- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -90.12 19254.03 -0.47%

TOPIX -4.79 1550.25 -0.31%

Hang Seng +101.20 23782.27 +0.43%

CSI 300 -5.23 3448.73 -0.15%

Euro Stoxx 50 +4.50 3389.62 +0.13%

FTSE 100 -4.38 7334.61 -0.06%

DAX +1.17 11967.31 +0.01%

CAC 40 +5.48 4960.48 +0.11%

DJIA -69.03 20855.73 -0.33%

S&P 500 -5.41 2362.98 -0.23%

NASDAQ +3.62 5837.55 +0.06%

S&P/TSX -111.80 15496.98 -0.72%

Major US stock indexes ended the session mainly in the red, as the growth in financial performance after a strong employment report was offset by a decrease in shares in the energy sector.

Data from Automatic Data Processing (ADP) showed that the growth rate of employment in the private sector of the US accelerated in February stronger than expected. According to the report, in February the number of employed increased by 298 thousand people compared to the revised upward indicator for January at the level of 261 thousand (originally reported growth of 246 thousand). Analysts had expected that the number of employed will increase by 190 thousand.

In addition, wholesale stocks in the US fell somewhat more than anticipated in January, but investment in inventories could still contribute to economic growth in the first quarter. The Ministry of Trade reported that wholesale stocks decreased by 0.2%, the biggest drop since February 2016, after rising 1.0% in December. The ministry reported last month that wholesale inventories were down 0.1% in January.

Oil futures fell by about 5%, due to mixed data on oil products stocks and general strengthening of the US dollar. The US Energy Ministry reported that in the week of February 25-March 3, oil reserves increased significantly, exceeding forecasts, while stocks of gasoline and distillate sharply decreased. According to the data, oil reserves increased by 8.2 million barrels to 528.4 million barrels. Analysts had expected an increase of only 1.660 million barrels.

The components of the DOW index have mostly declined (23 out of 30). Caterpillar Inc. shares fell more than others. (CAT, -2.70%). The leader of growth was shares of Microsoft Corporation (MSFT, + 0.78%).

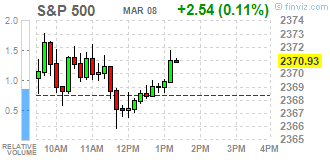

The sectors of the S & P index showed mixed dynamics. Most of all, the main materials sector fell (-2.2%). The leader of growth was the healthcare sector (+ 0.3%).

At closing:

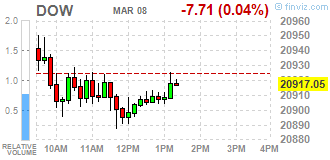

Dow -0.33% 20,855.35 -69.41

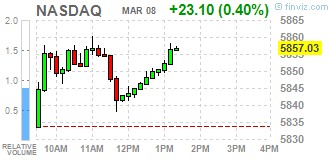

Nasdaq + 0.06% 5,837.55 +3.62

S & P -0.23% 2,363.05 -5.34

U.S. stock-indexes S&P 500 and the Dow Jones Industrial Average swung between losses and gains on Wednesday as gains in financials following a strong private sector hiring report were offset by declines in energy stocks. The ADP National Employment report showed the U.S. private sector added 298,000 jobs last month, much bigger than the 190,000 estimated by economists on average.

Most of Dow stocks in negative area (17 of 30). Top loser - Caterpillar Inc. (CAT, -1.85%). Top gainer - E. I. du Pont de Nemours and Company (DD, +0.98%).

S&P sectors mixed. Top loser - Basic Materials (-1.7%). Top gainer - Healthcare (+0.6%).

At the moment:

Dow 20913.00 0.00 0.00%

S&P 500 2369.50 +3.00 +0.13%

Nasdaq 100 5369.25 +19.50 +0.36%

Oil 51.16 -1.98 -3.73%

Gold 1208.00 -8.10 -0.67%

U.S. 10yr 2.56 +0.05

U.S. stock-index futures were flat as investors lacked a clear market-moving catalyst.

Global Stocks:

Nikkei 19,254.03 -90.12 -0.47%

Hang Seng 23,782.27 +101.20 +0.43%

Shanghai 3,241.18 -1.22 -0.04%

FTSE 7,339.79 +0.80 +0.01%

CAC 4,965.28 +10.28 +0.21%

DAX 11,994.71 +28.57 +0.24%

Crude $52.48 (-1.24%)

Gold $1,209.90 (-0.51%)

Upgrades:

Downgrades:

Other:

Exxon Mobil (XOM) target lowered to $85 from $90 at HSBC Securities

European stocks slipped Tuesday, dampened by downbeat data from Germany, the continent's largest economy, before the European Central Bank issues a policy update later this week. Tuesday's fall marked the fourth loss in a row for the pan-European benchmark, with equities largely pulling back after last week hitting their highest level in a year.

The Dow and the S&P 500 on Tuesday logged their first back-to-back declines since late January as sharp losses in energy and telecommunications sectors dragged on the broader market. On the docket are the all-important nonfarm payrolls data on Friday and two major central bank meetings from the European Central Bank on Thursday and the Federal Reserve next week.

Asian equity investors were cautious early Wednesday, taking their cue from a lack of risk appetite in the U.S. overnight, as global markets continued to drift. Markets have been stuck in range-bound trading for much of the week as traders nervously await further clues from the U.S. Federal Reserve and President Donald Trump on the country's monetary and fiscal policy outlook.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.