- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +171.26 19564.80 +0.88%

TOPIX +11.60 1564.69 +0.75%

Hang Seng -48.42 23728.07 -0.20%

CSI 300 -23.34 3435.10 -0.67%

Euro Stoxx 50 -5.49 3384.71 -0.16%

FTSE 100 -0.55 7382.35 -0.01%

DAX -7.62 12059.57 -0.06%

CAC 40 +2.97 4963.80 +0.06%

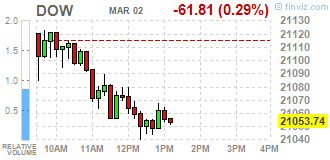

DJIA -112.58 21002.97 -0.53%

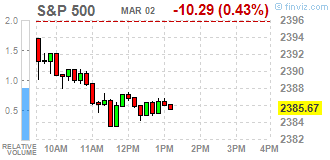

S&P 500 -14.04 2381.92 -0.59%

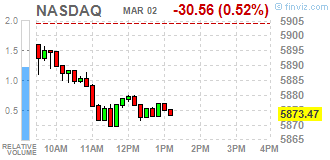

NASDAQ -42.81 5861.22 -0.73%

S&P/TSX -63.03 15536.65 -0.40%

Major US stock indexes fell modestly as investors took profits after a record of the day on Wall Street, who led the Dow Jones Industrial Average above 21,000 for the first time in history.

Further drop in the indices held back positive data on the US labor market. According to the US Department of Labor, the number of new applications for unemployment benefits for the week that ended Feb. 25 fell to 1900 and amounted to 223000. This is the lowest level for initial claims since March 31, 1973, when he was 222000. Level the previous week was revised downward for 2000 from 244,000 to 242,000. The moving average for 4 weeks was 234250. was recorded a decrease of 6,250 from the revised average of the previous week. This is the lowest level of the average April 14, 1973, when it amounted to 232750. The average value of the previous week was revised downward from 241,000 to 240.500.

In addition, it became known that the index of business activity in New York deteriorated significantly following February, confounding analysts' expectations, and reached its lowest level since October 2016. According to the ISM New York, the index assesses the economic conditions in the manufacturing sector and services for the companies listed in New York, declined to 51.3 in February from 57.7 in January. Economists had forecast that the index was 58.1 points.

Oil prices fell more than 2% to 3-week low. The cause of this trend was the increase in oil inventories in the US to a record high, as well as news that the volume of oil production in Russia remained unchanged in February. In addition, the pressure on prices exerted the strengthening of the American currency.

DOW index components ended the day mostly in negative territory (22 of 30). Most remaining shares fell Caterpillar Inc. (CAT, -4.32%). leaders of growth were shares of The Home Depot, Inc. (HD, + 0.87%).

Almost all sectors of the S & P index registered a decline. conglomerates (-1.6%) sectors fell most. Increasing demonstrated only utilities sector (+ 0.2%).

At the close:

Dow -0.55% 20,999.54 -116.01

Nasdaq -0.73% 5,861.22 -42.81

S & P -0.60% 2,381.59 -14.37

Major U.S. stock-indexes slipped on Thursday as investors booked profits after a record day on Wall Street that propelled the Dow Jones Industrial Average above 21,000 for the first time ever. Wall Street's main indexes on Wednesday posted their best day since the November election, boosted by President Donald Trump's more measured tone in a speech to Congress and as bank stocks surged on increased chances of an interest rate hike this month.

Most of Dow stocks in negative area (17 of 30). Top loser - Caterpillar Inc. (CAT, -4.63%). Top gainer - Pfizer Inc. (PFE, +0.92%).

Most of S&P sectors are also in negative area. Top loser - Conglomerates (-1.3%). Top gainer - Utilities (+0.4%).

At the moment:

Dow 21055.00 -36.00 -0.17%

S&P 500 2386.00 -7.50 -0.31%

Nasdaq 100 5370.50 -15.50 -0.29%

Oil 52.82 -1.01 -1.88%

Gold 1233.60 -16.40 -1.31%

U.S. 10yr 2.49 +0.03

U.S. stock-index futures were flat as investors took a breather after yesterday's surge to news records amid renewed optimism about the U.S. economy.

Global Stocks:

Nikkei 19,564.80 +171.26 +0.88%

Hang Seng 23,728.07 -48.42 -0.20%

Shanghai 3,230.57 -16.36 -0.50%

FTSE 7,382.48 -0.42 -0.01%

CAC 4,966.04 +5.21 +0.11%

DAX 12,081.04 +13.85 +0.11%

Crude $53.05 (-1.45%)

Gold $1,239.10 (-0.87%)

Upgrades:

Exxon Mobil (XOM) upgraded to Neutral from Underperform at Credit Suisse

Downgrades:

Other:

European stocks on Wednesday charged to their highest close this year, fortified by expectations that an increase in U.S. government spending will benefit European companies. As well, investors anticipated that the Federal Reserve will consider the world's largest economy strong enough to withstand another interest-rate increase.

U.S. stock-market indexes closed at a new round of records Wednesday as investors welcomed President Donald Trump's conciliatory tone during his address to a joint session of Congress, despite a lack of details on his economic plans.

Investors piled into risky investments on Thursday, pushing global stocks to multimonth highs as markets digested speeches from U.S. Federal Reserve officials and President Donald Trump's address to Congress. Regional stock indexes tracked strong overnight gains in the U.S. and Europe with a renewed sense of global optimism, after a lukewarm reaction to Trump's speech on Wednesday.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.