- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Leading Index | May | -0.1% | |

| 06:00 | Germany | Producer Price Index (YoY) | May | 2.5% | 2.1% |

| 06:00 | Germany | Producer Price Index (MoM) | May | 0.5% | 0.2% |

| 08:00 | Eurozone | Current account, unadjusted, bln | April | 35.1 | 10.6 |

| 08:30 | United Kingdom | Retail Price Index, m/m | May | 1.1% | 0.2% |

| 08:30 | United Kingdom | Producer Price Index - Output (YoY) | May | 2.1% | 1.7% |

| 08:30 | United Kingdom | Producer Price Index - Input (YoY) | May | 3.8% | 0.8% |

| 08:30 | United Kingdom | Producer Price Index - Input (MoM) | May | 1.1% | 0.2% |

| 08:30 | United Kingdom | Producer Price Index - Output (MoM) | May | 0.3% | 0.2% |

| 08:30 | United Kingdom | Retail prices, Y/Y | May | 3% | 2.9% |

| 08:30 | United Kingdom | HICP ex EFAT, Y/Y | May | 1.8% | 1.7% |

| 08:30 | United Kingdom | HICP, m/m | May | 0.6% | 0.3% |

| 08:30 | United Kingdom | HICP, Y/Y | May | 2.1% | 2% |

| 09:00 | Eurozone | Construction Output, y/y | April | 6.3% | 1.9% |

| 12:30 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 12:30 | Canada | Bank of Canada Consumer Price Index Core, y/y | May | 1.5% | 1.2% |

| 12:30 | Canada | Consumer Price Index m / m | May | 0.4% | 0.2% |

| 12:30 | Canada | Consumer price index, y/y | May | 2% | 2.1% |

| 13:00 | Switzerland | SNB Quarterly Bulletin | |||

| 14:00 | Eurozone | ECB President Mario Draghi Speaks | |||

| 14:30 | U.S. | Crude Oil Inventories | June | 2.206 | -0.481 |

| 18:00 | U.S. | Fed Interest Rate Decision | 2.5% | 2.5% | |

| 18:00 | U.S. | FOMC Economic Projections | |||

| 18:00 | U.S. | FOMC Statement | |||

| 18:30 | U.S. | FOMC Press Conference | |||

| 22:45 | New Zealand | GDP y/y | Quarter I | 2.3% | 2.4% |

| 22:45 | New Zealand | GDP q/q | Quarter I | 0.6% | 0.6% |

Major US stock indexes have increased significantly, as comments by US President Donald Trump about the resumption of US-China trade negotiations have increased the optimism of market participants awaiting Fed policy easing.

Trump reported on Twitter that he “had a very good telephone conversation” with President Xi. He added: “Next week we will have an extended meeting at the (G-20) summit in Japan. Our special teams will begin negotiations before our meeting. ” The summit will begin on June 28th. Chinese media reported that President Xi confirmed a meeting with Trump on the G-20.

It is expected that the US central bank will leave interest rates unchanged following its two-day meeting, which will begin on Tuesday, but will lay the foundation for rate cuts later this year. According to the FedWatch CME Group tool, traders expect three rate cuts by the end of the year. The decision of the Fed on rates will be announced at 18:00 GMT on Wednesday. Fed Chairman Jerome Powell will also hold a press conference after the announcement.

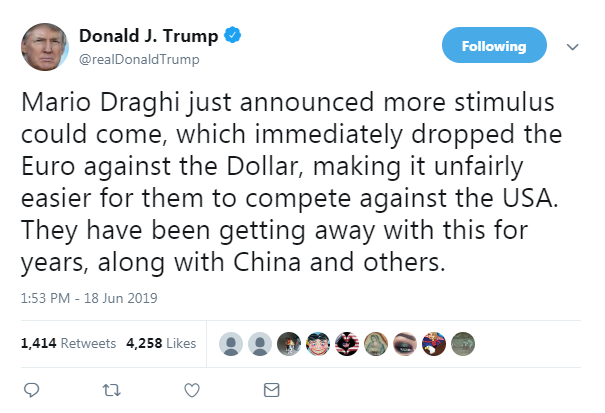

Investors also welcomed the prospect of additional stimulus from the European Central Bank. Draghi, president, the ECB said today that it may be necessary to soften the policy again through new rate cuts or asset purchases if inflation does not return to its goal.

Against this background, ambiguous data on the US real estate market went unnoticed. As the report of the Ministry of Commerce showed, the volume of housing construction in the past month decreased by 0.9% to the annual norm, taking into account seasonal fluctuations of 1.269 million units, amid falling home construction for one family. The data for April were revised upwards to show that housing construction is growing at a rate of 1,281 million units instead of an increase to 1,235 million units, as previously reported. Economists had forecast that housing construction would increase to 1,239 million units in May. At the same time, building permits rose by 0.3% to 1.294 million units in May. This was the second monthly increase in permits.

Most of the components of DOW finished trading in positive territory (24 out of 30). The growth leader was the shares of The Boeing Company (BA; + 5.55%). The Procter & Gamble Co. shares turned out to be an outsider. (PG; -1.21%).

Almost all sectors of the S & P recorded an increase. The largest growth was shown by the industrial goods sector (+ 2.0%). Only the utility sector decreased (-0.2%).

At the time of closing:

Dow 26,465.54 +353.01 +1.35%

S & P 500 2,917.75 +28.08 +0.97%

Nasdaq 100 7,953.88 +108.86 +1.39%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Leading Index | May | -0.1% | |

| 06:00 | Germany | Producer Price Index (YoY) | May | 2.5% | 2.1% |

| 06:00 | Germany | Producer Price Index (MoM) | May | 0.5% | 0.2% |

| 08:00 | Eurozone | Current account, unadjusted, bln | April | 35.1 | 10.6 |

| 08:30 | United Kingdom | Retail Price Index, m/m | May | 1.1% | 0.2% |

| 08:30 | United Kingdom | Producer Price Index - Output (YoY) | May | 2.1% | 1.7% |

| 08:30 | United Kingdom | Producer Price Index - Input (YoY) | May | 3.8% | 0.8% |

| 08:30 | United Kingdom | Producer Price Index - Input (MoM) | May | 1.1% | 0.2% |

| 08:30 | United Kingdom | Producer Price Index - Output (MoM) | May | 0.3% | 0.2% |

| 08:30 | United Kingdom | Retail prices, Y/Y | May | 3% | 2.9% |

| 08:30 | United Kingdom | HICP ex EFAT, Y/Y | May | 1.8% | 1.7% |

| 08:30 | United Kingdom | HICP, m/m | May | 0.6% | 0.3% |

| 08:30 | United Kingdom | HICP, Y/Y | May | 2.1% | 2% |

| 09:00 | Eurozone | Construction Output, y/y | April | 6.3% | 1.9% |

| 12:30 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 12:30 | Canada | Bank of Canada Consumer Price Index Core, y/y | May | 1.5% | 1.2% |

| 12:30 | Canada | Consumer Price Index m / m | May | 0.4% | 0.2% |

| 12:30 | Canada | Consumer price index, y/y | May | 2% | 2.1% |

| 13:00 | Switzerland | SNB Quarterly Bulletin | |||

| 14:00 | Eurozone | ECB President Mario Draghi Speaks | |||

| 14:30 | U.S. | Crude Oil Inventories | June | 2.206 | -0.481 |

| 18:00 | U.S. | Fed Interest Rate Decision | 2.5% | 2.5% | |

| 18:00 | U.S. | FOMC Economic Projections | |||

| 18:00 | U.S. | FOMC Statement | |||

| 18:30 | U.S. | FOMC Press Conference | |||

| 22:45 | New Zealand | GDP y/y | Quarter I | 2.3% | 2.4% |

| 22:45 | New Zealand | GDP q/q | Quarter I | 0.6% | 0.6% |

- Core inflation remains muted. There is a certain disconnect with the current data and market-based expectations

- Inflation path is converging more slowly than before

- Some market-based inflation indicators lost information content

- Agrees to talk with Trump during G20

- Hopes two sides can keep in contact on resolving disputes

- Says that agreed trade teams should keep talking to solve issues

- Says flexibility cannot be used without limit, MPC has set out a framework for policy trade-off

- BoE retains the ability to relaunch the term funding scheme as necessary

- Says his comments at ECB panel have no bearing on BoE policy announcement on Thursday

Statistics

Canada released its Monthly Survey of Manufacturing on Tuesday, which showed

that the Canadian manufacturing sales declined 0.6 percent m-o-m in April to

CAD57.78 billion, following a revised 2.6 percent m-o-m surge in March

(originally a 2.1 percent m-o-m gain).

Economists had

anticipated an advance of 0.4 percent m-o-m for April.

According to

the survey, sales decreased in 8 of 21 industries, representing 36.1 percent of

total manufacturing sales. The transportation equipment (-6.7 percent m-o-m) and

primary metal (-5.3 percent m-o-m) industries posted the largest declines in April.

Excluding transportation equipment, manufacturing sales increased by 0.8 percent

m-o-m in April.

Overall, sales

of durable goods fell 3.5 percent m-o-m in April, while sales of non-durable

goods rose 2.6 percent m-o-m.

U.S. stock-index futures rose on Tuesday as more dovish statements from the ECB fueled expectations of a similar accommodative stance from the Fed.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,972.71 | -151.29 | -0.72% |

Hang Seng | 27,498.77 | +271.61 | +1.00% |

Shanghai | 2,890.16 | +2.54 | +0.09% |

S&P/ASX | 6,570.00 | +39.10 | +0.60% |

FTSE | 7,445.87 | +88.56 | +1.20% |

CAC | 5,489.10 | +98.15 | +1.82% |

DAX | 12,281.92 | +196.10 | +1.62% |

Crude oil | $52.13 | +0.39% | |

Gold | $1,356.60 | +1.02% |

Danske Bank's analysts have changed their call for the ECB outlook and are now expecting it to cut rates by 20bp, introduce a tiering system, extended forward guidance, and restart QE in a package which could come already in September on the back of Draghi's speech in Sintra this morning and Benoit Coeuré's interview in the Financial Times yesterday.

- “In ECB perspective, nose-diving inflation expectations and a higher probability of looming risks will materialize has caused a change in the call.

- At the annual ECB conference in Sintra, Portugal, Draghi gave another seminal speech, similar to 2017. However, this time, Draghi opened the door wide open to new easing where he was specific that 'coming weeks, the Governing Council will deliberate how our instruments can be adapted commensurate to the severity of the risk to price stability.' Importantly, there has been a huge change from ECB in past 12 days since the last GC meeting as ECB will now act if there is no improvement in the economic outlook, so that inflation to target is threatened which compares to ECB acting if downside risks materialize.”

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 21.74 | 0.09(0.42%) | 2000 |

ALTRIA GROUP INC. | MO | 50.98 | 0.12(0.24%) | 2455 |

Amazon.com Inc., NASDAQ | AMZN | 1,902.50 | 16.47(0.87%) | 57152 |

American Express Co | AXP | 122.04 | 0.59(0.49%) | 100 |

Apple Inc. | AAPL | 195.65 | 1.76(0.91%) | 151466 |

AT&T Inc | T | 32.45 | 0.15(0.46%) | 28039 |

Boeing Co | BA | 359.02 | 4.12(1.16%) | 31852 |

Caterpillar Inc | CAT | 127.46 | 0.14(0.11%) | 1992 |

Chevron Corp | CVX | 121.56 | 0.17(0.14%) | 833 |

Cisco Systems Inc | CSCO | 56.09 | 0.69(1.25%) | 27248 |

Citigroup Inc., NYSE | C | 66.55 | 0.01(0.02%) | 20895 |

Deere & Company, NYSE | DE | 156 | 1.63(1.06%) | 497 |

E. I. du Pont de Nemours and Co | DD | 75.03 | 0.28(0.37%) | 348 |

Exxon Mobil Corp | XOM | 75.38 | 0.29(0.39%) | 2217 |

Facebook, Inc. | FB | 192.85 | 3.84(2.03%) | 1153992 |

FedEx Corporation, NYSE | FDX | 164 | 0.28(0.17%) | 2126 |

Ford Motor Co. | F | 10.06 | 0.01(0.10%) | 5834 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.97 | 0.23(2.14%) | 15290 |

General Electric Co | GE | 10.14 | 0.09(0.90%) | 244791 |

General Motors Company, NYSE | GM | 36.2 | 0.06(0.17%) | 1535 |

Goldman Sachs | GS | 191.2 | 0.37(0.19%) | 2214 |

Google Inc. | GOOG | 1,106.23 | 13.73(1.26%) | 3797 |

Hewlett-Packard Co. | HPQ | 20.05 | 0.15(0.75%) | 1310 |

Home Depot Inc | HD | 208.5 | 1.52(0.73%) | 1031 |

Intel Corp | INTC | 46.49 | 0.36(0.78%) | 28472 |

International Business Machines Co... | IBM | 135.46 | 0.51(0.38%) | 1172 |

Johnson & Johnson | JNJ | 139.98 | 0.54(0.39%) | 1179 |

JPMorgan Chase and Co | JPM | 109.39 | 0.17(0.16%) | 12701 |

McDonald's Corp | MCD | 204.55 | 0.74(0.36%) | 1322 |

Merck & Co Inc | MRK | 83.98 | 0.68(0.82%) | 2172 |

Microsoft Corp | MSFT | 134 | 1.15(0.87%) | 82066 |

Nike | NKE | 82.75 | 0.64(0.78%) | 4540 |

Pfizer Inc | PFE | 43.05 | 0.17(0.40%) | 3691 |

Procter & Gamble Co | PG | 111.42 | 0.43(0.39%) | 2476 |

Starbucks Corporation, NASDAQ | SBUX | 83.4 | 0.38(0.46%) | 6376 |

Tesla Motors, Inc., NASDAQ | TSLA | 230.92 | 5.89(2.62%) | 180511 |

The Coca-Cola Co | KO | 51.2 | 0.33(0.65%) | 5238 |

Twitter, Inc., NYSE | TWTR | 36.83 | 0.39(1.07%) | 41997 |

United Technologies Corp | UTX | 125.09 | 0.86(0.69%) | 1679 |

Verizon Communications Inc | VZ | 58.01 | 0.38(0.66%) | 5924 |

Visa | V | 171 | 1.44(0.85%) | 12575 |

Wal-Mart Stores Inc | WMT | 109.65 | 0.49(0.45%) | 481 |

Walt Disney Co | DIS | 141.95 | 0.98(0.70%) | 20020 |

Yandex N.V., NASDAQ | YNDX | 38.74 | 0.38(0.99%) | 1710 |

Bank of America (BAC) upgraded to Outperform from Market Perform at BMO Capital Markets

The Commerce

Department reported on Tuesday the building permits issued for privately owned

housing units rose by 0.3 percent m-o-m in May to a seasonally adjusted annual

pace of 1.294 million, while housing starts fell by 0.9 percent m-o-m to an

annual rate 1.269 million.

Economists had

forecast housing starts dropping by 0.4 percent m-o-m last month and building

permits being flat m-o-m.

Data for April were

revised up to show homebuilding increasing to a pace of 1.281 million units,

instead of gaining to a rate of 1.235 million units as previously reported.

According to

the report, permits for single-family homes, the largest segment of the market,

surged 3.7 percent m-o-m at 815,000 in May, while approvals for the

multi-family homes segment declined 5.0 percent m-o-m to a 479,000 unit-rate.

Analysts at TD Securities are expecting that Canada’s manufacturing sales for April will post a 0.8% decline against market expectations for a modest 0.4% increase.

- “Manufacturing PMIs have been signaling something ominous since the start of the year, and we think the shutdown of a large auto plant could provide the catalyst for a correction coming off a 2.1% advance in March.”

Analysts at TD Securities note that the German ZEW survey offered the first glimpse at survey indicators for June, and the survey's expectations component fell sharply from -2.1 to -21.1, back near its late-2018 lows, and far below market expectations.

- “The Current Situation Index was slightly better than expected, however, falling only slightly to 7.8. On a sectoral basis, the deterioration in the index came from banks, the auto industry, pharmaceuticals, electronics, mechanical engineering, and retail, and suggests broad-based concern across the economy.”

Analysts at TD Securities are expecting that the U.S. housing starts to advance mildly in May, increasing 0.4% m/m to 1,240k.

- “This would mark the third consecutive monthly increase for the series and its highest level since January. Similarly, building permits should have picked up modestly (+0.2% m/m) to 1,293k during the month.”

Standard Chartered's analysts note that their clients see the G20 summit on 28-29 June as a pivotal event that may determine the intensity of US-China trade tensions and the ensuing policy responses.

- “In the run-up to the summit in Osaka, President Trump continues to exert pressure on China on trade and other issues, while President Xi is preparing the nation for an extended trade war.

- We are convinced that a meeting between the two leaders is in the making. Trump has expressed a strong desire to meet Xi at the summit. While China has yet to confirm the meeting, we do not think it will waste an opportunity to demonstrate its commitment to averting a trade war that could disrupt global economic growth.

- Xi and Trump will likely agree on the principles for the resumption of trade talks.

- We think the market may be too pessimistic about a trade deal within the next two to three months. The two sides appear to have reached an understanding on 90% of the issues after 11 rounds of talks; resolving the remaining issues will require more political will than time. Imposing additional US tariffs on all imports from China, which Trump has threatened in the absence of a deal, would likely take a big toll on the US economy in an election year.

- If the G20 summit fails to prevent an escalation of the trade war, we expect China’s government to deploy more fiscal stimulus, supplemented by credit expansion and a possible selective easing of property-market policies, to keep GDP growth above 6%. The authorities may also allow more FX flexibility, partly due to shifting fundamentals.”

TD Securities' analysts note that the ECB President Mario Draghi opened the first full day of the ECB's Sintra conference with an extremely dovish speech on monetary policy.

- “In it, he hinted at upcoming policy easing and changes to forward guidance (as soon as July), if the economy does not improve, and said that all tools would be on the table, including rate cuts and further QE. He suggested that the ECB's 2% inflation target should be changed to a symmetric target, meaning that policy might need to be left looser going forward.”

In view of analysts at Danske Bank, China’s growth recovery is likely to be delayed by further trade war escalation, but stimulus is set to cushion the drag from higher uncertainty.

“We look for growth to fall to 6.2% in 2019 from 6.6% in 2018. In 2020 we expect the economy to grow 6.1%. We look for a trade deal in H2, which should pave the way for a recovery in Q4. Uncertainty is elevated, though, and an all-out trade war that runs into 2020 would delay any lift to growth. We expect more policy stimulus with a further cut in the RRR and subsidies for consumer goods. USD/CNY to rise to 7.10 over the next quarter. China is set to face some headwinds from production moving to other Asian countries and US export controls in tech. China's likely response will be more focus on self-reliance, even more investments in the tech industry and new efforts to create a better business environment for foreign companies in order to attract FDI.”

The European Union's trade surplus in goods with the United States increased in the first four months of 2019 while its deficit with China widened.

The European Union's surplus with the United States grew to 48.2 billion euros in Jan-Apr 2019 from 46.0 billion euros in the same period of 2018, EU statistics office Eurostat reported. With China, the EU's trade deficit expanded to 62.0 billion from 57.2 billion euros.

Overall, the goods trade deficit of the 28-nation bloc increased to 21.7 billion euros in Jan-Apr 2019 from 10.3 billion a year earlier. For the narrower 19-country eurozone, exports grew by 5.2% year-on-year in April and imports by 6.6%, leading to a narrowing of its trade surplus to 15.7 billion euros in April from 17.1 billion a year earlier.

The Centre for European Economic Research (ZEW) said the Indicator of Economic Sentiment for Germany decreased sharply in June 2019, and now stands at -21.1 points. This corresponds to a drop of 19.0 points compared to the previous month. Economists had expected decrease to -5.9. The indicator’s long-term average is 22.0 points. Over the same period, the assessment of the economic situation in Germany slightly worsened by 0.4 points, with the corresponding indicator falling to a current reading of 7.8 points. The economic outlook for Germany is therefore similarly negative as it was in the last quarter of 2018.

“The sharp drop in the ZEW Indicator of Economic Sentiment coincides with an increased uncertainty regarding the future development of the global economy and substantially worsened figures for the German economy at the beginning of the second quarter,” comments ZEW President Professor Achim Wambach.

The financial market experts’ sentiment concerning the economic development of the eurozone also experienced a significant drop, with the corresponding indicator currently standing at -20.2 points, 18.6 points below the reading from the previous month. By contrast, the indicator for the current economic situation in the eurozone climbed 3.3 points to a level of minus 3.7 points in June.

According to the report from Eurostat, the euro area annual inflation rate was 1.2% in May 2019, down from 1.7% in April 2019. A year earlier, the rate was 2.0%. European Union annual inflation was 1.6% in May 2019, down from 1.9% in April 2019. A year earlier, the rate was 2.0%.

The lowest annual rates were registered in Cyprus (0.2%), Portugal (0.3%) and Greece (0.6%). The highest annual rates were recorded in Romania (4.4%), Hungary (4.0%) and Latvia (3.5%). Compared with April 2019, annual inflation fell in sixteen Member States, remained stable in five and rose in six.

In May 2019, the highest contribution to the annual euro area inflation rate came from services (+0.47 percentage points, pp), followed by energy (+0.38 pp), food, alcohol & tobacco (+0.29 pp) and non-energy industrial goods (+0.08 pp).

France and Germany could be the biggest beneficiaries in an escalation in trade tariffs between the U.S. and China, Barclays economists have projected.

U.S. Commerce Secretary said that Trump is “perfectly happy” to slap tariffs on the remaining $300 billion of Chinese imports if the world’s two largest economies fail to agree a trade deal.

However, Christian Keller, head of economic research at Barclays, suggested that trade substitution resulting from additional tariffs, and other non-tariff related barriers, opens opportunities for core euro area economies to gain export market share.

“Our comparison of China’s import structure across its main trading partners reveals that France, Germany and the U.K. are the closest ‘U.S. proxies’ in terms of relative sectoral decomposition of their exports to China. We would therefore expect these countries to win the most if China opts to shop elsewhere,” Keller said.

Barclays’ new baseline global trade scenario assumes a full-blown trade war which would see the U.S. impose a 25% tariff on “virtually all Chinese imports” and a Chinese retaliation, reducing bilateral trade by around 30%.

Returns on investing in commodities will be boosted as central banks ease monetary policy and governments take steps to offset the impact of global trade disputes, Goldman Sachs said.

The investment bank said it was forecasting 3-month total commodity index returns of 10% for the S&P Goldman Sachs Index and 9% returns on a 12-month outlook. In March, it had forecast a 3-month return of 5.1% and a 12-month return of 2.8%. The longer term returns were seen as lower due expected growth in oil supply.

"Interest rates are lower and oil prices are weaker, all combining for easier financial conditions ... policymakers have demonstrated a willingness to underwrite any demand weakness stemming from trade war concerns," Goldman said.

"Combined with the sharp decline in the U.S. rates curve, subdued inflationary pressures stemming from lower commodity prices and a likely rollover of the current OPEC+ production deal, this sets the stage for a third quarter rally in investment, manufacturing and, from current discounted levels, commodity prices."

QE still has considerable headroom

QE limits are specific to contingencies faced by the ECB

If outlook doesn't improve, additional stimulus is needed

Negative rates have proven to be a very important tool

Indicators for the coming quarters point to lingering softness

ECB able to enhance forward guidance by adjusting its bias and conditionality to account for variations in adjustment path of inflation

In the coming weeks, we will deliberate how our instruments can be adapted commensurate to the severity of the risk to price stability

Dovish comments from Draghi sent euro to its low for the day with EUR/USD testing the 1.1200 handle currently.

Vladimir Miklashevsky, senior economist at Danske Bank, points out that two weeks ago, the market bought EUR/USD as Fed officials hinted rate cuts could be coming and the ECB revealed a reluctance to follow the Fed down the road of monetary easing.

“Today, Draghi will get a second chance to talk down the EUR when he speaks at Sintra. He will have to come up big, i.e. signal rate cuts and/or that QE is coming, to convince the market to sell EUR/USD before the Fed likely makes a dovish shift tomorrow. It is crunch time for the ECB and the Fed and we stick to our call for EUR/USD to rise to 1.15 in 3M as the Fed is set to ‘out-ease’ the ECB.”

The European Central Bank will struggle to fight the next recession on its own, former IMF chief economist Olivier Blanchard told.

“I am nearly sure that the ECB cannot by itself at this point fight a recession, that it will need help, it is fairly obvious,” Blanchard told.

He explained that the question is not so much the lack of available tools, but more their actual impact on the market.

“They have a lot ammunition, the question is how much it kills, because they can really buy assets in large quantities, but it may at this stage have little effect on the rates, which is what matters in the end,” Blanchard added.

Blanchard also said that “monetary policy needs help from fiscal policy.” However, different analysts have raised doubts whether governments will do their part in the near future, given that the structural reform effort was not quite there in the aftermath of the 2011 sovereign debt crisis.

In view of analysts at TD Securities, today's German ZEW report will give us some of the first survey data for the month of June, and a better idea of how much global trade tensions are weighing on investor sentiment.

“With the détente in the US-EU auto tariff spat having been announced shortly after the last ZEW report was published, that should help to ease local worries to some extent. Markets are looking for the expectations component to worsen from -2.1 to -5.8 in June, but we see upside risks and look for a smaller fall to -3.0 instead. For the current assessment, we look for a decline from 8.2 to 7.0 (mkt: 6.1). The first full day of the ECB's Sintra conference also takes place, with President Draghi due to speak at 8am, Vice President de Guindos at 8:30, Chief Economist Lane at 10:30am, and a discussion panel featuring Draghi, Carney, and Yellen at 2pm.”

According to the report from European Automobile Manufacturers' Association (ACEA), in May 2019, the EU passenger car market recorded a modest increase (+0.1%) after eight consecutive months of decline. Demand in the region was mainly driven by the Central European countries, where registrations went up by 6.2% last month. By contrast, the five major Western European markets posted mixed results: with demand in Spain (-7.3%), the United Kingdom (-4.6%) and Italy (-1.2%) slowing down, but growing in Germany (+9.1%) and France (+1.2%).

From January to May 2019, new car registrations across the European Union fell by 2.1% compared to last year, counting 6.7 million units in total. With the exception of Germany, the five big EU markets all posted slight declines so far this year.

Danske Bank analysts point out that for the Japanese economy, demand has been slowing and a record fiscal budget will keep the economy afloat in 2019, along with hoarding effects in the run-up to the VAT hike in October.

“From 2020 onwards, the economy will have to find support abroad to keep growing. We expect GDP growth of 1.0% in 2019 and 0.5% in 2020 and 2021. With a shrinking population, exports are key to growth, even if the Japanese economy is quite closed. A rebound in global growth therefore remains paramount to the outlook. The VAT hike poses a risk to domestic demand, although the impact should be much smaller than after previous tax hikes. Future trade negotiations between the US and Japan could also cause some turbulence. The inflation outlook still looks modest and we expect the Bank of Japan to remain on hold through 2021.”

New home prices in China rose at their fastest pace in five months in May, complicating government efforts to keep frothy housing markets under control as it rolls out more stimulus for the slowing economy.

Average new home prices in China’s 70 major cities rose 0.7% in May from the previous month, picking up from a 0.6% rise in April and the quickest pace since December, according to National Bureau of Statistics (NBS) data.

That marked the 49th straight month of price gains. Sixty-seven of the total 70 cities surveyed by the NBS reported higher prices in May, the same as April.

On an annual basis, home prices increased 10.7% in May, unchanged from April’s growth rate.

Higher prices were mainly driven by the smaller tier-3 cities, up 0.8% on a monthly basis compared with a 0.5% gain in April, the statistics bureau said in a note accompanying the data.

Prices in China’s four top-tier cities - Beijing, Shanghai, Guangzhou and Shenzhen - saw slower growth in May, increasing 0.3% versus 0.6% growth in the previous month.

Bank of Japan Governor Haruhiko Kuroda said the central bank will "certainly" debate heightening overseas risks at a rate review this week, underscoring concerns among policymakers about the economic fallout of a U.S.-China trade war.

"As for recent overseas economic developments, there are strong downside risks regarding the Sino-U.S. trade friction and China's economy," Kuroda told parliament.

"We'll certainly debate such overseas developments" at the upcoming rate review, he said, but added that the BOJ is already keeping monetary policy ultra-loose.

"The BOJ will guide monetary policy appropriately taking into account the impact overseas economic changes could have on Japan's economic outlook and the momentum for achieving our inflation target," Kuroda said.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1421 (3775)

$1.1355 (4509)

$1.1319 (596)

Price at time of writing this review: $1.1233

Support levels (open interest**, contracts):

$1.1179 (3003)

$1.1138 (3679)

$1.1093 (2440)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 5 is 64362 contracts (according to data from June, 17) with the maximum number of contracts with strike price $1,1300 (4509);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2814 (1019)

$1.2771 (315)

$1.2732 (370)

Price at time of writing this review: $1.2535

Support levels (open interest**, contracts):

$1.2495 (1945)

$1.2462 (2336)

$1.2424 (1011)

Comments:

- Overall open interest on the CALL options with the expiration date July, 5 is 16816 contracts, with the maximum number of contracts with strike price $1,3000 (3035);

- Overall open interest on the PUT options with the expiration date July, 5 is 15123 contracts, with the maximum number of contracts with strike price $1,2500 (2336);

- The ratio of PUT/CALL was 0.90 versus 0.89 from the previous trading day according to data from June, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 60.24 | -2.03 |

| WTI | 52.09 | -1.53 |

| Silver | 14.83 | -0.27 |

| Gold | 1339.55 | -0.19 |

| Palladium | 1456.25 | -0.79 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 7.11 | 21124 | 0.03 |

| Hang Seng | 108.81 | 27227.16 | 0.4 |

| KOSPI | -4.68 | 2090.73 | -0.22 |

| ASX 200 | -23.1 | 6530.9 | -0.35 |

| FTSE 100 | 11.53 | 7357.31 | 0.16 |

| DAX | -10.58 | 12085.82 | -0.09 |

| Dow Jones | 22.92 | 26112.53 | 0.09 |

| S&P 500 | 2.69 | 2889.67 | 0.09 |

| NASDAQ Composite | 48.36 | 7845.02 | 0.62 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68535 | -0.27 |

| EURJPY | 121.814 | 0.14 |

| EURUSD | 1.1221 | 0.1 |

| GBPJPY | 136.074 | -0.37 |

| GBPUSD | 1.25352 | -0.43 |

| NZDUSD | 0.64956 | 0.02 |

| USDCAD | 1.34074 | -0.02 |

| USDCHF | 0.99849 | 0 |

| USDJPY | 108.551 | 0.04 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.