from the weakest level since July 2010 against the dollar even though the fact that the media reported that the government announced an additional incentive measures. According to the newspaper Yomiuri, the government this month announced the fiscal stimulus for a total of 12 trillion yen. Also, the newspaper added that the supplementary budget for the current fiscal year to March will include the cost of public works in the amount of 5 trillion yen to 6 trillion yen. However, whether the information is fact, no one knows, because the newspaper did not say who her source.

EUR / USD: during the European session the pair fell, setting all-time low of $ 1.3015

GBP / USD: during the European session, the pair rose to $ 1.6072

USD / JPY: during the European session the pair fell to a new intraday low of Y87.60

At 15:00 GMT, Canada will provide data on the index of the Ivey PMI for December. Finish the day at 22:30 GMT Australia publication index of activity in the construction sector from AiG for December.

EUR/USD

Offers $1.3125/30, $1.3105/15, $1.3088, $1.3065

Bids $1.3025, $1.3010/00, $1.2998, $1.2995-80, $1.2950

GBP/USD

Offers $1.6195/205, $1.6170/80, $1.6150/55, $1.6130/35, $1.6100/05

Bids $1.6010/00, $1.5980, $1.5965/60, $1.5920

AUD/USD

Offers $1.0600, $1.0550, $1.0525/30

Bids $1.0440, $1.0425/20, $1.0410/05, $1.0380

EUR/JPY

Offers Y116.50, Y116.00, Y115.20, Y114.80

Bids Y114.00, Y113.50, Y113.20, Y113.00, Y112.50

USD/JPY

Offers Y89.00, Y88.50, Y88.35/40, Y88.15/20

Bids Y87.50/40, Y87.20/15, Y87.00, Y86.55/50

EUR/GBP

Offers stg0.8220/25, stg0.8200, stg0.8170, stg0.8150/55

Bids stg0.8115/10, stg0.8095/90, stg0.8080, stg0.8065/60, stg0.8045

Most European stocks declined, driven by a small correction index Stoxx Europe 600 Index, which reached its highest level in nearly three years.

Cost Rolls Royce Holdings Plc fell 1.6% after reporting that he had bribed the executive power of Chinese Air China and China Eastern Airlines, to get the order of $ 2 billion. The stock price of Peugeot (UG) SA rose 6.3% after a broker stated that the company may start selling assets.

Stoxx 600 (SXXP) fell 0.1% to 287.43 (at 10:50 GMT).

The cost of Infineon Technologies AG (IFX) decreased by 3.2% to 6.36 euros, showing the biggest drop in a month, as Bank of America Corp downgraded the stock to 'sell' from 'neutral'.

The stock price of BNP Paribas SA (BNP) and Barclays Plc (BARC) rose by 2.1% (to 45.31 euros) and 3.4% (up to 286 pence), respectively. Deutsche Bank AG - Germany's largest lender, rose 3.2% to 35.91 euros, Societe Generale SA (GLE) - the second largest bank in France, added 2% to 29.91 euros.

Cost Wereldhave NV (WHA) rose by 3.4% to 50.65 euros after the company agreed to sell its U.S. real estate Lone Star Funds for $ 720 million.

To date:

FTSE 100 6,070.36 -19.48 -0.32%

CAC 40 3,706.65 -23.37 -0.63%

DAX 7,735.62 -40.75 -0.52%

EUR/USD $1.3000, $1.3050, $1.3150, $1.3200

USD/JPY Y87.50

AUD/USD $1.0400, $1.0500Asian stocks fell, with the regional benchmark retreating after posting its longest streak of weekly gains since March last year.

Nikkei 225 10,599.01 -89.10 -0.83%

S&P/ASX 200 4,717.33 -6.45 -0.14%

Shanghai Composite 2,285.36 +8.37 +0.37%

Nomura Holdings Inc., Japan’s biggest brokerage by market value, dropped 5 percent, halting a record winning streak on speculation the stock may be overheating.

Aozora Bank Ltd. tumbled 10 percent after Reuters reported Cerberus Capital Management LP may sell most of its stake in the lender.

Shui On Land Ltd. fell 1.3 percent after the Hong Kong-based developer said it expects a significant decline in full-year profit.

The dollar retreated from a three-week high against the euro after data showed that the U.S. unemployment rate in December was 7.8%, while it was expected that the rate will remain unchanged. Meanwhile, an unpleasant surprise was an upward revision (to 7.8% from 7.7%) than last month. Note that this situation increases the likelihood that the Federal Reserve will further stimulus measures in the near future.

The euro rose after reports released the last Fed meeting showed that the central bank could finish his third round of monthly bond purchases, known as quantitative easing later this year. The dollar rose to its highest level against the yen since July 2010, and therefore, the Japanese currency headed for its most prolonged weekly decline for the last 24 years.

The dollar index, which is used to track the value of the U.S. currency against the currencies of the partner, increased by 0.3% to 80.617.

The Canadian dollar has appreciated by 0.2% against the dollar after government data showed that the unemployment rate unexpectedly fell in December (up 7.1%), reaching a four-year low at the same time. At the same time, the number of jobs increased by 39,800.

Sterling fell against all major peers except the yen after a report showed that activity in the UK services sector unexpectedly fell in December.Asian stocks outside Japan fell, paring the biggest weekly advance in more than a month, after Federal Reserve policy makers said they will probably end their $85 billion monthly bond-purchase program sometime this year. Japanese equities jumped as markets reopened from holidays.

Nikkei 225 10,688.11 +292.93 +2.82%

Hang Seng 23,331.09 -67.51 -0.29%

S&P/ASX 200 4,723.78 -16.90 -0.36%

Rio Tinto Group, the world’s second-largest mining company, dropped 1 percent in Sydney as metals prices fell.

Toyota Motor Corp. surged 6.4 percent as the yen weakened to the lowest level against the dollar since July 2010, boosting the earnings outlook for exporters.

Japan Exchange Group Inc. fell 9.7 percent in its Tokyo trading debut after the merger between Osaka Securities Exchange Co. and Tokyo Stock Exchange Group.

European (SXXP) stocks climbed to their highest in more than 22 months, as U.S. reports showed employers added more workers in December and the services industry expanded more than forecast.

ThromboGenics NV added 3.3 percent after confirming the launch date for its Jetrea vision restoration treatment. Fresnillo Plc (FRES), the world’s biggest primary silver producer, slid 4 percent after UBS AG downgraded the shares. Randgold Resources Ltd. (RRS) lost 4.1 percent as the price of the metal fell.

The Stoxx Europe 600 Index advanced 0.4 percent to 287.83 at the close of trading, its highest since February 2011. The gauge rose 3.3 percent this week.

National benchmark indexes rose in 14 of the 18 western European markets.

FTSE 100 6,089.84 +42.50 +0.70% CAC 40 3,730.02 +8.85 +0.24% DAX 7,776.37 +19.93 +0.26%

Bankia SA (BKIA), the lender that received the largest Spanish bailout, surged 49 percent to 61.5 euro cents, for the biggest gain on the Stoxx 600.

Sonova Holding AG (SOON) advanced 2.9 percent to 107.7 Swiss francs after Bank of America’s Merrill Lynch unit upgraded the maker of hearing health-care products to buy from neutral.

Fresnillo slid 4 percent to 1,810 pence after UBS downgraded the shares to neutral from buy, saying the stock has outperformed silver and its peers. The price of the metal today fell to its lowest since August.

Randgold Resources, a gold producer in West Africa, lost 4.1 percent to 5,975 pence as the price of metal dropped. A gauge of commodity-company shares fell 0.9 percent, for the worst performance of the 19 industry groups on the Stoxx 600.

Marks & Spencer Group Plc (MKS), the U.K.’s biggest clothing retailer, retreated 3.1 percent to 376.4 pence. Nomura Holdings Inc. lowered its 2013 pre-tax estimates for the retailer to 666 million pounds ($1.07 billion) from 694 million pounds, citing a fall in general merchandise sales.

Major U.S. stock indexes retreated from highs, but still ended the session in positive territory. For the week DOW index rose 3,78%, Nasdaq rose 4,76%, S & P500 gained 4.64%

Support markets have published data on the labor market, as well as report on the index of business activity in the non-manufacturing sector of the U.S. ISM.

Today's report on the labor market was generally positive. However, against the background of a published last minutes of the last meeting of the Federal Open Market Committee, it was perceived as an additional indication that this year the Fed will curtail economic stimulus programs and therefore its impact on the market was limited.

However, it is worth noting that the markets to some extent overestimated yesterday's publication of the Fed. Pay attention to the fact that key members of the Committee, namely, Fed Chairman Bernanke, Vice Chairman and President Yellen New York Fed Dudley, is unlikely to refer to those "some members of the committee, who believe that the end of 2013 would be appropriate to delay or stop the purchase of assets. " Moreover, less than a month ago, all but one member of the Federal Open Market Committee voted to expand the program of asset purchases and the establishment of economic guidance for determining time for completion of incentive programs. Since then, much has changed. Also worth noting is that the expectations of the majority of committee members of a relatively moderate economic growth in the next two years may not be the case when, as will be made pending a decision on the "budget cliff" - namely, reduction of budget expenditures.

Most of the components of the index rising DOW (23 of 30). At the moment, the leader shares in Walt Disney (DIS, +1.91%). Maximum loss carry stock Microsoft (MSFT, -1.87%), which has a pressure reducing their rating analysts Argus amid weak sales results of the new operating system Windows 8.

At the moment all sectors of the S & P are in positive territory. Leading financial sector (+1.0%). In the zero is just the technology sector.

At the close:

Dow +43.85 13,435.21 +0.33%

Nasdaq +1.09 3,101.66 +0.04%

S & P +7.1 1,466.47 +0.49%

The yen traded near a 2 1/2 year low as speculation grew that Japan’s Prime Minister Shinzo Abe will ramp up efforts to spur growth, paring demand for refuge assets. The Japanese government will announce around 12 trillion yen ($136 billion) in fiscal stimulus this month to boost the nation’s shrinking economy, the Yomiuri newspaper said today. The extra budget for this fiscal year through March will include 5-6 trillion yen of public works spending, the report said, without saying where it obtained its information.

The Dollar Index gained for a fourth day before Richmond Federal Reserve President Jeffrey Lacker speaks tomorrow in Columbia, South Carolina. Minutes released last week of the U.S. central bank’s latest meeting showed policy makers may curtail monetary stimulus this year. Lacker said on Jan. 4 further monetary stimulus is unlikely to boost growth and will “test the limits” of the U.S. central bank’s credibility. “At some point, we will need to withdraw stimulus by raising interest rates and reducing the size of our balance sheet,” he said in prepared remarks to the Maryland Bankers Association in Baltimore.

Demand for the euro was limited before data which may show unemployment in the 17-nation currency block increased. Jobless rate probably rose to 11.8 percent in November from 11.7 percent in the previous month, according to the median estimate of economists surveyed by Bloomberg News before the data tomorrow.

EUR/USD: during the Asian session the pair fell to $1.3025.

GBP/USD: during the Asian session the pair fell below $1.6020.

USD/JPY: during the Asian session the pair fell below Y88.00.

It is a quiet start to the start to the week, with limited data expected from the UK and the eurozone. There is a slightly fuller US schedule, but the data is largely second tier. However, the pace will pick up as the week progresses and more people get back in the swing following the year-end holidays, building towards the ECB and BOE policy meets later in the week. On the continent, at 0930GMT, the Sentix confidence data is released. Then, at 1000GMT, the EMU November PPI data will be released, with analysts looking for 0.2% m/m and +2.4% y/y. The calendar starts in the UK with the release of the UK Halifax December House Price Index at 0800GMT.

08:00United Kingdom Halifax house price indexDecember 0.0%+0.1%

08:00United Kingdom Halifax house price index 3m Y/YDecember -1.2%

08:00Switzerland Foreign Currency ReservesDecember 424.8423.0

09:30Eurozone Sentix Investor ConfidenceJanuary -16.8-13.7

10:00Eurozone Producer Price Index, MoMNovember +0.1%-0.1%

10:00Eurozone Producer Price Index (YoY)November +2.6%+2.4%

15:00Canada Ivey Purchasing Managers IndexDecember 47.551.3

22:30Australia AiG Performance of Construction IndexDecember 37.0© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.