- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +274.55 19393.54 +1.44%

TOPIX +17.77 1553.09 +1.16%

Hang Seng +35.76 23776.49 +0.15%

CSI 300 +5.63 3458.44 +0.16%

Euro Stoxx 50 +70.59 3390.20 +2.13%

FTSE 100 +119.46 7382.90 +1.64%

DAX +232.78 12067.19 +1.97%

CAC 40 +102.25 4960.83 +2.10%

DJIA +303.31 21115.55 +1.46%

S&P 500 +32.32 2395.96 +1.37%

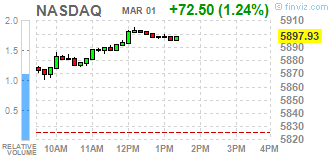

NASDAQ +78.59 5904.03 +1.35%

S&P/TSX +200.43 15599.68 +1.30%

Major US stock indexes rose significantly on Wednesday. The Dow first rose above 21,000 points level, while the dollar and US Treasury bond yields jumped as investors are betting that the increase in US interest rates will be held in the near future.

In addition, as shown by the final data provided by Markit Economics, seasonally adjusted manufacturing PMI index fell in February to 54.2 points from 55.0 points in January. The latter value was lower than the preliminary estimate (54.3 points), and forecasts of experts (54.4 points).

However, a report published by the Institute for Supply Management (ISM), showed that in January of activity in the US manufacturing sector has grown significantly, reaching its highest level since November 2014. The PMI for the manufacturing was 57.7 points versus 56.0 points in January. Analysts had expected the index to remain unchanged.

The focus of the market has also proved Fed's Beige Book. In this report, it was reported that the US economy continued to grow slowly, but steady pace, and the company as a whole, were optimistic at the beginning of 2017 "While respondents were generally are positive with respect to the near future, many expressed concern with regards to the political changes , - noted in the report. The Beige Book also pointed to the prolonged economic trends, including a "modest to moderate" economic growth, continued job growth and limited price pressures and pressure on wages.

Almost all the components of DOW index ended the session in positive territory (28 of 30). leaders of growth were shares of JPMorgan Chase & Co. (JPM, + 3.58%). Most fell shares of Intel Corporation (INTC, -0.66%).

Almost all sectors of the S & P index recorded an increase. Leaders of growth were the financial sector (+ 2.2%). Reducing demonstrated only utilities sector (-0.5%).

At the close:

Dow + 1.45% 21,114.42 +302.18

Nasdaq + 1.35% 5,904.03 +78.59

S & P + 1.36% 2,395.82 +32.18

Major U.S. stock-indexes rallied on Wednesday, with the Dow hitting a record above 21000 points, while the dollar and U.S. Treasury yields jumped as investors bet that a U.S. interest rate hike would come soon. New York Fed President William Dudley - one of the most influential U.S. central bankers, and usually considered a dove - said late Tuesday that the case for tightening monetary policy had become "a lot more compelling", while San Francisco Fed President John Williams said he saw "no need to delay" raising rates.

Most of Dow stocks in positive area (21 of 30). Top loser - Intel Corporation (INTC, -1.33%). Top gainer - JPMorgan Chase & Co. (JPM, +3.20%).

Most of S&P sectors are also in positive area. Top loser - Utilities (-0.1%). Top gainer - Financials (+1.9%).

At the moment:

Dow 21108.00 +301.00 +1.45%

S&P 500 2395.50 +32.75 +1.39%

Nasdaq 100 5386.25 +54.00 +1.01%

Oil 53.90 -0.11 -0.20%

Gold 1248.40 -5.50 -0.44%

U.S. 10yr 2.46 +0.10

U.S. stock-index futures rose, bolstered by President Donald Trump's speech to Congress. In addition, bank stocks gained on higher chances of an interest rate increase this month.

Global Stocks:

Nikkei 19,393.54 +274.55 +1.44%

Hang Seng 23,776.49 +35.76 +0.15%

Shanghai 3,246.64 +4.90 +0.15%

FTSE 7,356.11 +92.67 +1.28%

CAC 4,946.79 +88.21 +1.82%

DAX 12,020.28 +185.87 +1.57%

Crude $54.17 (+0.30%)

Gold $11,240.50 (-1.07%)

Upgrades:

Downgrades:

Intel (INTC) downgraded to Underperform from Mkt Perform at Bernstein

Other:

Apple (AAPL) target raised to $165 from $133 at BTIG Research; Buy

Stock indices of the majority of Western European countries are rising, getting support from rising expectations of a Fed interest rates hike, and positive macroeconomic data from the eurozone. Donald Trump's speech in Congress also has a positive impact on the dynamics of trading, but investors have not received the expected detailed plan of tax reform and fiscal stimulus. Donald Trump only promised to spend $ 1 trillion on infrastructure.

As for the data, manufacturing activity in the euro area rose in February to 55.4 points from 55.2 points in January.

The manufacturing PMI in Germany rose to a record 56.8 points from 56.4 points. British PMI in the manufacturing sector fell to 54.6 points from 55.7 points a month earlier, however, the index remains above the value of 50, indicating the expansion of the sector.

The market value of Societe Generale increased by 3,2%, Royal Bank of Scotland up 2,5%, Barclays +1,5%, Credit Suisse +3.5%.

Shares of British exporters rose on the background of a weaker pound.

Burberry Group shares rose 0,9%, British American Tobacco up 0,6%, Imperial Brands up 0.6%.

At the moment:

FTSE 100 7,327.38 +63.94 + 0.88%

CAC 40 4,927.79 +69.21 + 1.42%

Xetra DAX 11,999.38 +164.97 + 1.39%

European stocks closed moderately higher Tuesday, with shares of defense companies among the notable winners, as investors prepared to hear about U.S. President Donald Trump's plans to boost growth in the world's largest economy.

The Dow on Tuesday halted its record-setting streak as investors remained cautious ahead of a speech by President Donald Trump that could determine whether the market's recent surge will be justified by government policy. Since the election, investors had been betting that Trump's policies on taxes and regulation will accelerate economic growth and boost corporate profits. However, few legislative details or timing have been forthcoming, something analysts say is increasingly needed to sustain the market's advances.

Hawkish comments from U.S. Federal Reserve officials have increased the likelihood of a March rate increase, sending the dollar, sovereign-debt yields and Japanese stocks higher amid U.S. President Donald Trump's speech to Congress. Many markets in the region had been quiet in recent days as investors took a wait-and-see attitude ahead of Trump's address.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.