- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 15-06-2012

European stocks rose to the highest this month after the Bank of England announced credit-easing measures, boosting optimism central banks will take steps to stimulate the global economy.

BOE Governor Mervyn King said in a speech late yesterday that the case for more stimulus in the U.K. is growing. He also unveiled two plans to improve cash supply to the banking system.

A “funding-for-lending” program will allow banks to swap assets with the BOE for money to be loaned their customers. The central bank will also activate an unused facility to inject at least 5 billion pounds ($7.8 billion) a month into the system at a minimum rate of 25 basis points more than the benchmark interest rate, now at a record low of 0.5 percent.

National benchmark indexes advanced in all of the 18 western-European markets except Iceland. The U.K.’s FTSE 100 added 0.2 percent and Germany’s DAX rallied 1.5 percent. France’s CAC 40 climbed 1.8 percent.

Telekom Austria AG advanced 1.4 percent to 8.15 euros after America Movil agreed to acquire a 21 percent stake in the company from investor Ronny Pecik. The acquisition is part of America Movil’s strategy to establish a foothold in Europe as the debt crisis lowers the value of telecommunications assets.

The euro strengthened against the dollar for a second week as investors reduced record bets against the currency before Greece’s June 17 election, and amid speculation central banks may provide aid to financial markets.

The 17-nation currency pared earlier losses against the dollar on concern its decline since April has been overdone. Central banks are preparing for coordinated action to provide liquidity, if needed, after a general election in Greece in two days, Reuters reported. The dollar headed for weekly declines versus major peers as weaker U.S. growth added to the case for further monetary stimulus from the Federal Reserve.

The yen strengthened the most in two weeks against the dollar after the Bank of Japan refrained from expanding monetary stimulus that debases the currency. The central bank kept its asset-purchase fund at 40 trillion yen ($510 billion) today, matching the forecasts of economists.

The Dollar Index, which Intercontinental Exchange Inc. uses to track the greenback against the currencies of six U.S. trading partners, slipped for a fourth day, falling as much as 0.5 percent to 81.615, the least since May 23. It was down 1 percent for the week.

U.S. stocks advanced, sending the Standard & Poor’s 500 Index toward a second weekly rally, amid speculation global central banks will take steps to boost economies as investors awaited Greek elections this weekend.

Central banks intensified warnings that Europe’s failure to tame its debt crisis threatens the economy as Greece’s election in two days looms as the next flashpoint for investors. A victory by Syriza, the party that promises to renege on Greece’s end of the bailout, could speed the nation’s exit from the euro. The Group of 20 leaders prepare to gather in Mexico next week, and U.S. policy makers meet June 19-20.

Stocks rose today even as economic data disappointed. Industrial production unexpectedly fell in May for the second time in three months as factories turned out fewer vehicles and consumer goods. Confidence among U.S. consumers declined in June to the lowest level this year. Manufacturing in the New York region expanded in June at the slowest pace in seven months.

Some of the largest companies gained today. Microsoft (MSFT), the world’s largest software maker, added 2 percent to $29.92. Dow Chemical, the biggest U.S. chemical company by revenue, increased 2.7 percent to $32.87.

Facebook rose 2.1 percent to $28.87, extending its weekly advance to 6.5 percent. The company told regulators ahead of its initial public offering that the midpoint of its proposed price range wasn’t “meaningfully different” from a $30.89 per-share fair value estimate earlier this year.

SAIC Inc. jumped 3.2 percent to $12.03. The defense contractor specializing in computer services was raised to overweight from neutral at JPMorgan Chase & Co. The 6-month share-price estimate is $13.

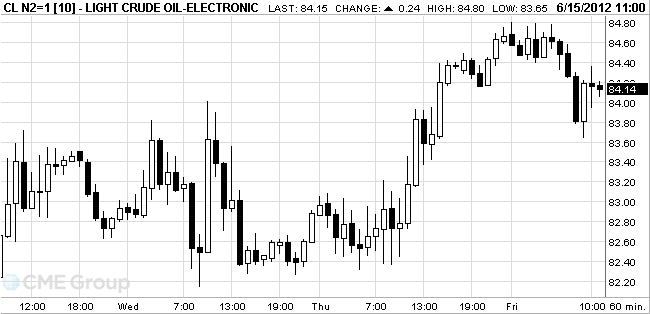

Oil fluctuated in New York amid speculation that central banks will take steps to bolster global economic growth.

Futures climbed as much as 1.1 percent and dropped 0.3 percent as policy makers from the U.K. to Japan and Canada stepped up warnings about the threat to world financial markets should Europe fail to contain its debt crisis. Greek elections June 17 may determine whether the country remains in the euro bloc. The Federal Reserve starts a two-day meeting June 19.

Bank of England Governor Mervyn King said late yesterday that the case for more stimulus in the U.K. “is growing.”

Greeks will vote for the second time in six weeks after a May 6 ballot failed to yield a government. The constitution permits a third election, too. The final polls, published on June 1, showed no party set to win a majority. Exit polls will be released when voting ends at 7 p.m. June 17 in Athens, with a first official result estimate due around 9:30 p.m.

Crude for July delivery rose to $84.80 a barrel on the New York Mercantile Exchange. Prices are down 0.1 percent this week and 15 percent this year.

Brent oil for August settlement gained 64 cents, or 0.7 percent, to $97.81 a barrel on the London-based ICE Futures Europe exchange.

Gold prices rise on Friday after weak statistical data from the U.S. increased the demand for the metal as a safe asset and increased the likelihood of new measures to support the economy by the Fed.

A day earlier, it was reported that the number of initial claims for unemployment benefits for the past week has increased by 6000 and reached 386,000, while the number of initial claims for the previous week was revised upward - up to 380,000 from 377,000. Analysts had expected a reduction in the number of applications during the period of two thousand unrevised from the previous rate - up to 375,000.

U.S. Trade Ministry said that annual inflation in the country in May slowed to 1.7% from 2.3% in April, and in monthly terms, consumer prices last month fell by 0.3%, which is the first in two years and the largest decline over the past 3.5 years. Analysts had expected a reduction in inflation in monthly terms by 0.2% and slowing its rate to 1.8% - in year.

Investor sentiment also affected by pessimistic developments in Europe, and pushes to the thoughts of the possibility of coordinated action by global central banks to support the economy. On the eve of the Spanish ten-year government bond yield exceeded the record high of 7%.

In addition, in advance of weekend investors are waiting for the parliamentary elections in Greece, which will be held on Sunday. Pending the outcome of this event, investment in gold looks more secure.

The June gold futures on the COMEX today rose to 1630.0 dollars per ounce.

Resistance 3:1350 (МА (55) for D1)

Resistance 2:1342 (Jun 11 high)

Resistance 1:1332 (Jun 12-13 high)

Current price: 1330.00

Support 1:1306 (МА (200) for Н1)

Support 2:1298 (Jun 8-12 lows)

Support 3:1290 (МА (200) for D1)

EUR/USD $1.2500, $1.2560, $1.2600, $1.2750

USD/JPY Y79.00, Y79.25, Y79.50, Y79.60, Y80.00

EUR/JPY Y100.30

EUR/GBP stg0.8025

AUD/USD $1.0000, $0.9900

U.S. stock futures advanced on speculation central banks will act to boost economies as Europe’s debt crisis threatens growth.

Equity futures pared gains as a report showed the manufacturing in the New York region expanded in June at the slowest pace in seven months as orders and sales cooled.

Global Stocks:

Nikkei 8,569.32 +0.43 +0.01%

Hang Seng 19,233.94 +425.54 +2.26%

Shanghai Composite 2,306.85 +10.90 +0.47%

FTSE 5,466.44 -0.61 -0.01%

CAC 3,066.97 +34.52 +1.14%

DAX 6,191.41 +52.80 +0.86%

Crude oil $83.77 (-0.17%)

Gold $1624.30 (+0.29%)

China +$1.5bn

Japan -$10.2bn

Brazil +$8.6bn

OPEC -$4.9bn

UK +$32.3bn

The new orders index declined six points to 2.2, and the shipments index fell a steep nineteen points to 4.8.

Price indexes were markedly lower, with the prices paid index falling eighteen points to 19.6 and the prices received index dropping eleven points to 1.0.

Employment indexes also retreated, though they still indicated a small increase in employment levels and a slightly longer average workweek.

Indexes for the six-month outlook were generally lower than last months levels, suggesting that optimism was waning somewhat, with the future general business conditions index falling to 23.1, its fifth consecutive monthly decline.

In a series of supplementary questions, manufacturers were asked about their capital spending plans: 43 percent said that they expected to

increase capital spending over the next six to twelve months, while just 16 percent planned reductions.

Data:

06:50 Eurozone ECB President Mario Draghi Speaks -

08:30 United Kingdom Trade in goods April -8.6 -8.5 -10.1

09:00 Eurozone Employment Change Quarter I -0.2% -0.2% -0.2%

09:00 Eurozone Trade Balance s.a. April 4.3 4.2 6.2

Sterling dropped against all of its 16 major peers after Bank of England Governor Mervyn King presented joint steps with the Treasury to increase the flow of credit to U.K. banks and said the case for more stimulus is “growing.” Two-year note yields approached a record low and implied yields on interest- rate futures slid as investors added to bets for lower borrowing costs.

The yen strengthened at least 0.3 percent against all of its 16 most-traded counterparts after the Bank of Japan refrained from expanding monetary stimulus that debases the currency.

The dollar was set for weekly declines versus most major peers before U.S. data that may show production slowed and consumer confidence fell, adding to the case for further easing by the Federal Reserve. The central banks of the world’s biggest economies are preparing for coordinated action to provide liquidity if needed after a general election in Greece this weekend widely seen as a referendum on keeping the nation in the euro, Reuters reported earlier.

EUR/USD: the pair traded in a range $1.2610-$1.2645.

GBP/USD: the pair in the beginning trading session fell, however restored later.

USD/JPY: in current of the European session the pair continued falling.

US data starts at 1230GMT when the NY Fed Empire State Manufacturing Index is expected to fall to a reading of 13.5 in June after see-sawing sharply in the previous two months. At 1315GMT, industrial production is expected to hold steady in May after the April rebound. At 1355GMT, the Michigan Sentiment Index is expected to fall to a reading of 77.8 in early-June after rising in each of the last nine months.

EUR/USD

Offers $1.2740/50, $1.2690/710, $1.2670/80, $1.2650

Bids $1.2550/40, $1.2525/20, $1.2480-70, $1.2445/40

GBP/USD

Offers $1.5601, $1.5570, $1.5540, $1.5650, $1.5515/20

Bids $1.5475/70, $1.5455/50, $1.5435/30, $1.5405/395, $1.5350

USD/JPY

Offers Y80.20, Y80.10, Y80.00, Y79.80, Y79.40/50

Bids Y78.80/70, Y78.50, Y78.10/00

EUR/JPY

Offers Y101.10/20, Y101.00, Y100.75/80, Y100.35/50

Bids Y99.20/00, Y98.75/70, Y98.50, Y98.25/20, Y98.00

EUR/GBP

Offers stg0.8220/25, stg0.8200, stg0.8135/40

Bids stg0.8100, stg0.8085/80, stg0.8050/40, stg0.8025/20, stg0.8015/00, stg0.7950

Resistance 3: Y79.80 (May 25 high)

Resistance 2: Y79.50 (session high, Jun 14 high)

Resistance 1: Y79.10 (area of Jun 8-14 low)

The current price: Y78.85

Support 1: Y78.75 (50,0% FIBO Y77,60-Y79,80)

Support 2: Y78.50 (61.8% FIBO Y77,60-Y79,80)

Support 3: Y78.10 (Jun 5 low)

Resistance 3: Chf0.9650 (area of Jun 6-12 highs)

Resistance 2: Chf0.9570/80 (Jun 14 high, МА (100) for Н1, МА (200) for Н1)

Resistance 1: Chf0.9520 (session high)

The current price: Chf0.9507

Support 1: Chf0.9475 (Jun 11 low)

Support 2: Chf0.9410 (50,0% FIBO Chf0,9040-Chf0,9780)

Support 3: Chf0.9370 (May 21 low)

Resistance 3 : $1.5660 (38,2% FIBO $1.6300-$1.5260)

Resistance 2 : $1.5600 (area of Jun 7-13 highs)

Resistance 1 : $1.5565 (Jun 14 high)

The current price: $1.5542

Support 1 : $1.5480/70 (Jun 14 low, МА (200) for Н1, support line from Jun 12)

Support 2 : $1.5450 (Jun 12 low)

Support 3 : $1.5400 (Jun 8 low)

Resistance 3 : $1.2820 (May 21 high)

Resistance 2 : $1.2785 (50,0% FIBO $1,3280-$1,2280)

Resistance 1 : $1.2670 (38,2% FIBO $1,3280-$1,2280, Jun 11 high)

The current price: $1.2630

Support 1 : $1.2610 (session low)

Support 2 : $1.2590 (resistance line from May 21)

Support 3 : $1.2540 (May 14 low)

European stocks rose on speculation central banks will take steps to stimulate the global economy and as investors awaited the outcome of Greek elections this weekend. U.S. index futures and Asian shares gained.

FTSE 100 5,513.34 +46.29 +0.85%

CAC 40 3,065.88 +33.43 +1.10%

Xetra DAX 6,189.64 +51.03 +0.83%

EUR/USD $1.2500, $1.2560, $1.2600, $1.2750

USD/JPY Y79.00, Y79.25, Y79.50, Y79.60, Y80.00

EUR/JPY Y100.30

EUR/GBP stg0.8025

AUD/USD $1.0000, $0.9900

Asian stocks gained, with the regional benchmark index heading for its biggest weekly advance in almost five months, as optimism that central banks from China to the U.S. will act to stimulate economic growth tempered concerns Europe’s debt crisis will worsen.

Nikkei 225 8,569.32 +0.43 +0.01%

S&P/ASX 200 4,057.33 +15.09 +0.37%

Shanghai Composite 2,306.85 +10.90 +0.47%

Agricultural Bank of China Ltd., the nation’s third-largest lender by market value, climbed 2.1 percent. Esprit Holdings Ltd. gained 9.2 percent in Hong Kong, heading for its first advance in three days, as the clothier said it will continue with its transformation strategy after both its chairman and chief executive officer quit. DeNA Co., Japan’s biggest social- gaming operator, jumped 12 percent in Tokyo after announcing plans to buy back shares.

02:30 Japan BoJ Interest Rate Decision - 0.10% 0.10% 0.10%

02:30 Japan BoJ Monetary Policy Statement

The yen strengthened against all of its 16 major counterparts after the Bank of Japan refrained from expanding monetary stimulus that debases the currency. The BOJ kept its asset-purchase fund at 40 trillion yen ($506 billion) today, matching the forecasts of 13 economists surveyed by Bloomberg News.

The central bank unexpectedly increased the fund on Feb. 14 and introduced a 1 percent inflation goal. That triggered a 1.1 percent drop in the yen that day against the dollar, then the most since Oct. 31 when Japan intervened in to stem a gain in its currency.

The dollar was set for weekly declines versus most major peers before U.S. data that may show production slowed and consumer confidence fell, adding to the case for further easing by the Federal Reserve. U.S. data due today are projected to show the recovery in the world’s largest economy is losing momentum. Growth in industrial production probably slowed to 0.1 percent last month from 1.1 percent in April, according to the median estimate of economists surveyed by Bloomberg News.

A gauge of manufacturing in the New York region fell to 13 in June from 17.1 in May, a separate survey showed. The Thomson Reuters/University of Michigan preliminary index of sentiment declined to 77.5 this month from 79.3 in May, the highest since October 2007, economists forecast.The central banks of major economies are preparing for coordinated action to provide liquidity if needed after the general election in Greece this weekend, Reuters reported earlier.

Demand for the euro was damped after Moody’s Investors Service downgraded five Dutch banking groups. In a statement dated today, the rating company cited risks to the economic outlook and “fragile” investor confidence in Europe.

EUR/USD: during the Asian session the pair updated a week’s high.

GBP/USD: during the Asian session the pair fell.

USD/JPY: during the Asian session the pair fell below Y79.00.

Also at 0900GMT, German Chancellor Angela Merkel is due to deliver a speech at a business conference, in Berlin, while at 0930GMT,

German Finance Minister Wolfgang Schaeuble is also due to deliver a speech. UK data at 0830GMT includes Trade data as well as Construction Output. US data starts at 1230GMT when the NY Fed Empire State Manufacturing Index is expected to fall to a reading of 13.5 in June after see-sawing sharply in the previous two months. At 1315GMT, industrial production is expected to hold steady in May after the April rebound. At 1355GMT, the Michigan Sentiment Index is expected to fall to a reading of 77.8 in early-June after rising in each of the last nine months.

Yesterday the dollar fell for a second day against the yen after reports signaled a slowing U.S. economy, boosting the case for the Federal Reserve to take more steps to bolster growth.

The U.S. currency declined versus 15 of its 16 major peers after initial jobless claims rose last week and inflation declined in May. The consumer price index fell 0.3 percent, more than forecast and the biggest drop since December 2008, after no change the prior month, the Labor Department reported today in Washington. Claims for jobless benefits unexpectedly climbed by 6,000 to 386,000 in the week ended June 9 from a revised 380,000 the prior week that was more than first estimated, Labor Department figures showed today in Washington.

The euro rose versus the dollar on bets its 5 percent decline since April was overdone even as Spanish bond yields rose to a record after Moody’s Investors Service cut the nation’s credit rating. The euro fell earlier against the yen after Italy’s costs of borrowing for three years climbed to the highest since December at an auction. Investors were also waiting for an election in Greece this weekend that may indicate whether the nation will remain in the euro bloc.

Moody’s yesterday cut Spain’s rating three steps to Baa3, one level above junk, citing its increased debt burden and weakening economy. The Spanish 10-year yield climbed as much as 25 basis points, or 0.25 percentage point, to a euro-era record 6.998 percent.

New Zealand’s dollar rallied against all 16 major counterparts after the central bank gave no immediate sign it would cut interest rates when it kept its benchmark at a record low.

The kiwi approached a one-month high after Reserve Bank of New Zealand Governor Alan Bollard said the current exchange rate is more comfortable than March and signaled he expects to hold the 2.5 percent official cash rate till mid-2013.

- WORSE EUROPEAN CRISIS TO HAVE BIG EFFECT WORLD

- MUST KEEP JAPAN FINANCIAL SYSTEM STABLE

- EUROPEAN DEBT REMAIN BIGGEST RISK TO WATCH

- CEN BANKS KEEPING IN CLOSE TOUCH ON EUROPE

- Central banks watching European debt crisis

- CENTRAL BANKS WATCHING EUROPEAN DEBT CRISIS

Asian stocks fell, with the regional index heading for its third drop in five days, as Spain’s credit rating was cut and economic reports in the U.S and Europe added to concern the global economy is slowing.

Nikkei 225 8,568.89 -18.95 -0.22%

S&P/ASX 200 4,042.2 -21.59 -0.53%

Shanghai Composite 2,295.95 -22.98 -0.99%

Hutchison Whampoa Ltd., which operates ports in Germany and Spain, slid 1.5 percent in Hong Kong.

Esprit Holdings Ltd. sank 12 percent as the clothier’s chief executive officer and chairman quit within 24 hours of each other.

James Hardie Industries SE, a building-materials supplier that counts the U.S. as its biggest market, lost 2.1 percent in Sydney as retail sales in the world’s largest economy dropped.

European stocks dropped for a second day as Moody’s Investors Service downgraded Spain and Cyprus, while Switzerland’s central bank said that Credit Suisse Group AG must increase its capital this year.

Moody’s cut Spain’s rating by three steps to Baa3 from A3 late yesterday, citing the nation’s increased debt burden, weakening economy and limited access to capital markets. Moody’s also lowered Cyprus’s bond rating to Ba3 from Ba1, attributing the downgrade to the increased likelihood of Greece leaving the euro area. The country’s government may have to give more support to Cypriot banks as a consequence.

The yield on Spain’s 10-year debt rallied as high as 6.998 percent today, the highest since before the Mediterranean nation started using the euro in 1999.

Italy sold 4.5 billion euros ($5.7 billion) of debt, matching its maximum target, at an auction. The country’s Treasury sold 3 billion euros of its three-year benchmark bond to yield 5.3 percent. That compared with a yield of 3.91 percent when it last sold the securities on May 14.

National benchmark indexes gained in 10 of the 18 western- European markets today. The U.K.’s FTSE 100 dropped 0.3 percent and Germany’s DAX slipped 0.2 percent. France’s benchmark CAC 40 added 0.1 percent. Greece’s ASE Index rallied 10 percent for its biggest climb since August.

Nokia slumped 18 percent to 1.83 euros, its lowest price since 1996 and its biggest tumble since 2001. The mobile-phone maker struggling to recover lost market share predicted that second-quarter operating margins at its devices unit will worsen. The company plans to cut as many as 10,000 jobs and close facilities.

Bayerische Motoren Werke AG (BMW), the world’s biggest maker of luxury vehicles, dropped 2.6 percent to 56.29 euros. Daimler AG, the third-largest maker of luxury autos, decreased 2 percent to 33.60 euros. Morgan Stanley reduced its earnings-per-share prediction for the carmakers by 5 percent to 10 percent for 2012 to 2014.

Glencore International Plc and Xstrata Plc slipped 3.8 percent to 341.7 pence and 2.2 percent to 899.6 pence, respectively, as a gauge of mining companies lost 1.1 percent.

U.S. stocks rose, erasing most of this week’s loss in the Standard & Poor’s 500 Index, as data on inflation and jobless claims fueled bets the Federal Reserve will act to spur growth and investors awaited Greek elections.

Speculation grew that the Fed will discuss stimulus efforts at its meeting next week after reports showed jobless claims unexpectedly climbed by 6,000 to 386,000 last week and the cost of living fell by the most in more than three years.

The Labor Department reported today that the consumer price index fell 0.3 percent, more than forecast and the biggest drop since December 2008, after no change the prior month. Economists projected a 0.2 percent decrease, according to the median estimate in a Bloomberg News survey.

Home Depot (HD), the largest U.S. home-improvement retailer, climbed 2 percent to $51.97 and McDonald’s (MCD), the world’s largest restaurant chain, advanced 1.6 percent to $89.40.

International Game Technology rallied 11 percent, the most in the S&P 500, to $14.63. The maker of casino machines authorized a share buyback plan of as much as $1 billion in an effort to reward investors after a 23 percent stock drop this year.

Kroger Co. climbed 4.3 percent to $22.21. The largest U.S. grocery-store chain said profit for the year ending Jan. 31 will be as much as $2.40 a share, up from a prior forecast of as much as $2.38. Kroger also said its board approved a new $1 billion share buyback program, replacing an authorization that was exhausted on June 12.

Resistance 3: Y79.80 (May 25, Jun 7-11 highs)

Resistance 2: Y79.50 (session high, Jun 14 high)

Resistance 1: Y79.10 (earlier support, area of Jun 8, 12 and 14 lows)

Current price: Y78.83

Support 1: Y78.75 (50,0 % FIBO Y77,60-Y79,80)

Support 2: Y78.50 (61.8 % FIBO Y77,60-Y79,80)

Support 3: Y78.10 (Jun 5 low)

Resistance 3: Chf0.9780 (highs of 2011-2012)

Resistance 2: Chf0.9650 (area Jun 6, 8-12 highs)

Resistance 1: Chf0.9570/80 (Jun 14 high, МА (100) for Н1, МА (200) for Н1)

Current price: Chf0.9502

Support 1: Chf0.9475 (Jun 11 low)

Support 2: Chf0.9410 (50,0 % FIBO Chf0,9040-Chf0,9780)

Support 3: Chf0.9370 (May 21 low)

Resistance 3 : $1.5660 (38,2 % FIBO $1.6300-$ 1.5260)

Resistance 2 : $1.5600 (area of Jun 7, 11 and 13 highs)

Resistance 1 : $1.5560 (Jun 14 high)

Current price: $1.5548

Support 1 : $1.5530 (МА (100) for Н1)

Support 2 : $1.5480/70 (Jun 14 low, МА (200) for Н1, support line from Jun 12)

Support 3 : $1.5400 (Jun 8 low)

Resistance 3 : $1.2820 (May 21 high)

Resistance 2 : $1.2785 (50,0 % FIBO $1,3280-$ 1,2280)

Resistance 1 : $1.2670 (38,2 % FIBO $1,3280-$ 1,2280, Jun 12 high)

Current price: $1.262

Support 1 : $1.2590 (resistance line from May 21 broken yesterday)

Support 2 : $1.2540/00 (May 14 low, МА (200) for Н1, МА (100) for Н1)

Support 3 : $1.2440 (Jun 8 and 12 lows)

Nikkei 225 8,568.89 -18.95 -0.22%

S&P/ASX 200 4,042.2 -21.59 -0.53%

Shanghai Composite 2,295.95 -22.98 -0.99%

FTSE 100 5,467.05 -16.76 -0.31%

CAC 40 3,032.45 +2.41 +0.08%

DAX 6,138.61 -13.88 -0.23%

Dow 12,652 +156 +1.24%

Nasdaq 2,836 +18 +0.63%

S&P 500 1,329 +14 +1.08%

EUR/USD $1,2634 +0,55%

GBP/USD $1,5553 +0,27%

USD/CHF Chf0,9508 -0,61%

USD/JPY Y79,40 -0,03%

EUR/JPY Y100,26 +0,45%

GBP/JPY Y123,46 +0,19%

AUD/USD $1,0020 +0,75%

NZD/USD $0,7822 +0,79%

USD/CAD C$1,0229 -0,62%

02:30 Japan BoJ Interest Rate Decision - 0.10% 0.10% 0.10% 02:30 Japan BoJ Monetary Policy Statement - 06:50 Eurozone ECB President Mario Draghi Speaks - 07:30 Japan BOJ Press Conference - 08:30 United Kingdom Trade in goods April -8.6 -8.5 09:00 Eurozone Employment Change Quarter I -0.2% -0.2% 09:00 Eurozone Trade Balance s.a. April 4.3 4.2 12:30 Canada Manufacturing Shipments (MoM) April +1.9% +2.2% 12:30 U.S. NY Fed Empire State manufacturing index June 17.09 14.1 13:00 U.S. Net Long-term TIC Flows April 36.2 45.3 13:00 U.S. Total Net TIC Flows April -49.9 13:15 U.S. Industrial Production (MoM) May +1.1% +0.1% 13:15 U.S. Capacity Utilization May 79.2% 79.2% 13:55 U.S. Reuters/Michigan Consumer Sentiment Index (preliminary) June 79.3 77.5

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.