- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-01-2013

The yen dropped against the dollar for the first time in three days as Prime Minister Shinzo Abe told central-bank governor Masaaki Shirakawa he wants the Bank of Japan to double its inflation goal to 2 percent. Japan’s currency slid versus all of its 16 most-traded peers after Shirakawa said the BOJ was in close contact with the government, adding to bets policy makers will boost stimulus that tends to debase the yen. The bank meets next week. The yen declined versus major peers as Abe talked with Shirakawa at a meeting of Japan’s Council on Economic and Fiscal Policy in Tokyo. The regular gatherings resumed today after being abolished by the previous government. Minutes will become available three business days after the meetings are held, according to the Cabinet Office.

The euro fell for a second day against the greenback before the European Central Bank meets tomorrow. The ECB will keep its main refinancing rate at a record-low 0.75 percent tomorrow, according to the median forecast of 55 analysts in a Bloomberg survey. Five predicted the central bank will lower the rate to 0.5 percent. Also today published the final Eurozone GDP, which are fully consistent with the projections. Later also presented a report on industrial production in Germany, which showed an increase of 0.2%, while analysts had expected an increase of 1.1%.

Pound decreased, which was due to the publication of data showing that the trade deficit fell less than expected. Office for National Statistics said that the trade deficit narrowed to 9.164 billion pounds from 9.487 billion pounds in October, while economists forecast a reduction in the deficit to 9.05 billion pounds.

The Canadian dollar was able to regain some lost ground against the dollar after data on Canada's housing market in December, were slightly better than forecast. The number of housing starts in Canada in December fell by 1.7% compared to November and adjusted for seasonal variation was 197,976 homes a year. This figure was slightly worse than expected. According to the forecast, the number of bookmarks in December should have been 195,000 homes a year.

European stocks rose to the highest in more than 22 months as Alcoa Inc. began the U.S. earnings season with sales that beat projections.

Alcoa, the largest U.S. aluminum producer, unofficially kicked off the earnings season late yesterday as it reported fourth-quarter sales of $5.9 billion, beating the $5.6 billion average analyst estimate. Fourth-quarter profits from S&P 500 companies probably increased 2.9 percent, according to analysts’ estimates compiled.

German industrial production rose 0.2 percent in November, after a revised 2 percent drop a month earlier, the Economy Ministry in Berlin said. That’s the first time output climbed in four months. Economists on average had predicted a 1 percent increase, according to a Bloomberg survey.

National benchmark indexes advanced in 16 of the 18 western European markets. The U.K.’s FTSE 100 added 0.7 percent, while France’s CAC 40 climbed 0.3 percent. Germany’s DAX gained 0.3 percent.

A gauge of telecommunications shares was the best performer among the 19 industry groups in the Stoxx 600. Mobile-phone operators including Deutsche Telekom AG and France Telecom SA discussed the creation of a pan-European network with Competition Commissioner Joaquin Almunia, the Financial Times reported, citing people familiar with the matter.

Telecom Italia soared 8.8 percent to 75.7 euro cents, the biggest rally since May 2010. Deutsche Telekom advanced 3.4 percent to 9.14 euros and France Telecom climbed 4.3 percent to 8.75 euros. Vodafone Group Plc gained 1.9 percent to 165.5 pence.

Delta Lloyd surged 6.6 percent to 13.71 euros, the largest increase since June 29, after Aviva sold its 19.4 percent stake in the Dutch company for 433.8 million euros ($568 million). Aviva, the U.K.’s second-biggest insurer by market value, slipped 2.2 percent to 373.7 pence.

J Sainsbury Plc lost 2.9 percent to 329.2 pence after the U.K.’s third-largest supermarket chain said same-store sales excluding revenue from fuel rose 0.9 percent in the 14 weeks ended Jan. 5, the weakest of 32 consecutive quarters of gains. A gauge of retail shares was the worst-performing industry group in the Stoxx 600, falling 0.7 percent.

Euro did rebound from the new 2-day low of $ 1.3035 against the background of the positive dynamics of the U.S. stock, recovered from a 2-day decline. EUR / USD has recently reached session high of $ 1.3079. Now trading is around $ 1.3060, still 0.1% from the opening price.

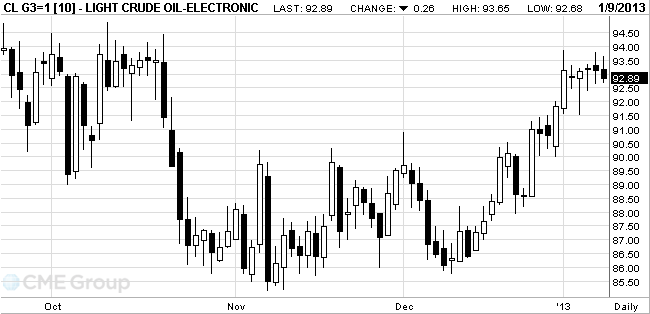

Oil

declined after a government report showed that

Futures

fell after the Department of Energy said crude stockpiles rose 1.31 million

barrels to 361.3 million last week. A 2 million-barrel gain was the median

estimate of analysts surveyed by Bloomberg. Gasoline and distillate inventories

also rose. Crude output climbed to 7 million barrels a day, the most since

1993. The

Increasing

output in the

Crude

imports rose 18 percent to 8.34 million barrels a day, the first gain in four

weeks. Fuel imports increased 7.8 percent to 2.09 million barrels a day last

week.

Gasoline

inventories climbed 7.41 million barrels to 233.1 million, versus an expected

gain of 2.5 million. Distillate inventories increased 6.78 million barrels to

130.7 million, versus a forecast advance of 1.9 million.

Refineries

operated at 89.1 percent of capacity last week, the report showed, down from

90.4 percent the previous week.

The Energy

Department raised its oil-price projections for 2013 yesterday and forecast

that global consumption will expand to a record. WTI will average $89.54 a

barrel, up 1.3 percent from the December estimate of $88.38, it said in the

monthly Short-Term Energy Outlook. The

Crude oil

for February delivery fell to $92.68 a barrel on the New York Mercantile Exchange.

The contract traded at $93.45 before the release of the inventory report at

10:30 a.m. in

Brent oil

for February settlement slipped 58 cents, or 0.5 percent, to $111.36 a barrel

on the London-based ICE Futures Europe exchange. The North Sea crude traded at

an $18.44 premium to the

At auction in New York a couple rallied, swallowing up the European session Y87.74 and moving day high at Y87.99. U.S. economic calendar is empty today, but traders noted the Fitch warning of a possible downgrade of Japan due to its high level of debt. In addition, Japanese politicians continue to voice their commitment to improve the inflation target of 2%.

January 22 The Bank of Japan will announce its decision on monetary poliitke. Investors expect the Central Bank, under severe pressure okazvashiysya Abe government, demonstrates very pigeon attitude.

Gold prices traded in a narrow range as investors await the outcome of the meetings of central banks of the euro area and Japan.

Last week, gold has fallen in price to a minimum of more than four months below $ 1.630 an ounce, as investors spooked minutes of the last meeting of the Federal Reserve, who showed concern about the side effects of "quantitative easing."

In 2012, gold has risen in price the 12th consecutive year by the central banks of the U.S. stimulus package and Europe. According to analysts, the Bank of Japan in January will consider further easing of policy, and the European Central Bank will not change interest rates at a meeting on Thursday.

Support prices may have increased demand in the physical market of Asia, especially in the largest consumer of gold - China and India. Premiums for delivery to India on Tuesday rose to its highest level in two months, as traders rush to place orders before the expected increase in import duties.

Yesterday, at the beginning of today's session, the price of gold prices rose amid signs that the buyers in China are increasing their investment in the precious metal on the eve of the Lunar New Year.

The amount of physical gold traded on the Shanghai gold market (Shanghai Gold Exchange), the main venue for trading this metal in China, jumped to record high this week. Trading volume on Monday exceeded 19,500 pounds, which is more than three times higher than the average of previous 30 sessions, according to the site SGE.

This was proof that the Chinese buyers took advantage has declined in recent years prices for gold purchases before the holidays. In addition, imports of gold to mainland China from Hong Kong reached a 7-month high in November, said the bank. This data is mostly considered an indicator of changes in demand for gold in the country. November data are the latest available at the moment.

Gold prices were down for the sixth session in a row, falling over this time by 6%. Growth of quotations of futures on Tuesday broke the 3-day price drop.

Buyers in China, tend to increase portfolios before the Lunar New Year, the celebration which will begin on February 10 and will continue for a week, during which markets will be closed.

February futures price of gold on COMEX today rose to 1666.00 dollars an ounce, and then decreased to the level of 1653.70 dollars per ounce.

Bloomberg's

Hans Nichols reports that Obama will name Jack Lew as Treasury Secretary

tomorrow.

Lew, who is

currently Obama's Chief Of Staff, has been seen as the frontrunner for a long

time.

Previously

he was Obama's budget chief, and previous to that he was at Citi.

While Lew

is seen as likely being an easy nomination, there is some GOP opposition to

him.

Several

Republicans said Tuesday they don’t view Lew as a man interested in hearing GOP

concerns. One aide called him “tone deaf” in understanding the compromises that

Republicans could accept during high-stakes talks.

U.S. stock futures rose as Alcoa Inc. (AA) kicked off the earnings season by posting fourth-quarter sales that exceeded analysts’ estimates.

Global Stocks:

Nikkei 10,578.57 +70.51 +0.67%

Hang Seng 23,218.47 +107.28 +0.46%

Shanghai Composite 2,275.34 -0.73 -0.03%

FTSE 6,096.85 +43.22 +0.71%

CAC 3,714.57 +8.69 +0.23%

DAX 7,718.22 +22.39 +0.29%

Crude oil $93.26 +0.12%

Gold $1663.50 +0.08%

Downgrades:

McDonald's (MCD) downgraded to Mkt Perform from Outperform at Raymond James

Bank of America (BAC) downgraded to Neutral from Outperform at Credit Suisse

Other:

Amazon.com (AMZN) resumed with a Buy at Goldman

EUR/USD $1.3200, $1.2940, $1.2900

USD/JPY Y87.75, Y87.00

AUD/USD $1.0400

AUD/NZD NZ$1.2585

AUD/JPY Y90.00Data

00:00Australia HIA New Home Sales, m/mNovember +3.4%+4.7%

00:30Australia Retail sales (MoM)November 0.0%+0.3%-0.1%

09:30United Kingdom Trade in goodsNovember -9.5-9.0-9.2

10:00Eurozone GDP (QoQ)(finally)Quarter III -0.1%-0.1%-0.1%

10:00Eurozone GDP (YoY)(finally)Quarter III -0.6%-0.6%

11:00Germany Industrial Production s.a. (MoM)November -2.0% +1.1%+0.2%

The yen fell against the dollar, stopping with his two-day consolidation, which was caused by the meeting of Prime Minister Shinzo Abe and the central bank governor Masaaki Shirakawa, in which hodey Abe said he wants to double the inflation target to 2 percent.

Japan's currency weakened by at least 0.2% against all 16 major currencies after Shirakawa said that the Bank of Japan is in close contact with the government. Against it far more likely that the policy will increase the incentive, which is directed to the depreciation of the currency.

Euro against the dollar, as many market participants are waiting for tomorrow's meeting of the European Central Bank, which will be announced rate decision.

According to the poll, 55 economists suggest that the ECB President Mario Draghi will hold the key refinancing rate at a record low of 0.75%, while the five experts expect it to fall 0.5%.

Meanwhile, the corporation Citigroup Inc expects the ECB to cut rates at its meeting next month.

Also today published the final Eurozone GDP, which are fully consistent with the projections. Later also presented a report on industrial production in Germany, which showed an increase of 0.2%, while analysts had expected an increase of 1.1%.

Pound decreased, which was due to the publication of data showing that the trade deficit fell less than expected. Office for National Statistics said that the trade deficit narrowed to 9.164 billion pounds from 9.487 billion pounds in October, while economists forecast a reduction in the deficit to 9.05 billion pounds.

EUR / USD: during the European session the pair fell to $ 1.3043

GBP / USD: during the European session the pair fell to $ 1.6008

USD / JPY: during the European session, the pair rose to Y87.74

At 13:15 GMT in Canada, there are data on the number of new foundations of bookmarks for December. At 15:30 GMT the United States to report on crude oil inventories from the Department of Energy in January. At 18:00 GMT the U.S. puts 10-year bonds. Finish the day at 21:45 GMT New Zealand report on the trade balance (for 12 months, from the beginning of the year) and the trade balance for November.

EUR/USD

Offers $1.3200, $1.3190, $1.3140/50, $1.3120, $1.3100/10

Bids $1.3050, $1.3010/00

GBP/USD

Offers $1.6170/80, $1.6150/55, $1.6130/35, $1.6100/05, $1.6080

Bids $1.6030/20, $1.6010/00, $1.5980, $1.5965/60

AUD/USD

Offers $1.0600, $1.0550, $1.0520/30

Bids $1.0490/85, $1.0480/70, $1.0450/40, $1.0425/20, $1.0410/00

EUR/GBP

Offers stg0.8220/25, stg0.8200/10, stg0.8180/85, stg0.8170, stg0.8160/65

Bids stg0.8130, stg0.8120, stg0.8105/00, stg0.8080, stg0.8065/60

EUR/JPY

Offers Y115.50, Y114.95/00, Y114.75/80

Bids Y114.00, Y113.50, Y113.20, Y113.00

USD/JPY

Offers Y88.35/40, Y88.00, Y87.80/85

Bids Y87.05/00, Y86.55/50, 86.30/25, Y86.00

European stocks show an increase for the first 3 days after Alcoa Inc. kicked off earnings season for the fourth quarter of 2012. The company's revenue fell 2% to $ 5.9 billion, but exceeded the average analyst estimate, which was $ 5.6 billion

Also have a positive impact on the market investor expectations data on industrial production in Germany.

To date:

FTSE 100 6,071.41 +17.78 +0.29%

DAX 7,701.68 +5.85 +0.08%

CAC 3,709.32 +3.44 +0.09%

Shire Plc shares rose 1.5% after the announcement of the CEO of the company's profit growth.

Paper Delta Lloyd NV jumped 6.8% after Aviva Plc sold its share of the Dutch insurance company.

The market value of Sainsbury Plc fell 2.9% after reporting slower sales growth in eight years.

PSA Peugeot Citroen shares fell 0.7%. The company reduced sales in 2012 by 17% - to 2.97 million vehicles, compared with 3.5 million in 2011.

UR/USD $1.3200, $1.2940, $1.2900

USD/JPY Y87.75, Y87.00

AUD/USD $1.0400

AUD/NZD NZ$1.2585

AUD/JPY Y90.00

Asian stocks climbed, halting a two- day retreat, as Japan’s Nikkei 225 Stock Average reversed losses after the yen weakened and Alumina Ltd. jumped as partner Alcoa Inc. posted sales that beat estimates.

Nikkei 225 10,578.57 +70.51 +0.67%

Hang Seng 23,218.47 +107.28 +0.46%

S&P/ASX 200 4,708.14 +17.89 +0.38%

Shanghai Composite 2,275.34 -0.73 -0.03%

Alumina rose 4.6 percent in Sydney after Alcoa kicked off U.S. earnings season.

Chemical maker Nufarm Ltd. rallied 6.2 percent in Sydney after Monsanto Co., the world’s biggest seed company, raised its profit forecast.

Honda Motor Co. and Toyota Motor Corp. both climbed more than 1 percent as the yen fell against all of its major counterparts.The yen rose for a second day versus the dollar, extending a rally from a 29-month low, amid ebbing risk appetite and bets the currency’s three-month slide already incorporates proposed Bank of Japan stimulus measures. The yen gained versus all of its 16 most-traded peers even as Finance Minister Taro Aso said Japan will buy euro-denominated sovereign debt to help weaken the currency.

The Bank of Japan next meets Jan. 21-22. Policy makers boosted stimulus at their previous gathering in December while refraining from raising their inflation goal from 1 percent. Newly elected Prime Minister Shinzo Abe had called for a doubling of the inflation measure.

Japan will use foreign-exchange reserves to buy European Stability Mechanism bonds to help weaken the yen, Aso told reporters in Tokyo. The decision will also help the “financial stability of Europe,” he said.

The Japanese government will watch the currency market “closely” and will strengthen cooperation with the BOJ to counter deflation, according to a draft of its emergency economic measures released. Abe said on Jan. 1 that “bold” monetary policy was one of the three prongs of his economic plan.

The euro dropped for the first time in three days, approaching its 50-day moving average of $1.2995. The euro headed toward its 50-day moving average versus the dollar after failing to breach it for the past two days. Moving averages, which indicate momentum, are seen by some traders as potential turning points in the direction of a currency’s price.

The pound fell toward the weakest level in a month against the dollar before a Bank of England meeting this week. Policy makers are forecast to keep interest rates at a record low as they struggle to stoke a recovery. The U.K. economy shrank 0.1 percent last year, while the U.S. expanded 2.2 percent, according to a Bloomberg News surveys.

Asian stocks fell, sending the regional benchmark index lower for a second day, as Japanese exporters declined after the yen strengthened and as earnings results from HTC Corp. missed estimates.

Nikkei 225 10,508.06 -90.95 -0.86%

Hang Seng 23,111.19 -218.56 -0.94%

S&P/ASX 200 4,690.25 -27.07 -0.57%

Shanghai Composite 2,276.07 -9.29 -0.41%

HTC, Asia’s second-largest smartphone maker, slipped 4 percent in Taipei.

Mazda Motor Corp., which gets about 72 percent of its sales outside of Japan, sank 5 percent as the yen’s advance dimmed the outlook for overseas earnings.

Samsung Electronics Co. the world’s largest maker of mobile phones and televisions, lost 1.3 percent in Seoul after reporting earnings.

Most European stocks fell after German exports dropped and investors speculated recent gains have overshot the outlook for company profits as Alcoa Inc. prepared to kick off the U.S. earnings season.

German exports declined more than forecast in November. Exports adjusted for working days and seasonal changes fell 3.4 percent from October, the steepest drop in more than a year, the Federal Statistics Office in Wiesbaden said today. Economists had forecast a 0.5 percent decrease.

Still, economic confidence in the euro area increased more than economists expected in December even as the 17-nation currency bloc remained mired in its second recession in four years. An index of executive and consumer sentiment rose to 87 from 85.7 in November, the European Commission said. Economists had forecast a reading of 86.3.

National benchmark indexes declined in 10 of the 18 western European markets. Germany’s DAX Index slipped 0.5 percent and the U.K.’s FTSE 100 dropped 0.2 percent. France’s CAC 40 was little changed.

Debenhams sank 7.7 percent to 108.1 pence, the biggest decline since March 2009. The U.K.’s second-largest department- store chain cut its forecast for full-year margin growth as it stepped up promotions to gain shoppers.

A gauge of automobile companies was the worst performer among 19 industry groups in the Stoxx 600. Car sales in western Europe slid 16 percent in December, LMC Automotive said in a report yesterday.

Bayerische Motoren Werke AG (BMW) lost 3.4 percent to 73.21 euros, while Daimler AG declined 1.3 percent to 42.50 euros. Renault SA slipped 2 percent to 39.67 euros.

Michael Page International Plc and Hays Plc slid 3.8 percent to 398.8 pence and 1.5 percent to 84.55 pence, respectively. The U.K. recruitment companies retreated as smaller rival Robert Walters Plc said the market is still challenging and there’s yet to be any indication the situation will improve this year. Robert Walters closed unchanged at 203 pence, erasing an earlier loss of as much as 5.9 percent.

Galp Energia SGPS SA declined 3.8 percent to 12.05 euros. The shares were downgraded to neutral from buy at Bank of America Corp., citing “potentially weak” fourth-quarter earnings and 2013 guidance.

Vodafone advanced 1.7 percent to 162.4 pence, the highest since Dec. 13. Verizon Communications Chief Executive Officer Lowell McAdam said his company has the strength to buy Vodafone’s 45 percent stake in the U.S.’s largest wireless carrier, the Journal reported late yesterday.

U.S. stocks fell in anticipation of the start of today's corporate reporting season, which traditionally opens the aluminum giant Alcoa after the end of the regular session.

It is expected that the company will show a relatively strong financial results. If these expectations are met, market sentiment improved, as many perceive financial performance Alcoa as a barometer of the situation in the industrial sector of the global economy. However, it is worth noting that, according to FactSet reporting Alcoa is not a good indicator for the reporting season in general.

Today released only one American statistic - consumer lending in the U.S. in November rose to $ 16.05 billion

According to published protocols November and December meetings of the Federal Reserve, on the discount rate, the heads of the U.S. Federal Reserve expressed "cautious optimism" about growth in November and December, pointing to continued improvement in the housing market. However, they noted a constant level of activity in the manufacturing sector and the continuing rise in unemployment.

DOW index components were mixed. Leader was led Hewlett-Packard (HPQ, +1.45%). Maximum loss suffered shares Verizon Communications Inc. (VZ, -3.56%), which had a pressure on reports that the company may buy Vodafone stake in Verizon Wireless.

According to trade in the health sector alone was able to show growth (+0.2%). All other sectors suffered losses. Most industrial goods sector declined (-0.8%).

At the close:

Dow 13,329 -55 -0.41%

Nasdaq 3,092 -7 -0.22%

S & P 500 -0.33% 1.457 -500:00Australia HIA New Home Sales, m/mNovember +3.4%+4.7%

00:30Australia Retail sales (MoM)November 0.0%+0.3%-0.1%

The yen fell versus all of its major counterparts on expectations the Bank of Japan will accede to government pressure to expand monetary easing that tends to weaken the currency. The yen declined versus the dollar and euro ahead of data this week that may show Japan had a current-account deficit in November, supporting the case for increased stimulus at the central bank’s next meeting. Japan’s Chief Cabinet Secretary Yoshihide Suga said today the next BOJ governor should see the need for bold monetary easing.

The euro stemmed a loss from yesterday on prospects European Central Bank officials meeting tomorrow will refrain from lowering borrowing costs. ECB President Mario Draghi and his board will probably keep the euro-area’s benchmark borrowing cost unchanged at 0.75 percent, according to the median estimate in a Bloomberg survey of economists before the policy decision tomorrow. Analysts in a separate poll predicted that German data today will show industrial production climbed 1 percent in November from a month earlier, when it dropped 2.6 percent.

The Australian dollar slid against most peers after data showed that retail sales and job vacancies unexpectedly declined. Australia’s statistics bureau said today that retail sales fell 0.1 percent in November from the previous month, when they stalled. The median estimate of analysts in a Bloomberg survey was for a 0.3 percent advance. Job vacancies dropped 6.9 percent over the same period, according to a separate report.

EUR/USD: during the Asian session, the pair traded in the range of $1.3065-90.

GBP/USD: during the Asian session the pair fell to $1.6035.

USD/JPY: during the Asian session, the pair climbed to Y87.55.

There is no early data in Europe Wednesday and the first calendar entries are sector outlooks from German trade bodies. At 0900GMT, the German construction associations release a joint sector outlook, while the Wholesale and Export Association release their sector outlook at 0930GMT, both in Berlin. There is an insight into the Greek economy at 1000GMT, with the release of both the November trade data and the November industrial production numbers. Also at 1000GMT, the third estimate of the EMU GDP for the third quarter is set for release. The DIW also releases its new German growth forecasts at 1000GMT. Further eurozone data is due at 1100GMT, with the release of the Portuguese November trade balance and the German November industrial output numbers. Back in Europe, at 1230GMT, German Chancellor Angela Merkel and Maltese Prime Minister Lawrence Gonzi will hold a joint press conference in Berlin.

Change % Change Last

Gold 1,659 +13 +0.77%

Oil 93.16 -0.03 -0.03%Change % Change Last

Nikkei 225 10,508.06 -90,95 -0,86%

Hang Seng 23,111.19 -218,56 -0,94%

S&P/ASX 200 4,690.25 -27,07 -0,57%

Shanghai Composite -9,29 2,276.07 -0.41%

FTSE 100 6,053.63-10.95 -0.18%

CAC 40 3,705.88+1.24 +0.03%

DAX 7,695.83-36.83 -0.48%

Dow 13,329 -55 -0.41%

Nasdaq 3,092 -7 -0.22%

S&P 500 1,457 -5 -0.33%(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD$1,3080 -0,27%

GBP/USD $1,6055 -0,37%

USD/CHF Chf0,9240 +0,31%

USD/JPY Y87,05 -0,84%

EUR/JPY Y113,85 -1,12%

GBP/JPY Y139,70 -1,25%

AUD/USD $1,0503 +0,01%

NZD/USD $0,8364 -0,07%

USD/CAD C$0,9865 +0,07%00:00Australia HIA New Home Sales, m/mNovember +3.4%+4.7%

00:30Australia Retail sales (MoM)November 0.0%+0.3%-0.1%

00:30Australia Retail Sales Y/YNovember +3.1%

02:00China Trade Balance, blnDecember 19.620.1

02:00China New LoansDecember 523550

09:30United Kingdom Trade in goodsNovember -9.5-9.0

10:00Eurozone GDP (QoQ)(finally)Quarter III -0.1%-0.1%

10:00Eurozone GDP (YoY)(finally)Quarter III -0.6%

11:00Germany Industrial Production s.a. (MoM)November -2.6%+1.1%

11:00Germany Industrial Production (YoY)November -3.7%-2.9%

13:15Canada Housing StartsDecember 196198

15:30U.S. Crude Oil Inventories- -11.1

18:00U.S. USA 10-y Bond Auction-

21:45New Zealand Trade BalanceNovember -718-670© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.