- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 10-04-2014

(pare/closed(GMT +2)/change, %)

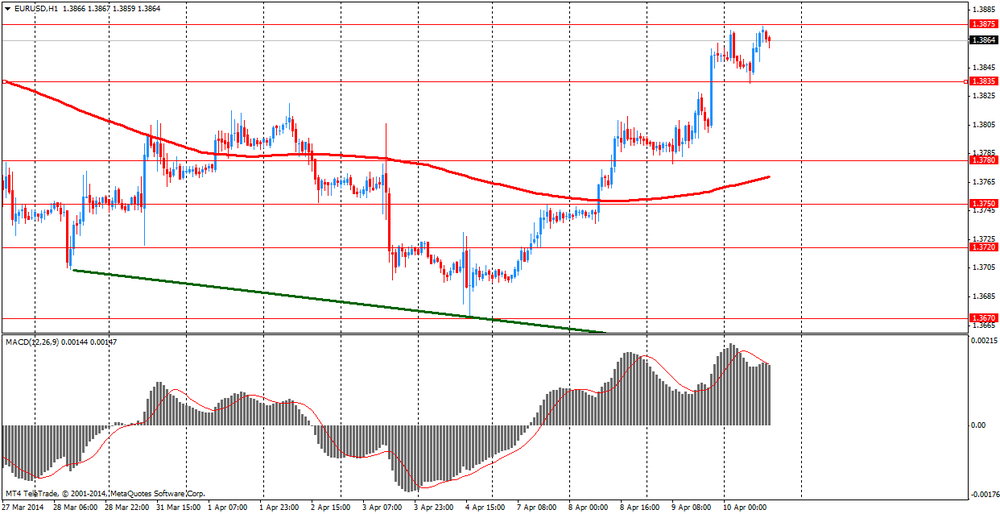

EUR/USD $1,3887 +0,24%

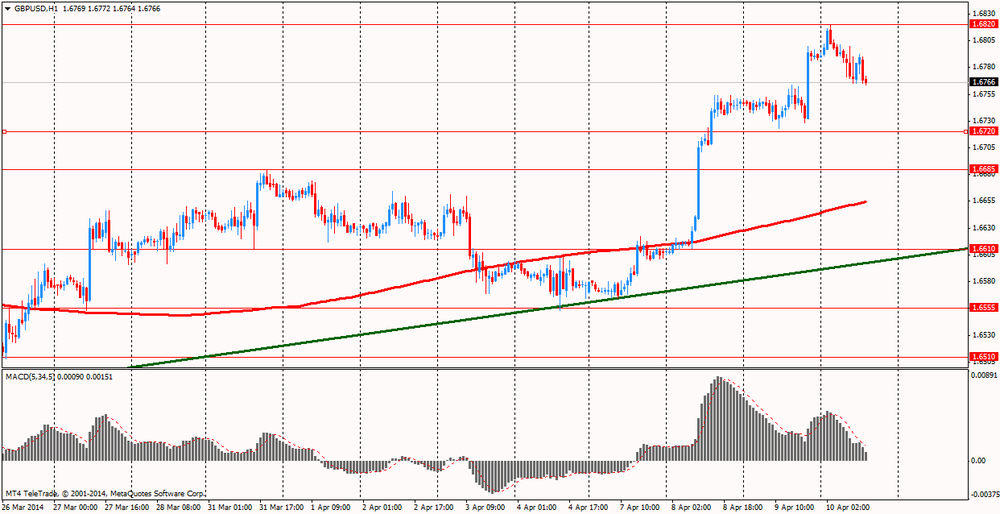

GBP/USD $1,6782 -0,05%

USD/CHF Chf0,8761 -0,39%

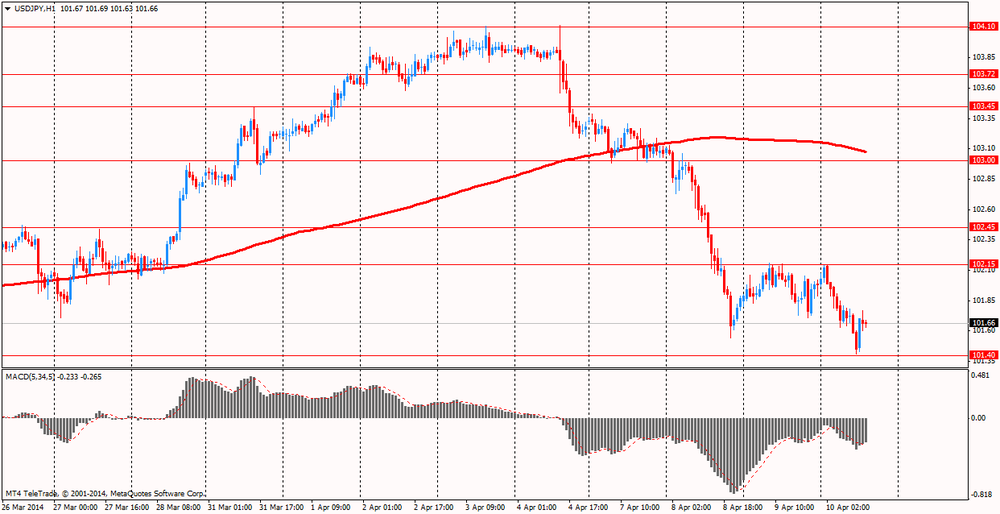

USD/JPY Y101,43 -0,54%

EUR/JPY Y140,86 -0,29%

GBP/JPY Y170,23 -0,58%

AUD/USD $0,9410 +0,31%

NZD/USD $0,8670 -0,47%

USD/CAD C$1,0931 +0,45%

01:30 China PPI y/y March -2.0% -2.2%

01:30 China CPI y/y March +2.0% +2.5%

06:00 Germany CPI, m/m (Finally) March +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) March +1.0% +1.0%

12:30 U.S. PPI, m/m March -0.1% +0.1%

12:30 U.S. PPI, y/y March +0.9% +1.0%

12:30 U.S. PPI excluding food and energy, m/m March -0.2% +0.2%

12:30 U.S. PPI excluding food and energy, Y/Y March +1.1% +1.1%

13:00 G20 Meetings

13:00 IMF IMF Meetings

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) April 80.0 81.2The euro rose against the U.S. currency against the backdrop of French data on industrial production and inflation. Also helped strengthen the news on Greece. Note that Greece for the first 4 years is selling government bonds to gain for them more than 3 billion euros , which was above the expectations of the government. Government bonds with a maturity of 5 years and a low rate of 4.95 % used in demand : the government received bids worth over 20 billion euros from potential buyers. Last Greek bonds exposed to the market in March 2010 , and since then the country's economy depended on help from the "troika" of international creditors (European Commission, European Central Bank and International Monetary Fund. The fact that the country has again entered the market loans , is a positive signal for the economic situation in Greece.

Important for the euro were comments and ECB chief economist Peter Preta , who said that the central bank has not changed its assessment on the conservation rates at current or lower levels for a long period . Pret assured that " forward-looking statements " had a positive impact on the currency markets . Markets Trust ECB, which comes true in a low inflation environment , the economist said . He also noted that the eurozone economy remains quite vulnerable. The recovery process in the euro area is still " modest flows , uneven pace , but it covers more countries ." Senior economist at the Bank acknowledged that , while confidence indicators have increased markedly , the activity has not increased at a pace that raises questions.

Pound fell against the dollar, almost completely offsetting while yesterday's rise as the Bank of England left policy unchanged . The Bank of England did not bring any surprises , decided to leave its key rate at a record low of 0.5% , which she held for 5 years ( since March 2009 ), and a program of bond purchases in the amount of £ 375 billion is expected , the bank managers will not change policies in the coming months as the UK economy for a long time in a state of stagnation , once again demonstrates the rapid growth in a low inflation environment .

It should be noted that the heads of the Bank of England signaled its intention to continue the policy of "cheap money " as long as the increasing number of Britons do not find a job , and the economy approaches the functioning at full capacity , provided that inflation will remain under control. Dates of the first interest rate hikes are crucial : if the central bank will have to wait too long, inflation could accelerate sharply , as if he would take action too quickly, the economic recovery could stall .

The yen rose against the dollar , which was associated with the release of data on the reduction of Chinese exports , which increased demand for " safe havens ." The strengthening of the Japanese yen helped decrease expected to raise interest rates after the release of the Fed minutes of the meeting FOMC. The report showed that in March, China unexpectedly recorded a reduction in exports by 6.6 % compared with the same month last year , after falling 18.1 % in February, which was the worst since the financial crisis. Analysts expected export growth by 4.8%. While imports fell last month to 11.1% in February after rising to 10.1% , resulting in a trade surplus of $ 7.71 billion , according to the General Administration of Customs of China. Experts predicted import growth of 3.9% and a deficit of $ 0.9 billion, the Customs Administration of China announced that it expects to improve trade performance in the second quarter amid recovery in global demand .

USD/JPY Y102.00, Y102.20, Y102.50, Y102.95, Y103.00, Y103.05, Y103.20-25

EUR/USD $1.3700, $1.3715, $1.3760, $1.3795, $1.3800, $1.3900

GBP/USD $1.6700

EUR/GBP stg.0.8225, stg0.8240, stg0.8315, stg0.8340

USD/CHF Chf0.8930

GBP/CHF Chf1.4600, Chf1.4700

EUR/CHF Chf1.2180, Chf1.2230, Chf1.2240

AUD/USD $0.9300, $0.9350, $0.9455

AUD/JPY Y94.70

USD/CAD C$1.0965, C$1.0970, C$1.0980

06:45 France Industrial Production, m/m February -0.2% +0.1%

06:45 France Industrial Production, y/y February -0.1% -0.8%

06:45 France CPI, m/m March +0.6% +0.5%

06:45 France CPI, y/y April +0.9% +0.6%

08:00 Eurozone ECB Monthly Report April

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

The euro rose against the dollar on French data on industrial production and inflation. Inflation in France, agreed by EU methodology , slowed in March, mainly due to falling oil prices , data showed on Thursday statistical office Insee. Harmonised inflation (HICP) fell more than expected to 0.7 percent in March from 1.1 percent in February. It was expected that inflation will be 0.8 percent.

Annual consumer price inflation fell to 0.6 percent from 0.9 percent the previous month and remained below the expected 0.7 percent.

Food prices fell 0.2 percent, while the prices of petroleum products decreased by 6 percent. Meanwhile, the cost of clothing and footwear increased by 0.6 percent.

On a monthly measurement of consumer prices rose by 0.4 percent after rising 0.6 percent the previous month. At the same time, the HICP rose by 0.5 percent.

Basic consumer prices rose by 0.1 percent compared with the previous month, amounting to an annual increase of 0.4 percent in March.

French industrial production expanded slightly in February , data showed on Thursday Insee. Industrial production in the second -largest eurozone economy grew by 0.1 % in February from January . Analysts had forecast an average increase of 0.2%.

Reduced energy production and release in the oil refining industry restrained overall industrial production, while manufacturing output grew by 0.3%. On an annual basis , industrial production fell by 0.8 % after falling 0.1% the month before.

Support for the single currency had news that Greece has successfully returned to the debt markets . Today, Greece held the first since 2010 auction on sovereign debt , in which were placed 5 - year bonds worth 3 billion euros against 2.5 billion target average yield was 4.95 % against the expected 5-5.25 %. Vice Prime Minister of Greece , said after the auction that the " bond issue said that Greece's debt is acceptable ."

The British pound is trading slightly lower against the dollar after the Bank of England left policy unchanged . The Bank of England did not bring any surprises , decided to leave its key rate at a record low of 0.5% , which she held for 5 years ( since March 2009 ), and a program of bond purchases in the amount of £ 375 billion

CB stated that it intends to keep rates low for at least as long as the b / p drops below 7%, and it is not expected before 2016. However, his representatives have repeatedly said that the mere drop rates b / d less than 7% will not be a direct incentive to improve .

Minutes of the meeting will be published on Wednesday, April 23.

EUR / USD: during the European session, the pair rose to $ 1.3874

GBP / USD: during the European session, the pair fell to $ 1.6765

USD / JPY: during the European session, the pair fell to Y101.41 and stepped

At 12:30 GMT , Canada will release the housing price index on the primary market in February. In the U.S. at 12:30 GMT will import price index for March, at 18:00 GMT - monthly budget execution report for March. At 23:50 GMT the meeting minutes will be published on the Bank of Japan's monetary policy in March .

EUR/USD

Offers $1.4000, $1.3970, $1.3950, $1.3930, $1.3890-900, $1.3875/85

Bids $1.3825/15, $1.3800, $1.3780, $1.3750

GBP/USD

Offers $1.6900, $1.6880, $1.6840/50, $1.6825

Bids $1.6730/25, $1.6710/00, $1.6685/80, $1.6660/50

AUD/USD

Offers $0.9600, $0.9550, $0.9500

Bids $0.9420/00, $0.9350, $0.9310/00, $0.9250

EUR/JPY

Offers Y142.00, Y141.45/50, Y141.20

Bids Y140.50, Y140.25/20, Y139.50

USD/JPY

Offers Y103.00, Y102.80/85, Y102.50, Y102.20/25, Y101.75/80

Bids Y101.20, Y101.00, Y100.50

EUR/GBP

Offers stg0.8320/25, stg0.8300

Bids stg0.8200, stg0.8190-80

USD/JPY Y102.00, Y102.20, Y102.50, Y102.95, Y103.00, Y103.05, Y103.20-25

EUR/USD $1.3700, $1.3715, $1.3760, $1.3795, $1.3800, $1.3900

GBP/USD $1.6700

EUR/GBP stg.0.8225, stg0.8240, stg0.8315, stg0.8340

USD/CHF Chf0.8930

GBP/CHF Chf1.4600, Chf1.4700

EUR/CHF Chf1.2180, Chf1.2230, Chf1.2240

AUD/USD $0.9300, $0.9350, $0.9455

AUD/JPY Y94.70

USD/CAD C$1.0965, C$1.0970, C$1.0980

01:00 Australia Consumer Inflation Expectation April +2.1% +2.4%

01:30 Australia Unemployment rate March 6.0% 6.0% 5.8%

01:30 Australia Changing the number of employed March 47.3 14.3 18.1

02:00 China Trade Balance, bln March -23.0 -0.9 +7.7

The yen strengthened against most counterparts while the Australian dollar pared gains after China reported an unexpected drop in imports and exports, fueling concern about demand for commodities. China’s overseas shipments declined 6.6 percent from a year earlier, the customs administration said today, attributing the drop partly to distortions from inflated data in early 2013. Imports fell 11.3 percent, leaving a trade surplus of $7.71 billion.

The U.S. dollar slid to a five-month low versus a basket of peers before a Federal Reserve policy maker speaks after central-bank minutes undercut prospects for an increase in interest rates. Janet Yellen said following the March meeting that the bank may start to increase interest rates “around six months” after ending its asset-buying program. The U.S. central bank cut monthly bond purchases by $10 billion to $55 billion last month. The Fed is winding down stimulus it has used to support the economy, while keeping its target for overnight lending between banks in a range of zero to 0.25 percent since 2008.

Chicago Fed President Charles Evans will participate in a panel discussion in Washington today.

The Aussie rose after employers added more than seven times as many jobs as forecast. The nation’s statistics bureau said employers added 18,100 jobs compared with the forecast for 2,500 additions. The jobless rate fell to 5.8 percent, the lowest level since November and the first decline in six months.

New Zealand’s dollar touched its highest level since 2011. The nation’s manufacturing expanded last month to the highest level since July, according to the Performance of Manufacturing Index compiled by the Bank of New Zealand Ltd. and Business NZ.

EUR / USD: during the Asian session, the pair rose to $ 1.3870

GBP / USD: during the Asian session, the pair rose to $ 1.6820

USD / JPY: during the Asian session, the pair rose fell below Y102.00

BOE rate announcement at 1100GMT the domestic interest, though no change widely expected.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.