- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

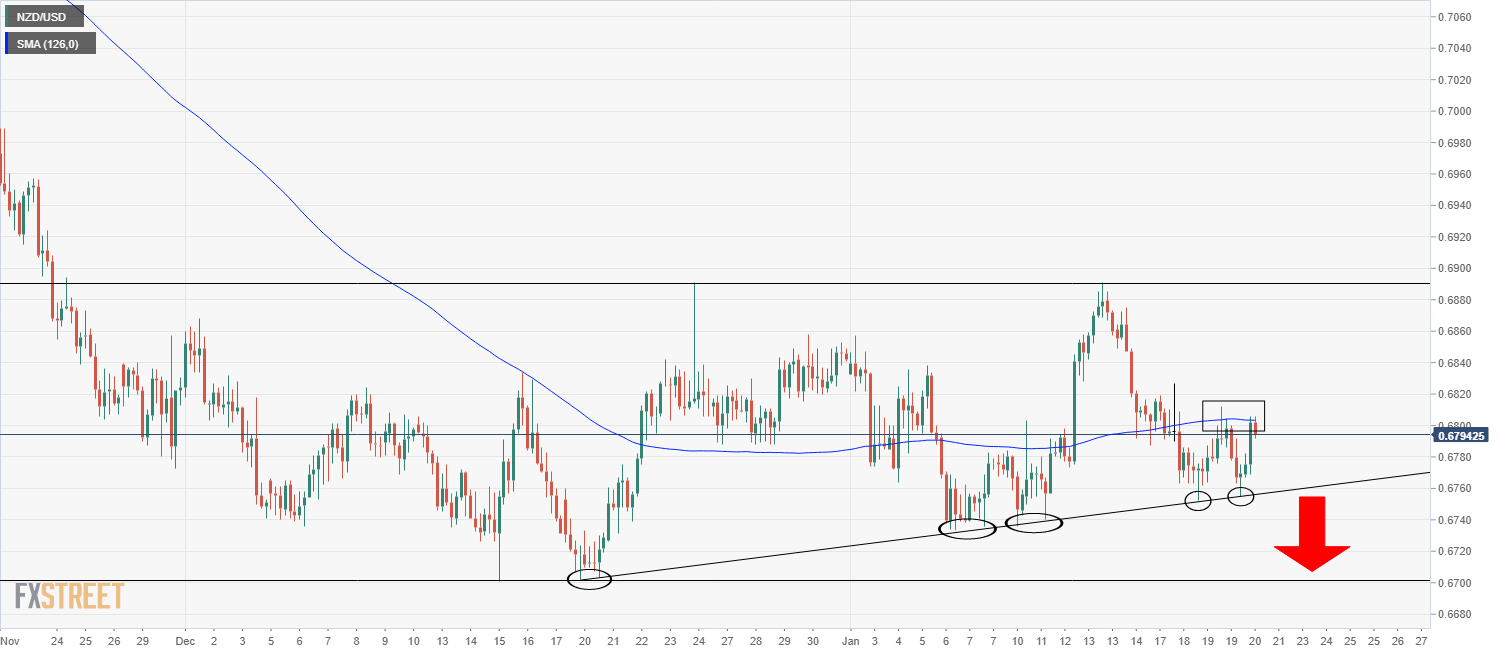

- NZD/USD refreshes weekly bottom as sellers poke five-week-old support line.

- Downtick in US stock futures triggers latest weakness amid chatters over Fed action.

- Positives concerning the US-China talks, NZ data fails to impress buyers.

- Light calendar keeps sellers hopeful ahead of next week’s FOMC.

NZD/USD remains on the back foot around the monthly support line, recently refreshing daily/weekly low near 0.6750 amid Friday’s Asian session.

The kiwi pair failed to cheer the broad US dollar weakness, as well as positive signals from the largest trading partners like Australia and China the previous day. The quote also recently ignores upbeat headlines and mixed data that may have helped Antipodeans as equity futures begin the day on a back foot.

That said, New Zealand’s Business NZ PMI for December eased to 53.7 versus 56.0 expected and 50.6 prior. Further, Visitor Arrivals YoY for November improved to +3.8% from -27.3%.

In addition to the downbeat US stock futures, headlines from the NZ Herald seem to have weighed down the NZD/USD prices of late. “Almost 2000 Omicron cases a day - 10 times the Delta-peak - are expected in the Auckland region in just six weeks in the event of an outbreak, according to latest modeling,” said the news.

It’s worth noting that Australia’s Unemployment Rate dropped to the 14-year low of 4.2% while the Employment Change also rose past expectations on Thursday. Further, The People’s Bank of China (PBOC) surprised markets with a first cut in the 5-year Loan Prime Rate (LPR), by 5 basis points (bps) to 4.60%, in 21 months on the previous day.

Additionally, the US Jobless Claims jumped to the highest since late October and the Philadelphia Fed Manufacturing Survey details also improved for January, which in turn eased inflation fears and dragged the US Treasury yields as well as the US Dollar Index.

Elsewhere, US Treasury Secretary Yellen recently said in the CNBC interview that Inflation rose by more than most economists, including me, expected and of course, it's our responsibility with the Fed to address that. And we will. Additionally, SCMP signaled that China’s Yang Jiechi and US national security adviser Jake Sullivan are up for a crunch meeting but no date was indicated.

Amid these plays, the US 10-year Treasury yields posted a second consecutive daily loss, down four basis points to 1.79% at the latest, whereas the S&P 500 Future dropped 0.30% intraday by the press time.

Given the risk-off mood and the Omicron fears weighing on the NZD/USD prices amid a light calendar, the pair traders are likely to extend the losses as pre-Fed fears grow during an absence of any major data/events on Friday.

Technical analysis

Although sustained trading below the 21-DMA level of 0.6800 keeps NZD/USD bears hopeful, a clear downside break of an ascending trend line from December 20, near 0.6750, becomes necessary for the NZD/USD prices to aim for the 2021 bottom surrounding the 0.6700 threshold.

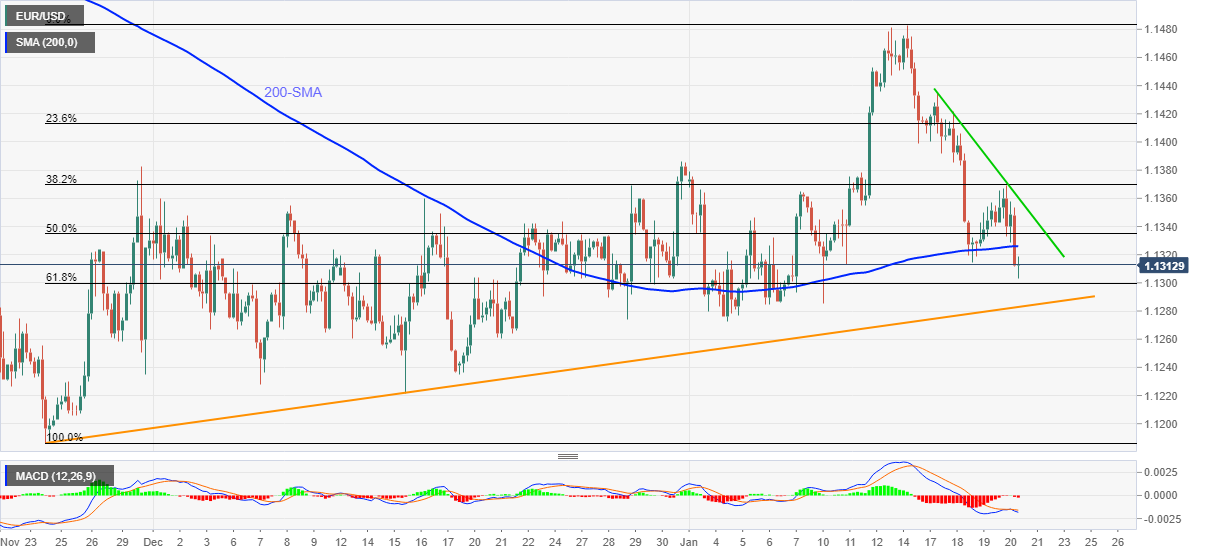

- EUR/USD remains pressured after breaking 200-SMA for the first time in two weeks.

- Bearish MACD signals, weekly descending trend line also keep sellers hopeful.

- Two-month-old support line challenges sellers, 61.8% Fibonacci retracement offers immediate support.

EUR/USD fails to cheer greenback weakness, stays depressed around 1.1310 during the initial Asian session on Friday.

While portraying the sober mood of the major pair traders, the quote remains below 200-SMA for the first time in a fortnight amid bearish MACD signals, suggesting further declines.

However, the 61.8% Fibonacci retracement (Fibo.) of November-January upside and a two-month-long rising support line, respectively near 1.1300 and 1.1280, become the key challenges for the EUR/USD sellers.

Should the quote breaks 1.1280, it becomes vulnerable to retest the year 2021 bottom of 1.1186. During the fall, 1.1230 and 1.1200 may act as buffers.

Alternatively, a clear upside break of the 200-SMA level surrounding 1.1330 needs validation from the weekly resistance line, near 1.1360 by the press time, to convince short-term EUR/USD buyers.

Even so, December’s peak of 1.1386 and the 1.1435-40 area may test the pair’s further upside ahead of directing it to the monthly top around 1.1485.

EUR/USD: Four-hour chart

Trend: Further weakness expected

- AUD/USD pauses the latest pullback from 100-DMA, weekly top.

- US-China top diplomats brace for the first meeting of 2022, US Treasury Secretary Yellen expects inflation to ease soon.

- US data weighed on yields, USD contrast to Aussie jobs report, inflation figures that favored AUD.

- Cautious mood to restrict pair’s performance amid light calendar ahead of next week’s FOMC.

AUD/USD hovers around 0.7220 following a U-turn from the weekly top around the 100-DMA. That said, the Aussie pair struggles for a clear direction but stays on the way to post the second consecutive weekly upside during early Friday morning in Asia.

The risk barometer pair cheered strong Aussie employment figures and Inflation expectations, for December and January respectively, during the initial Thursday. The People’s Bank of China (PBOC) surprised markets with a first cut in the 5-year Loan Prime Rate (LPR), by 5 basis points (bps) to 4.60%, in 21 months and helped AUD/USD as well.

The up-moves gained additional support after the US Philadelphia Fed Manufacturing Survey eased and jobless claims jumped to the three-week high, allowing Fed to have some leeway in its fight with the inflation, as recently signaled by US Treasury Secretary Janet Yellen.

Also on the positive side was the latest news from the South China Morning Post (SCMP) suggesting the US-China diplomatic talks after an abrupt rejection of the same on January 10.

Australia’s Unemployment Rate dropped to the 14-year low of 4.2% while the Employment Change also rose past expectations to keep the Aussie policymakers optimistic, which in turn propelled AUD/USD. On the other hand, the US Jobless Claims jumped to the highest since late October and the Philadelphia Fed Manufacturing Survey details also improved for January.

Elsewhere, US Treasury Secretary Yellen recently said in the CNBC interview that Inflation rose by more than most economists, including me, expected and of course, it's our responsibility with the Fed to address that. And we will. Additionally, SCMP signaled that China’s Yang Jiechi and US national security adviser Jake Sullivan are up for a crunch meeting but no date was indicated.

Amid these plays, the US 10-year Treasury yields posted a second consecutive daily loss after refreshing the two-year high on Wednesday. The same weighed on the US Dollar Index (DXY) and propelled gold prices, allowing Antipodeans to cheer the risk-on mood.

Although the recent signals hint at the US Federal Reserve’s (Fed) cautious approach in tacking the jump in inflation, the Fed policymakers are up for a fight and hence market players may remain divided ahead of the next week’s key meeting. The same joins a light calendar to restrict moves of the risk barometer pair AUD/USD for a short-term.

Read: Forex Today: Dollar hit by poor employment figures

Technical analysis

Sustained U-turn from the seven-week-old support line, around 0.7180 by the press time, joins firmer RSI to direct AUD/USD towards the 100-DMA level surrounding 0.7280, also helping it cross.

However, the quote’s further advances will be challenged by the monthly high of 0.7315 and the previous support line from August near 0.7350.

Chinese top diplomat Yang Jiechi and US national security adviser Jake Sullivan are preparing for a crunch meeting on core national security concerns, per South China Morning Post (SCMP).

The news also mentioned sources familiar with the matter as saying, “But the two sides remain deeply divided on protocol and agenda items.”

The key US and Chinese representatives were to meet on January 10 but couldn’t due to the political rift among the world’s top two economies over boycott of the Beijing Winter Olympics, as well as a call by US lawmakers for the UN to publish a report on Xinjiang, the news mentions.

“The US wants to press Beijing over China’s nuclear build-up, while China believes Washington should take the initiative and reduce its vastly larger arsenal first,” said SCMP.

Other issues that could be discussed in the meeting are, “Taiwan, the South China Sea, the East China Sea, Xinjiang and Hong Kong,” per the news.

FX implications

The news should help the Antipodeans and commodities to keep the latest recovery moves.

Read: Forex Today: Dollar hit by poor employment figures

“Inflation rose by more than most economists, including me, expected and of course it's our responsibility with the Fed to address that. And we will,” US Treasury Secretary Janet Yellen said in CNBC interview late Thursday.

Additional quotes

If the US is successful in controlling the pandemic she sees inflation easing over the course of 2022.

Has confidence in the fed's ability to make appropriate judgements on the economy.

US Treasury is prepared to impose significant consequences on Russia over actions in Ukraine.

There is a buffer stock of savings accumulated that will continue to support the economy in the years ahead, even when fiscal support is reduced.

it is our hope and intention to bring inflation down to levels consistent with the Federal Reserve interpretation of price stability.

Responsibility for addressing inflation is shared by the Fed and the Biden administration.

If people come back into the labor market, some of the supply pressures will ease.

Many pieces of Build Back Better (BBB) legislation important for workforce, climate change provisions are critical.

US households in good financial shape, in many ways stronger than before pandemic.

FX implications

The news exerts downside pressure on the risk catalysts, like equities and Antipodeans, after Thursday’s risk-on performance.

Read: Forex Today: Dollar hit by poor employment figures

- AUD/JPY has dipped back towards 82.50 as US equity market sentiment deteriorated, confirming failure to break out of recent ranges.

- The Aussie was underpinned on Thursday by strong jobs data and China monetary policy easing.

Though the currency has pulled back from its earlier session highs in tandem with a pullback from high in the US equity market, the Aussie remains on course to finish Thursday’s trading session as the best performer in the G10. But as sentiment on Wall Street has deteriorated, the safe-haven yen has been climbing the G10 rankings. The net result for AUD/JPY is that the pair has pulled back to trade just above 82.50, where it trades higher by about 0.2% on the day, having at one point earlier in the session challenged the 83.00 level, where it at the time was trading about 0.6% higher.

The Aussie’s outperformance on Thursday came following a stronger than forecast December jobs report, which showed the economy adding 64.8K jobs on the month, well above the 43.3K expected. The unemployment rate also dropped sharply to 4.2% from 4.6%, a much larger drop than the expected decline to 4.5%. The data will come as a surprise to the RBA, who forecast that Australia would end 2021 with an unemployment rate of about 4.75% and that this wouldn’t fall to 4.2% until the end of 2022. The jobs report thus endorsed very hawkish market expectations for RBA interest rate policy – despite the RBA insisting last year that the conditions for a rate hike would not be met until 2023 at the earliest, futures price a 70% probability of lift-off in May.

The data also underpinned expectations that the bank will axe its QE programme in its entirety at the upcoming February meeting. Separately, China’s PBoC eased monetary policy settings with cuts to its one and five-year loan prime rates on Thursday, boosting hopes that the recent slowdown in Chinese growth will abate later in the year, boosting the outlook for Aussie exports. Despite the positive developments that underpinned the Aussie on Thursday, the day’s price action suggests confirmed that AUD/JPY is not yet ready to break out of the recent 82.00-83.00 range that has persisted since last Friday. If risk-appetite stabilises and FX markets are free to trade more as a function of central bank divergence, then a bullish breakout above 83.00, which would open the door to a move towards 84.00, remains very much on the cards.

What you need to know on Friday, January 21:

The greenback traded with a soft tone on Thursday, ending the day mixed across the FX board. The EUR was among the weakest, while the AUD and the CAD were the strongest.

Disappointing US employment-related figures were behind the broad dollar’s weakness at the beginning of the American session, as weekly unemployment claims unexpectedly jumped to 286K in the week ended January 7, the highest reading since late in October. Like most major developed economies, US workers and businesses are struggling with Omicron-related disruptions.

The US Federal Reserve relies on what it calls “the jobs market at close to full employment” to accelerate an aggressive reduction of its financial support to tame inflation. The unexpected increase in unemployment claims may be just a one-off, but if it keeps rising, the Fed may have to put a break. The central bank is having a monetary policy meeting next week and will unveil the outcome on Wednesday, January 26.

US Treasury yields remain stable through the day, with the yield on the 10-year Treasury note at 1.83%. Stocks, on the other hand, managed to advance, with all US indexes trading in the green heading into the close, although they retreated from intraday highs.

The EUR/USD pair trades around 1.1310, while GBP/USD hovers around 1.1620. The AUD/USD pair peaked at 0.7276, now trading around 0.7240, while USD/CAD stands at 1.2474. The USD/JPY pair is marginally lower at around 114.15.

Gold is ending the day pretty much unchanged, around $1,840 a troy ounce but managed to post a fresh two-month high of $ 1,847.92 a troy ounce. Meanwhile, crude oil prices surged to fresh multi-year highs, with WTI touching $87.08 a barrel but ending the day at around $85.20.

Facebook and Instagram join the NFT mania

Like this article? Help us with some feedback by answering this survey:

- US equities were broadly higher on Thursday, aided as PBoC easing boosted global markets and amid dip-buying.

- The Nasdaq 100 index on Wednesday closed more than 10% below its November record highs, confirming a correction.

- There is lots of focus on Netflix earnings after the Thursday market close.

US equities are trading broadly higher this Thursday, as stocks in the region track gains seen in Europe and, before that, Asia markets are the PBoC on Thursday took further steps to ease monetary policy. The Chinese central bank cut its one-year loan prime rate to 3.7% from 3.8% and its five-year loan prime rate (which is a reference rate for mortgages) to 4.6% from 4.65%. As a result, the S&P 500 currently trades around 0.7% higher in the 4560s, though has pulled back sharply from earlier session highs at 4600 where the index was trading with gains of about 1.5%.

Looking across the S&P 500 GICS sectors, the gains are broad, with the big tech-dominated Information Technology and Communications Services sectors up 0.8% apiece, Financials up 1.0%, Health Care up 0.8% and Industrials up 0.6%. The Nasdaq 100 index is up about 0.8% having bounced from yesterday’s closing levels just above 15K back towards the 15.2K area. Much was made of the fact that the index closed slightly more than 10% below its November record highs above 16.7K. Chatter about the move lower from recent highs in the index, which has been driven primarily by fears of a more hawkish Fed, being an “overreaction”, and about “dip-buying” is growing.

Traders have pointed at upcoming Netflix Q4 earnings after Thursday’s close, the first of the major tech companies, as being a key moment for the tech sector’s near-term direction. Traders and analysts will be assessing whether Netflix was able to bring in enough new subscribers to justify big spending on shows in 2022. A solid report may spur dipping buying, not only in Netflix shares but perhaps across the sector. The proximity of next week’s Fed meeting suggests that extent of any post-Netflix earnings dip-buying across the tech sector might ultimately prove fairly limited.

More clarity from the Fed on their potential rate hike timeline in 2022 will be needed if the Nasdaq 100 is to have a run at recuperating recent losses. Elsewhere, the Dow gained about 0.5% and the CBOE S&P 500 volatility index or VIX stabilised below the annual highs it printed on Wednesday at 24.00, dropping back marginally under 23.00.

- GBP/USD has been choppy but ultimately remained well supported above 1.3600.

- Sterling continues to shrug off Westminster noise surrounding the potential ousting of UK PM Boris Johnson.

- Focus now turns to Friday’s UK Retail Sales data, which is unlikely to impact BoE tightening expectations much.

GBP/USD has been choppy on Thursday with the US dollar seeing a mixed reaction to weaker than expected initial jobless claims and housing data, though the pair has for the most part remained well supported to the north of the 1.3600 level. At current levels in the 1.3620s, cable looks on course to post an on-the-day gain of about 0.1% or roughly 20 pips. Sterling continues to shrug off Westminster noise surrounding the potential ousting of Boris Johnson from his position as UK PM. Analysts note that his potential replacements, such as UK Chancellor Rishi Sunak (who is the front-runner to replace him), would be unlikely to mark a significant shift in economic policy.

Friday’s UK December Retail Sales report is the only remaining tier-one data of note to cable this week. The data is unlikely to dissuade market participants from pricing in a high likelihood that the BoE hikes interest rate by another 25bps on February 3 in wake of this week’s strong UK labour market and hotter than expected inflation data. That should be enough to keep sterling supported until the end of the week, but traders should also note that the US dollar also faces upside risks in the coming days as traders brace for next week’s Fed meeting. The US central bank is expected to endorse money market pricing for as many as four rate hikes in 2022 and give the green light to a rate hike as soon as March.

It may thus prove difficult to trade GBP/USD based upon central bank divergence. A better play might be to see GBP/USD in the short-term as more of a guage for risk appetite, given sterling risk-sensitive properties. After the major US tech index the Nasdaq Composite fell into “correction” territory on Wednesday (i.e. more than 10% down from a recent high), Thursday has seen some stabilisation (aided by more monetary policy easing in China). If stocks continue to stabilise/tentatively recover in the coming days, GBP/USD may be able to move back towards a challenge of 1.3700.

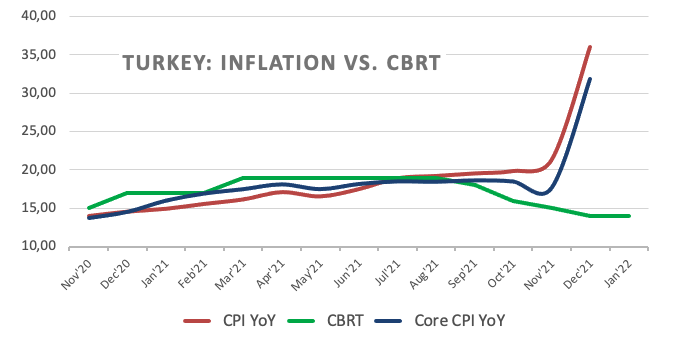

- USD/TRY breaks to the downside but holds well above confluence support.

- CBRT stands pat at 14% this month, ends strings of interest rate cuts

- Daily RSI still holds above 50.00 despite the latest downtick in the spot.

USD/TRY has returned to the red after the Turkish central bank’s (CBRT) no-rate change decision earlier this Thursday.

The spot is trading close to five-day lows of 13.26, gradually breaking lower, as the Turkish lira drew some support from the CBRT policy announcements.

The Turkish central bank kept the key rate steady at 14%, putting an end to strings of rate cuts, which sent the local currency into a downward spiral over the last year.

The major ignores the rebound in the US dollar alongside the Treasury yields after the US 10-year TIPS auction.

USD/TRY: Technical outlook

Looking at USD/TRY’s technical chart, the confluence of the bullish 21 and 50-Daily Moving Averages (DMA) at 13.05 will be a tough nut to crack should the daily lows give way.

A firm break below the latter will trigger a fresh downswing towards the upward-sloping 100-DMA at 11.00.

January lows of 12.76 could come to the rescue of bulls beforehand.

The 14-day Relative Strength Index (RSI) is trading listlessly, at the time of writing, although remains above the midline, keeping buyers hopeful.

Bulls need to find a strong foothold above the 14.00 threshold to negate the recent bearish momentum. The December 21 high of 14.14 will be the next relevant upside target.

USD/TRY: Daily chart

- AUD/USD off the highs despite risk rebound, strong Aussie jobs.

- DXY rebounds as yields pause the pullback, PBOC eases policy further

- Surging covid cases in Australia and Fed-RBA divergence to cap the upside.

AUD/USD is retreating towards 0.7250, having hit a fresh four-day high of 0.7276 in the last hours.

Resurgent US dollar demand across the board is hurting the commitment of the buyers, as the Treasury yields pause their corrective pullback from two-year highs. The US dollar index rises to 95.60, as of writing, up 0.09% on the day.

The aussie spiked to multi-day highs, earlier on, after the US stocks rebounded and fuelled risk recovery across markets, boosting the high-beta currency AUD.

Strong Australian labor market report for December combined with the Chinese central bank’s (PBOC) cuts to the mortgage lending rates add to the bullish sentiment around the aussie pair.

The Australian Unemployment Rate dropped to a 13-year low of 4.25 in the reported period, fanning speculation that the Reserve Bank of Australia (RBA) could end its bond-buying program and bring forward cash rate hikes.

The further upside for AUD/USD could remain elusive amid divergent monetary policy outlooks between the Fed and RBA. Meanwhile, the continuous rise in COVID-19 infection in the most populous state of Australia, New South Wales (NSW), also remains a concerning factor for aussie bulls.

Traders also weigh in the growing risks surrounding the Russia-Ukraine crisis and US President Joe Biden's comments on the US-China trade tariffs.

AUD/USD: Additional levels to consider

- EUR/USD remains on the backfoot as DXY tracks the uptick in the yields.

- ECB minutes showed a divided outlook on inflation, the risk tone remains upbeat.

- Yields and the dollar lead way, as US economic data fail to impress.

EUR/USD is holding the lower ground below 1.1350, as the US dollar attempts a bounce in tandem with the Treasury yields amid a risk-on mood.

The sentiment on Wall Street improved dramatically, in anticipation of the corporate earnings reports. That fuelled a fresh sell-off in the US Treasuries, which in turn, prompted the yields to resume their uptrend. The upturn in the yields lifted the sentiment around the dollar at the euro’s expense.

Escalating Russia-Ukraine crisis, with the US imposing sanctions on four Ukrainian officials, accusing them of destabilizing Ukraine, also boosts demand for the safe-haven US dollar.

Meanwhile, the shared currency remains undermined by the European Central Bank (ECB) minutes of its December meeting, which underscored policymakers’ division on the inflation outlook. Further, dovish comments from ECB President Christine Lagarde and policymaker Pablo de Cos bode ill for the major.

Looking ahead, the main currency pair continues to remain at the mercy of the price action in the yields and the dollar, as traders shrug off mixed American economic data releases in the downbeat weekly Jobless Claims and Existing Home Sales. The Philadelphia Fed Manufacturing Survey for January, however, outpaced expectations with 23.2.

EUR/USD: Additional levels to consider

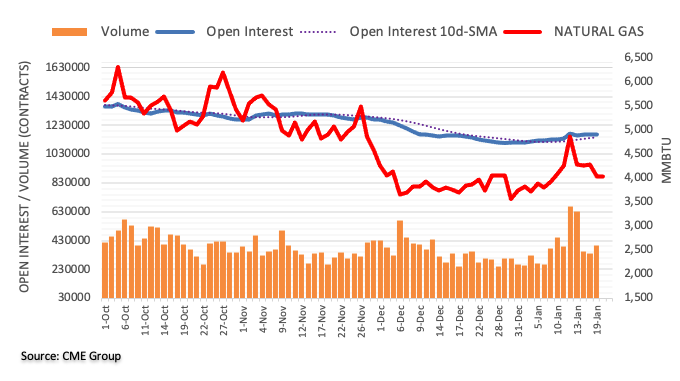

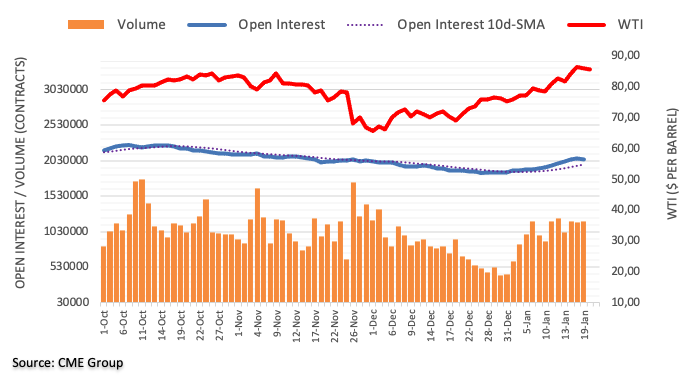

- WTI recently broke above its prior $85.00-$86.00 intra-day tradig range to hit session highs near $87.00.

- The official EIA inventory report wasn’t as bearish as feared, helping WTI recover back into the green on the day.

Front-month WTI futures leapt above their previous intra-day $85.00-$86.00 per barrel trading range to hit highs in at $87.00 in recent trade and, at current levels near $86.50, now trade back in the green on the day. WTI still trades about $1.50 below Wednesday’s multi-year peaks near-$88.00, but is equally about $1.50 up from Asia Pacific session lows, with the latest official US crude inventory report not as bearish as feared. Wednesday’s private API inventory report had suggested that crude oil stocks had risen by 1.4M barrels last week versus prior expectations for a small draw. However, official EIA data showed that inventories had risen by just half a million barrels last week. The fall in distillate stocks of 1.2M barrels was roughly in line with that of the API report, whilst the build in gasoline stocks was much higher at over 5.8M barrels versus 3.5M barrels in the API report.

In terms of the major themes driving crude oil markets right now, amid consensus expectations for robust demand this year, supply-side themes are currently getting more attention. Chief amongst them is OPEC+’s ongoing struggles to lift output in line with recent output quota hikes. On Wednesday, the IEA said the producer group produced 800K barrels per day less than its production target in December and the recent outage of an Iraqi-Turkish pipeline and attack on UAE infrastructure highlighted the risk of continued underproduction. Meanwhile, with Russia seemingly on the verge of a military incursion into Ukraine, there is uncertainty about what kind of sanctions the world’s third-largest crude oil producer may face and whether this might affect their oil exports. For now, geopolitics, supply fears and expectations for continued robust demand will likely keep prices underpinned and analysts will likely continue to call for $100 per barrel oil this year.

- Technical indicators are modestly biased to the upside in the short-term in USD/MXN.

- Pair needs to break and hold above 20.55 to clear the way to more gains.

The USD/MXN is falling on Thursday after hitting on Wednesday a two week high at 20.52. The bullish bias in the near term is still intact, while at the same time the dominant trend still points south.

The pair is correcting to the upside from the main bearish trend, after finding support at 20.25/30. A decline below 20.35 should point to a new test of the critical area of 20.25/20.30 that includes the flat 200-day simple moving average.

On the upside, daily close above 20.55 (100-day SMA) should strengthen the US dollar. The next resistance stands at 20.70 and then at 20.90.

The weekly chart showed the 20-week SMA at 20.53; a close above would be a negative development for the Mexican peso, suggesting a potential bottom has been established.

USD/MXN daily chart

-637782952813089428.png)

- USD/CAD is sold-off heavily into the US dollar’s weakness amid easing T-yields.

- Surging WTI prices keep the downside momentum intact in the major.

- The pair eyes daily close below 200-DMA to unleash additional declines.

USD/CAD is struggling to extend the rebound from near two-month lows of 1.2451 in the American session, as the relentless rise in WTI prices continues to undermine the sentiment around the major.

Despite the latest downtick, the Canadian dollar preserves most of the daily advance, as oil prices continue to ride higher on escalating geopolitical tensions, with the US imposing sanctions on four Ukrainian officials it accused of destabilizing the latter, as America is trying hard to dissuade Russia from invading Ukraine.

Meanwhile, the black gold shrugged off a build in the US weekly crude stockpiles to the tune of 515K, according to the data published by Energy Information Administration on Thursday. The risk-on market profile aids the rally in the higher-yielding oil, adding credence to the bullish momentum around the resource-linked loonie.

On the US dollar-side of the equation, the pullback in the Treasury yields from two-year highs kept the greenback pressured, in turn, rendering negative for the spot. The correction in the US rates comes after it rallied hard earlier this week on aggressive Fed rate hike expectations.

Technically, USD/CAD remains vulnerable while below the critical horizontal 200-Daily Moving Average (DMA) at 1.2501.

That said, the recent range lows near 1.2450 appear at risk, as the 14-day Relative Strength Index (RSI) points north below the midline.

Meanwhile, the bear cross remains in play after the 21-DMA breached the 50-DMA from above on Tuesday.

A fresh downswing, if triggered, could expose the round level of 1.2400 while any meaningful recovery will need acceptance above the 200-DMA on a daily closing basis.

USD/CAD: Daily chart

USD/CAD: Additional levels to consider

- NZD/USD is currently struggling to push above the 0.6800 level, hampered by resistance in the form of the 21DMA.

- The pair found support during APac trade at a trendline going back to mid-December.

- A break below this support could open the door to a push lower towards 0.6700.

Though the pair does trade reasonably higher versus Asia Pacific session lows in the 0.6750s, NZD/USD is currently struggling to push above 0.6800, with the 21-day moving average acting as resistance for a second successive session. Amid a lack of domestic data or positive drivers, the kiwi has struggled to emulate the outperformance seen in its Aussie counterpart, which is deriving an independent boost from strong Australian labour market data. Indeed, chatter from New Zealand PM Jacinda Ardern about a potential toughening of domestic Covid-19 curbs in case of community transmission in the country, albeit not about a return to the fullscale lockdowns of old, may well be hampering the kiwi.

It was notable during the Asia Pacific session how NZD/USD found support at an uptrend that has been in play since the middle of December. The pair’s struggles to get back above 0.6800, however, suggest it is vulnerable to a broader pick up in the fortunes of the US dollar heading into next week’s Fed meeting. A push higher by the DXY on hawkish expectations, for example, could translate into a bearish breakout below 0.6750 and on towards a test of December lows just above 0.6700. For now, sub-par US weekly jobless claims data that saw initial claims leap to 280K from 230K the week prior, perhaps indicative of some Omicron-related labour market weakness, has been enough to keep the buck bulls at bay.

- Japanese yen among top performers as US yields remain steady.

- DXY down for the day but off lows.

- USD/JPY heads for lowest daily close in a month.

The USD/JPY dropped further during the American session and bottomed at 113.95, the lowest level in six days. The move lower took place amid a stronger Japanese yen across the board and despite higher equity prices in Wall Street.

Unexpected increase in Jobless Claims

Economic data from the US showed Initial Jobless Claims came in at 286K, the highest level in three months, the Philadelphia Fed Business Outlook rose more than expected to 23.2 from 15.4 and Existing Home Sales dropped 4.6% in December. The numbers weighed on the US dollar and supported the recovery in equity prices.

Next week, the Federal Reserve will have its two day meeting, announcing their decision on Wednesday. Market participants await signs for a March rate hike. The greenback has been rising on the back of those speculations, losing momentum early in January.

The USD/JPY is correcting lower and a daily close below 114.00 should point to further weakness from a technical perspective. The next support stands at 113.50. On the upside, a recovery above 114.95 (20-day moving average) would be a sign that the correction is over

Technical levels

- Spot silver has surged another near 2.0% to above $24.50 on Thursday, taking its on-the-week gains above 7.0%.

- Recent stabilisation of the US dollar and US real yields has given precious metals the green light to rally.

- XAG/USD is currently testing its 200DMA, having failed to break above it on both of the last two attempts recently.

In a bullish medium-term signal, spot silver (XAG/USD) prices broke to the north of a key long-term downtrend (linking the May, June and November 2021 highs) on Thursday to surge above the $24.50 per troy ounce level. At current levels around the $24.60 mark, spot prices are now up nearly 2.0% on the day, taking gains on the week to over 7.0%. The precious metal is now eyeing a test of its 200DMA at $24.65, a break above which would open the door to a test of the $25.00 level and the November 2021 highs in the $25.40s.

Over the past two days, during which time XAG/USD has rallied about $1.20 from underneath the $23.50 level, precious metals have taken the opportunity to rally amid subdued trading conditions in US bond and currency markets. The rally in US real yields has faded over the past two sessions and the DXY, which started the week on a strong footing, has struggled to hold above 95.50.

Meanwhile, China has been easing monetary policy settings, with the PBoC already cutting MLF and mortgage rates this week and pledging to embark on further stimulus in the weeks ahead. This has boosted appetite for base metals (copper, iron ore, nickel etc.) on hopes for Chinese growth to stabilise and pick up again later in the year and seems to be aiding spot silver – a greater proportion of silver’s demand comes from industrial usage in comparison to gold.

Looking ahead for the precious metal, technical momentum has clearly swung in a substantially bullish direction but, for this to continue, a break above the 200DMA will be needed. Over the past seven months, XAG/USD has tested its 200DMA on two occasions and failed to break above it twice. Both of these failed attempts were followed by significant drawdowns (of 17.5% and 15.6%). With the Fed on course to tighten in 2022 and risks for the US dollar and real yields subsequently tilted to the upside, some traders may see XAG/USD’s current levels as a good time to add to short positions. Some may be reluctant to sell into such a ferocious rally, however.

The pound is again pushing higher this afternoon. GBP should remain well supported in the coming weeks. But with a lot of rate hikes already in the price, economists at Rabobank see GBP as vulnerable to a correction later on in the year.

Strong and stable leadership may generate a modest rally in the pound

“On anticipation that the market will unwind some of the anticipated policy tightening, we see scope for the pound to fall back by the middle of the year.”

“Stronger leadership in the UK could provide encouragement about the prospects for post-Brexit Britain and help to bolster the pound.”

“While we expect GBP to remain well supported vs. the EUR in the weeks ahead, we see scope for a move back towards 0.85 on a 3 to 6-month view.”

- EUR/GBP recently pushed to fresh 23-month lows underneath the 0.8310 level on Thursday.

- The release of the latest ECB minutes did not impact FX market sentiment.

- Markets are focused on another likely rate hikes from the BoE next month.

EUR/GBP recently pushed to fresh 23-month lows underneath the 0.8310 level on Thursday and is now down about 0.3% on the session and eyeing a test of 0.8300. The release of the latest ECB minutes did not impact FX market sentiment as it did not contain any surprises/new revelations. EUR/GBP’s latest push lower marks a near 70 pip reversal from Wednesday’s highs near 0.8380, with traders seemingly having taken the opportunity provided by the rally to add to short positions as the pair retested its November 2021 lows (at 0.8380).

Traders might reason that with the recent run of data strongly supportive of expectations for the BoE to hike interest rates again in February, BoE/ECB policy divergence is set to remain a key driver of EUR/GBP downside. Recall that labour market data on Tuesday saw the UK unemployment rate drop back to pre-pandemic levels and that Consumer Price Inflation data on Wednesday hit its highest in 30 years.

Some analysts are calling for the pair to retest late-2019/early-2020 lows in the 0.8270/80s soon, despite uncertainty about whether Boris Johnson will stay in his role as UK PM. Indeed, analysts at Berenberg said a change in PM could actually end up as a positive for UK markets, given that the Conservative party would likely choose a replacement based on who has the best chance of beating Labour leader Keir Starmer at the next general election.

The bank argues that a new PM would likely pursue “similar policies to Johnson in a much calmer and more deliberate fashion”. ING says that “unsurprisingly, political risk has not damaged GBP”, and adds that “the focus remains squarely on whether the BoE hikes 25bp on February 3”. The bank continues to favour EUR/GBP retesting the aforementioned 2019/2020 sub-0.8300 lows soon.

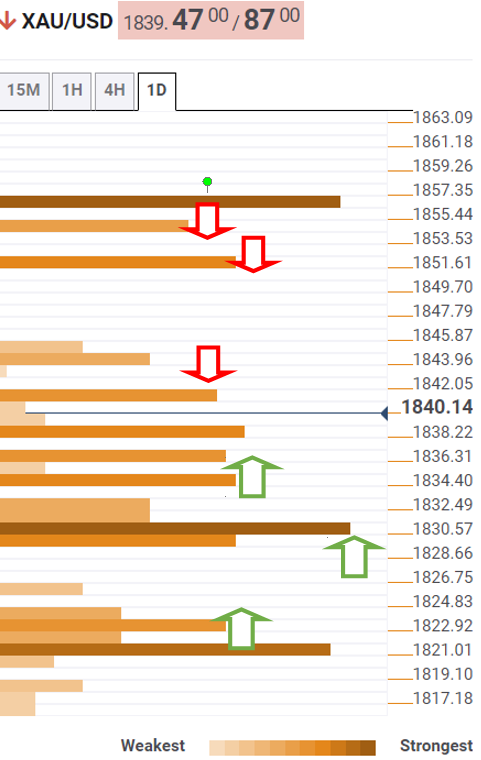

- Gold rises for the second day in a row, heads for the highest close in two months.

- Dollar mixed across the board as equity prices rebound.

Gold broke to the upside following US economic data, and it peaked during the American session at $1847, the highest level in almost two months. It holds a bullish tone but shows difficulties holding above $1845.

Metals are up for the second day in a row. XAG/USD is up 1.78% at $24.58, the highest level since November 22. Gold and silver have broken relevant short-term technical levels boosting further the upside.

Another factor helping metals is the pullback in US yields from the recent peak together with Thursday’s rebound in Wall Street. The Dow Jones gains 0.83% and the Nasdaq 1.47%.

Economic data in the US came in mixed. Initial Jobless Claims jumped to 286K, the highest level in three months and significantly above expectations. On the positive, the Philly Fed Index rose from 15.4 to 23.2 in December. The last report, Existing Home Sales came in at 6.18 million (annual rate) below the 6.44 of market consensus.

Levels to watch

The technical bias continues to point to the upside, after breaking on Wednesday the $1830 area. Now XAU/USD is facing resistance in the band $1845/50. Above resistance levels are seen at $1855 followed by $1864.

A pullback under $1830 should remove the positive bias and favor further losses, targeting $1820 initially and then $1810.

Technical levels

- The daily pullback in DXY meets support near 95.40.

- US yields remain in corrective mode along the curve so far.

- Initial Claims surprised to the downside last week.

The greenback, in terms of the US Dollar Index (DXY), now alternates gains with losses around the 95.60 region.

US Dollar Index offered on lower yields, mixed data

After bottoming out in the vicinity of the 95.40 level, the index managed to regain some composure and trim those earlier losses.

The knee-jerk reaction in the buck, in the meantime, looks underpinned by another negative performance in US yields, while mixed results from the US calendar on Thursday added to the downbeat mood in DXY.

Initial Claims rose more than expected by 286K in the week to January 15, while the Philly Fed bettered consensus at 23.2 for the current month. In addition, Existing Home Sales dropped 4.6% MoM in December to 6.18M units.

US Dollar Index relevant levels

Now, the index is losing 0.09% at 95.53 and a break above 95.83 (weekly high Jan.18) would open the door to 96.46 (2022 high Jan.4) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 94.78 (100-day SMA) followed by 94.62 (2022 low Jan.14) and then 93.27 (monthly low Oct.28 2021).

- Existing home sales dropped 4.6% in December.

- The data did not result in an FX market reaction.

US Existing Home sales fell by 4.6% in December according to data published by the National Association of Realtors on Monday. That took the 12-month rolling number of sales lower to 6.18M from 6.48M in November, lower than the expected 6.44M. The median price of homes sold was $358K, up 15.8% YoY.

Market Reaction

FX markets did not react to the latest housing market data.

- WTI is trading in the mid-$85.00s after bearish inventory data knocked it back from highs.

- But for now, geopolitics, supply fears and expectations for continued robust demand will likely keep prices underpinned.

Front-month WTI futures have spent Thursday’s session consolidating in the $85.00s amid a lack of fresh catalysts to drive the price action either way. At current levels near $85.50, WTI trades slightly more than 50 cents lower on the session. Indeed, crude oil markets appeared to experience selling pressure ahead of the Wednesday futures market close at 2200GMT before gapping lower at the Thursday futures market reopen at 2300GMT as a result of bearish inventory figures. At current levels, WTI is about $2.0 below Wednesday’s highs.

According to the latest weekly private US inventory report from API, crude oil stocks rose by 1.4M barrels last week versus consensus expectations for a 0.9M barrel decline. Gasoline stocks, meanwhile, rose by 3.5M barrels whilst distillate stocks fell by 1.2M barrels. If official data released by the US EIA at 1530GMT confirm Wednesday’s API figures, that would mark the first rise in crude oil stocks in seven weeks. This could further weigh on prices and technicians would be keenly watching how WTI responds to support in the $85.00 area.

In terms of the major themes driving crude oil markets right now, amid consensus expectations for robust demand this year, supply-side themes are currently getting more attention. Chief amongst them is OPEC+’s ongoing struggles to lift output in line with recent output quota hikes. On Wednesday, the IEA said the producer group produced 800K barrels per day less than its production target in December and the recent outage of an Iraqi-Turkish pipeline and attack on UAE infrastructure highlighted the risk of continued underproduction.

Meanwhile, with Russia seemingly on the verge of a military incursion into Ukraine, there is uncertainty about what kind of sanctions the world’s third-largest crude oil producer may face and whether this might affect their oil exports. For now, geopolitics, supply fears, and expectations for continued robust demand will likely keep prices underpinned and analysts will likely continue to call for $100 per barrel oil this year.

USD/CAD has maintained a tight, sideways trading range around 1.25 this week. Economists at Scotiabank think the pair is set to move downward towards the October low around 1.22.

Bear trend remains deeply entrenched

“Short-term price action suggests firm USD support on dips in European trade which might tilt intraday risks towards a test of the low 1.25s early in our session. But we think the broader, bear trend remains deeply entrenched in this market and modest USD gains are likely to attract better USD selling pressure.”

“Broader price patterns continue to reflect strong, longer run resistance in the low 1.26 zone and downside potential in the USD to the upper 1.22s – effectively a retest of the Oct low. A break below this point indicates scope for additional CAD gains in the medium term towards 1.20.”

- The headline Philly Fed manufacturing index rose to 23.2, above the expected 20.0.

- FX markets did not react to the stronger than expected survey.

According to a report from the Federal Reserve Bank of Philadelphia released on Thursday, the headline Manufacturing Activity Index of the Manufacturing Business Outlook Survey rose to 23.2 in January from 20.0 in December. That was bigger than the expected rise to 20.0.

Subindices

- The New Orders Index rose to 17.9 from 13.7.

- The Prices Paid Index rose to 72.5 from 66.1.

- The Employment Index fell to 26.1 from 33.9.

- The Six-Month Business Conditions Index rose to 28.7 from 19.0.

- The Six-Month Capital Expenditures Index rose to 26.2 from 20.0.

Market reaction

FX markets did not react to the stronger than expected Philly Fed survey.

- There were 286K initial claims in the week ending on January 8, more than expected.

- In a reaction to the data, the dollar saw modest negative ticks.

There were 286,000 initial claims for unemployment benefits in the US during the week ending January 15, data published by the US Department of Labor (DoL) revealed on Thursday. This reading followed last week's print of 231,000 (revised up from 230K) and was well above consensus market expectations for 220,000. Continued claims in the week ending on January 8 also came in higher than expected at 1635K versus expectations for a more modest rise to 1580K from 1551K the week before. The insured unemployment rate rose slightly to 1.2% from 1.1%.

Market Reaction

The DXY saw some modest negative ticks in response to the data and has now dropped back to test the 95.50 area.

- AUD/USD gained traction for the second straight day, albeit struggled to capitalize on the move.

- Elevated US bond yields helped revive the USD demand and acted as a headwind for the major.

- The formation of a bearish flag on the daily chart also warrants some caution for bullish traders.

The AUD/USD pair built on the previous day's rebound from an over one-month-old ascending channel support and gained traction for the second successive day on Thursday.

The upbeat Australian employment details, along with signs of stability in the equity markets turned out to be a key factor that benefitted the perceived riskier aussie. The AUD/USD pair shot to a one-week high, though bulls struggled to capitalize on the move beyond mid-0.7200s amid reviving US dollar demand.

Firming expectations for an eventual Fed lift-off in March remained supportive of elevated US Treasury bond yields and acted as a tailwind for the greenback. Nevertheless, the AUD/USD pair, so far, has held in the positive territory and was last seen trading around the 0.7240 region during the early North American session.

Looking at the technical picture, the recent recovery from the 2021 low – levels just below the key 0.7000 psychological mark – has been along an upward sloping channel. Given the sharp decline from the October 2021 swing high, the mentioned trend channel seems to constitute the formation of a bearish flag pattern.

That said, neutral technical indicators on the daily chart haven't been supportive of a firm near-term direction and warrant some caution before placing aggressive bets. Hence, it will be prudent to wait for a convincing break below the channel support, currently near the 0.7180 area, before positioning for a further decline.

The AUD/USD pair might then accelerate the downward towards testing the 0.7100 round-figure mark. The downward trajectory could further get extended towards the 0.7060-55 intermediate support before the pair eventually drops back to challenge the 0.7000 mark.

On the flip side, a sustained strength beyond the 0.7250 area has the potential to lift the AUD/USD pair towards the 200-day SMA, just ahead of the 0.7300 mark. Some follow-through buying should pave the way for a move towards challenging the trend-channel resistance, around the 0.7345 region, which should act as a pivotal point.

AUD/USD daily chart

-637782819161209987.png)

Technical levels to watch

- EUR/USD returns to the negative territory near 1.1330.

- Sellers aim at another visit to the 2022 low at 1.1272.

EUR/USD’s initial bullish attempt seems to have run out of steam in the proximity of 1.1380 on Thursday.

The bias appears tilted to further retracement in the very near term. That said, a deeper decline remains on the cards if spot breaks below the weekly low at 1.1314 (January 18). Such a move should open the door to a test of the so far YTD low at 1.1272 (January 4).

The longer term negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1719.

EUR/USD daily chart

\

\

GBP/USD has settled in the lower 1.36s after its decline from the mid-figure area that began last week. Economists at Scotiabank expect cable to find solid support at 1.36 and bounce back to test the 1.37 level.

Below 1.3590/600, support is at 1.3575

“The 1.36 figure zone is set to act as decent support for the GBP in its upward trend since mid-December.”

“The 1.3635 mark fell short of a test of mid-figure resistance through which the GBP will have to break to form a more convincing reversal of recent losses and test 1.37; the 200-day MA at 1.3734 follows as resistance.”

“Below 1.3590/600, support is 1.3575 and the 100-day MA of 1.3546.”

EUR/USD trades flat. Economists at Scotiabank expect the world’s most popular currency pair to settle within a 1.1250-1.1350 range if it fails to surpass the mid-1.13s in the coming days.

Break of 1.14 faces resistance at 1.1420/35

“EUR/USD may struggle in the near-term to push past the mid-1.13s and a failure to do so in the coming days would likely see the EUR re-settle in the ~1.1250-1.1350 range where it sat through December and part of January.”

“Support is 1.1315 followed by the 1.13 zone.”

“A break of 1.14 faces resistance at 1.1420/35 and then the mid-figure area.”

- EUR/USD did not react to the latest ECB minutes release which contained few new surprises.

- The pair continues to pivot the 1.1350 area as analysts warn central bank divergence could yet send it lower.

- The uptrend that has supported the price action since late November is a key level to watch.

The latest ECB minutes release contained little by way of surprises or new revelations that recent “sources” hadn’t already leaked to the press, hence the lack of any notable EUR/USD reaction. The pair thus continues to pivot the 1.1350 area and at current levels in the 1.1330s, trades flat on the session. In wake of the minutes, the consensus analyst view very much remains that the ECB currently does not see the conditions for rate hikes in 2022, or indeed in its forecast horizon, having been met. However, the bank is clearly wary of upside inflation risks (a major source of dissenting votes at the last meeting) and, as a result, is ready to pivot hawkishly and in a data-dependent manner if upside risks manifest.

Recent inflation data suggests this upside scenario is becoming ever more possible. German producer prices grew at a pace of 24.2% in December, well above expectations for 19.4% and at a fresh record high. Meanwhile, the final estimate of Eurozone December Consumer Price Inflation confirmed last month’s rise to 5.0% (also a record high for the Eurozone). But even if the upside inflation scenarios manifest, not many analysts expect the ECB to live up to already very hawkish money market pricing, which currently imply rate hikes starting as soon as October. Given that the Fed is very likely to live up to or perhaps even exceed money market expectations for four rate hikes in 2022, the theme of central bank divergence is likely to continue to weigh on EUR/USD in 2022.

US data in the form of weekly jobless claims, the January Philly Fed manufacturing survey and more housing figures likely won’t shift the macro narrative driving currencies much given the proximity to next week’s Fed meeting. But strong data may encourage further EUR/USD selling, with the pair already about 0.7% lower on the week. The main support levels to watch are the weekly lows just under 1.1320 and the 50-day moving average at 1.1321. Then there is the uptrend which has been supporting the price action going all the way back to late November. Should that break, that would open the door to technical selling that could eventually send EUR/USD all the way back to the 2021 lows under 1.1200.

- The UK political turmoil failed to assist GBP/USD to capitalize on its modest intraday gains.

- Elevated US bond reived the USD demand and prompted intraday selling around the pair.

- Rising BoE rate hike bets acted as a tailwind for sterling and helped limit any further slide.

The GBP/USD pair surrendered its modest intraday gains and was last seen hovering near the daily low, around the 1.3600 mark heading into the North American session.

Growing demands for UK Prime Minister Boris Johnson's resignation over a series of lockdown parties in Downing Street turned out to be a key factor that acted as a headwind for the British pound. The GBP/USD pair met with a fresh supply near the 1.3635 region on Thursday and was further pressured by the emergence of some US dollar dip-buying.

Firming expectations that the Fed would begin raising interest rates in March to contain stubbornly high inflation remained supportive of the elevated US Treasury bond yields. This, in turn, helped revive the USD demand. That said, signs of stability in the equity markets kept a lid on any meaningful upside for the safe-haven greenback.

Apart from this, rising bets for additional rate hikes by the Bank of England could help limit any deeper losses for the GBP/USD pair. The market bets were reaffirmed by Wednesday's release of the US CPI print. This, along with the announcement that COVID-19 restrictions in the UK would be lifted next week, should lend some support to sterling.

The mixed fundamental backdrop warrants some caution before placing aggressive directional bets ahead of the crucial FOMC monetary policy meeting on January 25-26. Investors will look for clearer signals about the timing when the Fed will commence the rate hike cycle. This will influence the USD and provide a fresh impetus to the GBP/USD pair.

In the meantime, traders on Thursday will take cues from the US economic docket, featuring the Philly Fed Manufacturing Index, Weekly Initial Jobless Claims and Existing Home Sales data. This, along with the US bond yields and the broader market risk sentiment, will drive the USD demand and produce some trading opportunities around the GBP/USD pair.

Technical levels to watch

According to the accounts of the December European Central Bank monetary policy meeting, it was cautioned that a "higher for longer" inflation scenario could not be ruled out.

Additional Points:

"Members concurred that the recent and projected near-term increase in inflation was driven largely by temporary factors that were expected to ease in the course of 2022."

"It was stressed that the projected convergence of inflation expectations towards 2% was to be welcomed although the outlook was surrounded by exceptionally high uncertainty."

"For 2023 and 2024, inflation in the baseline projection was already relatively close to 2% and, considering the upside risk to the projection, could easily turn out above 2%."

"It was seen as important to preserve the flexibility to act decisively to keep inflation expectations anchored in both directions, and thus also preserve the credibility of the governing council."

"The governing council should therefore communicate clearly that it was ready to act if price pressures proved to be more persistent."

"The ECB is ready to act if price pressures proved to be more persistent and inflation failed to fall below the target as quickly as the baseline projections foresaw."

"Concerns were also expressed about any premature scaling back of monetary stimulus and asset purchases."

"Progress on economic recovery and towards the governing council’s 2% medium-term inflation target permitted a gradual normalisation of the monetary policy stance."

"Members widely agreed that substantial monetary policy support was still needed."

"It was argued that the governing council should look through the current supply disruptions."

"There were also growing risks to financial stability, especially in the housing market."

"The point was made that declaring an end to the emergency might be considered premature given the current deterioration in the pandemic situation."

"It was questioned whether lengthening the reinvestment horizon could be interpreted as adding more monetary stimulus."

"A concern was voiced that continued asset purchases could lead to an unwelcome flattening of the yield curve if short-term interest rates needed to be raised before the end of the reinvestment horizon."

"The governing council should retain the ability to calibrate and recalibrate the monetary policy stance in a data-driven manner in either direction."

"Some members retained reservations about some elements of the proposed package such that they could not support the overall package. These reservations pertained, in particular, to the recalibration of APP purchases and the extension of the PEPP."

- Spot gold is consolidating just under $1840 after Wednesday’s short-squeeze.

- Technicians may look to $1830 support to build longs, but analysts warn that gold is “expensive” given higher real yields.

Spot gold (XAU/USD) prices are consolidating just under the $1840 mark on Thursday following Wednesday’s short-squeeze that saw prices surge from around $1810 and above resistance in the $1830 area. Many market participants had been calling for gold to move lower in recent weeks as hawkish Fed bets have been amped up and as real yields have moved higher. Some likely placed their stops just above recent highs in the $1830s and triggering of these may have contributed to the speed of the move through the $1830s and above $1840.

Any dip back to the $1830 area may be used by the gold bulls as an opportunity to reload on longs and perhaps target a move towards Q4 2021 highs in the $1870s. However, it is notable that with real yields substantially higher versus when spot gold was last at current levels near $1840, some may view the precious metal as not relatively more expensive. On November 22 when XAU/USD was last trading near $1840, 10-year TIPS yields were around -1.0%, versus current levels about 40bps higher.

Ahead of next week’s Fed meeting, which is expected to be a hawkish affair, analysts warn that spot gold remains at risk of experiencing selling pressure. A tense geopolitical backdrop, with Russia seemingly on the verge of a military incursion into Ukraine, may continue to offer the safe-haven metal some support, however.

- DXY reverses the initial pullback and returns to the 95.60 area.

- Further gains likely above the 4-month line near 95.30.

DXY manages to bounce off daily lows in the 95.40/45 band on Thursday.

The intense upside in the dollar has recently surpassed the 4-month line, today near 95.30, and in doing so it has reinstated the short-term bullish bias. That said, the next target is seen at the weekly high at 95.83 (January 18) ahead of the YTD high at 96.46 recorded on January 4.

Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.19.

DXY daily chart

- EUR/JPY retreats further and retests the mid-129.00s on Thursday.

- The continuation of the downside targets the 128.80 region.

EUR/JPY is down for the third consecutive session and extends the bearish move to the 129.50 zone on Thursday.

Price action in the cross now seems to favour extra decline in the short-term horizon, particularly after EUR/JPY remains unable to retest/surpass the YTD peaks in the 131.50/60 region (January 5). Against that, extra losses could retest the Fibo level (of the October-December drop) at 128.82.

While below the 200-day SMA, today at 130.53, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

- USD/JPY attracted dip-buying near 114.00 on Thursday, though lacked bullish conviction.

- Stability in the equity markets undermine the safe-haven JPY and extended some support.

- Elevated US bond yields revived the USD demand and also acted as a tailwind for the pair.

The USD/JPY pair had good two-way price moves through the mid-European session and was last seen trading in the neutral territory, around the 114.30 region.

A combination of supporting factors assisted the USD/JPY pair to defend the 114.00 mark and stage a goodish intraday bounce from the weekly low set earlier this Thursday. Signs of stability in the equity markets undermined the safe-haven Japanese yen. This, along with the recent widening of the US-Japanese government bond yield differential, acted as a tailwind for the major.

In fact, the yield on the 10-year Japanese government bond remained near zero due to the Bank of Japan's yield curve control policy. Conversely, the yield on the benchmark 10-year US government bond shot to the highest level since January 2022 on Wednesday amid growing market acceptance that the Fed would begin raising interest rates in March to combat stubbornly high inflation.

Moreover, the US 2-year notes, which are highly sensitive to rate hike expectations, held steady above the 1.0% threshold, or the highest level since February 2020. This, in turn, helped revive the US dollar demand, which further extended some support to the USD/JPY pair. Bulls, however, struggled to capitalize on the intraday uptick or find acceptance above mid-114.00s.

The lack of follow-through buying suggests that investors now seem reluctant to place aggressive bets ahead of the upcoming FOMC policy meeting on January 25-26. This warrants some caution before confirming that the recent pullback from the 116.35 area, or a five-year high touched earlier this January, has run its course and positioning for any meaningful gains.

Market participants now look forward to the US economic docket – featuring the releases of the Philly Fed Manufacturing Index, Weekly Initial Jobless Claims and Existing Home Sales data. This, along with the US bond yields, will drive the USD demand. Apart from this, the broader market risk sentiment should produce some trading opportunities around the USD/JPY pair.

Technical levels to watch

Senior Economist at UOB Group Alvin Liew comments on the latest BoJ monetary policy event.

Key Takeaways

“The Bank of Japan (BOJ), as widely expected, decided to keep its policy measures unchanged at its Monetary Policy Meeting (MPM) on 18 Jan 2022.”

“In its latest outlook for economic activity and prices (The Bank’s View), the most notable change was the upgrade of its FY2022-2023 inflation forecasts to 1.1% from 0.9% and 1.0% previously. The BOJ noted that risks to price outlook were “evenly balanced”, seen as a signal acknowledging the recent supply-constraint effects and commodity-driven price pressures.”

“The other change was the downgrade of its FY2021 growth forecast to 2.8% (from 3.4%) while upgrading FY2022 growth to 3.8% (from 2.9%) and lowering FY2023 growth to 1.1% (from 1.3%). The BOJ also kept its cautious recovery outlook but highlighted the risks to economic activity are skewed to the downside for now due to COVID-19 impact but will be expected to be balanced thereafter.”

“While the inflation outlook has been upgraded, it remains a distance away from the 2% target (at least till FY2023) and as such it does not change our view that the BOJ will not be tightening anytime soon and will maintain its massive stimulus for the next few years. There remains an entrenched belief that the BOJ has reached the end of the line on normalisation and will remain in a holding pattern on policy until at least April 2023 when Governor Kuroda is scheduled to leave the BOJ.”

- USD/TRY tests fresh weekly lows near 13.30 on Thursday.

- The CBRT left the One-Week Repo Rate unchanged at 14.00%.

- The CBRT said available policy tools prioritize the Turkish lira.

The Turkish lira is gathering further traction and now dragging USD/TRY to weekly lows in the 13.2500/2000 band on Thursday.

USD/TRY weaker on steady CBRT

USD/TRY is now seen dropping for the second session in a row as the lira remains bid vs. the greenback following the decision by the Turkish central bank (CBRT) to leave the One-Week Repo Rate unchanged at 14.00% at its meeting on Thursday. It was the first time the central bank kept the policy rate on hold since August.

The CBRT statement showed the central bank “blames” the “unhealthy price formations” in the FX space, supply disruptions and demand developments for the ongoing (very) high inflation.

In addition, the CBRT said that it will prioritize the lira when it comes to the policy framework and reiterated the willingness to achieve the medium-term inflation target of 5% YoY.

USD/TRY key levels

So far, the pair is retreating 0.01% at 13.3730 and a drop below 12.7523 (2022 low Jan.3) would pave the way for a test of 12.6123 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

The Central Bank of the Republic of Turkey (CBRT) announced its policy decision this Thursday and left the one-week repo rate unchanged at 14%, in line with the market expectations.

Join our live coverage on the CBRT event

Market reaction

The Turkish lira moved little in reaction to the announcement, with the USD/TRY hovering near the lower end of a one-week-old trading range, below mid-13.00s.

Key takeaways from the accompanying policy statement:

- A comprehensive review of the policy framework is being conducted with the aim of prioritizing the Turkish lira in all policy tools.

- Expect the disinflation process to start on the back of measures taken.

- Seeing sustainable price and financial stability along with the decline in inflation owing to the base effect.

- Inflation in the recent period has been driven by distorted pricing behaviour due to unhealthy price formations in fx.

- Inflation is also affected by supply-side factors, commodities.

- The cumulative impact of the recent policy decisions being monitored.

- held steady below mid-13.00s, well within a narrow.

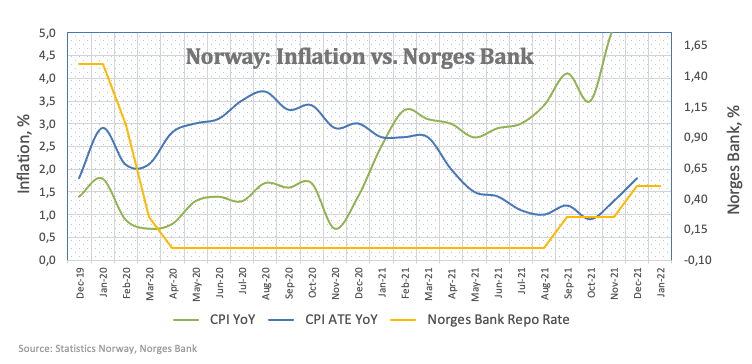

Norges Bank confirmed today that the key rate will be hiked in March. Four rate hikes are expected this year – this is a medium-term positive for the krone, in the opinion of economists at ING.

Expect four rate hikes this year

“We expect Norges Bank to signal a total of four 2022 rate hikes at its meeting in March, and there’s little reason to doubt that will happen.”

“Monetary policy remains a bullish factor for Norway's krone in an environment where we expect markets to reward those currencies that can count on hawkish central banks.”

“As soon as market sentiment stabilises, NOK’s attractive yield and benign external drivers point towards further appreciation.”

“We expect EUR/NOK to slip below 9.90 in 1Q, and to reach 9.50 by year-end.”

- USD/CHF edged lower for the second successive day, though the downside seems cushioned.

- A softer risk tone underpinned the safe-haven CHF and exerted some pressure on the major.

- Elevated US bond yields acted as a tailwind for the USD and helped limit any deeper losses.

The USD/CHF pair recovered a major part of its early lost gound and was last seen trading with only modest intraday losses, around mid-0.9100s during the first half of the European session.

The pair extended the previous day's retracement slide from the weekly swing high, around the 0.9175 region and edged lower for the second successive day on Thursday. A weaker tone around the European equity markets underpinned the safe-haven Swiss franc, which, in turn, was seen as a key factor that exerted pressure on the USD/CHF pair.

On the other hand, elevated US Treasury bond yields, bolstered by the prospects for a faster policy tightening by the Fed, acted as a tailwind for the US dollar. This, in turn, helped limit any further losses for the USD/CHF pair, warranting some caution for aggressive bearish traders and before positioning for any further depreciating move.

Investors seem convinced that the Fed would begin raising interest rates soon and have fully priced in an eventual lift-off in March to combat stubbornly high inflation. The expectations were reaffirmed by last week's data, which showed that the headline US CPI surged to the highest level since June 1982 and core CPI registered the biggest advance since 1991.

Hence, the market focus will remain glued to the upcoming FOMC monetary policy meeting on January 25-26. The outcome will be looked upon for clearer signals about the likely timing when the Fed will be commencing its rate hike cycle. This will influence the near-term USD price dynamics and provide a fresh directional impetus to the USD/CHF pair.

In the meantime, traders on Thursday will take cues from the US macro releases – the Philly Fed Manufacturing Index, Weekly Initial Jobless Claims and Existing Home Sales data. This, along with the US bond yields, will drive the USD demand. Apart from this, the broader market risk sentiment should produce some trading opportunities around the USD/CHF pair.

Technical levels to watch

- EUR/NOK trades on a choppy fashion so far this week.

- The Norges Bank left the repo rate unchanged at 0.50%.

- The central bank signalled an interest rate hike in March.

EUR/NOK alternates gains with losses so far this week in the area just below the psychological 10.0000 mark.

EUR/NOK muted on NB decision, looks to oil

EUR/USD resumes the upside following Wednesday’s decline after the Norges Bank left the policy rate unchanged at 0.50% at its meeting on Thursday.

Indeed, the Scandinavian central bank matched estimates on Thursday although it reiterated its intention to hike the key rate at the March event. The Norges Bank justified the decision on the solid performance of the Norwegian fundamentals and noted that the elevated underlying inflation is now approaching the bank’s target.

The bank also noted that there is still uncertainty surrounding the progress of the omicron pandemic, while the Committee expressed its concerns over the potential increase in prices and wages stemming from the supply disruptions and price pressures overseas.

Despite prices of the barrel of the European benchmark Brent crude rose sharply since mid-December, NOK failed to appreciate in an equally (or even close) pace during the same period.

EUR/NOK significant levels

As of writing the cross is gaining 0.18% at 9.9777 and faces the next resistance at 10.0443 (55-day SMA) followed by 10.0782 (2022 high Jan.6) and then 10.1181 (200-day SMA). On the other hand, a breach of 9.9018 (2022 low Jan.13) would open the door to 9.8383 (low Nov.17 2021) and finally 9.8166 (low Nov.1 2021).

- Eurozone inflation arrives at 5.0% YoY in December.

- Monthly CPI in the bloc rises to 0.4% in December.

- EUR/USD remains unfazed around 1.1350 on the EZ data.

According to Eurostat’s final reading of the Eurozone CPI report for December, the consumer prices came in at 5.0% on a yearly basis, in line with the flash estimate of 5.0% and 5.0% expectations. While the core figures rose by 2.6%, matching the 2.6% consensus forecasts.

On a monthly basis, the bloc’s CPI figure for December arrived at 0.4% versus 0.4% expectations and 0.4% previous while the core CPI numbers also came in at 0.4% versus 0.4% expected and 0.4% last.

Key details (via Eurostat):

“The lowest annual rates were registered in Malta (2.6%), Portugal (2.8%) and Finland (3.2%). The highest annual rates were recorded in Estonia (12.0%), Lithuania (10.7%) and Poland (8.0%). Compared with November, annual inflation fell in seven Member States, remained stable in two and rose in eighteen.”

“In December, the highest contribution to the annual euro area inflation rate came from energy (+2.46 percentage points, pp), followed by services (+1.02 pp), non-energy industrial goods (+0.78 pp) and food, alcohol & tobacco (+0.71 pp).”

FX implications:

EUR/USD is little changed on the data release, currently trading at 1.1349, up 0.07% so far.

GBP/USD seems to have gone into a consolidation phase above 1.3600. However, the near-term technical outlook doesn't yet point to a buildup of bullish momentum and sellers wait for 1.3600 support to fail, FXStreet’s Eren Sengezer reports.

Near-term resistance seems to have formed at 1.3650

“In case Wall Street's main indexes continue to push lower after the opening bell, we could see the dollar regather its strength. On the other hand, GBP/USD could benefit from the risk-positive market environment if US stocks rebound in a convincing way.”

“Interim resistance for GBP/USD seems to have formed at 1.3650, where the 50-period SMA on the four-hour chart is located. The pair needs to rise above that level and start using it as support to attract bulls. 1.3680 (static level) and 1.3700 (psychological level, broken ascending trendline coming from December) align as the next hurdles.”

“On the downside, the 100-period SMA forms dynamic support a little below 1.3600. If we see a four-hour candle close below that support, the next bearish target could be seen at 1.3530 (Fibonacci 38.2% retracement).”

See: GBP/USD could climb as high as 1.3750 – ING

In response to US President Joe Biden’s warnings amidst the Russia-Ukraine crisis, Kremlin came out with a statement on Thursday, stating that it fears US sanctions threats could also embolden Ukraine to try to resolve conflict in Eastern Ukraine militarily, per AFP News Agency.

Additional comments

“Kremlin declines to comment on parliamentarians' call for Putin to recognize breakaway east Ukraine regions as independent states.”

“There is some positive sign of NATO willingness to discuss some security issues with Russia, but they are not the ones that are fundamentally important to Moscow.”

“Doesn't rule out the conversation between Biden and Putin at some point.”

“US sanctions threats do not help reduce tensions in Europe and can have a destabilizing effect.”

Late Wednesday, US President Biden said that “Putin has never seen sanctions like the ones I'm promising.,” threatening that “Russia will be held accountable if it invades, it will be a disaster for Russia if they further invade Ukraine.”

Market reaction

The above comments have little to no impact on the broader market sentiment, reflective of the 0.33% gains in the S&P 500 futures. Meanwhile, the US dollar index is trading flat at 95.50, as of writing.

Economist at UOB Group Enrico Tanuwidjaja reviews the latest trade balance results in Indonesia.

Key Takeaways

“Trade surplus at record high in 2021, recording a full 12-month cycle of surplus.”

“High commodity prices may sustain the trade surplus momentum in the next quarter.”

“Indonesia may record a small current account surplus in 2021, first in the last decade.”

- EUR/USD extends the upside to the 1.1370 region.

- Final December EMU CPI, ECB Accounts next on tap.

- US Initial Claims, Philly Fed Index come next in the NA session.

The buying interest around the single currency remains unchanged and pushes EUR/USD to 2-day highs in the 1.1370 in the wake of the opening bell in Euroland on Thursday.

EUR/USD underpinned by risk-on trade

EUR/USD posts gains for the second straight session so far in the second half of the week, always in response to the renewed offered stance in the US dollar, which in turn remains under pressure following the decline in US yields.

The early rate cut by the Chinese central bank (PBoC) seems to have bolstered the appetite for riskier assets, motivating spot to extend gains for another session. Indeed, the PBoC reduced the 1Y Loan Prime Rate (LPR) to 3.7% (from 3.8%) and the 5Y LPR to 4.6% (from 4.65%). The bank’s move on the latter was the first one since April 2020.

In the meantime, US yields keep correcting lower and weigh further on the greenback, at the time when market participants seem to be pricing in more and more an interest rate hike by the Fed at the March meeting.

In the domestic calendar, the final December inflation figures in the euro area come next, while the ECB will publish its Account of the last meeting. Earlier, Germany’s Producer Prices rose 5% MoM during December and 24.2% over the last twelve months.

Data wise across the Atlantic, weekly Claims and the Philly Fed manufacturing gauge will be in the limelight seconded by Existing Home Sales.

What to look for around EUR

EUR/USD came under pressure after hitting new YTD highs in the 1.1480 region earlier in the month, finding some contention in the low-1.1300s so far this week. In the meantime, the Fed-ECB policy divergence and the performance of yields are expected to keep driving the price action around the pair for the time being. ECB officials have been quite vocal lately and now acknowledge that high inflation could last longer in the euro area, sparking at the same time fresh speculation regarding a move on rates by the central bank by end of 2022. On another front, the unabated advance of the coronavirus pandemic remains as the exclusive factor to look at when it comes to economic growth prospects and investors’ morale in the region.

Key events in the euro area this week: EMU Final December CPI, ECB Accounts (Thursday) - ECB Lagarde, EC’s Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Italy elects President of the Republic in late January. Presidential elections in France in April.

EUR/USD levels to watch

So far, spot is gaining 0.07% at 1.1350 and faces the next up barrier at 1.1482 (2022 high Jan.14) followed by 1.1485 (100-day SMA) and finally 1.1510 (200-week SMA). On the other hand, a break below 1.1314 (weekly low Jan.14) would target 1.1272 (2022 low Jan.4) en route to 1.1221 (monthly low Dec.15 2021).

- GBP/USD edged higher for the second successive day, though lacked bullish conviction.

- Rising bets for additional BoE rate hike extended support amid subdued USD demand.

- The UK political drama acted as a headwind for sterling and capped gains for the major.