- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| raw materials | closing price | % change |

| Oil | 64.67 | -0.89% |

| Gold | 1,323.80 | -1.36% |

| index | closing price | change items | % change |

| Nikkei | -286.01 | 21031.31 | -1.34% |

| TOPIX | -17.57 | 1699.56 | -1.02% |

| Hang Seng | -768.30 | 30022.53 | -2.50% |

| CSI 300 | -70.55 | 3842.72 | -1.80% |

| Euro Stoxx 50 | +14.30 | 3331.25 | +0.43% |

| DAX | -30.12 | 11940.71 | -0.25% |

| CAC 40 | +14.70 | 5130.44 | +0.29% |

| DJIA | -9.29 | 23848.42 | -0.04% |

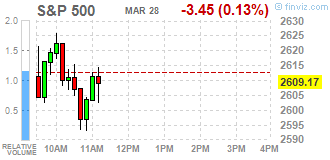

| S&P 500 | -7.62 | 2605.00 | -0.29% |

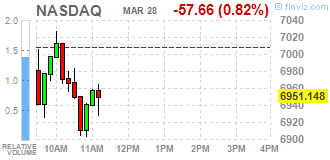

| NASDAQ | -59.58 | 6949.23 | -0.85% |

| Pare | Closed | % change |

| EUR/USD | $1,2309 | -0,78% |

| GBP/USD | $1,4080 | -0,58% |

| USD/CHF | Chf0,95638 | +1,06% |

| USD/JPY | Y106,79 | +1,32% |

| EUR/JPY | Y131,42 | +0,55% |

| GBP/JPY | Y150,322 | +0,76% |

| AUD/USD | $0,7660 | -0,27% |

| NZD/USD | $0,7205 | -0,87% |

| USD/CAD | C$1,29224 | +0,34% |

| Time | Region | Event | Period | Previous | Forecast |

| 01:50 | Japan | Retail sales, y/y | February | 1.6% | 1.7% |

| 02:30 | Australia | Private Sector Credit, m/m | February | 0.3% | 0.3% |

| 02:30 | Australia | Private Sector Credit, y/y | February | 4.9% | |

| 08:00 | United Kingdom | Nationwide house price index, y/y | March | 2.2% | 2.6% |

| 08:00 | United Kingdom | Nationwide house price index | March | -0.3% | 0.2% |

| 09:00 | Switzerland | KOF Leading Indicator | March | 108 | 107.3 |

| 09:55 | Germany | Unemployment Rate s.a. | March | 5.4% | 5.3% |

| 09:55 | Germany | Unemployment Change | March | -22 | -15 |

| 10:30 | United Kingdom | Mortgage Approvals | February | 67.48 | 66 |

| 10:30 | United Kingdom | Consumer credit, mln | February | 1.357 | 1.4 |

| 10:30 | United Kingdom | Net Lending to Individuals, bln | February | 4.7 | 4.8 |

| 10:30 | United Kingdom | Business Investment, y/y | IV square | 1.9% | 2.1% |

| 10:30 | United Kingdom | Business Investment, q/q | IV square | 0.9% | 0% |

| 10:30 | United Kingdom | Current account, bln | IV square | -22.8 | -24 |

| 10:30 | United Kingdom | GDP, q/q | IV square | 0.5% | 0.4% |

| 10:30 | United Kingdom | GDP, y/y | IV square | 1.8% | 1.4% |

| 14:00 | Germany | CPI, m/m | March | 0.5% | 0.5% |

| 14:00 | Germany | CPI, y/y | March | 1.4% | 1.7% |

| 14:30 | Canada | Industrial Product Price Index, y/y | February | 2% | |

| 14:30 | Canada | Industrial Product Price Index, m/m | February | 0.3% | 0.5% |

| 14:30 | Canada | GDP (m/m) | January | 0.1% | 0.1% |

| 14:30 | USA | Continuing Jobless Claims | March | 1828 | 1875 |

| 14:30 | USA | Initial Jobless Claims | March | 229 | 230 |

| 14:30 | USA | PCE price index ex food, energy, m/m | February | 0.3% | 0.2% |

| 14:30 | USA | PCE price index ex food, energy, Y/Y | February | 1.5% | 1.6% |

| 14:30 | USA | Personal Income, m/m | February | 0.4% | 0.4% |

| 14:30 | USA | Personal spending | February | 0.2% | 0.2% |

| 15:45 | USA | Chicago Purchasing Managers' Index | March | 61.9 | 62 |

| 16:00 | USA | Reuters/Michigan Consumer Sentiment Index | March | 99.7 | 102.0 |

| 19:00 | USA | Baker Hughes Oil Rig Count | March | 804 | |

| 19:00 | USA | FOMC Member Harker Speaks | | |

Major U.S. stock-indexes mostly lower on Wednesday, dragged down by top-weighted technology shares. Amazon.com Inc. (AMZN) was among the biggest losers, tumbling by more than 5 percent on reports that the U.S. President Donald Trump would like to change the company's tax treatment.

Most of Dow stocks in positive area (19 of 30). Top gainer - Walmart Inc. (WMT, +1.96%). Top loser - Intel Corp (INTC; -3.45%).

Most of S&P sectors in positive area. Top gainer - Healthcare (+0.8%). Top loser - Services (-1.0%).

At the moment:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Dow | 23887.00 | +28.00 | +0.12% |

| S&P 500 | 2611.75 | -4.00 | -0.15% |

| Nasdaq 100 | 6479.00 | -82.25 | -1.25% |

| Crude Oil | 64.68 | -0.57 | -0.87% |

| Gold | 1335.80 | -6.20 | -0.46% |

| U.S. 10yr | 2.75% | -0.04 | -1.44% |

U.S. stock-index futures were mixed on Wednesday, with Nasdaq underperforming due to continuing sello-ff in tech stocks, fueled by concerns about increased regulations in the wake of Facebook's (FB; +0.2%) data privacy issue.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 21,031.31 | -286.01 | -1.34% |

| Hang Seng | 30,022.53 | -768.30 | -2.50% |

| Shanghai | 3,122.22 | -44.43 | -1.40% |

| S&P/ASX | 5,789.50 | -42.80 | -0.73% |

| FTSE | 7,007.56 | +7.42 | +0.11% |

| CAC | 5,095.70 | -20.04 | -0.39% |

| DAX | 11,900.97 | -69.86 | -0.58% |

| Crude | 64.68 | | -0.87% |

| Gold | 1,333.70 | | -0.62% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 44.93 | 0.03(0.07%) | 3475 |

| ALTRIA GROUP INC. | MO | 61.25 | 0.53(0.87%) | 2290 |

| Amazon.com Inc., NASDAQ | AMZN | 1,463.00 | -34.05(-2.27%) | 207417 |

| American Express Co | AXP | 91.21 | -0.21(-0.23%) | 616 |

| Apple Inc. | AAPL | 167.14 | -1.20(-0.71%) | 503121 |

| AT&T Inc | T | 35.08 | 0.18(0.52%) | 24516 |

| Barrick Gold Corporation, NYSE | ABX | 12.43 | -0.13(-1.04%) | 2284 |

| Boeing Co | BA | 321.7 | 0.58(0.18%) | 15747 |

| Caterpillar Inc | CAT | 147 | 0.01(0.01%) | 2023 |

| Chevron Corp | CVX | 114.8 | 0.14(0.12%) | 900 |

| Cisco Systems Inc | CSCO | 42.52 | -0.16(-0.37%) | 70972 |

| Citigroup Inc., NYSE | C | 68.14 | -0.14(-0.21%) | 22881 |

| Deere & Company, NYSE | DE | 152 | 0.44(0.29%) | 400 |

| Exxon Mobil Corp | XOM | 73.61 | -0.09(-0.12%) | 4632 |

| Facebook, Inc. | FB | 152.21 | -0.01(-0.01%) | 1051973 |

| FedEx Corporation, NYSE | FDX | 233.75 | -0.89(-0.38%) | 1450 |

| Ford Motor Co. | F | 10.82 | -0.01(-0.09%) | 18571 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.15 | -0.09(-0.52%) | 14134 |

| General Electric Co | GE | 13.54 | 0.10(0.74%) | 483777 |

| General Motors Company, NYSE | GM | 34.83 | -0.04(-0.11%) | 17306 |

| Goldman Sachs | GS | 248 | 0.74(0.30%) | 8548 |

| Google Inc. | GOOG | 1,000.00 | -5.10(-0.51%) | 18452 |

| Home Depot Inc | HD | 175.9 | 1.22(0.70%) | 3362 |

| HONEYWELL INTERNATIONAL INC. | HON | 146.4 | 2.06(1.43%) | 555 |

| Intel Corp | INTC | 50.65 | -0.54(-1.05%) | 106926 |

| International Business Machines Co... | IBM | 151.85 | -0.06(-0.04%) | 3863 |

| JPMorgan Chase and Co | JPM | 108.35 | 0.18(0.17%) | 13915 |

| McDonald's Corp | MCD | 157.76 | 0.28(0.18%) | 1323 |

| Microsoft Corp | MSFT | 89.25 | -0.22(-0.25%) | 196686 |

| Nike | NKE | 66.21 | 0.04(0.06%) | 1868 |

| Pfizer Inc | PFE | 35.1 | 0.09(0.26%) | 2081 |

| Procter & Gamble Co | PG | 77.8 | 0.01(0.01%) | 3478 |

| Tesla Motors, Inc., NASDAQ | TSLA | 267.53 | -11.65(-4.17%) | 263655 |

| The Coca-Cola Co | KO | 43 | 0.11(0.26%) | 742 |

| Twitter, Inc., NYSE | TWTR | 27.86 | -0.21(-0.75%) | 459779 |

| Verizon Communications Inc | VZ | 47.77 | 0.46(0.97%) | 3184 |

| Visa | V | 117.18 | -0.22(-0.19%) | 18199 |

| Wal-Mart Stores Inc | WMT | 86.14 | 0.09(0.10%) | 5850 |

| Walt Disney Co | DIS | 99.5 | 0.14(0.14%) | 1769 |

| Yandex N.V., NASDAQ | YNDX | 39.89 | 0.16(0.40%) | 11136 |

Verizon (VZ) upgraded to Buy from Hold at HSBC Securities

AT&T (VZ) upgraded to Buy from Hold at HSBC Securities

Visa (V) initiated with an Outperform at Bernstein

DowDuPont (DWDP) initiated with an Outperform at BMO Capital Markets

The international trade deficit was $75.4 billion in February, up $0.1 billion from $75.3 billion in January. Exports of goods for February were $136.5 billion, $2.9 billion more than January exports. Imports of goods for February were $211.9 billion, $3.0 billion more than January imports.

Wholesale inventories for February, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $626.7 billion, up 1.1 percent from January 2018, and were up 5.7 percent (±0.9 percent) from February 2017. The December 2017 to January 2018 percentage change was revised from up 0.8 percent (±0.4 percent) to up 1.0 percent.

The price index for gross domestic purchases increased 1.8 percent in 2017, compared with an increase of 1.0 percent in 2016. The PCE price index increased 1.7 percent, compared with an increase of 1.2 percent. Excluding food and energy prices, the PCE price index increased 1.5 percent, compared

with an increase of 1.8 percent.

During 2017 (measured from the fourth quarter of 2016 to the fourth quarter of 2017), real GDP increased 2.6 percent, compared with an increase of 1.8 percent during 2016. The price index for gross domestic purchases increased 1.9 percent during 2017, compared with an increase of 1.4 percent during

2016.

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2017, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.

Real gross domestic income (GDI) increased 0.9 percent in the fourth quarter, compared with an increase of 2.4 percent in the third. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 1.9 percent in the fourth quarter,

compared with an increase of 2.8 percent in the third quarter.

The increase in real GDP in the fourth quarter primarily reflected positive contributions from PCE, nonresidential fixed investment, exports, residential fixed investment, state and local government spending, and federal government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased

-

Has made clear to relevant firms in a letter that they may plan on the assumption that UK authorisation or recognition will only be needed by the end of the implementation period

-

Reasonable for financial services firms to plan that they will be able to continue undertaking activities during the implementation period in much the same way as now

-

Oil market is ''stabilising'' and oil prices are ''improving'' Iraqi minister Luaibi says

The survey of 109 firms, consisting of 53 retailers, revealed a weak month for retailers, with year-on-year sales volumes declining for the first time since October 2017.

Additionally, sales for the time of year were significantly below normal, and by the greatest extent since April 2013. The volume of orders placed with suppliers, meanwhile, was broadly unchanged.

The fall in retail sales was broad-based, with lower sales at non-specialised stores (i.e. department stores), furniture & carpets, clothing, and other normal goods the main drags on headline sales growth.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2544 (4352)

$1.2501 (4682)

$1.2478 (1335)

Price at time of writing this review: $1.2386

Support levels (open interest**, contracts):

$1.2337 (3201)

$1.2293 (5953)

$1.2246 (3550)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 6 is 105689 contracts (according to data from March, 27) with the maximum number of contracts with strike price $1,2150 (6606);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4332 (2824)

$1.4270 (2747)

$1.4232 (2154)

Price at time of writing this review: $1.4174

Support levels (open interest**, contracts):

$1.4069 (652)

$1.4030 (880)

$1.3987 (1183)

Comments:

- Overall open interest on the CALL options with the expiration date April, 6 is 31132 contracts, with the maximum number of contracts with strike price $1,4300 (2824);

- Overall open interest on the PUT options with the expiration date April, 6 is 31143 contracts, with the maximum number of contracts with strike price $1,3800 (3555);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from March, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Held talks with China President Xi Jinping during visit

-

China's Xi accepted Kim Jong Un's invitation to visit N.Korea

-

Kim, Xi exchanged views on improving ties, situation on Korean peninsula

-

Will take necessary steps to counter any damage to economy from next year's scheduled sales tax hike

Both economic and income expectations, as well as propensity to buy, are on the increase again.

GfK forecasts an increase in consumer climate for April of 0.1 points in comparison to the previous month to 10.9 points. Apparently the drop in mood in February was just a small dip, even if the losses from the previous month have only partly been compensated for. The decision of SPD party members to enter into the Grand Coalition did not have any significant extra effect on the mood.

European stocks finished with solid gains Tuesday, breaking a string of losses as concerns about a potential global trade war eased and as investors turned their focus to merger news and other corporate developments.

U.S. stocks ended sharply lower Tuesday, as a selloff in the technology sector fueled a rout that wiped out much of Monday's sizable gains. Recent weakness has been attributed to concerns over a potential trade war between China and the U.S. as investors assess the likelihood of any protectionist policies and the impact of any retaliatory measures from trading partners.

Technology stocks led the way lower in Asia on Wednesday, dragged by the sector's slide in the U.S., as the region lost its early-week gains.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.