- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 12-06-2012

European stocks rose for the first time in three days on speculation that the Federal Reserve will opt for more stimulus, outweighing a surge in Spanish borrowing costs to a euro-era record.

The Federal Open Market Committee holds its next policy meeting on June 20. Federal Reserve Bank of Chicago President Charles Evans said he would support a variety of measures to generate faster job growth.

Spanish borrowing costs climbed as European government bonds slumped on concern policy makers aren’t doing enough to prevent the currency bloc’s financial woes from deepening. The yield on Spain’s 10-year bonds rose 20 basis points to 6.71 percent today, after earlier breaching the euro-era record of 6.78 percent reached on Nov. 17.

Fitch cut the longer-term issuer default ratings of 18 Spanish banks today, including Bankia SA. The company downgraded Spain’s sovereign rating last week. Fitch cited concern that loans will further deteriorate.

National benchmark indexes advanced in 11 of the 18 western-European markets. France’s CAC 40 climbed 0.1 percent, the U.K.’s FTSE 100 added 0.8 percent and Germany’s DAX increased 0.3 percent. Italy’s FTSE MIB slid 0.7 percent as bank stocks retreated.

TomTom surged 16 percent to 3.80 euros, its biggest rally since October after Apple agreed to use its digital maps in the next version of its mobile software.

Lafarge climbed 2.1 percent to 31.28 euros after the world’s largest cement maker said it will increase its earnings by 1.75 billion-euro ($2.2 billion) with new products and spending reductions. That included 1.3 billion euros in cost cuts over the period.

The euro fell against most of its major counterparts after Spanish bond yields surged and Fitch Ratings said the nation won’t meet budget-deficit goals, adding to concern Europe’s debt crisis is worsening. The 17-nation currency fluctuated against the dollar after weakening for a fourth day as Spain’s 10-year bond yields reached a euro-era record. The yield on 10-year Spanish debt touched 6.83 percent, a euro-era record. Similar-maturity Italian bond yields rose 14 basis points, or 0.14 percentage point, to 6.17 percent, after reaching as high as 6.30 percent.

Fitch also cut its rating on 18 Spanish banks, citing concern about further loan deterioration. The company cut Spain’s long-term credit rating to BBB on June 7, two levels from junk status.

The yen weakened versus most peers after the International Monetary Fund said it was overvalued. Japan should consider additional monetary stimulus, including buying longer-maturity government bonds and private securities, the IMF said in a report today.

The BOJ, which starts a two-day policy meeting on June 14, refrained from adding to monetary stimulus last month after expanding its asset-purchase program in April. Japanese Finance Minister Jun Azumi earlier this month pledged to take “decisive” action on currencies after the yen climbed to 77.66 per dollar, the strongest since February.

The Dollar Index, which Intercontinental Exchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, was little changed at 82.490 after falling as much as 0.2 percent.

U.S. stocks rose, rebounding from yesterday’s slump, as speculation that policy makers will stimulate the economy overshadowed concern about Europe’s debt crisis after Fitch Ratings downgraded 18 Spanish banks.

Stocks rose after Federal Reserve Bank of Chicago President Charles Evans said he would support measures to generate faster job growth. Spanish borrowing costs jumped to the most in the history of the euro as Fitch said the nation will “significantly” miss its budget deficit targets.

The crisis in Spain, coinciding with the prospect of Greece leaving the euro after elections on June 17, has roiled markets around the world. Benchmark gauges fell yesterday, reversing earlier gains, as optimism over Spain’s bailout plan gave way to skepticism it will halt the debt crisis.

Zynga Inc. dropped 11 percent to $4.95, a record low. The biggest maker of games played on Facebook fell after analysts at Cowen & Co. said daily active users for its social gaming declined 8.2 percent in May.

Boeing (ВА) rallied 2.7 percent to $72.02. The world’s largest aerospace company was raised to outperform from market perform by Sanford C. Bernstein analyst Douglas Harned. The 12-month share-price estimate is $92.

Oil rose from an eight-month low on speculation that policy makers will do more to stimulate the economy and on expectations that U.S. inventories dropped.

Prices gained as much as 1.2 percent after Federal Reserve Bank of Chicago President Charles Evans said he would support a variety of measures to generate faster job growth. Government data will show oil inventories fell the most in almost five months last week, a Bloomberg survey of analysts showed.

The policy-setting Federal Open Market Committee will meet next week as slowing job growth at home and a deepening crisis in Europe weigh on the economic outlook. Evans, who isn’t a voting member of the FOMC this year, has been one of the most vocal proponents of additional easing.

Oil for July delivery gained to $83.72 a barrel on the New York Mercantile Exchange after dropping to $81.07, the lowest intraday level since Oct. 6. Prices are down 15 percent this year.

Brent oil for July settlement fell 55 cents, or 0.6 percent, to $97.45 a barrel on the London-based ICE Futures Europe exchange.

The price of gold rising against the backdrop of withdrawal of investors from risky assets due to concerns about whether the financial assistance of the banking system in Spain would not be able to contain the spread of the debt crisis in the eurozone.

Last Saturday Eurogroup (eurozone finance ministers' council) found it possible to provide Spanish to recapitalize troubled banks and 100 billion euros from European funds, but market participants refer to this decision with caution.

In addition, with pessimism in the markets were taken by the Finance Minister of Cyprus Vasosa Siarlisa that the country may soon turn to the EU for financial assistance, which put additional pressure on investor sentiment.

The June gold futures on the COMEX today rose to 1608.6 dollars per ounce.

Resistance 3:1350 (МА (55) for D1)

Resistance 2:1342 (Jun 11 high)

Resistance 1:1310 (session high)

Current price: 1302.00

Support 1:1298 (Jun 8-11 low, session low)

Support 2:1286 (МА (200) for D1)

Support 3:1265 (Jun 4 low)

EUR/USD $1.2450, $1.2540, $1.2625

USD/JPY Y79.00, Y79.05, Y79.25, Y79.30, Y80.00

EUR/JPY Y99.80

EUR/GBP stg0.8050

AUD/USD $0.9770, $0.9950, $1.0000

U.S. stock futures rose as speculation the Federal Reserve will take steps to stimulate the economy tempered concern about a worsening European debt crisis.

Global Stocks:

Nikkei 8,536.72 -88.18 -1.02%

Hang Seng 18,872.56 -81.07 -0.43%

Shanghai Composite 2,289.79 -16.07 -0.70%

FTSE 5,458.92 +26.55 +0.49%

CAC 3,058.17 +15.41 +0.51%

DAX 6,185.57 +44.52 +0.72%

Crude oil $83.32 (+0.75%)

Gold $1605.70 (+0.56%)

EUR/USD

Offers $1.2620, $1.2600, $1.2580/85, $1.2550/60, $1.2520/30

Bids $1.2445/40, $1.2425/20, $1.2410/00, $1.2385/80

GBP/USD

Offers $1.5650, $1.5615/25, $1.5600, $1.5550/55

Bids $1.5405/395

AUD/USD

Offers $1.0030, $1.0020, $1.0000/10, $0.9985/90, $0.9950, $0.9940

Bids $0.9850, $0.9800, $0.9775/70, $0.9750

USD/JPY

Offers Y80.20, Y80.10, Y80.00, Y79.70/80

Bids Y79.20, Y79.10/00, Y78.85/80

EUR/JPY

Offers Y101.10/20, Y101.00, Y100.75/80, Y100.45/50, Y100.30/35, Y100.00, Y99.75/80

Bids Y99.05/00, Y98.75/70, Y98.50, Y98.25/20, Y98.00, Y97.75/70

EUR/GBP

Offers stg0.8220/25, stg0.8200, stg0.8135/40, stg0.8110/20, stg0.8095/100

Bids stg0.8050/45, stg0.8015/00, stg0.7950

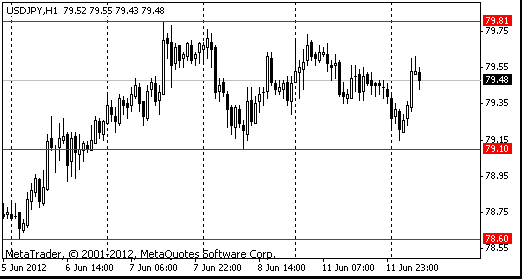

Resistance 3: Y80.55 (May 3 and 16 highs)

Resistance 2: Y80.15 (May 22 high, МА (100) for D1)

Resistance 1: Y79.80 (May 25, Jun 7-11 highs)

Current price: Y79.58

Support 1: Y79.30 (МА (100) for Н1)

Support 2: Y79.10 (session low, Jun 8 low)

Support 3: Y78.95 (МА (200) for Н1)

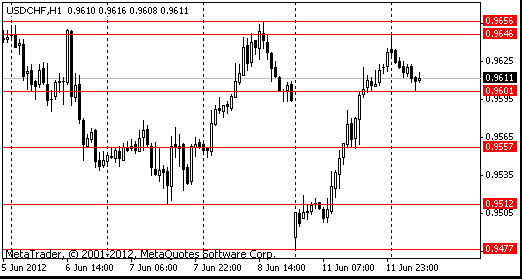

Resistance 3: Chf0.9780 (highs of 2011-2012)

Resistance 2: Chf0.9665/75 (session high, Jun 5 high)

Resistance 1: Chf0.9630 (МА (200) for Н1)

Current price: Chf0.9598

Support 1: Chf0.9590/80 (МА (100) for Н1, session low)

Support 2: Chf0.9475 (May 11 low)

Support 3: Chf0.9410 (50,0 % FIBO Chf0,9040-Chf0,9780)

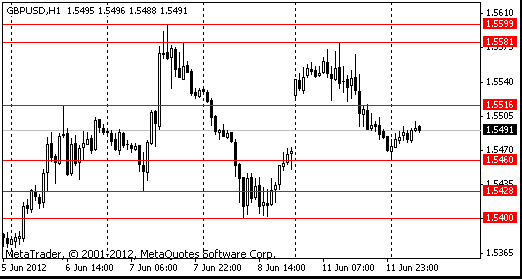

Resistance 3 : $1.5720 (area of May 24, 28-29 highs)

Resistance 2 : $1.5660 (38,2 % FIBO $1.6300-$ 1.5260)

Resistance 1 : $1.5580/600 (Jun 7 and 11 highs)

Current price: $1.5480

Support 1 : $1.5480 (МА (100) for Н1)

Support 2 : $1.5450 (session low)

Support 3 : $1.5400 (Jun 8 low)

Resistance 3 : $1.2785 (50,0 % FIBO $1,3280-$ 1,2280)

Resistance 2 : $1.2670 (38,2 % FIBO $1,3280-$ 1,2280, Jun 11 high)

Resistance 1 : $1.2520 (МА (100) for Н1)

Current price: $1.2522

Support 1 : $1.2470 (МА (200) for Н1)

Support 2 : $1.2430 (Jun 8 low)

Support 3 : $1.2400 (Jun 5 low)

EUR/USD $1.2450, $1.2540, $1.2625

USD/JPY Y79.00, Y79.05, Y79.25, Y79.30, Y80.00

EUR/JPY Y99.80

EUR/GBP stg0.8050

AUD/USD $0.9770, $0.9950, $1.0000

Asian stocks fell, with the regional benchmark index retreating from a two week high, as surging Spanish bond yields stoked concern that a bailout for the nation’s banks won’t tame the European debt crisis.

Nikkei 225 8,536.72 -88.18 -1.02%

S&P/ASX 200 4,072.9 +9.20 +0.23%

Shanghai Composite 2,289.79 -16.07 -0.70%

Esprit Holdings Ltd., a clothier that counts Europe as its No. 1 market, decreased 1 percent in Hong Kong.

Brilliance China Automotive Holdings Ltd. dropped 2 percent, pacing declines among Chinese carmakers, after the government said vehicle prices dropped in May.

BHP Billiton Ltd., the world’s biggest mining company and Australia’s largest oil producer, lost 0.6 percent in Sydney as crude and copper futures slid.

00:00 Japan BOJ Governor Shirakawa Speaks -

01:30 Australia National Australia Bank's Business Confidence May 4 -2

The yen halted gains against its major counterparts after comments by the International Monetary Fund stoked speculation global policy makers will tolerate attempts by Japan to weaken its currency. The yen fell against the euro for the first time in three days after the IMF said Japan’s currency was “moderately overvalued” and the fund’s First Deputy Managing Director David Lipton said intervention can be used to avoid a disorderly market. The Bank of Japan, which is due to start a two-day policy meeting on June 14, should ease policy further, Lipton said in Tokyo today. The BOJ refrained from adding to monetary stimulus last month after expanding its asset-purchase program in April.

The Dollar Index snapped a three-day advance as Federal Reserve Bank of Chicago President Charles Evans said he would support a variety of measures to generate faster job growth. The Chicago Fed’s Evans has been “in favor of pretty much any accommodative policy,” he said in an interview with Bloomberg Television airing today. “More asset purchases would be useful. More mortgage-backed securities purchases would be good,” said Evans, who doesn’t vote on the policy-setting Federal Open Market Committee this year.

The Australian and New Zealand dollars rallied from an earlier drop amid speculation recent losses were excessive and after a private index showed the smaller South Pacific nation’s home prices climbed last month. The so-called Aussie and kiwi declined earlier as Asian shares slid on concern Italy will become the next focus of Europe’s debt crisis after Spain requested a bailout for its banks.

EUR/USD: during the Asian session the pair restored after yesterday's falling.

GBP/USD: during the Asian session the pair traded in a range $1.5460-$1.5500.

USD/JPY: during the Asian session the pair gain to a yesterday's high.

UK data at 0830GMT sees the release of industrial production data for April. In clear focus for Tuesday, German Chancellor Angela Merkel speaks at 1200GMT at a conference organised by the CDU economic council. The Finnish PM speaks around the same time. US data continues with the 1230GMT release of the Import/Export Price Index, while at 1255GMT the Johnson Redbook weekly chain store sales are due. At 1400GMT, IMF Managing Director Christine Lagarde speaks in Washington on the UN Conference on Sustainable Development to be held in Rio De Janeiro, to the Center for Global Development.

Yesterday the euro fell against most of its major peers as Spain’s bailout spurred concern that the sovereign-debt crisis is deepening as it spreads among indebted nations before Greek elections June 17.

The 17-nation currency earlier rose, touching a two-week high, after Spain asked for as much as 100 billion euros ($126 billion) to save its banking system, making it the fourth member of the currency bloc to seek a rescue. The bailout helped move Italy to the front lines of the crisis, as bets increased Europe’s third largest economy may be the next one to succumb.

Seven months after winning a landslide victory, Spanish Prime Minister Mariano Rajoy was forced to abandon his bid to recapitalize banks without external help. The bailout loan will be channeled through the state’s bank-rescue fund, known as FROB, and extended to lenders that need it, Economy Minister Luis de Guindos Jurado said in Madrid on June 9.

Spanish and Italian 10-year bonds fell for a fourth day, reversing earlier gains. The Spanish yield rose 31 basis points to 6.52 percent, while the rate on the Italian securities climbed 27 basis points to 6.04 percent.

Italy’s economy, the third-biggest in the region, shrank 0.8 percent in the first three months of this year from the fourth quarter, Istat, the Rome-based national statistics institute said, confirming an initial estimate. Household spending decreased 1 percent and exports fell 0.6 percent.

EUR/USD: yesterday the pair fell on two figures, lowered below $1.2500.

GBP/USD: yesterday the pair fell below $1.5500.

USD/JPY: yesterday the pair traded in range Y79.35-Y79.70.

UK data at 0830GMT sees the release of industrial production data for April. In clear focus for Tuesday, German Chancellor Angela Merkel speaks at 1200GMT at a conference organised by the CDU economic council. The Finnish PM speaks around the same time. US data continues with the 1230GMT release of the Import/Export Price Index, while at 1255GMT the Johnson Redbook weekly chain store sales are due. At 1400GMT, IMF Managing Director Christine Lagarde speaks in Washington on the UN Conference on Sustainable Development to be held in Rio De Janeiro, to the Center for Global Development.

Asian stocks rose, with the regional benchmark index on course for its biggest gain in almost five months, as China’s trade data beat estimates and investors speculated a bailout for Spain’s banks will help ease Europe’s debt crisis.

Nikkei 225 8,624.9 +165.64 +1.96%

S&P/ASX 200 4,063.7 -44.87 -1.09%

Shanghai Composite 2,305.86 +24.41 +1.07%

China Cosco Holdings Co. jumped 12 percent in Hong Kong as China’s rising imports and exports boosted prospects for shipping lines.

Canon Inc., a camera maker that gets about 31 percent of sales from Europe, rose 3.5 percent in Tokyo.

Sumco Corp. surged 14 percent after the maker of silicon wafers for semiconductors posted operating profit that beat estimates. Gauges of volatility fell across the region.

European stocks erased gains in the final hour of trading, led by a selloff in Spanish and Italian lenders, as optimism faded that Spain’s 100 billion euro ($125 billion) bank bailout will contain the sovereign debt crisis.

The Spanish state’s bank-rescue fund, known as FROB, will receive the money and extend it to lenders. The sum is equivalent to about 10 percent of Spain’s gross domestic product. FROB debt counts as public debt, which amounted to 69 percent of GDP last year.

National benchmark indexes fell in 12 out of 18 western European markets. Germany’s DAX climbed 0.2 percent, the U.K.’s FTSE 100 slipped 0.1 percent and France’s CAC 40 slid 0.3 percent.

Italian lenders declined as the country’s 10-year bonds reversed an earlier advance with investors betting the country is now at the frontline of Europe’s financial woes. UniCredit SpA dropped 8.8 percent to 2.48 euros, Mediobanca SpA slid 5.6 percent to 3.05 euros and Intesa Sanpaolo SpA dropped 5.9 percent to 1.03 euros.

Volkswagen AG increased 1.3 percent to 123.45 euros and Porsche SE rose 2.4 percent to 41.41 euros after VW was said to have cleared an important hurdle toward buying the 50.1 percent of the Porsche sports-car business that it doesn’t already own.

U.S. stocks fell, following the biggest weekly rally in the Standard & Poor’s 500 Index this year, as optimism over Spain’s bailout plan gave way to skepticism it will succeed in halting the debt crisis.

Spain requested as much as 100 billion euros ($125 billion) of European bailout funds to shore up its banking system. The crisis in Spain, coinciding with the prospect of Greece leaving the euro after elections on June 17, roiled markets around the world, sending the euro to an almost two-year low on June 1 and pushing Spanish borrowing costs to near euro-era records.

Apple dropped 1.6 percent to $571.17. It unveiled the next version of its mobile software, adding maps and integration with Facebook Inc., to extend its lead over Google Inc. in the market for handheld devices and downloadable applications. It also upgraded its MacBook computers, adding faster chips and sharper displays to the high-end Pro model months before competing devices with Microsoft Corp.’s Windows arrive on store shelves.

AK Steel paced a plunge in steelmakers. The shares fell 14 percent to $4.99, the lowest price since 2004. Sal Tharani, an analyst at Goldman Sachs, cut his rating to sell. Hot-rolled steel, a benchmark product used in autos and appliances, will fall below $600 a ton, he said in a note published yesterday.

Resistance 3: Y80.55 (May 16 high)

Resistance 2: Y80.15 (May 22 high)

Resistance 1: Y79.80 (Jun 7 high)

The current price: Y79.63

Support 1: Y79.10 (Jun 8 low)

Support 2: Y78.60 (Jun 6 low)

Support 3: Y78.00/10 (area of Jun 4-5 lows)

Resistance 3: Chf0.9770 (Jun 1 high)

Resistance 2: Chf0.9720 (May 30 high)

Resistance 1: Chf0.9645/55 (area of Jun 6-12 high)

The current price: Chf0.9611

Support 1: Chf0.9600 (session low)

Support 2: Chf0.9555 (low of the American session on Jun 11)

Support 3: Chf0.9512 (Jun 7 low)

Resistance 3 : $1.5600 (Jun 7 high)

Resistance 2 : $1.5580 (Jun 11 high)

Resistance 1 : $1.5515 (high of the American session on Jun 11)

The current price: $1.5491

Support 1 : $1.5460 (session low)

Support 2 : $1.5430 (Jun 7 low)

Support 3 : $1.5400 (Jun 8 low)

Resistance 3 : $1.2625 (Jun 7 high)

Resistance 2 : $1.2565 (high of the American session on Jun 11)

Resistance 1 : $1.2505 (session high)

The current price: $1.2493

Support 1 : $1.2435/45 (area of Jun 6-12 low)

Support 2 : $1.2405 (Jun 5 low)

Support 3 : $1.2365 (May 30 low)

Change % Change Last

Gold 1,597 +6 +0.36%

Oil 81.12 -2.98 -3.54%

Change % Change Last

Nikkei 225 8,624.9 +165.64 +1.96%

S&P/ASX 200 4,063.7 -44.87 -1.09%

Shanghai Composite 2,305.86 +24.41 +1.07%

FTSE 100 5,432.37 -2.71 -0.05%CAC 40 3,042.76 -8.93 -0.29%

DAX 6,141.05 +10.23 +0.17%

Dow 12,411 -143 -1.14%

Nasdaq 2,810 -49 -1.70%

S&P 500 1,309 -17 -1.26%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2466 -0,40%

GBP/USD $1,5470 +0,01%

USD/CHF Chf0,9632 +0,39%

USD/JPY Y79,39 -0,09%

EUR/JPY Y98,95 -0,53%

GBP/JPY Y122,80 -0,10%

AUD/USD $0,9855 -0,61%

NZD/USD $0,7678 -0,30%

USD/CAD C$1,0320 +0,57%

00:00 Japan BOJ Governor Shirakawa Speaks -

00:15 U.S. FOMC Member Charles Evans Speaks -

01:30 Australia National Australia Bank's Business Confidence May 4

05:45 Switzerland SECO Economic Forecasts Quarter III

08:30 United Kingdom Industrial Production (MoM) April -0.3% +0.2%

08:30 United Kingdom Industrial Production (YoY) April -2.6% -0.9%

08:30 United Kingdom Manufacturing Production (MoM) April +0.9% +0.1%

08:30 United Kingdom Manufacturing Production (YoY) April -0.9% +0.4%

12:30 U.S. Import Price Index May -0.5% -1.0%

14:00 United Kingdom NIESR GDP Estimate May +0.1%

15:30 U.S. FOMC Member Tarullo Speaks -

18:00 U.S. Federal budget May 59.1 -107.2

22:00 New Zealand Westpac Consumer Sentiment Quarter II 102.4

23:01 United Kingdom Nationwide Consumer Confidence May 44 45

23:10 Australia RBA's Governor Glenn Stevens Speech -

23:50 Japan Core Machinery Orders April -2.8% +1.9%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.