- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- Gold prices consolidate recent losses as key SMA confluence test bears.

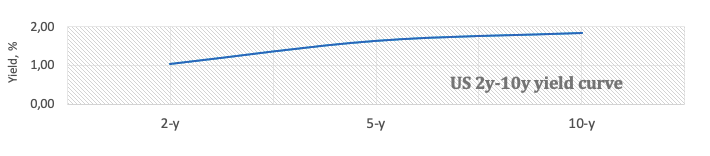

- US Treasury yields grind higher after refreshing two-year top on Fed rate hike bets.

- Virus woes escalate and so do geopolitical tensions concerning Russia-Ukraine, suggesting safe-havens to stay firmer.

- Second-tier US housing data to decorate calendar, Fed chatters are crucial ahead of next week’s FOMC.

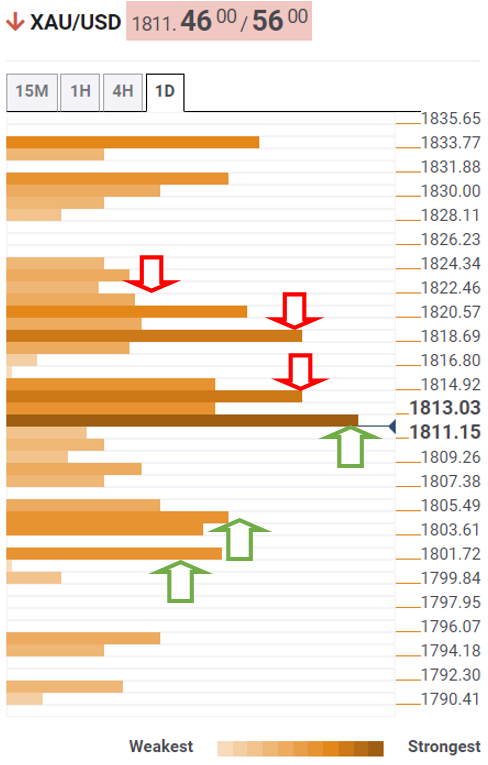

Gold (XAU/USD) prices keep the bounce off weekly low at around $1,815, up 0.05% intraday during Wednesday’s Asian session.

The yellow metal dropped to the lowest since December 11 the previous day as Fed Fund Futures propelled US Treasury yields and the US Dollar Index (DXY). However, geopolitical fears and downbeat sentiment concerning the South African covid variant, known as Omicron, joined US data to pare the losses.

Read: Gold Price Forecast: Poised to resume its decline amid inflation concerns

That said, the DXY dropped the most in 12 days on Tuesday after the Fed Fund Futures cited heavy chances of witnessing the above 1.0% Fed rate during early 2023. With that, the US Treasury bond yields for the 10-year and 2-year tenures rose to the highest levels since early 2020, which in turn weighed on the equities, commodities and Antipodeans. It should be noted that the stated US bond coupons recently dwindle around the highest levels since January 2020 with the benchmark 10-year yields around 1.87% by the press time.

Even so, downbeat New York Fed manufacturing gauge joined escalating fears of a war between Russia and Ukraine to keep the gold buyers hopeful. The NY Empire State Manufacturing Index slumped to negative for the first time in two years in December, -0.7 versus 25.7 expected and 31.9 prior, whereas US NAHB Housing Market Index eased to 83 versus 84 market forecasts and previous readouts.

Also acting as a risk-negative catalyst is the record high covid cases in Australia’s most populous state New South Wales (NSW) as well as worsening virus conditions in Japan and China.

To sum up, escalating chatters over the Fed rate hikes may underpin US dollar strength and can weigh on gold prices. However, other challenges to the risk appetite mentioned above might defend the gold buyers amid a light calendar in the US and Fedspeak blackout.

Read: Fed preview: End of money printing brrrrr – Four 25bp rate hikes this year and QT in September

Technical analysis

As gold buyers lurk around a five-week-old ascending trend line, near $1,805 at the latest, the yellow metal’s recent rebound once again target the 61.8% Fibonacci retracement of November-December downside, near $1,830.

Given the easing bearish bias of the MACD and RSI recovery, not to forget the bull cross of the 50-SMA to 100-SMA, the gold prices are likely to overcome the $1,830 hurdle this time.

However, tops marked in July and September close to $1,834 acts as an extra hurdle to the north before fueling the bullion towards the $1,850 intermediate resistance and November’s peak of $1,877.

Alternatively, a confluence of the stated SMA around $1,811 acts as immediate support before directing gold sellers toward the stated support line near $1,805.

In a case where gold prices decline past $1,805, the $1,800 threshold and 23.6% Fibo. level close to $1,782 should be watched carefully for the precious metal’s further downside.

To sum up, gold buyers regain upside momentum and are likely to overcome short-term hurdle this time.

Gold: Four-hour chart

Trend: Recovery expected

Australia has reported a record high of COVID-19 deaths, and its second-largest state declared an emergency in hospitals to cope with surging patient admissions and a staffing shortage due to the coronavirus. Australian Prime Minister Scott Morrison has said in recent trade that he has not received advice to shorten the isolation rules.

The 74 deaths occurred in its three most populous states. New South Wales reported 36, Victoria reported 22 and Queensland 16. The previous daily record was 59 coronavirus-related deaths on Sept. 4, 2020.

More than 2,700 people have died with COVID-19 in Australia, which has a population of 26 million.

Meanwhile, this week, Morrison's approval ratings slid after his handling of the Omicron-driven coronavirus outbreak fuelled a backlash, a widely watched poll showed on Tuesday, putting opposition Labor into a leading position months away from a federal election.

“Boris Johnson is set to announce the lifting of ‘Plan B’ Covid restrictions on Wednesday as a plot to oust him by Tory MPs first elected in 2019 emerged,” said the UK Telegraph during late Tuesday.

The news also mentioned UK PM Boris Johnson to have appeared forlorn in a television interview while apologizing for ‘misjudgments that I have made … whether in Downing Street or throughout the pandemic’.

Key quotes (via Telegraph)

The Cabinet is expected to sign off scrapping work from home guidance and Covid passports at a meeting on Wednesday morning, although some face mask rules could remain.

The Prime Minister gave his first public comments in six days on Tuesday, issuing a "categorical" denial that he was warned that a Downing Street garden drinks event on May 20, 2020, was "against the rules".

Yet as he laid out his defense, a group of 20 recently elected Tory MPs, many representing former Labour heartland "Red Wall" seats, met to discuss his fate in a gathering described as the "pork pie plot".

Those present told The Telegraph the group discussed submitting letters of no confidence together – a move that would markedly increase the political danger for Mr. Johnson. If 54 Tory MPs submit letters to the 1922 Committee, an automatic leadership vote is triggered.

Tory whips believe the number submitted is in the 20s, but one 2019 rebel claimed the 54 threshold could be triggered as early as Wednesday.

FX reaction

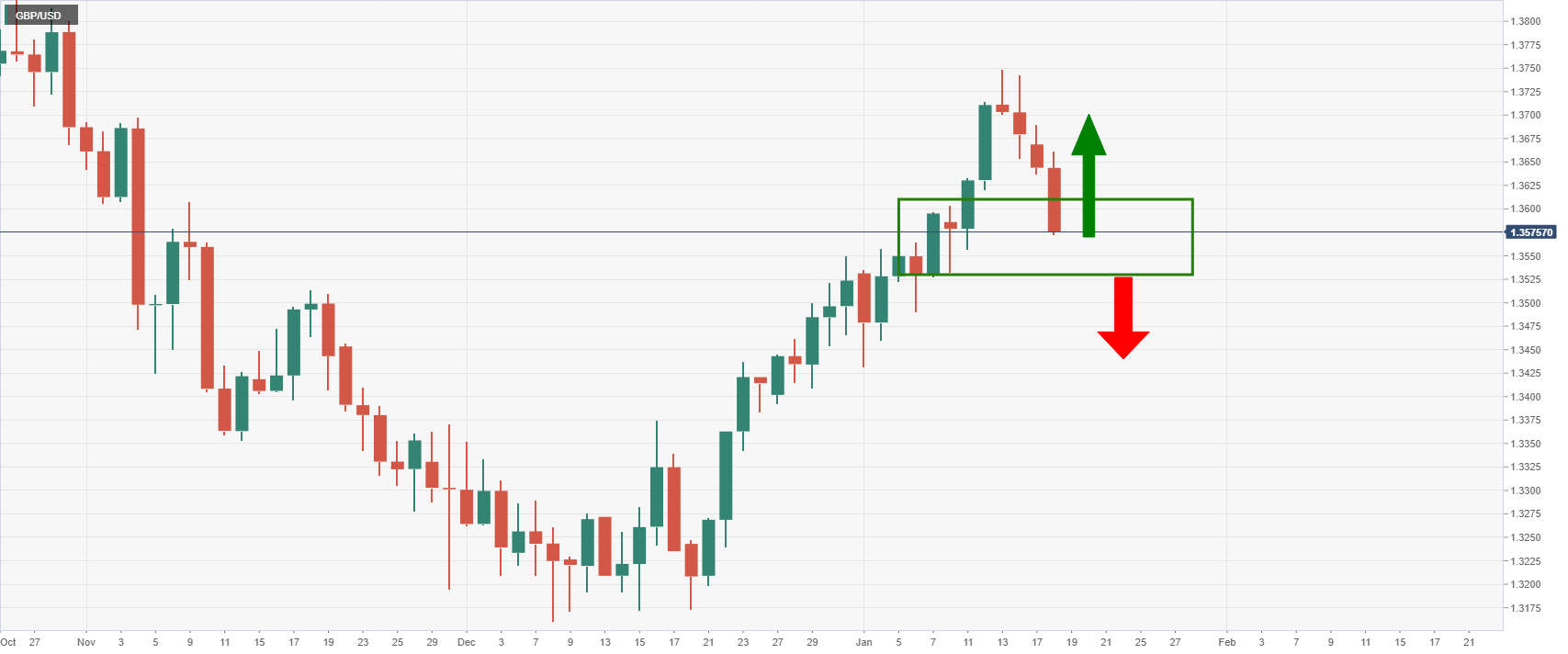

Given the mixed news, mostly negative for the GBP/USD prices, coupled with the broad US dollar strength, the cable prices stay pressured around 1.3600 by the press time of early Wednesday morning in Asia. It’s worth noting that the cable prices dropped the most in 12 days the previous day despite firmer UK jobs report on broad US dollar gains.

Read: GBP/USD drops into daily support structure in session lows

“We still have tools at our disposal to deal with rising oil prices and will engage OPEC as needed,” said White House (WH) Spokesperson, per Reuters.

The US diplomat crossed wires as the energy benchmark rallied to the highest since October 2014 while poking $86.50 at the latest.

On a different page, Turkish state-owned media Botas reported an oil pipeline explosion and fire that carries around 450kb/d of crude oil from Iraq to Turkey.

Market implications

WTI crude oil bulls take a breather around the multi-year high of $86.50 following a stellar rally amid fears of US intervention, as well as fresh chatters concerning Omicron weighing on the global energy demand.

Read: WTI eases back to $85.00 level after hitting fresh multi-year highs near $86.00

- USD/CAD holds lower ground after two-day downtrend, bears eye monthly low.

- DXY jumped the most in 12 days on rising bets over faster Fed rate hikes.

- Eight-year high oil price, hopes of BOC rate increase defend bears.

- US housing data will join BOC CPI and risk catalysts to direct short-term moves.

USD/CAD struggles to defend the 1.2500 threshold after it became an exception to the G10 currency pairs that slumped versus the US dollar rally the previous day. That said, the quote seesaws near 1.2515 during the initial hours of Wednesday’s Asian session.

In doing so, the quote justifies strong prices of Canada’s main export item WTI crude oil as well as the rising bets on the Bank of Canada (BOC) rate lift ahead of the BOC Consumer Price Index (CPI) data.

That said, WTI crude oil prices rose to the highest since October 2014 while closing around $85.84 at the end of Tuesday’s North American trading session. The oil benchmark not only cheered hopes of economic recovery but also benefited from geopolitical tensions between Russia and Ukraine.

Elsewhere, interest rate futures hint at 70% probabilities favoring the BOC to announce a rate hike during the next week’s monetary policy meeting. However, that makes today’s inflation data all the more important. Forecasts suggest that the key BOC CPI Core ease to 3.5% versus 3.6% prior while the headlines Consumer Price Index for December may rise to 4.8% from 4.7% previous readouts.

It should be noted that the US Dollar Index (DXY) jumped the most since January 03 the previous day as the Treasury bond yields jumped to early 2020 days amid escalating hopes of faster rate hikes by the Federal Reserve. Adding to the bullish bias are worsening virus conditions and Russia-Ukraine tussles.

Talking about data, NY Empire State Manufacturing Index slumped to negative for the first time in two years, -0.7 versus 25.7 expected and 31.9 prior. Further, US NAHB Housing Market Index eased to 83 versus 84 market forecasts and previous readouts. At home, Canada Housing Starts declined below 270K expected to 236.1K, versus upwardly revised 303.8K prior.

Moving on, the USD/CAD pair may remain range-bound as both, namely the USD and the CAD, are the biggest winners of the G10 currencies and oil prices have fewer hurdles to the north on crossing the $85.00 hurdle. In addition to the Canadian data, US housing market numbers and virus updates will also be important to watch for clear direction.

Technical analysis

Although the 100-DMA and a monthly resistance line restrict the short-term upside of the USD/CAD prices respectively around 1.2620 and 1.2635, the bears need to conquer the 200-DMA and an upward sloping support line from June, close to 1.2500 and 1.2460 in that order to excel.

- EUR/USD holds lower grounds at weekly bottom after the biggest daily loss in two weeks.

- 50-DMA, two-month-old rising support line confine further declines.

- Clear break of horizontal area from November, MACD conditions keeps sellers hopeful.

- Buyers remain away until the quote stays below 100-DMA.

EUR/USD seesaws around 1.1320-25 during early Wednesday morning in Asia, having dropped the most in 12 days the previous day.

The major currency pair’s slump on Tuesday dragged MACD towards teasing the bears while breaking a two-month-long resistance-turned-support area of around 1.1380-85.

However, the 50-DMA level surrounding 1.1325 restricts the EUR/USD pair’s immediate declines ahead of an upward sloping support line from late November, close to 1.1300 at the latest.

Given the MACD conditions and a clear break of the key supports, EUR/USD prices are likely to conquer the 1.1300 support line, which in turn could drag the quote towards the 2021 bottom surrounding 1.1185.

During the fall, the 1.1230 and the 1.1200 threshold may offer an intermediate halt.

On the contrary, corrective pullback remains elusive below the horizontal area from November 16, near 1.1380-85.

Following that, the 50% Fibonacci retracement (Fibo.) level of October-November 2021 downside, near 1.1440, will test the EUR/USD buyers.

Even if the pair prices rise beyond 1.1440, 100-DMA and 61.8% Fibo. level, respectively around 1.1490 and 1.1500, will be tough resistances to break for the bulls.

EUR/USD: Daily chart

Trend: Further weakness expected

It has been another day of volatility and risk-off as US yields surged. The US 10-year yield hit a two-year peak of 1.866% overnight. In line with Treasury yields, the US dollar strengthened against a basket of currencies, hitting a one-week high of 95.83 DXY.

Conflict is a concern as Russia’s aggression toward Ukraine has prompted a reaction from the likes of the UK. Officials at the UK Foreign Office have been told to be ready to move into “crisis mode” at very short notice.

“This is critical work in shaping and securing our European neighbourhood,” staff were told in a communication.

However, “crisis mode” is not an indication the UK government thinks an invasion is imminent or definitely happening, but part of putting precautionary plans in place that would shuffle staff to higher priority areas and allow the FCDO to move quickly if the status is triggered, Bloomberg reported.

Nevertheless, there are reports that the UK is sending light, anti-armour, defensive weapon systems to Ukraine to help Ukraine increase its defensive capabilities.

Meanwhile, the White House said Tuesday that the current tensions presented an "extremely dangerous situation."

"We're now at a stage where Russia could at any point launch an attack in Ukraine," White House press secretary Jen Psaki told a press conference.

Meanwhile, it's expected that if Russia were to invade Ukraine, NATO would be likely to raise its alert level This would entail sending reinforcements of its troops in the Baltics and Poland and even in southeastern Europe.

This in turn would be a challenge for the EU. If Russia does invade, the EU would be likely to impose sanctions on Russia and risk a cut in supplies of gas to Europe (energy prices are already sky-high and inflation is a burden on the economy).

All in all, the US dollar, yen and Swiss franc are ones to watch, so too is gold; all of which are the typical safe havens.

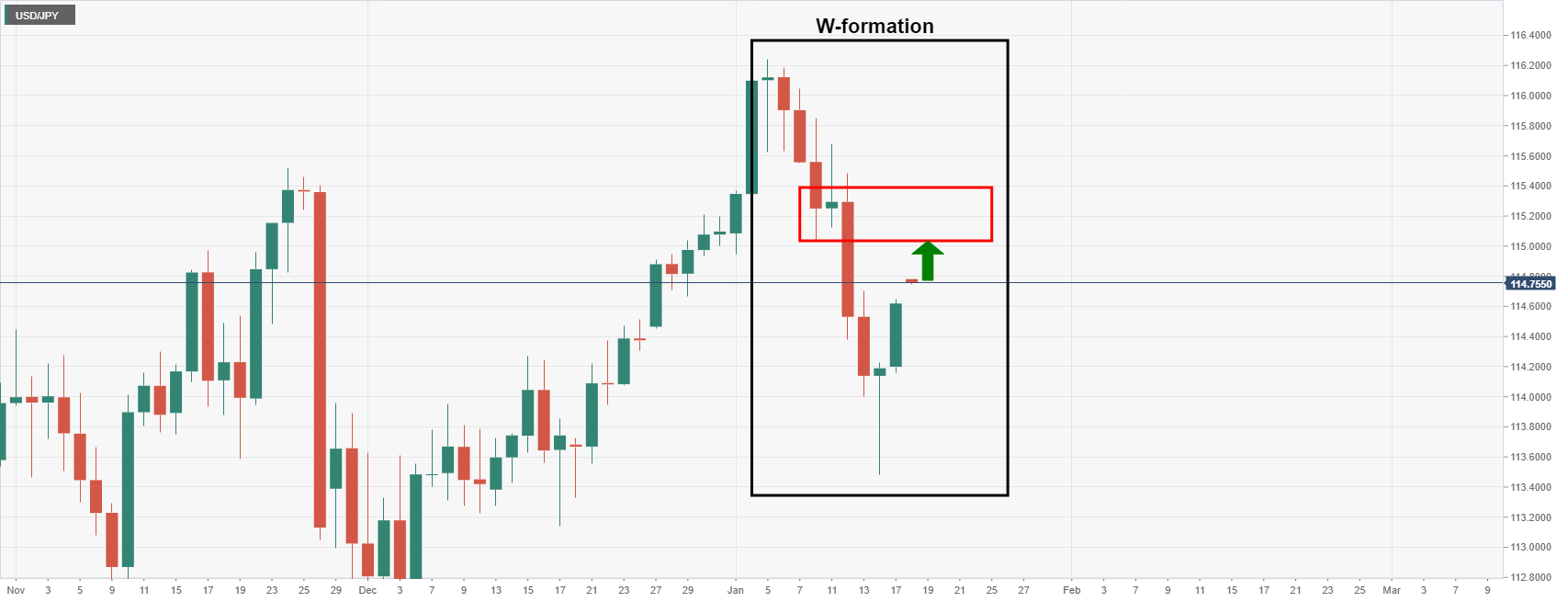

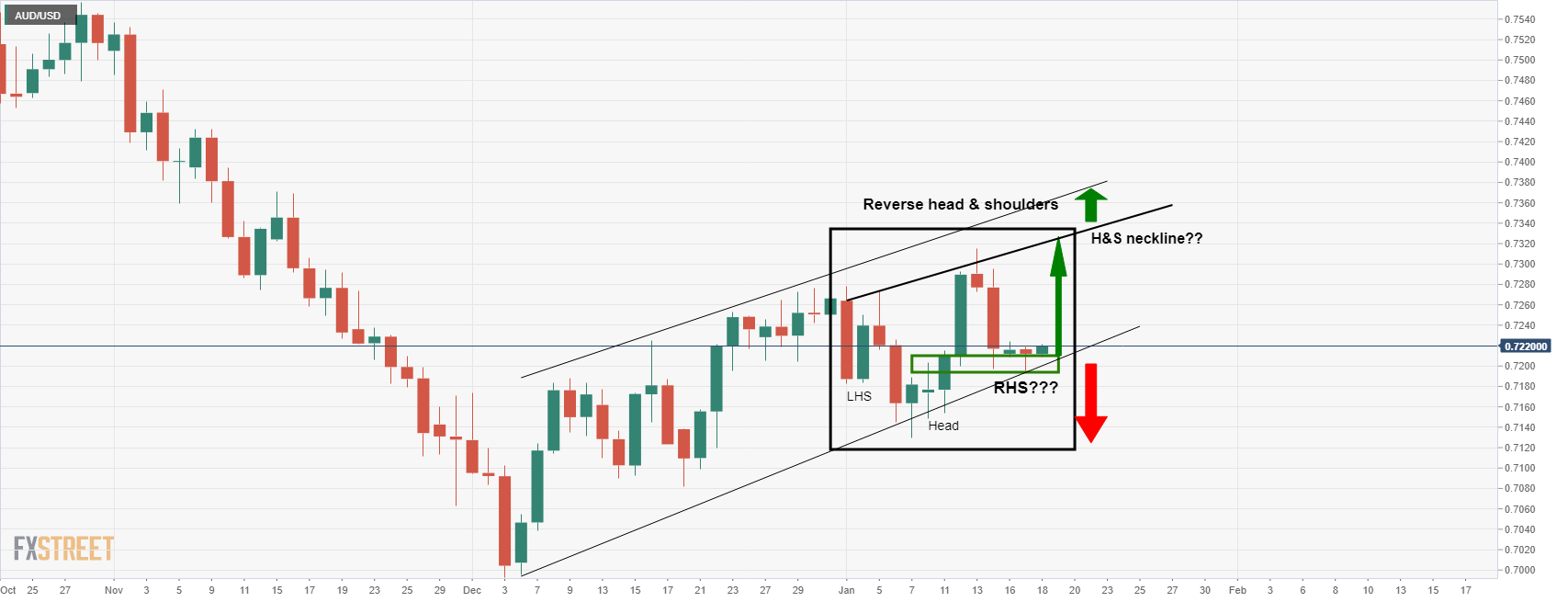

- AUD/USD is breaking into key support and the focus is on 0.7150.

- Bears will be looking for a significant breakout below trendline support.

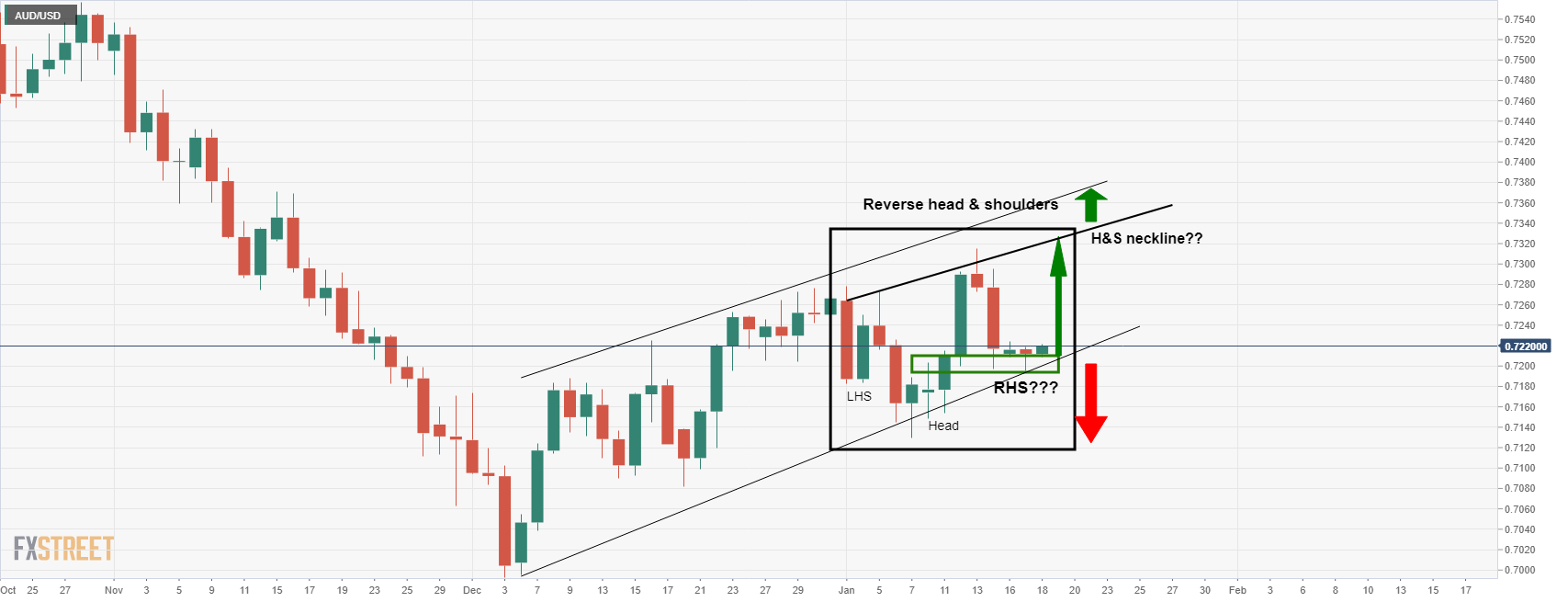

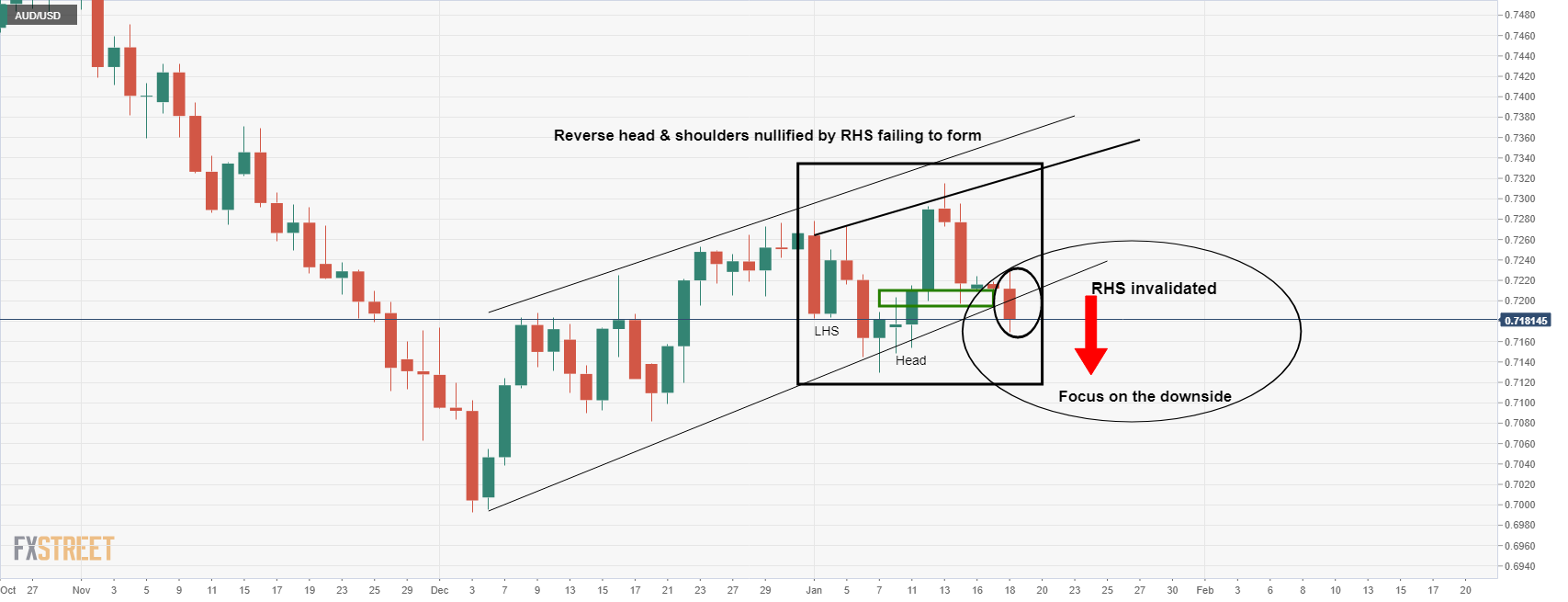

As per the prior analysis, AUD/USD Price Analysis: Consolidation in play, 0.7150 eyed while below 0.7230, daily support is key, the bears took over and now the bullish outlook based on the inverse head & shoulders is invalidated.

AUD/USD prior analysis

AUD/USD Price Analysis: Inverse H&S in the making from 0.7200 support

The above was an article that had identified the prospects of a bullish inverse head & shoulders taking shape on the daily chart.

AUD/USD was on the verge of either a break to the upside of a run below critical daily support, as follows:

However, due to the surge in US yields and the greenback following suit, the bears have taken over and broken a critical daily support structure.

AUD/USD inverse H&S invalidated

In turn, this has invalidated the bullish inverse head & shoulders pattern leaves 0.7150 exposed for the session ahead. 0.7150 could be the last stop before a significant sell-off below daily trendline support:

- US equities were broadly lower on Tuesday, as Fed tightening fears hit tech and weak Goldman Sachs earnings hit financials.

- The S&P 500 dropped 1.8%, the Nasdaq 100 dropped over 2.5% and the Dow dropped 1.5%.

- The S&P 500 dropped back under 4600 to hit fresh annual lows.

US equity markets experienced broad selling pressure on Tuesday, with the S&P 500 dropping 1.8% to slide back below 4600 and hit fresh annual lows, the Dow dropping 1.5% to slip under 35.5K and the Nasdaq 100 losing over 2.5%. Market commentators generally referred to “Fed tigthening fears” as the major driver of the downside. Michael O’Rourke, chief market strategist at JonesTrading commented that “we're having a repricing going on as the market prepares for interest rate hikes and we still have a bit of a ways to go to prepare for three rate hikes or four rate hikes”.

Despite a sharp rise in US government bond yields that hit tech/growth names hard (hence Nasdaq 100 underperformance), financial stocks were unable to benefit, with the S&P 500 GICS financials sector losing over 2.0% on downbeat Goldman Sachs earnings. Shares of the bank lost over 7.0% and hit their weakest levels since last May after earnings missed bottom-line expectations amid weak trading activity. The only sector in the green was energy, with the S&P 500 GICS sector up 0.2% amid a surge in oil prices to multi-year highs (with WTI near $86.00 per barrel).

In terms of the other major GICS sectors, the big tech-heavy Information Technology and Communication Services sectors lost 2.4% and 1.9% respectively while the Consumer Discretionary sector lost 2.0%. Consumer Staples, Industrials, Health Care, Materials and Utilities all lost between 1.1% to 1.6%. The broad selling pressure on Tuesday market a change in conditions compared to recent sessions which had been characterised more by rotation between “value” (incoming generating, low multiple) names to “growth” (low incoming generating, high multiple) names. As Fed rate hike expectations have amped up in sessions, investors have dumped growth stocks in favour of value.

The S&P 500 value index is down just 0.4% over the past five-session versus 2.7% losses in the S&P 500 growth index. Recent investment bank surveys allude to the souring of sentiment towards tech/growth names. BoA fund manager survey on Tuesday showed managers had aggressively cut their overweight tech positions to the lowest levels since 2008. Meanwhile, a survey conducted by Deutsche Bank found that most respondents see the US technology sector as in a bubble.

- USD/CAD has pulled back from over-1.2550 highs to trade back just above its 200DMA at 1.2500 again.

- Crude oil upside and hawkish BoC bets has largely insulated CAD from the US dollar’s advances on Tuesday.

USD/CAD has had a subdued session on Tuesday, with the pair having dropped back to trading just above its 200-day moving average at the 1.2500 level after briefly surpassing the 1.2550 mark midway through US trade. Surging crude oil prices that saw front-month WTI futures hit multi-year highs near the $86.00 per barrel level continued to provide the loonie with tailwinds, as has so often been the case in recent weeks (WTI is up nearly $20 from its December 20 lows). But this wasn’t enough to push USD/CAD below support in the 1.2500 area, with the pair supported by a broad recovery in the US dollar as US government bond yields advanced to reflect new hawkish Fed tightening bets ahead of next week’s meeting.

The net result is that USD/CAD looks set to end the session broadly flat, with both CAD and USD amongst the best G10 performers on the day, with the latter having shrugged off a disappointing NY Fed manufacturing survey for January. The loonie also shrugged off downbeat data in the form of underwhelming Housing Starts figures for December (which came in at 236.1K versus 270K forecasts). That’s likely because CAD continues to derive support from Monday’s bullish (though admittedly out-of-date given its compilation was pre-Omicron) BoC Business Outlook Survey (BOS), the headline index of which hit a new record high.

In wake of the BOS, CAD short-term interest rate markets are now pricing in a 70% chance that the BoC hikes rates at next week’s meeting. Given the BoC hasn’t even yet signalled a willingness to hike rates in Q1 2022, let alone the first month of 2022, that might be a bit of a stretch. At the very least, if the central bank doesn’t hike next week, it will likely signal a willingness to do so in the March meeting to keep pace with the Fed. Wednesday’s Canadian Consumer Price Inflation data (for December) will be viewed in the context of how it affects money market pricing for a rate hike in January and is the next key event to watch for USD/CAD traders.

An upside surprise could push USD/CAD below the big 1.2500 figure and on towards a test of recent lows in the 1.2450 area. A surprise January rate hike coupled with further crude oil markets gains (many commodity strategists see Brent hitting $100 later in the year amid a tighter than forecast market) could combine to send the pair back towards a test of last Q4 2021 lows in the 1.2300 area.

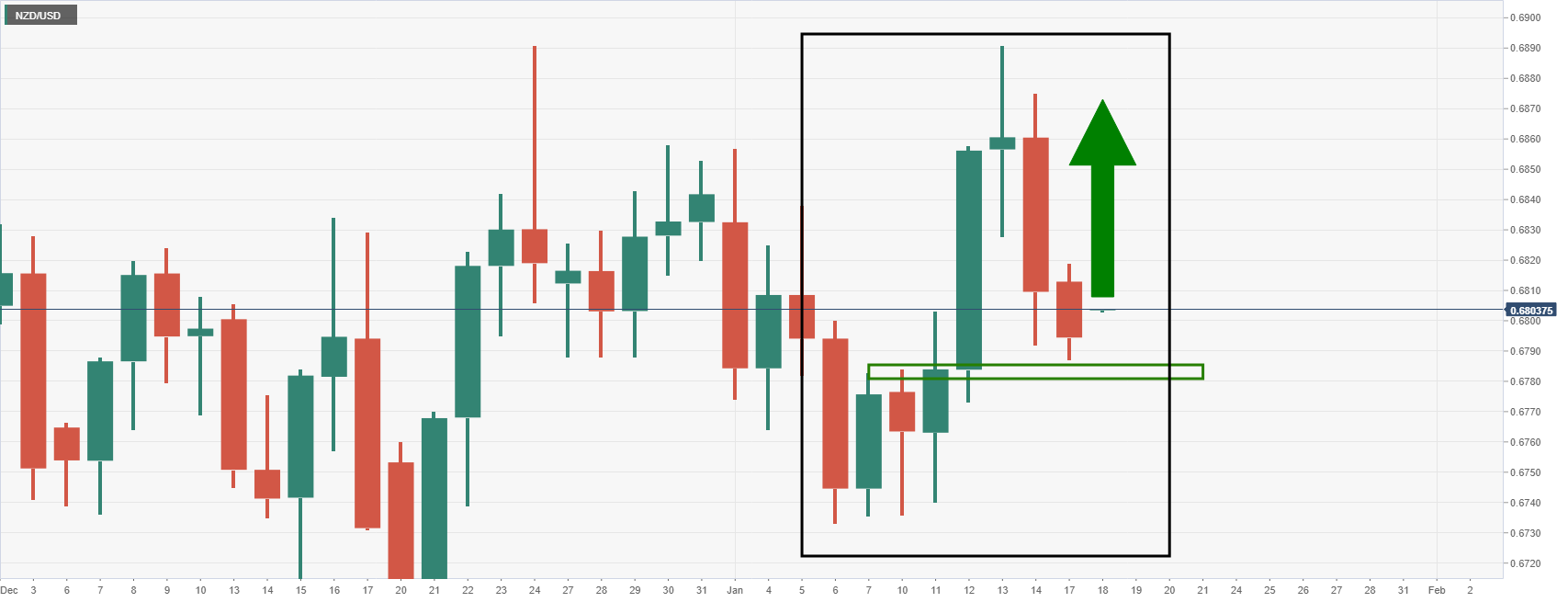

- NZD/USD bulls are stepping back in and eye the weekly M-formation's neckline near 0.6930.

- The US dollar and US yields are the driving forces mid-week.

NZD/USD was under pressure on Tuesday but is making an advance into the closing hours of the New York session, trading at 0.6773 after climbing from a low of 0.6752. The pair had been as high as 0.6808 at the start of the day before an almightly surge in the greenback.

benchmark US Treasury yields jumped to two-year highs and major equity market indexes dropped more than 1% on Tuesday as traders braced for the Federal Reserve to be more aggressive in tightening monetary policy to tackle inflation.

The US dollar struck a six-day high following the jump in Treasury yields. The US 10-year yield also hit a two-year peak of 1.866% overnight. In line with Treasury yields, the dollar strengthened against a basket of currencies, hitting a one-week high of 95.83 DXY.

As for risk appetite, the Dow Jones Industrial Average sank by over 1.9% to 35,262 and the S&P 500 dropped 1.9% to 4,569.82. The Nasdaq Composite slumped 2.31% to 15,238. All sectors were in the red as volatility remains in play at the start of the year, weighing on the high beat currencies and dollar bloc.

''While AUD and NZD have been the two worst-performing G10 currencies since the start of the year, they fared better than the EUR and CAD overnight. All in all, it’s a picture of volatility, and while not extreme, that theme is likely to carry through the year as global central banks look to tighten and rein in cash liquidity,'' analysts at ANZ bank argued.

''Yesterday’s NZIER QSBO data added fuel to the debate around how much more tightening might be delivered here. The survey pointed to a stretched labour market and to ongoing inflation pressures, but in a world where everyone else is also tightening, that may not help the NZD.''

NZD/USD techncial analysis

The bird is going through what could be a period of accumulation per the weekly chart's M-formation and neckline at 0.6930 as the target:

What you need to know on Wednesday, January 19:

The American dollar is the overall winner, up against all of its major rivals. US Treasury yields soared to levels last seen in February 2022, with the yield on the 10-year note reaching 1.856% and that on the 2-year note surpassing 1%. Stocks edged lower, with global indexes ending the day in the red.

The EUR/USD pair is currently trading at around 1.1420, despite an encouraging German ZEW survey, showing a sharp bounce in Economic Sentiment.

The GBP/USD pair broke below 1.3600, ignoring UK employment figures. The unemployment rate eased to 4.1% in the three months to November, while the unemployment claimant fell by 43.3K in December. Meanwhile, the scandal about the Downing Street parties in the worst of the UK lockdowns puts PM Boris Johnson leadership at risk.

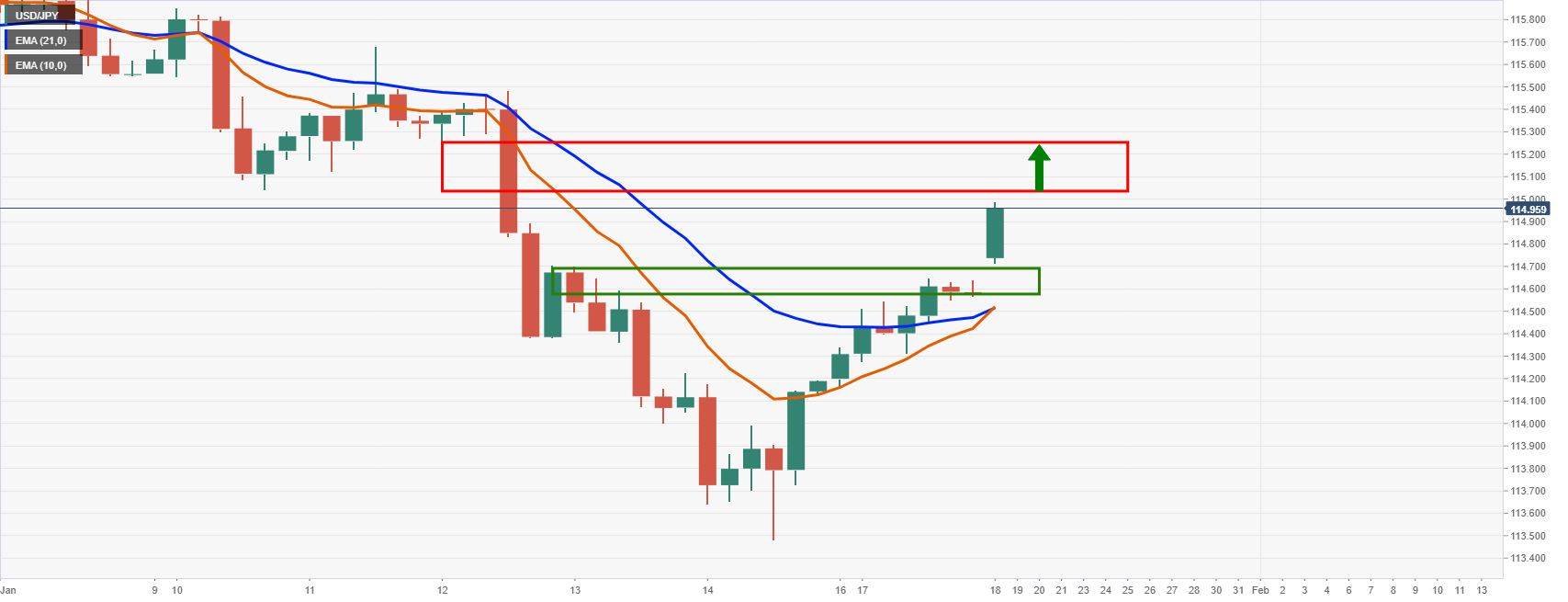

At the beginning of the day, the Bank of Japan announced its decision on monetary policy. As widely anticipated, the central bank remained on hold, although policymakers revised to the downside their growth forecasts for this fiscal year. The USD/JPY pair peaked at 115.05, but trimmed gains ahead of the close and ended the day unchanged at around 114.50.

AUD/USD fell to 0.7170, bouncing modestly ahead of the close. Weaker gold prices put additional pressure on the pair, as the bright metal settled around $1,814 a troy ounce.

The USD/CAD pair posted a modest intraday advance, as higher oil prices limited CAD’s weakness. WTI trades at $84.50 a barrel after reaching its highest since October 2014.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto market seems ready to rally

Like this article? Help us with some feedback by answering this survey:

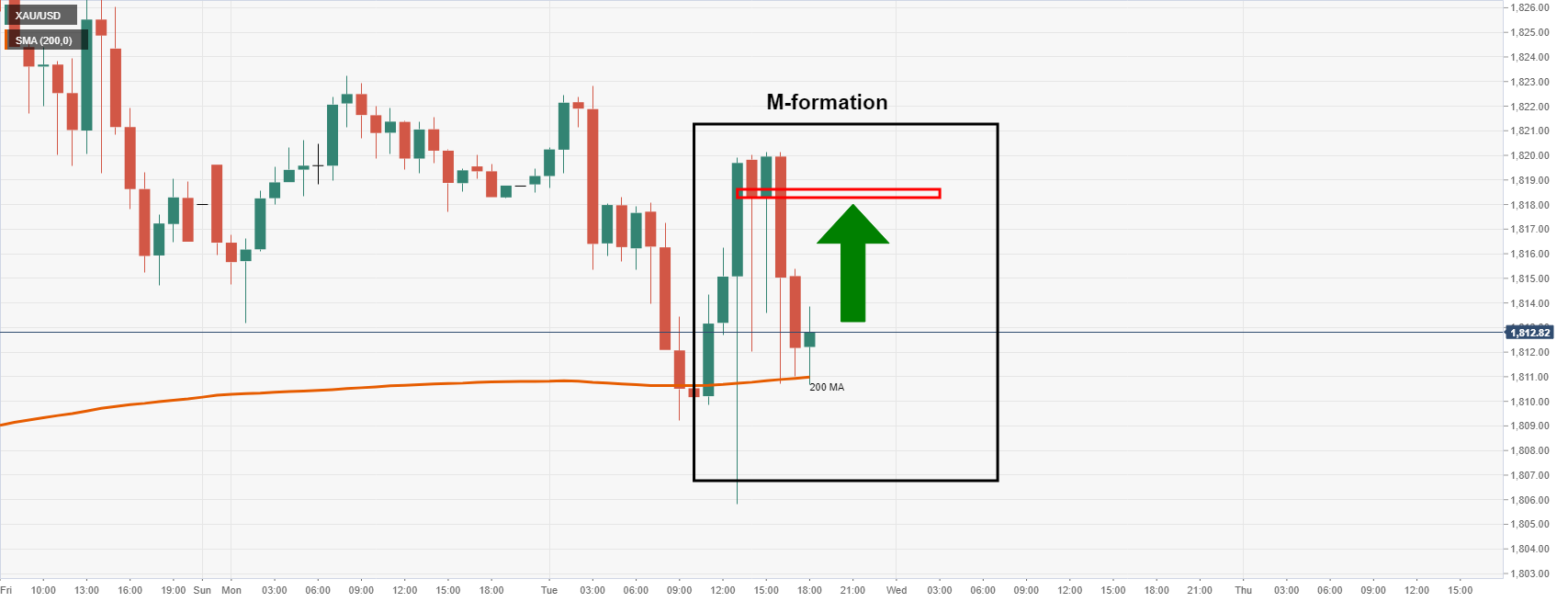

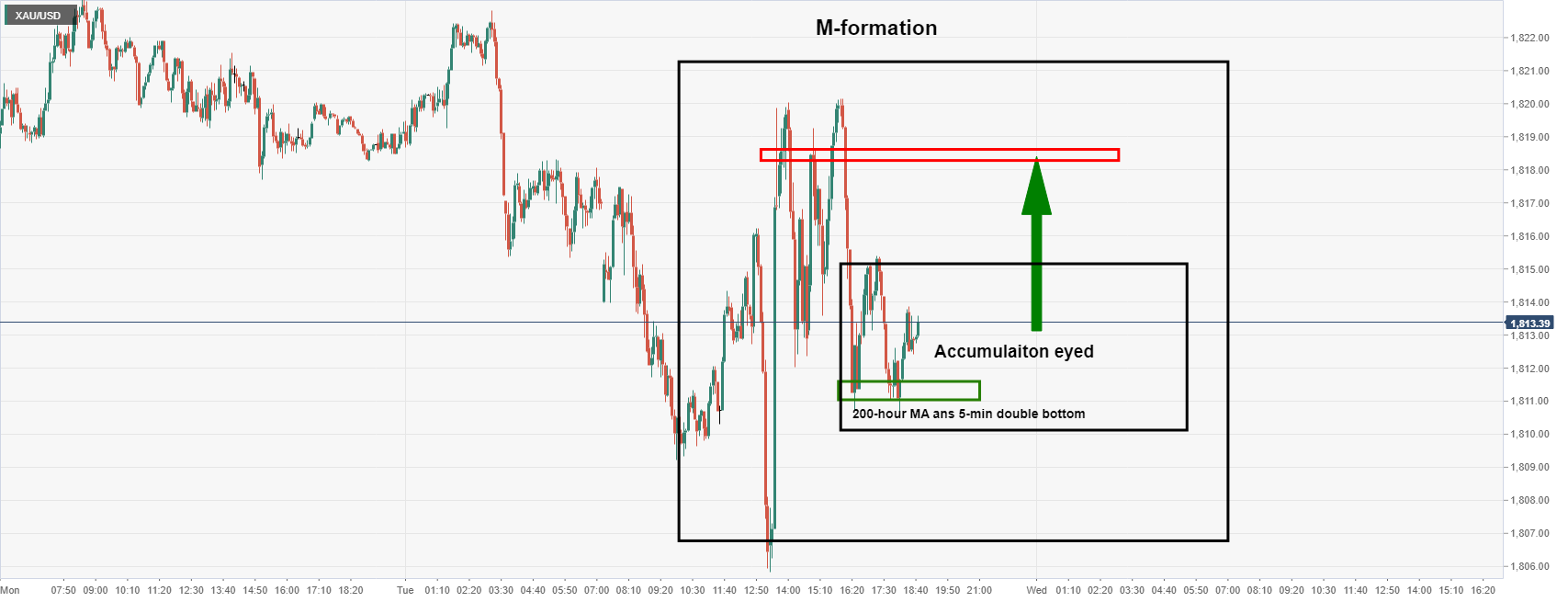

- Gold bulls are stepping in and accumulation following the hourly bearish impulse is in play.

- US dollar remains firm but US 2-year yields are topping out. A correction to $1,818 is eyed for the sessions ahead.

At $1,813.56, gold, XAU/USD, is attempting to correct the New York session's sell-off from $1,820 and has eyes to $1,1818 within an otherwise bullish trend as determined by the 200 moving average. The US dollar strength has, until now, undermined the performance of the bulls but despite the fresh highs in the greenback, gold is robust.

The 2-year US Treasury yield is slowing up which could be helping to support gold prices but overnight, the benchmark US Treasury yields jumped to two-year highs and major equity market indexes dropped more than 1% on Tuesday. Traders have braced for the Federal Reserve to be more aggressive in tightening monetary policy to combat inflationary pressures.

Consequently, the US dollar hit a six-day high following the jump in Treasury yields. The US 10-year yield also hit a two-year peak of 1.866% overnight. In line with Treasury yields, the US dollar strengthened against a basket of currencies, hitting a one-week high of 95.83 DXY.

For the remaining five business days, there are no Fed speakers until Chair Powell’s post-FOMC decision press conference on January 26. ''Given this way US yields are moving, it’s clear that the Fed’s full-court press last week made a significant impression on the bond market,'' analysts at Brown Brothers Harriman explained.

''We fully expect a hawkish hold next week that sets up liftoff at the March 15-16 meeting. WIRP suggests a hike then is now fully priced in, followed by hikes in June, September, and December. The expected terminal Fed Funds rates are also starting to move towards 2.0%, which is a key part of the market repricing,'' the analysts added and noted that the equity markets are finally getting the message.

The Dow Jones Industrial Average sank by over 1.9% to 35,262 and the S&P 500 dropped 1.9% to 4,569.82. The Nasdaq Composite slumped 2.31% to 145,238. All sectors were in the red.

Meanwhile, gold trend-follower positioning is also topping out, leaving fewer marginal buyers in precious metals to offset the aggressive rise in rates, analysts at TD Securities explained.

''As the market continues to pencil in additional Fed rate hikes, with a full 4 hikes priced for 2022 and a near-certain March rate hike priced, precious metals appear vulnerable to a consolidation.''

Gold technical analysis

An interesting development is taking place on the lower time frames in gold for which could equate to a short term opportunity:

The price is already holding in bullish territory as per the 200-hour moving average. The M-formation is a reversion pattern that has a high completion rate. The price is often drawn in by the neckline of the formation, in this case, this comes in at $1,818.

Traders can take advantage of the lower time frames, such as the five-min chart, and monitor for accumulation and an optimal area to buy into what could turn out to be a correction of the hourly bearish impulse:

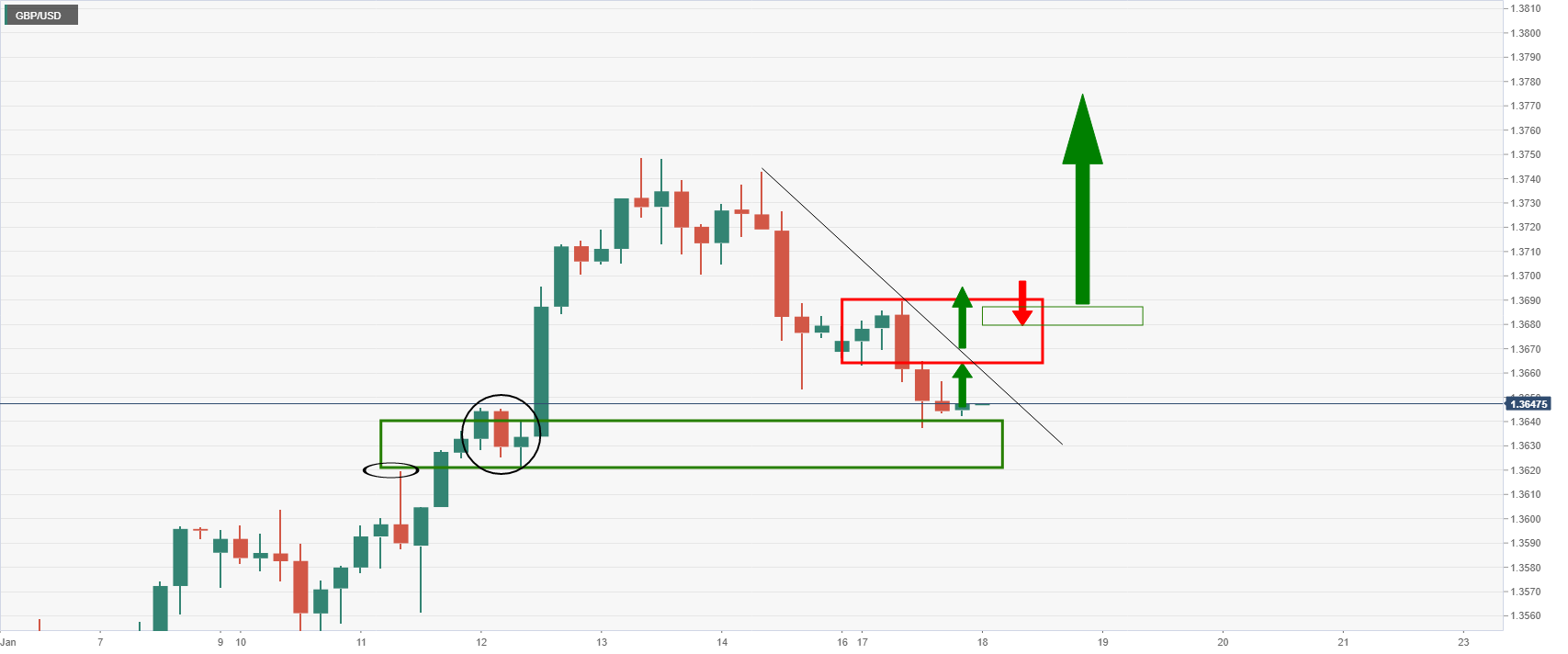

- GBP/USD sinks into critical demand territory as the dollar finds demand on a spike in US yields.

- A break below 1.3530 opens risk to the January 3 low a cent lower near 1.3430.

At 1.3574, GBP/USD has fallen some 0.51% on Tuesday from a high of 1.3661 to a fresh low of 1.3573. The surge in US Treasury yields has lifted the US dollar out of the doldrums while UK politics weighs on the tainted British currency as well.

Firstly, benchmark US Treasury yields jumped to two-year highs and major equity market indexes dropped more than 1% on Tuesday as traders braced for the Federal Reserve to be more aggressive in tightening monetary policy to tackle inflation.

The US dollar struck a six-day high following the jump in Treasury yields. The US 10-year yield also hit a two-year peak of 1.866% overnight. In line with Treasury yields, the dollar strengthened against a basket of currencies, hitting a one-week high of 95.83 DXY.

UK politics in focus

The UK's prime minister Boris Johnson is caught up in the ''Partygate'' scandal for which he has denied any wrongdoing and has lied to parliament about a lockdown party. His premiership is under threat. The uncertainty is a negative factor for the pound which is already pressured over European politics in the Brexit saga.

However, in the coming few months ahead, Johnson's popularity and sterling's robustness will be scrutinised once again when local elections are held across England, Scotland and Wales on May 5. A civil investigation in Partygate is underway but it is broadly accepted across the party that removing Johnson before this date would be extremely dangerous, as no one could be certain what the consequence would actually be. This could bring some solace to the pound.

Meanwhile, Brexit is a potentially bigger risk for the pound. despite Truss’ first meeting with EU officials seeming to indicate somewhat of a less confrontational approach, the discussions over the Northern Ireland protocol are still set to prove challenging.

As for UK economic data, British employers added a record number of staff in December failed to prop up sterling, despite the Unemployment Rate that fell slightly to 4.1% (vs. expectations: 4.2%). Both headline and ex-bonus wage growth continued to fall as more base effects disappear from the data, with headline wage growth falling slightly.

''Employment data for the three months ending in November continued to confirm the MPC's view that the transition from the furlough scheme went relatively smoothly,'' analysts at TD Securities explained.

''Moreover, vacancies rose to a record high, further highlighting the tightness of the labour market, and flash December PAYE data shows further signs of strength as it registered +184k despite effects from Omicron.''

''The Bank of England will now turn to tomorrow's inflation release, but as it stands, this labour report should pave the way for another rate hike in February—in line with our expectations—especially as Omicron appears to have had a relatively benign impact on the economy compared to previous waves.''

Casting minds back, in December, the BoE became the first major central bank to raise interest rates since the pandemic took hold in 2020. In response, the cable managed to rally over 4% from its December lows, but has lost ground in the last three sessions.

"Expectations have already run quite far," wrote Commerzbank analyst You-Na Park-Heger.

BoE eyed

She explained that there will be attention paid to what the BoE governor Andrew Bailey has to say on Wednesday when speaking to the Treasury Select Committee when inflation data is also due.

Traders will have noted that Gross Domestic Product data on Friday showed that the UK economy was better off than before the first COVID-19 lockdown which can help to underpin the pound as traders wait to see what will come of the BoE's monetary policy decisions in the coming months.

However, the latest positioning data shows that GBP net short positions have dropped back sharply from their recent highs following the 15 bps December rate hike from the BoE.

''The money market is still positioned for a fair amount of tightening next year though the fact that speculators are still net short of GBP still suggests that some types of investors remain sceptical of its outlook,'' analysts at Rabobank explained.

On the other hand, as analysts at Brown Brothers Harriman point out in a note today, ''WIRP suggests over 90% odds of another hike February 3, followed by hikes at very other meeting that would take the policy rate to 1.25% by year-end.'

The analysts at BBH said that they ''think this pricing overstates the BOE’s need to tighten, as headwinds abound from Brexit, higher energy costs, and fiscal tightening. ''

''Along the way, Quantitative Tightening will also kick in as the policy rate moves higher. The hawkish BOE outlook that had helped sterling outperform is getting crowded out a bit lately by the more hawkish Fed outlook. ''

GBP/USD technical analysis

Cable is down three straight days:

A break below 1.3530 opens risk to the January 3 low a cent lower near 1.3430.

France central bank head and ECB governing council member François Villeroy de Galhau reiterated on Tuesday that French inflation is likely to fall back under 2.0% by the end of 2022. However, should inflationary pressures prove more persistent, he added, he has no doubt that the ECB would adapt its monetary policy faster.

Market Reaction

EUR/USD selling continues and the pair has now dipped below its 50 and 21-day moving average to trade in the 1.1320s, down about 0.7% on the day. Recent losses do not appear to have anything to do with Villeroy's latest remarks which did not contain any new information/angles on ECB policy.

- AUD/NZD stuck close to its 21DMA on Tuesday just above 1.0600.

- Weak weekly Australia Consumer Confidence data was negated by a pessimistic NZ business survey.

- NZIER’s survey was also very inflationary, however, supporting the case for RBNZ rate hikes this year.

As has been the case for most of the last four sessions, AUD/NZD spent most of Tuesday’s session trading close to its 21-day moving average, which currently resides close to 1.0610. That means the pair continues to trade well within the 1.0580-1.0650ish ranges that have prevailed so far in 2022. Weekly Australia ANZ Consumer Confidence data release on Tuesday showed another sharp deterioration in confidence as Omicron continues to rage across Australia.

The Australian bank’s measure of consumer sentiment slid dropped 7.6% last week to its lowest since October 2020, below its levels during the surge in Delta infections during 2021 that saw certain areas of the country enter prolonged lockdowns. But the week data did not send AUD/NZD below 1.0600 as it was negated by equally downbeat data out of New Zealand. According to the think tank NZIER’s quarterly survey of business opinion (QSBO), a net 28.0% of surveyed companies expect general business conditions to deteriorate in Q4 compared to 11% in the previous quarter.

Perhaps this reflected anticipation that the wave of Omicron being seen in Australia would soon arrive on New Zealand’s shores. However, NZIER’s QSBO also showed a fresh build-up of inflationary pressures, which will likely encourage the RBNZ to press on with interest rate hikes in the coming months. A net 61% of surveyed firms reported increased costs in Q4, the most since June 2008, while 52% of survey respondents said they had raised prices, the highest such proportion since 1987. The report also spoke of acute labour shortages.

“Inflationary pressures were evident and appear to be accelerating,” said analysts at Kiwibank. “A closed border means it's becoming increasingly difficult to find skilled staff, and an exceptionally tight labour market is driving up wages” the bank added, saying that the reinforced the case for more monetary tightening from the RBNZ. For now though, AUD/NZD traders have been reticent to add bearish bets on RBNZ rate hike expectations in the run up to Australian December labour market data. If sufficiently strong, the data (released on Thursday) may be enough to spur further hawkish RBA rate bets. Despite the central bank saying it will not hike before 2023, markets currently expect the bank to lift rates before the end of H1 2022.

Analysts at MUFG Bank expect the EUR/USD pair to trade in the 1.100-1.1650 range during the next weeks. They see the pair moving to the downside, before staging a gradual rebound after the first quarter.

Key Quotes:

“The pair has found more support closer to the 1.1000-level similar to between 2015 and early 2017, and more recently between late 2019 and early 2020. The price action fits with our view that the EUR has become more deeply undervalued against the US dollar which is helping to dampen further downside risks in the near-term.”

“Our long-term PPP model estimates that EUR/USD is currently trading around one standard deviation below fair value which comes in at around 1.1250. It was only back in the early 2000’s that EUR/USD traded at even more extreme levels of undervaluation for a more sustained period of time.”

“There is still room to price in more Fed hikes further out the curve and price in a higher terminal rate. Additionally, the Fed could announce plans to begin shrinking their balance sheet sooner and more quickly than in the last tightening cycle. As a result, we still expect EUR/USD to trade closer to the 1.1000- level in Q1 before drifting gradually higher later this year.”

“One potential trigger for a weaker EUR in the month ahead is posed by rising geopolitical tensions between Russia and the West.”

Recent testimony, speeches and interviews have made it clear that the Federal Reserve “is gung ho and ready to start hiking in March”, explained analysts at Rabobank. They see the FOMC raising rates each quarter during 2022 unless there is a setback in the real economy.

Key Quotes:

“The next meeting of the FOMC takes place on January 25-26. There will be no update of economic projections, only a formal statement and a press conference by Powell. Since tapering continues until March, there will also be no rate hike in January. Powell will likely repeat his hawkish remarks of recent weeks and try to convince the markets, the public, and the politicians, that the Fed is now serious about inflation fighting.”

“At the post-meeting press conference on January 26, Powell may shed some light on the balance sheet normalization discussion. The minutes – to be released on February 16 – may give us more details on this debate.”

“Last summer, we expressed our fear that the Fed would be blindsided by inflation. However, we had no idea how long it would take for the FOMC to see the light. Keep in mind that at the time we wrote our special the FOMC still expected to keep rates unchanged until 2024! Then, at the December meeting, the Fed created the option to start hiking in March, by accelerating the pace of tapering. What we have heard in recent weeks from Powell and his fellow FOMC participants has convinced us that they have become serious about inflation fighting. In fact, they seem eager to show it through action. Therefore, we have put 4 Fed rate hikes of 25 bps each in our outlook for 2022.”

- USD/JPY has settled in the 114.50 area, roughly flat on the day despite a dovish BoJ and higher US yields.

- Safe-haven demand has underpinned the yen on a day where Fed tightening fears have driven US equities lower.

USD/JPY has eased back to near the 114.50 mark in recent trade after briefly spiking as high as the 115.00 handle during Asia Pacific trade on post-BoJ rate decision yen weakness. The more dovish than expected BoJ aside, some FX traders will be surprised at USD/JPY’s inability to track the latest advances in US bond yields that saw the US 10-year on Tuesday hit its highest level since January 2020 above 1.85%. By contrast, at current levels just above 114.50, USD/JPY is still trading some 1.5% below the 116.35 multi-year highs it hit in the first week of 2022.

USD/JPY’s failure on Tuesday to hold to the north of the 115.00 level, or indeed above the 21-day moving average at 114.91, post-BoJ/US bond yield spike likely has a lot to do with the market’s risk-off tone. US equities have tumbled on Tuesday as a result of Fed tightening fears and FX markets have unsurprisingly adopted a fairly defensive posture, which has seen safe-haven currencies JPY and USD outperform in unison. A much weaker than expected NY Fed manufacturing survey did not shift the dial for FX markets.

Recapping Tuesday’s BoJ meeting; as expected, the bank didn’t announce any new policy changes, but did modestly upgrade its inflation and growth forecasts, as sources had recently hinted was likely. The inflation forecast for the fiscal years 2022/23 and 2023/24 were both lifted to 1.1% from previously 0.9% and 1.0%, while the language on the risks to prices was adjusted to “generally balanced” from “skewed to the downside.

Governor Haruhiko Kuroda acknowledged that price pressures had risen, but was eager to push back against any chatter about rate hikes. “We are not debating an interest rate hike” he said in the post-meeting press conference, adding that “the median forecast of board members is for inflation to move around 1%... Under such conditions, we are absolutely not thinking about raising rates or modifying our easy monetary policy”. “We continue to expect the BoJ to stick to their current policy framework until at least Governor Kuroda’s term ends next April,” said an analyst at MUFG, adding that “the widening divergence between BoJ and Fed policy expectations should continue to place upward pressure on USD/JPY”.

- US dollar prints fresh highs versus main European currencies.

- EUR/USD having worst day in months, drops below the 20-day SMA.

The EUR/USD has been falling constantly since the European session, and on American hours reached a fresh weekly low at 1.1325. It is hovering near 1.1330/35, with the negative tone intact.

The euro is falling more than seventy pips versus the US dollar, having the worst day in months as US yields keep rising and amid a big drop in equity prices. Weaker-than-expected economic data from the US did not stop the greenback. The Empire manufacturing index dropped unexpectedly to contraction territory in January.

In Wall Street, the Dow Jones is falling by 1.39% and the Nasdaq drops 1.97%. The US 10-year yield stands at 1.84%, and the 30-year at 2.17%. The combination of higher yields and risk aversion is boosting the greenback on Tuesday, particularly against main European currencies.

From a technical perspective, if the EUR/USD fails to recover 1.1370 it could remain under pressure, looking at the 1.1300 zone and then the 1.1260 support area. The slide pushed the pair back below the 20-day simple moving average and into the previous trading range that prevails all December.

Technical levels

- Spot silver spiked to more than two-month highs above $23.50 in recent trade following a week NY Fed manufacturing survey.

- The move cuts against higher US yields and a stronger US dollar, suggesting the gains may prove short-lived.

Spot silver (XAG/USD) prices spiked nearly 60 cents from under $22.90 to near $23.50 (more than two-month highs) in recent trade in wake of a much weaker than expected January New York Fed Manufacturing survey. The headline index slumped into negative territory for the first time since October 2020 versus expectations for a decline from 31.9 to 25.7, a reflection of Omicron’s short-term hit to business conditions. At current levels just below the $23.50 mark, XAG/USD is now trading higher by nearly 2.0% on the day, having at one point traded closer to 1.0% lower.

Silver’s recent rally, which has seen the precious metal rebound from its 21-day moving average at $22.80 and scorch above its 50-day moving average just under $23.20, cuts against the moves being seen in bond and FX markets. Bond market participants, unfazed by the weak NY Fed survey, have continued to push US yields higher with focus instead on increasingly hawkish Fed expectations. The 2-year yield has pushed above 1.0% for the first time since February 2020 and is up about 6bps on the day, whilst the 10-year is up about 8bps and trading around 1.85%, its highest level since January 2020. This move is being driven by upside in real yields (rather than inflation expectations), which would typically weigh on precious metals.

Amid the rise in US yields that has outmatched the moves in yields in other developed markets, the US dollar has been catching a bid and the DXY, overcoming initial post-NY Fed data weakness, has pushed back to weekly highs above 95.50. That makes dollar-denominated precious metals more expensive for the holders of international currency, weighing on demand, and would thus typically send silver prices lower. Higher real yields and a stronger dollar suggest the most recent push higher in spot silver may be short-lived. If intra-day/swing traders do take the opportunity to add short positions at elevated levels above $23.50, they will likely be targetting a rest of Tuesday’s and last Friday’s lows in the $22.80 area.

- After hitting multi-year highs near the $86.00 per barrel level, WTI has since backed off to trade around $85.00.

- Market commentators have attributed rising geopolitical tensions in the Middle East as behind the latest push higher.

- Goldman Sachs is calling for oil (Brent) to hit $100 per barrel in H2 2022.

After hitting multi-year highs early on during the European trading session near the $86.00 per barrel level, front-month WTI futures have since backed off to trade around $85.00, though still hold onto gains of about 60 cents on the session. Market commentators have attributed geopolitical tensions as driving the latest upside in crude oil prices, after an attack by Yemen’s shia Houthi militia on the UAE earlier in the week ratched up tensions in the region. Following the drone and missile strikes that killed three people and triggered explosions in fuel trucks, the Houthis have been threatening to target further UAE facilities.

The latest increase in Middle Eastern tensions comes at a time when global crude oil markets are already looking a lot tighter than analysts had been expecting at the start of the year. A lower-than-expected hit to global demand from Omicron combined with the difficulties some smaller OPEC+ members have been having in lifting output led Goldman Sachs to announce a for oil (Brent) to hit $100 per barrel in H2 2022. The bank explained that the above factors had “kept the global oil market in a larger deficit than even our above consensus forecast”, a factor that has likely been driving growing premiums in various physical crude oil grades over future prices in recent weeks.

“If current geopolitical tensions continue and OPEC+ members can’t deliver on their 400,000 barrel per day increase, macros coupled with the strong technical outlook could see prices push toward the $100 mark” analysts at CMC Markets concluded. Indeed, the technicals for oil have been looking relentlessly bullish in recent weeks. Since the December 20 low at $66.11, WTI has rallied nearly $20.00 or close to 30%, after consistently printing higher highs followed by higher lows. Though WTI did print multi-year highs on Tuesday, it hasn’t yet been able to convincingly break above the 2021 highs. Was this to be the case and was WTI to surge above $86.00, the next level of resistance to target would be the January 2014 lows in the $91.50 area.

- Stronger US dollar sends cable to weekly lows.

- Pound fails to benefit from BoE rate hike expectations.

- GBP/USD falling for the third consecutive day, extends retreat.

The GBP/USD pair failed to recover 1.3600 and dropped further falling to 1.3572, hitting a fresh weekly low. It remains near the lows, under pressure amid a stronger US dollar and as equity prices tumble in Wall Street.

Weaker than expected US economic data (unexpected decline in the Empire Manufacturing Index) weakened the dollar only for a few minutes. The combination of higher US yields and risk aversion, are boosting the dollar. The DXY is up by 0.7%, at 95.60.

The Dow Jones is falling more than 500 points or 1.50%, while the Nasdaq slides 1.38%. European markets are also in red, falling on average 0.85%.

Earlier on Wednesday, data showed positive numbers of the UK labor market. The unemployment rate dropped to 4.1%, the lowest since June 2020. The numbers help keep at elevated levels expectations about another rate hike from the Bank of England at the next meeting.

“The hawkish BOE outlook that had helped sterling outperform is getting crowded out a bit lately by the more hawkish Fed outlook”, explained analysts at Brown Brothers Harriman. They see the next target at 1.3550 and warn that a break lower “would set up a test of the January 3 low near 1.3430.”

Technical levels

Jane Foley, Head of FX Strategy at Rabobank, expects EUR/USD to plummet towards the 1.10 level by mid-2022. After that, the world’s most popular currency pair is set to push higher by the end of the year.

Policy normalization in the eurozone to lift EUR/USD by year-end

“We see scope for EUR/USD to head towards 1.10 in the middle of the year.”

“By the end of 2022, we expect EUR/USD to be pushing higher as policy normalization in the eurozone becomes more topical.”

Gold has established above the $1,800 level. However, strategists at UBS expect the yellow metal to move downward and hit the $1,650 mark by the end of the year.

Silver to gradually drop towards $19/oz by end-2022

“We expect gold prices to fall to $1,650/oz by end-2022.”

“Silver is likely to gradually decline this year and reach $19/oz by end-2022.”

- USD/TRY fades the recent weakness and advances to 13.60.

- The pair keeps the consolidation theme well and sound so far.

- All the attention is now on the CBRT event on Thursday.

The Turkish lira resumes its depreciation on Thursday and pushes USD/TRY to the 13.60 region on Tuesday.

USD/TRY remains capped by 14.00

USD/TRY regains some upside traction in line with the bullish sentiment surrounding the greenback and manages to reverse two consecutive daily pullbacks.

Indeed, the US dollar extends the recovery following last week’s new lows vs. its main peers, always on the back of firm expectations of a Fed’s move on rates as soon as in March and the persistent move higher in US yields.

In the meantime, cautiousness among investors have been rising in past weeks, as the Turkish central bank will meet on Thursday, with consensus among market participants pretty divided on what could be the next move by the central bank.

What to look for around TRY

The pair seems to have moved into a consolidative phase within a 13.00-14.00 range since the beginning of the new year. Higher-than-expected inflation figures released earlier in the year put the lira under extra pressure in combination with some cracks in the confidence among Turks regarding the government’s recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under intense pressure for the time being.

Key events in Turkey this week: CBRT Meeting (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 1.33% at 13.6001 and a drop below 12.7523 (2022 low Jan.3) would pave the way for a test of 12.4787 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

Although the S&P 500 Index has had a tough start of the year and edging closer to the 4,600 mark, economists at UBS target the 5,000 and 5,100 levels by June and December, respectively.

Cyclicals to outperform

“We forecast 2022 revenue growth of 8%, translating into earnings per share growth of 12%.”

“Our S&P 500 price targets are 5,000 and 5,100 for June and December, respectively.”

“We retain a bias for cyclical parts of the market, including energy and financials, balanced by exposure to the attractively valued but more defensive healthcare sector.”

GBP/USD slips below the 1.36 level but firm jobs data leans into Bank of England (BoE) tightening risk. Strategists at Scotiabank expect the cable to lurch higher towards 1.40 but a correction lower is probable by late-2022.

Strong payrolls data marginally boosted BoE rate hike expectations

“UK firms added 184K employees to their ranks in December with no noticeable impact from the Omicron wave. For 2021, total payrolls increased by roughly 1.35M employees and as of last month totaled about 1.5% over their pre-pandemic peak in February 2020.”

“A faster pace of hiking amid a strong jobs market and elevated inflation would continue to lift the GBP toward 1.40 but it does leave it at risk of correcting in late-2022.”

“As the BoE reaches its neutral rate (likely 1.25%) by the end of this year or early-2023, flows will likely shift more toward dollar-denominated fixed-income assets as the Fed’s hiking cycle continues in 2023.”

USD/CAD is holding a little above 1.25. Economists at Sctoiabank believe the pair is likely to push lower on a break below the 1.2480 mark.

Minor resistance seen at 1.2530

“Short-term price action is generally flat in a tight range around the 1.25 point, however, with spot not weak enough yet to signal a renewed attack on 1.2450 support or strong enough to suggest a return to 1.2550+.”

“We spot minor resistance at 1.2530 and support at 1.2480 intraday, with the pair likely to trade with a little more momentum on a break either side of that range; we favour a push lower.”

- AUD/USD slipped under 0.7200 on Tuesday as key short-term trend support was broken and amid downside in global equities.

- Aussie traders were also fretting about further domestic data that showed weakening consumer confidence and Omicron infections surge.

AUD/USD broke below key short-term trendline support earlier during Tuesday’s session and has subsequently fallen underneath the 0.7200 level. At current levels in the 0.7180s, AUD/USD trades lower on the day by about 0.3%, a reflection of weakness in global equity markets which were rocked on Tuesday by sharp upside in US government bond yields and a stronger USD. A much weaker than expected NY Fed manufacturing survey did not have a lasting impact on FX markets, perhaps given Aussie traders are also fretting about another sharp downturn in weekly ANZ Consumer Confidence data, as new data revealed during Tuesday’s Asia Pacific session.

The Australian bank’s measure of consumer sentiment slid dropped 7.6% last week to its lowest since October 2020, below its levels during the surge in Delta infections during 2021 that saw certain areas of the country enter prolonged lockdowns. David Plank, ANZ's head of Australian economics, commented that “we don't think the economy is as weak as these data might suggest, with the shock of the Omicron surge and strains on testing capability the key drivers of the fall rather than underlying economic conditions”. However, the bank warns that the “result highlights that concerns about COVID have the potential to significantly impact the economy if they linger”.

Evidence of the economic impact of the Omicron surge complicates the RBA’s upcoming monetary policy decision, particularly regarding whether or not to end QE buying in February or to taper the purchase rate and continue until May. Recent economic data and the hawkish shift at the Fed and other major central banks (like the BoE) supports the case for an immediate end to QE next month. Traders now look ahead to December labour market data due on Thursday that will provide further inputs to the pre-Omicron recovery story. Further buck strength and risk-off flows risk sending AUD/USD back towards 2022 lows just below 0.7150 in the absence of another massive positive Australian labour market surprise.

Italy's parliament will vote for a new president on Monday, January 24. Economists at ING look at FX implications of different scenarios. The EUR/CHF pair is expected to suffer downside pressure.

Mostly downside risks for EUR/CHF

“Our base case of Draghi moving from prime minister to president of the Republic should prove to be a rather benign one for markets as investors should welcome the fact that he will still overlook the reform process even after next year’s elections. There is, however, not much political risk currently embedded into EUR/CHF, and we, therefore, see some rather contained positive implications from the best-case scenario for markets.”

“We think that if Berlusconi becomes the new president and tensions within the ruling alliance flare-up, we can definitely see some fresh pressure on EUR/CHF.”

“Despite evidence that the SNB has scaled up FX interventions at the start of the year, we doubt there is a clear line in the sand around the current 1.04 level, and a significant rise in Italian political risk can cause EUR/CHF to explore the 1.02/1.03 range. However, this is not our base case.”

- USD/CHF regained positive traction on Tuesday amid sustained USD buying interest.

- The ongoing sharp move up in the US bond yields acted as a tailwind for the greenback.

- Dismal US data capped gains amid risk-off, which tends to benefit the safe-haven CHF.

The USD/CHF pair held on to its intraday gains through the early North American session, albeit has retreated a few pips from the daily high and was last seen trading just above mid-0.9100s.

The pair caught some fresh bids on Tuesday and is now looking to build on last week's recovery move from sub-0.9100 levels, or the lowest level since early November. The momentum was sponsored by sustained buying interest around the US dollar, which continued drawing support from elevated US Treasury bond yields.

Investors seem convinced that the Fed would begin raising interest rates in March 2022 to combat stubbornly high inflation. The expectations were reinforced by last week's data, which showed that the headline US CPI surged to the highest level since June 1982 and core CPI registered the biggest advance since 1991.

This, in turn, pushed the yield on the benchmark 10-year US government bond to the highest level since January 2020 and underpinned the greenback. That said, an extended sell-off in the US bond markets took its toll on the global risk sentiment, which benefitted the safe-haven Swiss franc and acted as a headwind for the USD/CHF pair.

Apart from this, a slump in the US Empire State Manufacturing Index to -0.70 in January from the previous month's reading of 31.9 held back bulls from placing aggressive bets around the USD/CHF pair. Even from a technical perspective, spot prices, so far, have struggled to move back above the very important 200-day SMA.

Investors also seemed reluctant and prefered to wait on the sidelines ahead of the upcoming FOMC monetary policy meeting on January 25-26. This further makes it prudent to wait for a strong follow-through buying before confirming that last week's fall from the 0.9275-0.9280 region, or a near one-month high has run its course.

Technical levels to watch

- Headline NY Fed Manufacturing Index fell to -0.70 in January, well below expectations for 25.70.

- The DXY saw some mild weakness in an immediate reaction.

The headline General Business Conditions Index of the NY Fed's Empire State Manufacturing Survey slid to -0.70 in January, from December's 31.90 reading. That was much larger than the expected drop to 25.70 and marked the first time the reading had fallen into negative territory since June 2020.

Subindices:

- The New Orders subindex fell to -5.0 in January from 27.1 in December.

- The Prices Paid subindex fell to 76.7 from 80.2.

- The Employment subindex fell to 16.1 from 21.4.

- The Six-month Business Conditions subindex remained elevated at 35.1 versus 36.4 the month prior.

Market Reaction

The DXY has seen some modestly negative ticks in recent trade following the large miss on expectations in terms of the latest NY Fed survey, with the DXY recently falling back under 95.50.

- Spot gold has recently dropped under its 21 and 50DMAs in the $1810 area.

- Recent downside reflects the upside in US yields, which hurts the appeal of non-yielding precious metals.

Spot gold (XAU/USD) prices fell to their lowest level since this time last week on Tuesday, breaking below support in the form of the 21 and 50-day moving averages at $1810. Gold weakness, which has seen spot prices drop about 0.6% to current levels around $1807, reflects recent upside in US bond yields as traders further ramp up Fed tightening bets ahead of next week’s Fed meeting. Notably, the 2-year yield surpassed 1.0% for the first time since February 2020, whilst the 10-year rose briefly above 1.85% to hit fresh near-two-year highs before slipping back to just above the 1.80% level.

Real yields, with which precious metals like gold have the strongest negative correlation, were also up, with the 10-year TIPS trading in a -0.65% to -0.70% range and at its highest levels since early Q2 2021. Remember that higher real yields raise the opportunity cost of holding non-yielding assets like gold. In the absence of any Fed speak or tier one US data releases to drive Fed tightening expectations in the week ahead, movements in bond and currency markets, which will by virtue impact precious metals, are likely to be driven instead by animal spirits. With the market seemingly expecting four rate hikes in 2022 and a further four in 2023, risks for both the US dollar and yields (real and nominal) seem tilted to the upside.

That doesn’t bode well for spot gold prices, which may be looking at further losses, including a drop back under $1800, though such a move would require prices to fall under the 200DMA at $1803. Looking at the last few weeks, the 200DMA has had a mixed ability to offer support/resistance. A drop below $1800 would then see bearish short-term speculators turn their focus to a test of this year’s lows in the $1780s.

According to the Credit Suisse analyst team, the S&P 500 is expected to see a close below its 63-day average for a lengthier corrective phase and a fall back to 4596/83, with scope for the 4495 December low.

Lengthier corrective/consolidation phase to emerge

“A weekly close below 4658 should further reinforce our base case for a lengthier corrective phase with support seen next at 4615, then the recent low, gap support and now also trend support from December at 4594/82.”

“A close below 4582 would now raise the prospect we are indeed seeing a top complete to further increase the downside risk with supports seen next at 4568 ahead of the December reaction lows at 4531 and 4495.”

“Resistance is seen moving to 4685 initially, then the 13-day exponential average at 4602/07, with the immediate risk now seen staying lower whilst below here. Above 4758 remains needed to ease fears of a deeper setback.”

With a global growth slowdown looming and central bank divergence, economists at Danske Bank remain bearish on the Swedish krona; forecasting EUR/SEK at 10.50 in 12 months.

Riksbank pricing is too aggressive

“As for 2022, we still see a case for broad SEK to weaken as global monetary policy has started to diverge.”

“The biggest downside is probably against currencies where the central bank is front-loading policy normalization. The risk is more limited vs EUR, as the RB and the ECB are equally likely to sit out this year at least. That said we still see a strategic case for a weaker SEK against the EUR, as RB pricing is too aggressive (one full hike by end 2022 and three hikes by end 2023).”

“As long as inflation remains elevated, which we think it will do in H1, there should probably be a non-negligible premium for hikes in the money-market curve. Thus limiting the upside in EUR/SEK and maybe even helping to pull EUR/SEK lower from here in the near-term.”

“We raise the 1M estimate to 10.20 (10.10) and otherwise leave the forecast profile unchanged at 10.20 in 3M, 10.30 in 6M and 10.50 in 12M.”

- A combination of diverging forces failed to provide any meaningful impetus to USD/CAD.

- Bullish crude oil prices underpinned the loonie and acted as a headwind for the major.

- Surging US bond yields, the risk-off impulse benefitted the USD and extended support.

The USD/CAD pair extended its sideways consolidative price move heading into the early North American session and remained confined in a range around the 1.2500 psychological mark.

Rising geopolitical tensions in the Middle East pushed crude oil prices to a more than seven-year high, which underpinned the commodity-linked loonie and acted as a headwind for the USD/CAD pair. The downside, however, remains cushioned amid a broad-based US dollar strength, bolstered by a continual surge in the US Treasury bond yields.

In fact, the yield on the benchmark 10-year US government bond shot to the highest level since January 2020 amid growing acceptance for an eventual Fed lift-off in March. Moreover, the US 2-year notes, which are highly sensitive to rate hike expectations, surged past the 1.0% mark for the first time since February 2020 and benefitted the buck.

Meanwhile, an extended sell-off in the US bond markets tempered investors' appetite for perceived riskier assets and triggered a steep decline in the equity markets. This was seen as another factor that boosted the greenback's relative safe-haven status and helped limit any meaningful slide for the USD/CAD pair, at least for the time being.

Market participants now look forward to the release of the US Empire State Manufacturing Index, which, along with the US bond yields and the broader market risk sentiment will drive the USD demand. Apart from this, traders will further take cues from oil price dynamics to grab some short-term opportunities around the USD/CAD pair.

From a technical perspective, the pair's inability to gain any meaningful traction suggests that the recent sharp pullback from the 2021 high might still be far from being over. That said, repeated failures to find acceptance below the 1.2500 mark warrants some caution before positioning for any further near-term depreciating move.

Technical levels to watch

- EUR/GBP rose to two-week highs on Tuesday in the 0.8375 area, despite strong US jobs data.

- Analysts interpreted the latest UK jobs release as bolstering the likelihood of another BoE rate hike in February.

A strong UK labour market report has failed to lift sentiment towards pound sterling on Tuesday, with GBP amongst the worst performing G10 currencies on the session, sending EUR/GBP to two-week highs in the 0.8375 area. Technical buying appeared to boost the pair, which now trades higher by about 0.2% on the day, as it broke above last week’s highs in the 0.8360 area. The currency pair is now probing resistance in the form of the November 2021 lows in the 0.8380 regions ahead of a test of the 21-day moving average at 0.8394.

Traders should be aware that, since mid-December, selling EUR/GBP rallies has been a profitable short-term trading strategy and, as UK economic data exceeds expectations and bolsters expectations for BoE rate hikes, this may well remain the case. To quickly recap the highlights of Tuesday’s UK jobs report; the ONS revealed that employers added 184K (a record number) to their staff payrolls in December. That saw the unemployment rate drop to 4.1%, its lowest since June 2020, whilst job openings hit a record high of 1.247M in the three months to December, double their levels in the same time period last year. “Alongside rising headline inflation rates and growing evidence that Omicron's impact has been modest, a February rate rise from the Bank of England looks increasingly likely” concluded analysts at ING.

Whether increased confidence in the likelihood that the BoE will follow up December’s 15bps rate hike with another next month translates into EUR/GBP reverting back towards last week’s sub-0.8350 lows remains to be seen. Downside in US and European equities on Tuesday amid a sharp rise in US government bond yields on Fed rate hike bets is currently weighing on sterling, just as lower equities are also weighing on other risk-sensitive currencies.

Stuart Cole, head macroeconomist at Equiti Capital, told Reuters that “with the FOMC and BoE already in tightening mode, it is difficult not to see the ECB similarly changing tack and moving policy towards fighting inflation also, particularly given the impact of soaring energy prices and the expectation that these are expected to continue their steady rise higher”. “We had a good start to the year, but that early euphoria has waned, and equities might have a difficult couple of weeks in the run-up to the Federal Reserve meeting” he continued. Choppier waters for overall risk appetite suggest EUR/GBP downside may be limited for now.

- A combination of factors dragged NZD/USD away from a multi-week high touched last Thursday.

- Surging US bond yields continued acting as a tailwind for the USD and exerted some pressure.

- The risk-off impulse further contributed to driving flows away from the perceived riskier kiwi.

The NZD/USD pair maintained its offered tone through the mid-European session and was last seen trading near a one-week low, around the 0.6770 area.

The pair witnessed fresh selling on Tuesday and extended last week's retracement slide from the vicinity of the 0.6900 mark, or the highest level since November 24. A combination of factors assisted the US dollar to recover further from an over two-month low touched in reaction to the devastating US retail sales report on Friday. This, in turn, was seen as a key factor exerting pressure on the NZD/USD pair.

Expectations for an eventual Fed lift-off in March – amid concerns over stubbornly high inflation – pushed the yield on the benchmark 10-year US government bond to the highest level since January 2020. Moreover, the US 2-year notes, which are highly sensitive to rate hike expectations, surged past the 1.0% mark for the first time since February 2020 and continued underpinning the greenback.

Meanwhile, an extended sell-off in the US bond markets took its toll on the global risk sentiment and triggered a steep decline in the equity markets. This was seen as another factor that benefitted the greenback's relative safe-haven status and drove flows away from the perceived riskier kiwi. The downtick could also be attributed to some technical selling on a sustained break below the 0.6800 mark.

Market participants now look forward to the US economic docket, featuring the release of the Empire State Manufacturing Index for some impetus during the early North American session. This, along with the US bond yields and the broader market risk sentiment, will influence the USD price dynamics and produce some meaningful trading opportunities around the NZD/USD pair.

Technical levels to watch

UOB Group’s Economist Ho Woei Chen, CFA, assesses the latest batch of Chinese data releases.

Key Takeaways

“China’s 4Q21 GDP growth slowed to 4.0% (1.6% q/q SA) from 4.9% in 3Q21 but beat consensus and our forecasts (Bloomberg est: 3.3% y/y, 1.2% q/q SA; UOB est: 3.5% y/y, 1.4% q/q). Overall, the economy grew by 8.1% in 2021 while the growth in 2020 was revised lower to 2.2% from 2.3%. On average, China’s economy expanded by an annual pace of 5.1% in the last two years.”

“The industrial sector provided much needed support to the economy as private consumption recovery continued to lag. Fixed asset investment moderated but was largely in line with consensus forecast, reflecting the slowdown in property investment. Meanwhile, labour market condition remained stable as the large city surveyed jobless rate stayed at 5.1% for the third consecutive month while the nationwide jobless rate inched marginally higher to 5.1% from 5.0% in Nov.”

“The 10 bps cut to the 1Y medium-term lending facility (MLF) rate this morning reaffirms that the People’s Bank of China’s (PBOC) is stepping up near-term support for growth. It likely viewed that the 5 bps reduction in the 1Y Loan Prime Rate (LPR) in Dec was too small to have any material impact on China’s growth. The 7-day reverse repo rate was also cut by 10 bps to 2.1% from 2.2%. As such, the LPR setting on 20 Jan is expected to see the 1Y LPR reduced by at least another 5 bps to 3.75%.”

“The challenging economic environment in early 2022 including the continuation of the property downturn and ongoing COVID-19 uncertainties will hamper the growth recovery in 1H22. As such, we expect a more moderate GDP growth at 4.7% y/y in 1Q22, 5.0% y/y in 2Q22 before recovering to 5.6% y/y in 2H22 as support measures filter through and households increase spending. Our revised 2022 GDP growth forecast is lowered to 5.2% (previously 5.7%).”

- EUR/USD sheds ground for the third session in a row on Tuesday.

- Key contention emerges at the 4-month line near 1.1370.

EUR/USD extends the bearish move sparked soon after hitting new 2022 highs in the 1.1480/85 band earlier in the month.

The bias appears tilted to the downside for the time being. That said, a deeper decline remains on the cards if spot breaches the 4-month support line, today around 1.1370. On such event, the next support should emerge at the temporary 55-day SMA at 1.1347.

The longer term negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1725.

EUR/USD daily chart

If USD/CNH breaks above the 6.3710 level, the downside pressure is forecast to alleviate, noted FX Strategists at UOB Group.

Key Quotes

24-hour view: “We highlighted yesterday that ‘there is room for the rebound in USD to extend but any advance is unlikely to break the strong resistance at 6.3710’. USD subsequently rose to 6.3650 before dropping sharply. Upward pressure has eased and USD is likely to trade sideways for today, expected to be within a range of 6.3430/6.3600.”

Next 1-3 weeks: “There is not much to add to our update from yesterday (17 Jan, spot at 6.3610). As highlighted, downward momentum has waned quickly and the odds for further USD weakness are not high. However, only a breach of 6.3710 (no change in ‘strong resistance’ level) would indicate that the downside risk has dissipated. Looking ahead, any decline in USD is expected to encounter solid support at 6.3390 and

- DXY extends the recovery further north of the 95.00 mark.

- The next hurdle is seen at the 55-day SMA near 95.80.

The continuation of the rebound in the greenback remains well and sound and propels DXY well past the 95.00 barrier on Tuesday.

If the index manages to surpass the 4-month line around 95.20 on a sustainable fashion, then the upside momentum carries the potential to revisit the 55-day SMA, today at 95.76 ahead of the 20-day SMA at 95.81.

Looking at the broader picture, the longer-term positive stance remains unchanged above the 200-day SMA at 93.15.

DXY daily chart

The breakout of 114.75 would indicate that the downside pressure in USD/JPY has alleviated.

Key Quotes

24-hour view: “Yesterday, we held the view that ‘the rebound in USD has scope to extend but a break of the strong resistance at 114.75 is unlikely’. Our view was not wrong as USD rose to a high of 114.64 before easing off. Upward momentum is beginning to wane and USD is unlikely to strengthen much further. For today, USD is more likely to consolidate and trade between 114.20 and 114.65.”

Next 1-3 weeks: “We continue to hold the same view as yesterday (17 Jan, spot at 114.30). As highlighted, while the prospect for further USD weakness is not high, only a break of 114.75 (no change in ‘strong resistance’ level) would indicate that the downside risk that started late last week (see annotations in the chart below) has dissipated.”

- EUR/JPY resumes the downside and retests 130.50.

- Upside remains limited by the 131.50/60 band so far.

EUR/JPY fades the initial move further north of the 131.00 mark and sparked a moderate pullback to the mid-130.00s soon afterwards on Tuesday.

Price action remains unconclusive around the cross for the time being, with gains capped by the so far YTD top at 131.60 (January 5) and the 130.00 neighbourhood offering some decent contention.

The inability of EUR/JPY to surpass the 131.50/60 band on a convincing fashion, ideally in the near term, should shift the bias towards the downside.

EUR/JPY daily chart

- GBP/USD witnessed some selling for the third successive day amid sustained USD buying.

- Break below the 23.6% Fibo. level should pave the way for a slide towards 100-day SMA.

The GBP/USD pair edged lower for the third successive day and extended last week's rejection slide from the very important 200-day SMA or the highest level since October 29. The pair maintained its offered tone through the first half of the European session and was last seen trading near a one-week low, around the 1.3620 region.

Firming expectations that the Fed would start raising interest rates in March 2022 amid concerns over stubbornly high inflation continued pushing the US Treasury bond yields higher. This, along with the risk-off impulse in the equity markets, benefitted the safe-haven US dollar and exerted some downward pressure on the GBP/USD pair.

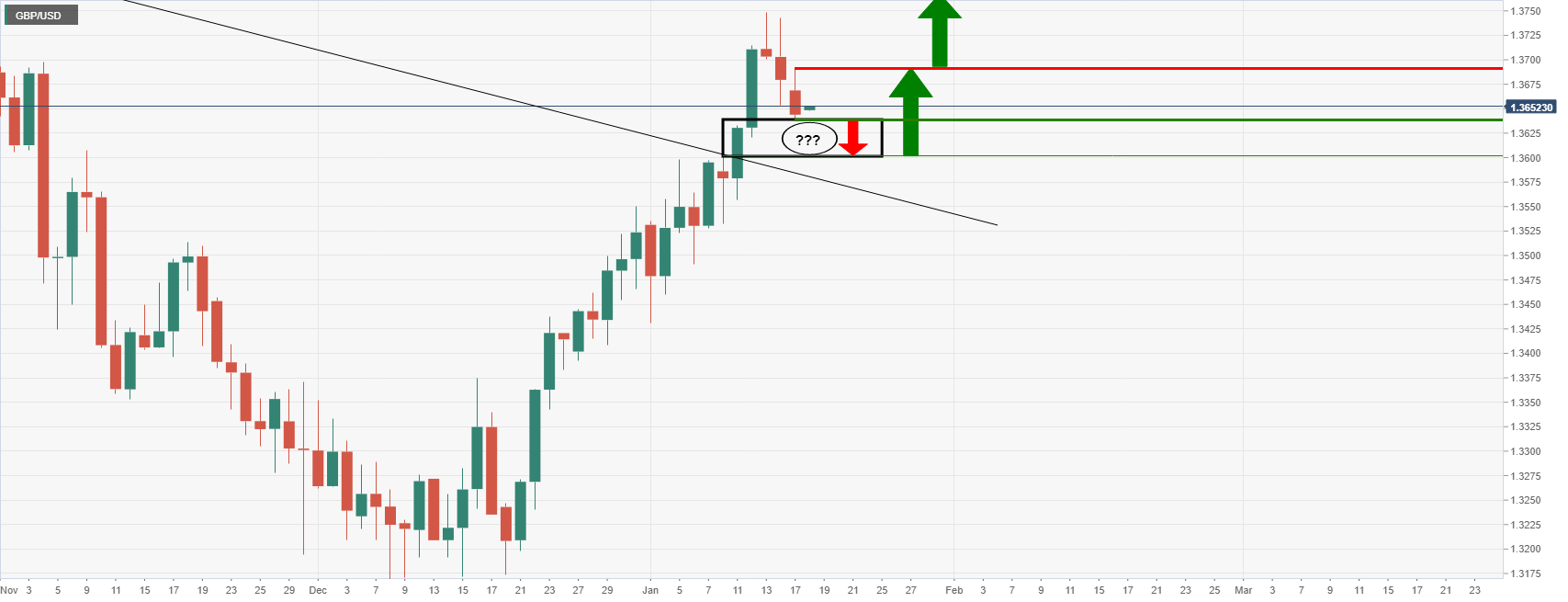

From a technical perspective, the corrective pullback has now dragged spot prices closer to support marked by the 23.6% Fibonacci retracement level of 1.3161-1.3749 strong move up. Some follow-through selling below, leading to a subsequent breakthrough the 1.3600 mark would expose the 100-day SMA support near mid-1.3500s.

This is followed by the 38.2% Fibo. level, around the 1.3525 region, which if broken decisively will suggest that the GBP/USD pair has topped out in the near term. The subsequent technical selling should pave the way for a slide below the key 1.3500 psychological mark, towards testing the 50% Fibo. level, around the 1.3455 region.

On the flip side, the daily swing high, around the 1.3660 area now seems to act as an immediate resistance ahead of the 1.3700 mark. Any further positive move might continue to meet with a fresh supply near the 1.3745-1.3750 region (200-DMA), which should act as a pivotal point and help determine the near-term trajectory for the GBP/USD pair.

GBP/USD daily chart

-637780986098440914.png)

Levels to watch

Japanese Prime Minister Fumio Kishida said on Tuesday that they want to impose quasi-emergency on some regions from January 21 to February 13, as reported by Reuters.

Earlier in the day, the Kydowo news agency report that Japan's Osaka prefecture was expected to report about 6,000 new coronavirus cases on Tuesday.

Market reaction