- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-01-2013

The yen rose for a second day versus the dollar, extending a rally from a 29-month low, amid ebbing risk appetite and bets the currency’s three-month slide already incorporates proposed Bank of Japan stimulus measures. The yen gained versus all of its 16 most-traded peers even as Finance Minister Taro Aso said Japan will buy euro-denominated sovereign debt to help weaken the currency.

The Bank of Japan next meets Jan. 21-22. Policy makers boosted stimulus at their previous gathering in December while refraining from raising their inflation goal from 1 percent. Newly elected Prime Minister Shinzo Abe had called for a doubling of the inflation measure.

Japan will use foreign-exchange reserves to buy European Stability Mechanism bonds to help weaken the yen, Aso told reporters today in Tokyo. The decision will also help the “financial stability of Europe,” he said.

The Japanese government will watch the currency market “closely” and will strengthen cooperation with the BOJ to counter deflation, according to a draft of its emergency economic measures released today. Abe said on Jan. 1 that “bold” monetary policy was one of the three prongs of his economic plan.

The euro dropped for the first time in three days, approaching its 50-day moving average of $1.2995. The euro headed toward its 50-day moving average versus the dollar after failing to breach it for the past two days. Moving averages, which indicate momentum, are seen by some traders as potential turning points in the direction of a currency’s price.

The pound fell toward the weakest level in a month against the dollar before a Bank of England meeting this week. Policy makers are forecast to keep interest rates at a record low as they struggle to stoke a recovery. The U.K. economy shrank 0.1 percent last year, while the U.S. expanded 2.2 percent, according to a Bloomberg News surveys.

Most European stocks fell after German exports dropped and investors speculated recent gains have overshot the outlook for company profits as Alcoa Inc. prepared to kick off the U.S. earnings season.

German exports declined more than forecast in November. Exports adjusted for working days and seasonal changes fell 3.4 percent from October, the steepest drop in more than a year, the Federal Statistics Office in Wiesbaden said today. Economists had forecast a 0.5 percent decrease.

Still, economic confidence in the euro area increased more than economists expected in December even as the 17-nation currency bloc remained mired in its second recession in four years. An index of executive and consumer sentiment rose to 87 from 85.7 in November, the European Commission said. Economists had forecast a reading of 86.3.

National benchmark indexes declined in 10 of the 18 western European markets. Germany’s DAX Index slipped 0.5 percent and the U.K.’s FTSE 100 dropped 0.2 percent. France’s CAC 40 was little changed.

Debenhams sank 7.7 percent to 108.1 pence, the biggest decline since March 2009. The U.K.’s second-largest department- store chain cut its forecast for full-year margin growth as it stepped up promotions to gain shoppers.

A gauge of automobile companies was the worst performer among 19 industry groups in the Stoxx 600. Car sales in western Europe slid 16 percent in December, LMC Automotive said in a report yesterday.

Bayerische Motoren Werke AG (BMW) lost 3.4 percent to 73.21 euros, while Daimler AG declined 1.3 percent to 42.50 euros. Renault SA slipped 2 percent to 39.67 euros.

Recruiters Retreat

Michael Page International Plc and Hays Plc slid 3.8 percent to 398.8 pence and 1.5 percent to 84.55 pence, respectively. The U.K. recruitment companies retreated as smaller rival Robert Walters Plc said the market is still challenging and there’s yet to be any indication the situation will improve this year. Robert Walters closed unchanged at 203 pence, erasing an earlier loss of as much as 5.9 percent.

Galp Energia SGPS SA declined 3.8 percent to 12.05 euros. The shares were downgraded to neutral from buy at Bank of America Corp., citing “potentially weak” fourth-quarter earnings and 2013 guidance.

Vodafone advanced 1.7 percent to 162.4 pence, the highest since Dec. 13. Verizon Communications Chief Executive Officer Lowell McAdam said his company has the strength to buy Vodafone’s 45 percent stake in the U.S.’s largest wireless carrier, the Journal reported late yesterday.

The single currency can not demonstrate substantial growth on Tuesday, as the downward pressure accompanies any attempt of its growth.

After the fall, caused by rumors that France was warned of downgrade, and achieve a new low at $ 1.3055 the single currency has recovered and now back to the $ 1.3070 amid continued risk aversion.

Earlier, the euro gained against the modest position of Finance Minister of Japan is that the country will use part of its foreign exchange reserves to buy bonds issued by the European Stability Mechanism (ESM), which is the foundation of saving the eurozone.

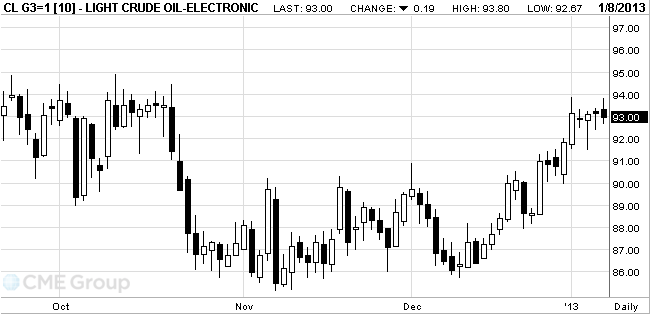

Oil fell for the first time in three days in New York on expectations that U.S. stockpiles rose from a three-month low last week.

Prices dropped as much as 0.6 percent as inventories probably rose 2 million barrels in the week ended Jan. 4, according to a Bloomberg survey before an Energy Department report tomorrow. Prices extended losses as U.S. stocks retreated as investors awaited fourth-quarter earnings reports.

Oil stockpiles probably increased by 0.6 percent to 362 million in the seven days ended Jan. 4, according to the median of nine analyst estimates in the Bloomberg survey. Seven respondents forecast a gain and two a decrease.

Inventories tumbled 11.1 million barrels the previous week as imports dropped to a 13-year low. Stockpiles have decreased during December and risen in January for the past six years because of inventory shifts for tax and accounting purposes. Companies in Gulf Coast states minimize supplies at the end of the year to reduce local taxes.

Oil advanced to $93.80 earlier as products jumped after Motiva Enterprises LLC shut a crude unit at its 325,000-barrel- a-day Port Arthur, Texas, refinery on Jan. 6. Gasoline for February delivery gained as much as 1.1 percent, and heating oil futures jumped as much as 1.4 percent.

Crude oil for February delivery slid to $92.67 a barrel on the New York Mercantile Exchange, down 8.5 percent from a year earlier. Trading volume was 12 percent below the 100-day average.

Brent oil for February advanced 30 cents, or 0.3 percent, to $111.70 a barrel on the London-based ICE Futures Europe exchange. Volume was 12 percent above the 100-day average.

Brent’s premium over West Texas Intermediate oil in New York widened for the first time in four days, to $18.78 from yesterday’s $18.21. The premium has narrowed from $25.53 on Nov. 15 as Enterprise Products Partners LP (EPD) and Enbridge Inc. (ENB) prepare to resume service on the 500-mile (805-kilometer) Seaway link at full rates after more than doubling the line’s capacity to 400,000 barrels a day from 150,000.

Gold futures gained for the first time in four sessions as demand increased in China, the world’s second-biggest buyer.

Imports by China from Hong Kong almost doubled in November from a month earlier, government data showed today. The U.S. Mint has sold 71,500 ounces of American Eagle gold coins this month, compared with 76,000 ounces for all of December. On Jan. 4, futures touched a four-month low on signals from the Federal Reserve that its latest stimulus program may end this year.

Japanese pension funds will more than double their gold holdings to 100 billion yen ($1.1 billion) by 2015 as the new government pushes for a higher inflation target, Itsuo Toshima, an adviser to the funds, said in an interview.

Gold futures for February delivery rose to $1,659.80 an ounce on the Comex in New York. The price dropped 2.5 percent in the previous three sessions.

Amid falling yields on 10-year U.S. Treasuries USD / JPY is also reduced, reaching a minimum Y86.97, after falling 60 pips.

Yield on 10-year U.S. government bond is close to 1.85%.

Analysts note that a 1.85% fall will signal the resumption of risk aversion, which would strengthen the pair rolled on recording profits.

US January IBD/TIPP Economic Optimism Index 46.5 Vs 45.1 In December

U.S. stock futures fell as investors awaited the start of the earnings season.

Global Stocks:

Nikkei 10,508.06-90.95 -0.86%

Hang Seng 23,111.19-218.56 -0.94%

Shanghai Composite 2,276.07-9.29 -0.41%

FTSE 6,068.23+3.65 +0.06%

CAC 3,717.53+12.89 +0.35%

DAX 7,725.27-7.39 -0.10%

Crude oil $93.39 +0.21%

Gold $1653.00 +0.41%

Downgrade:

Boeing (BA) downgraded to Hold from Buy at BB&T Capital Mkts

Other:

Bank of America (BAC) reiterated at Mkt Perform at FBR Capital. Target raised from $9 to $11.50.

EUR/USD $1.3100, $1.3200

USD/JPY Y87.00, Y88.00

GBP/USD $1.6040, $1.6050

USD/CHF Chf0.9260

AUD/USD $1.0400, $1.0420, $1.0500, $1.0520

AUD/NZD NZ$1.2600EUR/USD

Offers $1.3200, $1.3190, $1.3140/50

Bids $1.3100/090, $1.3065/60, $1.3050, $1.3010/00

GBP/USD

Offers $1.6195/205, $1.6170/80, $1.6150/55, $1.6130/35

Bids $1.6065/60, $1.6050/40, $1.6010/00, $1.5980

AUD/USD

Offers $1.0600, $1.0550, $1.0525/30, $1.0515/20

Bids $1.0440, $1.0425/20, $1.0410/05

EUR/JPY

Offers Y115.50, Y114.95/00

Bids Y114.15/10, Y114.00, Y113.50, Y113.20, Y113.00

USD/JPY

Offers Y88.35/40, Y88.15/20, Y88.00

Bids Y87.20/15, Y87.00, Y86.55/50, Y86.30/25

EUR/GBP

Offers stg0.8220/25, stg0.8200/10, stg0.8170, stg0.8165

Bids stg0.8125/20, stg0.8105/00, stg0.8080, stg0.8065/60, stg0.8045

Statistical data show that unemployment in the 17 countries of the euro zone in November 2012 rose to 11.8%, this is the highest level since the beginning of tracking this data in 1995.

According to the European Commission Combined index of business and consumer confidence in the euro-zone economy grew in December to 87 points from 85.7 points in the previous month. Continues to decline, retail sales in the eurozone. In annual terms, a decline of -2.6% vs. -2.1%. In comparison with the previous month figure rose +0.1% vs. +0.5%

Today, during a conference organized by the publication of Die Welt in Berlin, which will meet German Chancellor Angela Merkel, Greek Prime Minister Antonis Samaras and Spanish Finance Minister Luis de Gindos. On the subject of the talks was reported.

Debenhams Plc shares lost 5.6% after beating lowered forecasts for revenue. Quotes TGS Nopec Geophysical ASA rose by 6.8%.

FTSE 100 6,069.34 +4.76 +0.08%

DAX 7,725.33 -7.33 -0.09%

CAC 3,717.44 +12.81 +0.35%

EUR/USD $1.3100, $1.3200

USD/JPY Y87.00, Y88.00

GBP/USD $1.6040, $1.6050

USD/CHF Chf0.9260

AUD/USD $1.0400, $1.0420, $1.0500, $1.0520

AUD/NZD NZ$1.2600Asian stocks fell, sending the regional benchmark index lower for a second day, as Japanese exporters declined after the yen strengthened and as earnings results from HTC Corp. missed estimates.

Nikkei 225 10,508.06 -90.95 -0.86%

Hang Seng 23,111.19 -218.56 -0.94%

S&P/ASX 200 4,690.25 -27.07 -0.57%

Shanghai Composite 2,276.07 -9.29 -0.41%

HTC, Asia’s second-largest smartphone maker, slipped 4 percent in Taipei.

Mazda Motor Corp., which gets about 72 percent of its sales outside of Japan, sank 5 percent as the yen’s advance dimmed the outlook for overseas earnings.

Samsung Electronics Co. the world’s largest maker of mobile phones and televisions, lost 1.3 percent in Seoul after reporting earnings.

Asian stocks fell, with the regional benchmark retreating after posting its longest streak of weekly gains since March last year.

Nikkei 225 10,599.01 -89.10 -0.83%

S&P/ASX 200 4,717.33 -6.45 -0.14%

Shanghai Composite 2,285.36 +8.37 +0.37%

Nomura Holdings Inc., Japan’s biggest brokerage by market value, dropped 5 percent, halting a record winning streak on speculation the stock may be overheating.

Aozora Bank Ltd. tumbled 10 percent after Reuters reported Cerberus Capital Management LP may sell most of its stake in the lender.

Shui On Land Ltd. fell 1.3 percent after the Hong Kong-based developer said it expects a significant decline in full-year profit.

European stocks retreated, after the Stoxx Europe 600 Index reached its highest valuation in almost three years, offsetting gains by lenders as central-bank governors diluted a proposed liquidity rule.

In the U.S., Republicans are planning to use the need to raise the American government’s $16.4 trillion debt ceiling to force President Barack Obama to accept spending cuts to entitlement programs such as Medicare. Congress must act as early as mid-February to prevent a default.

National benchmark indexes fell in 11 of the 18 western- European markets. France’s CAC 40 Index fell 0.7 percent and Germany’s DAX lost 0.6 percent. The U.K.’s FTSE 100 retreated 0.4 percent.

Rolls-Royce fell 1.5 percent to 904.5 pence. Europe’s largest maker of commercial aircraft and ship engines bribed an executive at Air China Ltd. and China Eastern Airlines Corp. to obtain $2 billion of deals, according to a Sunday Times report. The company declined to comment on the article. The U.K.’s Serious Fraud Office is holding an enquiry into Rolls-Royce’s activity in several countries.

Infineon Technologies AG declined 2.2 percent to 6.43 euros, its biggest drop in a month, as Bank of America Corp. downgraded the shares to underperform, the equivalent of a sell recommendation, from neutral. The brokerage cited Infineon’s valuation.

Barclays Plc and BNP Paribas SA climbed 3.8 percent to 287.2 pence and 1.9 percent to 45.21 euros, respectively. Deutsche Bank AG, Germany’s largest lender, increased 2.8 percent to 35.78 euros and Societe Generale SA, France’s second- biggest bank, added 2.7 percent to 30.13 euros.

Peugeot gained 5.6 percent to 6.52 euros. More than 17 percent of the French carmaker’s shares are out on loan, according to data compiled by Markit. Some investors borrow shares and then sell them, betting that the securities will drop before they have to be repurchased.

Wereldhave NV added 2.3 percent to 50.11 euros after agreeing to sell its U.S. real estate to Lone Star Funds for about $720 million. The Dutch property company plans to focus on shopping centers in western Europe and use the proceeds from the sale to reduce its debt.

In the absence of any economic data and expectations of the early season reports major U.S. stock indexes are adjusted after growth, which they demonstrated last week.

Tomorrow after trading on major stock exchanges Wall Street its quarterly financial report will publish aluminum giant Alcoa (AA), which is the unofficial start of the season audience in the last quarter.

Among the most important news that today affect the dynamics of the market it is worth noting reports that the Basel Committee on Banking Supervision put some stricter standards of Basel-III.

Of corporate communications at the center of attention are the following:

- Shares of Amazon.com Inc. (AMZN) reached a record high against the increase of their rating analysts Morgan Stanley. Rating was upgraded to "overweight". Cause of rising expectations are called sales growth in e-commerce. AMZN shares went up today to $ 269.30.

- Shares of Intel Corp. (INTC) rose after raising their rating analysts Lazard Capital Markets to "buy" from "neutral."

- At Boeing (BA) new problems with Dreamliner-ohm. The company's shares fell after reports of fire on board. Problems with the Dreamliner-E have often led to delays in the delivery aircraft, although Boeing noted that the number of problems at the level of the other models in the start time of their production.

Most of the components of the index DOW dropped in price (18 of 30). More than 1% shares gained only McDonald's (MCD, +1.19%). Maximum loss incurred stock Walt Disney (DIS, -2.20%).

All sectors of the S & P is in the red, with the exception of the health sector (+0.3%). Maximum loss demonstrates sector utilities (-1.0%).

At the close:

Dow 13,384.29 -50.92 -0.38%

Nasdaq 3,098.81 -2.85 -0.09%

S & P 500 1,461.89 -4.58 -0.31%

00:01United Kingdom BRC Retail Sales Monitor y/yDecember +0.4%+0.7%+0.3%

00:30Australia Trade BalanceNovember -2.09-2.21-2.64

The yen headed for its biggest two- day gain since November, extending a rally from its 2 1/2 year low on speculation recent declines were excessive.

The currency strengthened against all of its 16 major counterparts even amid prospects Japanese Prime Minister Shinzo Abe will press the central bank to expand monetary stimulus at a Jan. 21-22 meeting in an effort to revive growth. The yen’s 14-day relative strength index against the dollar was at 25 today, below the 30 level that some traders view as a signal that an asset’s price has fallen too fast. The similar gauge for the yen versus the euro was at 30.

The euro maintained two days of gains versus the dollar amid speculation the European Central Bank will refrain from cutting borrowing costs this week. The ECB meets Jan. 10 and will keep its main refinancing rate at a record low of 0.75 percent, according to the median estimate of 55 economists in a Bloomberg News survey.

Data today may show the euro-area jobless rate rose to 11.8 percent in November from 11.7 percent in October, according to the median estimate of economists in a Bloomberg News poll. That would be the highest since the currency bloc was formed.

Australia’s dollar weakened against all of its 16 most- traded peers after the nation’s statistics office said imports outpaced exports by A$2.64 billion ($2.77 billion) in November. That compared with a revised A$2.44 billion shortfall in October and was the biggest deficit since March 2008.

EUR / USD: during the Asian session, the pair rose to $1.3140.

GBP / USD: during the Asian session, the pair traded in the range of $1.6100-30.

USD / JPY: during the Asian session the pair fell to Y87.20.

One of the highlights today sees German Chancellor Angela Merkel, Greek Prime Minister Antonis Samaras and Spanish Finance Minister Luis de Guindos take part in conference hosted by Die Welt, in Berlin. Merkel is also due to hold bilateral talks with the Greek PM. There is a raft of EMU data due for release at 1000GMT, including November retail trade, December economic sentiment numbers, December business climate indicator and the November unemployment rate. At 1100GMT, German November manufacturing orders will cross the screens, with consensus forecasts looking for a fall of 1.4% m/m.

Change % Change Last

Oil$93.29+0.10+0.11%

Gold$1,647.90+1.60+0.10%

Change % Change Last

Nikkei 225 10,599.01 -89,10 -0,83%

S&P/ASX 200 4,717.33 -6,45 -0,14%

Shanghai Composite +8,37 2,285.36 +0.37%

FTSE 100 6,064.58-25.26 -0.41%

CAC 403,704.64-25.38 -0.68%

DAX7,732.66-43.71 -0.56%

Dow13,384.29-50.92-0.38%

Nasdaq3,098.81-2.85-0.09%

S&P 5001,461.89-4.58-0.31%(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD$1,3115 +0,27%

GBP/USD $1,6115 +0,25%

USD/CHF Chf0,9211 -0,30%

USD/JPY Y87,78 -0,42%

EUR/JPY Y115,13 -0,12%

GBP/JPY Y141,44 -0,16%

AUD/USD $1,0502 +0,19%

NZD/USD $0,8370 +0,63%

USD/CAD C$0,9858 -0,10%

00:01United Kingdom BRC Retail Sales Monitor y/yDecember +0.4%+0.7%

00:30Australia Trade BalanceNovember -2.09-2.21

06:45Switzerland Unemployment RateDecember 3.0%3.0%

07:00Germany Trade BalanceNovember 15.215.9

07:00Germany Current AccountNovember 13.616.0

07:45France Trade Balance, blnNovember -4.7-4.8

10:00Eurozone Retail Sales (MoM)November -1.2%+0.5%

10:00Eurozone Retail Sales (YoY)November -3.6%-2.1%

10:00Eurozone Unemployment RateNovember 11.7%11.8%

10:00Eurozone Business climate indicatorDecember -1.19-1.08

10:00Eurozone Industrial confidenceDecember -15.1-14.5

11:00Germany Factory Orders s.a. (MoM)November +3.9%-1.4%

11:00Germany Factory Orders n.s.a. (YoY)November -2.4%-0.4%

21:30U.S. API U.S. Crude Oil Inventories- -12

21:45New Zealand Building Permits, m/mNovember -1.5%© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.