- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | June | 49.8 | 50.0 |

| 07:15 | France | Services PMI | June | 51.5 | 51.5 |

| 07:15 | France | Manufacturing PMI | June | 50.6 | 50.7 |

| 07:30 | Germany | Services PMI | June | 55.4 | 55.4 |

| 07:30 | Germany | Manufacturing PMI | June | 44.3 | 44.5 |

| 08:00 | Eurozone | Manufacturing PMI | June | 47.7 | 48 |

| 08:00 | Eurozone | Services PMI | June | 52.9 | 52.9 |

| 08:30 | United Kingdom | PSNB, bln | May | -4.97 | -5.10 |

| 11:00 | United Kingdom | BOE Quarterly Bulletin | |||

| 12:30 | Canada | Retail Sales YoY | April | 2.6% | |

| 12:30 | Canada | Retail Sales, m/m | April | 1.1% | 0.2% |

| 12:30 | Canada | Retail Sales ex Autos, m/m | April | 1.7% | 0.3% |

| 13:45 | U.S. | Manufacturing PMI | June | 50.5 | 50.4 |

| 13:45 | U.S. | Services PMI | June | 50.9 | 51.0 |

| 14:00 | U.S. | Existing Home Sales | May | 5.19 | 5.25 |

| 16:00 | U.S. | FOMC Member Mester Speaks | |||

| 16:00 | U.S. | FOMC Member Brainard Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | June | 788 |

Major US stock indexes have risen markedly, because Fed made it clear that it could reduce interest rates as early as next month to counter the growing global and domestic economic risks.

Many market participants interpreted the tone of the last Fed statement as more “dovish” than expected. According to the CME FedWatch tool, traders now estimate the likelihood of Fed monetary policy easing next month at 100%.

In addition, support to the market continued to provide expectations of progress in the trade dispute between the US and China. As the Chinese Ministry of Commerce announced on Thursday, senior representatives of the two largest economies in the world will resume trade negotiations in accordance with the wishes of their leaders, but China hopes that the United States will create the necessary conditions for dialogue.

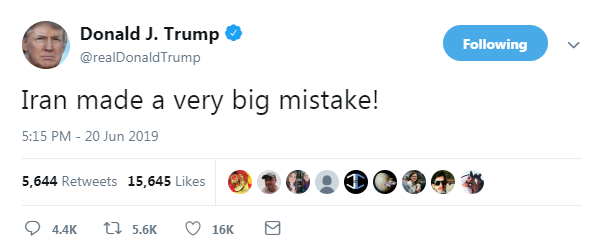

Energy stocks also supported the market, as WTI oil jumped almost 6% amid reports that Iran shot down a US military drone in international airspace over the Strait of Hormuz. Trump wrote on Twitter that Iran made a big mistake by knocking down a drone.

Most of the components of DOW finished trading in positive territory (26 out of 30). The growth leader was United Technologies Corp. (UTX; + 2.69%). The outsider was Merck & Co., Inc. (MRK; -0.71%).

Almost all sectors of the S & P recorded an increase. Raw materials grew the most (+ 1.9%). Only the conglomerate sector decreased (-0.6%).

At the time of closing:

Dow 26,753.17 +249.17 +0.94%

S & P 500 2,954.18 +27.72 +0.95%

Nasdaq 100 8,051.34 +64.02 +0.80%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | June | 49.8 | 50.0 |

| 07:15 | France | Services PMI | June | 51.5 | 51.5 |

| 07:15 | France | Manufacturing PMI | June | 50.6 | 50.7 |

| 07:30 | Germany | Services PMI | June | 55.4 | 55.4 |

| 07:30 | Germany | Manufacturing PMI | June | 44.3 | 44.5 |

| 08:00 | Eurozone | Manufacturing PMI | June | 47.7 | 48 |

| 08:00 | Eurozone | Services PMI | June | 52.9 | 52.9 |

| 08:30 | United Kingdom | PSNB, bln | May | -4.97 | -5.10 |

| 11:00 | United Kingdom | BOE Quarterly Bulletin | |||

| 12:30 | Canada | Retail Sales YoY | April | 2.6% | |

| 12:30 | Canada | Retail Sales, m/m | April | 1.1% | 0.2% |

| 12:30 | Canada | Retail Sales ex Autos, m/m | April | 1.7% | 0.3% |

| 13:45 | U.S. | Manufacturing PMI | June | 50.5 | 50.4 |

| 13:45 | U.S. | Services PMI | June | 50.9 | 51.0 |

| 14:00 | U.S. | Existing Home Sales | May | 5.19 | 5.25 |

| 16:00 | U.S. | FOMC Member Mester Speaks | |||

| 16:00 | U.S. | FOMC Member Brainard Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | June | 788 |

Morten Lund, an analyst at Nordea Markets, notes that the Bank of England (BoE) stroke a more dovish tone at the June meeting, as growth has softened, and the perceived risk of a no-deal has increased.

- “In line with both our view and consensus, the Bank of England (BoE) kept both the Bank Rate and the bond purchase programme unchanged. Although there was some speculation before the meeting whether MPC members Michael Saunders (most likely) or Andy Haldane could dissent due to recent high pay growth numbers, the decision was unanimous (9-0) to keep the policy rate on hold at 0.75%.

- The overall message was, in our opinion, clearly to the dovish side.

- Adding to the dovish message, the MPC noted that the global risk sentiment had weakened and the perceived risk of a no-deal had increased, as reflected by the weak sterling.

- We, however, find it difficult to argue for any rate hikes anytime soon as growth is set to slow in Q2, inflation has downside risks (see model below), G10 central banks have shifted in a dovish direction and the fear of a no-deal Brexit is very much alive and kicking.

- At the other side of the coin, we also do not find a rate cut likely (our AI model does not as well, see below). Basically, we think the BoE’s hands are tied due to Brexit and with inflation currently at target, a cut does not seem warranted in the coming months. We would only expect a cut in the case of a no-deal event.”

The Conference

Board announced on Thursday its Leading Economic Index (LEI) for the U.S. was

unchanged in May, remaining at 111.8 (2016 = 100), following a revised 0.1

percent increase in April (originally a 0.2 percent m-o-m gain).

Economists had

forecast an advance of 0.1 percent.

Ataman

Ozyildirim, Director of Economic Research at The Conference Board, said “The US

LEI was unchanged in May, following three consecutive increases. Positive

contributions from financial conditions and consumers’ outlook offset the

weakness in stock prices and the manufacturing sector. The yield spread’s

contribution to the LEI was neither positive nor negative. While the economic

expansion is now entering its eleventh year, the longest in US history, the LEI

clearly points to a moderation in growth towards 2 percent by year-end.”

The report also revealed the Conference Board Coincident Economic Index (CEI) for the U.S. went up 0.2 percent to 105.9 in May after a 0.1 percent uptick in April. Meanwhile, its Lagging Economic Index (LAG) for the U.S. fell 0.2 percent to 107.0, following a 0.1 percent drop in April.

- We need to calm the region down but we cannot with Iran creating so much mischief

- Saudis and allies are consulting and looking at various options on Iran

The European

Commission reported on Thursday its flash estimate showed the consumer confidence

indicator for the Eurozone decreased 0.7 points to -7.2 in June from the

previous month.

Economists had

expected the index to stay at -6.5.

Considering the

European Union (EU) as a whole, consumer sentiment also dropped 0.7 points to

-6.9.

Despite these declines,

both indicators stand well above their respective long-term averages of -10.7 (Eurozone)

and -10.0 (EU), the report said.

The Department

of Commerce reported on Thursday that current account (C/A) gap in the U.S. narrowed

to $134.4 billion in the first quarter of 2019 from an upwardly revised $143.9

billion gap in the previous quarter (originally -$134.4 billion). The deficit

was 2.5 percent of current-dollar GDP in the first quarter of 2019, down from

2.8 percent in the fourth quarter of 2018.

Economists had

forecast a deficit of $124.6 billion.

According to

the report, the $13.5-billion decrease in the C/A deficit mostly reflected a reduction

in the deficit on goods that was partly offset by an advance in the deficit on

secondary income.

Goods exports rose

$2.4 billion to $419.3 billion, primarily reflecting increases in automotive

vehicles, parts, and engines, mostly passenger cars, and in foods, feeds, and

beverages, mainly soybeans, which, however, were partly offset by a decline in

industrial supplies and materials. Meanwhile, goods imports fell $13.4 billion

to $635.9 billion, primarily reflecting a decrease in industrial supplies and

materials, mainly petroleum and products.

Secondary

income receipts dropped $2.8 billion to $35.6 billion, reflecting declines in

both private and U.S. government transfers.

U.S. stock-index futures surged on Thursday after the Federal Reserve indicated that it was ready to cut interest rates as soon as next month to battle growing global and domestic economic risks.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,462.86 | +128.99 | +0.60% |

Hang Seng | 28,550.43 | +348.29 | +1.23% |

Shanghai | 2,987.12 | +69.32 | +2.38% |

S&P/ASX | 6,687.40 | +39.30 | +0.59% |

FTSE | 7,457.53 | +53.99 | +0.73% |

CAC | 5,552.44 | +33.99 | +0.62% |

DAX | 12,410.43 | +101.90 | +0.83% |

Crude oil | $56.23 | +4.19% | |

Gold | $1,386.50 | +2.80% |

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits went up last week, pointing to underlying market strength

despite a steep slowdown in job growth in May.

According to

the report, the initial claims for unemployment benefits fell 6,000 to a

seasonally adjusted 216,000 for the week ended June 15.

Economists had

expected 220,000 new claims last week.

Claims for the

prior week were remained unchanged at 222,000.

Meanwhile, the

four-week moving average of claims increased 1,000 to 218,750 last week.

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 172.7 | 1.95(1.14%) | 3689 |

ALCOA INC. | AA | 22.9 | 0.50(2.23%) | 3251 |

ALTRIA GROUP INC. | MO | 50.18 | 0.28(0.56%) | 1977 |

Amazon.com Inc., NASDAQ | AMZN | 1,935.00 | 26.21(1.37%) | 79577 |

American Express Co | AXP | 125.14 | 0.46(0.37%) | 1104 |

Apple Inc. | AAPL | 200.7 | 2.83(1.43%) | 194952 |

AT&T Inc | T | 32.62 | 0.21(0.65%) | 33021 |

Boeing Co | BA | 372.6 | 4.04(1.10%) | 23551 |

Caterpillar Inc | CAT | 132.8 | 2.19(1.68%) | 6169 |

Chevron Corp | CVX | 123.7 | 0.81(0.66%) | 11565 |

Cisco Systems Inc | CSCO | 57.5 | 1.37(2.44%) | 52649 |

Citigroup Inc., NYSE | C | 68.09 | 0.50(0.74%) | 25611 |

Deere & Company, NYSE | DE | 162.25 | 2.31(1.44%) | 3495 |

Exxon Mobil Corp | XOM | 76.27 | 0.95(1.26%) | 3850 |

Facebook, Inc. | FB | 190.91 | 3.43(1.83%) | 237946 |

Ford Motor Co. | F | 10.12 | 0.08(0.80%) | 172068 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.5 | 0.31(2.77%) | 48425 |

General Electric Co | GE | 10.49 | 0.15(1.45%) | 218326 |

General Motors Company, NYSE | GM | 37.24 | 0.46(1.25%) | 5804 |

Goldman Sachs | GS | 196.7 | 1.06(0.54%) | 4107 |

Google Inc. | GOOG | 1,116.00 | 13.67(1.24%) | 11883 |

Home Depot Inc | HD | 209.77 | 1.83(0.88%) | 2096 |

HONEYWELL INTERNATIONAL INC. | HON | 176.53 | 1.12(0.64%) | 1493 |

Intel Corp | INTC | 48 | 0.93(1.98%) | 33044 |

International Business Machines Co... | IBM | 138.11 | 1.03(0.75%) | 3189 |

Johnson & Johnson | JNJ | 140.98 | 0.53(0.38%) | 935 |

JPMorgan Chase and Co | JPM | 110.66 | 0.75(0.68%) | 19924 |

McDonald's Corp | MCD | 205.5 | 0.95(0.46%) | 2985 |

Merck & Co Inc | MRK | 86.4 | 1.04(1.22%) | 9031 |

Microsoft Corp | MSFT | 137.65 | 1.96(1.44%) | 106771 |

Nike | NKE | 84.56 | 1.01(1.21%) | 1668 |

Pfizer Inc | PFE | 43.64 | 0.14(0.32%) | 9124 |

Procter & Gamble Co | PG | 111 | 0.58(0.53%) | 2153 |

Starbucks Corporation, NASDAQ | SBUX | 84.5 | 0.69(0.82%) | 6849 |

Tesla Motors, Inc., NASDAQ | TSLA | 223.61 | -2.82(-1.25%) | 302480 |

The Coca-Cola Co | KO | 51.32 | 0.20(0.39%) | 2998 |

Twitter, Inc., NYSE | TWTR | 36.55 | 0.26(0.72%) | 191913 |

United Technologies Corp | UTX | 128.54 | 1.78(1.40%) | 2208 |

UnitedHealth Group Inc | UNH | 252 | 1.81(0.72%) | 1497 |

Verizon Communications Inc | VZ | 58 | 0.37(0.64%) | 1709 |

Visa | V | 172.98 | 2.29(1.34%) | 9584 |

Wal-Mart Stores Inc | WMT | 109.92 | 0.30(0.27%) | 9041 |

Walt Disney Co | DIS | 142.25 | 1.33(0.94%) | 18948 |

Yandex N.V., NASDAQ | YNDX | 39.99 | 1.00(2.56%) | 15165 |

Apple (AAPL) initiated with a Hold at Deutsche Bank; target $205

HP (HPQ) initiated with a Hold at Deutsche Bank; target $20

Apple (AAPL) target raised to $240 from $210 at Cascend Securities

Tesla (TSLA) target lowered to $158 from $200 at Goldman

FedEx (FDX) target lowered to $228 from $230 at Cowen

The

Manufacturing Business Outlook Survey, released by the Federal Reserve Bank of

Philadelphia on Thursday, revealed the expansion in the region's manufacturing

activity decelerated in June.

According to

the survey, the diffusion index for current general activity decreased from 16.6

in May to 0.3 this month. That was the lowest reading since February.

Economists had

forecast the index to drop to 11.0 last month.

A reading above

0 signals expansion, while a reading below 0 indicates contraction.

The June decrease

in the headline index was due to declines in the indexes for new orders (to 8.3

from 11 in May), shipments (to 16.6 from 27.6), and employment (to 15.4 from 18.2).

On the price front, both prices paid and prices received declined to their

lowest levels since October 2016.

- James Smith, the developed markets economist at ING, notes that, while the Bank of England (BoE) unanimously opted to keep rates on hold, the latest statement is slightly more dovish than might have been expected.

- "Back in May, Governor Mark Carney warned investors that, with just one rate hike priced in over the next two years, they may be underestimating the pace of future tightening. Since then, the revaluation of global monetary policy in light of the escalation in trade tensions has seen investors lower their expectations even further. In fact, markets now think UK interest rates are more likely to fall over the next couple of years.

- We had wondered if this would lead the Bank to hint more explicitly that market rate expectations are too low. In the event, however, they chose not to and interestingly have made reference to the fact that the perceived risk of a ‘no deal’ Brexit is rising. This is perhaps a subtle nod to the fact that risks to growth could lie to the downside over the summer months if uncertainty continues to rachet up.

- We tend to agree - while the recent growth numbers are being thrown around by sharp changes in inventories, we think underlying economic momentum will remain slightly weaker in the near-term as businesses ramp up preparations for an October ‘no deal’ Brexit."

- We wouldn’t totally rule out a rate hike from the Bank of England later this year if wage growth continues to perform solidly and the immediate threat from Brexit recedes – either through another Article 50 extension or less likely, a deal being ratified by parliament ahead of the October deadline."

Analysts at TD Securities are expecting the U.S. Philly Fed survey to show a decline to 10.7 in June following the notable 8.1 increase to 16.6 in May.

- “We flag that, as was the case with the NY Empire survey, this report may surprise further to the downside as it will likely reflect the negative sentiment from the US-Mexico trade spat that was at its high around the collection of the survey responses.”

Sonia Meskin, the U.S. economist at Standard Chartered, notes that at the June FOMC meeting, the Committee clearly left the door open for a rate cut, without indicating a definitive commitment to easing and was consistently communicated in the Summary of Economic Projections (SEP), the statement and the press conference.

- “We continue to expect a 25bps FFTR cut in July; we believe it would take a definitively positive G20 outcome and an improvement in the data for the FOMC not to cut next month. A 50bps cut is also on the table in case of a poor G20 outcome or a pronounced economic deterioration.

- Policy easing would be largely pre-emptive: the SEP and the post-meeting statement emphasized little change to the baseline outlook for growth and inflation but noted increasing downside risks, primarily from slowing global growth and trade tensions.

- Also in line with our expectations, Chair Powell mentioned in the press conference that a key goal of the ongoing policy framework review is to strengthen the FOMC’s commitment to the 2% medium-term inflation objective through communication strategies. We expect this to come in the form of forward guidance, as we described in Fed framework review won’t bring pre-emptive cuts. However, further downside risks to growth would be a concern, as they could entrench low inflation expectations. Separately, contrary to our expectation, the FOMC did not signal an end to the balance-sheet taper before September 2019.”

The Bank of Egland (BoE) announced its Monetary Policy Committee (MPC) voted unanimously to maintain Bank Rate at 0.75 percent at its latest meeting.

The MPC also voted unanimously to maintain the corporate bond purchases at £10 billion and UK government bond purchases at £435 billion.

In its statement, the BoE says:

- the recent UK data have been volatile, in large part due to Brexit-related effects on financial markets and businesses

- underlying growth in the United Kingdom appears to have weakened slightly in the first half of the year relative to 2018

- downside risks to growth have increased due to intensified trade tensions and perceived likelihood of a no-deal Brexit

- GDP is now expected to be flat in Q2 (down from +0.2% q/q previously) after growing by 0.5% in 2019 Q1

- CPI inflation is likely to fall below the 2% target later this year, reflecting recent falls in energy prices

- the labour market remains tight

- the economic outlook will continue to depend significantly on the nature and timing of EU withdrawal

- the appropriate path of monetary policy will depend on the balance of these effects on demand, supply and the exchange rate

- the Committee will always act to achieve the 2% inflation target

Bill Diviney, the senior economist at ABN AMRO, suggests that, despite aggressive pricing for Fed rate cuts, the FOMC statement and a dovish Chair Powell press conference appeared to more than satisfy market expectations, with bond yields moving lower and equities pushing higher.

- “Most significantly, the FOMC statement removed reference to ‘patience’ over policy, and strengthened Powell’s recent remark that the Fed will ‘act as appropriate to sustain the expansion’ by removing the qualifier ‘as always’. As well as highlighting the increased uncertainty over the outlook as the Fed’s primary concern, the statement bolstered the case for easing by pointing to ‘muted inflation pressures’. While the characterization of survey-based inflation expectations was kept as ‘little changed’, in the press conference Powell noted that they are ‘near the bottom’ of historical ranges and expressed concern over the risk of expectations becoming unanchored.

- While the ‘dots’ projections showed just one rate cut expected by the median committee member in 2020, 7 of 17 members now expect 50bp of cuts in 2019. In the press conference, Chair Powell gave this a further dovish spin by stating that even those who expected no change in policy this year nonetheless saw a stronger case for further accommodation.

- Powell also countered suggestions that a US-China trade deal alone might be enough to prevent rate cuts, by pointing to the weakness in business investment and manufacturing, and the slowdown in global growth as additional factors the committee is weighing.

- Our base case remains that the Fed will implement three 25bp cuts by Q1 2020, starting at the July meeting.”

James Smith, the developed markets economist at ING, notes that the UK's retail sales have fallen for the second month in a row.

- "Some of this is clearly down to the weather, where colder temperatures appear to have discouraged people from updating their summer wardrobes. Clothing and footwear sales slipped by 4.5% compared to April. This weakness means that the year-on-year growth rate in retail sales (ex-fuel) has slipped back from just over 6% in March to 2.2% now – although admittedly this also has a lot to do with the World Cup/weather-related spike at the same time last year.

- Barring a big recovery in June (which given the recent deluge of rain, seems fairly unlikely), it looks like consumer spending will add to the second quarter growth slump. It looks increasingly likely that second-quarter growth could come in flat or only marginally positive, given the likely drag from manufacturing production and inventory rundowns too.

- That said, with wage growth continuing to perform well, we think there is a reasonable chance that the Bank of England makes a more explicit hint that rates may need to rise earlier than markets think. For now though, we think Brexit uncertainty (in particular the rising risk of a general election later in the year) will prevent the committee from raising rates in 2019."

TD Securities' analysts note that as widely expected there was no change to BoJ policy, in a 7-2 vote.

- “They left the 10y yield target at about 0%, maintained policy balance rate at -0.1%, asset purchases were unchanged and likewise there was no change in forward guidance. However, the statement sounded cautious, highlighting “significant” downside overseas economic risks including developments in China, noting the need to pay close attention to the impact on sentiment.

- We don’t see a hurry for the BoJ to shift policy despite the Fed’s dovish although Kuroda recently highlighted several options for action. There may be a slight disappointment that BoJ did not alter its forward guidance.”

European Central Bank Vice President Luis de Guindos said that the last monetary decision taken by the central bank was taken unanimously by members of the Council.

"I believe (the decision) was taken unanimously. There was no divergent opinion with relation to the communique of the decision taken in Vilnius two weeks ago," de Guindos said.

At the meet, there had been two main issues, de Guindos said, including the extension of the forward guidance on when the bank would raise interest rates and the cost of the ECB's Longer-Term Refinancing Operation (TLTRO III).

"There was also unanimity in that, if the situation deteriorated because downside risks materialised, we would immediately react," de Guindos said.

James Smith, developed markets economist at ING, points out that Norges Bank has taken its tightening cycle a step further on Thursday by increasing interest rates a quarter point to 1.25% which is in stark contrast to many of its developed markets peers.

“Given this move was clearly flagged back in May, the bigger focus is the Norwegian central bank’s new interest rate projection – and as expected it’s a tale of two halves. Probably the biggest news is that the central bank thinks it will “most likely” hike again over the course of 2019, having previously seen the next move around the first quarter of 2020. That follows a better-than-expected reading from the latest oil investment survey for 2019 spending. We expect the central bank to hike rates again December, although as ever a lot will depend on how trade tensions evolve over coming months.”

British employers offered staff pay rises averaging 2.5% as part of wage settlements in the three months to May, matching the trend seen for most of this year.

Human resources data firm XpertHR said pay settlements had hovered around the same level since the start of 2019, despite a small pick-up in inflation.

"Following a dip in the second half of 2018, the first half of 2019 is dominated by pay rises in the region of 2.5%," XpertHR analyst Sheila Attwood said.

After years of falls in pay when adjusted for inflation, Britain's workers have had some of the biggest pay rises in a decade in recent months due to a tight labour market though they are modest compared to pre-financial crisis rates of pay growth.

Analysts at TD Securities point out that the EU Leaders have gathered to discuss filling the positions of EU Council President, EU Commission President, and ECB President.

“They had earlier hoped to finalise the nominations over dinner on Thursday (with a press conference to follow), but EU election results have complicated the negotiations, and there's no clear "winning formula" for the three top jobs now. It's not impossible that the ECB President be named later tonight (or at least, an unofficial list of finalists leaked), but it looks more and more like the decisions will now take place at an "emergency summit" on 30 June / 1 July.”

According to the report from Office for National Statistics, in the three months to May 2019, the quantity bought in retail sales increased by 1.6% when compared with the previous three months, with growth across all stores except department stores and household goods stores. The fall of 0.9% in the quantity bought in department stores in the three months to May 2019 was the eighth consecutive month of no positive growth in this sector.

The quantity bought in May 2019 decreased by 0.5% when compared with the previous month, with a strong decline of 4.5% in clothing sales. In May 2019, online retailing accounted for 19.3% of total retailing, with an overall growth of 8.2% when compared with the same month a year earlier.

When compared with a year earlier, both the amount spent and quantity bought showed growth of 2.7% and 2.3% respectively in May 2019. The year-on-year growth rate in the average store price for clothing fell for the ninth consecutive month in May 2019 but evidence from retailers suggested that the poor weather may have delayed the sales for summer ranges.

Analysts at TD Securities suggest that they are updating levels in the wake of Wednesday's FOMC meeting and with economic data mixed and Brexit/politics muddling the outlook, the MPC is likely to vote unanimously to leave policy on hold.

“Increasingly hawkish comments set against a more worrisome global backdrop set the stage for surprise this week. Our base case still sees a muted reaction in GBP, particularly as it has already had a decent run this week. Directional risks remain more a function of the UK's political backdrop and global risk environment.”

Survey-based indicators confirm a gradual weakening in growth momentum

Global financial conditions have been volatile in recent months

Global growth is projected to decelerate this year amid increasing headwinds

The European Central Bank is considering using all instruments at its disposal unless there is improvement in the euro zone economy, member of the ECB Governing Council Olli Rehn said.

"We in the Governing Council are ready to act as appropriate unless there is improvement in the economic conditions," Rehn told a conference in Brussels.

Asked whether the ECB should proceed with rate cuts or more asset purchases, Rehn said: "The whole range of instruments is on the table."

In view of analysts at Danske Bank, the key event today will be the Norges Bank meeting, where both consensus and Danske are looking for a 25bp rate hike.

“The Bank of England also meets, but in our view, the bank is firmly on hold. It is one of the small meetings without an updated inflation report or a press conference so we don't expect much change in the bank's message. The UK also releases May retail sales. A two-day EU summit starts today, where the main focus will be on potential clarity on the front-runners for the EU Commission presidency, ECB presidency other EU top positions. We will also monitor if the EC will formally open an EDP against Italy. On the data front, we expect Euro area consumer confidence for June to stay unchanged.”

U.S. President Donald Trump risks hurting investor sentiment if he removes Jerome Powell as chair of the Federal Reserve, according to a former Fed governor.

“To fire a Federal Reserve governor or chairman would be a very unprecedented move, it would result in turmoil in the financial markets, it would be something that you really don’t want to do because you don’t need an absolute increase in uncertainty which this would bring about,” Robert Heller, a member of the Fed’s Board of Governors from 1986 to 1989, told.

Heller’s comment came as Bloomberg, citing people familiar with the matter, reported on Wednesday that Trump said he believes he has the authority to demote Powell.

“We expect the Bank of England to keep rates unchanged at 0.75% at today's meeting. The vote is likely to be unanimous still, even as a number of influential MPC members have made some relatively hawkish speeches recently. The hawks are focusing on decent wage growth amid low unemployment, but the warnings with regards to rate increases are falling on deaf ears. The downside risks resulting from Brexit and trade uncertainties outweigh the upside risks of slightly elevated domestic price pressures. We forecast no rate hikes for this year and next.”

Goldman Sachs Group Inc analysts now expect the U.S. Federal Reserve to cut interest rates in July and in September, according to a research note issued after Fed Chairman Jerome Powell on Wednesday signaled a rate cut as early as next month.

This marks a reversal for Goldman, whose economists said as recently as June 16 that the hurdle for rate cuts is “higher than widely believed.” Goldman is one of the 24 primary dealers that does business directly with the Fed.

Interest rate futures surged in response to Powell’s remarks at the end of a two day policy meeting that left rates on hold. Traders are now betting heavily on three cuts by the end of the year. The Fed’s target rate the Fed funds rate is 2.25% to 2.50%.

Expects inflation to gradually pick up towards 2% target

Risks associated with overseas economies are significant

Need to watch for impact on business, consumer sentiment

The Italian government proposes to use 5.2 billion euros in expected improvements in its 2019 budget position to avoid EU disciplinary action for excessive debt, financial daily Il Sole 24 Ore said.

The newspaper said the improvements consisted of expected savings on forecast expenditure of about 2 billion euros and higher-than-expected revenues of 3.2 billion euros, saying Rome would offer to use these to reduce the forecast deficit.

"The package decided yesterday, in summary, is worth 5.2 billion euros in 2019 and would bring the deficit for this year to 2.2% (of gross domestic product)...," Il Sole said.

According to the report from Federal Statistical Office, in May 2019, the slowdown continued in both trading directions. For example, exports fell by 0.5 percent for the third time in succession. By contrast, imports grew by 0.9 percent. The trade balance showed a surplus of 1.7 billion francs compared to .1.9 billion francs in April.

In May 2019, exports recorded seasonally adjusted - 0.5 percent (real: - 1.2 percent) - the third monthly decline in a row. As a result, exports have tended to decline slightly overall since the beginning of the year. Meanwhile, imports increased by 0.9 per cent (in real terms: + 0.7 per cent), meaning that they have been on an upward trajectory since November 2018 - albeit now slowing. The surplus on the trade balance was 1.7 billion francs.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1421 (3919)

$1.1362 (4433)

$1.1336 (597)

Price at time of writing this review: $1.1265

Support levels (open interest**, contracts):

$1.1190 (3050)

$1.1145 (3721)

$1.1097 (2440)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 5 is 66284 contracts (according to data from June, 19) with the maximum number of contracts with strike price $1,1300 (4433);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2831 (1086)

$1.2798 (850)

$1.2773 (393)

Price at time of writing this review: $1.2680

Support levels (open interest**, contracts):

$1.2615 (1620)

$1.2578 (1354)

$1.2536 (1949)

Comments:

- Overall open interest on the CALL options with the expiration date July, 5 is 17661 contracts, with the maximum number of contracts with strike price $1,3000 (3030);

- Overall open interest on the PUT options with the expiration date July, 5 is 15422 contracts, with the maximum number of contracts with strike price $1,2500 (2300);

- The ratio of PUT/CALL was 0.87 versus 0.90 from the previous trading day according to data from June, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 61.55 | -0.15 |

| WTI | 54.34 | 0.15 |

| Silver | 15.15 | 1.07 |

| Gold | 1359.686 | 0.97 |

| Palladium | 1502.59 | 1.47 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 361.16 | 21333.87 | 1.72 |

| Hang Seng | 703.37 | 28202.14 | 2.56 |

| KOSPI | 26.07 | 2124.78 | 1.24 |

| ASX 200 | 78.1 | 6648.1 | 1.19 |

| FTSE 100 | -39.5 | 7403.54 | -0.53 |

| DAX | -23.22 | 12308.53 | -0.19 |

| Dow Jones | 38.46 | 26504 | 0.15 |

| S&P 500 | 8.71 | 2926.46 | 0.3 |

| NASDAQ Composite | 33.44 | 7987.32 | 0.42 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68827 | 0.11 |

| EURJPY | 121.36 | -0.05 |

| EURUSD | 1.12289 | 0.31 |

| GBPJPY | 136.638 | 0.35 |

| GBPUSD | 1.26416 | 0.7 |

| NZDUSD | 0.65377 | 0.14 |

| USDCAD | 1.32804 | -0.72 |

| USDCHF | 0.99339 | -0.67 |

| USDJPY | 108.076 | -0.36 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.