- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- Silver prices stay pressured after two-day declines, 12-day-old support line in focus.

- RSI pullback from overbought territory joins failures to cross 200-DMA to favor sellers.

- 100-DMA defends corrective pullback from December’s low, November’s high adds to the upside filters.

Silver (XAG/USD) fades bounce off weekly low under $24.00 during Tuesday’s Asian session.

The bright metal’s failures to keep the late Monday’s recovery could be linked to the failures to cross the 200-DMA and RSI pullback from the overbought region, which in turn signals extension of the latest weakness.

That said, an upward sloping trend line from January 07, near $23.45 by the press time, challenges the metal’s short-term declines ahead of the key 100-DMA support level surrounding $23.25.

Should XAG/USD remains bearish past $23.25, the monthly low near $21.95 and the previous month’s low around $21.40 will be in focus.

On the flip side, a downward sloping trend line from May, at $24.15 by the press time, restricts the metal’s immediate recoveries ahead of the 200-DMA level of $24.60.

If the XAG/USD prices rise past $24.60, November’s high of $25.40 and 61.8% Fibonacci retracement of May-December 2021 downside near $25.95, should lure the bulls.

Silver: Daily chart

Trend: Further weakness expected

Australian CPI overview

Early on Tuesday, at 00:30 GMT, markets will see the 2021’s fourth quarter (Q4) inflation data for the Australian economy.

The headline Consumer Price Index (CPI) QoQ is likely to rise from 0.8% QoQ to 1.0%, as well as to 3.2% from 3.0% YoY prior.

On the contrary, the Reserve Bank of Australia's (RBA) trimmed-mean CPI is expected to remain unchanged on the QoQ basis at 0.7% but may rise to 2.4% versus 2.1% during the stated period.

Given the recently strong Aussie jobs report and easing covid fears, AUD/USD bulls will pay close attention to the key inflation report for backing their hawkish bias for the Reserve Bank of Australia’s (RBA) rate hike concerns.

Ahead of the release, TD Securities said,

The better than expected outcomes for retail sales, employment and job vacancies in recent weeks means a beat on trimmed mean inflation makes the RBA's dovish stance untenable, setting the RBA on course for rate hikes, potentially a quarter earlier than our Q4 forecast.

On the same line were comments from Westpac stating,

In terms of key drivers, dwelling purchase prices, auto fuel and food will play an important role, and holiday travel will also contribute. There is an upside risk to dwellings as Homebuilder grants expire and cost pressures lift. Uncertainty around durable goods remains. Westpac forecasts a 1.1% q/q and 3.2% y/y rise for the headline CPI (market median is 1.0% and 3.2%). The offsetting soft components in Q4 are seasonal, thereby supporting a solid 0.7% (2.4%yr) gain in the trimmed mean measure.

How could it affect the AUD/USD?

AUD/USD struggles to extend the latest bounce off a five-week low, flashed the previous day, as market players await the key Aussie inflation figures. Also challenging the bulls are the concerns over the Fed’s rate hike and Russia-Ukraine tussles, which in turn weigh on stock futures and propel US Treasury yields to offer additional hurdle to the pair’s recovery moves.

However, the recently positive fundamentals from Australia will get a chance to propel the AUD/USD prices should today’s Q4 CPI data manage to match/surpass the upbeat forecasts. However, Fed becomes more important than the RBA and hence any upside moves may have a short-term life until being too strong.

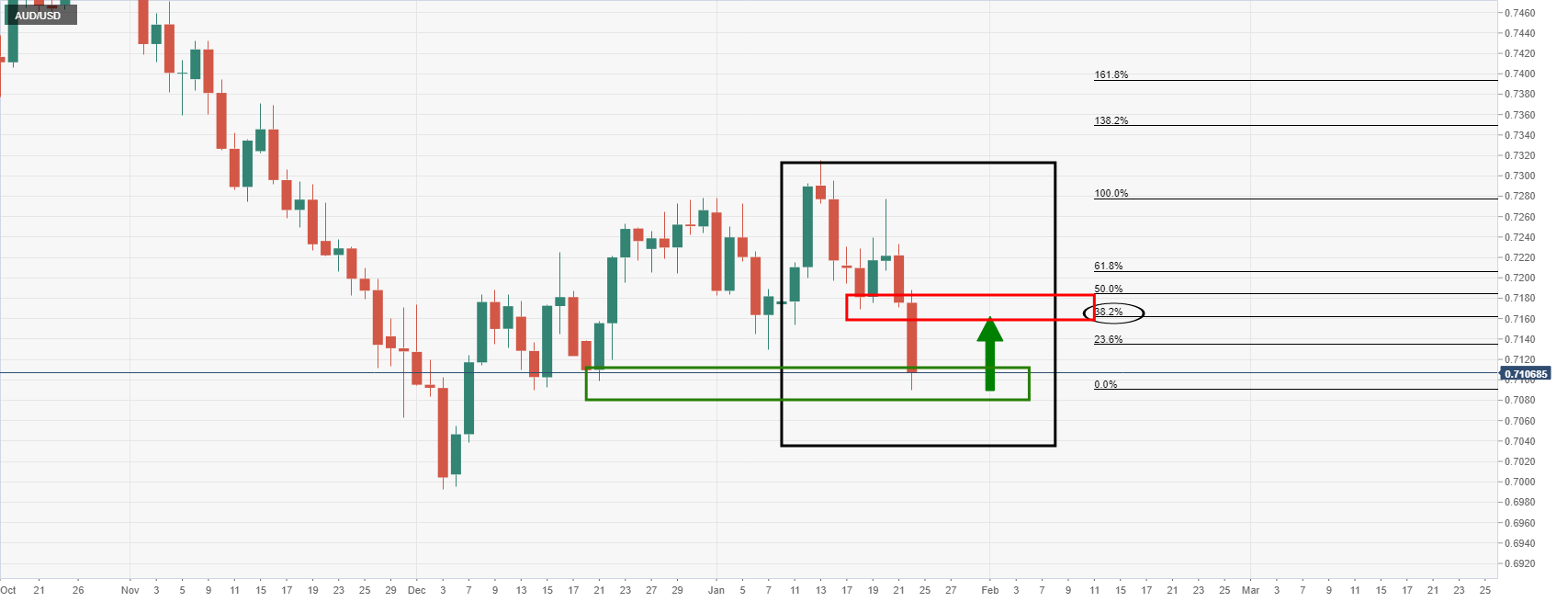

Technically, AUD/USD extends bounce off a multiple support-zone established since late November, around 0.7090-80. However, bearish MACD signals and the support-turned-resistance line from December 20, near 0.7170, pose as the short-term key hurdle followed by the 200-DMA level of 0.7200.

Key Notes

AUD/USD rebound approaches previous support near 0.7170 ahead of Australia inflation

AUD/USD Weekly Forecast: Unreliably optimistic Australian data hides a nearby crisis

About the Australian CPI

The Consumer Price Index released by the RBA and republished by the Australian Bureau of Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of AUD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. A high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or Bearish).

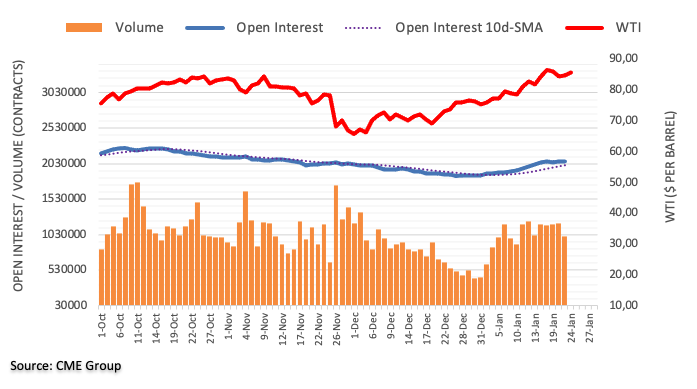

- WTI extends Monday’s corrective pullback from weekly low.

- Bullish Doji above the key SMAs, Momentum line’s rebound favors further recovery.

- Three-day-old resistance line adds to the upside filters.

WTI picks up bids towards $84.00, extending the late Monday’s recovery during the initial Asian session on Tuesday.

The oil benchmark’s latest recovery takes clues from a bullish Doji candlestick and Momentum line.

However, the monthly support line, now resistance around $84.00, precedes a descending trend line from the last Thursday, near $85.30, to test the recovery moves.

Following that, the recent high surrounding $86.95 may offer an intermediate halt during the run-up to the $90.00 psychological magnet.

Alternatively, pullback moves may initially aim for the 100-SMA level of $81.10 before eyeing the $80.00 round figure.

Though, WTI sellers may have a tough time keeping reins past $80.00 as the 200-SMA level of $76.75 will challenge further weakness of the commodity.

WTI: Four-hour chart

Trend: Further upside expected

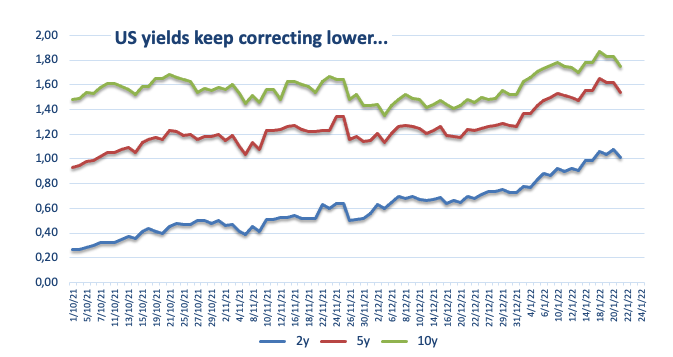

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rose for the second consecutive day to 2.38% by the end of Tuesday’s North American session, per the FRED website.

In doing so, the inflation gauge extends rebound from a four-month low flashed last week ahead of the key Federal Open Market Committee (FOMC) meeting, scheduled for Wednesday.

Given the escalating chatters over hawkish halt by the Fed during this week’s appearance, increasing inflation expectations can help the policymakers to prove right the market expectations, which in turn could propel yields and the US dollar.

In addition to the Fed meeting, US PCE Inflation data and the Q4 Advance GDP also gains major attention for the future actions of the US central bank.

Read: Inflation surge could push the Fed into more than four rate hikes this year

- EUR/USD keeps rebound from two-month-old support line to battle short-term key hurdles.

- 200-SMA, one-week-old descending trend line challenge buyers, steady RSI tests further upside.

- Key Fibonacci retracement levels add to the short-term trading filters.

EUR/USD pauses corrective pullback from two-month-old support around 1.1330 during the initial Asian session on Tuesday.

In doing so, the major currency pair battles the 200-SMA, as well as a descending trend line from January 17, by the press time.

Given the lack of firmer RSI and strong resistances, EUR/USD prices are likely to witness a pullback from the 50% Fibonacci retracement (Fibo.) level of November-January advances, near 1.1335.

However, the downside moves need validation from the aforementioned support line from late November, around 1.1300. Also challenging the EUR/USD sellers near the stated round figure is the 61.8% Fibo. level.

If at all the quote remains bearish past 1.1300, odds of its south-run to 1.1270 and 1.1230 can’t be ruled out.

Alternatively, recovery moves need to stay beyond 1.1335 to aim for December 2021 top near 1.1385.

Following that, the 1.1400 threshold and 1.1430 levels may challenge the EUR/USD bulls ahead of the monthly peak surrounding 1.1480.

EUR/USD: Four-hour chart

Trend: Pullback expected

- The Australian dollar got hit by risk-off market sentiment but recovered its earlier losses near the New York close.

- AUD/JPY Price Forecast: The pair is downward biased, though Monday’s price action suggests that buyers lift the cross-currency from 80.69.

The end of the New York session shows a slight improvement in market mood, which witnessed the AUD/JPY dipping to Monday’s daily low at 80.69, to then stage a recovery above the 81.00 figure. At the time of writing, the AUD/JPY is trading at 81.40.

The market mood of the European session, which witnessed worst than expected reported global PMI’s, carried over the North American one. However, increasing tensions in the Ukraine – Russia conflict spurred a sell-off across assets with the “risk” word attached, led by the US stock market. In the FX complex, risk-sensitive currencies like the AUD, the NZD, and the CAD were hit by safe haven peers, though trimmed earlier losses at the end of the session.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart depicts the pair as downward biased. The break under December 16, 2021, daily high at 82.44, witnessed the break of the 200, 100, and 50-day moving averages (DMAs), located at 82.53, 82.36, and 82.08, respectively.

Nevertheless, as portrayed by the candlestick chart, Monday’s price action left a large bottom wick that shows that buyers entered the market, lifting the AUD/JPY above the 81.00 figure and beyond it.

That said, the AUD/JPY first resistance level would be the 50-DMA at 82.08. A breach of the latter would expose the 100-DMA at 82.36, immediately followed by the 200-DMA at 82.53.

On the flip side, the first support would be 81.00. A break under that level would open the door for a test of December 3, 2021, a daily low at 78.79, but it would find some hurdles on the way south. Firstly the January 24 low at 80.70, followed by December 20, 2021, daily low at 80.27, and then the aforementioned December 3 daily low at 78.79.

- AUD/USD keeps corrective pullback from five-week low tracking rebound in equities, gold.

- Fears of Fed’s rate-hike, Russia-Ukraine tussles weighed on Aussie prices before the latest rebound.

- Easing covid numbers, PBOC rate cut aid buyers but broad risk-off mood stays on the table.

- Australia Q4 CPI can bolster RBA rate hike concerns after strong employment.

AUD/USD holds onto the corrective pullback from more than a month’s low around 0.7140, after two consecutive days of risk aversion.

The recovery moves could be linked to the consolidation of losses by the risk-sensitive assets while the Aussie pair particularly awaits key inflation data during early Tuesday morning in Asia.

Global markets turned risk-off at the key week’s start as traders piled on more bets over the US Federal Reserve’s (Fed) hawkish appearance during Wednesday’s Federal Open Market Committee (FOMC) meeting. Also souring the sentiment were fears of a war between Russia and Ukraine, as well as mixed data.

Although the US, Europe and the North Atlantic Treaty Organization (NATO) push Russia towards a ceasefire, reports took rounds that Moscow is up for a battle with Ukraine. As per the latest updates from the UK, leaders agreed that if Russia continues its intervention into Ukraine, allies must respond quickly, including through a package of sanctions.

Elsewhere, softer US Markit PMIs for January jostled mixed Aussie activity numbers from the Commonwealth Bank on Monday. However, the fears of supply chain disruptions and inflation woes couldn’t be ignored. US Treasury Secretary Janet Yellen accepted the same and praised Fed efforts, which in turn strengthened bullish bias over the FOMC.

It’s worth noting that the People’s Bank of China’s (PBOC) reverse repo cut should have also favored the buyers to take the risks, despite being too late, as the dragon nation is Australia’s largest customer.

Amid these plays, the US Treasury yields rose 2.9 basis points (bps) to 1.776% whereas Wall Street recovery early-day losses to close with mild gains. Further, gold prices also ended Monday’s North American trading session on a positive side.

Looking forward, Australia’s Consumer Price Index (Q4), expected 1.0% versus 0.8% prior, becomes crucial for the AUD/USD traders after a strong employment report and recently hawkish concerns over the Reserve Bank of Australia’s (RBA) rate lift. Also on the watcher’s list is the National Australia Bank’s (NAB) sentiment numbers and the US Consumer Confidence data.

Technical analysis

AUD/USD extends bounce off a multiple support-zone established since late November, around 0.7090-80. However, bearish MACD signals and the support-turned-resistance line from December 20, near 0.7170, pose as the short-term key hurdle followed by the 200-DMA level of 0.7200.

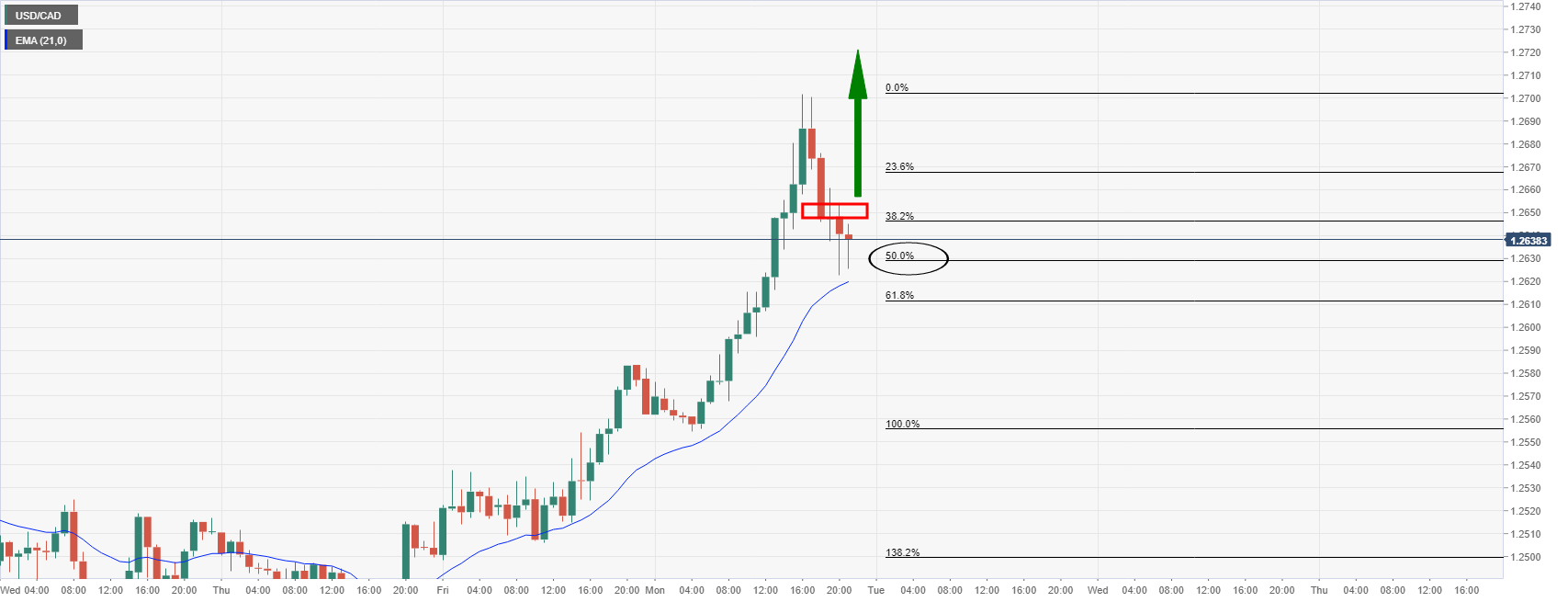

- USD/CAD bears looking for a strong correction to the neckline of the W-formaiton.

- Bulls are seeking an upside extension from the hourly correction at a discount.

The price of USD/CAD has corrected back to test the 50% mean reversion mark and is decelerating. This leaves prospects of a bullish continuation on the cards for the sessions ahead.

USD/CAD H1 chart

The bulls would target the 1.2720s as being a -0.272% bullish Fibo extension target that aligns with the prior resistance structure as per the daily chart below:

USD/CAD daily chart

The W-formation is a reversion pattern and the price, after filling the wick of yesterday's business with some change, would be expected to revert back to test the neckline of the 'W' pattern. This would align with a 61.8% golden ratio as well near to 1.2560.

What you need to know on Tuesday, January 25:

Markets were hit by a wave of risk aversion on Monday, benefitting the safe-havens and hurting the risk-sensitive currencies, though the latter group had pared back on much of their earlier underperformance by the end of US trade as risk appetite recovered. Market commentators said that geopolitical concerns about the rising risk of a new Russian/Ukrainian military conflict and equity investor worries about Fed tightening were the main drivers of the broadly downbeat tone on Monday.

As it became clear that the risk asset sell-off (led by US equities) had gone too far, dip-buyers returned to the market and the major US equity indices enjoyed a ferocious intra-day recovery from lows. The S&P 500 ended the session 0.3% higher, up an incredible 4.5% versus earlier intra-day lows.

The hardest risk-sensitive currencies recovered in tandem. AUD/USD, which had dipped as low as the 0.7090s where it traded over 1.1% lower, recovered back to the 0.7140 area, down a comparatively modest 0.5% on the day. Coming up on Tuesday, Aussie traders will be watching key Q4 Consumer Price Inflation data that could, if hotter than expected, bolster hawkish RBA policy bets and further facilitate the rebound.

USD/CAD, which had risen as much as 1.0% to above 1.2700, was last trading in the 1.2630 area, up about 0.4% on the day. NZD/USD, which was last down 0.2%, recovered back to 0.6700 from an earlier dip as low as the 0.6660 mark, which was its lowest point since November 2020. Kiwi traders also await key Consumer Price Inflation data for Q4 out on Thursday.

Finally amongst the more risk-sensitive G10 currencies, GBP/USD recovered back to the 1.3480s from a brief dip below 1.3450, where it continues to trade lower by about 0.5% on the session. Broadly weaker than anticipated flash January PMIs didn’t help sterlings cause, though arguably support the case for more BoE rate hikes given their continued strong inflationary signal.

USD was the safe haven of choice and the top-performing G10 currency of the day, with the DXY rising about 0.3%, though in the end failing to hold above the 96.00 level as risk-appetite recovered later in the session. Nonetheless, it reached its highest point in two weeks, aided by hawkish Fed chatter/concerns, while much weaker than expected flash Services PMI data was shrugged off as a result of the temporary Omicron impact rather than any underlying economic weakness.

JPY, EUR and CHF all look on course to end the day about 0.2% lower versus the buck, with EUR/USD holding above 1.1300, USD/JPY rising back to the 114.00 area and USD/CHF rising back towards 0.9150.

- The British pound falls some 0.27% versus the Japanese yen.

- GBP/JPY Price Forecast: Upward biased, despite losing in the day.

In the New York session, the British pound slides against the safe-haven status of the Japanese yen. The GBP/JPY is trading at 153.64, down 0.27% at the time of writing.

The GBP/JPY began in the right foot in the overnight session, though subdued around the daily highs at 154.50. Nevertheless, as the market mood worsened amid rising tensions in eastern Europe, alongside domestic political issues, the GBP/JPY plunged to 153.00.

That said, alongside the UK economic docket, portraying a dismal IHS Markit PMI report, boosted the Japanese yen, which remains the strongest currency of the day, against most of the G8 complex.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY has an upward bias despite falling on Monday. The pair faced support around the 200-day moving average (DMA) which lies at 152.98, resuming the upward move, breaching the 100 and the 50-DMA in the upward move.

However, an upslope trendline drawn from October 2021 cycle lows to September 2021 ones, previously breached, is resistance so that any upward moves might be capped around 154.00. A breach of the latter would open the door for further gains. The next resistance would be the psychological 155.00, followed by the January 21 daily high at 155.22, followed by 156.00

On the flip side, the first support would be the DMAs mentioned above. The 50-DMA lies at 153.37, the 100-DMA at 153.28, and the 200-DMA at 152.96.

- EUR/USD held up well on Monday, recovering from an earlier dip under 1.1300 after key support held.

- Traders should be prepared for a potential bearish breakout towards the mid/low 1.1200s.

EUR/USD held up well on Monday despite the market’s deeply risk-off tone, with the pair finding good dip-buying interest when it hit the 1.1300 level earlier in the session and recovering to trade flat on the day in the 1.1320s. Unlike other G10/USD pairs (like AUD/USD and NZD/USD), EUR/USD continues to hold above an uptrend that has supported it since late November/early December. As has been the case for the past four sessions, the price action continues, for the most part, to stick between the 21 and 50-day moving averages at 1.1345 and 1.1315 respectively.

The euro’s defensive qualities as a funding currency seemed to win through on Monday, but FX strategists have warned that the Eurozone is highly vulnerable to a NATO/Ukraine/Russia conflict if it results in further sharp upside in European gas prices. Some have suggested it would make sense for an element of “risk premia” to be priced into the euro as the risk of military conflict rises. That is something traders should be on the lookout for this week and, when combined with expectations for a hawkish Fed meeting on Wednesday and the risk that further risk-off flows continue to benefit the safe-haven US dollar, suggests downside risks for EUR/USD. Traders should watch out for any possible bearish breakout towards the mid/low 1.1200s.

Data appears to be taking more of a backseat as a driver of the price action. Mixed flash Eurozone PMIs for January out in the European morning, where manufacturing held up much better than forecast but services were weak, hardly had an impact on the euro. Equally, a big miss on expectations for the US flash Services PMI, which fell to its lowest since July 2020 and nearly back into contractionary territory (i.e. under 50) didn’t seem to phase the buck much. The main data to watch this week for EUR/USD traders is US GDP on Thursday and some of the individual Eurozone nations (Spain, France and Germany) and US December Core PCE inflation on Friday.

- Geopolitical tensions spurred by the Ukraine – Russia crisis favors the US dollar.

- USD/CHF Technical outlook: Neutral-bearish biased, but a break above 0.9200 would expose the 0.9300 supply zone.

After finishing the last week in the red, the USD/CHF trims some of Friday’s losses amid a risk-off market mood. At press time, the USD/CHF is trading at 0.9135, up some 0.18%.

Factors like the escalating tensions in the Ukraine – Russian conflict and the prospects of the Federal Reserve, tightening monetary policy conditions, boost the greenback to the detriment of the so-called safe-haven status of the Swiss franc.

In the meantime, the US Dollar Index, a gauge of the greenback’s performance against a basket of its rivals, edges up 0.21%, sitting at 95,854. Contrarily, the US 10-year benchmark note rate slides four and a half basis points, down to 1.731%, helped to put a lid on the upside prospects of the USD/CHF.

USD/CHF Price Forecast: Technical outlook

The daily chart shows that the USD/CHF is neutral-bearish biased. The daily moving averages (DMAs) above the spot price express the bearishness of the pair. However, the DMAs horizontal slope leaves the USD/CHF exposed to upward pressure.

To the upside, the USD/CHF first resistance would be the 200-day moving average (DMA) at 0.9160. A breach of the latter would expose the 50-DMA at 0.9206, followed by the 100-DMA at 0.9211.

On the flip side, the USD/CHF first demand zone would be the 0.9100 figure. A break under that level exposed the 2022 YTD low at 0.9095, followed by November 2, 2021, a daily low at 0.9089.

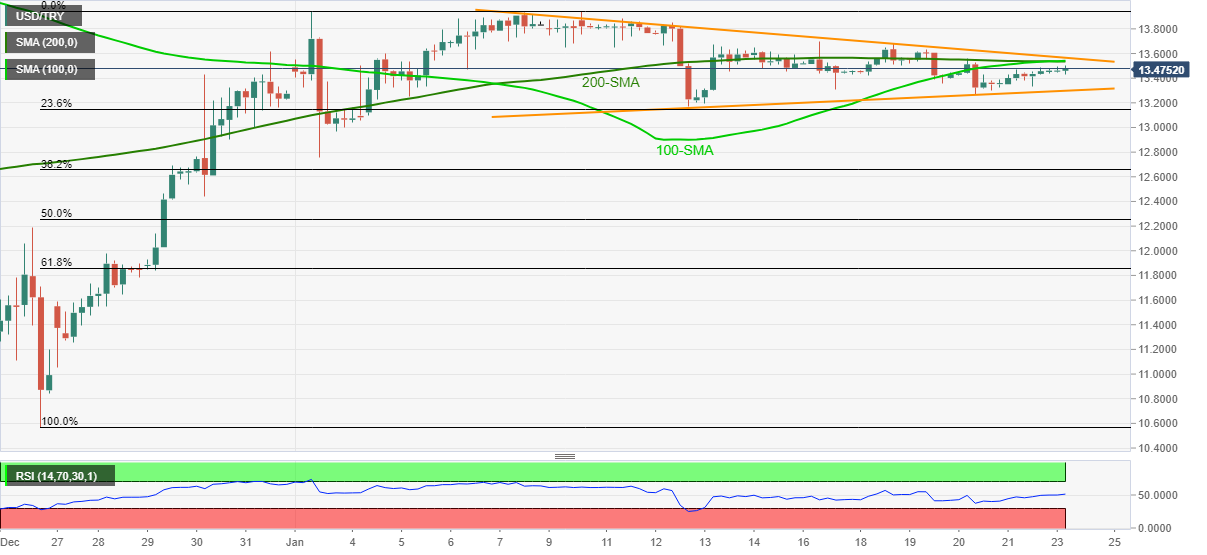

- USD/TRY is now starting to make a move to the upside.

- The bulls will be looking for a break of prior highs for the sessions ahead.

The price of USD/TRY has been consolidating for the entire month above the 21-day moving average and capped below a significant area of resistance:

USD/TRY daily chart

-637786481181166325.png)

However, the bulls are taking control as they take on the first layer of resistance as follows:

-637786486308103759.png)

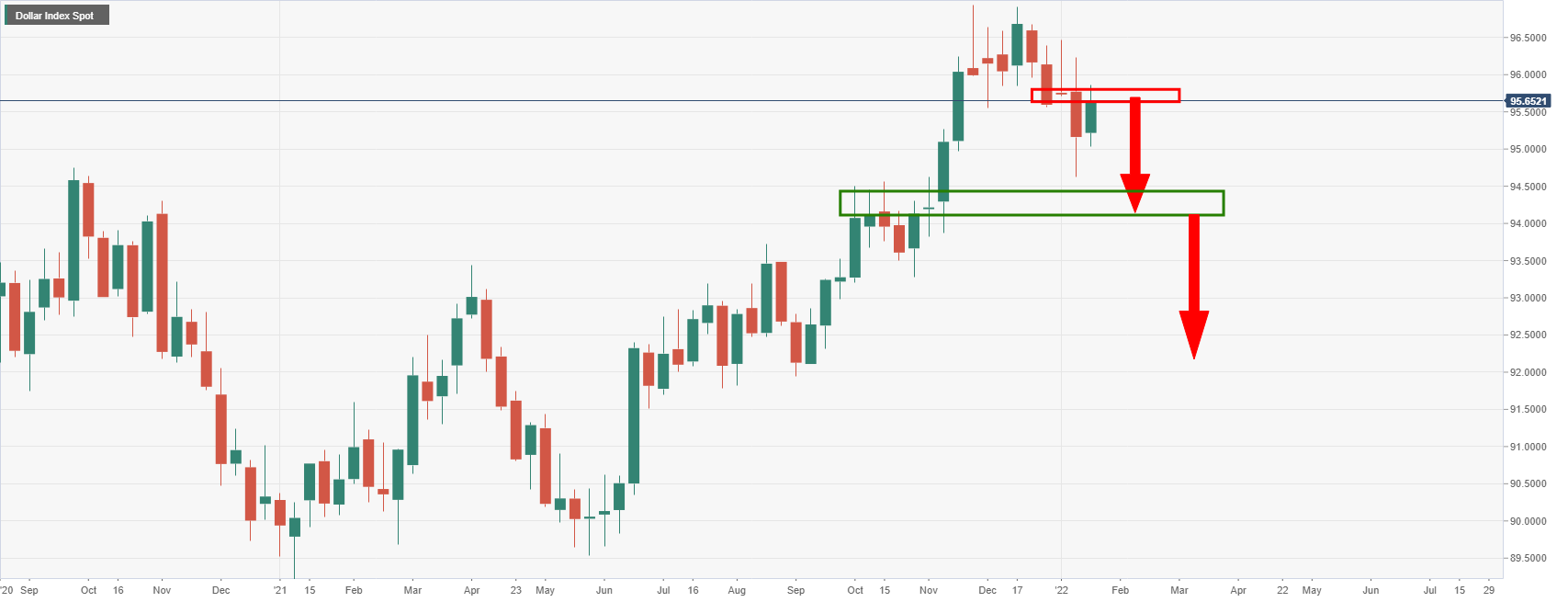

The M-formation is a reversion pattern and the price has broken the neckline resistance at 13.4241 which would now be expected to act as support. Given the turmoil in markets and probabilities of escalation of tensions in Central Asia, the US dollar's bias is to the upside:

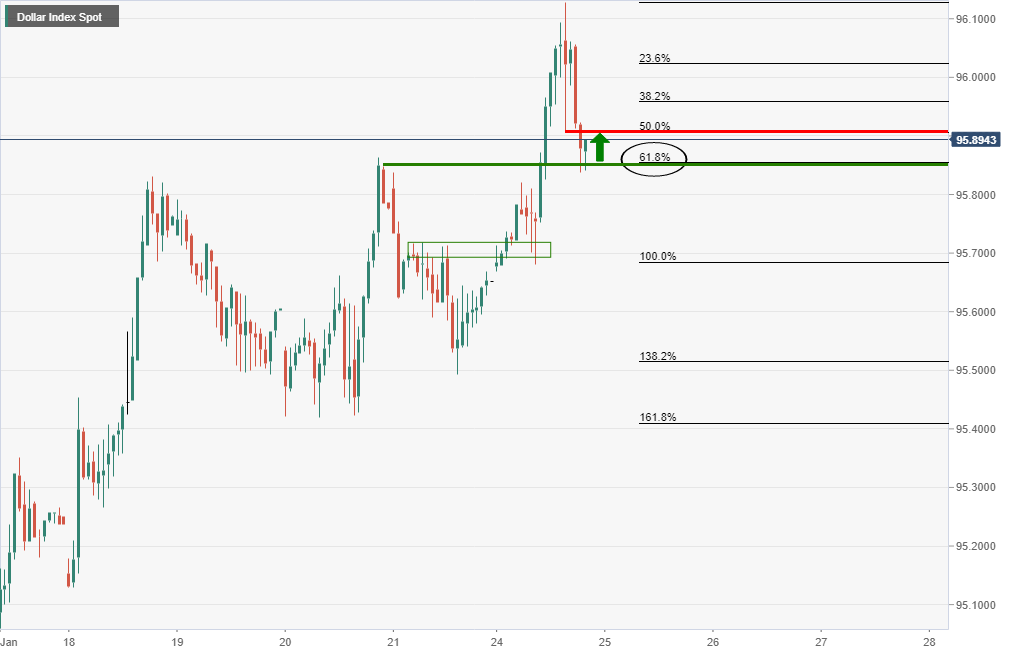

DXY daily chart

The US dollar, as measured vs a basket of major currencies in the DXY index, has been testing the 61.8% ratio that meets with prior highs as a firm layer of potential support for the sessions ahead.

- NZD/USD’s drop continued on Monday with the pair hitting its lowest point since November 2020.

- NZD held up better than its risk-sensitive peers, perhaps amid reluctance to sell it ahead of key Q4 CPI data.

The NZD/USD sell-off that really got kicking last Thursday when the pair breached long-term uptrend support and tumbled below 0.6750 continued on Monday as risk appetite continued to deteriorate. The pair on Monday fell beneath the 0.6700 level for the first time since November 2020 and has stabilised in the 0.6680 region, down about 0.4% on the day, up from its earlier session lows in the 0.6660 area. NZD/USD has for the most part been trading as a function of broader risk appetite and tracking movements in US equity markets, which are substantially lower on the day, though are in fairness also off earlier lows.

Driving the generalised risk-off moves seen in markets on Monday that has hit risk-sensitive currencies (like NZD) particularly hard whilst benefitting safe-haven currencies like USD, JPY and CHF has been renewed focus on Fed tightening as well as geopolitics. The New Zealand dollar, though suffering in the unfavourable market mood, has not been the worst hit amongst the G10, with CAD, GBP, AUD, SEK and NOK all fairing worse. That could be a reflection that, prior to Monday, NZD had already been one of the worst-performing G10 currencies this month and NZD bears were a little tired.

Alternatively, it could be a reflection of reluctance to sell the kiwi ahead of Thursday’s key Q4 2021 Consumer Price Inflation report. This report, which could reveal headline inflation nearing or hitting 6.0% YoY, could pump expectations for RBNZ tightening in a way that might shield NZD from further hawkish Fed-related USD advances. ING commented that “the market’s tightening expectations for the Reserve Bank of New Zealand are already quite aggressive (a 25bp hike in mid-February and at least five more in 2022), but we think that a strong CPI read may fuel speculation that the Bank will go for 50bp in February, which should be translated into a stronger NZD”. The bank does caveat that for NZD/USD to recover, broader risk appetite will need to stabilise.

- GBP/USD bears moved in on the weekly W-formation's target.

- The US dollar is now stalling which could give some support to cable.

As per the prior analysis, GBP/USD Price Analysis: Bears eye a trip to 1.3450 as per weekly chart, cable has indeed move din on the target area as follows:

GBP/USD prior analysis

The above was the W-formation's neckline targetted.

Below was the expected trajectory of the price action on the hourly chart, noting the prospect of a restest of the support (liquidity grab) and subsequent projected decline.

GBP/USD live charts

The price action and flight path followed suit into the weekly support target area.

At this juncture, much will now depend on geopolitics, global equities and the US dollar that will benefit from safe-haven flows or any uber hawkish surprise at the Federal Reserve meeting.

As it stands, the US dollar, as measured by the DXY index, is stalling for now:

The 61.8% ratio meets with prior highs as a firm layer of potential support for the sessions ahead.

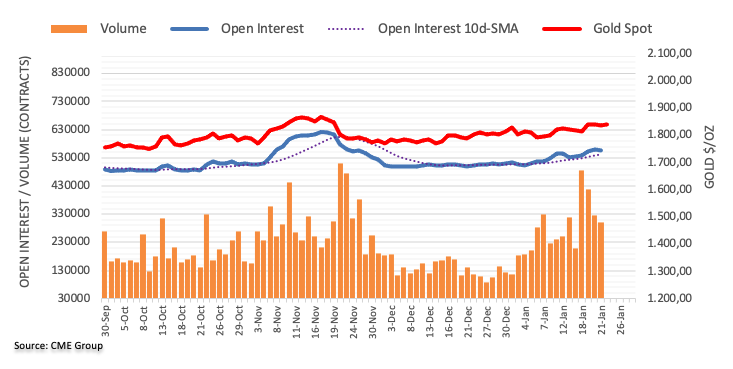

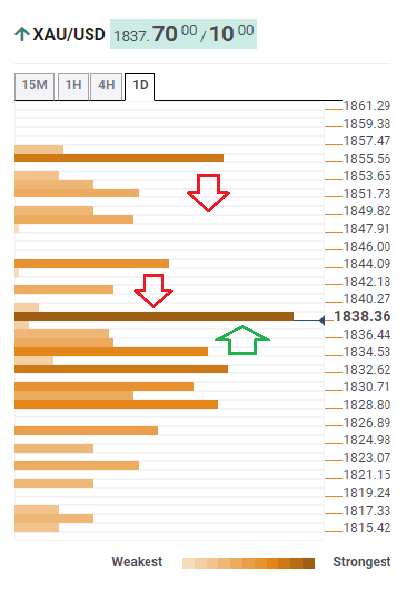

- The non-yielding metal edges up during the New York session, gains 0.29%

- The conflict between Russia and Ukraine escalates, triggering a risk-off market mood.

- XAU/USD Technical Outlook: Neutral-bullish, though a break under $1834 opens the door towards $1800.

In the last two hours, the yellow metal has dropped almost $10.00 amid increasing tensions in the Ukraine – Russian conflict, alongside increasing woes of the US central bank tightening monetary policy conditions. Nevertheless, at writing, gold is trading in the green at $1833.33 a troy ounce.

On Monday, NATO said that it was putting forces on standby and reinforcing eastern Europe military presence, in what Russia denounced an escalation of tensions over Ukraine, according to Reuters. The move responds to Russia’s, which amassed an estimated 100K troops near the Ukrainian border. Russia denies that an invasion is planned, but the deployment of forces from the north, east, and south spurred a crisis similar to the Russian Crimean annexation.

Usually, in geopolitical crises, gold is the ultimate safe-haven asset. However, with the Federal Reserve monetary policy meeting ahead of Wednesday, investors preferred to stay sidelined, awaiting its outcome. Among other investment banks, Goldman Sachs forecast at least four rate hikes in 2022, leaving the Federal Funds Rate (FFR) at 1%.

At press time, the US 10-year Treasury yield is at 1.7245%, down five basis points, while the 10-year Treasury Inflation-Protected Securities (TIPS) sits at -0.628%. In the meantime, the US Dollar Index, a measurement of the greenback’s value vs. a basket of six peers, edges up 0.36%, sitting at 95.983.

XAU/USD Price Forecast: Technical outlook

Gold has achieved to stay above July 15, 2021, daily high at $1,834, in the last three trading days. XAU/USD is neutral-upward biased, as portrayed by the daily moving averages below the spot price, but its horizontal slope leaves the yellow metal under downward pressure.

To the upside, XAU/USD’s first resistance would be the January 20, $1,847.90, followed by Pitchfork’s top trendline around the $1850-60 area, followed by November 16, 2021, daily high at $1,877.18.

On the flip side, gold’s first support is January 21 daily low at $1,828.53. A breach of the latter would expose the Pitchfork’s mid-line around $1,820-25 area, followed by the January 18 daily low at $1,805.75.

- AUD/USD bears stay in control and now test deeper support.

- Geopolitics could tip AUD/USD over the edge into the abyss and towards the depths of the 0.70 area.

As per the pre-open analysis, AUD/USD Price Analysis: Bears are in control at critical support, the bears have been in control at the start of this week and snapped the critical support.

AUD/USD prior analysis

AUD/USD, live daily chart

The risk-off tone to markets at the start of this week has seen US stocks plummet and the high beta currencies, such as the Aussie taken along for the ride.

Relatively higher yields in the US and the anticipation of Fed rate hikes this year suggests that USD could continue to benefit in the face of possible conflict in central Asia.

DXY H1 chart

The US dollar, as measured by the DXY index, is stalling for now and looks to be homing in on the 50% retracement of the last bullish impulse. The 61.8% ratio meets with prior highs as a firmer layer of potential support for the sessions ahead.

Meanwhile, AUD/USD's M-formation on the daily chart is a compelling chart pattern for the week ahead. A reversion towards 0.7150/60 would be expected for the days ahead:

However, considering how fluid the geopolitics is, if there is a Russian invasion of Ukraine, the US dollar would be expected to continue higher. In turn, this would be taking the Aussie down with it for a test of bullish commitments in the lower end of the 0.70 areas.

The base case is for a softer Australian dollar over time for analysts at Wells Fargo. However, they point out the risks appear tilted toward a smaller decline than their forecast of AUD/USD at 0.70 by the third quarter and at 0.68 by the end of the year.

Key Quotes:

“The economy is enjoying a solid rebound, and could prove more resilient than expected even in the face of the latest wave of COVID cases, a scenario that should offer some direct support for the Australian currency.”

“A resilient economy could also prompt the Reserve Bank fo Australia to end its bond purchases more quickly, and possibly signal earlier rate increases, both factors that would offer some support for the Australian dollar.”

“While not our base case, should Chinese growth respond in a strong positive fashion to policy easing from Chinese authorities, that would likely also be helpful for Australian dollar. In this more favorable scenario, the AUD/USD exchange rate could fall only moderately, perhaps not weakening much below the $0.7000 level.”

“We expect the RBA to hold its Cash Rate steady at 0.10% through all of 2022. However, we now see rate hikes beginning in early 2023, and expect a 15 bps rate hike in February next year, followed by 25 bps rate hikes in May, August and November.”

- USD/CAD is currently probing the 1.2700 level having rallied from the mid-1.2500s on Monday amid widespread losses for risk assets.

- Safe-haven demand amid geopolitical tensions and amid pre-Fed positioning has boosted the US dollar.

USD/CAD has continued to push higher in recent trade as the global risk asset rout has accelerated during US trading hours. US equities are now leading the downside, with the S&P 500 now down more than 3.0% on the day, and this is taking its toll on risk-sensitive currencies, of which the Canadian dollar is included. USD/CAD is now testing the 1.2700 level having started the day closer to 1.2550 and is on course to post on-the-day gains of about 1.0%. The loonie’s losses are on a similar scale to those being seen in its risk-sensitive G10 peers, like AUD (-1.1%), NZD (-0.8%), GBP (-0.8%) and NOK (-1.5%).

Monday’s swift move higher marks a clean upside break of the 1.2450-1.2550 range that had prevailed over the past week and a half and has seen the pair move above its 21-day moving average at 1.2640. USD/CAD hasn’t yet been able to surpass its 50DMA at just above the 1.2700 level, which is now acting as resistance. But if US stocks keep dropping at the present rate, it's only a matter of time. A break above 1.2700 would open the door to a test of the next major area of resistance around 1.2800.

US dollar strength as market participants look for safe-haven assets (the dollar’s safe-haven G10 peers the yen and Swiss franc are also doing well), but also as markets pre-position for a hawkish Fed meeting this week, is driving the upside. The bank is expected to pave the way for rate lift-off in March and will also continue to discuss its quantitative tightening (QT) options, which Fed Chair Jerome Powell is likely to talk about in the press conference. The minutes of this meeting will also be hotly anticipated a few weeks later for information on the QT discussion.

Some analysts/markets commentators have been going a bit over the top in recent days with their Fed calls (for example, some calling for the bank to hike at every meeting this year), meaning the bar to exceed already very hawkish expectations is high. But in a risk-off, hawkish Fed-dominated market environment, the argument to be short USD this week is not a strong one. One thing to note for USD/CAD is that if geopolitical tensions continue to escalate, this might drive oil prices back up again (they are currently down today in tandem with other risk assets). That could shelter the loonie from dollar strength to a degree.

- US equities have been getting battered on Monday, with the S&P 500 on course to close 10% below recent highs.

- The S&P 500 fell under 4300 to hit its lowest levels since July.

- US equities are suffering from a double whammy of concerns over Fed tightening and about a potential war in Ukraine.

US equity markets are trading sharply lower on Monday, with the S&P 500 index on course to confirm a “correction”, i.e. a close of more than 10% below the recent highs printed back in the first week of 2022. The index slumped below the 4300 level on Monday, to hit its lowest point since last July and is currently trading in the 4270s, down 2.8% on the day and down more than 10% since the start of the year.

The Nasdaq 100 index cratered 2.9% to hit the 14.0K level, taking its on-the-year losses to over 14.0% and its pullback from the November record highs to more than 16.0%. The Dow dropped 1.9% to fall into the mid-36K area, taking its on-the-year losses to 7.5% and losses versus recent record highs to just over 9.0%. The S&P 500 Volatility Index or VIX, meanwhile, continued its recent surge and surpassed its December “Omicron” high at 35.32 to nearly hit 38, its highest level since October 2020.

Driving the day

US equities are suffering from a double whammy of concerns over Fed tightening and concerns about the potentially imminent breakout of war in Eastern Europe. Regarding the former, markets are expecting a hawkish Fed to signal intent to hike interest rates multiple times this year, as well as reveal more details on potential quantitative tightening plans. The exact timing/speed of this tightening is hotly debated, with some analysts going as far as saying the Fed might even hike rates this week and then continue hiking rates at every meeting for the rest of the year.

That is probably a little over the top – since the pandemic, the Jerome Powell-led Fed has delivered clear forward guidance that it has largely stuck to and has been averse to wrong-footing markets. That should take a rate hike this week of the table. But momentum is clearly there for four, or maybe even more, rate hikes in 2022. The rapid shift in Fed direction (no one was talking about multiple 2022 rate hikes even as recently as November) has battered the cheap-money addicted sectors of US equity markets, such as the tech sector.

In terms of geopolitics, Western powers have been making moves to remove diplomats and their families from Ukraine in a signal that they anticipate a Russian invasion to be imminent. NATO leaders have also announced intentions to bolster troop presence in Eastern Europe, signaling fears that any potential conflict could spill across Ukrainian borders and into neighboring countries. Equity markets continue to watch the escalation in rhetoric/actions with concern and strategists note that Eastern European “war risk” could remain embedded in the price for some time.

- The GBP/USD plunges near 100-pips as risk-sentiment worsens in the day.

- Tensions in Eastern Europe, Fed tightening monetary policy conditions, and UK political issues weighed on the GBP.

- Although expansionary, IHS Markit Manufacturing PMI’s showed the impact of the Omicron variant.

At the time of writing, the British pound plunges during the New York session, trading at 1.3456, down almost close to 100-pips, as the Russian – Ukraine crisis escalates, alongside the Federal Reserve monetary policy meeting, which the US central bank could use to set the guidelines regarding tightening policy conditions.

In the meantime, the US stock indices get whipped out, losing between 1.67% and 2.51%, while in the FX market, the low yielders’ Japanese yen, Swiss Franc, the euro, and the greenback, are the gainers of the session.

UK IHS PMI came worse than expected

Early in the European session, the UK’s IHS Markit PMI for January came worse than expected. The Manufacturing PMI came at 56.9 vs. 57.6 expected, while the Services index was at 53.3 vs. 54.0 expected. The composite PMI came at 53.4 vs. 54.0, falling for the third straight month to the lowest since February 2021.

In the meantime, pressures on PM Boris Johnson keep mounting after the so-called Downing Street No 10 “party gate” came known by December of 2021. Johnson’s approval ratings are plunging, and reported by CNN, “there appears to be a growing sense among some parts of his ruling Conservative Party that he is becoming a liability.” In the last week, two polls suggested that two-thirds of voters want him to resign.

Putting this aside, Brexit jitters about the North Ireland protocol and article 16 would further pressure the weakened British pound, which has fallen in the month 0.58%.

Meanwhile, the US economic docket featured the IHS Markit PMI’s. The Manufacturing index came at 55.0 vs. 57.7 in December, while the Services index dropped seven points to 50.9 from 57.6. As a result, the composite hit the 50.8 mark, down from 57.0.

Therefore, GBP/USD trader’s focus is on the Federal Reserve monetary policy meeting, which begins on Tuesday. The monetary policy statement is released on Wednesday, followed by the Fed’s Chair Jerome Powell press conference.

According to analysts at Wells Fargo, the US Dollar should broadly strengthen against most emerging market currencies, including the Indian rupee as the Federal Reserve lifts interest rates and eventually shrinks its balance sheet. They forecast USD/INR at 74.50 by the end of the first quarter and at 75.00 by the third.

Key Quotes:

“India is currently experiencing a third wave of COVID infections lead by the Omicron variant, and early evidence suggests the renewed spread of the virus may be having a negative impact on economic activity. With that said, we do not expect another full-scale lockdown, and believe the economic effects of the current wave will be somewhat mild and rather short-lived. We do, however, expect inflationary pressures to build, and for core inflation to move above the upper bound of the Reserve Bank of India's target range in the near future.”

“As underlying inflation rises above the RBI's target range, we expect the central bank to turn more hawkish. To that point, we now expect policymakers to begin raising interest rates in Q1-2022 and to steadily tighten monetary policy over the course of this year.”

“Despite tighter monetary policy, we continue to believe the Indian rupee will weaken over the long term. Fed tightening should contribute to a weaker rupee; however, we expect depreciation to be gradual as the RBI would likely use its large stockpile of FX reserves to mitigate rupee volatility.”

- US dollar trims losses across the board, DXY back under 96.00.

- Wall Street indices sharply lower, but off lows.

- EUR/USD recovers and rises back to the recent range.

The EUR/USD dropped to 1.1289, reaching the lowest level since January 10 and then rebounded. It is back above 1.1320, still in negative territory but off lows and back above the critical 1.1300 area.

If the pair manages to remain above 1.1300 it would remain in the current range with resistance at 1.1350 (horizontal level and the 20-day moving average). A daily close clearly under 1.1300 should increase the bearish pressure, targeting 1.1270.

The rebound took place as US stocks move off lows and the DXY backed away from weekly highs. The Index peaked at 96.12 and is back under 96.00. Still, caution and risk aversion dominates financial markets, but over the last hours there have been some improvements. Metals and even crypocurrencies trimmed losses.

The euro has been among the top performers of the last hours. It erased losses versus the Swiss franc with EUR/CHF rising from 1.0295 to 1.0350 and it printed fresh weekly highs against the pound as EUR/GBP cling to 0.8400.

Ahead of the key event of the week, the FOMC meeting, US data released on Wednesday came in below expectations with the Service and Manufacturing Markit PMI at 50.9 and 55 respectably, below the 55 and 56.7 of market consensus.

Technical levels

- AUD/USD continued to decline in recent trade in tandem with the broader risk asset sell-off and is now under 0.7100.

- The pair broke below a key level of long-term support earlier in the session, exacerbating the selling pressure.

Since breaking below a key level of long-term uptrend support (in the 0.7180 area), AUD/USD has fallen sharply and, in recent trade, dipped below the 0.7100 level for the first time in more than one month. The pair, which currently trades in the 0.7090s, currently trades about 1.2% lower, with the Aussie one of the worst performing G10 currencies alongside NOK and SEK, though other risk-sensitive G10 currencies (GBP, CAD, NZD) are also fairing poorly.

The risk-off mood to FX market trade is a function of broader risk aversion, with US and European equities experiencing a sharp downturn and most risk-sensitive commodities also being hit. The S&P 500 is nearly 2.5% lower on the day, the Stoxx 600 is nearly 4.0% down on the day, WTI is nearly $2.0 lower and spot copper prices are about 2.5% lower. Market commentators are citing a combination of concerns over NATO/Ukrainian tensions with Russia and the rising risk of a war in Eastern Europe, as well as concerns about Fed tightening. A note from Goldman Sachs on Monday that got a lot of attention speculated the bank might hike interest rates at all of its remaining meetings in 2022.

Focus will switch back to domestic Australian themes during Tuesday’s Asia Pacific session when the all-important Q4 2021 Consumer Price Inflation report is released. Some think the data could bolster expectations for a hawkish RBA policy turn at upcoming meetings. According to Reuters, the median economist forecast is for the headline CPI rate to rise to 3.2% and for the core rate to rise to 2.4%, which would be the highest since 2014. Analysts at two Australian banks said they see the RBA’s preferred “trimmed mean” measure of inflation hitting 2.5%, putting back at the centre of the central bank’s 2-3% target inflation range two years ahead of current forecasts.

Analysts at one of the banks said that this will result in the RBA revising higher their CPI forecasts, with the new forecasts to show trimmed mean inflation remaining at the midpoint of the inflation target for the duration of the forecast horizon. “Come the RBA's February meeting, QE is clearly gone,” analysts at the bank said, adding that as “for the rates view, much depends on its (the RBA’s) willingness to tolerate inflation at or above target as it waits until wages growth is closer to 3% plus”.

Senior Economist Julia Goh and Economist Loke Siew Ting at UOB Group assesses the latest inflation data in the Malaysian economy.

Key Takeaways

“Headline inflation held above the 3.0% level at 3.2% y/y in Dec 2021 (Nov: +3.3%), in line with our estimate and Bloomberg consensus (both at 3.1%). This brought 2021 full-year inflation to an average of 2.5%, matching our full-year projection (MOF est: 2.4%; 2020: -1.2%).”

“December’s inflation outturn primarily reflected higher prices of food, furniture & furnishing, household appliances, recreation services & culture, restaurant & hotels, personal care, and financial services. Food prices as a whole posted the largest gain in nearly 4 years at 3.4% last month, with a broad-based increase across prices of food at home and away from home.”

“We expect inflation to average 3.0% in 2022 (MOF est: 2.1%) amid upside risks coming from prolonged global supply chain bottlenecks, post-pandemic labour shortages, volatile commodity prices, expiry of government’s price control schemes, and potential subsidy rationalization programs. That said, a sanguine outlook on the economic recovery coupled with more aggressive monetary policy tightening by Fed could trigger a more hawkish tilt in Bank Negara Malaysia’s (BNM) policy stance this year.”

- Manufacturing, Services and Composite PMI all fell to their lowest levels since 2020.

- There didn't seem to be much reaction at the time but the downbeat data likely won't help the market's mood improve.

According to a preliminary January survey by IHS Markit, Service PMI fell to 50.9 this month from 57.6 in December. That was much larger than the expected decline to 55.0 and marked the lowest reading since July 2020. IHS Markit's Manufacturing PMI also fell more than expected to 55.0 from 57.7 versus forecasts for a drop to 56.7. That marked the lowest such reading since October 2020. The Composite Index fell to 50.8 from 57.0, its lowest since July 2020.

Market Reaction

The weak US data doesn't seem to have triggered much of an FX or equity market reaction, though will likely contribute to the overarching downbeat market mood.

- USD/TRY keeps the consolidative trade well in place.

- No reaction to the recent steady stance from the CBRT.

- Turkey’s finmin sees inflation at around 40% in the next months.

Consolidation seems to be the new name of the game around USD/TRY, as it continues to trade within the 13.00-14.00 range since the beginning of the new year.

USD/TRY looks stabilized within 13.00-14.00

USD/TRY alternates gains with losses in the mid-13.00s, extending the prevailing side-lined mood for yet another session on Monday.

The lira seems to have derived some strength after Turkey’s finmin N.Nebati hinted at the idea that the domestic inflation could reach 40% in the next months earlier in the session, quite an ambitious target considering that consumer prices rose more than 36% in December vs. the same month of 2020 and Producer Prices gained almost… 80% YoY. Nebati also ruled out further tightening by the CBRT in the form of interest rate hikes.

In the meantime, there was no meaningful reaction in the FX space after the Turkish central bank (CBRT) left the One-Week Repo Rate unchanged at 14.00% at its meeting last Thursday, matching the broad consensus.

What to look for around TRY

The pair keeps the multi-session consolidative theme well in place, always within the 13.00-14.00 range. Higher-than-expected inflation figures released earlier in the year put the lira under extra pressure in combination with some cracks in the confidence among Turks regarding the government’s recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under pressure for the time being.

Key events in Turkey this week: Capacity Utilization, Manufacturing Confidence (Tuesday) – Economic Confidence Index (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is retreating 0.11% at 13.4107 and a drop below 12.7523 (2022 low Jan.3) would pave the way for a test of 12.7471 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- A downbeat market sentiment favors the safe-haven status of the Japanese yen vs. the greenback, US T-bond yields fall.

- JP Morgan closes its long positions in the Russian rouble as tensions in Eastern Europe arise.

- USD/JPY Technical Outlook: Points upward, but a break under 113.50 could send the pair tumbling to 112.53.

After testing the YTD lows reached on January 14 around 113.48, the USD/JPY edges up, some 0.09%. At the time of writing, the USD/JPY is trading at 113.75 during the New York session.

Market sentiment downbeat amid increasing tensions in Eastern Europe and the Fed monetary policy meeting

The risk-off market mood spurred by increasing tensions in Eastern Europe and the two-day Federal Reserve monetary policy meeting keeps investors unease on mounting expectations that the US central bank would be aggressive tightening its policy conditions amid rising inflation, which reached 7% on December’s report.

According to Reuters, JP Morgan closed all its remaining long positions in the Russian rouble on Monday, “warning the military build-up near Ukraine meant geopolitical uncertainty was now prohibitively high.” That alongside the US 10-year Treasury yield moving lower, from around 1.80% in the last week, at press time plunges almost six basis points, from 1.772% to 1.719%, weighs on the USD/JPY, which has a positive correlation with US T-bond yields.

In the meantime, the US Dollar Index, a gauge of the greenback against six peers, is at 96.00, reached at 14:22 GMT.

The economic docket witnessed a release of Markit PMI’s across the globe. In Japan, the Manufacturing PMI rose to 54.6, but the Services component plummeted to 46.6 from 52.1 in December. As a result, the composite PMI is down to 48.8, the first time below 50 since the September reading. Meanwhile, the Markit PMI for the US will be unveiled at 14:45 GMT in the US. December’s reading portrayed the Manufacturing PMI at 57.7, the Services PMI at 57.6, and the Composite stayed at 57.0.

USD/JPY Price Forecast: Technical outlook

The USD/JPY daily chart witnessed a second touch at the YTD lows around 113.48, near the 78.6% Fibonacci retracement, drawn from November 2021 cycle lows at 112.53 up to January 4 pivot high at 116.34. That alongside the 100-day moving average (DMA) around 113.28 should cape any downward moves in the pair, which in the case of being broken, would expose November 30, 2021, daily low at 112.53.

The USD/JPY first resistance level would be 114.00. A breach of the latter would expose the 50-DMA at 114.32, followed by the January 18 daily high at 115.08.

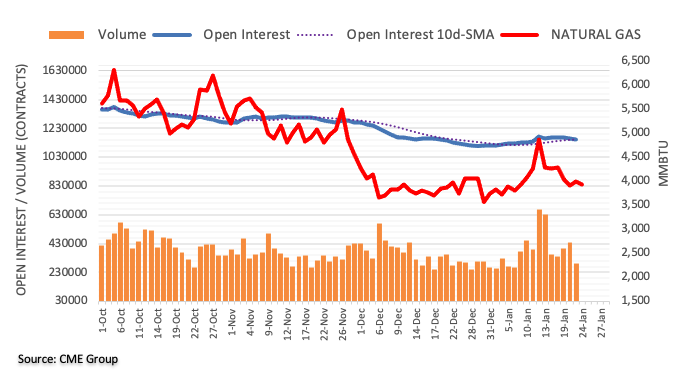

- WTI has fallen back into the mid-$83.00s from earlier highs around $86.00.

- Oil prices have been selling off recently as the US dollar picks up and other risk assets decline.

Crude oil prices fell sharply on Monday in tandem with a broad risk asset pullback that has also seen US (and European) equities, risk-sensitive currencies and cryptocurrency markets move sharply lower. Front-month WTI futures currently trade in the mid-$83.00s per barrel, down about $1.50 on the day, having been as high as $86.00 earlier in the session. Support in the $83.00 area is for now holding up, but a break below here could open the door to a drop back towards $80.00 per barrel.

Traders have been citing a combination of Fed tightening fears (as this week’s Fed meeting looms) and concerns about geopolitical escalation in Eastern Europe as weighing on the macro mood. Safe-haven assets such as USD, JPY, CHF and bonds have been outperforming and generally seeing solid demand and some are attributing the stronger US dollar as another factor weighing on crude oil prices on Monday. A stronger dollar makes USD-denominated crude oil more expensive for the holders of international currencies, thus weighing on its demand.

Analysts note that, while the broadly downbeat market mood does seem to be weighing on crude oil prices, rising geopolitical tensions between Russia/Ukraine/NATO, as well as in the Middle Ease as the UAE fends off more Houthi militia attacks, are a source of upside risk for crude oil prices. It remains unclear how any NATO (economic) response to a Russian military incursion into Ukraine would impact the country’s more than 11M barrels per day in crude oil output.

EUR/CHF is now back at the December low near 1.0325/1.0310 – removal of which can trigger a dive towards the 1.0225/1.0210 area, economists at Société Générale report.

Break above 1.0450 needed to affirm a meaningful bounce

“Daily MACD is still in negative territory which denotes upside momentum is lacking.”

“The pair has to cross above 1.0450, the 61.8% retracement of recent down move to affirm a meaningful bounce.”

“Failure to defend 1.0325/1.0310 can lead to next leg of decline towards projections of 1.0275 and 1.0225/1.0210.”

The S&P 500 saw an aggressive fall of 5.7% last week and this leaves the market nearly down 9% from its 2021 record high. The weekly close below the 200-day moving average (DMA) at 4429 warns of further weakness to 4345, with scope for the October 2021 lows at 4290/79, analysts at Credit Suisse report.

VIX set to soar towards 35.00

“The S&P 500 closed the week below our corrective of its long-term 200-DMA, currently at 4429, reinforcing its existing top below 4582. With weekly RSI momentum also holding a major top, we look for further weakness yet.”

“Below the 78.6% retracement of the rally from last October at 4396 can see support next at a small price gap from last October at 4387/64, then potential trend/”neckline” support at 4345.”

“We see scope for a move below 4345 to test the key lows of last October at 4290/79, but we look for an attempt to find a floor above here. Below 4279 though would mark a further deterioration with support then seen next at the 38.2% retracement of the rally from October 2020 at 4213.”

“Resistance is seen at 4426/29 initially, then 4455 with the immediate risk seen staying lower whilst below 4495.”

“VIX above 27.40 warns of a further rise to 35.00.”

- Spot silver prices have pulled back sharply below the $24.00 level in recent trade, despite gold prices remaining resilient.

- The recent bout of selling pressure has seen XAG/USD hit its lowest levels since last Wednesday.

- Technicians are eyeing a test of support in the $23.70 and $23.40 areas.

Spot silver (XAG/USD) prices have been choppy in recent trade, with prices recently collapsing back to the south of the $24.00 level and towards $23.80, with the precious metal now trading lower by about 2.0% on the day. Silver is seeing divergence with spot gold on Monday, with the latter seemingly catching a bid amid safe-haven demand as a result of geopolitical concerns whilst the former fails to do so. Silver could be suffering as a result of a broadly stronger US dollar, which as (like gold) has been gaining on safe-haven grounds.

Either way, the recent bout of selling pressure has seen XAG/USD hit its lowest levels since last Wednesday. The bears will be eyeing support in the form of the 24, 25 November highs in the $23.70 area ahead of a potential retest of the late December highs in the $23.40 area. If silver does hit these levels, a big question will be whether the recent pullback has been sufficient to attract dip-buyers.

Ahead of this week’s Fed meeting, which is unanimously expected to be a very hawkish affair, the appeal of interest-rate-sensitive assets (such as precious metals) may be somewhat limited. Geopolitics and over-arching risk appetite will of course also be important drivers of silver this week, and US data in the form of Q4 GDP and December Core PCE inflation will be worth watching.

Gold is moving ahead into a time cycle change, which is likely to feature a season of change favouring a better outlook. Technically, gold is trapped within a current triangle pattern that requires prices to break and sustain over $1,876, Benjamin Wong, Strategist at DBS Bank, reports.

Looking for more horsepower

“On the Ichimoku weekly, gold is yet over the cloud’s resistance at $1,863 and the 50% Fibonacci retracement of the $2,075-$1,677 range grip at $1,876 to command a complete bullish outlook. Gold needs to garner more horsepower before it can stage the break of the triangle pattern, which means breaking through $1,876 and last June’s $1,916 peak.”

“Gold has so far peaked at $1,848 (retracing 76.4% the mid-November through mid-December drop), and a minor retracement of the 38.2% Fibonacci order can bring it back to $1,812. Below that rests the 50-day moving average (DMA) and 200-DMA confluence at $1,805.”

- A combination of negative factors dragged NZD/USD to an over one-year low on Monday.

- Hawkish Fed expectations provided a strong boost to the greenback and exerted pressure.

- The risk-off mood further contributed to driving flows away from the perceived riskier kiwi.

The NZD/USD pair edged lower through the early North American session and dropped to the 0.6680 area, or the lowest level since November 2020 in the last hour.

Following a brief consolidation during the first half of the trading on Monday, the NZD/USD pair met with a fresh supply and prolong its bearish trend witnessed over the past two weeks or so. The US dollar made a solid comeback amid growing acceptance that the Fed will tighten its monetary policy at a faster pace than anticipated.

In fact, the markets have fully priced in the prospects for an eventual lift-off in March and expect a total of four rate hikes in 2022. Apart from this, the risk-off mood – as depicted by an extension of the recent fall in the equity markets – further benefitted the safe-haven greenback and drove flows away from the perceived riskier kiwi.

Meanwhile, the combination of factors dragged the NZD/USD pair below the 2021 swing lows support, taking along some trading stops placed near the 0.6700 round-figure mark. Hence, the downfall could further be attributed to some technical selling, which might have already set the stage for a further near-term depreciating move.

Market participants now look forward to the release of the flash US PMI prints (Manufacturing and Services) for a fresh impetus. This, along with the US bond yields, will influence the USD price dynamics. Traders will further take cues from the broader market risk sentiment to grab some short-term opportunities around the NZD/USD pair.

The key focus, however, will remain on the outcome of a crucial two-day FOMC monetary policy meeting, scheduled to be announced during the US session on Wednesday. Investors will look for clues about the likely timing of when the Fed will commence its policy tightening cycle. This, in turn, will drive the USD and determine the near-term trajectory for the NZD/USD pair.

Technical levels to watch

- EUR/GBP hit its highest level in three weeks on Monday, reversing higher from an earlier dip to nearly hit 0.8390.

- Traders have attributed upside as a function of the generalised risk-off tone to broader macro trade.

- Mixed Eurozone and downbeat UK PMIs didn’t have much of an impact.

EUR/GBP hit its highest level in three weeks on Monday, reversing higher from an earlier dip towards the 0.8350 level to come within a whisker of hitting the 0.8390 mark. At current levels in the 0.8380s, the pair is trading with modest on-the-day gains of about 0.1%. Traders have attributed upside as a function of the generalised risk-off tone to broader macro trade. Markets worry that a Russian military incursion into Ukraine might be imminent as Western powers move to remove diplomats from Kyiv and reinforce the NATO presence in neighbouring countries.

US and European equities trade lower as a result and in FX markets, risk-sensitive currencies (like GBP) are the worse performers. Mixed preliminary January PMI results out of both the UK and Eurozone doesn’t seem to have shifted the dial much for EUR/GBP. In the Eurozone, the manufacturing PMI was substantially better than forecast, while services was a little worse. In the UK, the PMIs were worse than forecast across the board, but IHS said that with inflationary pressures remaining elevated near record highs, the BoE remains odds on to hike interest rates again at next week’s meeting.

Meanwhile, FX strategists continue to view the uncertainty about UK PM Boris Johnson’s future in the top spot as not having much of an impact on sterling. Analysts at MUFG said “we do not expect heightened political uncertainty to materially impact pound performance given there is unlikely to be any near-term change in government policies”. Analysts at ING said “politics has yet to hit GBP on the view that even if PM Johnson were to resign, Chancellor Sunak would be seen as a safe pair of hands as an alternative”. Ahead this week, there isn't much by way of notable tier one data aside from Spanish, French and German flash Q4 GDP numbers of Friday.

Economists at ABN Amro expect more weakness in EUR/USD. They forecast the pair at 1.05 and 1.00 by the end of 2022 and 2023, respectively.

Significant policy divergence between the Fed and the ECB over the coming years

“We now expect that the Fed will begin hiking interest rates in March 2022 and to hike four times in 2022.”

“We believe that the ECB is facing a different set of macroeconomic circumstances than faced by the US central bank. The ECB has also explicitly ruled out a rate hike in 2022 and has hinted that it could well be ‘on hold’ for much longer.”

“Our forecast for EUR/USD at year-end 2022 is 1.05 and 1.00 for year-end 2023.”

- USD/CAD gained strong positive traction for the second successive day on Monday.

- Fed rate hike bets, the prevalent risk-off mood boosted the safe-haven greenback.

- An intraday pullback in oil prices undermined the loonie and remained supportive.

The USD/CAD pair built on its intraday ascent and climbed to a nearly two-week high, around the 1.2625 region heading into the North American session.

The pair attracted some dip-buying near the 1.2555 area on Monday and built on the previous session's positive move from the very important 200-day SMA amid a broad-based US dollar strength. The markets have fully priced in the prospects for an eventual Fed lift-off in March and expect a total of four rate hikes in 202. This, along with the prevalent risk-off mood, provided a goodish lift to the safe-haven greenback and assisted the USD/CAD pair to gain traction for the second successive day.

On the other hand, an intraday pullback in crude oil prices undermined the commodity-linked loonie. This was seen as another factor that pushed the USD/CAD pair higher, taking along some short-term trading stops placed near the 1.2600 round-figure mark. Hence, the uptick could further be attributed to some technical buying. That said, any meaningful upside still seems elusive ahead of this week's key central bank event risks – the BoC and the FOMC monetary policy decisions on Wednesday.

The markets have been speculating that the Bank of Canada could increase rates as early as this week amid a jump in Canada’s annual inflation rate to a three-decade high in December. Apart from this, escalating geopolitical tensions between Russia and Ukraine as well as in the Middle East should limit the downside for crude oil prices. The fundamental backdrop makes it prudent to wait for a strong follow-through buying before confirming that the USD/CAD pair has bottomed out already.

Market participants now look forward to the release of the flash US PMI prints (Manufacturing and Services) for a fresh impetus. This, along with the broader market risk sentiment, will drive the USD demand. Traders will further take cues from oil price dynamics to grab some short-term opportunities around the USD/CAD pair.

Technical levels to watch

Enrico Tanuwidjaja, Economist at UOB Group, reviews the latest bank Indonesia (BI) event.

Key Takeaways

“BI kept rates unchanged at its first meeting of the year at 3.5%.”

“However, RRR hike is expected to start in March, signalling normalization has begun.”

“We keep our view for BI to start hiking in H2 2022 to reach 4.5% by the end of this year.”

- Gold is holding near $1840 despite the stronger USD on a heightened safe-haven bid amid geopolitical concerns.

- What is expected to be a very hawkish Fed meeting will test gold’s resilience this week.

As geopolitical concerns mount about a potential Russian military incursion into Ukraine, spot gold (XAU/USD) prices are finding support via safe-haven demand and, for now, shrugging off the negative headwinds from a firmer US dollar. XAU/USD has been gradually rising since the Monday Asia Pacific session open in the mid-$1830s to current levels around $1840. The subdued tone to trade in US government bond markets, where long-term yields are modestly lower (10 and 30-year -1bps), is also acting as somewhat supportive for the yield-sensitive precious metal.

A Goldman Sachs note warning that the Fed might lift interest rates at all of the remaining meetings this year got a lot of attention amongst analysts this morning but doesn’t seem to have moved the needle much for markets. Admittedly, US 2-year yields are about 2bps higher, but as noted, the rest of the yield curve is flat to lower with geopolitics the main topic of discussion so far on the day. That suggests the main driver of Monday’s USD upside (DXY +0.3% to near 96.00, near two-week highs) is safe-haven more than Fed-related, which is why gold has been able to trade on a stronger footing.

Whether gold’s resilience to ongoing dollar advances can last is another question. This week’s Fed meeting is likely to be a hawkish affair, though the bar for the meeting to exceed the market’s very hawkish expectations is seemingly quite higher. Gold bulls will be hoping that at the very least, the precious metal is able to hold within its recent $1830-$1845ish range.

A further escalation in the tense geopolitical situation in Eastern Europe might be enough to send XAU/USD back above $1850 if also coupled with less hawkish than feared Fed vibes. The other major events to watch out for this week include US earnings, which could shift equity and also macro sentiment, and the Advance Q4 GDP growth estimate (on Thursday) and December Core PCE (on Friday).

- EUR/USD resumes the downtrend and challenges 1.1300.

- Sellers aim at another visit to the 2022 low at 1.1272.

EUR/USD fades Friday’s decent advance and shifts the attention to the downside on Monday.

The bias appears tilted to further decline in the very near term. That said, a breach of recent lows in the 1.1300 zone should pave the way for a potential visit to the 2022 low at 1.1272 (January 4).

The longer term negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1712.

EUR/USD daily chart

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the latest interest rate decision by the Bank Negara Malaysia (BNM).

Key Takeaways

“Bank Negara Malaysia (BNM) kept the Overnight Policy Rate (OPR) unchanged at 1.75% … (20 Jan). This came in line with our estimate and market expectations. The next two scheduled monetary policy meetings are on 2-3 Mar and 10-11 May.”

“The overall tone of the latest statement remains optimistic on Malaysia’s growth outlook in 4Q21 and 2022. Key growth drivers include rising global demand, domestic private spending, improved labour market, and ongoing policy support. BNM sees underlying inflation or core inflation rising but to remain modest amid continued slack in the economy and labour market. The inflation outlook, however, is still subject to global commodity price movements and prolonged supply-related disruptions.”

“There was no mention of the need to review the degree of monetary accommodation. BNM continued to judge that the existing monetary policy stance remained appropriate and accommodative. However, given BNM’s sanguine outlook on the economic recovery and to be ahead of the curve, we think BNM may consider normalising interest rates in the coming months. Our view is also backed by improving labour market conditions, progress in vaccinations, and better management of the pandemic. We are revising our OPR view to two 25bps rate hikes, with the first hike in 2Q22 followed by another in 3Q22 (vs. one 25bps rate hike in 3Q22 previously). This will bring the year-end OPR target to 2.25%.”

- DXY advances to multi-day highs and flirts with 96.00.

- The YTD peak at 96.46 emerges as the next hurdle of note.

DXY quickly leaves behind Friday’s downtick and resumes the way up to the proximity of the 96.00 mark on Monday.

The intense upside in the dollar has recently surpassed the 4-month line, today near 95.30, and in doing so it has reinstated the short-term bullish bias. That said, a break above the temporary barrier at the 55-day SMA (95.89) should open the door to a move to the so far 2022 top at 96.46 (January 4).

Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.24.

DXY daily chart

Quek Ser Leang at UOB Group’s Global Economics & Markets Research noted USD/IDR is predicted to keep the 14,280-14,380 range in the near term.

Key Quotes

“USD/IDR traded between 14,275 and 14,375 for the whole of last week, higher than our expected consolidation range of 14,260/14,360. The relatively quiet price actions offer no fresh clues and we continue to expect USD/IDR to consolidate, likely within a range of 14,280/14,380.”

“Looking ahead, USD/IDR has to break below the rising trend-line support (currently at 14,240) or above the declining trend-line resistance (currently at 14,405) before a sustained directional movement is likely.”

- GBP/USD witnessed selling for the third successive day and dropped to over a two-week low.

- A sustained break below the 1.3535-1.3530 confluence was seen as a fresh trigger for bears.

- The stage now seems all set for a slide towards testing the 50% Fibo., around mid-1.3400s.

The GBP/USD pair added to its intraday losses and dropped to a two-and-half-week low, below the 1.3500 psychological mark during the mid-European session.

The UK political crisis, along with disappointing UK PMI prints undermined the British pound. Apart from this, a strong pickup in the US dollar demand turned out to be a key factor that dragged the GBP/USD pair lower for the third successive day.

From a technical perspective, a sustained break below the 1.3535-1.3530 confluence was seen as a fresh trigger for bearish traders. The mentioned region comprised of the 100-day SMA and the 38.2% Fibonacci retracement level of 1.3161-1.3749 strong move up.

Meanwhile, oscillators on the daily chart have just started drifting into the negative territory and support prospects for further losses. Hence, some follow-through slide towards the 50% Fibo. level, around the 1.3455 region, remains a distinct possibility.

On the flip side, any attempted recovery might now meet with a fresh supply near the 1.3530-1.3535 confluence support breakpoint. This, in turn, should cap the upside for the GBP/USD pair near the 1.3580-1.3585 region, which should now act as a pivotal point.

The latter is closely followed by the 1.3600 mark and the 23.6% Fibo. level, which if cleared decisively will negate the bearish bias. The GBP/USD pair might then accelerate the momentum towards the 1.3660 resistance en-route the 1.3700 round-figure mark.

GBP/USD daily chart

-637786232010138338.png)

Levels to watch

- EUR/JPY extends the leg lower to the mid-128.00s.

- Further south comes the December lows near 127.50.

EUR/JPY comes under further pressure in the 128.50 region at the beginning of the week.

Price action in the cross now seems to favour extra decline in the short-term horizon, particularly after EUR/JPY extended the breakdown of the key 200-day SMA (130.51) in past sessions. Next on the downside should come the December 2021 low near 127.50.

While below the 200-day SMA, today at 130.51, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

USD/MYR is still expected to navigate within the 4.1700-4.2000 range for the time being, suggested Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“USD/MYR traded between 4.1800 and 4.1940 last week, narrower than our expected consolidation range of 4.1680/4.2060. Momentum indicators are mostly neutral and USD/MYR could continue to consolidate this week, expected to be within a range of 4.1700/4.2000.”

“Looking ahead, the risk of USD/MYR breaking below the bottom of the expected range (at 4.1700) first appears to be greater but any weakness is expected encounter solid support at 4.1620 and 4.1560.”

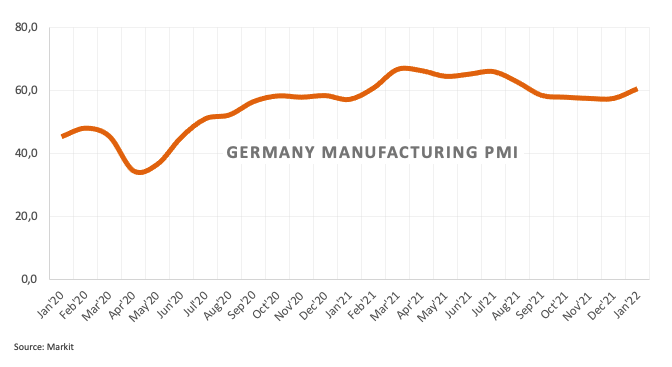

In its monthly report published on Monday, Germany's Bundesbank noted that the German economy likely shrunk in the last quarter of 2021, per Reuters.

Regarding the inflation outlook, Bundesbank said that price pressures could remain exceptionally high in early 2022 due to surging energy costs.

"The adjustments in behaviour and the triggered containment measures in some cases had a significant impact on economic activity in the service sector, especially in December," the Bundesbank noted in its publication. "Germany's real gross domestic product is likely to have fallen slightly in the final quarter of 2021."

Market reaction

The EUR/USD pair remains under bearish pressure during the European trading hours and was last seen losing 0.25% on the day at 1.1310.

Quek Ser Leang at UOB Group’s Global Economics & Markets Research suggested USD/THB could extend the range bound theme between 32.85 and 33.29 for the time being.

Key Quotes

“Last Monday (17 Jan, spot at 33.25), we held the view that USD/THB ‘could dip below 33.25’. We added, ‘the next support at 32.83 is unlikely to come into the picture’. While our view for a weaker USD/THB was not wrong, we did not expect the sharp drop that dipped below 32.83 (low of 32.81). The rebound from the low amid oversold conditions suggest that USD/THB is unlikely to weaken further.”

“For this week, USD/THB is more likely to consolidate and trade sideways between 32.85 and 33.29.”

- AUD/USD witnessed some selling for the second straight day and dropped to over a two-week low.

- Hawkish Fed expectations underpinned the USD and turned out to be a key factor exerting pressure.

- A generally weaker risk tone also contributed to drive flows away from the perceived riskier aussie.

The AUD/USD pair continued losing ground through the first half of the European session and dropped to over a two-week low, further below mid0.7100s in the last hour.

The pair extended last seek's rejection slide from the 100-day SMA resistance and witnessed some follow-through selling for the second successive day on Monday. The US dollar continued drawing some support from expectations that the Fed will tighten its monetary policy at a faster pace than anticipated. This, in turn, was seen as a key factor dragging the AUD/USD pair lower.

The markets seem convinced about an eventual Fed lift-off in March and have been pricing in a total of four hikes in 2022. This has been fueling concerns that rising borrowing costs could dent the earnings outlook for companies. This, along with escalating geopolitical tensions, weighed on investors' sentiment and further collaborated to drive flows away from the perceived riskier aussie.

Apart from this, the downfall could further be attributed to some technical selling below a short-term ascending trend-line support, around the 0.7200 mark, which was broken on Friday. The subsequent downfall might already set the stage for a further near-term depreciating move. Hence, a slide towards testing the next relevant support, around the 0.7100 mark, remains a distinct possibility.

Market participants now look forward to the release of the flash US PMI prints, due later during the early North American session. This, along with the US bond yields and the broader market risk sentiment, will influence the USD and provide some impetus to the AUD/USD pair. The focus, however, will remain on the outcome of the FOMC meeting, scheduled to be announced on Wednesday.

Technical levels to watch

Unfavourable equity market developments have taken away some of the support for the pound from the ongoing hawkish repricing of Bank of England (BoE) rate hike expectations. Economists at MUFG Bank expect the GBP to remain depressed if equity markets continue suffering losses.

Equity weakness hits pound even as BoE moves closer to another hike

“The 30-day correlation between daily % changes in cable and the MSCI’s ACWI equity index has risen back up to +0.65 from a recent low of +0.12 on 10th December. It has been the strongest sustained period of positive correlation between cable and global equity market performance since 2013, and highlights that the pound is vulnerable to further near-term weakness if equity market weakness extends.”