- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| raw materials | closing price | % change |

| Oil | 65.49 | -0.59% |

| Gold | 1,353.40 | +0.26% |

| index | closing price | change items | % change |

| Nikkei | +148.24 | 20766.10 | +0.72% |

| TOPIX | +6.38 | 1671.32 | +0.38% |

| Hang Seng | +239.48 | 30548.77 | +0.79% |

| CSI 300 | -25.05 | 3879.89 | -0.6% |

| Euro Stoxx 50 | -19.35 | 3278.72 | -0.59% |

| DAX | -99.05 | 11787.26 | -0.83% |

| CAC 40 | -28.94 | 5066.28 | -0.57% |

| DJIA | +669.40 | 24202.60 | +2.84% |

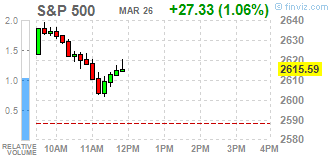

| S&P 500 | +70.29 | 2658.55 | +2.72% |

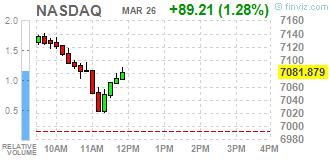

| NASDAQ | +227.88 | 7220.54 | +3.26% |

| Pare | Closed | % change |

| EUR/USD | $1,2447 | +0,76% |

| GBP/USD | $1,4228 | +0,67% |

| USD/CHF | Chf0,94499 | -0,24% |

| USD/JPY | Y105,46 | +0,71% |

| EUR/JPY | Y131,27 | +1,47% |

| GBP/JPY | Y150,049 | +1,39% |

| AUD/USD | $0,7747 | +0,62% |

| NZD/USD | $0,7295 | +0,80% |

| USD/CAD | C$1,28512 | -0,32% |

| Time | Region | Event | Period | Previous | Forecast |

| 10:00 | Eurozone | Private Loans, Y/Y | February | 2.9% | 3% |

| 10:00 | Eurozone | M3 money supply, adjusted y/y | February | 4.6% | 4.6% |

| 11:00 | Eurozone | Consumer Confidence | March | 0.1 | 0.1 |

| 11:00 | Eurozone | Industrial confidence | March | 8.0 | 7.0 |

| 11:00 | Eurozone | Economic sentiment index | March | 114.1 | 113.4 |

| 11:00 | Eurozone | Business climate indicator | March | 1.48 | 1.40 |

| 15:00 | USA | S&P/Case-Shiller Home Price Indices, y/y | January | 6.3% | 6.1% |

| 16:00 | USA | Richmond Fed Manufacturing Index | March | 28 | 23 |

| 16:00 | USA | Consumer confidence | March | 130.8 | 131.2 |

| 17:00 | USA | FOMC Member Bostic Speaks | | | |

Major U.S. stock-indexes were solidly higher on Monday, as the WSJ's report that the United States and China had quietly started negotiations to improve the U.S. access to Chinese markets eased concerns about a trade war between these two countries. Financials names and Microsoft's (MSFT; +5.4%) shares were among the major contributors to today's surge. On the contrary, Facebook (FB; -2.9%) continued to weight down, as the Federal Trade Commission confirmed that it had opened an investigation into the company's privacy practices.

Most of Dow stocks in positive area (25 of 30). Top gainer - Microsoft Corp. (MSFT, +5.41%). Top loser - General Electric Co. (GE, -1.91%).

All S&P sectors in positive area. Top gainer - Financials (+1.4%).

At the moment:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Dow | 23818.00 | +206.00 | +0.87% |

| S&P 500 | 2615.50 | +17.75 | +0.68% |

| Nasdaq 100 | 6613.00 | +58.75 | +0.90% |

| Crude Oil | 65.58 | -0.30 | -0.46% |

| Gold | 1355.40 | +5.50 | +0.41% |

| U.S. 10yr | 2.83% | 0.00 | 0.00% |

-

Says Putin will make final decision about russian response

-

Decision by western states is a mistake

-

We regret western states' expulsions of russian diplomats

-

Says protested to state department over "wrongful" expulsion of russian diplomats

U.S. stock-index futures surged on Monday, as the WSJ's report that the United States and China had quietly started negotiations to improve U.S. access to Chinese markets eased concerns about a trade war between these two countries.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 20,766.10 | +148.24 | +0.72% |

| Hang Seng | 30,548.77 | +239.48 | +0.79% |

| Shanghai | 3,133.92 | -18.84 | -0.60% |

| S&P/ASX | 5,790.50 | -30.20 | -0.52% |

| FTSE | 6,949.73 | +27.79 | +0.40% |

| CAC | 5,117.64 | +0.44% | +22.42 |

| DAX | 11,953.12 | +66.81 | +0.56% |

| Crude | $65.71 | | -0.26% |

| Gold | $1,348.20 | | -0.13% |

Microsoft (MSFT) target raised to $130 from $110 at Morgan Stanley

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 218.02 | 2.66(1.24%) | 4880 |

| ALCOA INC. | AA | 45.5 | 0.79(1.77%) | 1248 |

| ALTRIA GROUP INC. | MO | 60 | 0.73(1.23%) | 3368 |

| Amazon.com Inc., NASDAQ | AMZN | 1,529.50 | 33.94(2.27%) | 92804 |

| American Express Co | AXP | 91.95 | 1.50(1.66%) | 1482 |

| AMERICAN INTERNATIONAL GROUP | AIG | 54.35 | 0.94(1.76%) | 2981 |

| Apple Inc. | AAPL | 168.07 | 3.13(1.90%) | 320847 |

| AT&T Inc | T | 35.08 | 0.38(1.10%) | 39605 |

| Barrick Gold Corporation, NYSE | ABX | 12.6 | 0.10(0.80%) | 37450 |

| Boeing Co | BA | 329.5 | 8.50(2.65%) | 46654 |

| Caterpillar Inc | CAT | 148.35 | 4.06(2.81%) | 27271 |

| Chevron Corp | CVX | 114.5 | 1.52(1.35%) | 3803 |

| Cisco Systems Inc | CSCO | 43.42 | 1.00(2.36%) | 23933 |

| Citigroup Inc., NYSE | C | 69.35 | 1.45(2.14%) | 55945 |

| Deere & Company, NYSE | DE | 151.02 | 3.02(2.04%) | 2210 |

| Exxon Mobil Corp | XOM | 73.7 | 0.81(1.11%) | 17611 |

| Facebook, Inc. | FB | 161.15 | 1.76(1.10%) | 872531 |

| FedEx Corporation, NYSE | FDX | 234 | 4.52(1.97%) | 9110 |

| Ford Motor Co. | F | 10.77 | 0.21(1.99%) | 102018 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.78 | 0.26(1.48%) | 18254 |

| General Electric Co | GE | 13.31 | 0.24(1.84%) | 214216 |

| General Motors Company, NYSE | GM | 35.99 | 0.82(2.33%) | 10060 |

| Goldman Sachs | GS | 250.84 | 5.58(2.28%) | 6085 |

| Google Inc. | GOOG | 1,046.00 | 24.43(2.39%) | 16494 |

| Home Depot Inc | HD | 175.3 | 3.50(2.04%) | 15169 |

| Intel Corp | INTC | 50.6 | 1.24(2.51%) | 93225 |

| International Business Machines Co... | IBM | 151.5 | 2.61(1.75%) | 8988 |

| International Paper Company | IP | 51.05 | 0.90(1.79%) | 976 |

| Johnson & Johnson | JNJ | 126.46 | 1.36(1.09%) | 6080 |

| JPMorgan Chase and Co | JPM | 109.4 | 2.39(2.23%) | 40128 |

| McDonald's Corp | MCD | 157.55 | 2.57(1.66%) | 8122 |

| Merck & Co Inc | MRK | 54.16 | 0.75(1.40%) | 4942 |

| Microsoft Corp | MSFT | 90.26 | 3.08(3.53%) | 320368 |

| Nike | NKE | 65.58 | 0.95(1.47%) | 16823 |

| Pfizer Inc | PFE | 34.75 | 0.26(0.75%) | 14559 |

| Procter & Gamble Co | PG | 76.58 | 0.67(0.88%) | 4433 |

| Starbucks Corporation, NASDAQ | SBUX | 57 | 0.69(1.23%) | 4926 |

| Tesla Motors, Inc., NASDAQ | TSLA | 308.25 | 6.71(2.23%) | 45361 |

| The Coca-Cola Co | KO | 42.7 | 0.37(0.87%) | 10966 |

| Twitter, Inc., NYSE | TWTR | 31.66 | 0.63(2.03%) | 149719 |

| United Technologies Corp | UTX | 124.48 | 2.17(1.77%) | 300 |

| UnitedHealth Group Inc | UNH | 215.41 | 2.86(1.35%) | 2534 |

| Verizon Communications Inc | VZ | 46.7 | 0.41(0.89%) | 17732 |

| Visa | V | 119.42 | 2.42(2.07%) | 16401 |

| Wal-Mart Stores Inc | WMT | 86.12 | 0.70(0.82%) | 13180 |

| Walt Disney Co | DIS | 100.5 | 1.96(1.99%) | 15493 |

| Yandex N.V., NASDAQ | YNDX | 41.88 | 0.73(1.77%) | 2502 |

Intel (INTC) upgraded to Mkt Perform from Underperform at Raymond James

Altria (MO) initiated with a Buy at Deutsche Bank; target $72

-

Says China willing to strengthen communication, coordination with EU to cope with chaos caused by U.S. on global aluminium, steel trade

-

China will further open up its door wider

-

China will not force foreign firms to transfer technology, further strengthen intellectual property rights

Consumer spending was mainly reflected in the use of credit cards, with outstanding levels of card borrowing growing at a rate of 6.3 per cent over the year, while use of loans and overdrafts continues to fall.

Gross mortgage lending in February is estimated to have been £19bn, 4.9 per cent more than a year earlier but below the monthly average of £21.4bn for 2017. Remortgage approvals in the month are up over 9 per cent in both number and value compared to February 2017.

UK businesses' deposits grew by almost 7 per cent in the past 12 months, while borrowing over the same period grew slightly by 0.5 per cent. Within business sectors, manufacturers' borrowing expanded, while construction and property-related sectors contracted.

-

Also calls for a modernised capital markets union and improved banking union to develop euro zone integration

-

Calls for agreement on a schedule for a common euro zone bank deposit insurance scheme

-

More transparent EU bankruptcy laws, better harmonised insolvency laws

February 2018 monthly values are actual and compared with February 2017.

-

Goods exports rose $446 million (11 percent) to $4.5 billion.

-

Goods imports rose $187 million (4.6 percent) to $4.2 billion, a new high for total imports in a February month. The previous high was $4.1 billion, in February 2017.

-

The monthly trade balance was a surplus of $217 million (4.9 percent of exports).

-

Meat and edible offal led the export rise, up $85 million (13 percent) to $768 million.

-

Sheep meat (lamb and mutton) rose $77 million (21 percent) in value and 3.2 percent in quantity.

-

Beef was little changed, down 0.3 percent in value and 5.0 percent in quantity.

-

Meat and edible offal exported in the year ended February 2018 rose 14 percent in value and 1.6 percent in quantity from the February 2017 year.

-

Logs, wood, and wood articles rose $62 million (19 percent) to $382 million.

-

Untreated logs rose $45 million (22 percent) to $255 million.

-

Logs, wood, and wood articles exported in the year ended February 2018 rose 16 percent in value and 12 percent in quantity from the February 2017 year.

-

Milk powder, butter, and cheese rose $55 million (5.3 percent) to $1.1 billion.

-

Butter rose $38 million (28 percent) in value. Quantity fell 1.9 percent.

-

Milk powder was little changed, up 0.3 percent in value to $559 million. Quantity rose 10 percent. The unit value of milk powder exports fell 9.0 percent from February 2017.

-

Says anything that will inhibit global trade will be a negative for united states

-

Asked if new tariffs will weigh on U.S. economic growth or inflation, says it is too soon to know

-

Policy target agreement says policy aimed at supporting maximum level of sustainable employment

-

Target agreement keeps reference to focus on 2 pct inflation target midpoint

-

Says in extreme times there might be trade-offs

-

In general times the addition of employment goal shouldn't make much difference

European stocks dropped for a third straight day on Friday, suffering their lowest close in more than a year as trade war fears returned to the fore after tensions between the U.S. and China escalated.

It has been a brutal stretch for U.S. equities. The Dow Jones Industrial Average and the broad-market S&P 500 are looking at an unusually unsightly March, amid a rise in volatility and heightened concerns about trade wars.

Selling eased for Asia-Pacific stocks as the morning progressed Monday, though trade actions between China and the U.S. continue to be the central preoccupations for market participants. The Wall Street Journal reported, however, that China and the U.S. have quietly started negotiating to improve American access to mainland markets.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2509 (3071)

$1.2471 (1680)

$1.2447 (1333)

Price at time of writing this review: $1.2374

Support levels (open interest**, contracts):

$1.2285 (5162)

$1.2242 (3864)

$1.2195 (4358)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 6 is 105903 contracts (according to data from March, 23) with the maximum number of contracts with strike price $1,2150 (6600);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4275 (2823)

$1.4234 (2149)

$1.4203 (1714)

Price at time of writing this review: $1.4162

Support levels (open interest**, contracts):

$1.4062 (755)

$1.4024 (854)

$1.3983 (1304)

Comments:

- Overall open interest on the CALL options with the expiration date April, 6 is 31054 contracts, with the maximum number of contracts with strike price $1,4200 (2823);

- Overall open interest on the PUT options with the expiration date April, 6 is 30151 contracts, with the maximum number of contracts with strike price $1,3800 (3580);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from March, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.