- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

The major US stock indexes finished trading with an increase on the background of positive labor market data, which are preparing the ground for the first rate hikes this year. As the report of the Ministry of Labor showed, in February, job growth in the US increased more than expected, and wages steadily increased. According to the report, the number of jobs in the non-agricultural sector grew by 235,000 in February. Over the past three months, employment growth averaged 209,000 people. The sharp rise in hiring was accompanied by a steady increase in wages, while the average hourly wage rose by 6 cents, or by 0.2%. The salary growth in January was revised to 0.2% from 0.1%. The unemployment rate fell by 0.1%, to 4.7%. Economists predicted an increase in employment by 190,000.

Components of the DOW index closed mostly in positive territory (23 out of 30). More shares fell The Boeing Company (BA, -1.04%). The leader of growth is shares of General Electric Company (GE, + 2.17%).

Almost all sectors of the S & P index recorded an increase. The leader of growth was the utilities sector (+ 0.9%). Only the sector of conglomerates dropped (-0.1%).

At the close of trading:

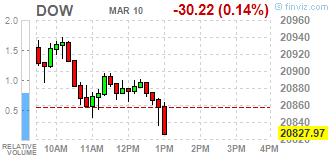

Dow +0.22% 20,904.56 +46.37

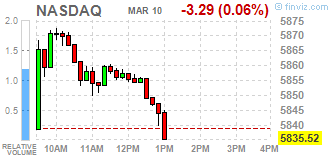

Nasdaq +0.39% 5,861.73 +22.92

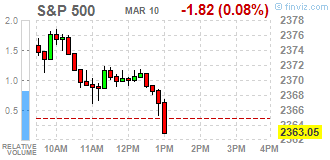

S&P +0.33% 2,372.79 +7.92

Major U.S. stock-indexes little changed on Friday despite a solid jobs report which virtually sealed the deal for the Federal Reserve to raise interest rates next week, and potentially set the course for an aggressive tightening path this year. Data showed 235,000 jobs were added in the public and private sectors in February, far exceeding economists' average estimate of 190,000.

Most of Dow stocks in positive area (19 of 30). Top loser - The Boeing Company (BA, -1.16%). Top gainer - General Electric Company (GE, +1.92%).

Almost all of S&P sectors also in positive area. Top loser - Financials (-0.1%). Top gainer - Utilities (+0.4%).

At the moment:

Dow 20805.00 -23.00 -0.11%

S&P 500 2362.50 -0.75 -0.03%

Nasdaq 100 5374.00 +3.25 +0.06%

Oil 48.39 -0.89 -1.81%

Gold 1201.00 -2.20 -0.18%

U.S. 10yr 2.58 -0.02

U.S. stock-index futures extended gains after a better-than-expected February U.S. nonfarm payrolls report emphasized the strength of the labor market and bolstered the odds of the first interest rate rise this year.

Global Stocks:

Nikkei 19,604.61 +286.03 +1.48%

Hang Seng 23,568.67 +67.11 +0.29%

Shanghai 3,212.43 -4.32 -0.13%

FTSE 7,359.12 +44.16 +0.60%

CAC 5,016.11 +34.60 +0.69%

DAX 12,047.21 +68.82 +0.57%

Crude $49.64 (+0.73%)

Gold $1,198.20 (-0.42%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 35.65 | 0.29(0.82%) | 470 |

| ALTRIA GROUP INC. | MO | 76.51 | 0.32(0.42%) | 1739 |

| Amazon.com Inc., NASDAQ | AMZN | 856.65 | 3.65(0.43%) | 14123 |

| AMERICAN INTERNATIONAL GROUP | AIG | 64.08 | 0.87(1.38%) | 2595 |

| Apple Inc. | AAPL | 139.26 | 0.58(0.42%) | 70439 |

| AT&T Inc | T | 42 | 0.06(0.14%) | 2329 |

| Barrick Gold Corporation, NYSE | ABX | 17.79 | 0.07(0.40%) | 79786 |

| Boeing Co | BA | 181.9 | 1.33(0.74%) | 1408 |

| Caterpillar Inc | CAT | 92.05 | 0.66(0.72%) | 9126 |

| Chevron Corp | CVX | 110.5 | 0.46(0.42%) | 440 |

| Cisco Systems Inc | CSCO | 34.19 | 0.12(0.35%) | 1659 |

| Citigroup Inc., NYSE | C | 62.2 | 0.65(1.06%) | 57607 |

| Exxon Mobil Corp | XOM | 81.8 | 0.13(0.16%) | 7769 |

| Facebook, Inc. | FB | 138.98 | 0.74(0.54%) | 85536 |

| Ford Motor Co. | F | 12.55 | 0.05(0.40%) | 44588 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.7 | 0.30(2.42%) | 113633 |

| General Electric Co | GE | 29.83 | 0.17(0.57%) | 55152 |

| Goldman Sachs | GS | 252.06 | 1.88(0.75%) | 14293 |

| Google Inc. | GOOG | 843.92 | 5.24(0.62%) | 1624 |

| Home Depot Inc | HD | 147.49 | 0.87(0.59%) | 1290 |

| Intel Corp | INTC | 35.99 | 0.17(0.47%) | 19426 |

| International Business Machines Co... | IBM | 178 | 0.82(0.46%) | 470 |

| Johnson & Johnson | JNJ | 126.36 | 0.41(0.33%) | 2453 |

| JPMorgan Chase and Co | JPM | 92.3 | 0.73(0.80%) | 30452 |

| Merck & Co Inc | MRK | 66.14 | 0.25(0.38%) | 1000 |

| Microsoft Corp | MSFT | 65.03 | 0.30(0.46%) | 5809 |

| Nike | NKE | 56.54 | 0.18(0.32%) | 510 |

| Pfizer Inc | PFE | 34.35 | 0.30(0.88%) | 1336 |

| Starbucks Corporation, NASDAQ | SBUX | 55.21 | 0.02(0.04%) | 8087 |

| Tesla Motors, Inc., NASDAQ | TSLA | 246.75 | 1.85(0.76%) | 14287 |

| The Coca-Cola Co | KO | 42.16 | 0.13(0.31%) | 1088 |

| Twitter, Inc., NYSE | TWTR | 15.27 | 0.05(0.33%) | 5342 |

| Visa | V | 89.66 | 0.55(0.62%) | 678 |

| Walt Disney Co | DIS | 111.44 | 0.41(0.37%) | 913 |

| Yandex N.V., NASDAQ | YNDX | 22.88 | 0.03(0.13%) | 800 |

Upgrades:

FedEx (FDX) upgraded to Buy from Hold at Edward Jones

Downgrades:

Other:

European stocks finished modestly higher Thursday, with bank shares charging up as European Central Bank Mario Draghi suggested deflationary pressures have lessened, though energy shares lost ground as oil prices slid. Draghi said the ECB removed language from his previous statements that had said the bank would act, if warranted, to achieve its inflation objectives by using all the instruments available within its mandate.

U.S. stocks eked out gains Thursday on the back of a rebound in energy shares as the bull market quietly marked its unofficial eighth birthday. Thursday marks the eighth anniversary of the bull market, based on the fact that the S&P 500 notched its bear-market closing low on March 9, 2009. The benchmark index has gone on to gain 249% since that point.

Asian stocks edged up and the dollar rose to 1-1/2-month highs versus the yen on Friday, ahead of the closely-watched U.S. non-farm payrolls report due later in the day. Shares in South Korea rose 0.3 percent and the won firmed slightly after the country's Constitutional Court upheld parliament's impeachment of President Park Geun-hye over a graft scandal involving big business.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.