- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 11-04-2014

Euro recovered previously lost ground against the dollar, while returning to the highs of the day. Experts note that the revival of interest players to risk , coupled with the recent ECB inaction served as the catalyst of the current pulse euros. Meanwhile, the impact on the dynamics of expectations publication next week final inflation data for March, as well as a report on the current account balance for March. These releases will be a kind of test of strength for the single currency.

Meanwhile, adding that today the euro received supports from the German inflation data . EU harmonized methodology inflation in Germany slowed to its lowest level in nearly four years , the final data showed Destatis. Harmonized index of consumer prices ( HICP ) rose 0.9 percent year on year in March, according to preliminary estimates . It was the weakest level since June 2010 . In February, prices rose 1 percent . On a monthly measurement of the HICP increased by 0.3 percent , as originally anticipated by March 28. The consumer price index rose by 1 percent per year in March after the 1.2 percent rise in the previous month . Statistical Office confirmed the preliminary assessment . Last inflation is the lowest since August 2010 . On a monthly basis, consumer prices rose by 0.3 percent, according to a preliminary projection . More info Destatis showed that wholesale prices fell by 1.7 percent in March compared with the corresponding month of the previous year , after declining by 1.8 percent in February and 1.7 percent in January. From February to March , wholesale prices remained unchanged.

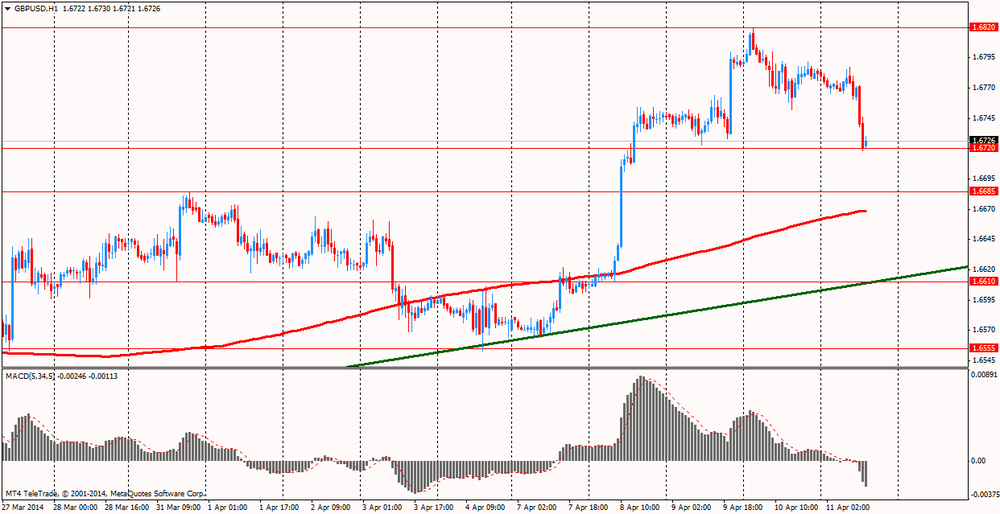

Pound was down against the U.S. dollar , which was associated with the release of data for Britain, which showed that the volume of construction in the UK fell in February at the fastest pace in three months , which was associated with difficult weather conditions. According to the report , the volume of construction fell in February by 2.8 percent after increasing 2.1 percent in January , which was revised upward to 1.8 percent. Last fall was the highest since November, when construction fell by 4.1 percent . Recall that the construction of 6.3 percent of gross domestic product in Britain. We also learned that in February, the total volume of new buildings decreased by 2.6 percent , which stood at the head of the fall in private housing sector - by 6.3 percent . It was the biggest decline in this category since March 2013, when the industry is also affected by the adverse weather conditions. However , annualized private housing sector recorded growth of 15.3 percent, which was associated with an increase in property prices , increase in the number of housing transactions , improved credit conditions and mortgage lending. In annual terms, the volume of construction rose 2.8 percent in February , amid new buildings increase by 3.1 percent , as well as repair and maintenance by 2.3 percent . Within three months ( February) construction output increased by 0.3 percent compared with the previous three months .

USD/JPY Y101.40-50, Y102.00, Y102.50, Y102.75, Y102.90, Y103.00

EUR/JPY Y140.50

EUR/USD $1.3700, $1.3740, $1.3750, $1.3800, $1.3850, $1.389

GBP/USD $1.6900

EUR/GBP stg.0.8175

AUD/USD $0.9200, $0.9300, $0.930, $0.9350, $0.9375, $0.9380, $0.9400

USD/CAD C$1.0800, C$1.0815, C$1.0895, C$1.0955, C$1.1000

06:00 Germany CPI, m/m (Finally) March +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) March +1.0% +1.0% +1.0%

Euro fell against the dollar on German inflation data . EU harmonized methodology inflation in Germany slowed to its lowest level in nearly four years , the final data showed Destatis, published on Friday .

Harmonized index of consumer prices ( HICP ) rose 0.9 percent year on year in March, according to preliminary estimates . It was the weakest level since June 2010 . In February, prices rose 1 percent . On a monthly measurement of the HICP increased by 0.3 percent , as originally anticipated by March 28.

The consumer price index rose by 1 percent per year in March after the 1.2 percent rise in the previous month . Statistical Office confirmed the preliminary assessment . Last inflation is the lowest since August 2010 . On a monthly basis, consumer prices rose by 0.3 percent, according to a preliminary projection.

More info Destatis showed that wholesale prices fell by 1.7 percent in March compared with the corresponding month of the previous year , after declining by 1.8 percent in February and 1.7 percent in January. From February to March , wholesale prices remained unchanged.

Dollar ends week the biggest drop in eight months against most major currencies after the published minutes of the last meeting of the Federal Reserve reduced the likelihood of an early rise in interest rates in the United States . It is learned that after the meeting of Federal Reserve officials moved away from quantitative benchmarks , ie abandoned former promises to increase its benchmark interest rate at a certain level of unemployment. Instead, they said they would consider " a wide range of information," including labor market conditions , inflationary pressures and financial conditions. Recall that during the last meeting of the Central Bank decided to reduce the amount of monthly bond purchases at $ 10 billion to $ 55 billion earlier Fed Chairman Janet Yellen said the bank 's readiness to begin to raise interest rates six months after the after the final collapse of the program asset purchases .

Additional pressure on the U.S. currency may have today's publication of the inflation data in the U.S.. According to the median forecast of economists producer price index is likely to rise in March by 1.0 % compared with the previous period a year earlier. Recall that in February it amounted to 0.9% ( the lowest since November 2010 ) .

EUR / USD: during the European session, the pair fell to $ 1.3871

GBP / USD: during the European session, the pair fell to $ 1.6718

USD / JPY: during the European session, the pair rose to Y101.87 and stepped

In the U.S. at 12:30 GMT will producer price index, producer price index excluding prices for food and energy in March in 13:55 GMT - consumer sentiment index from the University of Michigan in April.

EUR/USD

Offers $1.4000, $1.3970, $1.3950, $1.3930, $1.3910/15

Bids $1.3880, $1.3850/40, $1.3815-00, $1.3780

GBP/USD

Offers $1.6880, $1.6840/50, $1.6825, $1.6795/805

Bids $1.6730/25, $1.6710/00, $1.6685/80, $1.6660/50

AUD/USD

Offers $0.9500, $0.9480, $0.9435/40, $0.9415/20

Bids $0.9350, $0.9310/00, $0.9250

EUR/JPY

Offers Y142.50, Y142.15/20, Y142.00, Y141.30/35

Bids Y140.80, Y140.50, Y140.25/20

USD/JPY

Offers Y103.00, Y102.50, Y102.20/25, Y101.95/00

Bids Y101.20, Y101.00, Y100.50

EUR/GBP

Offers stg0.8330/35, stg0.8300

Bids stg0.8230, stg0.8200, stg0.8190-80

01:30 China PPI y/y March -2.0% -2.2% -2.3%

01:30 China CPI y/y March +2.0% +2.5% +2.4%

The dollar was set for the biggest weekly slide in eight months against a basket of its major peers as the Federal Reserve’s meeting minutes damped speculation that U.S. interest rates will rise. Fed policy makers cut monthly bond purchases last month by $10 billion to $55 billion. After concluding the two-day policy meeting on March 19, Fed Chair Janet Yellen said the central bank may start to increase interest rates “around six months” after ending its asset-buying program.

The greenback held a four-day decline against the euro before U.S. data that economists say will show inflation pressures are still subdued. U.S. producer prices probably rose 1.1 percent in March from a year earlier, economists forecast in a Bloomberg News survey before the figure is released today. That compares with a 0.9 percent increase in February, which matched the lowest level since at least November 2010.

The Australian and New Zealand dollars dropped as a decline in Asian shares damped demand for higher-yielding currencies.

EUR / USD: during the Asian session, the pair rose to $ 1.3900

GBP / USD: during the Asian session the pair fell to $ 1.6765

USD / JPY: during the Asian session, the pair rose to Y101.75

UK construction data at 0830GMT the morning focus.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.